- Home

- »

- Organic Chemicals

- »

-

1-Decene Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![1-Decene Market Size, Share & Trends Report]()

1-Decene Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (PAO, Detergent Alcohol, Polyethylene), By Region (North America, Europe, Asia Pacific, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68039-385-9

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

1-Decene Market Summary

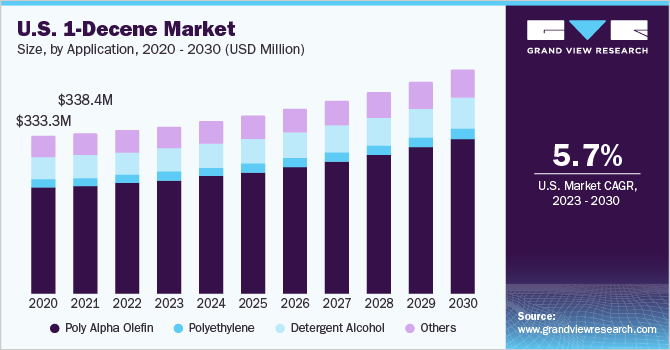

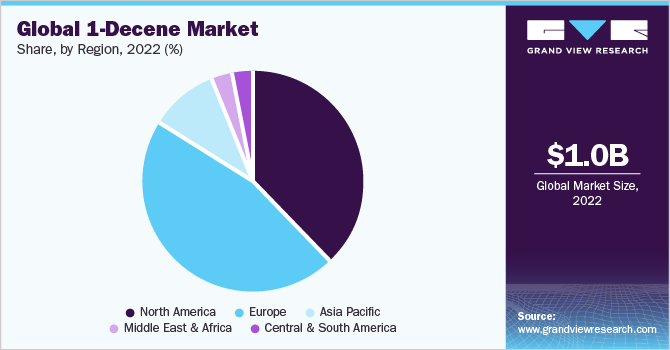

The global 1-decene market size was valued at USD 1.0 billion in 2022 and is projected to reach USD 1.66 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. Increasing demand for synthetic lubricants, capacity expansions by key industry players, and focus on the development of alpha olefins from bio-based materials are likely to propel the industry demand.

Key Market Trends & Insights

- The Europe region dominated the global industry in 2022 and accounted for the maximum share of more than 46.2% of the overall revenue.

- The Asia Pacific region is estimated to register the fastest growth rate during the forecast period.

- In terms of applications, the poly alpha olefin application segment dominated the industry in 2022 and accounted for the maximum share of more than 67.35% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 1.0 Billion

- 2030 Projected Market Size: USD 1.66 Billion

- CAGR (2023-2030): 5.7%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

The increasing popularity of synthetic lubricants, as they offer better lubrication and cause less engine wear & tear has triggered Poly Alpha Olefin (PAO) demand over the recent past. It is prepared by oligomerization of linear alpha olefins and C-10 is the most preferred alpha-olefin for PAO production.

Increasing Poly Alpha Olefin (PAO) demand for producing engine/gear oils, greases, and other lubricants is expected to be the key factor driving the industry's growth. The Shale gas boom, particularly in the U.S. and China, has provided new hope for petrochemical producers and has pushed ethylene production, which is an essential raw material for 1-decene production. The ample availability of critical raw materials in these regions is also expected to have a positive influence on product demand. 1-decene is obtained through the oligomerization of ethylene and can only be produced through full-range alpha olefin distribution, which cannot be obtained through on-purpose production processes like 1-hexene or 1-octene.

This has led to a limited C-10 supply for PAO production. The short supply of PAO in the market has left synthetic lubricant manufacturers with no choice other than to seek alternate raw materials for oil production. Ester-based synthetic oils are thus getting popular and are likely to affect the market growth over the forecast period. The global industry has always been highly sensitive to economic conditions along with the supply-demand scenario. The market price is normally based on the cost-plus pricing method, in which raw material prices play an important part. Ethylene prices have been fluctuating and the same trend can be observed in the case of alpha olefin prices.

Application Insights

On the basis of applications, the global industry has been further categorized into poly alpha olefin, polyethylene, detergent alcohol, and others. The poly alpha olefin application segment dominated the industry in 2022 and accounted for the maximum share of more than 67.35% of the overall revenue. The segment is estimated to retain its dominance throughout the forecast period. This is attributed to the increasing demand for PAO for synthetic lubricant production.

Poly alpha olefin is anticipated to emerge as the largest as well as the fastest-growing application segment as PAO offers exceptional technical performance and also helps in the prevention of the environment. Detergent alcohols and their derivatives are key raw materials used for producing surfactants in laundry and dishwashing applications. This application segment is expected to witness an above-average growth rate over the forecast period.

Regional Insights

The Europe region dominated the global industry in 2022 and accounted for the maximum share of more than 46.2% of the overall revenue. The region is projected to expand further at a steady growth rate retaining its leading position throughout the forecast period. This is attributed to the increasing PAO and synthetic lubricant production in the region by key product manufacturers. Regional growth can also be attributed to the easy availability of raw materials. Furthermore, as the U.S. is the largest oil manufacturing country, it has been responsible for the higher penetration in the North America regional market.

Moreover, the strong presence of the major industry participants, such as ExxonMobil Corp., Shell Chemicals, Chevron Phillips Chemical Company LP, and INEOS Oligomers, having patented technology for alpha olefin production has driven 1-decene demand in North America. The Asia Pacific region is estimated to register the fastest growth rate during the forecast period. This is mainly due to the rising demand for PAO for the production of lubricants.

Key Companies & Market Share Insights

The global industry is concentrated due to the presence of a few multinational players having their patented technology. The market has witnessed a high level of integration from major industry participants. Key members, such as Shell Chemicals, Chevron Phillips, and Q-Chem, have integrated their operations across the value chain including the production and supply of raw materials to end-use products. Some of the key players in the global 1-decene market include:

-

Shell Chemicals

-

Chevron Phillips

-

INEOS

-

Qatar Chemicals

-

SASOL

-

ExxonMobil

1-Decene Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.10 billion

Revenue forecast in 2030

USD 1.66 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; France; China; India; Japan; Thailand; Malaysia; Indonesia; Brazil; Saudi Arabia

Key companies profiled

Shell Chemicals; Chevron Phillips; INEOS; Qatar Chemicals; SASOL; ExxonMobil

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 1-Decene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global 1-decene market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Poly Alpha Olefin

-

Polyethylene

-

Detergent Alcohols

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Malaysia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global 1-decene market size was estimated at USD 1.07 billion in 2022 and is expected to reach USD 1.10 billion in 2023.

b. The global 1-decene market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 1.66 billion by 2030.

b. Europe dominated the 1-decene market with a share of 46.2% in 2022. This is attributable to the high demand for PAO for synthetic lubricant production in the region.

b. Some key players operating in the 1-decene market include Shell Chemicals, Chevron Phillips, INEOS, Qatar Chemicals, SASOL, and ExxonMobil.

b. Key factors that are driving the market growth include increasing demand for synthetic lubricants, capacity expansions by key industry players and focus on the development of alpha olefins from bio-based materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.