- Home

- »

- Next Generation Technologies

- »

-

3D Automotive Printing Market Size & Share Report, 2030GVR Report cover

![3D Automotive Printing Market Size, Share & Trends Report]()

3D Automotive Printing Market Size, Share & Trends Analysis Report By Offering (Hardware, Software) By Technology (SLA, SLS, FDM), By Material (Polymer, Metal), By Component (Interior, Exterior), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-294-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

3D Automotive Printing Market Size & Trends

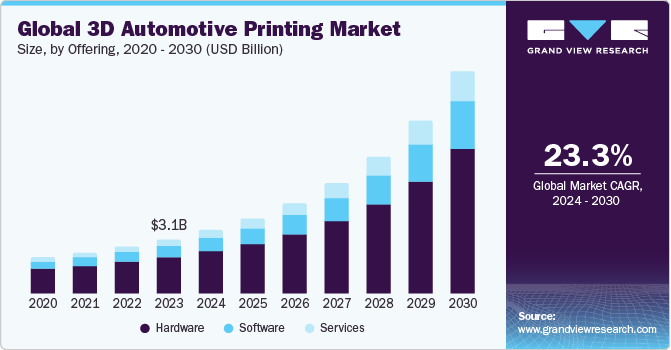

The global 3D automotive printing market size was estimated at USD 3.10 billion in 2023 and is expected to register a CAGR of 23.3% from 2024 to 2030. The rising demand for customized products in the automotive industry has emerged as a significant driver of advancement and growth in the market. Additive manufacturing allows manufacturers to produce parts tailored to individual customer specifications. This capability is particularly beneficial for luxury and high-performance vehicles where buyers often seek unique features.

In March 2024, BMW AG, the BMW Group, announced plans to use Wire Arc Additive Manufacturing (WAAM) for future vehicle production. This decision comes after extensive trials of the metal additive manufacturing process at the company's manufacturing campus in Germany. The automaker had been exploring Wire Arc Additive Manufacturing (WAAM) technology since 2015 and has been building test components with an MX3D production cell since 2021.

Additive manufacturing significantly accelerates the product development cycle by enabling rapid prototyping, which allows automotive manufacturers to produce and test multiple iterations of a component quickly. This technology streamlines the design process, reducing the time required to move from concept to final product. As a result, companies can efficiently refine and validate designs, addressing potential issues early in development. This expedited timeline not only enhances productivity but also provides a competitive advantage by allowing faster adaptation to market demands and technological advancements.

The use of lightweight materials in 3D printing is a significant trend in the automotive industry. This trend is driven by the need to reduce vehicle weight, improve fuel efficiency, and lower emissions. In traditional manufacturing processes, such as casting or machining, producing lightweight components can be challenging due to limitations in design and material properties. However, 3D printing allows for the creation of complex geometries and the use of lightweight materials that can meet the structural requirements of automotive parts while reducing weight. For instance, carbon fiber-reinforced polymers (CFRP) are lightweight materials employed in 3D printing. CFRP composites offer high strength-to-weight ratios, making them ideal for applications where weight reduction is crucial, such as in the aerospace and automotive industries. By incorporating carbon fiber into 3D printed parts, automotive manufacturers can achieve significant weight savings without compromising structural integrity.

Additionally, the adoption of 3D printing for the development of electric and autonomous vehicles is a significant trend in the automotive industry. Major automotive companies, including BMW AG, Ford Motor Company, AB Volvo, General Motors, and Dr. Ing. h.c. F. Porsche AG is utilizing 3D printing technology in this area. 3D printing offers advantages such as faster production times, cost savings, and the ability to create complex geometries that traditional manufacturing processes may struggle to achieve. As the electric and autonomous vehicle market continues to grow, the utilization of 3D printing technology is expected to play a crucial role in driving innovation and advancements in the automotive industry.

Market Concentration & Characteristics

The 3D automotive market growth stage is high. One of the key advantages driving the adoption of additive manufacturing in the automotive industry is cost efficiency. By leveraging 3D printing technology, automakers can reduce costs associated with traditional manufacturing processes. The capability to produce complex parts in a single manufacturing step eliminates the need for multiple components and assembly, resulting in cost savings. Additionally, 3D printing technologies are becoming increasingly integrated into mainstream automotive manufacturing processes, with more companies adopting these technologies across various tiers of the automotive supply chain. This increasing market penetration is indicative of the growing acceptance and recognition of 3D printing as a viable manufacturing solution within the automotive industry.

Moreover, technological advancements drive the continuous evolution of the industry, with various additive manufacturing processes at the forefront of innovation. These processes, including fused deposition modeling (FDM), stereolithography (SLA), and selective laser sintering (SLS), among others, offer unique capabilities and advantages suited to different automotive applications. Emerging technologies like digital light processing (DLP), electron beam melting (EBM), and multi jet fusion (MJF) further expand the opportunities for automotive 3D printing by improving speed, accuracy, and material versatility.

Material innovation is another key characteristic in the market, with a wide array of materials being utilized to meet the diverse performance requirements of automotive components. Thermoplastics, thermosets, metals, ceramics, and composites are among the materials commonly used in 3D printing for automotive applications. Advanced materials with enhanced properties such as high strength, heat resistance, and electrical conductivity are continuously being developed to push the boundaries of automotive 3D printing and enable the production of high-performance parts.

The market faces several restraints, such as high initial investment costs, Intellectual property concerns, and a lack of technical knowledge and a skilled workforce. Implementing 3D printing technologies in the automotive industry requires a significant upfront investment. This includes the cost of purchasing 3D printers, which can vary widely depending on the technology and capabilities required. Additionally, there are expenses associated with acquiring materials, software, and auxiliary equipment, such as post-processing tools and inspection devices. Furthermore, training personnel to operate and maintain 3D printers effectively adds to the initial investment. For smaller automotive companies or those with limited financial resources, these upfront costs can be prohibitive and may deter them from adopting 3D printing technologies.

The 3D automotive printing industry is characterized by its diverse range of applications spanning various aspects of automotive manufacturing. From prototyping and tooling to end-use part production, 3D printing plays a crucial role in accelerating development cycles and enhancing design flexibility within the automotive industry. This technology enables the creation of concept models, functional prototypes, customized components, and even entire vehicle structures, catering to the evolving needs of automotive manufacturers.

Offering Insights

Based on offering, the hardware segment dominated the market and accounted for the largest revenue share of 67.1% in 2023. This is due to its essential role in additive manufacturing, continuous technological innovation, diverse product offerings, intense market competition, and adherence to industry standards and certifications. As additive manufacturing continues to revolutionize the automotive industry, hardware manufacturers will remain key players driving innovation and growth in the market. Additionally, manufacturers are constantly developing new printer models with enhanced features such as larger build volumes, faster printing speeds, and higher resolution. These advancements enable automotive companies to produce complex components with greater precision and efficiency, driving demand for 3D printing hardware.

The services segment is expected to register the highest CAGR of 25.7% over the forecast period. As the adoption of additive manufacturing technology grows within the automotive industry, many companies are seeking external expertise and services to supplement their in-house capabilities. Outsourcing 3D printing services allows automotive manufacturers to access specialized skills, equipment, and resources without making substantial investments in infrastructure or training.

Application Insights

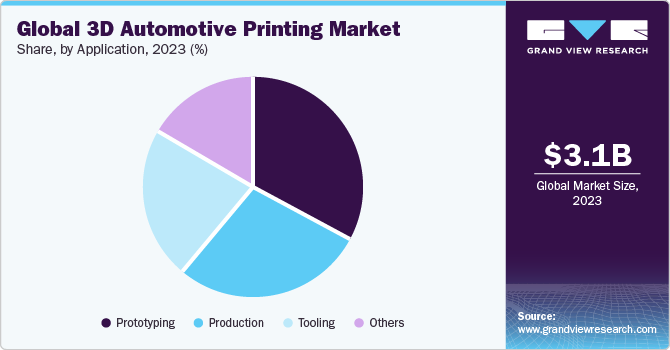

Based on application, the prototyping segment dominated the target market with the largest revenue share in 2023. Prototyping is a critical stage in the automotive manufacturing process. Before finalizing designs for mass production, automotive manufacturers need to create prototypes to test the functionality, aesthetics, and performance of various components. Additive manufacturing offers significant advantages in this regard, as it allows for the rapid and cost-effective production of prototypes with complex geometries and intricate details. Additionally, printing enables iterative design processes, allowing engineers to quickly modify and refine designs based on test results and feedback. This iterative approach accelerates the development cycle, reducing time-to-market for new vehicle models.

The production segment is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the industry’s transformative shift towards more customizable and on-demand manufacturing models. Consumers are increasingly demanding personalized vehicles with unique features and designs. 3D printing enables manufacturers to efficiently produce customized parts without the need for expensive tooling or lengthy retooling processes. This flexibility in manufacturing aligns well with the evolving demands of the market.

Type Insights

Based on type, the fused deposition modeling (FDM) segment dominated the market with the largest revenue share in 2023. FDM technology is known for its relatively low cost compared to other additive manufacturing processes. The affordability of FDM printers and materials makes them accessible to a wide range of automotive manufacturers, including small and medium-sized enterprises (SMEs) with limited budgets. This cost-effectiveness has contributed to the widespread adoption of FDM technology within the automotive industry. Additionally, FDM technology is scalable and can be used to produce both small and large-scale automotive components. Whether manufacturing a single prototype or producing batches of end-use parts, FDM printers can accommodate varying production volumes, making them suitable for automotive manufacturers of all sizes.

The stereolithography (SLA) segment is expected to grow at the fastest CAGR over the forecast period. SLA printers are known for their high printing speed and efficiency compared to other additive manufacturing technologies, such as selective laser sintering (SLS). The fast build times offered by SLA technology enable automotive manufacturers to accelerate their product development cycles and reduce time-to-market for new vehicle models and components. Additionally, recent advancements in SLA technology have resulted in the development of printers with larger build volumes capable of producing larger automotive components or multiple parts simultaneously.

Material Insights

Based on material, the metal segment dominated the market with the largest revenue share in 2023. Metal 3D printing offers superior mechanical properties compared to other materials commonly used in automotive manufacturing, such as plastics or composites. Metals like titanium, aluminum, and stainless steel provide high strength, durability, and heat resistance, making them suitable for producing critical automotive components such as engine parts, brackets, and structural components. Additionally, metal 3D printing technologies, such as fused deposition modeling (FDM) and electron beam melting (EBM), enable the production of high-performance, complex parts with tight tolerances and intricate geometries.

The polymer segment is expected to grow at the fastest CAGR over the forecast period. Polymer-based 3D printing offers a wide range of materials with diverse properties, including acrylonitrile butadiene styrene (ABS), polylactic acid, nylon, polyethylene terephthalate glycol (PETG), and thermoplastic polyurethane (TPU). These materials can be engineered to meet specific performance requirements, such as strength, flexibility, heat resistance, and chemical resistance. With ongoing material innovation and development, polymer 3D printing in the automotive industry continues to expand its applicability across various applications, including prototyping, tooling, and end-use parts production.

Component Insights

Based on component, the interior component segment dominated the market with the largest revenue share in 2023. Interior components often feature intricate designs and complex geometries that are challenging to manufacture using traditional methods. Additive manufacturing technologies, such as fused deposition modeling (FDM) and stereolithography (SLA), offer the flexibility to produce highly detailed and customized interior components, including dashboard panels, center consoles, door handles, and trim pieces. Additionally, interior components play a significant role in reducing vehicle weight to improve fuel efficiency and overall performance. 3D printing allows us to manufacture lightweight yet durable interior parts using advanced polymers or composite materials.

The exterior segment is expected to grow at the fastest CAGR over the forecast period. The dominance of the segment can be attributed to innovation in design and customization offered by 3D printers. Exterior components, such as body panels, grilles, spoilers, and trim pieces, play a crucial role in defining a vehicle's aesthetics and brand identity. 3D printing technology enables automotive designers to explore innovative and customizable designs for exterior components, including complex geometries, intricate patterns, and textured surfaces. This design flexibility allows for greater differentiation and personalization of vehicles, driving demand for 3D-printed exterior components.

Regional Insights

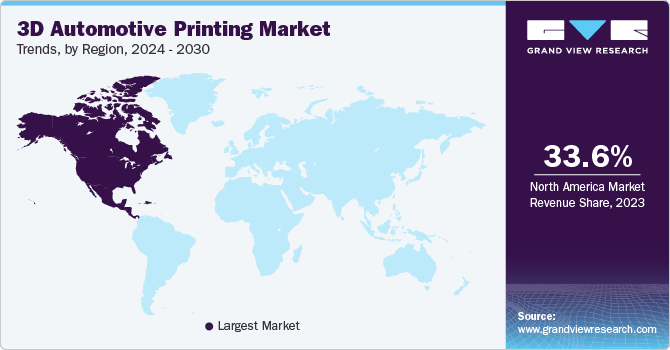

North America asserted its dominance in 2023, capturing the largest revenue share at 33.6%. This dominance can be attributed to the presence of a robust automotive industry with a high concentration of automotive manufacturers, suppliers, and research institutions. This ecosystem fosters innovation and collaboration in adopting advanced manufacturing technologies like 3D printing. Additionally, North America is home to leading additive manufacturing technology providers such as Stratasys Ltd., 3D Systems Corporation, Autodesk, Inc., and service bureaus specializing in automotive applications. These companies offer a wide range of 3D printing solutions tailored to the needs of automotive manufacturers, including advanced materials, large-scale production capabilities, and expertise in design optimization.

U.S. 3D Automotive Printing Market Trends

The 3D automotive printing market in the U.S. held the largest share, 53.9%, in North America in 2023 and is also anticipated to grow at a significant CAGR from 2024 to 2030. The U.S. government has been supportive of additive manufacturing technologies through initiatives such as funding for research and development, workforce training programs, and partnerships with industry stakeholders. These efforts have helped to accelerate the adoption of 3D printing in various sectors, including automotive manufacturing.

Asia Pacific 3D Automotive Printing Market Trends

Asia Pacific recorded the fastest CAGR of 25.1% in the 3D automotive printing market over the forecast period. The presence of a large consumer market in Asia Pacific drives demand for customized and personalized automotive products. 3D printing enables manufacturers to offer tailor-made solutions, such as custom-designed interior components and personalized vehicle accessories, catering to diverse consumer preferences and enhancing market competitiveness. Additionally, the availability of skilled labor and relatively lower labor costs in certain countries in the Asia Pacific contribute to the region's attractiveness for 3D printing adoption. This allows automotive manufacturers to leverage additive manufacturing technologies cost-effectively while maintaining high production standards.

China 3D automotive printing market is experiencing significant growth, driven by the rising adoption of electric vehicles and autonomous driving technologies across the country, supported by government incentives and environmental concerns. For instance, in 2022, China saw an 82% surge in new electric vehicle (EV) sales, capturing nearly 60% of the global market share for EV purchases. China's robust manufacturing infrastructure and skilled workforce contribute to its prominence in the global 3d automotive printing market.

Europe 3D Automotive Printing Market Trends

The 3D automotive printing market in Europe is on the rise, driven by several key factors. Europe is home to a highly advanced automotive industry with a strong focus on innovation and technology. Major automotive manufacturers and suppliers in countries like Germany, France, Italy, and the U.K. are increasingly integrating additive manufacturing technologies into their production processes to enhance efficiency, reduce costs, and accelerate product development cycles. Additionally, Europe has a well-established network of research institutions, universities, and technology centers specializing in additive manufacturing and automotive engineering. Collaborative research projects and partnerships between academia and industry are driving innovation and advancements in 3D printing technologies tailored to automotive applications.

The growth of the U.K. 3D automotive printing market can be attributed to a combination of factors, including industry expertise, government support, sustainability goals, technological innovation, and market demand for customization. As the automotive industry continues to evolve, 3D printing is expected to play a significant role in driving innovation and competitiveness in the U.K. automotive sector.

Key 3D Automotive Printing Company Insights

Some of the key companies operating in the 3D automotive printing market include Stratasys Ltd., 3D Systems Corporation, among others.

-

Stratasys Ltd. is one of the leading manufacturers of additive manufacturing printers and solutions. The company specializes in producing a wide range of 3D printing technologies, including fused deposition modeling (FDM) and stereolithography (SLA). Stratasys serves various industries, including aerospace, automotive, healthcare, and consumer goods, by providing solutions for rapid prototyping, tooling, and production of end-use parts. It operates globally and has a significant presence in the additive manufacturing market.

-

3D Systems Corporation is a comprehensive 3D printing and digital manufacturing solutions provider based in the U.S. The company offers a range of products and services, including 3D printers for both plastics and metals, software solutions for design and production optimization, on-demand manufacturing services, and digital design tools. With a global presence, 3D Systems operates through multiple offices and facilities across North America, Latin America, Europe, Middle East & Africa, and Asia Pacific regions. The company's offerings cater to various industries, including automotive, aerospace, healthcare, consumer goods, and more.

Voxeljet AG and EOS GmbH are some of the emerging market companies in the target market.

-

Voxeljet AG is a supplier of 3D printing systems for industrial applications. The company specializes in powder-binder-jetting technology, which offers geometric freedom for complex designs and optimization of manufacturing processes. The company provides comprehensive 3D printing solutions, including printers for plastics, metals, and ceramics, as well as materials, software, on-demand manufacturing services, and digital design tools.

-

EOS GmbH is an emerging player in the additive manufacturing industry, specializing in industrial 3D printing solutions. It offers advanced technology and a wide range of solutions for industrial 3D printing of metals and plastics. The expertise lies in technologies such as selective laser sintering (SLS) and direct metal laser sintering (DMLS).

Key 3D Automotive Printing Companies:

The following are the leading companies in the 3D automotive printing market. These companies collectively hold the largest market share and dictate industry trends.

- 3D Systems Corporation

- Stratasys Ltd.

- Voxeljet AG

- Materialise NV

- Autodesk, Inc.

- The ExOne Company

- Envisiontec GmbH

- Ultimaker BV

- Nexa3D

- SLM Solutions

- EOS GmbH

- Desktop Metal, Inc.

Recent Developments

-

In March 2024, Stratasys Ltd. announced that it had acquired the technology portfolio and intellectual property (IP) of Arevo, Inc., a technology company based in Silicon Valley, California, that specializes in direct digital additive manufacturing of parts using composite materials. This acquisition includes foundational patents in carbon fiber printing, Z-strength improvement, in-situ and AI build monitoring, and hardware design. By integrating this technology into Stratasys' FDM print systems, the company aims to expand its manufacturing applications and offer higher-performing parts, more reliable builds, and improved system throughput.

-

In March 2024, EOS GmbH launched the EOS M 290 1kW, a new Laser Powder Bed Fusion (LPBF) metal additive manufacturing (AM) platform designed for serial production. The EOS M 290 1kW is suitable for various industries, including automotive, and offers an extensive range of validated materials and processes. This platform aims to provide enhanced design flexibility, weight reduction, and cost-effectiveness in metal additive manufacturing.

-

In April 2024, Materialise NV introduced three new materials to enhance accessibility in industrial 3D printing. These materials include Polyamide 11 (PA11), Bluesint PA12, and AlSiMg aluminum alloy. PA11 is a 100% bio-based polymer made from castor beans, Bluesint PA12 allows for 3D printing with up to 100% re-used powder, and AlSiMg is a strong and lightweight aluminum alloy suitable for industries like automotive and aerospace. These materials offer improved performance and reliability, addressing the specific needs of automotive manufacturers in prototyping, tooling, and end-use part production. The new materials aim to expand the capabilities of additive manufacturing in the automotive industry, enabling faster development cycles, cost savings, and greater design freedom.

3D Automotive Printing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.63 billion

Revenue forecast in 2030

USD 12.76 billion

Growth Rate

CAGR of 23.3% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Offering, type, material, component, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; China; Japan; India; South Korea; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

3D Systems Corporation; Stratasys Ltd.; Voxeljet AG; Materialise NV; Autodesk, Inc.; The ExOne Company; Envisiontec GmbH; Ultimaker BV; Nexa3D; SLM Solutions; EOS GmbH; Desktop Metal, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Automotive Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global 3D automotive printing market report based on offering, type, material, component, application, and region.

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Extrusion System

-

Motion System

-

Build Platform Environs

-

Control And Monitoring System

-

-

Software

-

Design Software

-

Inspection Software

-

Printer Software

-

Scanning Software

-

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Stereolithography (SLA)

-

Selective Laser Sintering (SLS)

-

Fused Deposition Modeling (FDM)

-

Electron Beam Melting (EBM)

-

Digital Light Processing (DLP)

-

Others

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Metal

-

Polymer

-

Ceramic

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Interior Component

-

Exterior Component

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Prototyping

-

Tooling

-

Production

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D automotive printing market size was estimated at USD 3.10 billion in 2023 and is expected to reach USD 3.63 billion in 2024.

b. The global 3D automotive printing market is expected to grow at a compound annual growth rate of 23.3% from 2024 to 2030 to reach USD 12.76 billion by 2030.

b. The hardware segment claimed the largest market share of 67.1% in 2023 in the 3D Automotive Printing Market, driven by its crucial role in prototyping, extensive adoption in the automotive industry, and continuous advancements in hardware technologies.

b. Prominent players in the 3D automotive printing market are 3D Systems Corporation, Stratasys Ltd., Voxeljet AG, Materialise NV, Autodesk, Inc., The ExOne Company, Envisiontec GmbH, Ultimaker BV, Nexa3D, SLM Solutions, EOS GmbH, and Desktop Metal, Inc.

b. The 3D automotive printing market is driven by factors such as growing adoption and increasing investment by OEMs and suppliers, advancements in 3D printing materials, and rapid prototyping & reduced development time.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."