- Home

- »

- Next Generation Technologies

- »

-

3D Digital Asset Market Size, Share & Trends Report, 2030GVR Report cover

![3D Digital Asset Market Size, Share & Trends Report]()

3D Digital Asset Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Application, By Vertical (Automotive, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-404-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Digital Asset Market Summary

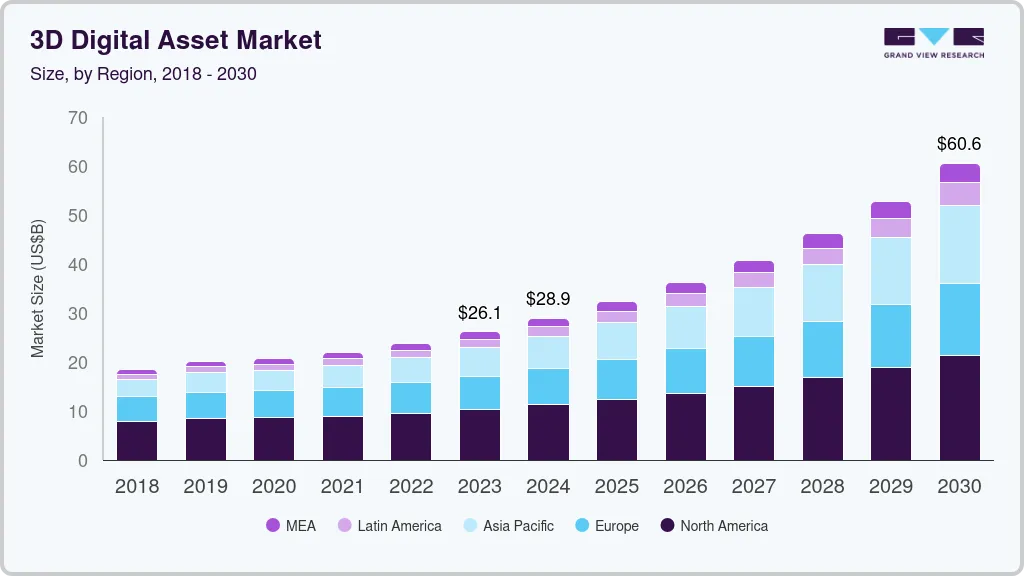

The global 3d digital asset market size was estimated at USD 26.14 billion in 2023 and is projected to reach USD 60.58 billion by 2030, growing at a CAGR of 13.1% from 2024 to 2030. A 3D digital asset refers to a digital object created using 3D modeling software. These assets are used in various industries, including gaming, film, architecture, and product design.

Key Market Trends & Insights

- North America dominated the 3D digital asset market with the largest revenue share of 39.6% in 2023.

- The 3D digital asset market in U.S. is anticipated to exhibit at a significant CAGR over the forecast period.

- Based on component, the software segment led the market with the largest revenue share of 44.5% in 2023.

- Based on deployment, the on-premises segment led the market with the largest revenue share of 55.70% in 2023.

- Based on application, the visualization segment led the market with the largest revenue share of 23.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 26.14 Billion

- 2030 Projected Market Size: USD 60.58 Billion

- CAGR (2024-2030): 13.1%

- North America: Largest market in 2023

Various factors are driving the market growth, such as technological advancements, growing gaming, film, and animation industries, and implementation of Virtual Reality (VR) and Augmented Reality (AR). VR and AR applications require realistic 3D assets to create immersive environments and interactive experiences. VR and AR are increasingly used in training, education, real estate, and other sectors, driving demand for 3D content.

In the e-commerce industry, 3D models allow consumers to view products from all angles and in different settings, enhancing online shopping experiences. Thus, e-commerce platform providers use 3D assets in interactive advertisements and virtual showrooms to engage customers. In addition, architects and real estate developers use 3D models to create detailed visualizations of buildings and spaces, aiding in design and marketing. 3D digital assets enable virtual tours of properties, enhancing the sales process. 3D models are also used in educational software and simulations to provide interactive and engaging learning experiences. Therefore, various industries such as healthcare, aviation, and manufacturing use 3D simulations for training purposes.

Cloud-based tools facilitate collaboration among designers and developers, increasing the efficiency of 3D asset creation. Online marketplaces and libraries for 3D assets make it easier for developers to access and purchase high-quality models. Moreover, the development of industry standards for 3D asset formats and quality ensures compatibility and usability across different platforms and applications. 3D modeling can reduce physical prototyping and waste, and it can be customizable.

Component Insights

Based on component, the software segment led the market with the largest revenue share of 44.5% in 2023. Real-time rendering, ray tracing, and physically based rendering technologies are improving the visual quality and realism of 3D assets. Advancements in technologies such as AI and Machine Learning are automating tasks like asset creation, optimization, and management, increasing efficiency and productivity. Furthermore, in the e-commerce sector, the need for high-quality product visualizations to enhance online shopping experiences is driving 3D digital asset software adoption.

The services segment is predicted to foresee at the fastest CAGR during the forecast period. The convergence of technology, increasing demand for immersive experiences, and growing business needs are driving the growth of the 3D digital asset services segment. Businesses and consumers seek personalized and customized 3D assets for customized applications, driving growth in 3D digital asset services. In addition, the rise of VR and AR applications in gaming, education, real estate, and healthcare requires specialized 3D assets, boosting the need for 3D digital asset services.

Deployment Insights

Based on deployment, the on-premises segment led the market with the largest revenue share of 55.70% in 2023. Industries handling sensitive data, such as healthcare, defense, and finance, prefer on-premises solutions to ensure data security and compliance with privacy regulations. Moreover, companies working with proprietary designs and intellectual property often choose on-premises storage to safeguard their assets from unauthorized access. Furthermore, on-premises solutions offer lower latency and higher performance for tasks requiring significant computational power, such as rendering high-resolution 3D models or running complex simulations.

The cloud segment is anticipated to exhibit at the fastest CAGR over the forecast period. Cloud solutions provide the flexibility to scale storage and processing power up or down based on demand, accommodating fluctuating project needs without significant upfront investment. In addition, businesses can easily expand their operations globally, accessing and managing 3D assets from anywhere with internet connectivity. Furthermore, cloud services eliminate the need for substantial upfront investments in hardware and infrastructure, converting capital expenses into predictable operational costs. Cloud platform provides real-time collaborations so that multiple users can work on the same project simultaneously, improving productivity and speeding up project timelines.

Application Insights

Based on application, the visualization segment led the market with the largest revenue share of 23.4% in 2023. High-resolution displays, such as the proliferation of 4K and 8K displays, VR headsets, and advanced projectors, enhance the visual quality of 3D assets, driving demand for high-fidelity visualizations. Moreover, improvements in rendering software enable more realistic and detailed visualizations, with better lighting, shading, and texture effects. Furthermore, VR and AR technologies provide immersive environments for viewing and interacting with 3D assets, fueling demand for realistic and interactive visualizations.Businesses use VR and AR for training, product visualization, marketing, and design reviews, necessitating high-quality 3D visualizations.

The virtual experience segment is anticipated to exhibit at the fastest CAGR over the forecast period. Enhanced VR headsets, AR glasses, and immersive input devices provide more realistic and engaging virtual experiences. Moreover, reduced costs and improved availability of VR and AR devices make these technologies more accessible to consumers and businesses. Furthermore, advances in graphics rendering, real-time simulation, and spatial audio contribute to more immersive and realistic virtual environments.Virtual workspaces and collaboration tools facilitate remote teamwork and project management, enhancing productivity and communication.

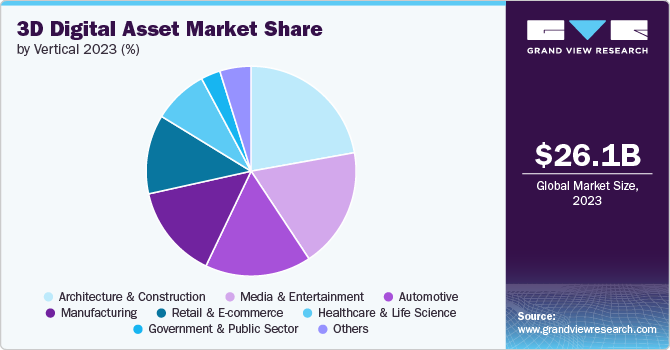

Vertical Insights

Based on vertical, the architecture & construction segment led the market with the largest revenue share of 22.18% in 2023. Improvements in rendering software enable the development of highly detailed and realistic 3D models, enhancing architectural and construction planning. Moreover, advances in real-time rendering technologies allow for interactive design reviews and immediate feedback.Building Information Modeling (BIM) technologies use 3D models to integrate various aspects of building design, including structural, mechanical, and electrical systems, improving coordination and accuracy. Furthermore, BIM supports the entire lifecycle of a building, from design through construction to maintenance, optimizing project management and facility operations.

The automotive segment is anticipated to exhibit at the fastest CAGR over the forecast period. The development of autonomous driving systems relies on 3D models for sensor integration, simulation of driving scenarios, and testing of autonomous algorithms. Automotive manufacturers use 3D visualizations to create virtual showrooms and configurators, allowing customers to explore and customize vehicles online. In addition, high-quality 3D renderings and animations are used in marketing campaigns to showcase vehicle features and designs effectively.

Regional Insights

North America dominated the 3D digital asset market with the largest revenue share of 39.6% in 2023. North America is a hub for technological innovation, with advancements in 3D modeling, rendering, and simulation technologies driving market growth. In addition, the film, television, and gaming industries in North America rely heavily on high-quality 3D assets for computer-generated imagery, special effects, and immersive experiences. Furthermore, significant investments in research and development by North American companies support the advancement of 3D asset technologies and applications.

U.S. 3D Digital Asset Market Trends

The 3D digital asset market in U.S. is anticipated to exhibit at a significant CAGR over the forecast period. The market growth in the U.S. is influenced by several factors that reflect the country’s leadership in technology, innovation, and diverse industry applications. Moreover, continued advancements in 3D modeling, rendering, and simulation technologies drive the development of more detailed and accurate digital assets.

Europe 3D Digital Asset Market Trends

The 3D digital asset market in the Europe is expected to witness at a significant CAGR over the forecast period. European automotive manufacturers use 3D modeling and simulation for design, prototyping, and manufacturing, supporting innovation and efficiency in vehicle development. In addition, the aerospace industry relies on 3D digital assets for the design and testing of aircraft and components, driving market growth.

Asia Pacific 3D Digital Asset Market Trends

The 3D digital asset market in the Asia Pacific is anticipated to register at the fastest CAGR over the forecast period. The growing gaming industry in APAC, particularly in countries like China, South Korea, and Japan, drives demand for high-quality 3D assets for game design and development. Moreover, the film and media industries use 3D assets for visual effects, animation, and immersive experiences. Furthermore, increased adoption of virtual reality (VR) and augmented reality (AR) technologies across various sectors, including education, real estate, and retail, boosts the need for detailed 3D digital assets.

Key 3D Digital Asset Company Insights

Key 3D digital asset companies include Adobe, Autodesk Inc., and echo3D, Inc. Companies active in the global market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in March 2023, Adobe collaborated with Epic Games, a game creator, to deliver a new wave of game developers with advanced Substance 3D tools. Substance Modeler and Painter would be accessible to creators through Fab, Epic Games' upcoming unified digital marketplace. The Fab platform aims to unite a vast network of artists and developers, offering a comprehensive suite of resources for digital world creation including 3D models, animations, and visual effects, all in a single location.

Key 3D Digital Asset Companies:

The following are the leading companies in the 3D digital asset market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Autodesk Inc.

- echo3D, Inc.

- Meta

- Microsoft

- NVIDIA Corporation

- Siemens

- Sony Corporation

- Trimble Inc.

- Unity Technologies

Recent Developments

-

In July 2024, NVIDIA Corporation introduced advancement in Universal Scene Description, known as OpenUSD, is set to widen its use across robotics, industrial design, and engineering, speeding up the capability of developers to create precise virtual environments for the next wave of artificial intelligence. Due to new generative AI features based on OpenUSD and development frameworks powered by NVIDIA Corporation and integrated into the NVIDIA Omniverse platform, a broader range of industries would be able to create visual applications for industrial and engineering design projects and simulate environments for advancing the development of physical AI and robotics.

-

In July 2024, Meta introduced Meta 3D Gen (3DGen). It produces high-quality 3D shapes and textures in less than a minute, incorporating support for physically based rendering (PBR). This feature is crucial for relighting 3D assets in practical real-world scenarios.

-

In June 2024, echo3D, Inc. introduced a 3D asset manager, 3D DAM. The platform included a content management system (CMS) and content delivery network (CDN) designed primarily for 3D content, alongside tools for compression, conversion, collaboration, and managing access permissions. It also features version control and reporting functionalities, in addition to providing access to a library comprising over 800,000 free 3D models.

3D Digital Asset Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.95 billion

Revenue forecast in 2030

USD 60.59 billion

Growth rate

CAGR of 13.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Adobe; Autodesk Inc.; echo3D, Inc.; Meta; Microsoft; NVIDIA Corporation; Siemens; Sony Corporation; Trimble Inc.; and Unity Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Digital Asset Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global 3D digital asset market report based on component, deployment, application, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

3D Scanners

-

Motion Capture Systems

-

-

Software

-

3D Modelling Software

-

3D Scanning Software

-

3D Animation Software

-

3D Rendering & Visualization Software

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Application Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Visualization

-

Simulation

-

Digital Prototyping

-

Gaming & Animation

-

Virtual Experience

-

Marketing & Advertising

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Architecture & Construction

-

Media & Entertainment

-

Manufacturing

-

Healthcare & Life Science

-

Retail & E-commerce

-

Automotive

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global 3D digital asset market size was estimated at USD 26.14 billion in 2023 and is expected to reach USD 28.95 billion in 2024.

b. The global 3D digital asset market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030 to reach USD 60.59 billion by 2030.

b. North America dominated the 3D digital asset market with a share of 39.6% in 2023. North America is a hub for technological innovation, with advancements in 3D modeling, rendering, and simulation technologies driving market growth. In addition, the film, television, and gaming industries in North America rely heavily on high-quality 3D assets for computer-generated imagery, special effects, and immersive experiences.

b. Some key players operating in the 3D digital asset market include Adobe; Autodesk Inc. ; echo3D, Inc.; Meta; Microsoft; NVIDIA Corporation; Siemens; Sony Corporation; Trimble Inc.; and Unity Technologies.

b. A 3D digital asset refers to a digital object created using 3D modeling software. These assets are used in various industries, including gaming, film, architecture, and product design. Various factors are driving the growth of the 3D digital asset market, such as technological advancements, growing gaming, film, and animation industries, implementation of Virtual Reality (VR) and Augmented Reality (AR).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.