- Home

- »

- Display Technologies

- »

-

4K TV Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![4K TV Market Size, Share & Trends Report]()

4K TV Market (2024 - 2030) Size, Share & Trends Analysis Report By Screen Size (Below 52 Inches, 52 To 65 Inches, Greater Than 65 Inches), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-1-68038-482-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

4K TV Market Summary

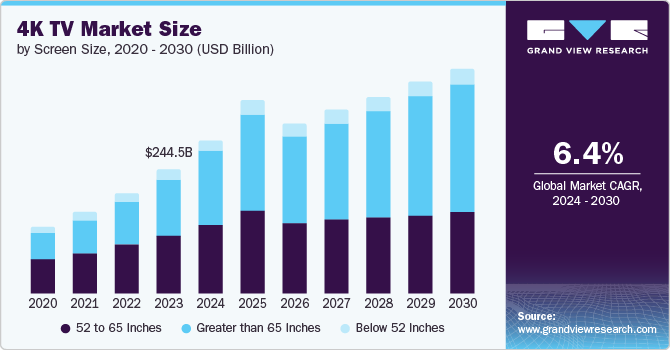

The global 4K TV market size was valued at USD 244.51 billion in 2023 and is projected to reach USD 441.63 billion by 2030, growing at a CAGR of 6.4% from 2024 to 2030. 4K TVs display pictures in four times better resolution (2160p) than full HD TVs (1080p). This enhanced pixel density results in a sharper, brighter, and more immersive display, creating a satisfying video viewing experience for consumers.

Key Market Trends & Insights

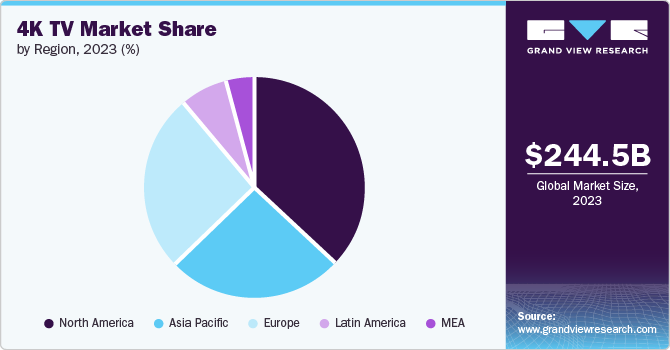

- North America held the highest revenue share of 36.8% in 2023.

- The UK witnessed a promising market share in Europe.

- Based on screen size, the 52 to 65 inches segment dominated the market with a revenue share of 47.2% in 2023.

- By screen size, the greater than 65 inches segment is anticipated to register the fastest CAGR of 9.6% during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 244.51 Billion

- 2030 Projected Market Size: USD 441.63 Billion

- CAGR (2024-2030): 6.4%

- North America: Largest market in 2023

Advancements in display technology and high production volume have resulted in significant manufacturer cost reductions in recent years. Knowing the growth opportunities and potential of this market, new players are emerging and offering products at competitive prices. It has resulted in an increased demand from a wider consumer base, leading to market growth.The availability of 4K content is steadily increasing worldwide. Streaming platforms such as Netflix and Amazon Prime, cable providers, and filmmakers offer a wider selection of 4K movies, shows, and documentaries to boost audience numbers. Companies are spending heavily on advertising campaigns to attract untapped consumers. Social media and globalization have resulted in a strong consumer base growth for high-quality content, irrespective of the country of origin and language. This rapidly growing 4K content library incentivizes consumers to upgrade their TVs to higher resolution, leading to constant market growth.

Manufacturers are investing heavily in the research and development of electronic products and launching better television models regularly to retain an edge over their competitors. For instance, in July 2024, Hisense, a prominent name in the 100-inch TV segment, introduced a ULED 100-inch TV during the UEFA EURO 2024 tournament for an enhanced soccer viewing experience. Additionally, Android-powered and other smart TVs with advanced features such as voice control enhance user convenience beyond content consumption and are being incorporated into professional applications such as telemedicine, military surveillance, and information display, making 4K TVs a more compelling value proposition.

Screen Size Insights

The 52 to 65 inches screen size segment dominated the market with a revenue share of 47.2% in 2023. This segment offers a sufficiently large screen for an immersive viewing experience to a majority of households in urban areas with smaller living spaces. These TVs use a large and practical screen size, so they can be comfortably accommodated without overwhelming the room's aesthetics. Furthermore, a wider variety of models with advanced features such as HDR and improved refresh rates are readily available in the 52 to 65 inch segment, making it a popular choice among consumers.

However, the Greater than 65 inches segment is anticipated to register the fastest CAGR of 9.6% during the forecast period, surpassing the revenue share of the 52 to 65 inches segment in this timeframe. Increasing disposable income levels and a continuous urge to upgrade to a more premium product among consumers are major drivers leading to segment growth. Furthermore, consumers' preferences regarding content consumption are changing over time, and people now enjoy watching movies and web series in the comfort of their homes instead of going out, resulting in a strong demand for bigger screens.

Regional Insights

North America held the highest revenue share of 36.8% in 2023. This sizeable share is due to a large consumer base in the region with high disposable income that can afford high-end electronics. Moreover, 4K streaming requires a stable and high-speed internet connection. A well-developed infrastructure for high-speed internet and digital media delivery facilitates seamless streaming of 4K content, a crucial element for maximizing the benefits of 4K TVs. Additionally, innovative marketing campaigns companies employ lead to further demand growth for these products among consumers.

U.S. 4K TV Market Trends

The U.S. has a well-developed streaming infrastructure, with major players such as Netflix, Hulu, and Amazon Prime Video and cable TV companies such as HBO offering a vast library of 4K content. This readily available content incentivizes consumers to upgrade to 4K TVs for an enhanced viewing experience. Additionally, the country is witnessing a thriving gaming culture, leading to a high demand for high-performance displays. 4K TVs, often compatible with the latest gaming consoles, cater to this segment, further driving market expansion.

Europe 4K TV Market Trends

Europe accounted for a considerable revenue share in 2023. Similar to North America, 4K streaming platforms such as Disney+, Netflix, and Max are offering a variety of ultra-HD content to European consumers. The high-income, early adopter population in this region demonstrates a preference for high-quality, premium electronics. 4K TVs, with their superior picture quality, address this requirement, driving significant market demand.

The UK witnessed a promising market share in Europe. A high per capita income and growing popularity of ultra-HD gaming culture have led to a surged demand for 4K TVs. For instance, the Xbox Series X and Sony PS5 support 4K streaming and provide a highly realistic gaming experience. Additionally, shifting preferences of consumers from theatres to home-based content consumption has been positively influencing the country’s market.

Asia Pacific 4K TV Market Trends

Emerging economies within Asia Pacific, particularly China and India, are experiencing significant economic growth. This translates to rising disposable incomes, creating a large and growing consumer base with high purchasing power to invest in premium electronics such as 4K TVs. A significant proliferation of local and international OTT platforms offering cost-effective subscription plans and equally affordable tariff rates for internet services has led to a large consumer base buying 4K TVs. Additionally, China is a manufacturing hub for 4K TVs, which results in shorter supply chains and enhanced affordability, leading to market growth.

India has a wide consumer base for its thriving regional cinema industry. The increasing production and availability of high-quality regional movies and shows in 4K resolution incentivizes viewers to upgrade their TVs for a more immersive experience in their preferred language. Additionally, an increasing focus of government on domestic manufacturing through policies such as production linked incentive (PLI) scheme offers fertile ground for manufacturers to upscale production and launch products at affordable prices. This confluence of factors has resulted in significant market growth.

Key 4K TV Company Insights

Some key companies involved in the 4K TV market include Samsung Electronics, Sony Corporation, and LG Electronics.

-

Samsung Electronics Co., Ltd. is a South Korean multinational consumer electronics and appliances company. It is a prominent manufacturer of TVs, Android smartphones, and electronic components such as displays, camera modules, and semiconductors required for electronics. The company holds multiple patents for its AMOLED technology incorporated in mobile and TV displays. Samsung offers a diverse range of TVs from 32 to 98 inches across HD and QHD 8K resolutions.

-

Sony Corporation is a Tokyo-based electronics company under the Sony Group. The company is well-recognized for introducing the world's first portable music player, Walkman, and the first commercial LED-backlit LCD TV in 2004. Sony sells its TVs under the brand BRAVIA and offers a range of products, such as OLED TVs, in screen sizes from below 50 to 100 inches. Moreover, they offer Android-powered and smart TVs in HD to 8K HDR resolutions, thus catering to diverse customer requirements.

Key 4K TV Companies:

The following are the leading companies in the 4K TV market. These companies collectively hold the largest market share and dictate industry trends.

- Changhong (CHiQ)

- Hisense USA (Hisense International)

- LG Electronics, Inc.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Skyworth Digital Holdings Co., Ltd.

- Sony Corporation

- VIZIO, Inc.

- Vū Technologies

Recent Developments

-

In June 2024, Samsung launched its 2024 QLED 4K TV series featuring quantum dot technology and 4K upscaling in India. The technology is expected to enhance the viewing experience for Indian consumers with high color accuracy and display contrast ratio, specifically catering to the premium gaming and 4K content watching audiences.

-

In May 2024, Sony India launched its BRAVIA 2 series of 4K Ultra HD TVs, integrated with Google TV. The TV comes with a new X1 processor, which is expected to enhance the viewing experience by offering a high contrast ratio and superior picture quality for Indian consumers. The TV is also compatible with PS5, addressing the requirements of gamers in the country.

4K TV Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 303.94 billion

Revenue Forecast in 2030

USD 441.63 billion

Growth Rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Screen size, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, China, Japan, South Korea, India, Brazil

Key companies profiled

Changhong; Hisense USA (Hisense International); LG Electronics, Inc.; Panasonic Corporation; Samsung Electronics Co., Ltd.; Sharp Corporation; Skyworth Digital Holdings Co., Ltd.; Sony Corporation; VIZIO, Inc.; Vū Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 4K TV Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 4K TV market report based on screen size and region.

-

Screen Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Below 52 inches

-

52 to 65 inches

-

Greater than 65 inches

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.