- Home

- »

- Next Generation Technologies

- »

-

5G RAN Professional Services Market, Industry Report, 2030GVR Report cover

![5G RAN Professional Services Market Size, Share & Trends Report]()

5G RAN Professional Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Consulting Services, Planning & Design Services), By Deployment Mode (On-premises, Cloud), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-572-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2019 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

5G RAN Professional Services Market Summary

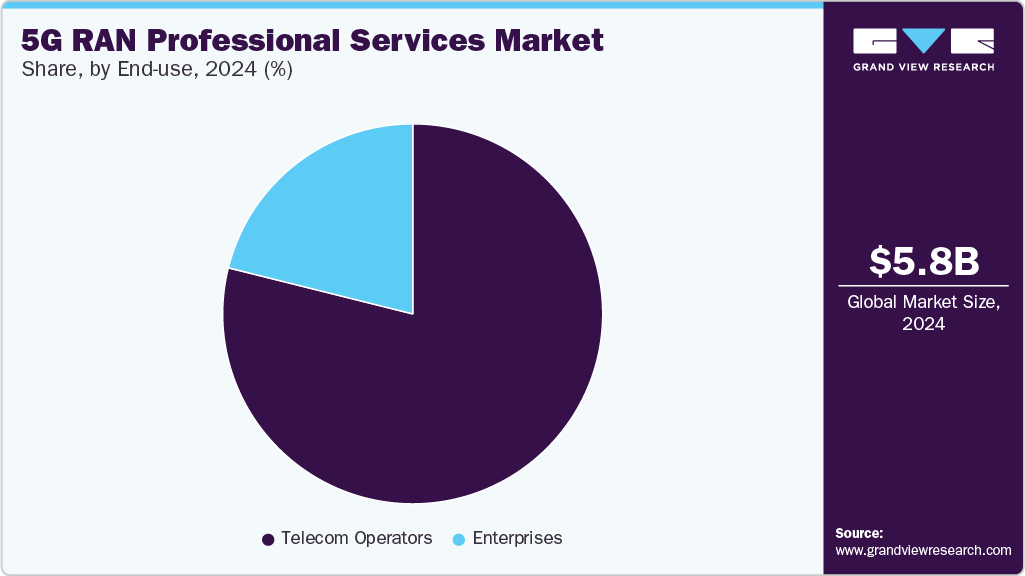

The global 5G RAN professional services market size was estimated at USD 5.84 billion in 2024 and is projected to reach USD 16.57 billion by 2030, growing at a CAGR of 17.0% from 2025 to 2030. The market is witnessing rapid growth, driven by the global rollout of 5G networks and the increasing complexity of deploying and managing next-generation radio access infrastructure.

Key Market Trends & Insights

- The Asia Pacific 5G RAN professional services market is anticipated to grow at a CAGR of 18.9% during the forecast period.

- The U.S. 5G RAN professional services market held a dominant position in 2024.

- By service type, the consulting services segment accounted for the largest share of 26.1% in 2024.

- By deployment mode, the on-premise segment is expected to grow at a significant CAGR of 15.3% during the forecast period.

- By end use, the enterprises segment is projected to grow at the fastest CAGR of 24.0% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5.84 Billion

- 2030 Projected Market Size: USD 16.57 Billion

- CAGR (2025-2030): 17.0%

- Asia Pacific: Largest market in 2024

Key drivers include the rising demand for high-speed, low-latency connectivity, growing mobile data consumption, and the proliferation of Internet of Things (IoT) devices. Telecom operators are increasingly relying on professional services for network planning, integration, optimization, and maintenance to accelerate 5G deployments and ensure quality of service. In addition, the shift toward cloud-native and virtualized network architectures is fueling demand for specialized expertise to manage complex 5G RAN environments.Technological advancements are significantly shaping the 5G RAN professional services landscape. The adoption of Open RAN, virtual RAN (vRAN), and massive MIMO technologies is transforming how networks are designed and deployed, necessitating tailored professional services to support multi-vendor ecosystems and ensure interoperability. Artificial intelligence (AI) and machine learning (ML) are also being integrated into network operations, enabling predictive maintenance, self-healing capabilities, and dynamic resource allocation. These trends are expanding the scope of professional services to include AI-driven automation, software integration, and continuous network performance tuning.

Substantial investments from both the public and private sectors are also bolstering the market. Governments across the globe are launching national 5G strategies and providing funding to accelerate infrastructure development. At the same time, telecom operators and equipment vendors are investing heavily in R&D, pilot deployments, and the development of 5G-ready services. This influx of capital is not only accelerating network rollouts but also increasing the demand for skilled service providers capable of handling complex 5G RAN integration, testing, and lifecycle management tasks across diverse geographies.

Regulatory frameworks are playing a crucial role in shaping the 5G RAN professional services market. National telecom regulators actively allocate spectrum, define network security guidelines, and set standards for network interoperability and vendor diversity, particularly in support of Open RAN. In regions such as the U.S. and Europe, regulatory policies are encouraging the use of secure, energy-efficient, and multi-vendor solutions. These efforts are creating both opportunities and challenges for professional service providers, who must navigate evolving compliance requirements while helping clients build and maintain regulatory-compliant 5G networks.

Despite its growth potential, the 5G RAN professional services market faces several constraints. A major challenge is the shortage of skilled professionals with expertise in emerging technologies such as Open RAN, edge computing, and network automation. In addition, high deployment costs, especially in rural and underserved areas, can delay projects and reduce service provider margins. Security concerns and geopolitical tensions around network infrastructure vendors may also complicate procurement and deployment processes. Lastly, the need for continuous upgrades and evolving standards can add complexity and increase long-term operational costs for service providers and their clients.

Service Type Insights

The consulting services segment accounted for the largest share of 26.1% in 2024. The growing adoption of Open RAN and disaggregated network models drives the growth of the segment as it requires deep technical and strategic consulting expertise. Since Open RAN promotes multi-vendor interoperability and a decoupled hardware-software stack, operators rely on consultants to evaluate vendor options, ensure standards compliance, and manage integration risks. Consulting firms guide telecom players through interoperability testing, systems validation, and open ecosystem alignment, helping reduce time-to-market and optimize performance across a diverse range of hardware and software components.

The deployment services segment is expected to grow at a significant CAGR during the forecast period. The accelerated rollout of 5G networks worldwide fuels the growth of the deployment services. As telecom operators race to expand their 5G coverage, they require highly specialized deployment services to install and configure new RAN equipment, including base stations, antennas, and small cells. The complexity and scale of 5G infrastructure, especially with dense urban deployments and multiple frequency bands (sub-6 GHz and mmWave), make it necessary for operators to engage professional service providers who have technical know-how and logistical capabilities to execute deployment quickly and efficiently.

Deployment Mode Insights

The cloud segment held the largest market share in 2024. The shift toward virtualization and disaggregation of network infrastructure is propelling the growth of cloud deployment in the 5G RAN professional services market. Traditional RAN systems, which are hardware-centric and vendor-locked, are being replaced by virtualized and software-defined RAN (vRAN) architectures that can be deployed on cloud platforms. This shift enables operators to decouple hardware from software, allowing for more agile, scalable, and cost-effective network deployments. Professional services are essential in this transition, as they support cloud-native design, orchestration, and management of distributed RAN components, often across multi-vendor environments.

The on-premise segment is expected to grow at a significant CAGR of 15.3% during the forecast period. The rise of private 5G networks for industrial and enterprise applications is accelerating the demand for on-premise deployments. Enterprises in sectors such as manufacturing, logistics, mining, and energy are adopting private 5G networks to support automation, real-time monitoring, and autonomous operations. These networks require localized, on-premise infrastructure to ensure ultra-low latency, minimal downtime, and seamless integration with internal systems. As a result, professional service providers are increasingly engaged to deploy and optimize customized 5G RAN solutions within enterprise premises.

End Use Insights

The telecom operators segment dominated the market in 2024. The adoption of Open RAN and multi-vendor ecosystems is pushing telecom operators to seek professional services. Open RAN introduces greater flexibility and cost-efficiency but requires interoperability across different vendors’ hardware and software components. Ensuring seamless integration in such multi-vendor environments demands specialized expertise that operators may lack in-house. Professional service providers help bridge this gap by managing vendor coordination, integration testing, and system validation, which are critical for the success of Open RAN deployments.

The enterprises segment is projected to grow at the fastest CAGR of 24.0% over the forecast period. The digital transformation initiatives being pursued by enterprises globally contribute to the growth of 5G RAN professional services. Companies are modernizing their IT and operational technology infrastructures to gain competitive advantages, boost productivity, and support innovation. 5G is a key enabler of this transformation by providing the high-speed, low-latency connectivity needed to support automation, AI, and IoT platforms. Professional services help enterprises assess network requirements, develop deployment roadmaps, and implement scalable 5G RAN solutions that align with their digital goals.

Regional Insights

The North America 5G RAN professional services market held a significant share in 2024. The growth in the region is driven by early adoption of 5G technologies, strong investment from telecom operators, and widespread enterprise digitalization. The region benefits from a mature telecom infrastructure and a high concentration of technology companies that demand customized and advanced network solutions. There is increasing demand for services related to RAN virtualization, network optimization, and private 5G deployment across industrial sectors.

U.S. 5G RAN Professional Services Market Trends

The U.S. 5G RAN professional services market held a dominant position in 2024 due to the aggressive 5G rollouts by major carriers such as Verizon, AT&T, and T-Mobile, all of whom rely on professional services for RAN deployment and management. The presence of leading technology firms and a strong push for private 5G networks in industries such as manufacturing, logistics, and healthcare is fueling demand for professional services.

Europe 5G RAN Professional Market Trends

The Europe 5G RAN professional services market was identified as a lucrative region in 2024. A coordinated regulatory approach and substantial investments from both public and private sectors characterize European market. Operators across the region are accelerating deployments to meet EU connectivity targets, driving demand for deployment, testing, and integration services. There is also growing interest in Open RAN frameworks and green network initiatives, encouraging operators to engage with professional services firms for sustainable and future-ready network design.

5G RAN professional services market in the UK is expected to grow rapidly in the coming years due to the competitive telecom landscape and government-backed initiatives to support nationwide 5G coverage. Enterprises in sectors such as transportation, public safety, and finance are actively exploring private 5G networks, increasing demand for customized RAN planning, deployment, and optimization services.

Germany 5G RAN professional services market held a substantial market share in 2024. The market is advancing rapidly, driven by strong industrial demand for private networks and Industry 4.0 applications. The country’s emphasis on manufacturing and logistics efficiency has accelerated the deployment of on-premise 5G RAN infrastructure, requiring expert professional services.

Asia Pacific 5G RAN Professional Services Market Trends

The Asia Pacific 5G RAN professional services market is anticipated to grow at a CAGR of 18.9% during the forecast period. The growth of the market in the region is driven by large-scale infrastructure development, rapid urbanization, and digital transformation across various industries. Governments across the region are investing in nationwide 5G coverage and smart city initiatives, creating strong demand for RAN deployment and system integration services. The region's diverse market conditions, from advanced economies to emerging markets, offer a wide range of service opportunities.

Japan 5G RAN professional services market is growing steadily, supported by early 5G adoption and a strong focus on technological innovation. Major telecom operators are deploying advanced RAN technologies to support applications in robotics, IoT, and smart manufacturing, driving demand for deployment and network engineering services. Japan's proactive stance on Open RAN adoption has also opened new avenues for professional services related to vendor-neutral network integration.

5G RAN professional services market in China held a substantial market share in 2024. The government's extensive support for 5G infrastructure development, including subsidies and policy incentives, has created strong momentum for service providers. Chinese operators are investing in next-generation RAN technologies and are increasingly engaging with professional services firms for network optimization, energy efficiency planning, and maintenance.

Key 5G RAN Professional Services Company Insights

Some of the key companies in the 5G RAN professional services market include Nokia Corporation, Infovista, Intel Corporation., Dell EMC, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Nokia Corporation is a provider of telecommunications infrastructure and services, playing a pivotal role in the 5G RAN professional services market. Leveraging its extensive portfolio of radio access technologies and expertise in network planning and deployment, Nokia offers a comprehensive suite of services including 5G RAN design, site acquisition, network integration, optimization, and lifecycle management. The company also offers Open RAN and cloud-native architecture, enabling operators to build more flexible and vendor-neutral 5G networks. Through its "AnyRAN" approach and use of artificial intelligence for network automation and self-optimization, Nokia supports operators in accelerating 5G rollouts and enhancing network performance.

-

Intel Corporation plays a strategic and enabling role in the 5G RAN professional services market through its leadership in silicon innovation and network virtualization technologies. While not a traditional telecom equipment vendor, Intel provides the foundational hardware and software platforms, such as Intel Xeon processors, FlexRAN reference architecture, and advanced FPGAs, that power virtualized and Open RAN infrastructures. These technologies support telecom operators and network integrators in deploying flexible, software-defined 5G RAN solutions.

Key 5G RAN Professional Services Companies:

The following are the leading companies in the 5G RAN professional services market. These companies collectively hold the largest market share and dictate industry trends.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Infovista

- Tech Mahindra

- Tata Consultancy Services

- Nominos USA Inc

- Link Consulting Services

- GRANDMETRIC

- Dell EMC

- Intel Corporation

Recent Developments

-

In April 2025, Nokia extended its long-term strategic collaboration with T-Mobile US through a multi-year agreement aimed at enhancing and expanding the carrier’s nationwide 5G network coverage and capacity. As part of the deal, Nokia will supply its cutting-edge AirScale RAN solutions, including the latest Levante Ultra-Performance baseband units and Habrok Massive MIMO radios, both powered by energy-efficient ReefShark System-on-Chip (SoC) technology. This initiative is designed to improve the efficiency, performance, and reliability of T-Mobile’s 5G network, which already serves over 98% of the U.S. population.

-

In February 2025, Bell Canada expanded its 5G network partnership with Nokia to deploy Nokia’s Cloud RAN (Radio Access Network) solution and lay the foundation for future Open RAN integration. This multi-year agreement includes the rollout of Nokia’s Cloud RAN software and Open Fronthaul-compatible radios. It enables Bell to transition its network architecture while enhancing agility, scalability, and vendor diversity. The deployment leverages Nokia’s AirScale portfolio combined with Red Hat OpenShift’s cloud-native platform and Dell PowerEdge servers installed at cell sites and data centers to provide the processing power and reliability required for demanding 5G workloads.

5G RAN Professional Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.55 billion

Revenue forecast in 2030

USD 16.57 billion

Growth rate

CAGR of 17.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2019 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report deployment mode

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, deployment mode, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

Telefonaktiebolaget LM Ericsson; Nokia Corporation; Infovista; Tech Mahindra; Tata Consultancy Services; Nominos USA Inc; Link Consulting Services; GRANDMETRIC; Dell EMC; Intel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

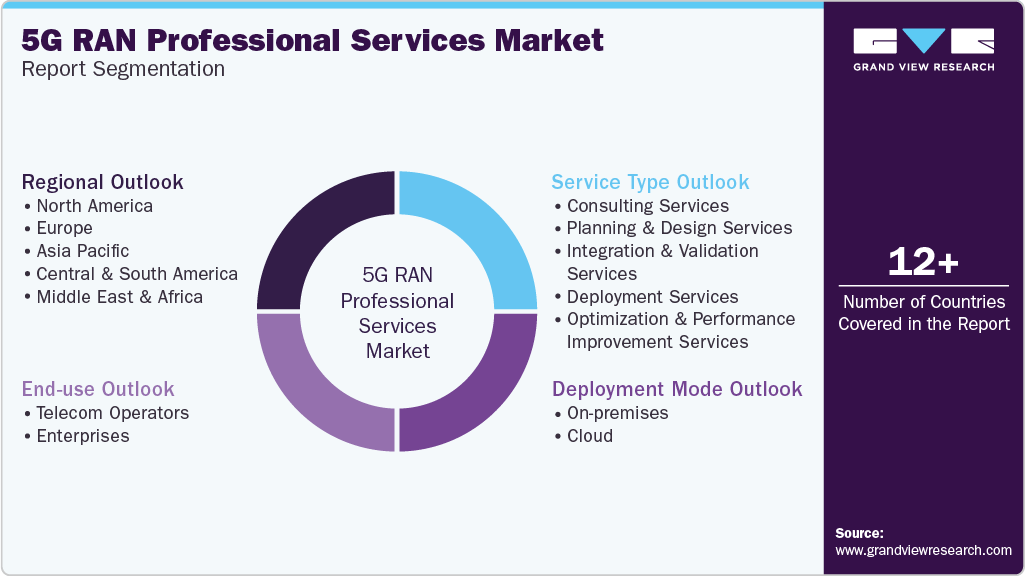

Global 5G RAN Professional Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global 5G RAN professional services market report based on service type, deployment mode, end use, and region.

-

Service Type Outlook (Revenue, USD Billion, 2019 - 2030)

-

Consulting Services

-

Planning & Design Services

-

Integration & Validation Services

-

Deployment Services

-

Optimization & Performance Improvement Services

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2019 - 2030)

-

On-premises

-

Cloud

-

-

End Use Outlook (Revenue, USD Billion, 2019 - 2030)

-

Telecom Operators

-

Enterprises

-

-

Regional Outlook (Revenue, USD Billion, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G RAN professional services market size was estimated at USD 5.84 billion in 2024 and is expected to reach USD 7.55 billion in 2025.

b. The global 5G RAN professional services market size is expected to grow at a significant CAGR of 17.0% to reach USD 16.57 billion in 2030.

b. Asia Pacific held the largest market share of 41.6% in 2024 due to large-scale infrastructure development, rapid urbanization, and digital transformation across various industries.

b. Some key players operating in the 5G RAN professional services market include Telefonaktiebolaget LM Ericsson; Nokia Corporation; Infovista; Tech Mahindra; Tata Consultancy Services; Nominos USA Inc; Link Consulting Services; GRANDMETRIC; Dell EMC; Intel Corporation.

b. The 5G RAN professional services market is witnessing rapid growth, driven by the global rollout of 5G networks and the increasing complexity of deploying and managing next-generation radio access infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.