- Home

- »

- Medical Devices

- »

-

Ablation Catheters Market Size, Share & Trends Report, 2030GVR Report cover

![Ablation Catheters Market Size, Share & Trends Report]()

Ablation Catheters Market (2024 - 2030) Size, Share & Trends Analysis Report By Ablation Catheters Market, By Type (Radiofrequency (RF) Ablation, Cryoablation, Pulse Field Ablation), End Use (Inpatient Facilities, Outpatient Facilities), And Segment Forecasts

- Report ID: GVR-4-68040-390-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ablation Catheters Market Summary

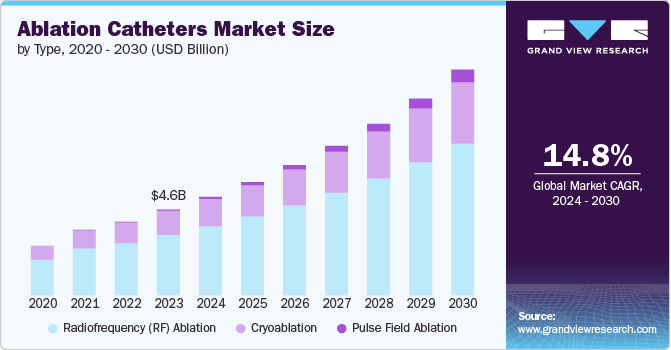

The global ablation catheters market size was estimated at USD 4.6 billion in 2023 and is projected to reach USD 12.1 billion by 2030, growing at a CAGR of 14.8% from 2024 to 2030. The global increase in cardiovascular diseases, especially arrhythmias, is a primary driver of the ablation catheters market.

Key Market Trends & Insights

- North America ablation catheters market dominated the overall global market and accounted for the 48.3 %revenue share in 2023.

- Ablation catheters market in the U.S. held a significant share of the North America market in 2023.

- By type, the radiofrequency (RF) ablation segment held the largest share of 70.7% in 2023.

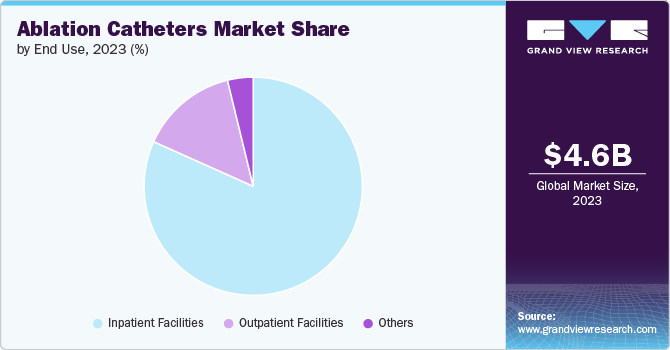

- By end use, the inpatient facilities segment held the largest share of 81.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.6 Billion

- 2030 Projected Market Size: USD 12.1 Billion

- CAGR (2024-2030): 14.8%

- North America: Largest market in 2023

For instance, as per the reports published by the National Library of Medicine in June 2023, the anticipated prevalence of arrhythmias in the general population was projected to range between 1.5% and 5%. Among these cardiac irregularities, atrial fibrillation emerges as the most common subtype. Moreover, as per reports published by CDC, the prevalence of atrial fibrillation in the U.S. is likely to reach around 12.1 million individuals by 2030. Conditions like atrial fibrillation, which affect millions worldwide, necessitate effective and minimally invasive treatment options. Ablation catheters, used to selectively destroy abnormal cardiac tissue, offer a solution with higher success rates and fewer complications compared to traditional methods. As awareness of these conditions and their potential complications rises, so does the demand for reliable, efficient treatments, thereby propelling the market for ablation catheters.

The ablation catheters market is significantly influenced by rapid technological advancements.Persistent technological progress fosters the evolution of increasingly sophisticated ablation catheters, such as high-resolution mapping systems, advanced catheters, and precision-focused ablation technologies. These innovations collectively elevate the precision and efficacy of diagnostic and therapeutic procedures within the field.For instance, in November 2023, Medtronic received CE Mark approval for its cutting-edge pulsed field and cryoablation technologies—Nitron CryoConsole and PulseSelect Pulsed Field Ablation System. This regulatory milestone showcases a significant stride in advancing the therapeutic landscape for atrial fibrillation treatment. The PulseSelect System has been strategically engineered to provide a highly effective, efficient, and safe treatment for atrial fibrillation. This innovative system incorporates a novel ablation modality utilizing pulsed electric fields to isolate the pulmonary veins. It was integrated into the Medtronic Pulsed Field Ablation (PFA) portfolio after European approval of the Affera Mapping and Ablation System. This strategic move solidifies Medtronic's unique position in the market as the sole provider offering both single-shot and focal PFA options, catering to diverse patient and clinician requirements.

Moreover, the inefficacy of specific pharmacological interventions has significantly driven the expansion of the ablation catheter market. Traditional medications often yield suboptimal outcomes in addressing complex cardiovascular and arrhythmia-related conditions, prompting healthcare providers and patients to turn to alternative modalities such as ablation catheters. Patients with intricate arrhythmias or heart rhythm disorders may not respond adequately to pharmacological treatments, increasing the demand for advanced and targeted therapeutic options. Ablation catheters play a crucial role in diagnosing and treating these conditions by offering precise mapping and ablation capabilities. In cases where conventional medications fail to deliver effective results or cause undesirable side effects, ablation catheter procedures provide a more tailored and effective approach to managing cardiac arrhythmias.

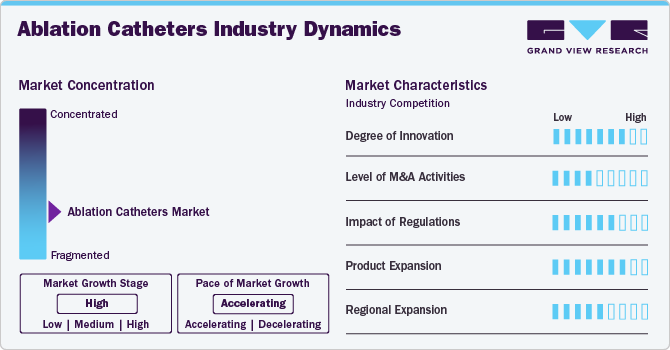

Market Concentration & Characteristics

The ablation catheters market exhibits a high degree of innovation, driven by advancements in technology and procedural techniques. Innovations include the development of high-resolution mapping systems, catheters with improved maneuverability and precision, and the integration of novel ablation modalities such as cryoablation and pulsed field ablation. These advancements enhance the efficacy, safety, and versatility of ablation procedures, catering to the evolving needs of healthcare providers and improving outcomes for patients with cardiac arrhythmias.

Regulations play a critical role in shaping the ablation catheters market by ensuring the safety, efficacy, and quality of devices. Regulatory bodies like the FDA in the United States and the CE Mark in Europe set standards for device approval, clinical trials, and manufacturing practices. Compliance with these regulations is essential for market entry and maintaining product quality, which influences innovation cycles and market competitiveness. Regulatory changes can impact market dynamics, affecting product development timelines and market access strategies for manufacturers.

The ablation catheters market has seen moderate levels of mergers and acquisitions (M&A) activity. Key players frequently engage in strategic acquisitions to expand their product portfolios, enhance technological capabilities, and gain market share. For instance, in November 2022, Boston Scientific Corporation finalized its acquisition of Obsidio, Inc., a medical technology firm. This strategic acquisition aimed to enhance Boston Scientific's portfolio of cardiac devices. These activities aim to capitalize on synergies, consolidate market position, and accelerate innovation in minimally invasive therapies for cardiac arrhythmias, driving growth and competitiveness within the sector.

Product expansion in the ablation catheters market involves the introduction of innovative technologies such as advanced mapping systems, precision-guided catheters, and novel ablation modalities like cryoablation and pulsed field ablation. For instance, in March 2022, Siemens Healthineers AG introduced the AcuNav Volume 4D ICE catheter in the U.S., marking a significant advancement in its imaging technologies for structural heart and electrophysiology procedures. Companies continually innovate to improve procedural efficacy, patient outcomes, and safety profiles. These expansions cater to the growing demand for minimally invasive treatments for cardiac arrhythmias, driving market growth and competitiveness.

Global expansion in the ablation catheters market involves expanding market presence across regions through strategic partnerships, market entry initiatives, and regulatory approvals. Companies aim to leverage their technological expertise in cardiac arrhythmia treatments to penetrate emerging markets and strengthen footholds in established ones. This expansion strategy focuses on addressing regional healthcare needs, enhancing patient access to advanced ablation technologies, and capitalizing on global demand for minimally invasive solutions, thereby driving overall market growth and competitiveness.

Type Insights

The radiofrequency (RF) ablation segment held the largest share of 70.7% in 2023, driven by rapid technological advancements and increasing demand for minimally invasive treatment options. These catheters play a crucial role in treating cardiac arrhythmias such as atrial fibrillation and ventricular tachycardia by delivering targeted heat energy to the abnormal heart tissue, thereby restoring normal rhythm. With a rising prevalence of cardiovascular diseases globally, coupled with the growing elderly population, there is a growing need for efficient and precise treatment modalities, which is fueling the adoption of RF ablation catheters. For instance, in October 2022, Biosense Webster, Inc., a division of Johnson & Johnson MedTech, introduced the HELIOSTAR Balloon Ablation Catheter in Europe. This marks the debut of the first RF balloon ablation catheter. The HELIOSTAR Balloon Ablation Catheter is intended for catheter-based cardiac electrophysiological mapping of the atria, including stimulating and recording functions. Moreover, when utilized with a compatible multichannel RF generator, it facilitates cardiac ablation procedures.

The pulse field ablation is projected to grow fastest in the coming years, due to increasing demand for innovative treatment options for cardiac arrhythmias and technological advancements in the field. Pulse field ablation catheters have emerged as a promising alternative to traditional ablation techniques by utilizing pulsed electric fields to create precise lesions on cardiac tissue. These catheters hold immense potential in treating atrial fibrillation and ventricular tachycardia, providing physicians with a highly efficient and targeted means of restoring normal heart rhythm. For instance, in January 2024, Abbott initiated the first human procedures utilizing its new Volt system in conjunction with its EnSite X cardiac mapping platform. These procedures are part of a clinical study involving over 30 patients in Australia. These strategic initiatives are anticipated to boost the segment over the forecast period.

End Use Insights

The inpatient facilities segment held the largest share of 81.7% in 2023due to advancements in cardiac care and a rapidly aging population. This growth is driven by the increasing prevalence of arrhythmias and cardiac conditions requiring specialized treatment. As a result, the inpatient facilities market focusing on electrophysiology is expanding rapidly, with hospitals and healthcare organizations investing in advanced equipment & skilled personnel to meet the rising demand for these specialized services.

Healthcare organizations are investing in both facility expansion and comprehensive training initiatives to meet the growing need for quality care and expertise in electrophysiology across diverse patient populations. For example, programs such as the Clinical Cardiac Electrophysiology Fellowship at Brigham and Women's Hospital and West Roxbury Veteran’s Administration Medical Center, along with EHRA Training Fellowships, offer specialized training opportunities for physicians in clinical electrophysiology, fostering expertise development within the field.

The outpatient facilities segment is expected to grow at a significant rate over the forecast period. These outpatient centers offer specialized diagnostic testing, consultations, and minimally invasive procedures. The integration of cutting-edge technology in outpatient settings enhances accessibility and efficiency, providing patients with timely & comprehensive care. Healthcare facilities are increasingly incorporating outpatient services alongside traditional inpatient settings, ensuring patients have access to high-quality cardiac care across diverse healthcare settings.

Regional Insights

North America ablation catheters market dominated the overall global market and accounted for the 48.3 %revenue share in 2023. North America shoulders a substantial burden of cardiovascular diseases (CVDs) such as Heart Failure (HF), cardiac arrest, and cardiac arrhythmias, primarily due to factors like unhealthy lifestyles, smoking, and an aging population. The rising prevalence of these conditions drives demand for ablation catheters used in diagnosis and treatment. North America benefits from well-established healthcare systems with comprehensive insurance coverage for various medical procedures involving ablation catheters. This financial support enhances patient accessibility to treatments, thereby stimulating market growth. Early detection and intervention for CVDs are pivotal for better patient outcomes, with ablation catheters playing a crucial role in early diagnosis through tools like cardiac mapping and electrophysiological testing, further bolstering market expansion.

U.S. Ablation Catheters Market Trends

Ablation catheters market in the U.S. held a significant share of the North America market in 2023. The U.S. faces a high prevalence of cardiovascular diseases (CVDs), particularly coronary artery disease and Heart Failure (HF). These conditions necessitate interventions facilitated by ablation catheters. According to data from the American Heart Association in 2018, over 130 million adults in the U.S. are projected to suffer from heart-related diseases by 2035, driven by lifestyle changes, obesity, and smoking rates. These factors are expected to drive market growth. New product launches address unmet needs in the ablation catheter market, such as advanced mapping systems, precision-focused catheters, and implantable devices with enhanced longevity and performance. By introducing innovative solutions like Abbott Laboratories' TactiFlex ablation catheter launched in May 2023, which targets paroxysmal Atrial Fibrillation (AFib) and typical atrial flutter with sensor-enabled heat energy delivery, companies aim to capture market share and stimulate growth in the U.S. ablation catheter market.

Europe Ablation Catheters Market Trends

The Europe ablation catheters market is experiencing notable growth. riven by companies securing product approvals that expand their portfolios of ablation catheters for healthcare providers and patients. Approved devices are favored by healthcare professionals, leading to increased market share and revenue in the ablation catheter market. For example, in February 2023, Abbott announced European approvals for its TactiFlex ablation catheter, a sensor-enabled device for treating abnormal heart rhythms. The launch of TactiFlex in Europe, initially in the UK and Germany, underscores its strategic introduction and potential impact on market dynamics.

The UK ablation catheters market is one of the major markets in the region. The growing aging population in the country has contributed to the increased demand for ablation catheters. According to the Office for National Statistics in the UK, 3.3 million people aged 65 years and over were living in Wales and England in 2021. There is a rising preference in the UK for minimally invasive ablation catheter procedures over traditional interventions. This trend towards less invasive procedures is driving growth in the market for ablation catheters used in these treatments.

Ablation catheters market in Germany is witnessing notable growth.According to data from the latest Deutscher Herzbericht 2022, there were 121,172 fatalities attributed to coronary heart diseases (CHDs) in Germany in 2021, with 45,181 of these cases resulting from acute heart attacks. Consequently, the mortality rate for CHDs stood at 129.7 deaths per 100,000 inhabitants. As a result, there has been an increasing demand for ablation catheters in Germany, particularly those used for catheter ablation and other minimally invasive procedures. Additionally, advancements in technology and the introduction of new ablation catheter devices have further fueled market growth in the country.

Asia Pacific Ablation Catheters Market Trends

The Asia Pacific ablation catheters marketis experiencing robust growth. The region's growth is driven by factors such as a significant geriatric population, increasing incidence of heart diseases, and unmet clinical needs. Additionally, improvements in healthcare infrastructure, rising patient awareness, and higher healthcare spending levels are expected to enable manufacturers to capitalize on these opportunities. Rapid advancements in healthcare infrastructure and rising disposable incomes in emerging economies like India and China are projected to drive demand for ablation catheter systems. Furthermore, technological advancements within the region further contribute to the market's expansion.

Ablation catheters market in China is expanding notably. Prevalence of cardiac arrhythmias in China is increasing due to factors such as an aging population, sedentary lifestyles, and rising rates of obesity and hypertension. For instance, atrial fibrillation (AFib), one of the most common cardiac arrhythmias, is on the rise in China. This rising disease burden is driving the demand for ablation catheters for diagnosis and treatment.

The Japan ablation catheters market is expanding significantly. Japan has one of the most rapidly aging populations globally. In September 2022, Japan’s population declined by 820,000, while the number of seniors aged 65 years and older increased by 60,000, reaching a record total of 36.27 million individuals. This surge in the senior population marked a 0.03% increase from 2021, representing the highest growth rate recorded thus far. As people age, they become more susceptible to cardiac arrhythmias and other heart-related conditions. This demographic trend is a significant driver for the ablation catheter market, as the growing number of elderly individuals increases the demand for treatments addressing cardiac arrhythmias.

Latin America Ablation Catheters Market Trends

The Latin Americaablation catheters market is growing. A study published in the European Heart Journal in August 2022 provided insights into the incidence and mortality rates of cardiovascular diseases (CVD) across various countries in Latin America. The study highlighted variations in CVD burden, with different countries experiencing different levels of incidence and mortality. Brazil exhibited the highest incidence of CVD at 3.86 per 1000 person-years, indicating a significant prevalence of the disease.

Ablation catheters market in Brazil is notably expanding owing to the prevalence of cardiovascular diseases. Many countries in the MEA region are increasing their healthcare expenditure to improve healthcare access and quality. Higher healthcare spending creates opportunities for investment in advanced medical technologies, including ablation catheters, to meet the needs of patients with cardiovascular diseases (CVDs), further driving market growth. Certain countries in the MEA region, such as the UAE and Saudi Arabia, are emerging as medical tourism destinations, attracting patients from neighboring countries and beyond for specialized medical treatments, including cardiac care. The availability of advanced ablation catheters and expertise in these countries contributes to market growth.

MEA Ablation Catheters Market Trends

The ablation catheters market in MEA is experiencing growthdriven by the increasing geriatric population, rising prevalence of cancer, and the growing demand for early disease diagnosis. MEA is a key economic and technologically advanced region with a high per capita disposable income. Favorable government initiatives to increase reimbursement coverage are key factors expected to boost market growth during the forecast period. Moreover, the Gulf Corporation Council (GCC) is growing at a rapid pace, indicating the development of technologically advanced medical devices and healthcare infrastructure. The United Arab Emirates (UAE), Saudi Arabia, and Qatar are the three largest medical device markets in this region.

Ablation catheters market in Saudi Arabia is expanding rapidly. Atrial fibrillation (AFib) is a key driver of the ablation catheter market in Saudi Arabia due to its high prevalence, associated complications, advancements in treatment options, increasing awareness, and government support for healthcare initiatives. These factors contribute to the growing demand for ablation catheters used in the management of AFib in Saudi Arabia.

Key Ablation Catheters Company Insights

The competitive scenario in the ablation catheters market is highly competitive, with key players such as Abbott; Boston Scientific Corporation; JnJ (Biosense Webster); Medtronic; Biotronik SE & Co. KG; Imricor; CardioFocus; MicroPort Scientific Corporation holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Ablation Catheters Companies:

The following are the leading companies in the ablation catheters market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Boston Scientific Corporation

- JnJ (Biosense Webster)

- Medtronic

- Biotronik SE & Co. KG

- Imricor

- CardioFocus

- MicroPort Scientific Corporation.

Recent Developments

-

in February 2024, Biosense Webster, Inc., received European CE mark approval for its VARIPULSE Platform, which is intended for treating symptomatic drug-refractory recurrent paroxysmal atrial fibrillation using pulse field ablation. This platform includes the VARIPULSE Catheter, the TRUPULSE Generator, and the CARTO 3 System, offering an integrated pulse field ablation solution with real-time visualization and feedback.

-

In August 2023, Boston Scientific Corporation secured approval from the U.S. FDA for its POLARx Cryoablation System. This system, designed for treating patients with paroxysmal atrial fibrillation includes the POLARx FIT Cryoablation Balloon Catheter.

-

In August 2023, Medtronic announced the availability of an updated ClosureFast RF ablation catheter with a reduced 6F profile in the U.S., after receiving clearance from the U.S. FDA. The ClosureFast procedure aims to address Chronic Venous Insufficiency (CVI), a progressive condition affecting leg veins responsible for blood return to the heart. It is estimated that around 30 million individuals in the U.S. are affected by CVI.

Ablation Catheters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.3 billion

Revenue forecast in 2030

USD 12.1 billion

Growth rate

CAGR of 14.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Mexico; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Boston Scientific Corporation; JnJ (Biosense Webster); Medtronic; Biotronik SE & Co. KG; Imricor; CardioFocus; MicroPort Scientific Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ablation Catheters Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the ablation catheters market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiofrequency (RF) Ablation

-

Cryoablation

-

Pulse Field Ablation

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Inpatient Facilities

-

Outpatient Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ablation catheters market size was estimated at USD 4.6 billion in 2023 and is expected to reach USD 5.3 billion in 2024.

b. The global ablation catheters market is expected to grow at a compound annual growth rate of 14.8% from 2024 to 2030 to reach USD 12.1 billion by 2030.

b. North America ablation catheters market dominated the overall global market and accounted for the 48.3 %revenue share in 2023. North America benefits from well-established healthcare systems with comprehensive insurance coverage for various medical procedures involving ablation catheters.

b. Some key players operating in the Ablation Catheters include Abbott; Boston Scientific Corporation; JnJ (Biosense Webster); Medtronic; Biotronik SE & Co. KG; Imricor; CardioFocus; MicroPort Scientific Corporation.

b. The global increase in cardiovascular diseases, especially arrhythmias, is a primary driver of the ablation catheters market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.