- Home

- »

- HVAC & Construction

- »

-

Abrasive Blasting Nozzle Market Size & Share Report, 2030GVR Report cover

![Abrasive Blasting Nozzle Market Size, Share & Trends Report]()

Abrasive Blasting Nozzle Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Venturi Nozzle, Straight Bore Nozzle, Wide Throat Nozzle, Others), By Material, By Bore Size, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-910-4

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Abrasive Blasting Nozzle Market Trends

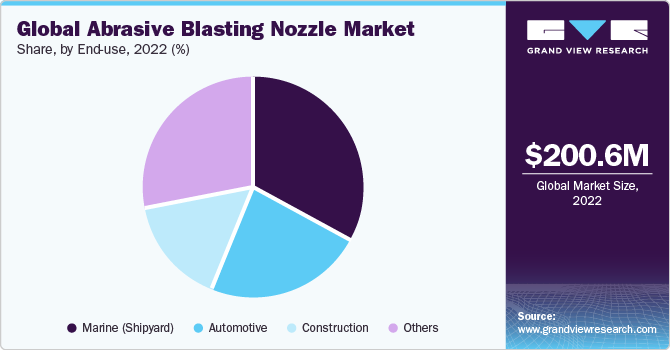

The global abrasive blasting nozzle market size was valued at USD 200.6 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. The continued steady growth can be attributed to the rising demand for abrasive blasting machines across various industries, such as automotive, industrial, and marine. The need to select an appropriate nozzle to achieve the desired results efficiently is expected to contribute to the growth. Abrasive blasting is critical in several applications, such as removing paint and rust from metal machinery. These nozzles are available in various configurations and lengths and are designed to cater to different requirements. Appropriate nozzle selection depends on the overall task to be performed, the surface to be cleaned, the volume of available compressed air, and the abrasive to be used.

Catering to such complex requirements necessitates a suitable nozzle to obtain the desired results. Abrasive blasting nozzles form a critical part of sandblasting machines. The rising demand for abrasive blasting machines for performing surface preparation, restoration, and graffiti removal drives the demand for blast nozzles. Continued adoption of blasting machines that can be operated using a remote control to abide by the operator guidelines drafted by the Occupational Safety and Health Administration (OSHA) is a major trend driving market growth.

A blasting nozzle plays a crucial role in the mechanical control of the blasting system. It helps optimize the utilization of abrasives, achieve appropriate blasting patterns, and use compressed air efficiently. Hence, manufacturers strongly emphasize regular and upfront equipment checking to ensure smooth operations and avoid undesired downtimes. This, in turn, helps reduce the overall prices and greatly benefits the end-users. Long nozzles are usually preferred over shorter ones unless the task involves accessing tight spaces.

Although the structure of an abrasive blasting nozzle is rudimentary, industry players have introduced innovative design techniques for optimizing the acoustics performance and productivity of blasting nozzles. They are making design enhancements to offer improved coating removal, ensure energy-efficient operations, and reduce noise emissions by around 15-30 dB compared to the existing nozzles. Such designs would prove instrumental in significant energy and labor cost savings. Sales are expected to increase, as these nozzles are employed for blasting operations in commercial and defense applications.

The COVID-19 pandemic impacted the market for abrasive blasting nozzle significantly. During the early stages of the pandemic, many manufacturing facilities and supply chains experienced temporary shutdowns or disruptions due to lockdown measures and restrictions. This led to delays in production and affected the availability of abrasive blasting nozzles in the market. The pandemic significantly impacted various industries, such as automotive, aerospace, and construction.

However, the pandemic also highlighted the importance of workplace safety and health measures. As a result, there was a greater emphasis on personal protective equipment (PPE) and adherence to safety protocols. This led to an increase in the demand for nozzles designed to improve worker safety, such as those with enhanced dust suppression features.

End-use Insights

The marine (shipyard) segment held the largest revenue share of 33.3% in 2022. The marine industry is increasingly utilizing abrasive blasting machines for surface treatment and ship rust removal. Industry participants focus on employing dust-less blasting in marine applications to ensure efficient ship maintenance, restoration, and ship cleaning. As a result, the demand in the marine industry has increased considerably, and the trend is expected to continue over the forecast period.

The construction segment is expected to expand at a significant CAGR of 6.0% over the forecast period. The demand for abrasive blasting machines in the construction sector is growing continuously, as construction and infrastructure development activities are being aggressively pursued worldwide. The requirement of these machines in woodwork applications, along with surface blasting of rough walls, is especially high. Municipal corporations use these machines extensively to remove graffiti from walls and other surfaces, thereby driving the segment's growth.

Type Insights

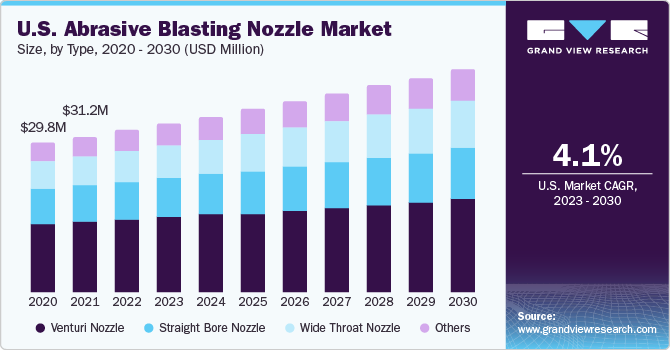

Based on type, the global market has been segmented into venturi nozzle, straight bore nozzle, wide throat nozzle, and others. The venturi nozzle segment held the highest market share of 45.3% in 2022. This is the abrasive blasting industry's most widely used and preferred nozzle type. They are majorly used for cleaning large surfaces. They are available in various variants, including mainly short venturi, long venturi, and double venturi.

The wide throat nozzle segment is estimated to register the fastest CAGR of 6.2% over the forecast period. This type of nozzle is an enhanced version of the long venturi-style nozzle. It features ample entry space (throat) and a large-sized exit bore. When matched with the same-sized hose, this nozzle type can increase the productivity by approximately 15%, compared to those with a smaller throat. It can also be used at higher pressures to yield a 60% larger pattern with lesser abrasive usage if equipped with a larger diverging exit bore.

Regional Insights

Asia Pacific held the largest market share of 37.3% in 2022, majorly due to the rapid growth of the construction industry in the region. It is also expected to emerge as the fastest-growing market over the forecast period, as construction activities are aggressively pursued in countries such as China, India, and South East Asian economies. The growing demand for abrasive blasting machines in critical end-use industries, such as automotive and aerospace, as well as industrial applications, is projected to further contribute toward the growth of the regional market over the forecast period.

On the other hand, the Middle East & Africa region is projected to demonstrate expansion at a significant CAGR of 5.3% over the forecast period. The MEA region has been experiencing significant industrial growth in sectors such as oil and gas, construction, manufacturing, and infrastructural development. These industries often require abrasive blasting for cleaning, surface preparation, and maintenance. As industrial activities increase, the demand for abrasive blasting nozzles rises.

Material Insights

The carbide tips segment dominated the market with the highest revenue share of 55.6% in 2022. Carbide nozzles are preferred over their counterparts, owing to benefits such as cost-effectiveness and durability that they can offer over other materials. The carbide tips segment has been further classified into tungsten carbide, boron carbide, and silicon carbide. Carbide tips offer excellent precision and control during abrasive blasting operations. Their sharp cutting edges allow for accurate targeting and removal of specific areas, ensuring selective surface treatment and minimal material loss. This precision helps achieve desired surface finishes and improves the overall blasting efficiency.

The steel tips segment is anticipated to witness substantial growth and is projected to expand at a CAGR of 5.9% over the forecast period. Steel tips are most commonly used with siphon sandblaster units. Owing to lesser pressure, the nozzle is subjected to lower amount of wear as compared to other high-pressure nozzles. Moreover, they have high cleaning efficiency due to their angular shape and hardness. They can effectively remove coatings, rust, and contaminants from various surfaces, including metal, concrete, and wood.

Bore Size Insights

Based on the bore size, the market has been segmented into 5/16 inch, 3/8 inch, 7/16 inch, and others. The 3/8-inch segment held the largest revenue share of 35.7% in 2022. 3/8 inch is the most commonly used bore size for producing an effective blast pressure with a 185 CFM compressor. The selection of a nozzle with an appropriate bore size depends on the nature of the application. For instance, a tighter blast pattern would require a nozzle with a smaller bore size, whereas applications involving larger surfaces would require a nozzle with a larger opening.

The 7/16-inch segment is estimated to register the fastest CAGR of 6.0% over the forecast period in the abrasive blasting nozzle market. A 7/16-inch bore-size nozzle features a large opening and consumes more airflow. It is typically suitable for applications with larger surfaces. The available air pressure and flow help select the bore size for maximum productivity.

Key Companies & Market Share Insights

Industry players are undertaking strategies such as product launches, acquisitions, and collaborations to drive their global reach. For instance, in July 2022, Fab-Tek of Central Mississippi, a metal fabrication and machining player, procured an advanced blast room from Titan Abrasive Systems, which manufactures surface finishing, high-caliber surface preparation, and sandblasting equipment. The primary objective behind acquiring this upgraded blast room is to streamline the cleaning and refinement processes of stainless steel metal conveyor systems, which constitute the core expertise of Fab-Tek's design and manufacturing endeavors.

Key Abrasive Blasting Nozzle Companies:

- Kennametal Inc.

- Marco International Group LLC

- CLEMCO

- Sponge-Jet Inc.

- Elcometer Limited

- Everblast

- BlastOne International

- Contracor

- Manus Abrasive Systems Inc.

- Graco Inc.

- AGSCO Corporation

- Airblast B.V.

- Burwell Technologies

- KEIR Manufacturing, Inc.

Recent Developments

-

In March 2023, Kennametal Inc. introduced the Blast Ninja nozzle to its extensive collection of abrasive blast nozzles for advanced surface preparation. Developed by Oceanit, an innovative 'Mind to Market' company based in Honolulu, the Blast Ninja is a high-quality nozzle with enhanced productivity and superior hearing protection. This military-grade product complies with OSHA guidelines, ensuring optimal safety standards

-

In February 2021, Elcometer, a supplier of inspection equipment catering to the concrete, coatings, and metal detection sectors, introduced an expansive collection of abrasive blast equipment. This comprehensive array encompasses dry abrasive blast machines, blast nozzles, precision media valves, blast hoses, and personal protective gear. The creation of this diverse product range was a collaborative endeavor involving Elcometer and its affiliated company, Blast Equipment Limited (BEL)

Abrasive Blasting Nozzle Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 210.1 million

Revenue forecast in 2030

USD 289.0 million

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, end-use, bore size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Kennametal Inc.; Marco International Group LLC; CLEMCO; Sponge-Jet Inc.; Elcometer Limited; Everblast; BlastOne International; Contracor; Manus Abrasive Systems Inc.; Graco Inc.; AGSCO Corporation; Airblast B.V.; Burwell Technologies; KEIR Manufacturing, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Abrasive Blasting Nozzle Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global abrasive blasting nozzle market report on the basis of type, material, end-use, bore size, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Venturi Nozzle

-

Straight Bore Nozzle

-

Wide Throat Nozzle

-

Others

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Carbide Tips

-

Tungsten Carbide

-

Boron Carbide

-

Silicon Carbide

-

-

Ceramic Tips

-

Steel Tips

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Construction

-

Marine (Shipyard)

-

Others

-

-

Bore Size Outlook (Revenue, USD Million, 2017 - 2030)

-

5/16 inch

-

3/8 inch

-

7/16 inch

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global abrasive blasting nozzle market size was valued at USD 200.6 million in 2022 and is expected to reach USD 210.1 million in 2023.

b. The global abrasive blasting nozzle market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 289.0 million by 2030.

b. The carbide tips segment dominated the abrasive blasting nozzle market with a share of 55.59% in 2022. This is attributable to benefits, such as cost-effectiveness and durability, they can offer over other materials.

b. Some key players operating in the abrasive blasting nozzle market include Kennametal Inc.; Marco Group International; Clemco Industries Corp.; Everblast Inc.; BlastOne International; Graco Inc.; T-Tex Industries; AGSCO Corp.; Airblast B.V.; Burwell Technologies.

b. Increasing demand for abrasive blasting machines in cleaning, repairing, and surface finishing, is boosting the abrasive blasting nozzle market growth globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.