- Home

- »

- Medical Devices

- »

-

Absorbable Sutures Market Size, Share, Industry Report 2030GVR Report cover

![Absorbable Sutures Market Size, Share & Trends Report]()

Absorbable Sutures Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Filament (Monofilament, Multifilament), By Application (Orthopedic Surgery, Neurological Surgery), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-498-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Absorbable Sutures Market Summary

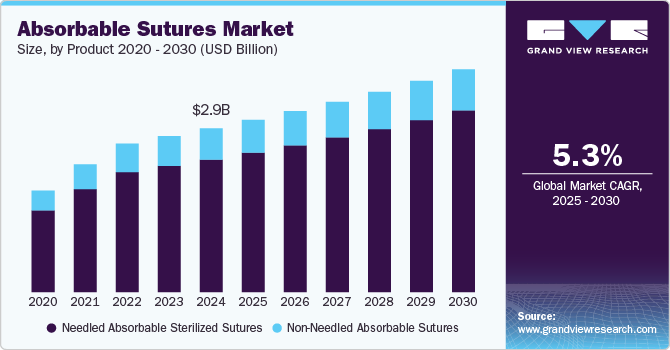

The global absorbable sutures market size was estimated at USD 2.9 billion in 2024 and is projected to reach USD 3.9 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The absorbable sutures industry is expanding due to several key drivers, including increasing demand for minimally invasive surgeries and advancements in suture materials.

Key Market Trends & Insights

- North America absorbable sutures market dominated globally, capturing 32.9% of the revenue share in 2024.

- The absorbable sutures market in the U.S. held a significant share in the North America region in 2024.

- Based on product, the needled absorbable sterilized sutures segment held the largest revenue share of 80.9% in 2024.

- Based on filament, the multifilament segment held the largest revenue share of 57.0% in 2024.

- Based on application, the cardiac surgery segment dominated and accounted for the largest revenue share of 26.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.9

- 2030 Projected Market Size: USD 3.9 Billion

- CAGR (2025-2030): 5.3%

- North America: Largest market in 2024

The shift towards less invasive procedures promotes faster recovery and reduced complications, boosting the use of absorbable sutures in various specialties such as general surgery, orthopedics, and ophthalmology. Technological innovations in suture materials, such as enhanced tensile strength and biocompatibility, are also contributing to market growth. Absorbable sutures are a type of sutures that gradually dissolve in the body over time, eliminating the need for removal. These sutures are made from materials like polyglycolic acid (PGA), polylactic acid (PLA), polyglactin, and polydioxanone (PDO), which are bioabsorbable and provide a range of benefits, including reduced patient discomfort, lower risk of infection, and quicker recovery times.

One of the key drivers of market growth is the increasing number of surgical procedures worldwide. According to the World Federation of Neurology, 12.0% of the total neurology patients succumb to these conditions each year, and according to Medico Experts, 22.6 million people suffer from neurological injuries, of which 13.8 million require surgery. In addition, according to the WHO, the number of Disability-Adjusted Life Years (DALYs) lost due to neurological diseases is anticipated to increase from 95 million in 2015 to 103 million in 2030 across the globe. An increasing number of neurological surgeries and the high demand for absorbable sutures specially designed for these procedures are expected to drive market growth.

The rising geriatric population is another significant driver of the absorbable sutures industry. As the global population ages, the demand for surgical procedures is expected to rise due to the higher incidence of age-related conditions such as heart disease, diabetes, and osteoporosis, which require surgical intervention. According to the United Nations, the global population aged 60 years or older is expected to increase from 1 billion in 2020 to 1.4 billion by 2030. This demographic shift has led to a corresponding rise in the number of elderly individuals requiring surgeries, driving the demand for absorbable sutures in various procedures.

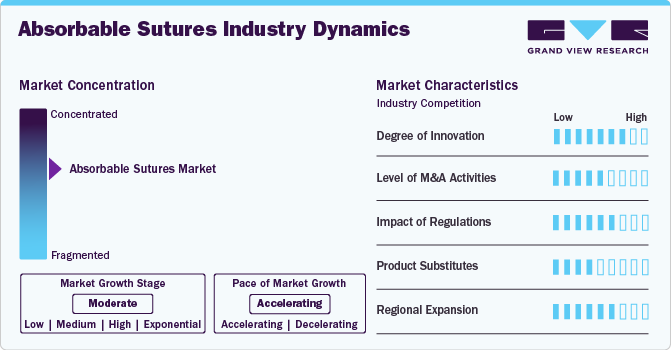

Market Concentration & Characteristics

The absorbable sutures industry is moderately concentrated, with key players such as Johnson & Johnson (Ethicon), Medtronic, and B. Braun Melsungen AG dominating the market. These companies hold significant shares due to their established product portfolios, global reach, and innovation in suture materials. The market features a mix of multinational corporations and regional players, contributing to product diversification. Advancements in materials, such as biodegradable polymers, and increasing demand for minimally invasive surgeries are key characteristics driving market growth. As competition intensifies, companies focus on product differentiation, technological innovations, and improving clinical outcomes to strengthen their market position.

The absorbable sutures industry has seen significant innovation with advancements in materials and functionality. In May 2023, MIT engineers introduced “smart” absorbable sutures inspired by traditional catgut, which can detect inflammation and deliver drugs. These sutures are coated with hydrogels, enabling them to house sensors, therapeutic molecules, or cells. The innovation offers multiple potential applications, particularly in enhancing recovery for patients with conditions like Crohn’s disease, as the sutures not only hold tissues together but also monitor healing and release necessary drugs. These developments mark a significant step forward in the functionality and versatility of absorbable sutures.

Regulations in the absorbable sutures industry ensure product safety, quality, and efficacy, with strict guidelines from bodies like the FDA and the European Medicines Agency (EMA). Manufacturers must adhere to standards related to material biocompatibility, sterilization, and absorption rates. Regulatory approval involves rigorous clinical testing and quality control measures, impacting product development timelines. Compliance with these regulations is essential for market entry and maintaining consumer trust. In addition, increasing regulatory scrutiny surrounding the approval of new materials, such as biodegradable polymers and drug-eluting sutures, drives innovation while ensuring patient safety, creating both challenges and opportunities for manufacturers in the industry.

Mergers and acquisitions (M&A) in the absorbable sutures industry are rapidly increasing as companies aim to bolster their technological capabilities and market reach. For instance, in May 2024, KKR acquired Healthium, a medical device company, from Apax Partners for USD 84 million. This acquisition will enable KKR to strengthen its presence in the healthcare sector, particularly in surgical and wound care solutions. Healthium offers a wide range of medical products with global reach. This strategic acquisition aims to improve product offerings and accelerate the development of innovative health solutions. Additionally, partnerships between established firms and startups are becoming common, enabling knowledge sharing and resource pooling, which fuels growth and innovation within the absorbable sutures industry.

In the absorbable sutures industry, product substitutes include non-absorbable sutures, staples, and tissue adhesives. Non-absorbable sutures, such as nylon or polypropylene, provide long-lasting wound closure but require removal. Staples offer fast and secure wound closure, particularly in surgeries with high-tension areas. Tissue adhesives, like cyanoacrylate, provide an alternative for small incisions or superficial wounds, eliminating the need for stitches. However, absorbable sutures remain the preferred option for internal surgical procedures due to their ability to dissolve naturally, reducing the risk of infection and eliminating the need for removal, offering a more convenient and effective solution.

The absorbable sutures industry is experiencing significant regional expansion, driven by increasing healthcare access and rising surgical procedures worldwide. North America and Europe dominate the market due to advanced healthcare infrastructure and high adoption rates of surgical techniques. However, the Asia Pacific region, led by India and China, is witnessing the fastest growth, supported by expanding healthcare facilities, a large patient population, and rising awareness of advanced surgical products. Additionally, Latin America and the Middle East are emerging markets, with increasing demand for absorbable sutures fueled by improving healthcare services and rising surgical interventions in these regions.

Product Insights

The needled absorbable sterilized sutures segment held the largest revenue share of 80.9% in 2024 and is expected to grow at the fastest CAGR over the forecast period. These sutures are pre-attached to a needle, ensuring precise and efficient application in a variety of surgeries, such as general, cardiovascular, and orthopedic procedures. The sterilization process ensures that the sutures are safe and free from contaminants, making them suitable for use in sterile environments. The convenience of pre-needled sutures, combined with their absorbable nature, which eliminates the need for removal, has driven their dominance in the market, ensuring high demand in healthcare settings.

The non-needled absorbable sutures segment is experiencing steady growth due to its versatility in various surgical applications. These sutures, often used in procedures requiring custom needle selection, offer flexibility for surgeons. Their growing demand is driven by the preference for personalized suturing options and their cost-effectiveness in certain medical fields.

Filament Insights

The multifilament segment held the largest revenue share of 57.0% in 2024 due to its superior strength, flexibility, and ease of handling. Made from multiple intertwined threads, multifilament sutures provide enhanced knot security and are less likely to slip during procedures. These sutures are particularly favored in high-tension surgical areas like cardiovascular and orthopedic surgeries. Their increased surface area facilitates better tissue holding, contributing to improved healing outcomes. The demand for multifilament absorbable sutures is driven by their reliability, ease of use, and performance, making them a preferred choice among surgeons across various medical specialties.

The monofilament segment is expected to grow at the fastest CAGR over the forecast period. Monofilament sutures, made from a single continuous strand, offer advantages such as reduced tissue drag and less chance of infection compared to multifilament sutures. Their smooth surface ensures minimal irritation and allows for precise tissue placement. Monofilament sutures are increasingly preferred in delicate procedures, including plastic and ophthalmic surgeries, due to their superior tensile strength and biocompatibility. The segment's rapid growth is driven by these benefits and the increasing adoption of minimally invasive surgical techniques that prioritize wound healing and infection control.

Application Insights

The cardiac surgery segment dominated the absorbable sutures industry and accounted for the largest revenue share of 26.7% in 2024 due to the high demand for surgical procedures involving the heart. Absorbable sutures are crucial in cardiac surgeries for closing incisions and securing tissue, as they eliminate the need for removal, reducing patient discomfort and risk of infection. These sutures provide reliable wound closure, supporting faster healing and minimizing complications. With the increasing prevalence of cardiovascular diseases and advancements in cardiac surgery techniques, the demand for absorbable sutures in cardiac surgeries is expected to continue growing. In addition, the focus on minimally invasive surgeries further boosts the adoption of absorbable sutures in this segment.

The orthopedic segment is expected to witness the fastest CAGR in the absorbable sutures industry due to the rising number of orthopedic surgeries, including joint replacements, bone fractures, and spinal procedures. Absorbable sutures offer advantages in orthopedic surgeries by promoting faster healing, reducing the risk of infection, and eliminating the need for suture removal, which enhances patient comfort. As the demand for minimally invasive procedures increases, absorbable sutures are gaining preference in orthopedic surgeries. In addition, advancements in material technologies, such as improved strength and biocompatibility, are further driving the growth of absorbable sutures in the orthopedic segment.

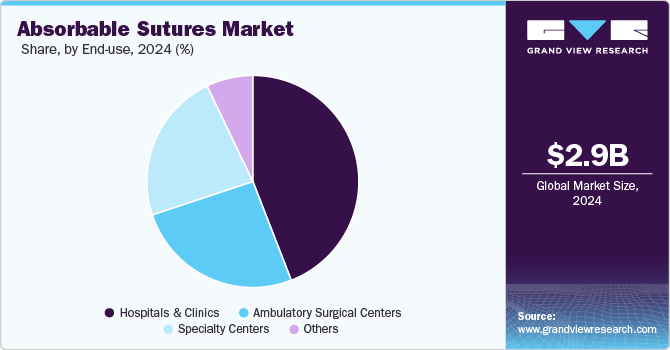

End Use Insights

The hospitals & clinics segment dominated the market and accounted for the largest revenue share of 44.1% in 2024. Hospitals and clinics are the primary healthcare facilities where absorbable sutures are widely used for various surgical procedures, including general, orthopedic, and cardiovascular surgeries. The growing number of surgical interventions, combined with the preference for absorbable sutures due to their convenience and effectiveness in wound healing, drives the demand. In addition, the availability of advanced surgical technologies and increasing awareness about infection control in healthcare settings contribute to the market’s dominance by hospitals and clinics.

Specialty centers are expected to register the fastest CAGR over the forecast period due to the increasing demand for specialized surgeries, such as orthopedic, plastic, and cardiovascular procedures. These centers focus on advanced treatments and minimally invasive surgeries, driving the adoption of absorbable sutures for better patient outcomes.

Regional Insights

North America absorbable sutures market dominated globally, capturing 32.9% of the revenue share in 2024. According to the American Hospital Association Statistics 2024, the U.S. has approximately 6,120 operational hospitals, performing 40–50 million surgeries annually for conditions such as cardiovascular diseases, cancer, and trauma (NCBI, 2020). Rising surgeries drive demand for surgical instruments. In addition, 702,880 heart disease deaths in 2022 highlight the growing demand for minimally invasive techniques, boosting market growth.

U.S. Absorbable Sutures Market Trends

The absorbable sutures market in the U.S. held a significant share in the North America region in 2024, driven by the increasing prevalence of chronic diseases, rising surgical procedures, and advancements in healthcare infrastructure. The demand for absorbable sutures is further supported by the growing adoption of minimally invasive surgeries and the presence of key players in the U.S. healthcare sector. The country's focus on improving patient outcomes and reducing surgical complications has contributed to the growth of the market, making the U.S. a dominant player in the North American absorbable sutures industry.

Europe Absorbable Sutures Market Trends

The European absorbable sutures market was the second largest globally in 2024. The growth is attributed to the rising chronic diseases like diabetes, affecting 61 million people in Europe, and is projected to reach 67 million by 2030. Increased adoption of robotic-assisted surgeries and expanding outpatient clinics further drive demand for advanced handheld tools.

Theabsorbable sutures market in the UK is witnessing significant growth due to the rising incidence of chronic diseases like diabetes and the expanding elderly population. For instance, according to the Department of Health & Social Care in the UK, the population aged 85 and older is expected to increase by one million between 2021 and 2036.

The absorbable sutures market in France is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. In 2021, France allocated approximately 12.31% of its GDP to healthcare, according to World Bank data. Its robust healthcare infrastructure promotes the adoption of minimally invasive surgical instruments and devices.

The germany absorbable sutures market is primarily fueled by the rising prevalence of chronic diseases. According to the International Diabetes Federation, in 2021, 10% of Germany's adult population of 62,027,700 had diabetes, amounting to 6,199,900 cases. This growing burden significantly drives the demand for advanced surgical tools. Furthermore, the presence of stainless-steel manufacturers in Germany is also expected to fuel market growth.

Asia Pacific Absorbable Sutures Market Trends

The Asia Pacific absorbable sutures market is growing rapidly due to rising chronic diseases like cancer, diabetes, and cardiovascular conditions, particularly in China, India, and Japan. With 1.4 million cancer diagnoses in India in 2022, demand for advanced surgical tools is growing. In addition, the adoption of minimally invasive techniques and innovations in surgical technology, such as robotic systems, is enhancing patient outcomes. Hospitals are increasingly investing in modern instruments to improve care, driving market growth across the region.

The absorbable sutures market in Japan is growing, primarily driven by the country’s aging population, with approximately 30% aged 65 and older in 2023, according to World Bank data. The introduction of advanced surgical tools and frequent product launches further fuel growth. Manufacturers are heavily investing in R&D to develop innovative instruments that enhance precision, efficiency, and patient care.

The China absorbable sutures market is expected to grow over the forecast period. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the absorbable sutures market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

The absorbable sutures market in India is set for significant growth over the forecast period. The increasing prevalence of gastrointestinal disorders and colorectal cancer drives this growth. With colorectal cancer cases rising at an estimated 5% annually, the demand for minimally invasive procedures has surged. India's aging population, projected to reach 20% by 2050, further fuels this demand.

Latin America Absorbable Sutures Trends

The Latin American absorbable sutures market is primarily driven by Brazil and Argentina. The geriatric population in Latin America is increasing, leading to a higher demand for healthcare services & products. For instance, according to the World Bank, the adult population aged 65 and above in the Latin America and Caribbean region was around 9% of the total population in 2023, which is anticipated to double by 2050.

Middle East & Africa Surgical Snare Market Trends

The Middle East and Africa absorbable sutures market is growing due to the increasing adoption of minimally invasive procedures and growing awareness of endoscopic techniques. Investments in healthcare infrastructure, particularly in the UAE and Saudi Arabia, are increasing, enhancing access to advanced medical devices. Additionally, the aging population in the region, expected to reach 7% by 2030, further supports market growth alongside government initiatives promoting advanced diagnostic and therapeutic solutions.

The absorbable sutures market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per the Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Absorbable Sutures Company Insights

The competitive scenario in the global absorbable sutures industry is high, with key players such as Johnson & Johnson, B Braun Melsungen AG, and Teleflex Incorporated holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Absorbable Sutures Companies:

The following are the leading companies in the absorbable sutures market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson

- Teleflex Incorporated

- B Braun Melsungen AG

- DemeTECH Corporation

- Lotus Surgicals Pvt Ltd

- Teleflex Incorporated

- Integra Lifesciences Corporation

- Healthium Medtech (formerly Suture India)

- Samyang Holdings Corporation

- Internacional Farmacéutica S.A. de C.V. (Atramat)

Recent Developments

-

In October 2024, A study in Nature Communications introduced a bioabsorbable electrical stimulation (BioES) suture, enhancing wound healing through electrical stimulation (ES). Unlike traditional absorbable sutures, BioES-sutures mimic natural electric fields to accelerate healing. Self-powered, they address the limitations of existing ES devices, offering a degradable, biocompatible solution for surgical and traumatic wound repair.

-

In September 2023, Genesis MedTech's triclosan-coated absorbable sutures, approved by China's NMPA, combat bacteria like MRSA and MRSE, reducing surgical site infections (SSIs). Backed by WHO and CDC guidelines, these sutures address a major hospital-acquired infection, offering significant clinical and economic benefits by lowering SSI risks across various surgical procedures.

Absorbable Sutures Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.0 billion

Revenue forecast in 2030

USD 3.9 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, filament, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Johnson & Johnson, Teleflex Incorporated, B Braun Melsungen AG, DemeTECH Corporation, Lotus Surgicals Pvt Ltd, Teleflex Incorporated, Integra Lifesciences Corporation, Healthium Medtech (formerly Suture India), Samyang Holdings Corporation, Internacional Farmacéutica S.A. de C.V. (Atramat)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Absorbable Sutures Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global absorbable sutures market report based on product, filament, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Needled Absorbable Sterilized Sutures

-

Non-Needled Absorbable Sutures

-

-

Filament Outlook (Revenue, USD Million, 2018 - 2030)

-

Monofilament

-

Multifilament

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Ophthalmic Surgery

-

Cardiac Surgery

-

Orthopedic Surgery

-

Neurological Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Specialty Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global market for absorbable sutures was estimated at USD 2.9 billion in 2024 and is expected to reach USD 3.0 billion in 2025.

b. The global absorbable sutures market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 3.9 billion by 2030.

b. The needled absorbable sterilized sutures segment dominated the market in terms of revenue of 80.9% in 2024 and is anticipated to grow at the fastest CAGR of 5.4%, due to their high demand in wound closure, biodegradability, and reduced risk of infection.

b. Major market players included in the absorbable sutures market are Johnson & Johnson, Teleflex Incorporated, B Braun Melsungen AG, DemeTECH Corporation, Lotus Surgicals Pvt Ltd, Teleflex Incorporated, Integra Lifesciences Corporation, Healthium Medtech (formerly Suture India), Samyang Holdings Corporation, Internacional Farmacéutica S.A. de C.V. (Atramat)

b. Key factors that are driving growth include the rising number of surgical procedures, increasing preference for biodegradable materials that eliminate the need for removal, and advancements in suture technology offering enhanced wound healing, strength, and reduced infection risks. Additionally, growing healthcare infrastructure and awareness further boost market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.