- Home

- »

- Organic Chemicals

- »

-

Acrylonitrile Market Size And Share, Industry Report, 2030GVR Report cover

![Acrylonitrile Market Size, Share & Trends Report]()

Acrylonitrile Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Acrylic Fibers, Adiponitrile, Styrene Acrylonitrile, ABS, Acrylamide, Carbon Fiber, Nitrile Rubber, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-871-8

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Acrylonitrile Market Summary

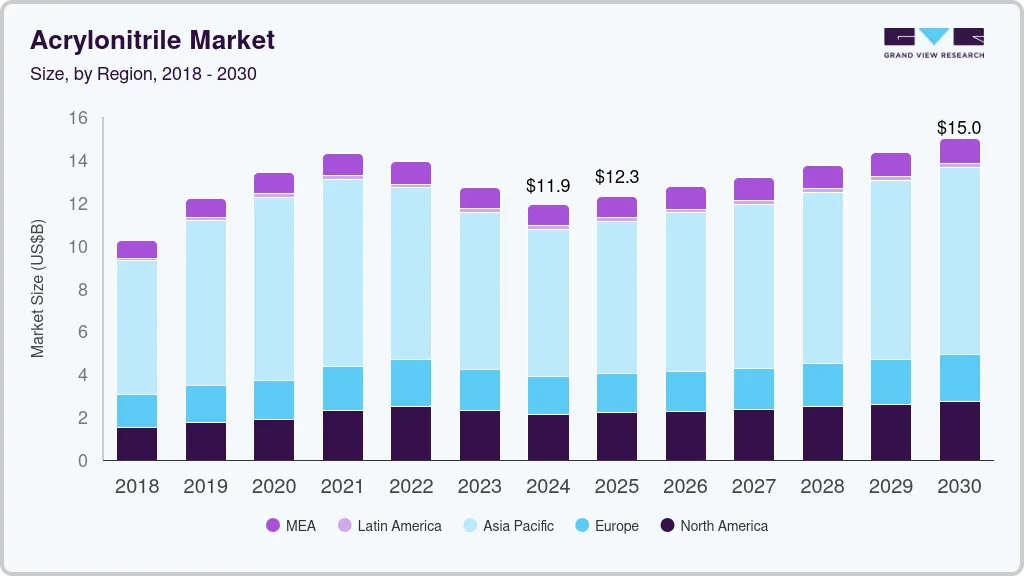

The global acrylonitrile market size was estimated at USD 11,913.9 million in 2024 and is projected to reach USD 15,005.5 million by 2030, growing at a CAGR of 4.0% from 2025 to 2030. The rising demand for acrylonitrile from industries such as automotive and construction is expected to drive growth in the sector.

Key Market Trends & Insights

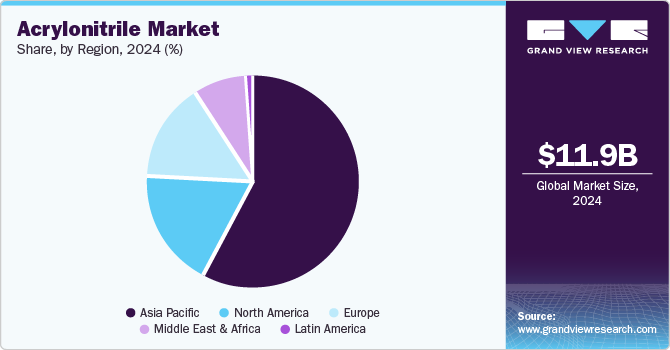

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Mexico is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, abs accounted for a revenue of USD 3,390.5 million in 2024.

- Carbon Fiber is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 11,913.9 Million

- 2030 Projected Market Size: USD 15,005.5 Million

- CAGR (2025-2030): 4.0%

- Asia Pacific: Largest market in 2024

The expanding construction industry is increasing the consumption of acrylonitrile, which is likely to impact industry growth positively. Acrylonitrile is used to produce several derivatives, including acrylonitrile butadiene styrene, acrylic fiber, acrylamide, carbon fiber, and nitrile rubber, all utilized in the construction sector.

Due to the favorable properties of plastics made from acrylonitrile, such as chemical resistance, durability, high strength, and thermal stability, demand for acrylonitrile is anticipated to remain high shortly.

The demand for products in the consumer appliances industry is rising, driven by attributes such as heat and chemical resistance. Changing lifestyles, evolving consumer preferences, and increasing per capita income will boost consumer appliance demand, which will, in turn, enhance the demand for acrylonitrile within the industry. In addition, the automotive industry is projected to increase its consumption of acrylonitrile due to its low weight, high strength, and durability at low temperatures. Acrylonitrile is widely used in this sector. The demand for acrylic fibers is particularly strong in the automotive industry, and their continued use is anticipated to further contribute to the sector's growth.

The demand for acrylonitrile is rising due to the increasing use of acrylic fibers. In addition, the growing textile and garment industries in the Asia Pacific region, driven by rapid urbanization, will further support the development of this industry. Acrylic fibers are known for their strong resistance to microbiological attack, UV degradation, and laundry bleach, making them excellent choices for clothing due to their lightweight nature. This material is the primary raw ingredient used to produce acrylic fibers. However, demand may decline due to the introduction of new, affordable polyester fibers. Furthermore, the growing preference for bio-based polymers, especially in developed economies, is expected to impact the demand for acrylic fibers negatively.

Drivers, Opportunities & Restraints

The rising demand for acrylonitrile, particularly its use in producing Acrylonitrile Butadiene Styrene (ABS), is a significant market driver for the acrylonitrile industry. ABS is a widely used thermoplastic known for its strength, durability, and impact resistance, making it popular in various applications such as automotive parts, consumer products, and electronic housing. As industries increasingly adopt lightweight and robust materials, the need for ABS is growing, boosting the demand for acrylonitrile. In addition, advancements in processing technologies and increasing consumption in emerging markets further contribute to this upward trend.

A primary market restraint for the acrylonitrile industry is the environmental and health concerns associated with its production and usage. Acrylonitrile is classified as a potential carcinogen, leading to stringent regulations and compliance requirements that can hinder production processes and raise costs. In addition, fluctuations in raw material prices, such as propylene and ammonia, can impact profit margins and supply stability. The availability of alternative materials that offer similar properties without the associated risks also threatens market growth. Overall, these factors can limit the expansion potential of the market for acrylonitrile.

The acrylonitrile industry presents significant opportunities driven by increasing demand in various applications, particularly in producing synthetic fibers, plastics, and resins. The growth of emerging economies and expanding industries such as automotive, electronics, and construction are boosting consumption. Innovations in manufacturing processes that enhance efficiency and reduce environmental impact can also create a competitive edge. In addition, developing acrylonitrile derivatives and specialized applications in pharmaceuticals and agriculture may further expand market potential. As sustainability becomes a priority, investments in eco-friendly technologies can open new avenues for growth.

Application Insights

The ABS segment accounted for the largest revenue share of 28.5% in 2024 and is expected to continue its dominance over the forecast period. The product's increasing use in the automotive, electronics, consumer goods, and construction industries can be attributed to its ease of installation and lightweight nature. The product exhibits mechanical solid strength, corrosion resistance, and more excellent durability than PVC. The carbon fiber segment is projected to experience the fastest CAGR during the forecast period due to its strength, lightweight, and exceptional stiffness, making it highly useful in building materials.

Carbon fiber is commonly used in various industries, including aerospace and defense, automotive, alternative energy, and construction. Due to increased investment in aerospace technology, the demand for carbon fiber is projected to grow rapidly in Asian countries, particularly in China and India. However, carbon fiber's high cost is expected to limit its demand in the coming years significantly.

Nitrile rubber, a type of synthetic rubber, is produced through the copolymerization of butadiene and acrylonitrile. It is valued for its resistance to oil and solvents, making it a popular choice in applications requiring durable synthetic materials.

Regional Insights

North America acrylonitrile market is projected to experience significant growth due to the presence of key companies in the United States, such as Ascend Performance Materials. These companies' primary emphasis on developing new products for the automotive and construction industries is expected to drive industry growth throughout the forecast period.

Asia Pacific Acrylonitrile Market Trends

The Asia Pacific acrylonitrile market is driven by the expanding construction sector, which is increasing the demand for building materials. In addition, the rising need for textiles and home furnishings is expected to impact this segment positively. Developing countries in the Asia-Pacific region, particularly India and China, are prioritizing the construction of commercial and new residential buildings, which is projected to grow. Factors such as the high demand for efficient building materials and advancements in civil construction also contribute to the regional market's growth.

Europe Acrylonitrile Market Trends

The Europe acrylonitrile market is expected to experience rapid growth over the forecast period. The significant demand for acrylonitrile in horizontal wells is especially notable in Norway, Italy, the Netherlands, Denmark, the UK, and France. The increasing need for consumer electronics has prompted European exploration and product (E&P) companies to engage in extensive drilling activities in both onshore and offshore locations.

Latin America Acrylonitrile Market Trends

The discovery of untapped oil and gas reserves in the region primarily drives the Latin America acrylonitrile market. During the forecast period, drilling activities in the region are expected to increase, supported by significant deposits of hydrocarbon unconventional reserves such as tight oil, shale gas, and oil sands. In addition, substantial investments from multinational oil and gas companies are anticipated to further contribute to this growth.

Middle East & Africa Acrylonitrile Market Trends

The Middle East and Africa acrylonitrile market is expected to grow significantly over the forecast period. Gas well and oil refinery applications are increasing in Saudi Arabia and Oman, and the trend is steady for South Africa, Kuwait, and Qatar.

Key Acrylonitrile Company Insights

Some of the key players operating in the market include Clariant, Dow, and Solvay.

-

INEOS Group is a British multinational conglomerate that manufactures chemicals, oil products, and petrochemicals. Their products are utilized across various industries, including construction, agriculture, technology, and textiles. INEOS is also engaged in sports, consumer brands, and other sectors.

-

Mitsubishi Chemical Group offers ethical pharmaceuticals, diagnostic reagents, instruments, capsules, pharmaceutical equipment, active pharmaceutical ingredients and intermediates, and self-health check services.

Key Acrylonitrile Companies:

The following are the leading companies in the acrylonitrile market. These companies collectively hold the largest market share and dictate industry trends.

- INEOS

- China Petroleum Development Crop.

- Asahi Kasei Advance Corp.

- Ascend Performance Material

- Chemelot

- Formosa Plastics Corp.

- Mitsubishi Chemical Corp.

- Secco

- Taekwang Industrial Co., Ltd.

- Sumitomo Chemical Co., Ltd.

Recent Developments

-

In June 2023, INEOS Nitriles introduced its inaugural bio-attributed product line for Acrylonitrile, branded as InvireoTM. The newly launched product will be manufactured at INEOS Nitriles' state-of-the-art facility in Cologne, Germany. The production of InvireoTM involves the utilization of bio-attributed propylene, enabling the replacement of conventional fossil fuel resources. This innovative product contributes to a reduction in greenhouse gas emissions and aids in the conservation of natural resources by incorporating renewable feedstock. INEOS has obtained certification from the Roundtable on Sustainable Biomaterials (RSB) and the International Sustainability & Carbon Certification (ISCC Plus).

-

In February 2023, Sumitomo Chemical received its inaugural ISCC PLUS certification for acrylonitrile production at its Ehime Works in Niihama, Ehime, Japan. The International Sustainability and Carbon Certification (ISCC) awarded this prestigious certification, validating the sustainable nature of the product.

Acrylonitrile Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12,310.6 million

Revenue forecast in 2030

USD 15,005.5 million

Growth rate

CAGR of 4.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Norway, China, India, Japan, Australia, Malaysia, Brazil, Argentina, Saudi Arabia, UAE.

Key companies profiled

INEOS, China Petroleum Development Crop., Asahi Kasei Advance Corp., Ascend Performance Material, Chemelot, Formosa Plastics Corp., Mitsubishi Chemical Corp., Secco, Taekwang Industrial Co., Ltd., Sumitomo Chemical Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acrylonitrile Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acrylonitrile market report based on application, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acrylic Fibers

-

Adiponitrile

-

Styrene Acrylonitrile

-

ABS

-

Acrylamide

-

Carbon Fiber

-

Nitrile Rubber

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malayasia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global acrylonitrile market size was estimated at USD 11,913.9 million in 2024 and is expected to reach USD 12,310.6 million in 2025.

b. The global acrylonitrile market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2030 to reach USD 15,005.5 million by 2030.

b. Asia Pacific dominated the acrylonitrile market with a share of 52.9% in 2024. This is attributable to the rising demand for acrylic fibers from the apparel and home furnishing industry.

b. Some key players operating in the global acrylonitrile market include INEOS, Sinopec Group, Sumitomo Chemicals, and Asahi Kasei, among others.

b. Key factors that are driving the market growth include increasing demand of acrylic fibers and growing utlization of production of plastics and composites.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.