- Home

- »

- Pharmaceuticals

- »

-

Active Pharmaceutical Ingredients Market Size Report, 2030GVR Report cover

![Active Pharmaceutical Ingredients Market Size, Share & Trends Report]()

Active Pharmaceutical Ingredients Market Size, Share & Trends Analysis Report By Type Of Synthesis (Biotech, Synthetic), By Type Of Manufacturer (Captive, Merchant), By Type, By Application, By Type Of Drug, By Region, And Segment Forecast to 2024 - 2030

- Report ID: GVR-1-68038-348-5

- Number of Report Pages: 191

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

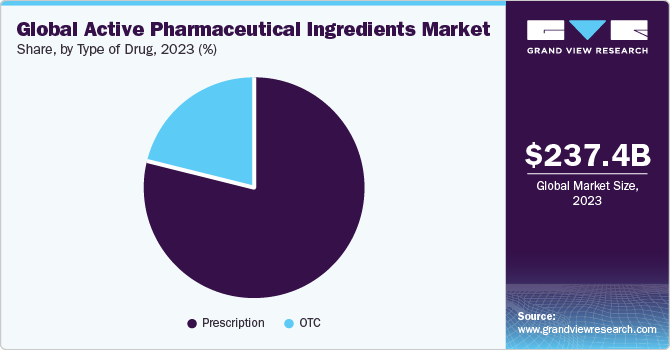

The global active pharmaceutical ingredients market size was estimated at USD 237.47 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.75% from 2024 to 2030. Advancements in Active Pharmaceutical Ingredient (API) manufacturing, growth of the biopharmaceutical sector, and an increase in geriatric population are among the key drivers of API market. An increase in prevalence of chronic diseases, such as cardiovascular diseases and cancer, is anticipated to boost market growth.

Global geriatric population is increasing. According to UN, in 2022, people aged 65 and above accounted for 771 million of the population, and the number is anticipated to reach 994 million by 2030 to 1.6 billion by 2050. The number of elderly people is showing fastest growth in Africa, with a threefold increase estimated in people aged 60 and above, followed by Latin America, reaching 18.8 billion by 2050. Aging is considered the greatest risk factor for development of diseases, including cardiovascular and neurological diseases. Thus, rapidly growing global geriatric population is resulting to be a high-impact-rendering driver for API market.

Increasing prevalence of infectious diseases and hospital-acquired infections is driving market growth. In addition, growing incidence of cardiovascular, genetic, and neurologic disorders is anticipated to act as a high-impact-rendering driver for market growth. Cardiovascular Diseases (CVDs) are the most prevalent causes of death globally. According to WHO, cardiovascular diseases cause death of 17.9 million people per day and are expected to cause approximately 25 million deaths by 2030. Increasing epidemiology of lifestyle, aided with rising number of smokers globally, growing incidence of obesity, and increasing dietary irregularities, are factors likely responsible to propel market growth. A recent report by the United Nations (UN) in May 2023 suggests that there has been a 75% increase in the number of girls and 61% in the number of boys with obesity in Europe.

Outsourcing of APIs has become profitable over in-house production. However, this trend took a different turn during the COVID-19 pandemic. Companies are looking to diversify their API suppliers and manufacturers to different locations instead of outsourcing it to just one manufacturer. In addition, risk mitigation is done using dual sourcing to ensure a continuous supply. Hence, key companies aim to capitalize on this ongoing outsourcing trend with new acquisitions. For instance, in August 2023, EUROAPI announced its deal to acquire BianoGMP to enhance its CDMO expertise in oligonucleotide manufacturing, which is a high-growth industry. This further demonstrates the company’s plans for vertical integration.

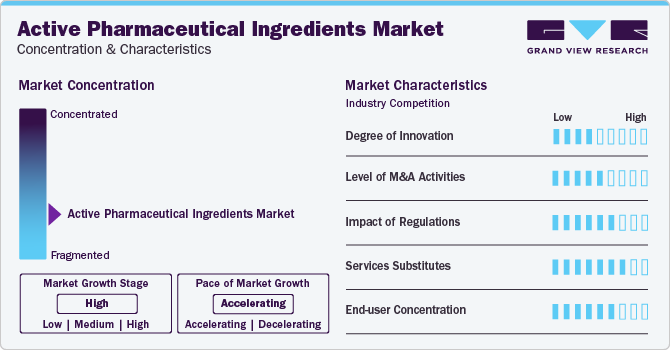

Market Concentration & Characteristics

Market growth stage is high, and pace of the active pharmaceutical ingredients market growth is accelerating. The API market is characterized by a high degree of strategic outsourcing by companies that allows them to focus on core competencies, which results in increased productivity.Moreover, patent expirations are responsible for remarkable losses for pharmaceutical firms. Loss of patent of blockbuster drugs leads to development of generics. Thus, outsourcing of APIs become profitable over in-house production.

Rise in demand for targeted therapies with high potency API compounds, such as HPAPI, is anticipated to create significant demand for personalized medicines further. For instance, ADCs leverage on specificity of antibodies for cancer cells. These cells use linker technology to attach themselves to the antibody. These advanced features of ADCs are anticipated to drive the market, with most pharmaceutical companies pursuing such development programs.

Increasing government initiatives globally to support API production for securing a robust supply of raw materials for pharmaceutical production is expected to drive market growth. For instance, in November 2022, India announced a scheme to push API manufacturing to reduce the dependency on China. The Department of Pharmaceuticals India rolled out a Production Linked Incentive (PLI) scheme of nearly USD 18,064.54 million (₹15,000 crores) for pharmaceuticals.

Furthermore, with COVID-19 pandemic and broader reshoring of API production, there is now a stronger emphasis on bringing clinical product supply security back to the U.S., where clinical studies are conducted. Furthermore, many small biotech companies require domestic fabrication of clinical trial APIs, since their research is dependent on a domestic U.S. funding source. In such instances, businesses must seek manufacturing partners capable of domestic production.

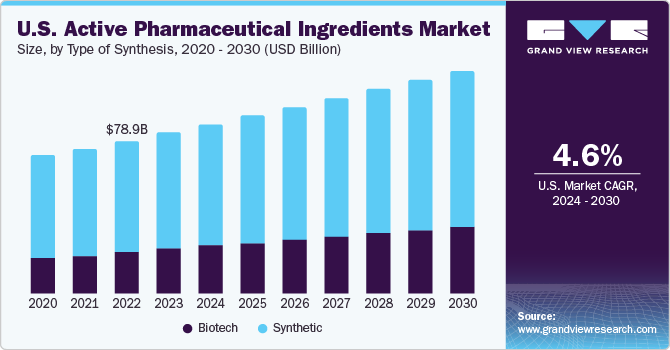

Type of Synthesis Insights

Synthetic segment held the largest revenue share of 70.66% in 2023. Major driver for synthetic API market is high demand for generic drugs. APIs used to develop generic drugs contribute to high revenue for synthetic and chemical API manufacturing companies. This is creating a wide opportunity for CDMOs working in this segment. Opportunity in the synthetic API market becomes even more lucrative for CDMOs owing to an increase in outsourcing trend, as companies want to improve profitability by reducing the cost of production. In October 2023, Cambrex announced completion of its USD 38 million small molecule API manufacturing facility. This investment doubled the size of the company’s manufacturing facility and enhanced its ability to acquire more customers to meet their evolving needs.

Biotech API segment is expected to show fastest growth during the forecast period. Growth of biotech API segment can be attributed to rising investments in biopharmaceutical and biotechnology sectors. This allows innovation of new molecules that aid in treating diseases such as cancer. Key players are highly focused on biotech APIs owing to high revenue generation and profitability associated with them.For instance, in May 2023, OLON Group announced its entry into the ADC API business with its facility located in Italy. The company invested €22 million (USD 23.13 million) for the production with a containment level of OEB6.

Type of Manufacturer Insights

Captive APIs segment held the largest market share in 2023. More companies are investing in solving challenges and developing new chemical ways for in-house production of APIs. This aids in reducing costs and risk of contamination. Protein synthesis and artificial intelligence are expected to accelerate development with greater control over the process.Furthermore, recent initiatives and developments by key players indicate a strong preference for in-house manufacturing over outsourcing.For instance, in September 2021, AstraZeneca announced an investment of USD 360 million in its API manufacturing facility in Ireland to commercialize novel products. Such initiatives undertaken by key players are anticipated to boost segment growth.

Merchant APIs segment is anticipated to grow at fastest growth over the forecast period.Contract manufacturing and outsourcing of API molecule development are growing trends in pharmaceutical sector. As captive production of APIs is expensive, companies have started opting for outsourcing to minimize expenses. Merchant APIs eliminate the need for investing in expensive equipment and sophisticated infrastructure. Post pandemic, key companies are expanding their capacities to enhance their market presence. For instance, in May 2023, MilliporeSigma announced the expansion of its U.S.-based facility, with an investment of USD 69 million, doubling its manufacturing capacity for Highly Potent Active Pharmaceutical Ingredient (HPAPI). The facility is dedicated to the development and commercial manufacturing of Antibody Drug Conjugates (ADCs).

Type Insights

Innovative APIs segment dominated the overall API market with a revenue share in 2023. The market's growth is attributed to increase in funding and favorable regulations for R&D facilities. Many novel innovative products are now in pipeline due to extensive research in this field and are expected to be launched in near future. Furthermore, increasing support from regulatory agencies for approval of new drugs is projected to facilitate market growth, which can be attributed to an increase in focus of government on healthcare and pharmaceuticals due to COVID-19.

Generic APIs segment is anticipated to show fastest growth over the forecast period. Expiry of patent of various branded molecules is a key factor that offer high opportunity for growth of generic API drugs.Post pandemic, pharmaceutical industry is nearing a patent cliff by 2030, with nearly 200 molecules losing exclusivity and over 100 biosimilars developing as of 2023. This creates an opportunity for generic API manufacturers as the demand for the API of these products is set to rise by the end of this decade. This includes over 60 molecules that belong to the oncology segment with complex high revenue generating API’s.

Application Insights

Cardiology segment dominated the API market with a revenue share in 2023 attributable to rising prevalence of cardiovascular diseases globally. According to the World Heart Report 2023, over half a billion people worldwide are affected by CVDs, causing approximately 20.5 million deaths in 2021 - almost a third of global deaths and an increase from the previously estimated 121 million CVD-related deaths. Cardiovascular disease is one of the world's most serious public health problems, prompting extensive research into APIs in the field. Simvastatin is a cholesterol-lowering drug belonging to statin class and used in treatment of dyslipidemia. Rosuvastatin calcium is an additional API used for cardiovascular diseases by AstraZeneca.

Oncology segment is anticipated to grow at fastest growth rate over the forecast period. Increasing global prevalence of cancer is a key factor driving this market. Collaboration among pharmaceutical companies, research institutions, and regulatory entities remains pivotal in expediting drug development, ensuring patient safety, & fostering innovation. For instance, in March 2023, Pfizer Inc. and Seagen Inc. confirmed a definitive merger agreement. Through this strategic deal, Pfizer will acquire Seagen, a renowned biotech firm specializing in revolutionary cancer treatments. The agreement includes a cash transaction of USD 229 per Seagen share, resulting in an enterprise value of USD 43 billion.

Type of Drug Insights

Prescription segment dominated the overall API market with a revenue share in 2023. The uptake of prescription drugs is largely dependent on physicians’ prescriptions. Use of prescription drugs, such as Proton Pump Inhibitors (PPI), in the management of general conditions, heartburn, has plateaued owing to several adverse effects. However, Histamine-2 Receptor Antagonist (H2RA) prescription rate has been impacted. Prescription drugs dominated in oncology segment as cancer is primarily treated using chemotherapy, targeted therapy, immunotherapy, and hormonal therapy. The use of biology is also increasing.Due to the increased efficacy of novel targeted therapies, the number of prescriptions for targeted therapies is rapidly increasing. Furthermore, major players are launching novel targeted therapies.

OTC segment is expected to show the fastest growth over the forecast period. OTC products are easily accessible to the population and is frequently impacted by changes in consumer behavior. Consumer preference is shifting from use of antacids for heartburn to ensuring gut health by taking probiotics. This paradigm shift is creating greater opportunities for preventive products, such as health supplements, nutraceuticals, and probiotics, while slashing the growth of existing products.

Regional Insights

North America API market for led with a share of 38.26% in 2023 owing to rising prevalence of cardiovascular, genetic, and other chronic diseases aided with growing research in field of drug development. Presence of key players such as AbbVie Inc.; Curia; Pfizer Inc. (Pfizer Center One); Viatris Inc.; and Fresenius Kabi AG is positively influencing growth. For instance, in February 2022, Viatris received FDA approval for Generic Restasis—a cyclosporine ophthalmic emulsion for treating dry eye disease. Region shows high value manufacturing areas, including complex & high potent APIs, gene therapies & biologicals, which is expected to provide relative growth. Moreover, there is significant expansion of innovators and CDMOs seen in the region, which is creating an expanded advantage for manufacturing and commercializing APIs.

API market in Asia Pacific is registering fastest growth over the forecasted years. Market is experiencing sharp growth as majority of API production occurs in countries present in the region with high API export rate.China is the largest producer of APIs, manufacturing over 1,600 varieties of chemical APIs. Moreover, several key global players are establishing their operations in the region. Rising investment and initiatives to support and expand manufacturing facilities is further driving growth of overall API market. For instance, in November 2022, Aurobindo Pharma is expected to complete Penicillin G plant approved under the PLI scheme by 2024, with investment of USD 2,000 million to ensure and promote domestic manufacturing of API by increasing the production capacity to 15,000 tons annually in India. Moreover, in June 2022, Piramal Pharma Solutions invested USD 30 million for expanding its capabilities in Telangana, India.

Key Companies & Market Share Insights

Some of the leading players operating in the active pharmaceutical ingredients market include AbbVie, Inc., Novartis AG, Regeneron Pharmaceuticals, Inc., and Eli Lilly and Company. Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This marketing strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced technology and infrastructure, allowing them to efficiently process & analyze a large volume of samples. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Evonik, CARBOGEN AMCIS, and Pharmazell, are some of the emerging market participants in the ophthalmic drugs market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Active Pharmaceutical Ingredients Companies:

- Dr. Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Cipla Inc.

- AbbVie Inc.

- Aurobindo Pharma

- Sandoz International GmbH (Novartis AG)

- Viatris Inc.

- Fresenius Kabi AG

- STADA Arzneimittel AG

Recent Developments

-

In August 2023, EUROAPI announced its deal to acquire BianoGMP to enhance its CDMO expertise in oligonucleotide manufacturing, which is a high-growth industry.

-

In July 2023, Teva Pharmaceutical Industries Ltd. designed a new strategy for development with potential sale of its API unit on the table. The API manufacturing facility is worth USD 2 billion.

-

In June 2023, Lonza acquired Synaffix to improve its ADC services portfolio.

-

In April 2023, Eli Lilly announced an investment of USD 1.6 billion in the U.S.-based LEAP Innovation Park. This brings the total investment to USD 3.7 billion to manufacture complex APIs for products such as genetic medicine.

-

In February 2023, Lonza completed the manufacturing of its facility in Switzerland. The company enhanced its capacity for its High Potent Active Pharmaceutical Ingredient (HPAPI) manufacturing facility.

-

In January 2023, Sterling Pharma Solutions acquired an API manufacturing facility from Novartis in Ringaskiddy, Ireland.

Active Pharmaceutical Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 252.34 billion

Revenue forecast in 2030

USD 352.98 billion

Growth rate

CAGR of 5.75% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type of synthesis, type of manufacturer, type, application, type of drug, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Russia, Hungary, Poland, Switzerland, Portugal, Greece, China; Japan; India; Australia; Thailand; South Korea; Vietnam, Indonesia, Malaysia, Taiwan, Philippines, Brazil; Mexico; Argentina; Columbia, Chile, Peru, South Africa; Saudi Arabia; UAE; Kuwait, Egypt, Israel, Belarus, Algeria, Jordan, Iran

Key companies profiled

Dr. Reddy’s Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Cipla Inc., AbbVie Inc., Aurobindo Pharma, Sandoz International GmbH (Novartis AG), Viatris Inc., Fresenius Kabi AG, STADA Arzneimittel AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Active Pharmaceutical Ingredients Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global active pharmaceutical ingredients market report based on type of synthesis, type of manufacturer, type, application, type of drug, and region:

-

Type of Synthesis Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biotech

-

Biotech APIs Market, By Type (Revenue, USD Billion, 2018 - 2030)

-

Generic APIs

-

Innovative APIs

-

-

Biotech APIs Market, By Product (Revenue, USD Billion, 2018 - 2030)

-

Monoclonal Antibodies

-

Hormones

-

Cytokines

-

Recombinant Proteins

-

Therapeutic Enzymes

-

Vaccines

-

Blood Factors

-

-

-

Synthetic

-

Synthetic APIs Market, By Type (Revenue, USD Billion, 2018 - 2030)

-

Generic APIs

-

Innovative APIs

-

-

-

-

Type of Manufacturer Outlook (Revenue, USD Billion, 2018 - 2030)

-

Captive APIs

-

Merchant APIs

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Generic APIs

-

Innovative APIs

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular Diseases

-

Oncology

-

CNS and Neurology

-

Orthopedic

-

Endocrinology

-

Pulmonology

-

Gastroenterology

-

Nephrology

-

Ophthalmology

-

Others

-

-

Type of Drug Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription

-

OTC

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global active pharmaceutical ingredients market size was estimated at USD 237.47 billion in 2023 and is expected to reach USD 252.34 billion in 2024.

b. The global active pharmaceutical ingredients market is expected to grow at a compound annual growth rate of 5.75% from 2024 to 2030 to reach USD 352.98 billion by 2030.

b. Synthetic APIs dominated the overall API market with a share of 70.66% in 2023. This is attributed to the higher availability of raw materials and easier protocols for the synthesis of these molecules.

b. Key players in the global API market are Merck & Co., Inc.; AbbVie Inc.; Teva Pharmaceutical Industries Ltd.; Viatris Inc.; Cipla Inc.; Boehringer Ingelheim International GmbH; Merck & Co., Inc.; Sun Pharmaceutical Industries Ltd.; Bristol-Myers Squibb Company; Albemarle Corporation and Aurobindo Pharma.

b. The active pharmaceutical ingredients market growth can be attributed to the advancements in active pharmaceutical ingredient (API) manufacturing and the rising prevalence of chronic diseases, such as cardiovascular diseases and cancer. Favorable government policies for API production along with changes in geopolitical situations are boosting the market growth.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation

1.1.1. Market Definitions

1.2. Objectives

1.2.1. OBJECTIVE - 1

1.2.2. OBJECTIVE - 2

1.2.3. OBJECTIVE - 3

1.3. Research Methodology

1.4. Information Procurement

1.4.1. PURCHASED DATABASE

1.4.2. GVR’S INTERNAL DATABASE

1.4.3. SECONDARY SOURCES

1.4.4. PRIMARY RESEARCH

1.5. Information or Data Analysis

1.5.1. DATA ANALYSIS MODELS

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. COMMODITY FLOW ANALYSIS

1.8. List of Secondary Sources

1.9. List of Abbreviations

1.10. List of Primary Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Segmentation and Scope

3.2. Market Lineage Outlook

3.2.1. Parent Market Outlook

3.2.2. Related/Ancillary Market Outlook

3.3. Market Dynamics

3.4. Market Drivers

3.4.1. Increasing geriatric population

3.4.2. Rising prevalence of target diseases such as hospital-acquired infections, genetic, cardiovascular, and neurological diseases

3.4.3. Increasing preference for targeted therapy approach in cancer treatment

3.4.4. Increasing preference for outsourcing APIs

3.5. Market Restraint Analysis

3.5.1. High capital investments and production cost

3.5.2. Stringent Safety and handling regulations regarding APIs

3.6. Business Environment Analysis

3.6.1. SWOT Analysis; By Factor (Political & Legal, Economic And Technological)

3.6.2. Porter’s Five Forces Analysis

3.6.3. COVID-19 Impact Analysis

3.7. Global Sales of API Molecules , USD Million, 2019-2023

3.7.1. Granisetron

3.7.2. Leflunomide

3.7.3. Mometasone

3.7.4. Ondansetron

3.7.5. Pazopanib

3.7.6. Pantoprazole

3.7.7. Pirfenidone

3.7.8. Praziquantel

3.7.9. Levocetirizine

3.7.10. Budesonide

3.7.11. Famcyclovir

3.7.12. Dutasteride

3.7.13. Sacubitiril Valsatran

3.7.14. Nintedanib

3.7.15. Olaparib

3.7.16. Ruxolitinib

3.7.17. Imatinib

3.7.18. Sorafenib

3.7.19. Abiraterone

3.7.20. Pomalidomide

3.7.21. Dasatanib

3.7.22. Relugolix

3.7.23. Niraparib

3.7.24. Efinaconazole

3.7.25. Linagliptin

3.7.26. Rivaroxaban

3.7.27. Tacrolimus

3.7.28. Vortioxetine

3.7.29. Mirabegron

3.8. Key Companies of API Molecules

3.8.1. Granisetron

3.8.2. Leflunomide

3.8.3. Mometasone

3.8.4. Ondansetron

3.8.5. Pazopanib

3.8.6. Pantoprazole

3.8.7. Pirfenidone

3.8.8. Praziquantel

3.8.9. Levocetirizine

3.8.10. Budesonide

3.8.11. Famcyclovir

3.8.12. Dutasteride

3.8.13. Sacubitiril Valsatran

3.8.14. Nintedanib

3.8.15. Olaparib

3.8.16. Ruxolitinib

3.8.17. Imatinib

3.8.18. Sorafenib

3.8.19. Abiraterone

3.8.20. Pomalidomide

3.8.21. Dasatanib

3.8.22. Relugolix

3.8.23. Niraparib

3.8.24. Efinaconazole

3.8.25. Linagliptin

3.8.26. Rivaroxaban

3.8.27. Tacrolimus

3.8.28. Vortioxetine

3.8.29. Mirabegron

Chapter 4. Type of Synthesis Business Analysis

4.1. Active Pharmaceutical Ingredients Market: Type of Synthesis Movement Analysis

4.2. Biotic APIs

4.2.1. Biotic APIs Market, 2018 - 2030 (USD Billion)

4.2.1.1. Biotech APIs Market, By Type (Revenue, USD Billion, 2018 - 2030)

4.2.1.2. Generic APIs

4.2.1.2.1. Generic APIs Market, 2018 - 2030 (USD Billion)

4.2.1.3. Innovative APIs

4.2.1.3.1. Innovative APIs Market, 2018 - 2030 (USD Billion)

4.2.1.4. Biotech APIs Market, By Product (Revenue, USD Billion, 2018 - 2030)

4.2.1.5. Monoclonal Antibodies

4.2.1.5.1. Monoclonal Antibodies Market, 2018 - 2030 (USD Billion)

4.2.1.6. Hormones

4.2.1.6.1. Hormones Market, 2018 - 2030 (USD Billion)

4.2.1.7. Cytokines

4.2.1.7.1. Cytokines Market, 2018 - 2030 (USD Billion)

4.2.1.8. Recombinant Proteins

4.2.1.8.1. Recombinant Proteins Market, 2018 - 2030 (USD Billion)

4.2.1.9. Therapeutic Enzymes

4.2.1.9.1. Therapeutic Enzymes Market, 2018 - 2030 (USD Billion)

4.2.1.10. Vaccines

4.2.1.10.1. Vaccines Market, 2018 - 2030 (USD Billion)

4.2.1.11. Blood Factors

4.2.1.11.1. Blood Factors Market, 2018 - 2030 (USD Billion)

4.3. Synthetic APIs

4.3.1. Synthetic APIs Market, 2018 - 2030 (USD Billion)

4.3.1.1. Synthetic APIs Market, By Type (Revenue, USD Billion, 2018 - 2030)

4.3.1.2. Generic APIs

4.3.1.2.1. Generic APIs Market, 2018 - 2030 (USD Billion)

4.3.1.3. Innovative APIs

4.3.1.3.1. Innovative APIs Market, 2018 - 2030 (USD Billion)

Chapter 5. Type of Manufacturer Business Analysis

5.1. Active Pharmaceutical Ingredients Market: Type of Manufacturer Movement Analysis

5.2. Captive APIs

5.2.1. Captive APIs Market, 2018 - 2030 (USD Billion)

5.3. Merchant APIs

5.3.1. Merchant APIs Market, 2018 - 2030 (USD Billion)

Chapter 6. Type Business Analysis

6.1. Active Pharmaceutical Ingredients Market: Type Movement Analysis

6.2. Generic APIs

6.2.1. Generic APIs Market, 2018 - 2030 (USD Billion)

6.3. Innovative APIs

6.3.1. Innovative APIs Market, 2018 - 2030 (USD Billion)

Chapter 7. Application Business Analysis

7.1. Active Pharmaceutical Ingredients Market: Application Movement Analysis

7.2. Cardiovascular Diseases

7.2.1. Cardiovascular Diseases Market, 2018 - 2030 (USD Billion)

7.3. Oncology

7.3.1. Innovative APIs Oncology Market, 2018 - 2030 (USD Billion)

7.4. CNS and Neurology

7.4.1. CNS and Neurology Market, 2018 - 2030 (USD Billion)

7.5. Orthopedic

7.5.1. Orthopedic Market, 2018 - 2030 (USD Billion)

7.6. Endocrinology

7.6.1. Endocrinology Market, 2018 - 2030 (USD Billion)

7.7. Pulmonology

7.7.1. Pulmonology Market, 2018 - 2030 (USD Billion)

7.8. Gastroenterology

7.8.1. Gastroenterology Market, 2018 - 2030 (USD Billion)

7.9. Nephrology

7.9.1. Nephrology Market, 2018 - 2030 (USD Billion)

7.10. Ophthalmology

7.10.1. Ophthalmology Market, 2018 - 2030 (USD Billion)

7.11. Others

7.11.1. Others Market, 2018 - 2030 (USD Billion)

Chapter 8. Type of Drug Business Analysis

8.1. Active Pharmaceutical Ingredients Market: Type of Drug Movement Analysis

8.2. Prescription

8.2.1. Prescription Market, 2018 - 2030 (USD Billion)

8.3. OTC

8.3.1. OTC Market, 2018 - 2030 (USD Billion)

Chapter 9. Regional Business Analysis

9.1. Active Pharmaceutical Ingredients Market Share By Region, 2023 & 2030

9.2. North America

9.2.1. North America Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.2.2. U.S.

9.2.2.1. Key Country Dynamics

9.2.2.2. Target Disease Prevalence

9.2.2.3. Competitive Scenario

9.2.2.4. Regulatory Framework

9.2.2.5. Reimbursement Scenario

9.2.2.6. U.S. Active pharmaceutical ingredients market, 2018 - 2030 (USD MILLION)

9.2.3. Canada

9.2.3.1. Key Country Dynamics

9.2.3.2. Target Disease Prevalence

9.2.3.3. Competitive Scenario

9.2.3.4. Regulatory Framework

9.2.3.5. Reimbursement Scenario

9.2.3.6. Canada Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3. Europe

9.3.1. Europe Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.2. Germany

9.3.2.1. Key Country Dynamics

9.3.2.2. Target Disease Prevalence

9.3.2.3. Competitive Scenario

9.3.2.4. Regulatory Framework

9.3.2.5. Reimbursement Scenario

9.3.2.6. Germany Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.3. UK

9.3.3.1. Key Country Dynamics

9.3.3.2. Target Disease Prevalence

9.3.3.3. Competitive Scenario

9.3.3.4. Regulatory Framework

9.3.3.5. Reimbursement Scenario

9.3.3.6. UK Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.4. France

9.3.4.1. Key Country Dynamics

9.3.4.2. Target Disease Prevalence

9.3.4.3. Competitive Scenario

9.3.4.4. Regulatory Framework

9.3.4.5. Reimbursement Scenario

9.3.4.6. France Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.5. Italy

9.3.5.1. Key Country Dynamics

9.3.5.2. Target Disease Prevalence

9.3.5.3. Competitive Scenario

9.3.5.4. Regulatory Framework

9.3.5.5. Reimbursement Scenario

9.3.5.6. Italy Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.6. Spain

9.3.6.1. Key Country Dynamics

9.3.6.2. Target Disease Prevalence

9.3.6.3. Competitive Scenario

9.3.6.4. Regulatory Framework

9.3.6.5. Reimbursement Scenario

9.3.6.6. Spain Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.7. Denmark

9.3.7.1. Key Country Dynamics

9.3.7.2. Target Disease Prevalence

9.3.7.3. Competitive Scenario

9.3.7.4. Regulatory Framework

9.3.7.5. Reimbursement Scenario

9.3.7.6. Denmark Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.8. Sweden

9.3.8.1. Key Country Dynamics

9.3.8.2. Target Disease Prevalence

9.3.8.3. Competitive Scenario

9.3.8.4. Regulatory Framework

9.3.8.5. Reimbursement Scenario

9.3.8.6. Sweden Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.9. Norway

9.3.9.1. Key Country Dynamics

9.3.9.2. Target Disease Prevalence

9.3.9.3. Competitive Scenario

9.3.9.4. Regulatory Framework

9.3.9.5. Reimbursement Scenario

9.3.9.6. Norway Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.10. Russia

9.3.10.1. Key Country Dynamics

9.3.10.2. Target Disease Prevalence

9.3.10.3. Competitive Scenario

9.3.10.4. Regulatory Framework

9.3.10.5. Reimbursement Scenario

9.3.10.6. France Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.11. Hungary

9.3.11.1. Key Country Dynamics

9.3.11.2. Target Disease Prevalence

9.3.11.3. Competitive Scenario

9.3.11.4. Regulatory Framework

9.3.11.5. Reimbursement Scenario

9.3.11.6. Italy Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.12. Poland

9.3.12.1. Key Country Dynamics

9.3.12.2. Target Disease Prevalence

9.3.12.3. Competitive Scenario

9.3.12.4. Regulatory Framework

9.3.12.5. Reimbursement Scenario

9.3.12.6. Spain Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.13. Switzerland

9.3.13.1. Key Country Dynamics

9.3.13.2. Target Disease Prevalence

9.3.13.3. Competitive Scenario

9.3.13.4. Regulatory Framework

9.3.13.5. Reimbursement Scenario

9.3.13.6. Switzerland Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.14. Portugal

9.3.14.1. Key Country Dynamics

9.3.14.2. Target Disease Prevalence

9.3.14.3. Competitive Scenario

9.3.14.4. Regulatory Framework

9.3.14.5. Reimbursement Scenario

9.3.14.6. Portugal Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.3.15. Greece

9.3.15.1. Key Country Dynamics

9.3.15.2. Target Disease Prevalence

9.3.15.3. Competitive Scenario

9.3.15.4. Regulatory Framework

9.3.15.5. Reimbursement Scenario

9.3.15.6. Greece Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4. Asia Pacific

9.4.1. Asia Pacific Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.2. Japan

9.4.2.1. Key Country Dynamics

9.4.2.2. Target Disease Prevalence

9.4.2.3. Competitive Scenario

9.4.2.4. Regulatory Framework

9.4.2.5. Reimbursement Scenario

9.4.2.6. Japan Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.3. China

9.4.3.1. Key Country Dynamics

9.4.3.2. Target Disease Prevalence

9.4.3.3. Competitive Scenario

9.4.3.4. Regulatory Framework

9.4.3.5. Reimbursement Scenario

9.4.3.6. China Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.4. India

9.4.4.1. Key Country Dynamics

9.4.4.2. Target Disease Prevalence

9.4.4.3. Competitive Scenario

9.4.4.4. Regulatory Framework

9.4.4.5. Reimbursement Scenario

9.4.4.6. India Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.5. South Korea

9.4.5.1. Key Country Dynamics

9.4.5.2. Target Disease Prevalence

9.4.5.3. Competitive Scenario

9.4.5.4. Regulatory Framework

9.4.5.5. Reimbursement Scenario

9.4.5.6. South Korea Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.6. Australia

9.4.6.1. Key Country Dynamics

9.4.6.2. Target Disease Prevalence

9.4.6.3. Competitive Scenario

9.4.6.4. Regulatory Framework

9.4.6.5. Reimbursement Scenario

9.4.6.6. Australia Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.7. Thailand

9.4.7.1. Key Country Dynamics

9.4.7.2. Target Disease Prevalence

9.4.7.3. Competitive Scenario

9.4.7.4. Regulatory Framework

9.4.7.5. Reimbursement Scenario

9.4.7.6. Thailand Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.8. Vietnam

9.4.8.1. Key Country Dynamics

9.4.8.2. Target Disease Prevalence

9.4.8.3. Competitive Scenario

9.4.8.4. Regulatory Framework

9.4.8.5. Reimbursement Scenario

9.4.8.6. Vietnam Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.9. Indonesia

9.4.9.1. Key Country Dynamics

9.4.9.2. Target Disease Prevalence

9.4.9.3. Competitive Scenario

9.4.9.4. Regulatory Framework

9.4.9.5. Reimbursement Scenario

9.4.9.6. Indonesia Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.10. Malaysia

9.4.10.1. Key Country Dynamics

9.4.10.2. Target Disease Prevalence

9.4.10.3. Competitive Scenario

9.4.10.4. Regulatory Framework

9.4.10.5. Reimbursement Scenario

9.4.10.6. Malaysia Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.11. Taiwan

9.4.11.1. Key Country Dynamics

9.4.11.2. Target Disease Prevalence

9.4.11.3. Competitive Scenario

9.4.11.4. Regulatory Framework

9.4.11.5. Reimbursement Scenario

9.4.11.6. Taiwan Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.4.12. Philippines

9.4.12.1. Key Country Dynamics

9.4.12.2. Target Disease Prevalence

9.4.12.3. Competitive Scenario

9.4.12.4. Regulatory Framework

9.4.12.5. Reimbursement Scenario

9.4.12.6. Philippines Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.5. Latin America

9.5.1. Latin America Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.5.2. Brazil

9.5.2.1. Key Country Dynamics

9.5.2.2. Target Disease Prevalence

9.5.2.3. Competitive Scenario

9.5.2.4. Regulatory Framework

9.5.2.5. Reimbursement Scenario

9.5.2.6. Brazil Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.5.3. Mexico

9.5.3.1. Key Country Dynamics

9.5.3.2. Target Disease Prevalence

9.5.3.3. Competitive Scenario

9.5.3.4. Regulatory Framework

9.5.3.5. Reimbursement Scenario

9.5.3.6. Mexico Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.5.4. Argentina

9.5.4.1. Key Country Dynamics

9.5.4.2. Target Disease Prevalence

9.5.4.3. Competitive Scenario

9.5.4.4. Regulatory Framework

9.5.4.5. Reimbursement Scenario

9.5.4.6. Argentina Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.5.5. Columbia

9.5.5.1. Key Country Dynamics

9.5.5.2. Target Disease Prevalence

9.5.5.3. Competitive Scenario

9.5.5.4. Regulatory Framework

9.5.5.5. Reimbursement Scenario

9.5.5.6. Columbia Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.5.6. Peru

9.5.6.1. Key Country Dynamics

9.5.6.2. Target Disease Prevalence

9.5.6.3. Competitive Scenario

9.5.6.4. Regulatory Framework

9.5.6.5. Reimbursement Scenario

9.5.6.6. Peru Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.5.7. Chile

9.5.7.1. Key Country Dynamics

9.5.7.2. Target Disease Prevalence

9.5.7.3. Competitive Scenario

9.5.7.4. Regulatory Framework

9.5.7.5. Reimbursement Scenario

9.5.7.6. Chile Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6. MEA

9.6.1. MEA Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6.2. South Africa

9.6.2.1. Key Country Dynamics

9.6.2.2. Target Disease Prevalence

9.6.2.3. Competitive Scenario

9.6.2.4. Regulatory Framework

9.6.2.5. Reimbursement Scenario

9.6.2.6. South Africa Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6.3. Saudi Arabia

9.6.3.1. Key Country Dynamics

9.6.3.2. Target Disease Prevalence

9.6.3.3. Competitive Scenario

9.6.3.4. Regulatory Framework

9.6.3.5. Reimbursement Scenario

9.6.3.6. Saudi Arabia Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6.4. UAE

9.6.4.1. Key Country Dynamics

9.6.4.2. Target Disease Prevalence

9.6.4.3. Competitive Scenario

9.6.4.4. Regulatory Framework

9.6.4.5. Reimbursement Scenario

9.6.4.6. UAE Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6.5. Kuwait

9.6.5.1. Key Country Dynamics

9.6.5.2. Target Disease Prevalence

9.6.5.3. Competitive Scenario

9.6.5.4. Regulatory Framework

9.6.5.5. Reimbursement Scenario

9.6.5.6. Kuwait Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6.6. Egypt

9.6.6.1. Key Country Dynamics

9.6.6.2. Target Disease Prevalence

9.6.6.3. Competitive Scenario

9.6.6.4. Regulatory Framework

9.6.6.5. Reimbursement Scenario

9.6.6.6. Egypt Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6.7. Israel

9.6.7.1. Key Country Dynamics

9.6.7.2. Target Disease Prevalence

9.6.7.3. Competitive Scenario

9.6.7.4. Regulatory Framework

9.6.7.5. Reimbursement Scenario

9.6.7.6. Israel Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6.8. Belarus

9.6.8.1. Key Country Dynamics

9.6.8.2. Target Disease Prevalence

9.6.8.3. Competitive Scenario

9.6.8.4. Regulatory Framework

9.6.8.5. Reimbursement Scenario

9.6.8.6. Belarus Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6.9. Algeria

9.6.9.1. Key Country Dynamics

9.6.9.2. Target Disease Prevalence

9.6.9.3. Competitive Scenario

9.6.9.4. Regulatory Framework

9.6.9.5. Reimbursement Scenario

9.6.9.6. Algeria Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6.10. Jordan

9.6.10.1. Key Country Dynamics

9.6.10.2. Target Disease Prevalence

9.6.10.3. Competitive Scenario

9.6.10.4. Regulatory Framework

9.6.10.5. Reimbursement Scenario

9.6.10.6. Jordan Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

9.6.11. Iran

9.6.11.1. Key Country Dynamics

9.6.11.2. Target Disease Prevalence

9.6.11.3. Competitive Scenario

9.6.11.4. Regulatory Framework

9.6.11.5. Reimbursement Scenario

9.6.11.6. Iran Active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Chapter 10. Competitive Landscape

10.1. Participant’s overview

10.2. Financial performance

10.3. Participant categorization

10.3.1. Market Leaders

10.3.2. Active Pharmaceutical Ingredients Market Share Analysis, 2023

10.3.3. Company Profiles

10.3.3.1. Dr. Reddy’s Laboratories Ltd.

10.3.3.1.1. Company Overview

10.3.3.1.2. Financial Performance

10.3.3.1.3. Product Benchmarking

10.3.3.1.4. Strategic Initiatives

10.3.3.2. Sun Pharmaceutical Industries Ltd.

10.3.3.2.1. Company Overview

10.3.3.2.2. Financial Performance

10.3.3.2.3. Product Benchmarking

10.3.3.2.4. Strategic Initiatives

10.3.3.3. Teva Pharmaceutical Industries Ltd.

10.3.3.3.1. Company Overview

10.3.3.3.2. Financial Performance

10.3.3.3.3. Product Benchmarking

10.3.3.3.4. Strategic Initiatives

10.3.3.4. Cipla Inc.

10.3.3.4.1. Company Overview

10.3.3.4.2. Financial Performance

10.3.3.4.3. Product Benchmarking

10.3.3.4.4. Strategic Initiatives

10.3.3.5. AbbVie Inc.

10.3.3.5.1. Company Overview

10.3.3.5.2. Financial Performance

10.3.3.5.3. Product Benchmarking

10.3.3.5.4. Strategic Initiatives

10.3.3.6. Aurobindo Pharma

10.3.3.6.1. Company Overview

10.3.3.6.2. Financial Performance

10.3.3.6.3. Product Benchmarking

10.3.3.6.4. Strategic Initiatives

10.3.3.7. Sandoz International GmbH (Novartis AG)

10.3.3.7.1. Company Overview

10.3.3.7.2. Financial Performance

10.3.3.7.3. Product Benchmarking

10.3.3.7.4. Strategic Initiatives

10.3.3.8. Viatris Inc.

10.3.3.8.1. Company Overview

10.3.3.8.2. Financial Performance

10.3.3.8.3. Product Benchmarking

10.3.3.8.4. Strategic Initiatives

10.3.3.9. Fresenius Kabi AG

10.3.3.9.1. Company Overview

10.3.3.9.2. Financial Performance

10.3.3.9.3. Product Benchmarking

10.3.3.9.4. Strategic Initiatives

10.3.3.10. STADA Arzneimittel AG

10.3.3.10.1. Company Overview

10.3.3.10.2. Financial Performance

10.3.3.10.3. Product Benchmarking

10.3.3.10.4. Strategic Initiatives

10.3.4. Strategy Mapping

10.3.4.1. Expansion

10.3.4.2. Acquisition

10.3.4.3. Collaborations

10.3.4.4. Disease Type/Drug Class Launch

10.3.4.5. Partnerships

10.3.4.6. Others

Chapter 11. Conclusion

List of Tables

Table 1 Global Active Pharmaceutical Ingredients Market, By Region, 2018 - 2030 (USD Billion)

Table 2 Global Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 3 Global Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 4 Global Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 5 Global Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 6 Global Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 7 North America Active Pharmaceutical Ingredients Market, By Country, 2018 - 2030 (USD Billion)

Table 8 North America Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 9 North America Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 10 North America Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 11 North America Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 12 North America Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 13 U.S. Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 14 U.S. Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 15 U.S. Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 16 U.S. Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 17 U.S. Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 18 Canada Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 19 Canada Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 20 Canada Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 21 Canada Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 22 Canada Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 23 Europe Active Pharmaceutical Ingredients Market, By Country, 2018 - 2030 (USD Billion)

Table 24 Europe Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 25 Europe Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 26 Europe Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 27 Europe Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 28 Europe Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 29 UK Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 30 UK Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 31 UK Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 32 UK Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 33 UK Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 34 Germany Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 35 Germany Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 36 Germany Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 37 Germany Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 38 Germany Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 39 France Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 40 France Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 41 France Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 42 France Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 43 France Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 44 Italy Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 45 Italy Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 46 Italy Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 47 Italy Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 48 Italy Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 49 Spain Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 50 Spain Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 51 Spain Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 52 Spain Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 53 Spain Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 54 Denmark Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 55 Denmark Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 56 Denmark Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 57 Denmark Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 58 Denmark Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 59 Sweden Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 60 Sweden Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 61 Sweden Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 62 Sweden Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 63 Sweden Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 64 Norway Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 65 Norway Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 66 Norway Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 67 Norway Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 68 Norway Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 69 Russia Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 70 Russia Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 71 Russia Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 72 Russia Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 73 Russia Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 74 Hungary Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 75 Hungary Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 76 Hungary Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 77 Hungary Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 78 Hungary Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 79 Poland Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 80 Poland Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 81 Poland Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 82 Poland Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 83 Poland Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 84 Switzerland Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 85 Switzerland Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 86 Switzerland Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 87 Switzerland Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 88 Switzerland Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 89 Portugal Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 90 Portugal Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 91 Portugal Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 92 Portugal Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 93 Portugal Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 94 Greece Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 95 Greece Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 96 Greece Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 97 Greece Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 98 Greece Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 99 Asia Pacific Active Pharmaceutical Ingredients Market, By Country, 2018 - 2030 (USD Billion)

Table 100 Asia Pacific Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 101 Asia Pacific Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 102 Asia Pacific Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 103 Asia Pacific Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 104 Asia Pacific Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 105 Japan Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 106 Japan Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 107 Japan Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 108 Japan Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 109 Japan Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 110 China Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 111 China Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 112 China Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 113 China Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 114 China Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 115 India Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 116 India Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 117 India Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 118 India Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 119 India Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 120 Australia Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 121 Australia Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 122 Australia Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 123 Australia Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 124 Australia Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 125 South Korea Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 126 South Korea Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 127 South Korea Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 128 South Korea Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 129 South Korea Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 130 Thailand Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 131 Thailand Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 132 Thailand Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 133 Thailand Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 134 Thailand Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 135 Vietnam Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 136 Vietnam Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 137 Vietnam Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 138 Vietnam Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 139 Vietnam Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 140 Indonesia Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 141 Indonesia Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 142 Indonesia Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 143 Indonesia Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 144 Indonesia Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 145 Malaysia Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 146 Malaysia Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 147 Malaysia Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 148 Malaysia Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 149 Malaysia Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 150 Taiwan Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 151 Taiwan Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 152 Taiwan Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 153 Taiwan Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 154 Taiwan Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 155 Philippines Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 156 Philippines Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 157 Philippines Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 158 Philippines Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 159 Philippines Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 160 Latin America Active Pharmaceutical Ingredients Market, By Country, 2018 - 2030 (USD Billion)

Table 161 Latin America Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 162 Latin America Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 163 Latin America Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 164 Latin America Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 165 Latin America Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 166 Brazil Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 167 Brazil Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 168 Brazil Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 169 Brazil Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 170 Brazil Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 171 Mexico Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 172 Mexico Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 173 Mexico Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 174 Mexico Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 175 Mexico Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 176 Argentina Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 177 Argentina Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 178 Argentina Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 179 Argentina Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 180 Argentina Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 181 Columbia Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 182 Columbia Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 183 Columbia Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 184 Columbia Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 185 Columbia Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 186 Peru Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 187 Peru Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 188 Peru Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 189 Peru Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 190 Peru Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 191 Chile Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 192 Chile Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 193 Chile Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 194 Chile Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 195 Chile Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 196 Middle East & Africa Active Pharmaceutical Ingredients Market, By Country, 2018 - 2030 (USD Billion)

Table 197 Middle East & Africa Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 198 Middle East & Africa Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 199 Middle East & Africa Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 200 Middle East & Africa Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 201 Middle East & Africa Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 202 South Africa Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 203 South Africa Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 204 South Africa Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 205 South Africa Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 206 South Africa Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 207 Saudi Arabia Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 208 Saudi Arabia Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 209 Saudi Arabia Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 210 Saudi Arabia Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 211 Saudi Arabia Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 212 UAE Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 213 UAE Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 214 UAE Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 215 UAE Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 216 UAE Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 217 Kuwait Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 218 Kuwait Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 219 Kuwait Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 220 Kuwait Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 221 Kuwait Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 222 Egypt Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 223 Egypt Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 224 Egypt Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 225 Egypt Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 226 Egypt Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 227 Israel Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 228 Israel Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 229 Israel Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 230 Israel Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 231 Israel Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 232 Belarus Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 233 Belarus Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 234 Belarus Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 235 Belarus Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 236 Belarus Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 237 Algeria Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 238 Algeria Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 239 Algeria Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 240 Algeria Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 241 Algeria Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 242 Jordan Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 243 Jordan Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 244 Jordan Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 245 Jordan Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 246 Jordan Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

Table 247 Iran Active Pharmaceutical Ingredients Market, By Type of Synthesis, 2018 - 2030 (USD Billion)

Table 248 Iran Active Pharmaceutical Ingredients Market, By Type of Manufacturer, 2018 - 2030 (USD Billion)

Table 249 Iran Active Pharmaceutical Ingredients Market, By Type, 2018 - 2030 (USD Billion)

Table 250 Iran Active Pharmaceutical Ingredients Market, By Application, 2018 - 2030 (USD Billion)

Table 251 Iran Active Pharmaceutical Ingredients Market, By Type of Drug, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value chain-based sizing & forecasting

Fig. 6 Market formulation & validation

Fig. 7 Active pharmaceutical ingredients market segmentation

Fig. 8 Market driver relevance analysis (Current & future impact)

Fig. 9 Market restraint relevance analysis (Current & future impact)

Fig. 10 Market challenge relevance analysis (Current & future impact)

Fig. 11 Penetration & growth prospect mapping

Fig. 12 SWOT analysis, by factor (political & legal, economic, and technological)

Fig. 13 Porter’s five forces analysis

Fig. 14 Market penetration vs growth prospect mapping

Fig. 15 Active pharmaceutical ingredients market: Type of synthesis movement analysis

Fig. 16 Biotech APIs market, 2018 - 2030 (USD Billion)

Fig. 17 Synthetic APIs market, 2018 - 2030 (USD Billion)

Fig. 18 Active pharmaceutical ingredients market: Type of manufacturer movement analysis

Fig. 19 Captive APIs market, 2018 - 2030 (USD Billion)

Fig. 20 Merchant APIs market, 2018 - 2030 (USD Billion)

Fig. 21 Active pharmaceutical ingredients market: Type movement analysis

Fig. 22 Generic APIs market, 2018 - 2030 (USD Billion)

Fig. 23 Innovative APIs market, 2018 - 2030 (USD Billion)

Fig. 24 Active pharmaceutical ingredients market: Application movement analysis

Fig. 25 Cardiovascular diseases market, 2018 - 2030 (USD Billion)

Fig. 26 Oncology market, 2018 - 2030 (USD Billion)

Fig. 27 CNS and Neurology market, 2018 - 2030 (USD Billion)

Fig. 28 Orthopaedic market, 2018 - 2030 (USD Billion)

Fig. 29 Endocrinology market, 2018 - 2030 (USD Billion)

Fig. 30 Pulmonology market, 2018 - 2030 (USD Billion)

Fig. 31 Gastroenterology market, 2018 - 2030 (USD Billion)

Fig. 32 Nephrology market, 2018 - 2030 (USD Billion)

Fig. 33 Ophthalmology market, 2018 - 2030 (USD Billion)

Fig. 34 Others market, 2018 - 2030 (USD Billion)

Fig. 35 Active pharmaceutical ingredients market: Type of drug movement analysis

Fig. 36 Prescription market, 2018 - 2030 (USD Billion)

Fig. 37 OTC market, 2018 - 2030 (USD Billion)

Fig. 38 Regional marketplace: Key takeaways

Fig. 39 Regional outlook, 2018 & 2030

Fig. 40 North America active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 41 U.S. active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 42 Canada active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 43 Europe active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 44 UK active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 45 Germany active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 46 Italy active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 47 Spain active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 48 France active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 49 Denmark active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 50 Sweden active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 51 Norway active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 52 Russia active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 53 Hungary active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 54 Poland active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 55 Switzerland active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 56 Portugal active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 57 Greece active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 58 Asia Pacific active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 59 Japan active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 60 China active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 61 India active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 62 Australia active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 63 South Korea active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 64 Thailand active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 65 Vietnam active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 66 Indonesia active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 67 Malaysia active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 68 Taiwan active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 69 Philippines active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 70 Latin America active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 71 Brazil active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 72 Mexico active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 73 Argentina active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 74 Columbia active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 75 Peru active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 76 Chile active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 77 MEA active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 78 South Africa active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 79 Saudi Arabia active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 80 UAE active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 81 Kuwait active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 82 Egypt active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 83 Israel active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 84 Belarus Arabia active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 85 Algeria active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 86 Jordan active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)

Fig. 87 Iran active pharmaceutical ingredients market, 2018 - 2030 (USD Billion)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation