- Home

- »

- Plastics, Polymers & Resins

- »

-

Adhesive Equipment Market Size And Share Report, 2030GVR Report cover

![Adhesive Equipment Market Size, Share & Trends Report]()

Adhesive Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Industrial Hot Melt, Adhesive Controllers, Adhesive Pumping Systems, Application Guns), By Application (Packaging,Construction, Lamination), By Region, And Segment Forecasts

- Report ID: 978-1-68038-542-7

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Adhesive Equipment Market Size & Trends

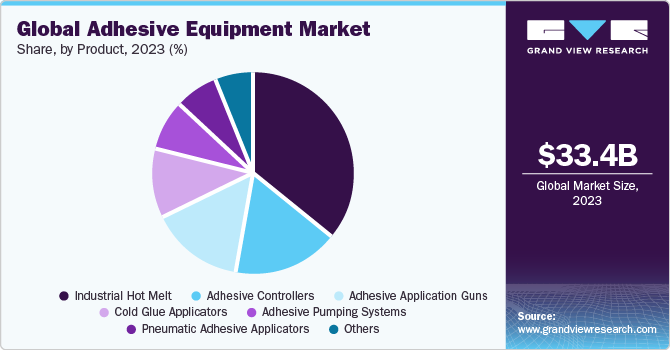

The global adhesive equipment market size was estimated at USD 33.41 billion in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The growing demand for lightweight and composite materials in industries such as construction and packaging has driven the need for advanced adhesive technologies. Adhesive equipment, such as precise dispensing systems, is essential for accurately applying adhesives to ensure the integrity of composite structures. For instance, adhesive equipment is extensively used in the packaging industry for bonding and sealing purposes. Moreover, adhesive equipment is employed to apply hot melt or pressure-sensitive adhesives for sealing cartons efficiently in high-speed packaging lines.

According to the U.S. Census Bureau, the construction value increased from USD 1.3 trillion in 2019 to USD 1.8 trillion in 2022. The growing construction industry serves as a significant catalyst for the increasing demand for adhesive equipment, playing a pivotal role in various aspects of modern construction processes. As construction practices evolve, adhesive equipment has become indispensable for enhancing efficiency, structural integrity, and overall sustainability.

Adhesive equipment is extensively used in panel bonding, a practice increasingly prevalent in construction. Panels made from materials like plywood, oriented strand board (OSB), or metal require precise bonding to form structural elements. Adhesive equipment enables efficient and uniform application of adhesives, ensuring a strong bond that contributes to the overall stability and durability of structures. This is particularly evident in the construction of prefabricated components and modular construction, where adhesive equipment streamlines the assembly process.

Moreover, the burgeoning packaging industry is a major driving force behind the escalating demand for adhesive equipment, playing a pivotal role in the efficiency, versatility, and overall success of modern packaging processes. As consumer preferences evolve and sustainability becomes a focal point, the demand for advanced adhesive equipment and the requisite equipment continues to rise, reshaping the landscape of packaging practices.

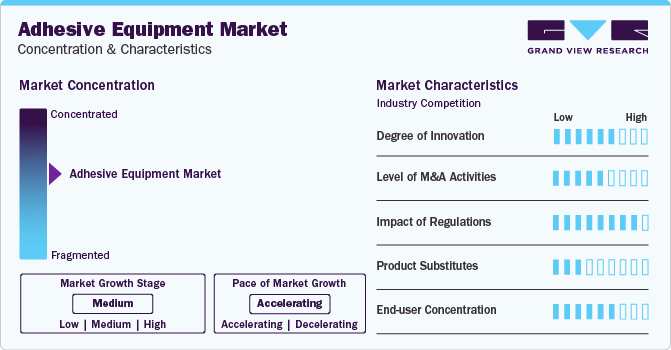

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market has witnessed substantial growth in recent years, driven by the increasing trend toward lightweight packaging. Adhesives offer an effective means of bonding lightweight materials such as paperboard, reducing the overall weight of packaging without compromising strength and durability. Adhesive application systems, including hot melt and cold glue systems, facilitate efficient bonding in high-speed packaging lines, ensuring the production of lightweight yet resilient packaging materials.

Moreover, the rise of e-commerce and the subsequent surge in demand for corrugated packaging have elevated the need for adhesive equipment. Adhesives play a critical role in the construction of corrugated boxes, ensuring secure sealing and structural integrity during transportation. Automated adhesive dispensing systems contribute to the efficiency of box assembly, catering to the high volume and rapid pace of modern packaging operations.

The packaging industry's growing focus on sustainability further underscores the importance of adhesive equipment. Water-based and solvent-free adhesives applied using advanced dispensing systems, align with eco-friendly packaging initiatives by reducing the environmental impact. Adhesive equipment facilitates the application of these sustainable adhesives, contributing to the creation of recyclable and compostable packaging solutions.

Innovations in packaging design, such as the use of speciality adhesives for creating resealable closures or easy-open features, drive the demand for adaptable adhesive equipment. Manufacturers rely on precise dispensing systems to apply these specialized adhesives accurately, ensuring that packaging meets consumer expectations for convenience and functionality.

The market sees a trend of consolidation, with key players engaging in mergers and acquisitions to expand their product portfolios and global reach. Strategic partnerships between equipment manufacturers and adhesive suppliers are common, ensuring compatibility and optimization of adhesive processes.

Moreover, the market is characterized by adherence to stringent quality standards and regulations, especially in industries such as aerospace, automotive, and healthcare. Adhesive equipment must meet specific requirements to ensure the reliability and performance of bonded materials. Compliance with regulations, such as REACH and RoHS, is crucial for manufacturers and end-users alike.

Application Insights

Based on application, the adhesive equipment segment plays a crucial role in the construction industry, facilitating the efficient and reliable bonding of various materials for structural integrity and durability. Dispensing systems, such as spray guns or applicators, are utilized to apply construction adhesives during the assembly of building components. For instance, in panel bonding applications, where materials like plywood or oriented strand board (OSB) are used, adhesive equipment ensures a secure bond, reducing the reliance on traditional fastening methods.

In the packaging industry, adhesive equipment plays a pivotal role in ensuring the secure and efficient bonding of various materials. Dispensing systems, including hot melt applicators and glue guns, are extensively used for applications such as carton sealing, where hot melt adhesives create strong bonds on corrugated surfaces. Labeling machines employ precise adhesive applicators for accurately dispensing glue, ensuring labels adhere seamlessly to packaging materials. Flexible packaging applications, like laminating films, rely on advanced adhesive equipment for uniform application, enhancing the durability and barrier properties of the final product.

Product Insights

Based on product, the industrial hot melt segment led the market with the largest revenue share of 36.3% in 2023, owing to increasing demand for efficient and versatile bonding solutions across diverse industries. This equipment finds widespread application in sectors such as packaging, construction, and textiles due to its ability to provide fast, reliable, and cost-effective bonding. The driving factors include the need for rapid assembly processes in manufacturing, the versatility of hot melt adhesives for bonding various substrates, and the industry's emphasis on sustainability, as hot melt adhesives often eliminate the need for solvents.

The adhesive controllers segment serves as a critical component in adhesive application systems, and their demand is propelled by rising need for precision, automation, and process. Adhesive controllers play a pivotal role in ensuring accurate adhesive application, reducing waste, and enhancing overall production efficiency. The increasing adoption of advanced adhesive technologies, including hot melt and reactive adhesives, further fuels the demand for sophisticated controllers that can manage and regulate intricate application processes.

Regional Insights

North America dominated the adhesive equipment market with the revenue share of 16.9% in 2023. The increasing demand for adhesives in various industries, such as technical textiles, construction, and packaging, is expected to drive the demand for the market. For instance, according to the Statistics Canada 2023 Report, completed housing projects have risen from 50,928 units in the first quarter of 2022 to 56,690 units in the fourth quarter of 2022, thereby reflecting an 11.0% growth in housing construction activities in the country in the same year. In addition, the increasing adoption of automation in manufacturing processes is leading to the development of advanced adhesive equipment.

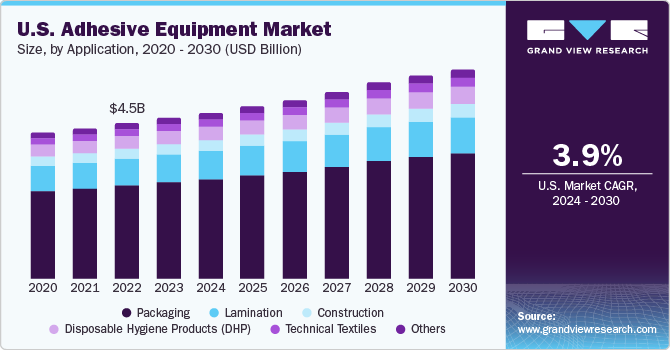

U.S. Adhesive Equipment Market Trends

The adhesive equipment market in the U.S. is expected to grow at the fastest CAGR of over 4.0% from 2024 to 2030. The growing emphasis on advanced manufacturing processes and technological innovations is expected to drive the market demand over the forecast period.

Asia Pacific Adhesive Equipment Market Trends

The adhesive equipment market in Asia Pacific is propelled by robust industrialization, expanding manufacturing sectors, and a surge in infrastructure development across the region. With the rise of the automotive, electronics, packaging, and construction industries, there is a growing demand for advanced adhesive technologies and equipment. The continuous drive for increased production efficiency, cost-effectiveness, and adherence to environmental regulations is steering the adoption of cutting-edge adhesive application solutions in the Asia Pacific region.

The China adhesive equipment market accounted with the revenue share of over 55.0% share in the Asia Pacific market, owing to growing industrialization and construction activities.As China's economy continues to expand and become more industrialized, there is a greater need for efficient and reliable equipment to help support this growth.

The adhesive equipment market in India accounted with the revenue share of over 20.0% share in the Asia Pacific market, owing to increased industrialization, infrastructure development, and a rising demand for efficient bonding solutions across diverse sectors. Moreover, the expanding packaging industry and construction activities fostered a growing market for adhesive equipment in the country.

Europe Adhesive Equipment Market Trends

The adhesive equipment in Europe is driven by a robust manufacturing sector, particularly in the automotive, packaging, and construction industries, that relies heavily on advanced adhesive technologies, propelling the need for efficient and precise adhesive equipment.

The Germany adhesive equipment market accounted with the revenue share of over 26.0% share in the European market, owing to the country's robust manufacturing sector, particularly in construction and packaging industries. The demand is fueled by the need for advanced adhesive technologies, precision application equipment, and a focus on sustainable bonding solutions.

The adhesive equipment market in UK is driven by the increased adoption of adhesive equipment due to the growing emphasis on precision, efficiency, and eco-friendly practices in various industries.

Middle East & Africa Adhesive Equipment Market Trends

The adhesive equipment market in the Middle East & Africa is experiencing dynamic growth fueled by robust infrastructural developments, expanding manufacturing sectors, and a surge in industrial activities across the region. With a focus on economic diversification, countries in the Middle East are investing significantly in construction, oil & gas, and automotive industries, driving the demand for advanced adhesive equipment.

The South Africa adhesive equipment market accounted with the revenue share of over 12.0% share in the Middle East & Africa market. The market is driven by increased demand from the construction, automotive, and packaging industries. The market is characterized by a rising adoption of advanced adhesive technologies to enhance manufacturing processes and meet evolving industry requirements.

Central & South America Adhesive Equipment Market Trends

The adhesive equipment market in Central & South America is experiencing dynamic growth fueled by expanding manufacturing sectors, robust infrastructural developments, and a surge in industrial activities across the region.

The Brazil adhesive equipment market accounted for the revenue share of over 15.0% share in Central & South America, propelled by expanding manufacturing activities, infrastructure development, and the automotive sector's demand. The market is characterized by a surge in the adoption of advanced adhesive technologies to improve production efficiency and meet the evolving needs of various industries.

Key Adhesive Equipment Company Insights

The global market is characterized by a high degree of fragmentation, with numerous regional and global manufacturers collectively holding about one-third of the market share. Henkel has emerged as a prominent player in the global market, alongside other key participants such as Nordson Corporation, Graco, Valco Melton, Dymax Corporation, and Robatech.

Environmental considerations have prompted companies like Henkel, Dow, Ashland, and 3M to explore bio-based alternatives derived from starch and other indirect food sources. Concurrently, concerns about environmental impact have motivated companies like Nordson to innovate adhesive dispensers with intermittent functionality, aiming to conserve adhesive and enhance bond strength. These developments are anticipated to contribute to the overall growth of the global adhesive equipment industry.

Key Adhesive Equipment Companies:

The following are the leading companies in the adhesive equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Robatech

- Glue Machinery Corporation

- Gluefast Company

- Henkel

- Nordson Corporation

- Adhesive & Equipment, Inc.

- Valco Melton

- Dymax Corporation

- Henline Adhesive Equipment Corporation

- ITW Dynatec

- Graco Inc.

- 3M

- Adhesive Dispensing Limited

Recent Developments

-

In November 2023, Henkel completed the acquisition of Seal for Life Industries LLC from Arsenal Capital Partners. Seal for Life, a U.S.-based company, specializes in providing protective coating and sealing solutions across diverse infrastructure markets including oil, gas, renewable energy, and water. With a global presence, the company achieved sales of around 250 million euros in 2023. The financial terms of the transaction were not disclosed

-

In August 2023, Nordson Corporation acquired ARAG Group and its affiliated companies, solidifying its position in the global market as an innovator in precision control systems and intelligent fluid components for agricultural spraying. This strategic move by Nordson aims to broaden it dispense capabilities into the precision agriculture sector

Adhesive Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 35.13 billion

Revenue forecast in 2030

USD 48.88 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

March 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Robatech; Glue Machinery Corporation; Gluefast Company; Henkel; Nordson Corporation; Adhesive & Equipment, Inc.; Valco Melton; Dymax Corporation; Henline Adhesive Equipment Corporation; ITW Dynatec; Graco Inc.; 3M; Adhesive Dispensing Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Adhesive Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global adhesive equipment market report based on product, application, and region:

-

Product Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Hot Melt

-

Adhesive Controllers

-

Cold Glue Applicators

-

Pneumatic Adhesive Applicators

-

Adhesive Pumping Systems

-

Adhesive Application Guns

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Construction

-

Lamination

-

Disposable Hygiene Products (DHP)

-

Technical Textiles

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global adhesive equipment market size was estimated at USD 33.41 billion in 2023 and is expected to reach USD 35.13 billion in 2024.

b. The global adhesive equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 48.88 billion by 2030.

b. Asia Pacific accounted for 47.6% of the global adhesive equipment market in 2023. The increasing demand for adhesives in various industries such as technical textiles, construction, and packaging are expected to drive the demand for adhesive equipment market.

b. Some of the key players operating in the adhesive equipment market include Robatech, Glue Machinery Corporation, Gluefast Company, Henkel, Nordson Corporation, Adhesive & Equipment, Inc., Valco Melton, Dymax Corporation, Henline Adhesive Equipment Corporation, ITW Dynatec, Graco Inc., 3M, Adhesive Dispensing Limited among others.

b. The growing demand for lightweight and composite materials in industries such as construction and packaging has driven the need for advanced adhesive technologies. Adhesive equipment, such as precise dispensing systems, is essential for accurately applying adhesives to ensure the integrity of composite structures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.