- Home

- »

- Advanced Interior Materials

- »

-

Oriented Strand Board Market Size & Share Report, 2030GVR Report cover

![Oriented Strand Board Market Size, Share & Trends Report]()

Oriented Strand Board Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Construction, Packaging, Others), By Region (North America, Europe, Asia Pacific, CSA, MEA), And Segment Forecasts

- Report ID: 978-1-68038-613-4

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oriented Strand Board Market Summary

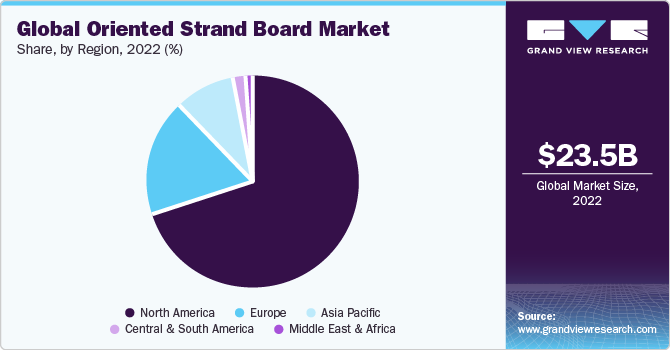

The global oriented strand board market size was valued at USD 23.50 billion in 2022 and is projected to reach USD 45.27 billion by 2030, growing at CAGR of 8.5% from 2023 to 2030. Superior and beneficial properties of oriented strand board (OSBs), such as low cost, high strength, and durability, are anticipated to spur its demand over the forecast period.

Key Market Trends & Insights

- North America dominated the global market and accounted for the revenue share of 70.2% in 2022.

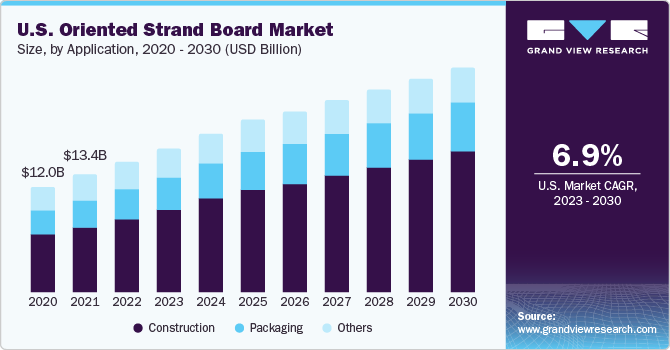

- The oriented strand board market in the U.S. is estimated to have substantial CAGR during the forecast period.

- Based on application, the construction segment held the largest share of 54.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 23.50 Billion

- 2030 Projected Market Size: USD 45.27 Billion

- CAGR (2023-2030): 8.5%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The emergence of terahertz technology for the measurement of moisture and density levels of the wood is expected to help in the production of advanced-grade products. The technology is being increasingly used to measure fiber orientation of OSBs owing to its sensitivity towards internal fiber structure.The construction industry led the U.S. OSB market, in terms of product usage, owing to high demand from the residential construction sector. The number of residential units in the country increased by 4.17% in 2017. It is further expected to grow at a substantial rate over the forecast period due to low mortgage rates along with increasing population and per capita income. The product is generally used as a smart alternative to the traditional lumber and plywood, as it ensures the availability of lumber supplies by efficient use of raw materials.

It is increasingly being used in I-joists, floor trusses, structural core panels, and stresses skin panels owing to technological innovations in the industry. This, in turn, will drive its growth in the years to come. The wood used in product manufacturing is generally derived from fast-growing trees, which can be replanted quickly, consequently resulting in a reduced rate of deforestation. Also, OSB panels are exempted from formaldehyde regulations, which is expected to drive its demand as a green building material.

Increasing construction infrastructure development has resulted in burgeoning demand for wood panels for interior decoration and furniture applications. High preference for OSB due to its low-cost has led to a surge in investments by industry players in capacity expansions and acquisitions to cater to the rising demand. The presence of a large number of well-established manufacturers significantly diminishes the opportunity for new companies in the market. Besides, high capital investments and dependency on varying annual growth of consumer industries may further discourage the entry of new firms.

Application Insights

The construction segment held the largest revenue share of 54.0% in 2022. Rising product usage in applications including single-layer flooring, subflooring, wall, ceiling, & panel sheathing, industrial containers, and mezzanine deck, coupled with strong housing demand in the U.S. is anticipated drive the segment. Superior product qualities, such as strength, rigidity, moisture resistance, core voids, lack of knot, coupled with low cost is predicted to fuel its demand in the packaging applications. The product is exempted from ISPM-15 regulations and hence is used in crating and packaging for exports. Moreover, it is easy to handle, cut, assemble, nail, and drill; which enables its use in packaging containers.

The packaging segment is expected to grow at a CAGR of 7.7% over the forecast period. Rising imports and exports across the globe are predicted to create an enormous demand for packaging. Increasing emphasis on cost-effectiveness coupled with a surge in demand for reusable packaging materials in the form of pallets and boxes is expected to drive product consumption over the forecast period. The product is used in several other applications including interior decoration and furniture. Superior characteristics, such as resistance to humidity, strength, and durability, are anticipated to accelerate its demand in interior decoration applications. Also, OSBs are lightweight, which further augments their demand for furniture applications.

Regional Insights

North America dominated the global oriented strand board market and accounted for the largest revenue share of 70.2% in 2022. Increasing usage of advanced products, such as the use of bio-adhesives as an alternative to the resins derived from crude oil, is anticipated to reduce the impact of crude oil price fluctuations, thereby benefitting the industry growth in the region. Europe exhibits a steady rise in OSB production, with Germany and Poland, being the largest producers.

Asia Pacific is expected to grow at the fastest CAGR of 14.5% during the forecast period. The Asia Pacific is estimated to be the fastest-growing region over the forecast period, owing to the high potential for infrastructure development. The region exhibits a high product demand in industrial applications as a substitute for plywood and blockboard, where high-end panel boards are required.

The growth of the market in the Asia Pacific region can be attributed to several factors. The rapid pace of urbanization and industrialization in countries like China and India has led to an increased need for construction materials, including OSB, for various infrastructure and housing projects. Additionally, the region's growing population has caused a rise in residential construction, resulting in a higher demand for OSB as an economical and environmentally sustainable alternative to traditional plywood

The rapidly expanding construction industry in Europe, due to low-interest rates and a high rate of net migration, is expected to be a major contributor to its growth.

Key Companies & Market Share Insights

The global market is consolidated in nature and major companies in the market are focused on providing high-quality products through cost leadership. They primarily compete based on product quality and price. Companies also focus on forming joint ventures as they face intense internal competition due to growth in the construction sector. Moreover, increasing product demand is compelling manufacturers to expand their production capacities.

Key Oriented Strand Board Companies:

- SONAE SGPS

- EGGER

- Nine Dragons Paper (Holdings) Limited

- COILLTE

- Kronoplus Limited

- SWISS KRONO Group

- Tolko Industries Ltd.

- Louisiana-Pacific Corporation

- Georgia-Pacific

- Weyerhaeuser Company

Recent Developments

-

In May 2023, Kronoplus Limited, a leading manufacturer of wood panel products announced the plan to invest USD 350 million in opening an oriented strand board making facility at its Alabama campus as a part of its expansion drive. The move is in response to meet growing demand for high quality construction materials from customers as well as expanding the product portfolio.

-

In May 2023, Louisiana-Pacific Corporation announced the plan to buy the assets owned by Wawa OSB Inc., including the oriented strand board facility in Wawa for an undisclosed amount. The move is part of the company’s efforts towards expanding capacity and position itself for long term growth.

Oriented Strand Board Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 26.34 billion

Revenue forecast in 2030

USD 45.27 billion

Growth Rate

CAGR of 8.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in Million Square Meters, Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Region

Regional scope

North America; Europe; Asia Pacific;Central & South America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Taiwan; South Korea; Argentina; Brazil; South Africa; Saudi Arabia

Key companies profiled

SONAE SGPS; EGGER; COILLTE; Kronoplus Limited; SWISS KRONO Group; Tolko Industries Ltd.; Louisiana-Pacific Corporation; Georgia-Pacific; Weyerhaeuser Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oriented Strand Board Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global oriented strand board market on the basis of application, and region:

-

Application Outlook (Volume in Million Square Meters, Revenue in USD Million, 2018 - 2030)

-

Construction

-

Packaging

-

Others

-

-

Regional Outlook (Volume in Million Square Meters, Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Taiwan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global oriented strand board market size was estimated at USD 23.50 billion in 2022 and is expected to reach USD 26.34 billion in 2023.

b. The global oriented strand board market is expected to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 45.27 billion by 2030.

b. Construction application accounted for the largest revenue share 54.0% in 2022 of oriented strand board market owing to its increasing use in subflooring, single layer flooring, ceilings, and walls.

b. Some of the key players operating in the oriented strand board market include EGGER Group, Kronopspan, Tolko Industries Ltd., Georgia-Pacific, Sonae Indústria, SGPS, S.A., and SWISS KRONO Group.

b. The key factors that are driving the oriented strand board market include the growth of construction sector coupled with its beneficial properties such as high strength, durability, and low cost.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.