- Home

- »

- Plastics, Polymers & Resins

- »

-

Adhesives & Sealants for Insulated Glass Market Report, 2025GVR Report cover

![Adhesives & Sealants for Insulated Glass Market Size, Share & Trends Report]()

Adhesives & Sealants for Insulated Glass Market Size, Share & Trends Analysis Report By Resin (Polyurethane, Silicone), By End Use (Automotive & Transportation, Building & Construction), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-811-4

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Bulk Chemicals

Report Overview

The global adhesives & sealants for insulated glass market size was valued at USD 4.92 billion in 2017 and is expected to witness a CAGR of 6.7% from 2018 to 2025. Rapidly growing construction and automotive & transportation sectors across the globe is the primary factor driving the product demand. Adhesives & sealants are utilized to assemble glass, metal, rubber, plastic, and other products during the manufacturing of automobiles and in construction projects. High-performance sealants have advantages over other joining techniques, such as welding, sewing, bolting, and screwing. As a result, adhesive bonding assists manufacturers in producing lightweight vehicles, which further aids in improving fuel economy and reducing the use of resources like conventional metals and plastics.

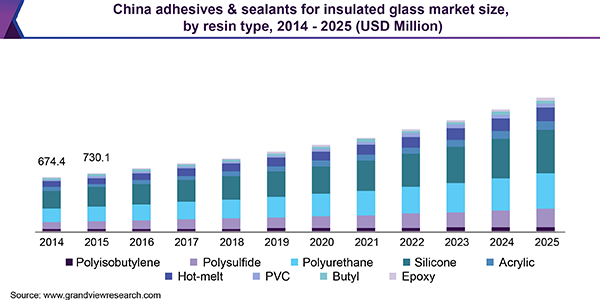

Rapid industrialization and exponential GDP growth in emerging markets, such as India and China, are expected to boost the manufacturing and chemical sectors. In 2017, countries including China, Cambodia, India, and Myanmar had the highest GDP growth rates of 6.6%, 6.9%, 7.2%, and 7.9% respectively. It is expected to boost the production activities across the Asia Pacific region, generating higher demand for adhesives & sealants over the forecast period.

Significant demand from the global construction sector is also estimated to drive market growth. For instance, a rise in disposable income coupled with an increasingly urban population is expected to boost the demand for urban housing infrastructure, especially in Latin America and Asia Pacific. Moreover, the recovery of the construction sector in North America and Europe is anticipated to propel the product demand over the years to come.

Adhesives & sealants are prepared from various polymers depending on the type or grade. Silicone, polyurethane (PU), and polysulfide are the most widely utilized resin types in insulated glass applications. The prices of polymers are dependent on the global crude oil market and their price trends are synced with those of crude oil as most of them are processed from this source. As a result, the volatility of raw materials, such as crude oil, is a major factor that restricts market growth.

Resin Type Insights

Polyurethane led the market in 2017 with a volume share of 31.80%. High flexibility and great impact and chemical resistance are the prominent factors driving their demand in insulated glass bonding applications. Also, the low cost of these sealants is estimated to drive their demand further. However, lower temperature and wear resistance than silicone sealants may restrain the segment growth.

In terms of revenue, silicone is estimated to expand at the fastest CAGR of 6.5% over the forecast period. Increasing consumption in the construction industry owing to its characteristics, such as high thermal stability, adhesion & aesthetic properties, and extreme weather resistance, is anticipated to drive the segment. Moreover, higher bonding speed and a longer lifespan than other resins is likely to boost the demand further.

Polysulfide resins are widely used in adhesives & sealants owing to their excellent corrosion resistance and strength. They bond to a number of metal substrates quickly, which helps in increasing efficiency and reducing production time. They are mainly subjected to applications where a tough, flexible, and watertight seal is required like chemical storage tanks, petrochemical, and wastewater treatment plants.

Moreover, they have versatile curing properties and are able to cure underwater. The growth of hot melt sealants is mainly driven by their eco-friendly nature. For instance, the emissions of Volatile Organic Compounds (VOCs) are reduced by using these adhesives. They also have a very fast set time as they do not use water or solvents. They are widely used in automotive, packaging, and assembly applications due to their strong resistance properties and high bonding speed.

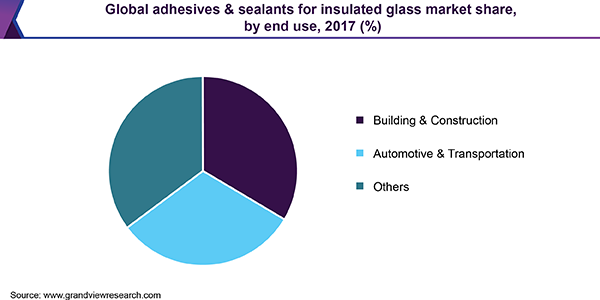

End-Use Insights

In terms of volume, automotive & transportation are anticipated to be the fastest-growing segment with a CAGR of 6.4% over the forecast period. Increasing automotive production coupled with the shift in trend from welding and metal jointing to adhesives is a key factor driving the segment growth. Furthermore, demand from consumers for better safety features along with stringent safety standards by various regulatory bodies is expected to propel the demand for insulated glass. This, in turn, will create lucrative opportunities for the market in the automotive industry.

Building & construction is predicted to be the second-fastest-growing segment during the forecast period. Adhesives & sealants are used in the building & construction industry to create invisible and permanent bonds between insulated glass and the metal or wooden surface. They provide excellent resistance to corrosion, water, and thermal conditions, which increases the longevity and service life of the building components. Thus, an increasing number of construction projects, especially in Asia Pacific, are expected to propel market development.

Other applications include aerospace, medical, marine, and agricultural machinery. Rising disposable income levels in the emerging economies are enabling farmers to invest substantially in agricultural machineries, such as tractors and harvesters, making agrarian machinery one of the fastest-growing market for insulated glass. Aerospace is another end-use segment utilizing adhesives & sealants for insulated glass. High-performance adhesives facilitate improved performance, reduced weight, and fuel efficiency for commercial aircraft.

Regional Insights

In terms of revenue, Asia Pacific captured the highest market share of the market in 2017. It is also estimated to be the fastest-growing regional market over the forecast period on account of rapid industrialization, rising urbanization owing to population growth, and strong economic development. Emerging countries, such as China, India, and Indonesia, are witnessing significant public & private investments in infrastructure and commercial & residential construction activities. Also, the high demand for passenger and commercial vehicles, particularly in such countries is expected to drive automotive production in the region.

All these factors are estimated to contribute to the product demand in the region. North America also accounted for a considerable industry share in 2017 with the U.S. being the major contributor. A resurgence of the U.S. housing sector is facilitating the growth of the construction sector, thereby fueling the product demand. Moreover, recent trend dictates that Original Equipment Manufacturers (OEMs) in this region are focusing on the up-gradation of the traditional models of heavy vehicles, such as buses and trucks, with energy-efficient components, such as insulated glass windscreens.

This is also estimated to drive the market in the region. In Europe, the market is anticipated to be primarily driven by the initiatives, such as Construction 2020 and EU Construction and Demolition Waste proposal, by the European Commission. Moreover, focusing on retrofitting the existing buildings with green building solutions to improve energy efficiency will increase the demand for insulated glass and, in turn, spur the adhesives & sealants market.

Key Companies & Market Share Insights

Prominent companies in the market include Henkel AG & Co. KGaA, Huntsman Corp., Kommerling, The 3M Company, and Dow Corning. The market is highly cost-intensive and is dominated by major multinational companies, which are present across the value chain. Acquisitions and expansions have emerged as the key strategies adopted by these companies. However, in recent times, academicians, as well as industry players, are focusing on the development of bio-based adhesives owing to the stringent government regulations. For instance, researchers at the Center for Bioplastics and Biocomposites, and Iowa State Univ. are investigating bioadvantaged polymers for the production of adhesives & sealants.

Adhesives & Sealants for Insulated Glass Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 5.5 billion

Revenue forecast in 2025

USD 8.2 billion

Growth Rate

CAGR of 6.7% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Germany, U.K., Italy, China, India, Japan, Brazil, Mexico

Key companies profiled

Henkel AG & Co. KGaA, Huntsman Corp., Kommerling, The 3M Company, and Dow Corning.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global adhesives & sealants for insulated glass market report on the basis of resin type, end-use, and region:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Polyisobutylene

-

Polysulfide

-

Polyurethane

-

Silicone

-

Acrylic

-

Hot-melt

-

PVC

-

Butyl

-

Epoxy

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Building & Construction

-

Automotive & Transportation

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global adhesives and sealants for insulated glass market size was estimated at USD 5.5 billion in 2019 and is expected to reach USD 5.8 billion in 2020.

b. The global adhesives and sealants for insulated glass market is expected to grow at a compound annual growth rate of 6.7% from 2019 to 2025 to reach USD 8.2 billion by 2025.

b. Polyurethane dominated the adhesives and sealants for insulated glass market with a share of 31% in 2019. This is attributable to high flexibility, great impact and chemicals resistance.

b. Some key players operating in the adhesives and sealants for insulated glass market include Henkel AG & Co. KGaA, Huntsman Corp., Kommerling, The 3M Company, and Dow Corning.

b. Key factors that are driving the market growth include advantages of high-performance sealants over other joining techniques, such as welding, sewing, bolting, and screwing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."