- Home

- »

- Next Generation Technologies

- »

-

Advanced Air Mobility Market Size, Industry Report, 2035GVR Report cover

![Advanced Air Mobility Market Size, Share & Trends Report]()

Advanced Air Mobility Market (2025 - 2035) Size, Share & Trends Analysis Report By Component, By Application, By End-use, By Operating Mode, By Type, By Product, By Propulsion Type, By Maximum Take-off Weight, By Range, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-099-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2035

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Advanced Air Mobility Market Summary

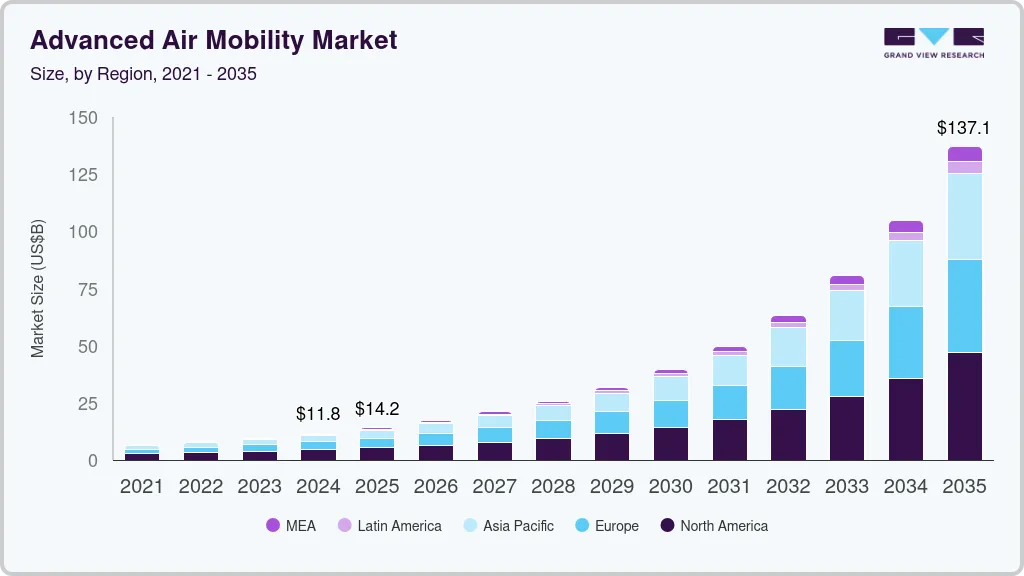

The global advanced air mobility market size was estimated at USD 11.75 billion in 2024 and is projected to reach USD 137.11 billion by 2035, growing at a CAGR of 25.5% from 2025 to 2035. The market growth is primarily driven by increasing urbanization, rising traffic congestion, and growing environmental concerns.

Key Market Trends & Insights

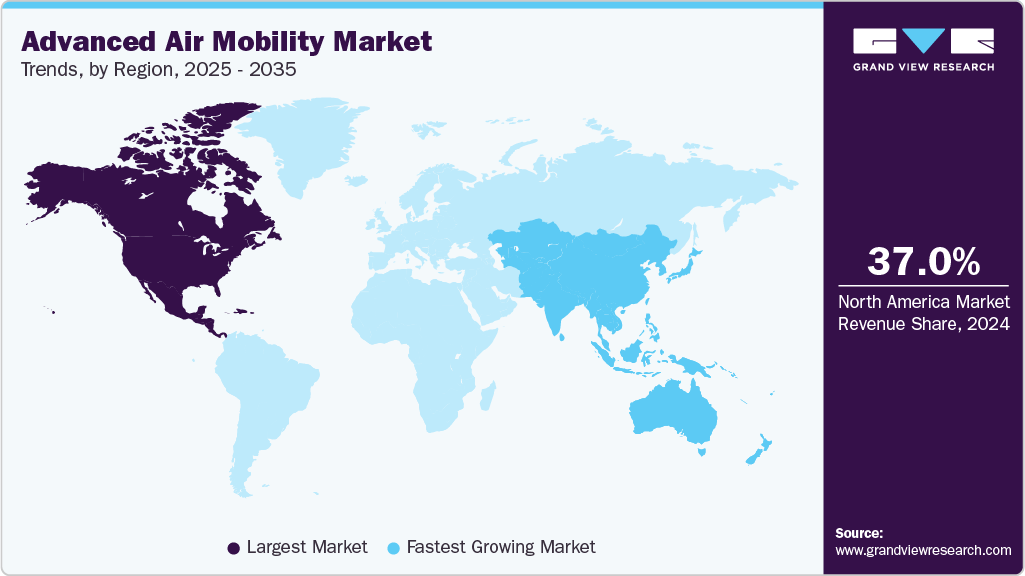

- North America accounted for the significant global market share of over 37.0% in 2024.

- The U.S. advanced air mobility market dominated with a share of 85.0% in 2024.

- By component, the hardware segment dominated the market with a share of 84.0% in 2024.

- By application, the surveillance & monitoring segment accounted for the largest share in 2024.

- Based on end-use, the commercial segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.75 Billion

- 2035 Projected Market Size: USD 137.11 Billion

- CAGR (2025-2035): 25.5%

- North America: Largest market in 2024

Key technological advancements in electric vertical takeoff and landing (eVTOL) aircraft, hydrogen fuel cells, and autonomous flight systems are enabling more efficient, sustainable, and accessible aerial mobility solutions. In addition, regulatory agencies worldwide are establishing certification frameworks and safety standards, while significant investments are being made in infrastructure such as vertiports and charging stations, which is expected to further drive the advanced air mobility industry growth. The rapid growth of urban populations worldwide has led to escalating traffic congestion in major metropolitan areas, creating an urgent need for innovative transportation solutions.

Advanced air mobility addresses these challenges by offering efficient, point-to-point aerial transport that bypasses ground traffic bottlenecks. This demand, coupled with the global push for sustainable transportation, is driving significant investments in zero-emission eVTOL (electric vertical take-off and landing) aircraft and related infrastructure, thereby positioning the advanced air mobility (AAM) as a transformative solution for urban mobility and driving the advanced air mobility industry growth.

In addition, growing technological advancements in electric propulsion systems, battery energy density, and hybrid-electric powertrains are driving the AAM industry growth. Fully electric propulsion is gaining traction due to its zero direct emissions, lower noise, and reduced maintenance, while hybrid systems offer extended range and operational flexibility. In addition, hydrogen fuel cell technology is emerging rapidly, as it addresses range limitations while maintaining sustainability goals. These propulsion advancements are making AAM vehicles more viable, efficient, and attractive for commercial deployment, thereby driving the advanced air mobility industry expansion.

Furthermore, the establishment of comprehensive regulatory frameworks by agencies such as the FAA in North America and EASA in Europe is accelerating AAM commercialization by providing clear certification pathways and safety standards. In addition, investments in essential infrastructure, such as vertiports, charging stations, and maintenance facilities, are expanding globally. Public-private partnerships and pilot projects are facilitating the integration of AAM into existing urban transport networks, enhancing public trust and operational readiness. This regulatory and infrastructural progress is vital for scaling the advanced air mobility industry from pilot phases to widespread adoption.

Moreover, companies are partnering with municipal governments and private investors to develop vertiport networks, which are critical for facilitating passenger boarding, charging, and maintenance. In addition, they are investing heavily in autonomous flight technologies and advanced air traffic management integration to enhance safety and operational efficiency. Expanding beyond urban air mobility, companies are exploring regional and rural service applications to connect underserved areas, thereby broadening market reach. This holistic approach, spanning technology innovation, regulatory compliance, infrastructure development, and service expansion, is driving the rapid growth of advanced air mobility industry.

Component Insights

The hardware segment dominated the market with a market share of over 84% in 2024, driven by the growing advancements in materials science which have led to the development of lightweight yet durable structures, enhancing the efficiency and performance of AAM vehicles. The integration of electric propulsion systems is reducing reliance on fossil fuels, aligning with global sustainability goals. Innovations in battery technology are extending the range and operational time of these vehicles, making them more viable for commercial applications.

The software segment is expected to witness the highest CAGR of over 27% from 2025 to 2035. The development of sophisticated flight control systems, powered by artificial intelligence (AI) and machine learning algorithms, enables real-time decision-making and autonomous operations. These systems enhance safety by minimizing human error and optimizing flight paths for efficiency. Software solutions are integral to air traffic management, coordinating the movements of numerous aircraft in increasingly congested airspaces. The implementation of digital platforms and automated systems is streamlining flight approvals and route planning, thereby accelerating the deployment of AAM services.

Application Insights

The surveillance & monitoring segment accounted for the largest market share in 2024, driven by the increasing need for real-time tracking, safety assurance, and operational oversight of aerial vehicles. The growing advancements in sensor technology, AI-powered analytics, and integration with Unmanned Aircraft System Traffic Management (UTM) systems enhance the capability to detect anomalies, prevent collisions, and optimize flight operations. In addition, growing investments in infrastructure such as vertiports and charging stations necessitate robust surveillance solutions to manage ground and airside activities securely. These factors are driving the demand for sophisticated surveillance and monitoring technologies, supporting safe, reliable, and scalable deployment of advanced aerial mobility services.

The passenger transport segment is expected to witness the highest CAGR from 2025 to 2035, primarily driven by the urgent demand for urban air mobility solutions in congested metropolitan areas, where eVTOL aircraft and air taxis offer faster, more sustainable alternatives to traditional ground transportation. Strong investments from both private companies and governments are accelerating the development and deployment of passenger AAM services. In addition, advancements in fully electric propulsion systems, which provide zero direct emissions, lower noise, and reduced maintenance, further support the growth of passenger transport applications.

End-use Insights

The commercial segment accounted for the largest market share in 2024, primarily driven by the need for efficient, sustainable, and cost-effective transportation solutions. Companies in logistics, travel, and services are integrating advanced air mobility solutions to enhance operational efficiency and reduce environmental impact. The growing demand for quick deliveries, particularly in e-commerce, is propelling the use of cargo drones for last-mile logistics. In addition, urban air mobility services, such as air taxis, are being developed to alleviate traffic congestion and provide faster transit options in metropolitan areas.

The government & military segment is expected to witness a significant CAGR from 2025 to 2035, driven by the need for enhanced operational capabilities, cost-effectiveness, and sustainability. The government and military sectors are increasingly adopting AAM technologies. Hybrid and electric advanced air mobility vehicles offer lower operational costs and reduced environmental impact compared to conventional aircraft, aligning with governmental initiatives to lower carbon footprints and increase energy efficiency. Furthermore, governments are investing in infrastructure development, such as vertiports and charging stations, to support the integration of AAM into existing transportation networks.

Product Insights

The rotary blade segment accounted for the largest market share in 2024, primarily driven by the versatility and operational flexibility of rotary-wing aircraft. Rotary-wing aircraft, such as helicopters and tiltrotors, offer the ability to access confined spaces and operate in diverse environments, making them suitable for missions such as emergency medical services, search and rescue operations, and military applications. Advancements in rotorcraft technology are focusing on improving efficiency, reducing noise levels, and enhancing safety features. The development of advanced materials and noise-reduction technologies is contributing to the evolution of rotary-wing aircraft, ensuring their continued relevance in the AAM ecosystem.

The hybrid segment is expected to witness the highest CAGR from 2025 to 2035, primarily driven by the need to balance environmental sustainability with operational efficiency. By combining electric motors with traditional combustion engines, hybrid systems offer extended range and payload capacity while reducing emissions and fuel consumption. This dual-power approach addresses the limitations of purely electric aircraft, such as limited battery life and charging infrastructure requirements. In addition, policy incentives and carbon pricing mechanisms are encouraging the adoption of hybrid technologies, making them economically viable for operators.

Maximum Take-off Weight Insights

The <100 kg segment accounted for the largest market share in 2024, primarily driven by the demand for lightweight and cost-effective solutions. The <100 kg segment encompasses small drones used for various applications, including aerial photography, surveying, and delivery services. These lightweight drones are easier to deploy and operate, making them accessible for both commercial and recreational use, which is further driving the market growth.

The 100-300 kg segment is expected to witness the highest CAGR from 2025 to 2035, owing to its optimal balance of payload capacity, operational efficiency, and versatility. Aircraft within this weight range are well-suited for urban air mobility applications such as passenger transport, cargo delivery, and emergency medical services, where moderate payloads and compact size are critical for navigating dense city environments and vertiport infrastructure. This segment benefits from advancements in electric and hybrid propulsion systems, which enable longer flight durations and lower emissions while maintaining manageable vehicle weight.

Operating Mode Insights

The remotely piloted segment accounted for the largest market share in 2024, primarily driven by the need for controlled and adaptable flight operations. The remotely piloted segment encompasses aircraft operated by human pilots from a distance. This mode of operation is particularly valuable in scenarios requiring human judgment, such as complex missions, emergency response, and areas with challenging environmental conditions. Remotely piloted aircraft offer flexibility and can be rapidly deployed, making them suitable for a wide range of applications, including surveillance, infrastructure inspection, and cargo transport.

The fully autonomous segment is expected to witness the highest CAGR from 2025 to 2035, driven by advancements in artificial intelligence (AI), machine learning, and sensor technologies, the fully autonomous segment is revolutionizing the AAM landscape. AI enables aircraft to interpret complex environments, make real-time decisions, and navigate without human intervention. This autonomy reduces operational costs by eliminating the need for onboard pilots and enhancing safety through consistent, data-driven decision-making. Companies are at the forefront, developing autonomous electric vertical takeoff and landing (eVTOL) aircraft. The integration of autonomous systems is also facilitating the development of smart air traffic management systems, further enhancing the efficiency and safety of AAM operations and driving the segmental growth.

Propulsion Type Insights

The electric propulsion segment accounted for the largest market share in 2024, primarily driven by the global push for sustainability and the need to reduce aviation's carbon footprint. Advancements in battery technology have significantly improved energy density and reduced weight, enhancing the efficiency and range of electric aircraft. These systems offer zero direct emissions, lower noise profiles, and simplified maintenance requirements, making them ideal for urban air mobility applications.

The hybrid segment is expected to witness the highest CAGR from 2025 to 2035, primarily driven by the limitations of current battery technology and the need for extended range and operational flexibility. Hybrid propulsion systems combine traditional combustion engines with electric motors. This dual-power approach allows aircraft to use electric power during certain phases of flight, such as takeoff and landing, where fuel consumption is typically highest. By optimizing fuel efficiency and reducing emissions, hybrid systems provide a practical transition toward more sustainable aviation.

Range Insights

The intracity (20km - 100km) segment accounted for the largest market share in 2024, driven by urban congestion and the demand for rapid, on-demand transportation. Intracity AAM solutions aim to provide fast, efficient, and environmentally friendly alternatives to traditional ground-based transit. Electric vertical take-off and landing (eVTOL) aircraft are particularly suited for urban environments, as they require minimal ground infrastructure and can bypass terrestrial traffic, significantly reducing travel time.

The intercity (above 100km) segment is expected to witness the highest CAGR from 2025 to 2035, primarily driven by the need for faster and more efficient transportation between cities. Intercity AAM solutions offer a viable alternative to traditional ground and rail transportation. The development of hybrid and electric aircraft capable of covering extended ranges is expanding the potential applications of AAM beyond urban centers. Collaborations between aviation manufacturers and regional governments are facilitating the establishment of necessary infrastructure, such as charging stations and maintenance facilities, to support intercity AAM operations, which is further driving the segmental growth.

Type Insights

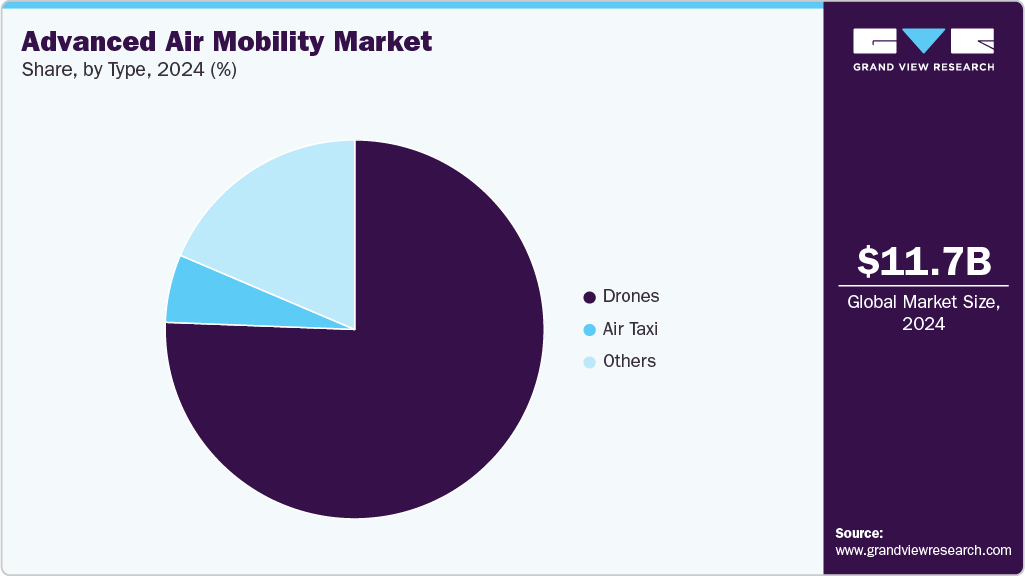

The drones segment accounted for the largest market share in 2024, primarily driven by advancements in artificial intelligence (AI), machine learning (ML), and sensor technologies. AI and ML enable drones to process real-time data, make autonomous decisions, and adapt to dynamic environments, enhancing their efficiency and capabilities. Government initiatives and investments in smart city projects are further accelerating the adoption of drones, as they offer cost-effective and scalable solutions for urban air mobility.

The air taxi segment is expected to witness the highest CAGR from 2025 to 2035, primarily driven by the need for sustainable and efficient urban transportation. The air taxi segment is gaining traction with the development of electric vertical take-off and landing (eVTOL) aircraft. The growing advancements in battery technology, autonomous flight systems, and digital connectivity are enhancing the safety, efficiency, and reliability of eVTOL aircraft. Strategic partnerships between aerospace companies, ride-sharing platforms, and urban mobility providers are accelerating the commercialization of air taxis and expanding their integration into city transport systems.

Regional Insights

North America accounted for the significant market with a share of over 37% in 2024, driven by the increasing demand for on-demand urban air transportation services to alleviate congestion and reduce travel times in densely populated urban areas. The region benefits from extensive infrastructure development, government support, and collaborations between established aerospace manufacturers and innovative startups. Hardware remains the largest segment, while software and autonomous flight technologies are the fastest growing, reflecting the push toward fully autonomous, zero-emission eVTOL aircraft for passenger and cargo transport.

U.S. Advanced Air Mobility Market Trends

The U.S. advanced air mobility market dominated the market with a share of over 85% in 2024, as the U.S. benefits from a well-established aerospace ecosystem, fostering innovation and facilitating the development of electric vertical takeoff and landing (eVTOL) aircraft. The growing collaborations between established aerospace manufacturers and technology companies are accelerating the commercialization of AAM platforms, positioning the U.S. at the forefront of this transformative industry.

Europe Advanced Air Mobility Market Trends

Europe advanced air mobility market is expected to grow at a CAGR of over 25% from 2025 to 2035, driven by a strong emphasis on sustainability and technological innovation. The European Union Aviation Safety Agency (EASA) has been instrumental in establishing regulatory frameworks, while countries such as the UK and Germany invest in infrastructure such as vertiports. Collaborations between public and private sectors, exemplified by projects such as E-Skyports Infrastructure's vertiport testbed in the UK, are pivotal in integrating eVTOL aircraft into urban transportation networks.

The UK advanced air mobility market is expected to grow at a significant rate in the coming years, driven by significant government investments and regulatory support aimed at fostering sustainable urban transportation. The UK government and private sector are actively collaborating to develop vertiport infrastructure and pilot programs, facilitating the integration of eVTOL aircraft into urban environments.

The advanced air mobility market in Germany is driven by its growing investments in vertiports and urban air mobility ecosystems to enable efficient eVTOL operations within and between cities. Regulatory frameworks aligned with the European Union Aviation Safety Agency (EASA) standards provide a clear pathway for certification and commercialization of AAM vehicles. Germany’s robust aerospace industry and public-private partnerships are accelerating advancements in electric propulsion and autonomous flight technologies, aiming to reduce urban traffic congestion and environmental impact.

Asia Pacific Advanced Air Mobility Market Trends

The Asia Pacific advanced air mobility market is expected to grow at the highest CAGR of 27% from 2025 to 2035, driven by increasing investments in electric vertical takeoff and landing (eVTOL) technologies, government support for low-altitude airspace development, and the integration of AAM into urban transportation networks.

The Japan advanced air mobility market is gaining traction, as the country's aging population has accelerated the demand for autonomous transportation solutions, including eVTOLs, to provide safer and more accessible mobility options. Additionally, Japan's well-maintained infrastructure and supportive government policies further bolster the development and deployment of advanced air mobility technologies.

The advanced air mobility market in China is rapidly expanding, propelled by strong government backing, rapid urbanization. Regulatory approvals and commercial operations of autonomous passenger drones are expanding, supported by investments in infrastructure and urban air mobility initiatives. The focus on zero-emission propulsion systems, including electric and hydrogen fuel cells, aligns with China’s environmental goals. The market benefits from integration with smart city projects and growing demand for efficient passenger and logistics aerial services.

Key Advanced Air Mobility Company Insights

Some of the key players operating in the market are Siemens AG and Rockwell Automation, Inc., among others.

-

Airbus S.A.S. is a global aerospace leader actively advancing the advanced air mobility (AAM) market through innovative electric vertical take-off and landing (eVTOL) aircraft. The company focuses on developing urban air mobility solutions such as CityAirbus NextGen, a fully electric, two-ton class eVTOL designed for short-range urban operations with an 80 km range and 120 km/h cruise speed. Airbus emphasizes strategic collaborations and ecosystem development to commercialize AAM, aiming to integrate these aircraft into city transportation networks and reduce urban congestion. Leveraging its aerospace expertise, Airbus is positioned to be a key player in shaping sustainable, efficient aerial mobility for passenger and cargo transport.

-

Guangzhou EHang Intelligent Technology Co. Ltd. specializes in autonomous aerial vehicles and is a pioneer in the AAM sector, focusing on fully autonomous passenger drones and cargo delivery solutions. EHang’s flagship product, the EHang 216, is an autonomous eVTOL designed for urban air mobility, capable of carrying passengers safely without a pilot onboard. The company leverages advanced AI and autonomous flight technologies to provide efficient, low-emission transportation options that address urban congestion and last-mile delivery challenges.

Lilium GmbH and Vertical Aerospace Group Ltd. are some of the emerging market participants in the advanced air mobility market.

-

Lilium GmbH is a German aerospace company developing an all-electric vertical take-off and landing jet designed for regional air mobility. Its flagship aircraft, the Lilium Jet, features a unique distributed electric propulsion system enabling high speed and longer range compared to typical eVTOLs, targeting intercity travel with ranges exceeding 250 km. The company aims to create a regional air mobility network that connects urban centers and suburbs efficiently, reducing reliance on ground transport.

-

Vertical Aerospace Group Ltd. is a UK-based aerospace manufacturer focused on developing zero-emission eVTOL aircraft for urban and regional air mobility. Its flagship model, the VA-X4, is designed to carry four passengers with a range of approximately 160 km and a top speed of 320 km/h, targeting commercial passenger transport markets. Vertical Aerospace emphasizes safety, performance, and certification readiness, working closely with aviation authorities to accelerate market entry. The company is also building partnerships with airlines and infrastructure providers to develop integrated urban air mobility ecosystems, aiming to become a leading supplier of sustainable aerial vehicles globally.

Key Advanced Air Mobility Companies:

The following are the leading companies in the advanced air mobility market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus S.A.S.

- Aurora Flight Sciences

- Bell Textron Inc.

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Embraer S.A.

- Joby Aviation

- Lilium GmbH

- Neva Aerospace

- Opener, Inc.

- PIPISTREL (Textron Inc.)

- Vertical Aerospace Group Ltd.

- Volocopter GmbH

- Workhorse Group, Inc.

- Wisk Aero (The Boeing Company)

Recent Developments

-

In May 2025, Vertical Aerospace Group Ltd. announced the development of a new 1,000-mile hybrid-electric VTOL variant based on its VX4 aircraft, aimed at serving defence, logistics, and wider commercial markets. This hybrid-electric model will significantly extend range and payload capabilities, enabling new applications such as air ambulance services and defense missions requiring longer endurance and higher payloads.

-

In March 2025, Guangzhou EHang Intelligent Technology Co. Ltd. successfully completed the first flight of its pilotless EH216-S eVTOL aircraft in Mexico, marking the aircraft’s debut in the country and expanding EHang’s operational footprint to 19 countries.

-

In March 2025, Wisk Aero released a comprehensive paper on Advanced Air Mobility (AAM) in Australia, highlighting the country’s potential to lead in autonomous flight innovation. The paper emphasizes the benefits of autonomous aircraft for enhancing connectivity in both urban and regional areas, improving safety, and supporting sustainable transportation.

Advanced Air Mobility Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.20 billion

Revenue forecast in 2035

USD 137.11 billion

Growth rate

CAGR of 25.5% from 2025 to 2035

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2035

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2035

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, product, type, maximum take-off weight, operating mode, propulsion type, range, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; Australia; Japan; India; South Korea; Brazil; Mexico; Saudi Arabia; UAE

Key companies profiled

Airbus S.A.S.; Aurora Flight Sciences; Bell Textron Inc.; Guangzhou EHang Intelligent Technology Co. Ltd.; Embraer S.A.; Joby Aviation; Lilium GmbH; Neva Aerospace; Opener, Inc.; PIPSTREL (Textron, Inc.); Vertical Aerospace Group Ltd.; Volocopter GmbH; Wisk Aero (The Boeing Company); Workhorse Group, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Advanced Air Mobility Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2035. For this study, Grand View Research has segmented the global advanced air mobility market report based on component, application, end-use, product, type, maximum take-off weight, operating mode, propulsion type, range, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2035)

-

Hardware

-

Aerostructure

-

Avionics

-

Flight Control System

-

Propulsion System

-

Others

-

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2035)

-

Cargo Transport

-

Passenger Transport

-

Mapping & Surveying

-

Special Mission

-

Surveillance & Monitoring

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2035)

-

Commercial

-

E-Commerce

-

Commercial Ridesharing Operators

-

Private Operators

-

Medical Emergency Organizations

-

Others

-

-

Government & Military

-

-

Product Outlook (Revenue, USD Million, 2018 - 2035)

-

Fixed Wing

-

Rotary Blade

-

Hybrid

-

-

Type Outlook (Revenue, USD Million, 2018 - 2035)

-

Air Taxis

-

Drones

-

Others

-

-

Maximum Take-off Weight Outlook (Revenue, USD Million, 2018 - 2035)

-

<100 kg

-

100 - 300 kg

-

>300 kg

-

-

Operating Mode Outlook (Revenue, USD Million, 2018 - 2035)

-

Remotely Piloted

-

Partially Piloted

-

Fully Autonomous

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2035)

-

Gasoline

-

Electric

-

Hybrid

-

-

Range Outlook (Revenue, USD Million, 2018 - 2035)

-

Intracity (20 km - 100 km)

-

Intercity (Above 100 km)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2035)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global advanced air mobility market size was estimated at USD 11.75 billion in 2024 and is expected to reach USD 14.20 billion in 2025.

b. The global advanced air mobility market is expected to grow at a compound annual growth rate of 25.5% from 2025 to 2035 to reach USD 137.11 billion by 2035.

b. The North America region accounted for the largest revenue share of over 37% in 2024. The aviation and defense sector, particularly in the U.S., is seeing an increase in the adoption of AAM solutions in the form of drone technology

b. Key players in the AAM market are Airbus S.A.S., Aurora Flight Sciences, Bell Textron Inc., Guangzhou EHang Intelligent Technology Co. Ltd, Embraer S.A., Joby Aviation, Lilium GmbH, Neva Aerospace, Opener, Inc., PIPISTREL (Textron Inc.), Vertical Aerospace Group Ltd., Volocopter GmbH, Wisk Aero, Workhorse Group, Inc.

b. The factors driving the advanced air mobility market are the innovation and developments in electrical propulsion systems, the trend of quick transportation and fast cargo delivery to customers, technological developments, and the integration of modern equipment, such as IoT devices, in the AAM industry is expected to accelerate the market’s growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.