- Home

- »

- Next Generation Technologies

- »

-

Infrastructure Monitoring Market Size & Share Report, 2030GVR Report cover

![Infrastructure Monitoring Market Size, Share & Trends Report]()

Infrastructure Monitoring Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology, By Application, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-089-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Infrastructure Monitoring Market Summary

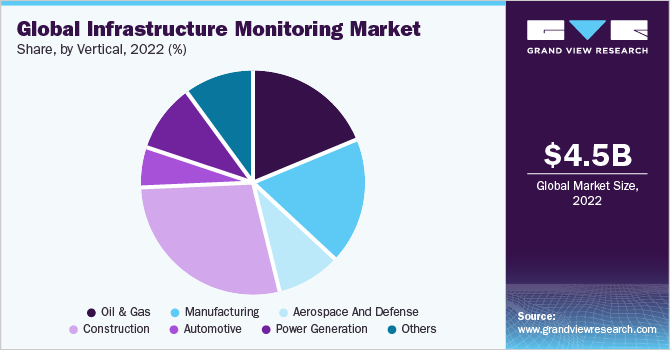

The global infrastructure monitoring market size was valued at USD 4.51 billion in 2022 and is projected to reach USD 10.26 billion by 2030, growing at a CAGR of 11.0% from 2023 to 2030. The key drivers for the growth of the market are the increasing need to ensure the safety, reliability, and longevity of critical infrastructure assets such as bridges, manufacturing equipment, buildings, dams, tunnels, and pipelines. The aging infrastructure, coupled with the growing demand for infrastructure in urban areas, has increased the emphasis on monitoring and maintaining existing structures.

Key Market Trends & Insights

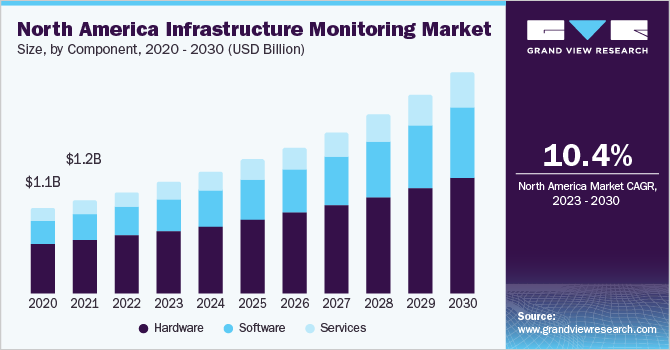

- North America dominated the overall infrastructure monitoring market in 2022, with a revenue share of 29.7%.

- Based on components, the hardware segment dominated with a market share of 58.8% in 2022.

- Based on technology, the wired technology segment held the largest revenue share of 56.8% in 2022.

- Based on application, the vibration monitoring segment gained the largest share of 22.9% in 2022 and is expected to witness a CAGR of 10.4% during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 4.51 Billion

- 2027 Projected Market Size: USD 10.26 Billion

- CAGR (2022-2030): 18.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

As infrastructure continues to age and governments prioritize the safety and resilience of critical assets, the structural monitoring system market is expected to show further growth. The market is expected to see advancements in sensor technologies, data management platforms, and integration with other emerging technologies, such as the Internet of Things (IoT) and cloud computing, enabling more efficient and comprehensive monitoring solutions.

Infrastructure monitoring refers to monitoring and assessing the condition, performance, and integrity of various equipment, assets & pipelines used in infrastructure systems. This type of monitoring is essential to ensure the safe and reliable operation of critical equipment and the efficient transportation of fluids or gases through pipelines.

Infrastructure monitoring for equipment involves the continuous or periodic monitoring of parameters such as temperature, vibration, pressure, electrical signals, and other relevant factors. This monitoring can be done using sensors and data acquisition systems installed on the equipment. The collected data is then analyzed to detect anomalies, identify potential issues, and optimize maintenance strategies.

Various regulatory bodies in the US have established guidelines and requirements for monitoring the systems across the infrastructure. Compliance with the regulations is essential to avoid penalties and maintain operational licenses. It helps operators demonstrate adherence to regulatory standards.

COVID-19 Impact

The market is poised to witness a significant long-term impact due to a combination of factors, including the effects of the Russia-Ukraine Conflict, COVID-19, and growing inflation. Consumer behavior, disruptions in supply chains, and government interventions arising due to the covid-19 pandemic have resulted in a market slowdown.

The persistent political and economic uncertainty in Eastern Europe resulting from the Russia-Ukraine Conflict and the potential implications on the demand-supply dynamics, pricing pressures, and import/export and trading activities has also significantly affected the market growth. Additionally, the influence of growing inflation across the global economy and outlines fiscal policies aimed at measuring and mitigating its effects on demand, cash flow, supply, and currency exchange is expected to contribute to sluggish growth during 2020 & first half of 2021.

Component Insights

Based on components, the market is classified into hardware, software, and services. The hardware segment dominated with a market share of 58.8% in 2022. It is expected to grow at a CAGR of 9.8% throughout the forecast period. The hardware components are essential for collecting data, enabling communication, and facilitating the monitoring process. Adopting these hardware components in infrastructure monitoring allows for real-time data collection, analysis, and decision-making. By utilizing reliable and advanced hardware, operators can ensure the monitored infrastructure's optimal performance, safety, and longevity.

The services segment is expected to grow at a CAGR of 11.9% during the forecast period. The services component plays a vital role in infrastructure monitoring. The services encompass a range of activities that support monitoring systems' implementation, operation, and maintenance. Service providers offer expertise in installing and commissioning monitoring systems. This involves physically installing sensors, data acquisition units, communication devices, and other hardware components.

Service professionals ensure the system is appropriately set up, calibrated, and integrated for accurate data collection. The services component is crucial for maximizing the benefits of the systems. Service providers bring the expertise, technical knowledge, and experience to ensure the proper installation, integration, operation, and maintenance of the overall system. Through these services, the operators can leverage the full potential of infrastructure monitoring for enhanced safety, efficiency, and asset management.

Technology Insights

In terms of technology, the market is classified into wired technology & wireless technology. The wired technology segment held the largest revenue share of 56.8% in 2022. It is expected to grow at a CAGR of 8.1% throughout the forecast period. Wired systems play a significant role in the market as they utilize physical cables and wired connections to transmit data between various monitoring system components.

Wired systems provide a robust and stable means of data transmission and communication. It is specifically suited for applications that require reliable and continuous monitoring, such as critical equipment and pipeline systems. The use of wired connections ensures secure and high-quality data transfer, supporting the integrity and efficiency of the monitoring process.

The wireless technology segment is expected to grow at the fastest CAGR of 13.9% during the forecast period. Wireless technology systems have emerged as a valuable solution for infrastructure monitoring systems. These systems utilize wireless communication methods to transmit data between various system components. The growth is attributed to the use of wireless sensors, remote monitoring, real-time data transmission, and cost-effectiveness compared to wired systems.

This technology is particularly suitable for applications with impractical or expensive wired connections. The adoption of wireless systems enhances the efficiency and effectiveness of monitoring practices, enabling timely decision-making, proactive maintenance, and improved overall asset management.

For instance, in May 2023, Scientists at Drexel University's College of Engineering created a wireless sensor system powered by solar energy. This innovative system is designed to monitor the deformation of bridges in real-time, providing ongoing surveillance of their structural integrity. In the event of a significant deterioration in bridge performance, the system can promptly notify relevant authorities, enabling timely intervention and maintenance measures.

Application Insights

Based on application, the market is classified into corrosion monitoring, crack detection, damage detection, vibration monitoring, thermal monitoring, multimodal sensing, strain monitoring, and others. The vibration monitoring segment gained the largest share of 22.9% in 2022 and is expected to witness a CAGR of 10.4% during the forecast period. Vibration monitoring allows for the assessment of structural dynamics, identification of potential issues related to stability, and evaluation of the impact of vibrations on overall infrastructure performance. It is extensively applied in various industries, including construction and other industrial facilities, to ensure the structural health and integrity of the infrastructure.

The damage detection segment is anticipated to witness a CAGR of 12.3% throughout the forecast period. Damage detection is a crucial application within the market. The growing emphasis on developing advanced sensor technologies & integration of machine learning & artificial intelligence is creating a significant opportunity for the damage detection application in the market. These sensors will offer higher sensitivity, improved accuracy, and increased durability, allowing for more precise and reliable detection of damages. For instance, integrating smart materials, such as carbon nanotubes or self-healing polymers, into sensors can enhance their capabilities and enable self-monitoring capabilities.

Vertical Insights

Based on vertical, the market is classified into oil & gas, manufacturing, aerospace and defense, construction, automotive, power generation, and others. The construction segment has dominated the overall market, with a revenue share of 28.3% in 2022. It is expected to register a CAGR of 11.3% during the forecast period. With the increasing complexity and scale of construction projects, there is a growing emphasis on monitoring and ensuring infrastructure safety, quality, and performance during the construction phase and beyond.

The construction industry widely adopts infrastructure monitoring systems to monitor various aspects such as structural integrity, geotechnical conditions, environmental factors, and construction processes. By implementing monitoring solutions, construction companies can proactively detect potential issues, minimize risks, and optimize construction practices, improving project outcomes and enhancing client satisfaction. The construction vertical's strong presence in the market underscores its commitment to delivering reliable and sustainable infrastructure solutions.

For instance, in March 2023, Bentley Systems, Incorporated, one of the leading software companies specializing in infrastructure engineering, has recently announced a non-exclusive commercial agreement. This agreement aims to strategically expedite the implementation of Infrastructure Internet of Things (IoT) technology. This collaboration aims to enhance the benefits and value of infrastructure digital twins for various stakeholders, including infrastructure designers, constructors, and owner-operators. By leveraging the power of Infrastructure IoT, these industry professionals can unlock new opportunities and achieve greater efficiencies in their infrastructure projects and operations.

The manufacturing segment is anticipated to witness a CAGR of 12.5% throughout the forecast period. With the increasing emphasis on high operational efficiency, asset management, and safety, manufacturers recognize the value of implementing monitoring systems to optimize production infrastructure. By adopting the systems, manufacturers can proactively detect and address the issues related to equipment performance, pipeline integrity, and overall infrastructure health. This enables them to minimize downtime, reduce maintenance costs, enhance productivity, and ensure the smooth operation of critical assets. As a result, the manufacturing vertical holds great potential for growth and adoption in the market.

Regional Insights

North America dominated the overall infrastructure monitoring market in 2022, with a revenue share of 29.7%. It is expected to grow at a CAGR of 10.4% throughout the forecast period. Industries across various sectors in North America have recognized the importance of ensuring the efficient operation and integrity of the infrastructure. This has increased demand for solutions to enhance safety, optimize maintenance practices, and improve overall operational performance.

Companies across the region are investing in new product launches to stay ahead in the market. For instance, in October 2022, Doosan Infracore introduced a new and improved telematics monitoring service named Smart X-care. This subscription-based service provides enhanced capabilities for Doosan equipment. To support Smart X-Care, a dedicated machine center has been established at the Doosan Infracore headquarters. This proactive approach ensures that equipment issues are promptly addressed, helping to maximize the performance and efficiency of Doosan machinery.

Asia Pacific is expected to grow at the fastest CAGR of 12.3% during the forecast period. Significant investments are being made in the region to enhance the infrastructure devices' performance, security, and economic stability. As one of the leading emerging economies, China has taken substantial steps to implement real-time equipment monitoring systems, aiming to improve operational efficiency and boost productivity. The utility sector, in particular, has witnessed rapid adoption of technology due to its ability to provide effective solutions for critical asset management.

Key Companies & Market Share Insights

The market is fragmented and is likely to witness high competition in the market. The prominent players are adopting strategies such as expansion to gain a competitive edge. In July 2022, Siemens partnered with AWS, during which Siemens Energy’s industrial detection and monitoring solution Safeguards the critical infrastructure from cyberattacks to ensure the uninterrupted functioning of communities worldwide and prevent disruptions in the global supply chain Some prominent players in the global infrastructure monitoring market include:

-

Acellent Technologies, Inc.

-

Parker Hannifin

-

Siemens AG

-

Emerson Electric

-

Digitex Systems

-

General Electric

-

Campbell Scientific, Inc.

-

National Instruments

-

Honeywell

-

Rockwell Automation

-

AVT Reliability Ltd.

-

Bridge Diagnostics, Inc. (BDI)

-

Yokogawa Electric Corporation

Recent Developments

-

In January 2023, Siemens collaborated with Skyway. This collaboration developed vertiport infrastructure by involving sustainable electric supply, standard charging processes, and researching energy demands.

-

In February 2022, Siemens and Desert Technologies launched a joint venture to develop solar and smart infrastructure by providing clean, reliable, and affordable energy in the MEA and Asia.

Infrastructure Monitoring Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.96 billion

Revenue forecast in 2030

USD 10.26 billion

Growth Rate

CAGR of 11.0% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); U.A.E.; South Africa

Key companies profiled

Acellent Technologies, Inc.; Parker Hannifin; Siemens AG; Emerson Electric; Digitex Systems; General Electric; Campbell Scientific, Inc.; National Instruments; Honeywell; Rockwell Automation; AVT Reliability Ltd.; Bridge Diagnostics, Inc. (BDI); Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Infrastructure Monitoring Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and offers a qualitative and quantitative analysis of the latest industry trends for each of the segment and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global infrastructure monitoring market report based on component, technology, application, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Corrosion Monitoring

-

Crack Detection

-

Damage Detection

-

Vibration Monitoring

-

Thermal Monitoring

-

Multimodal Sensing

-

Strain Monitoring

-

Others

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Oil & Gas

-

Manufacturing

-

Aerospace and Defense

-

Construction

-

Automotive

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global infrastructure monitoring market size was estimated at USD 4.51 billion in 2022 and is expected to reach USD 4.96 billion in 2023.

b. The global infrastructure monitoring market is expected to grow at a compound annual growth rate of 11.0% from 2023 to 2030 to reach USD 10.26 billion by 2030.

b. North America dominated the infrastructure monitoring market with a share of 29.7% in 2022. This is attributable to developed technology infrastructure and the presence of crowdsourced testing companies.

b. Some key players operating in the infrastructure monitoring market include Siemens AG, Emerson Electric, Digitex Systems, General Electric, Campbell Scientific, Inc., Acellent Technologies, Inc., Parker Hannifin, National Instruments, Honeywell, Rockwell Automation, AVT Reliability Ltd., Bridge Diagnostics, Inc. (BDI), and Yokogawa Electric Corporation.

b. Key factors driving the market growth include increasing need to ensure the safety, reliability, and longevity of critical infrastructure assets such as bridges, manufacturing equipment, buildings, dams, tunnels, and pipelines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.