- Home

- »

- Medical Devices

- »

-

Advanced Wound Dressing Market Size & Share Report, 2030GVR Report cover

![Advanced Wound Dressing Market Size, Share & Trends Report]()

Advanced Wound Dressing Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Foam Dressings, Film Dressings), By Application, By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-980-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Advanced Wound Dressing Market Summary

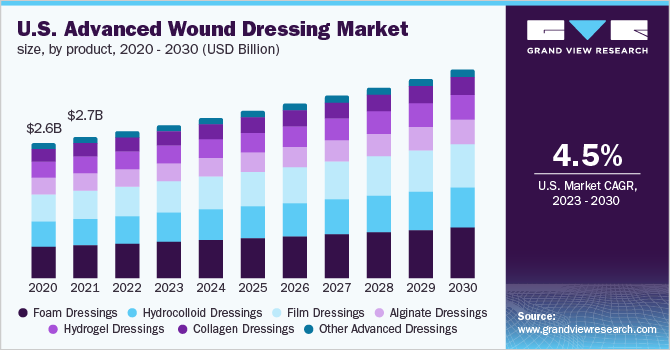

The global advanced wound dressing market size was estimated at USD 7.4 billion in 2022 and is projected to reach USD 10.5 billion by 2030, growing at a CAGR of 4.5% from 2023 to 2030. Immersive Virtual Reality (VR) technologies are gaining popularity in multiple sectors such as entertainment, healthcare, education, and automotive.

Key Market Trends & Insights

- North America dominated the global advanced wound dressing market with the largest revenue share of 45.4% in 2022.

- The immersive virtual reality market in the U.S.led the North America market and held the largest revenue share in 2022.

- By product, the foam dressings segment led the market, holding the largest revenue share of 23.4% in 2022.

- By application, the chronic wounds segment held the dominant position in the market and accounted for the leading revenue share of 59.8% in 2022.

- By end use, the home care segment is expected to grow at the fastest CAGR from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 7.4 Billion

- 2030 Projected Market Size: USD 10.5 Billion

- CAGR (2023-2030): 4.5%

- North America: Largest market in 2022

Increasing incidences of chronic diseases such as diabetes, cancer, and other autoimmune diseases are driving the demand for advanced wound dressings. Factors such as antimicrobial resistance, adoption of unhealthy and sedentary lifestyles, alcohol consumption, and smoking are some of the major factors contributing to the rise in the prevalence of non-communicable diseases.

According to International Diabetes Federation (IDF), 537 million individuals aged 20 to 79 are living with diabetes as of 2021, whereas, this number is predicted to increase to 643 million in 2030, and 783 million in 2045. In addition, the IDF reported that in 2021 approximately 6.7 million deaths globally were caused due to diabetes.

Cancer has been a global healthcare burden as it is one of the leading causes of death. According to estimates from the WHO, cancer is the leading cause of death globally and almost 1 in 6 deaths can be attributed to the disease. In addition, it also reported that over 70% of cancer-related deaths typically occur in middle- and low-income countries. According to estimates from Cancer Organization, in 2018, cancer was the second leading cause of death and about 1,735,350 new cancer cases were registered in the U.S. In addition, nearly 4,700 new cases of cancer are diagnosed each day in the country.

As a result of the rising prevalence of chronic conditions, the number of surgeries being performed has also increased. Wound care products, thus, are increasingly being used to prevent surgical site infections. Most surgical wounds, post-cancer surgery, are relatively large in size and deep, releasing exudates that require regular management. Advanced wound dressing products such as hydrogel, alginate, and foam help manage large wounds, thereby significantly reducing the risk of infection. Thus, the rising incidence of chronic diseases is expected to boost the demand for wound care products, thus propelling market growth.

Rapidly increasing demand for home healthcare services is visible in the growing workforce employed in homecare services. The growing demand is expected to act as a major driver for the market for advanced wound dressing. According to the U.S. Bureau of Labor Statistics, in the U.S., the number of home healthcare and personal care aides is expected to reach 13.0 million in 2020.

Moreover, the increasing geriatric population is likely to promote home healthcare services as aged people are more likely to avail of such services. As per the Population Reference Bureau in 2018, the number of Americans aged 65 and above is expected to increase from 52.0 million in 2018 to 95.0 million by 2060. In line with this, the percentage of the geriatric population would rise from 16.0% of the total population in the U.S. in 2018 to 23.0% in 2060.

COVID-19 negatively impacted the advanced wound dressing industry. However, post-pandemic, the advanced wound dressing industry is expected to witness a considerable growth rate. Post-pandemic, many companies reconsidered their strategies and entered into strategic alliances such as mergers, acquisitions, product launches, and geographic expansion to capture maximum market share.

For instance, a U.S.-based firm, Collagen Matrix, received 510(k) clearance from FDA for its fibrillar collagen wound dressing. Similarly, Smith & Nephew, PLC inaugurated its new R&D facility and manufacturing facility with an investment of USD 100 million. Such product launches and investments are anticipated to drive the advanced wound dressing post- COVID-19 pandemic.

Product Insights

The foam dressings segment dominated the market for advanced wound dressing and accounted for the largest revenue share of 23.4% in 2022. The segment is expected to witness a considerable growth rate over the forecast period. Foam dressings are made up of highly absorbent material called hydrophilic polyurethane. The foam helps in absorbing the moisture that aids in maintaining the integrity of the tissue. The increasing cases of burns and trauma in the U.S. are expected to propel the segment’s growth.

For instance, as per the American Burn Association (ABA), around 486,000 people undergo burn care treatment due to burn injuries in the U.S. Similarly, as per WHO, 180,000 deaths occur annually worldwide due to burn injuries. It also reported that complications of infection have accounted to be highest in burn patients. Foams are majorly used to prevent and heal the exudation of burn injuries and hence the increasing cases of such incidents are expected to surge segment growth over the forecast period.

The hydrocolloid dressings segment is projected to witness the fastest growth rate of CAGR of 5.0% over the forecast period. Hydrocolloid dressings are made of gel-forming agents such as Carboxy Methylcellulose (CMC) and gelatin. These materials are occlusive in nature which helps in moisture retention. These advanced dressings allow rapid healing and are impermeable to any type of bacterial infection. Thus, it helps in protecting the wound internally as well as externally.

The rising number of diabetes cases across the globe is expected to promote segment growth over the forecast period. For instance, as per the NCBI, the prevalence of diabetes in India rose from 7.1% in 2009 to 8.9% in 2019, and nearly 15.0% of this diabetic population suffers from diabetic wounds or diabetic ulcers. Hence, such instances are expected to surge the demand for hydrocolloid wound dressing over the forecast period.

Application Insights

The chronic wounds segment dominated the market for advanced wound dressing and accounted for the largest share of 59.8% in 2022. The increasing cases of chronic diseases, especially diabetes, and the rising geriatric population in the country are the major driving factors for the segment’s growth. For instance, as per the United Nations, Department of Economic and Social Affairs, globally, there were around 709 million people aged 60 and above in 2019. The segment is further subdivided into diabetic foot ulcers, pressure ulcers, venous leg ulcers, and others.

The acute wounds segment is anticipated to witness the fastest growth rate over the forecast period. Acute wounds comprise surgical and traumatic wounds and burns. The surgical and traumatic wound segment held the largest share in 2022 owing to the increasing cases of trauma in the U.S. The burns segment is anticipated to witness the fastest growth rate over the forecast period owing to the rising incidence of burn injuries.

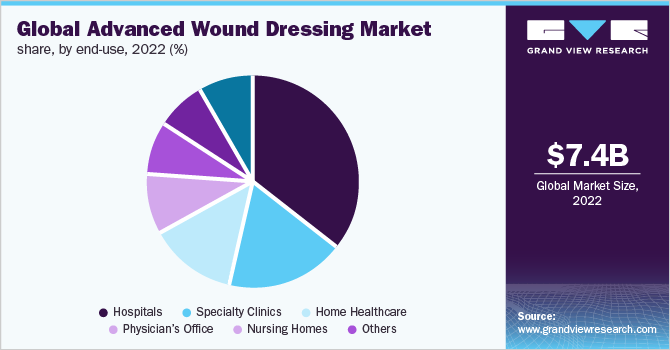

End-use Insights

The hospital segment dominated the market for advanced wound dressing and accounted for the largest revenue share of 38.9% in 2022. The increasing cases of diabetic foot ulcers and venous leg ulcers are the major driving factors for the growth of the segment. In addition, increasing cases of surgical wounds due to the rising number of surgeries is also driving the segment’s growth. Advanced wound dressing is generally used for healing SSI wounds. Thus, such factors may surge segment growth over the forecast period.

Homecare is expected to witness the fastest growth over the forecast period. Most of the surgeries require prolonged recovery periods, leading to frequent changing of dressing. Thus, the demand for advanced wound care products in home healthcare settings is increasing. Moreover, the geriatric and bariatric population and patients suffering from chronic wounds prefer home care over hospital stays.

Regional Insights

North America dominated the advanced wound dressing industry and accounted for the largest revenue share of 45.4% in 2022. Increasing road accidents, sports injuries, and the presence of several key players in the region are anticipated to drive the market for advanced wound dressing in the region. In addition, the presence of an adequate number of skilled professionals and highly developed healthcare infrastructure is also expected to drive the market in the region over the forecast period.

In Asia Pacific, the market for advanced wound dressing is anticipated to witness the fastest CAGR of 5.1% over the forecast period. The presence of developing countries such as China, India, and Japan is anticipated to boost growth. In addition, the rapidly growing medical tourism industry in these countries can also be attributed to the increase in demand for advanced wound dressings in this region. Further, the rising geriatric population in this region is expected to drive the advanced wound dressing industry. For instance, as per the People’s Archive of Rural India, an estimated 138 million elderly population resided in India in 2019.

Key Companies & Market Share Insights

Key players engage in adopting strategies such as mergers and acquisitions, partnerships, and launching new products to strengthen their foothold in the market. For instance, in May 2019, 3M acquired Acelity, Inc. to strengthen its wound management solutions and expand its customer pool.

Key players are investing heavily in research and development to manufacture technologically advanced products. For instance, in March 2017, ConvaTec Group PLC launched the Sensi-Care Skin Protectant Incontinence Wipes, which was expected to expand its wound business and increase its market share. Some prominent players in the global advanced wound dressing market include:

-

3M

-

Coloplast Corp.

-

Medline Industries

-

Smith & Nephew

-

ConvaTec Group PLC

-

Derma Sciences (Integra LifeSciences)

-

Ethicon (Johnson & Johnson)

-

Baxter International

-

Molnlycke Heath Care AB

-

Medtronic

Advanced Wound Dressing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.7 billion

Revenue forecast in 2030

USD 10.5 billion

Growth Rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M; Coloplast Corp.; Medline Industries; Smith & Nephew; ConvaTec Group PLC; Derma Sciences (Integra LifeSciences); Ethicon (Johnson & Johnson); Baxter International; Molnlycke Health Care AB; Medtronic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

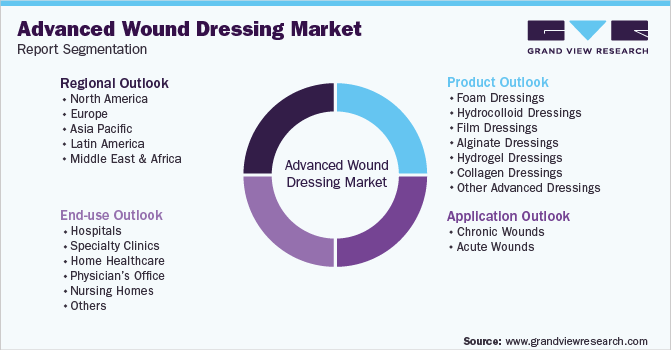

Global Advanced Wound Dressing Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global advanced wound dressing market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Foam Dressings

-

Hydrocolloid Dressings

-

Film Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Other Advanced Dressings

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global advanced wound dressing market size was estimated at USD 7.4 billion in 2022 and is expected to reach USD 7.7 billion in 2023.

b. The global advanced wound dressing market is expected to grow at a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 10.5 billion by 2030.

b. North America dominated the advanced wound dressing market with a market share of more than 45.4% in 2022. This is attributable to the rising incidence of chronic and acute wounds.

b. Some key players operating in the advanced wound dressing market include Smith & Nephew Plc., Mölnlycke Health Care AB, 3M, Convatec Group PLC., Medtronic, Coloplast Corp., and Baxter.

b. Key factors that are driving the advanced wound dressing market growth include the rising prevalence of chronic diseases globally, increasing awareness towards the usage of advanced wound care products, rising incidence of sports injuries, and rising geriatric population across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.