- Home

- »

- Medical Devices

- »

-

Advanced Wound Care OTC Market, Industry Report, 2033GVR Report cover

![Advanced Wound Care OTC Market Size, Share & Trends Report]()

Advanced Wound Care OTC Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Film Dressings, Non-Woven Post-Operative Dressings, Hydrocolloids, Hydrogel Dressings, Greasy Gauzes, Honey Dressings), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-633-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Advanced Wound Care OTC Market Summary

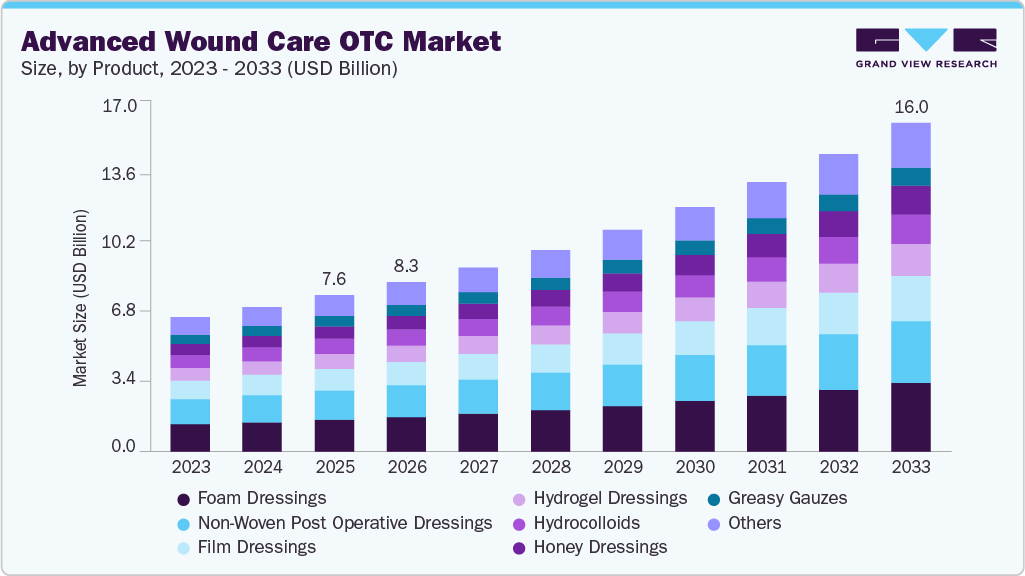

The global advanced wound care OTC market size was estimated at USD 7.63 billion in 2025 and is projected to reach USD 16.04 billion by 2033, growing at a CAGR of 9.93% from 2026 to 2033. The growth is attributed to the increasing prevalence of acute wounds such as surgical wounds, traumatic injuries, and burns, which require effective and immediate wound management solutions.

Key Market Trends & Insights

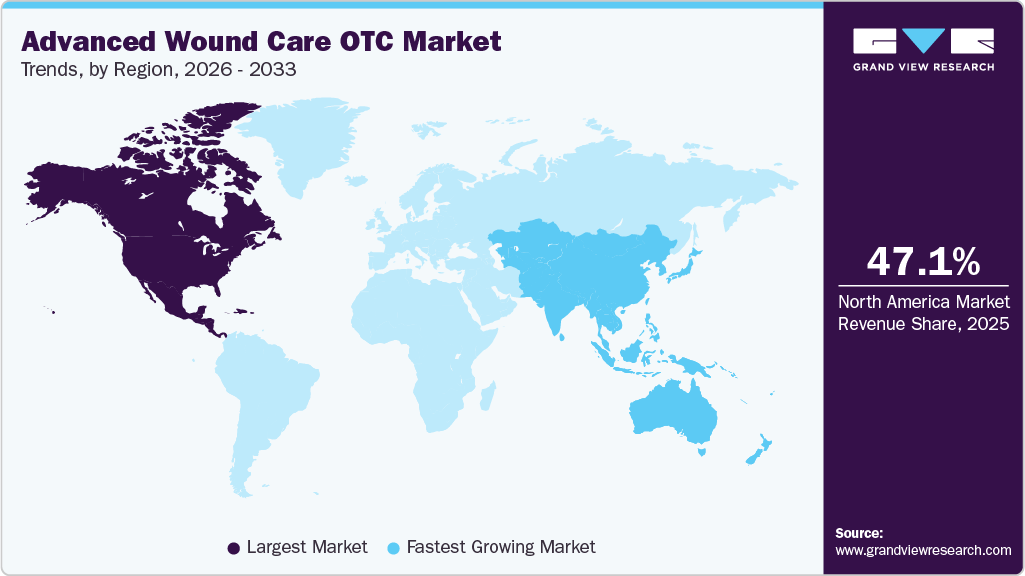

- North America dominated the advanced wound care OTC market with the largest revenue share of 47.11% in 2025.

- The advanced wound care OTC market in the U.S. accounted for the largest market revenue share in North America in 2025.

- Based on product, the foam dressings segment led the market with the largest revenue share in 2025.

- Based on application, the acute wounds segment led the market with the largest revenue share in 2025.

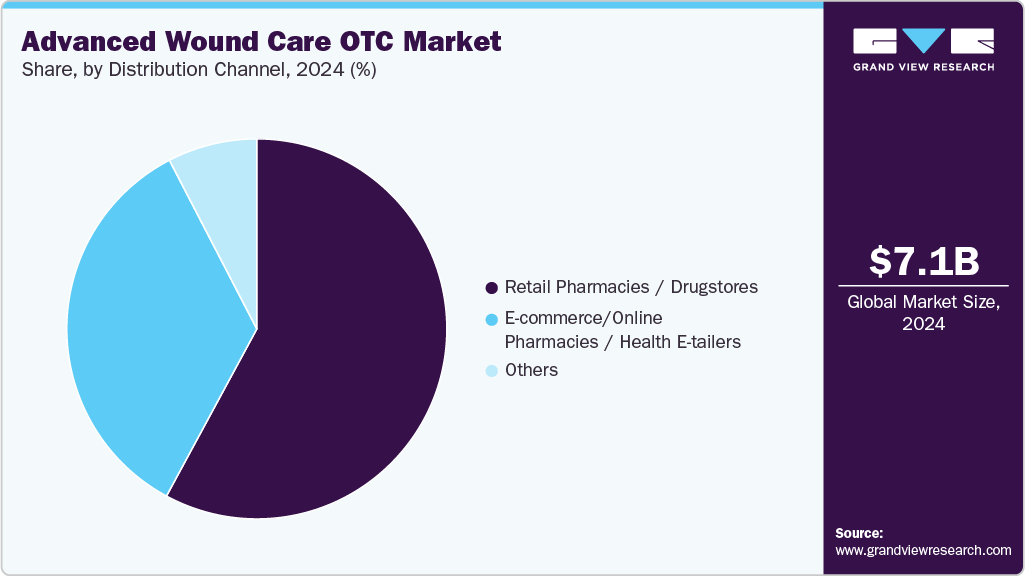

- By distribution channels, the retail pharmacies / drugstores segment led the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7.63 Billion

- 2033 Projected Market Size: USD 16.04 Billion

- CAGR (2026-2033): 9.93%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Rising rates of road accidents, sports injuries, and surgical procedures globally have led to a surge in demand for advanced OTC wound care products that promote faster healing and reduce the risk of infection. According to the data published by the Total Family Care Center in April 2025, approximately 11 million individuals in the U.S. experience acute wounds annually, with around 300,000 cases requiring hospital care.The growing number of regulatory approvals for over-the-counter advanced wound care products is poised to drive significant market growth in the coming years. These approvals are broadening consumer access to advanced wound care treatments outside traditional healthcare settings. For instance, in April 2024, Vomaris Inc. received FDA clearance for its PowerHeal bioelectric bandage for OTC use. Designed to treat superficial wounds like minor cuts, abrasions, and blisters, the bandage features microcell batteries made from elemental silver and zinc. When activated by a conductive medium such as wound exudate, saline, or hydrogel, the microcells produce therapeutic microcurrents that promote faster healing and help prevent infection.

The rising incidence of various types of wounds-including minor cuts, lacerations, abrasions, blisters, pressure ulcers, diabetic foot ulcers, and burns-is expected to drive growth in the OTC advanced wound care market significantly. In many countries, large segments of the population are affected by such injuries, fueling demand for accessible and effective at-home treatment solutions. For instance, according to data released by the Total Family Care Center in April 2025, an estimated 11 million people in the U.S. suffer from acute wounds each year, with only about 300,000 requiring hospitalization. This indicates that most of these cases are treated at home with OTC products, underscoring the strong market potential for advanced wound care solutions tailored for self-care and home use.

In addition, the incidence of burns is rising significantly. The American Burn Association (ABA) reported approximately 32,540 burn cases in 2023 across its burn care centers. In addition, from 2019 to 2023, a total of 156,073 burn cases were documented across more than 38 states in the U.S. This rising incidence of various wound types, including minor burns and diabetic foot ulcers, is expected to drive the demand for advanced wound care OTC products significantly.

The rapid expansion of digital distribution channels, such as e-commerce marketplaces, manufacturers' websites, and online pharmacies, is key to driving growth in the OTC advanced wound care market. These platforms provide consumers with greater convenience, broader access to products, and the ability to easily compare prices and reviews, making purchasing advanced wound care solutions simpler and more efficient.

Many companies increasingly utilize these digital channels to boost product visibility and expand their geographic reach. For instance, in April 2024, Remedium Healthcare Products launched NuVeria Labs' innovative Sacral Silicone Dressing on Amazon, enhancing accessibility by delivering advanced wound care products directly to consumers' doorsteps.

Key Opinions of Leaders

Company Name

KOLs

Growth Opportunities

Remedium Healthcare Products

“"Our commitment at Remedium Healthcare Products is to provide patients and caregivers with innovative and effective healthcare solutions. The launch of NuVeria Labs brand on Amazon is a testament to this commitment, offering convenient access to high-quality wound care products for consumers nationwide. We believe that everyone should have access to reliable and effective wound care solutions, regardless of where they are receiving treatment, With NuVeria Labs' Silicone Foam Dressings, we are making high-quality wound care and knowledge accessible to everyone, with just a few clicks." said Vlad Anastasov, President of Remedium Healthcare Products.”

- Enhanced Accessibility Through Online Platforms

- Commitment to Consumer-Centric Healthcare

- Leadership in Digital Health Expansion

Smith+Nephew

“Pressure injuries have a high burden on patients and healthcare systems,” said Rohit Kashyap, President, Advanced Wound Management at Smith+Nephew. “This alignment of the laboratory findings with the clinical literature clearly demonstrates the enhanced clinical efficacy of ALLEVYN LIFE Dressings in helping reduce the burden of preventable pressure injuries as one of the only 5-layer foam dressings with independent, non-bonded layers.”

- Focus on High-Burden Conditions

- Promotion of Advanced, Differentiated Products

- Strategic Market Expansion into Preventative Care

Source: Remedium Healthcare Products, Smith+Nephew, Grand View Research

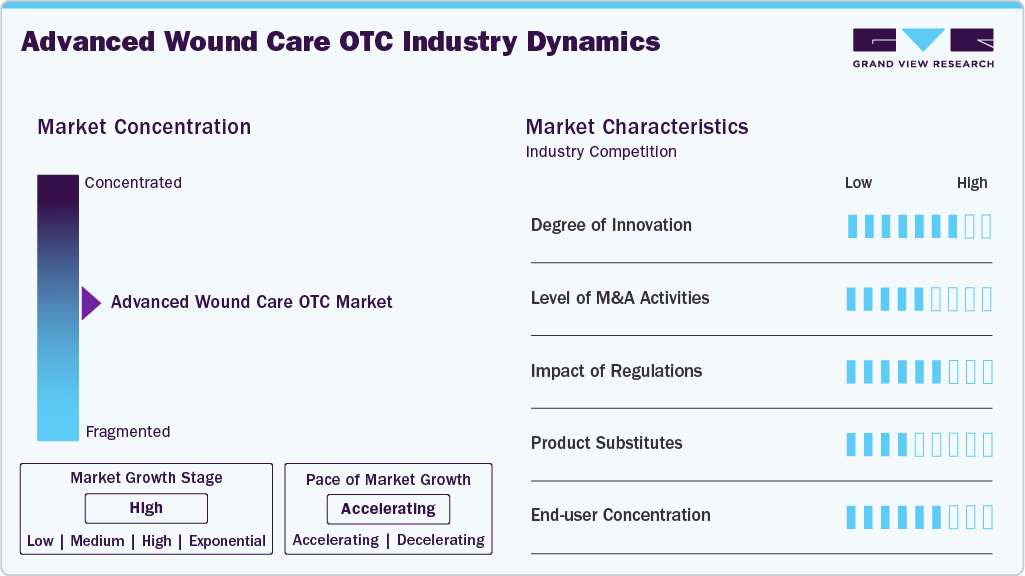

Market Concentration & Characteristics

The industry is experiencing a high degree of innovation, driven by the demand for professional-grade solutions that are accessible for home use. Innovations such as bioelectric therapy, exemplified by Vomaris Inc.'s PowerHeal bandage (FDA-approved in April 2024), bring hospital-level healing acceleration to consumers through microcell batteries that generate therapeutic currents. Similarly, multi-layer foam dressings like Smith+Nephew's ALLEVYN LIFE combine refined moisture management and pressure redistribution in a format suitable for non-clinical settings. Using antimicrobial materials (e.g., silver, honey, iodine) embedded in OTC products enhances infection control without prescription antibiotics.

Regulation significantly impacts the advanced wound care OTC industry by shaping product development, market-entry, and consumer access. In the U.S., the FDA's proposed reclassification of certain wound dressings and liquid wound washes containing antimicrobials or other chemicals into Class II or even Class III medical devices (requiring 510(k) premarket notification with special controls or even Premarket Approval - PMA) is a pivotal example. This move aims to ensure higher safety and efficacy standards for products with more active components or claims, but it also creates increased regulatory hurdles and costs for manufacturers, potentially slowing down the introduction of innovative products to the OTC space.

The industry has seen a moderate to high level of M&A activities driven by larger players seeking to expand their product portfolios, acquire innovative technologies, and strengthen their market presence. While comprehensive data specifically for the OTC segment is less granular than for the broader advanced wound care market, the overall consolidation trend within advanced wound care extends to consumer-accessible products.

Product substitutes primarily include traditional wound care products such as adhesive bandages, gauze pads, antiseptic creams, and cotton dressings. While these conventional options are widely available and inexpensive, they often lack advanced features, such as moisture balance, antimicrobial properties, or pressure relief in newer OTC solutions. In addition, home remedies like honey, aloe vera, or herbal treatments are sometimes used as alternatives, especially in regions with limited access to modern wound care. However, these substitutes may not offer the same level of clinical effectiveness, particularly for chronic or slow-healing wounds. As a result, substitutes are generally less effective in promoting optimal healing outcomes, reinforcing the value proposition of advanced OTC wound care products for consumers seeking faster recovery and infection prevention.

The industry exhibits moderate to high end-user concentration, with a significant portion of demand driven by individual consumers, caregivers, and patients managing chronic or acute wounds at home. Key user groups include the elderly, individuals with diabetes, and people prone to minor injuries, burns, or pressure ulcers, all of whom require frequent wound care. Still, they may prefer or need to avoid clinical visits. In addition, home healthcare providers and long-term care facilities are emerging as important end users, especially as the shift toward decentralized, home-based care accelerates. This concentration around specific demographics allows manufacturers to tailor products for ease of use, comfort, and extended wear while driving demand for education, digital access, and preventative care solutions in the industry.

Product Insights

On the basis of product, the foam dressings segment held the largest share in 2025. This growth can be attributed to the rising prevalence of chronic conditions such as diabetes, obesity, and cardiovascular diseases are significantly boosting the demand for foam dressings. These health issues often lead to persistent, slow-healing wounds like diabetic foot ulcers, venous leg ulcers, and pressure sores, which require effective moisture management, protection, and absorption of wound exudate. For example, data from the JAMA Network published in July 2023 estimates that approximately 18.6 million people worldwide suffer from diabetic foot ulcers annually, with around 1.6 million cases reported in the U.S. Foam dressings are especially well-suited for these wounds due to their high absorbency, ability to maintain a moist healing environment, and gentle, non-adherent removal-qualities that make them ideal for long-term use. As more patients opt to manage these chronic wounds at home-driven by cost reduction and limited access to regular clinical care-the convenience, accessibility, and effectiveness of OTC foam dressings are making them a preferred solution in advanced wound care.

The honey dressings segment is expected to witness the fastest CAGR of 11.31% over the forecast period. Owing to their well-established natural antimicrobial and healing properties and growing consumer preference for holistic and biocompatible treatments. As awareness about the benefits of medical-grade honey, such as its ability to promote a moist wound environment, reduce inflammation, and prevent infection, continues to rise, more patients and caregivers are turning to honey-based dressings for managing chronic and acute wounds at home. Additionally, advances in formulation and packaging have improved ease of use and shelf life, making honey dressings more accessible and convenient for OTC consumers.

Application Insights

On the basis of application, the acute wounds segment held the largest share in 2025. This growth can be attributed to the rising incidence of traumatic injuries and surgical interventions worldwide. For instance, data released by the U.S. Department of Transportation in April 2024 reported approximately 40,990 fatalities from road accidents in 2023, highlighting the continued burden of trauma-related hospital admissions. As the global population grows and the rate of accidents and injuries increases, there is a corresponding surge in the demand for effective wound management solutions. Additionally, advancements in advanced wound care products have significantly improved healing outcomes, reduced the risk of complications, and shortened recovery times, making them essential in emergency and acute care settings. These innovations include dressings that promote faster healing, control infection, and enhance patient comfort.

The chronic wound segment is expected to witness the fastest CAGR over the forecast period. This growth can be attributed to the increasing prevalence of underlying conditions such as diabetes, obesity, and cardiovascular diseases that contribute to slow-healing wounds like diabetic foot ulcers, venous leg ulcers, and pressure sores. As these chronic wounds require long-term, consistent care-including moisture management, infection control, and protection-there is a rising demand for effective, easy-to-use OTC products that patients can manage independently at home.

Distribution Channels Insights

On the basis of distribution channels, the retail pharmacies / drugstores segment dominated the advanced wound care OTC market in 2025. This can be attributed to the widespread accessibility and convenience these outlets offer to consumers seeking over-the-counter advanced wound care products. Retail pharmacies and drugstores are the first point of contact for individuals managing minor to moderate wounds at home, providing immediate access to a wide range of dressings without needing a prescription. Moreover, many pharmacies have introduced advanced private-label dressings that are more affordable alternatives to premium brands such as 3M, Smith & Nephew, and Mölnlycke. These private-label products enhance accessibility and affordability, particularly benefiting patients with chronic wounds who need to change dressings frequently.

However, the e-commerce, online pharmacies, and health e-tailers segment is projected to witness the fastest growth rate over the forecast period. This can be attributed to the increasing consumer preference for convenient, contactless shopping and wider product availability. Digital platforms offer easy access to a broad range of advanced wound care products, including specialized dressings and bioelectric bandages, which might not always be readily available in traditional retail outlets. Additionally, the ability to compare prices, read reviews, and receive home delivery enhances the overall consumer experience. This growing reliance on digital distribution channels enables manufacturers to expand their reach, engage directly with end users, and capitalize on the rapidly evolving OTC wound care market.

Regional Insights

North America dominated the global advanced wound care OTC market with the largest revenue share of 47.11% in 2025. The region has a high prevalence of chronic conditions such as diabetes and obesity, which significantly contribute to the demand for long-term wound care solutions. Additionally, strong regulatory frameworks like the FDA ensure the availability of safe and effective OTC products, boosting consumer confidence. The widespread adoption of digital health platforms and online pharmacies further supports market penetration, while the presence of key industry players and ongoing product innovations continues to drive growth.

U.S. Advanced Wound Care OTC Market Trends

The U.S. held the largest share of North America advanced wound care OTC market in 2025. The U.S. advanced wound care OTC market is experiencing growth, driven by the high prevalence of chronic conditions such as diabetes, obesity, and cardiovascular disease, which contribute to long-term wound complications like diabetic foot ulcers and pressure injuries. According to the CDC 2024, around 14.7% of U.S. adults have diabetes. Approximately 38.4 million U.S. adults and children are affected by the condition, with 29.7 million of these cases being diagnosed and 8.7 million remaining undiagnosed, as reported by the American Diabetes Association (ADA, 2023). Furthermore, the CDC 2024 states that there are 1.2 million new cases of diabetes among U.S. adults each year, translating to an incidence rate of about 5.9 per 1,000 people.

Additionally, there is a growing shift toward self-care and home-based treatment, fueled by rising healthcare costs and limited access to clinical services in rural or underserved areas. The widespread availability of advanced OTC products through retail chains, e-commerce platforms, and pharmacies has made professional-grade wound care more accessible to consumers.

Europe Advanced Wound Care OTC Market Trends

The advanced wound care OTC market in Europe is growing rapidly, owing to the aging population across many European countries is leading to a higher incidence of chronic wounds (such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers), which require sophisticated care beyond traditional bandages. Moreover, there's a growing patient awareness and preference for self-care and home healthcare, empowering individuals to manage less severe or chronic wounds independently with effective OTC solutions. An increasing demand for convenience and accessibility supports this trend.

The continuous product innovation drives the UK advanced wound care OTC market, bringing refined wound dressings and technologies (e.g., hydrocolloids, foam dressings, and antimicrobial solutions) that were once only available clinically into retail, offering improved healing outcomes and infection control for consumers. In addition, rising awareness among the public about advanced wound care solutions and the benefits of proper wound management also plays a crucial role in driving demand.

Asia Pacific Advanced Wound Care OTC Market Trends

The advanced wound care OTC market in Asia Pacific region is witnessing the fastest CAGR growth in the advanced wound care OTC market. This can be attributed to the region’s rapidly aging population, particularly in countries like Japan, China, and South Korea, where elderly individuals are more susceptible to chronic wounds such as diabetic foot ulcers, pressure injuries, and venous leg ulcers. Additionally, there is a shift toward home healthcare and self-treatment, encouraged by the need to reduce hospital burden and the growing preference for cost-effective care. Consumers are becoming more health-conscious and proactive, leading to higher adoption of OTC products such as advanced dressings, antimicrobial treatments, and moisture-retentive wound care items. Expanding e-commerce and retail pharmacy networks, especially in emerging economies like India, Vietnam, and Japan, makes these products more accessible to a broader population.

China's advanced wound care OTC market is experiencing strong growth driven by the demographic shift, with the population aged 60. This aging demographic is more susceptible to chronic wounds, such as pressure ulcers and diabetic foot ulcers, due to factors like reduced mobility, thinner skin, and comorbidities. The increased incidence of these conditions among older people necessitates effective wound care solutions, thereby driving demand in the advanced wound care market. In 2023, China's population aged 60 and above reached approximately 297 million, accounting for 21.1% of the total population. According to the World Health Organization (WHO), the proportion of people over the age of 60 is expected to reach 28% by 2040.

Latin America Advanced Wound Care OTC Market Trends

The advanced wound care OTC market in Latin America is experiencing steady growth, driven by the high prevalence of chronic conditions such as diabetes and obesity, particularly in Brazil and Argentina. These health issues contribute to a rising incidence of chronic wounds, including diabetic foot ulcers and venous leg ulcers, which require consistent and effective wound care. Patients increasingly turn to OTC advanced wound care products for at-home treatment in many rural and underserved areas with limited access to specialized healthcare. This trend is further supported by growing awareness of wound care and hygiene among consumers and healthcare professionals, aided by public health campaigns and educational efforts across the region.

Middle East Africa Advanced Wound Care OTC Market Trends

The advanced wound care OTC market in the Middle East and Africa is growing fast, driven by the rising burden of chronic diseases, particularly diabetes and obesity, prevalent across Gulf countries such as Saudi Arabia, the UAE, and Sub-Saharan Africa. These conditions contribute significantly to the incidence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, which require ongoing wound management. As more patients seek convenient and accessible treatment options, the demand for OTC advanced wound care products like hydrocolloid dressings and moisture-retentive bandages is increasing.

Key Advanced Wound Care OTC Companies Insights

Key players operating in the advanced wound care OTC market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Advanced Wound Care OTC Companies:

The following are the leading companies in the advanced wound care OTC market. These companies collectively hold the largest market share and dictate industry trends.

- Solventum

- 3M

- Medline Industries, LP.

- PAUL HARTMANN AG

- Cardinal Health

- Coloplast Group

- Convatec Group PLC

- Smith+Nephew

- Mölnlycke AB

- Sonoma Pharmaceuticals, Inc.

- B. Braun SE

- Beiersdorf

- DeRoyal Industries, Inc.

- Vomaris Innovations, Inc.

- Lavior

- Dimora Medical

- Remedium Healthcare Products

Recent Developments

-

In April 2025, Sonoma Pharmaceuticals, Inc. announced that its hypochlorous acid-based acne products have been registered with the Medicines & Healthcare Products Regulatory Agency (MHRA). These products will be available through a major UK health and beauty retailer and pharmacy chain, spanning over 1,200 stores across the UK.

-

In January 2025, Beiersdorf launched its first wound dressing under the Hansaplast brand. Now, the company is introducing a new plaster utilizing advanced hydrocolloid technology. The Second Skin Protection Plaster provides a more professional solution for minor everyday wounds, and Beiersdorf is promoting its benefits through social media, television, and retail outlets.

-

In November 2024, Sonoma Pharmaceuticals, Inc. announced it had obtained a new 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Microcyn technology-based hydrogel. This new clearance includes enhancements in biocompatibility and an extended shelf life.

-

In April 2024, Remedium Healthcare Products launched NuVeria Labs' innovative Sacral Silicone Dressing on Amazon Prime, making advanced wound care solutions more accessible by delivering them directly to consumers.

-

In December 2023, Lavior, a company specializing exclusively in comprehensive over-the-counter diabetic wound and skin care solutions, announced that its Diabetic Hydrogel Wound Dressing and Diabetic First Aid Gel plant-based creams are now available at Walmart stores nationwide.

Advanced Wound Care OTC Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8.27 billion

Revenue forecast in 2033

USD 16.04 billion

Growth rate

CAGR of 9.93% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Solventum; 3M; Medline Industries, LP.; PAUL HARTMANN AG; Cardinal Health; Coloplast Group; Convatec Group PLC; Smith+Nephew; Mölnlycke AB; Sonoma Pharmaceuticals, Inc.; B. Braun SE; Beiersdorf; DeRoyal Industries, Inc.; Vomaris Innovations, Inc.; Lavior; Dimora Medical; Remedium Healthcare Products.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Advanced Wound Care OTC Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global advanced wound care OTC market report on the basis of product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Foam Dressings

-

Adhesive

-

Non-Adhesive Foam Dressings

-

-

Film Dressings

-

Non-Woven Post Operative Dressings

-

Hydrocolloids

-

Hydrogel Dressings

-

Greasy Gauzes

-

Honey Dressings

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Acute Wounds

-

Surgical (post-surgical wounds) & Traumatic Wounds (lacerations, abrasions, and cuts)

-

Burns (only 1st degree burns)

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

Distribution Channels Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Pharmacies / Drugstores

-

E-commerce/Online Pharmacies / Health E-tailers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global advanced wound care OTC market size was estimated at USD 7.63 billion in 2025 and is expected to reach USD 8.27 billion in 2026.

b. The global advanced wound care OTC market is expected to grow at a compound annual growth rate of 9.93% from 2026 to 2033 to reach USD 16.04 billion by 2033.

b. The North America segment held the largest market share in 2025. The region has a high prevalence of chronic conditions such as diabetes and obesity, which significantly contribute to the demand for long-term wound care solutions. Additionally, strong regulatory frameworks like the FDA ensure the availability of safe and effective OTC products, boosting consumer confidence.

b. Key players operating in the advanced wound care OTC market include Solventum, 3M, Medline Industries, LP., PAUL HARTMANN AG, Cardinal Health, Coloplast Group, Convatec Group PLC, Smith+Nephew, Mölnlycke AB, Sonoma Pharmaceuticals, Inc., B. Braun SE, Beiersdorf, DeRoyal Industries, Inc., Vomaris Innovations, Inc., Lavior, Dimora Medical, and Remedium Healthcare Products.

b. Key factors that are driving the market growth include the increasing prevalence of acute wounds such as surgical wounds, traumatic injuries, and burns, which require effective and immediate wound management solutions. Rising rates of road accidents, sports injuries, and surgical procedures globally have led to a surge in demand for advanced OTC wound care products that promote faster healing and reduce the risk of infection.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.