- Home

- »

- IT Services & Applications

- »

-

E-commerce Platform Market Size, Industry Report, 2033GVR Report cover

![E-commerce Platform Market Size, Share & Trends Report]()

E-commerce Platform Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Application (Apparel & Fashion, Food & Beverage, Automotive, Home & Electronics, Healthcare, BFSI & Technology), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-430-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

E-commerce Platform Market Summary

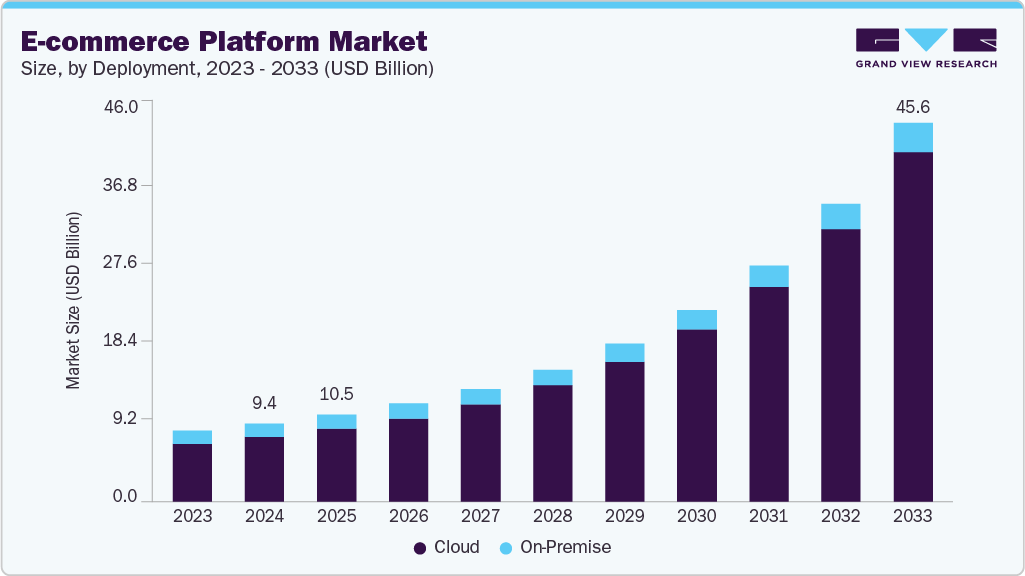

The global e-commerce platform market size was estimated at USD 9.40 billion in 2024 and is projected to reach USD 45.60 billion by 2033, growing at a CAGR of 20.2% from 2025 to 2033 due to the ongoing digital transformation across industries and the widespread adoption of the internet and smartphones. As global internet penetration increases, especially in emerging markets, businesses and consumers are increasingly moving online.

Key Market Trends & Insights

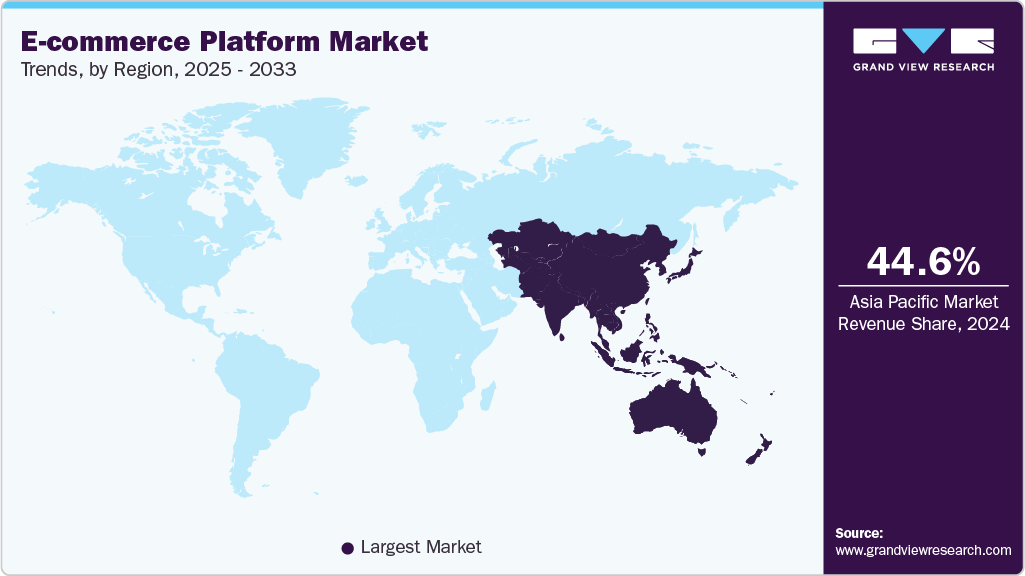

- Asia Pacific e-commerce platform dominated the global market with the largest revenue share of 44.6% in 2024.

- The Japan e-commerce platform market is expected to grow rapidly in the coming years.

- By deployment, the cloud segment led the market and held the largest revenue share of 82.5% in 2024.

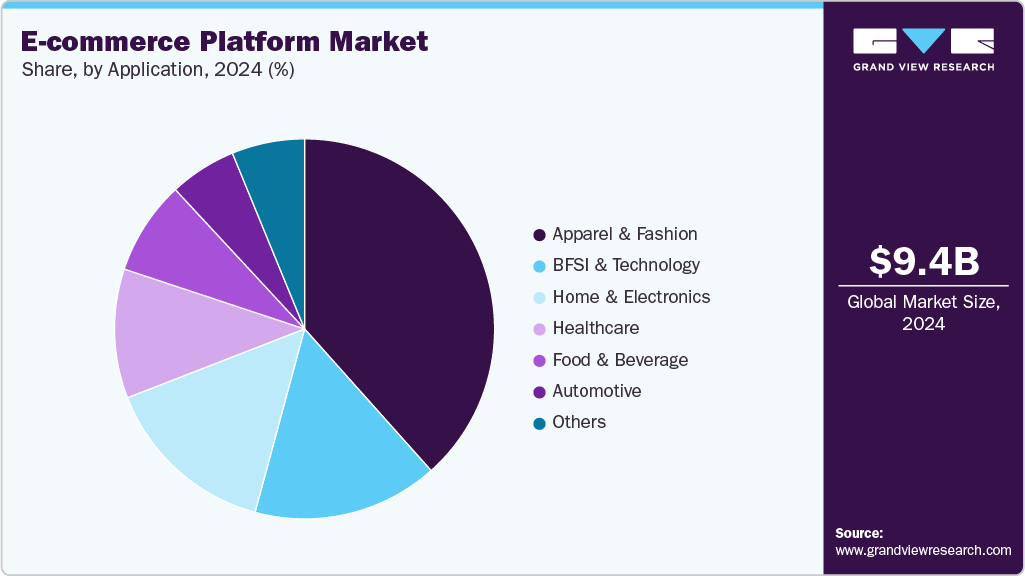

- By application, the apparel & fashion led the market and held the largest revenue share of 38.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.40 Billion

- 2033 Projected Market Size: USD 45.60 Billion

- CAGR (2025-2033): 20.2%

- Asia Pacific: Largest market in 2024

This shift is prompting traditional retailers to create digital storefronts using e-commerce platforms, thereby boosting market demand. Platforms with user-friendly interfaces, multi-device compatibility, and cloud-based services are particularly preferred, contributing to rapid market growth. The proliferation of smartphones and mobile applications contributes to the growth of the e-commerce platform industry, emphasizing the need to optimize for mobile-first shopping experiences. Moreover, consumer expectations for seamless cross-channel interactions are pushing platforms to support omnichannel retail strategies. Platforms that enable consistent branding, inventory management, and customer service across online and offline touchpoints are gaining traction, further driving growth.Small and medium-sized businesses (SMBs) are increasingly adopting e-commerce platforms because they are affordable, scalable, and easy to set up. Many platforms now provide low-code or no-code options, allowing entrepreneurs with limited technical skills to quickly launch online stores. The availability of plug-and-play solutions, freemium pricing models, and integrated payment gateways is making e-commerce more accessible, especially in emerging markets, broadening the customer base for platform providers.

The integration of artificial intelligence (AI), machine learning (ML), and big data analytics into e-commerce platforms is revolutionizing how businesses operate and connect with customers. AI-powered recommendation engines, dynamic pricing strategies, personalized marketing, and predictive analytics are improving user experiences and increasing conversion rates. These advancements boost platform loyalty and promote adoption across retail, fashion, electronics, and other industries. For example, in May 2025, Shopify launched a new generative AI feature called the AI Store Builder, designed to help merchants quickly establish their online stores. By entering descriptive keywords, users can generate three different store layouts, each with customized images and content. This tool aims to make the store setup process faster and easier, reducing the time and effort typically needed to build an e-commerce site.

Deployment Insights

The cloud segment led the market, capturing an 82.5% revenue share in 2024. Cloud deployments provide greater flexibility, enabling e-commerce businesses to easily integrate third-party services such as CRMs, ERPs, AI tools, marketing automation, and payment gateways. With API-first architectures and modular designs, cloud platforms allow extensive customization, making them suitable for a variety of industries and niche use cases. This adaptability makes cloud deployment highly appealing for businesses seeking tailored solutions without sacrificing performance.

The on-premise segment is expected to grow at the highest CAGR during the forecast period because. Despite progress in cloud security, some organizations still prefer on-premise deployment due to its perceived lower risk. Enterprises in sensitive industries like defense, finance, and intellectual property prioritize data protection by keeping full control over their digital assets in physically isolated environments. On-premise infrastructure allows these organizations to reduce potential threats from shared cloud environments, vendor lock-in, and external cybersecurity breaches, thereby ensuring greater confidentiality, compliance, and operational independence.

Application Insights

The apparel and fashion segment led the market and held the largest revenue share of 38.4% in 2024, fueled by the increasing consumer preference for online shopping, which offers convenience, variety, and competitive prices. Millennials and Gen Z shoppers are highly active in digital commerce and increasingly depend on e-commerce platforms to discover new brands, access global fashion trends, and buy apparel. This change in consumer behavior is encouraging brands to invest significantly in e-commerce platforms to reach digital audiences and increase sales.

The food & beverage segment is expected to grow at a significant CAGR throughout the forecast period. The popularity of meal kits, ready-to-eat (RTE) items, and subscription-based food delivery services is driving the growth of the food & beverage application segment. E-commerce platforms that support automated recurring billing, customizable meal plans, and user preference tracking help brands provide consistent, personalized experiences. This recurring revenue model is gaining popularity among health-conscious consumers and busy professionals, creating opportunities for platform providers to serve this expanding niche.

Regional Insights

North America e-commerce platform held a significant share in the global market in 2024, driven by high digital maturity, widespread broadband access, and advanced logistics infrastructure. The region benefits from a strong ecosystem of digital payment systems, well-established online consumer habits, and ongoing investments in omnichannel retail strategies by major brands.

U.S. E-commerce Platform Market Trends

The e-commerce platform market in the U.S. is expected to grow significantly at a CAGR of 17.7% from 2025 to 2033, due to the rapidly evolving retail landscape where traditional brick-and-mortar stores are aggressively transitioning online. The market is also seeing strong momentum from the expansion of niche D2C brands and startups leveraging SaaS-based platforms for fast, scalable launches. Moreover, growing consumer demand for real-time customer service, fast delivery, and flexible returns is driving investment in feature-rich, integrated e-commerce platforms tailored to high-expectation markets.

Europe E-commerce Platform Market Trends

The e-commerce platform market in Europe is anticipated to register considerable growth from 2025 to 2033 due to the strong regulatory frameworks that foster digital trust, cross-border commerce within the EU, and the growth of sustainable and ethical consumerism. Many businesses are leveraging platforms to comply with regional privacy laws like GDPR while catering to environmentally conscious consumers through eco-labeling, local sourcing, and carbon offset tracking capabilities. Multilingual support and multicurrency processing are also vital drivers, given the region's diversity.

The UK e-commerce platform market is expected to grow rapidly in the coming years. Retailers are adopting e-commerce platforms to navigate supply chain disruptions, automate tax compliance, and offer buy-now-pay-later (BNPL) options. The growth of the resale and rental fashion economy is also prompting the emergence of platforms focused on second-hand and circular retail models.

E-commerce platform market in germany held a substantial market share in 2024 due to its strong manufacturing base transitioning to B2B e-commerce models and the digitalization of small and medium-sized enterprises (SMEs). Emphasis on cybersecurity, data protection, and seamless ERP integration is influencing platform adoption. Moreover, German consumers' preference for invoice-based and localized payment systems has led to the growth of customizable platforms that align with regional consumer habits.

Asia Pacific E-commerce Platform Industry Trends

Asia Pacific dominated the global market with the largest revenue share of 44.6% in 2024. Rapid urbanization and rising middle-class spending are fueling demand for mobile-first platforms, social commerce integration, and real-time personalization. Additionally, the expansion of influencer-led commerce and integration of local super apps is a unique driver across several Southeast Asian and South Asian markets.

The Japan e-commerce platform market is expected to grow rapidly in the coming years, driven by an aging but digitally literate population increasingly adopting online retail for convenience and necessity. Platforms that support subscription models, personalized recommendations, and loyalty-based systems are in high demand. Moreover, local businesses are leveraging platforms to digitally transform traditional retail and offer hybrid shopping models that blend online and in-store experiences, catering to culturally nuanced shopping behavior.

E-commerce platform market in china held a significant share in 2024, driven by the mobile-first economy, the dominance of super apps like WeChat and Alipay, and the growth of livestreaming and social commerce. Chinese retailers are adopting highly customizable platforms that support gamification, AI-driven marketing, and community-based engagement. The rise of rural e-commerce, government support for digital transformation, and the integration of blockchain for supply chain transparency are further speeding up platform innovation and expansion in both urban and rural areas.

Key E-Commerce Platform Company Insights

Key players operating in the e-commerce platform industry are Shopify, Adobe Commerce, BigCommerce Pty. Ltd., WooCommerce, Wix.com, Inc., and Squarespace Commerce. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In July 2025, Wix.com, Inc. entered into a strategic partnership with Alibaba.com to help digital entrepreneurs, startups, and small businesses extend their global presence. Through this collaboration, Wix users are expected to gain access to Alibaba.com's wholesale marketplace, enhancing their global selling potential. In return, Alibaba.com merchants can leverage Wix’s advanced commerce infrastructure to build and manage both direct-to-consumer (D2C) and B2B storefronts, supporting a versatile and scalable online business model.

-

In June 2025, BigCommerce Pty. Ltd., in collaboration with Feedonomics, a U.S.-based data feed management platform, has integrated the AI-powered search engine Perplexity into its offerings. This integration enables merchants to enhance their brand visibility and relevance in AI-driven search results, aligning with the evolving ways consumers discover and interact with products online through intelligent search experiences.

-

In April 2025, WooCommerce expanded its collaboration with Affirm Holdings, Inc.a U.S.-based financial services provider by launching Affirm’s services in the UK This development allows WooCommerce merchants in the UK to integrate Affirm's flexible payment solutions directly into their checkout process, giving customers more control over how they pay and supporting merchant growth through enhanced purchasing options.

Key E-Commerce Platform Companies:

The following are the leading companies in the E-commerce platform market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Commerce

- BigCommerce Pty. Ltd.

- OMNIFUL

- OpenCart

- Oracle

- PrestaShop

- Salesforce Commerce Cloud

- Sana Commerce

- SAP SE

- Shopify

- shopware AG

- Squarespace Commerce

- Wix.com, Inc

- WooCommerce

E-commerce Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.46 billion

Revenue forecast in 2033

USD 45.60 billion

Growth rate

CAGR of 20.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Adobe Commerce; BigCommerce Pty. Ltd.; OMNIFU; OpenCart; Oracle; PrestaShop; Salesforce Commerce Cloud; Sana Commerce; SAP SE; Shopify; shopware AG; Squarespace Commerce; Wix.com, Inc; WooCommerce

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-commerce Platform Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global e-commerce platform market report based on deployment, application, and region:

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premise

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Apparel & Fashion

-

Food & Beverage

-

Automotive

-

Home & Electronics

-

Healthcare

-

BFSI & Technology

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global e-commerce platform market was valued at USD 9.40 billion in 2024 and is expected to reach USD 10.46 billion in 2025.

b. The global e-commerce platform market is expected to grow at a compound annual growth rate of 20.2% from 2025 to 2033 to reach USD 45.60 billion by 2033.

b. The cloud segment dominated the market and accounted for the revenue share of 82.5% in 2024. Cloud deployments offer superior flexibility, allowing e-commerce businesses to integrate third-party services such as CRMs, ERPs, AI tools, marketing automation, and payment gateways seamlessly.

b. Key players operating in the e-commerce platform market include Amazon.com, Inc., Bilibili, Facebook (Meta Platforms), Heliophilia Pte. Ltd. (Lemon8), JD.com, Kuaishou Technology, NTWRK, Pinterest TV, Popshop Live, QVC, Inc., Shopify (Shopify Live), Taobao.com, TikTok (ByteDance), YouTube (Google)

b. The global shift towards digital transformation across industries and the widespread adoption of the internet and smartphones. As global internet penetration rises, especially in emerging markets, businesses and consumers are increasingly shifting online.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.