- Home

- »

- Digital Media

- »

-

Advertising-based Video On Demand Market Report, 2030GVR Report cover

![Advertising-based Video On Demand Market Size, Share & Trends Report]()

Advertising-based Video On Demand Market Size, Share & Trends Analysis Report By Advertisement Position, By Device, By Enterprise Size, By Industry Vertical (Media & Entertainment, Retail & Consumer Goods), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-105-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

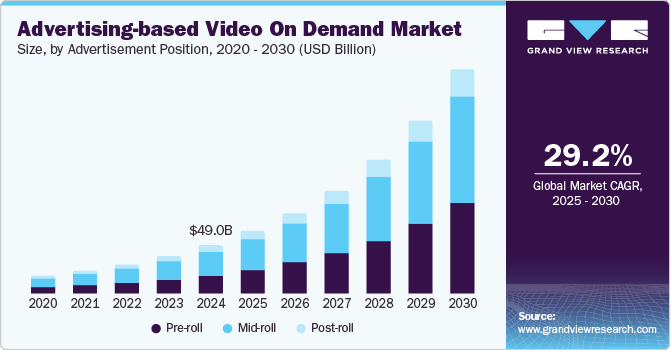

The global advertising-based video on demand market size was estimated at USD 49.04 billion in 2024 and is expected to grow at a CAGR of 29.2% from 2025 to 2030. AVOD services are gaining popularity, particularly as more subscription-based on-demand services proliferate and take up a substantial share of consumers' budgets. Advertising-based video on demand (AVOD) platforms leverage analytics of user activity as well as device specifications and capabilities to target advertisements to viewers. Because publishers may utilize user activity data to customize ad targeting, marketers are becoming more interested in AVOD services. AVOD platforms can use user activity analytics to provide tailored advertising that boosts conversion rates and ROI for advertisers.

Customers who are willing to watch advertising in exchange for free material are the target audience for Advertising-based video on demand (AVOD) providers. The absence of advertisements in the model is understandably appealing to consumers who have become accustomed to fast service and are willing to pay for convenience. YouTube is a prime example of an AVOD media service where content producers can upload original content to YouTube's servers and monetize their work with adverts. One significant challenge AVOD services face is balancing the number of adverts and the user experience. Too many advertisements or advertisements that are not relevant to the user may turn them off. Some advertising-based video on demand systems allow consumers to comment on the advertisements they watch, click a button to skip an intrusive ad, or respond to a survey question in its place.

Advertising-based video on demand (AVOD) platforms analyze user engagement and behavior analytics, revenue, and conversion rates to determine the efficacy of tailored advertising. In addition to audience reach, preferences, demographics, user activity and engagement metrics, and income, AVOD service providers can collect data from everything on their platforms. Service providers can enhance user suggestions and ad targeting, promote engagement, and optimize revenue production by analyzing AVOD data with the appropriate software solutions. In order to gauge the success of tailored commercials, AVOD systems can also track ad impressions, clicks, and conversions. These analytics allow AVOD platforms to identify the most successful advertising and modify their targeting tactics accordingly.

COVID-19 Impact

The COVID-19 epidemic has significantly affected AVOD platforms and the advertising sector. Due to lockdowns and social dissociation brought on by the pandemic, many customers are now spending more time online, which has caused a change in digital channels. The pandemic also substantially increased the e-commerce and internet services industries. Businesses in these areas have raised advertising spending to attract potential clients as more individuals have shifted to online shopping and other digital services. Digital advertising has become more popular as a result, especially on social media sites and search engines.

Digital advertising was at a disadvantage in the early stages of the pandemic, but as marketing spending began to pick up again, it became obvious that money was pouring in digitally. Budgets from advertisers have been redirected to digital advertising, especially AVOD platforms. The pandemic has increased media usage, particularly video streaming on televisions with internet connections. As a result, ad-supported streaming video has become more widely used, giving Advertising-based video on demand (AVOD) services a chance to develop. By giving them clear data to work with and allowing them to be extremely selective with their ad budgets, AVOD platforms are creating new opportunities for advertisers. Advertisers can increase their return on investment (ROI) by using AVOD platforms, which can assist with proper reporting and performance attribution.

The pandemic has accelerated the move toward AVOD platforms, with a notable increase in ad revenue beginning in Q2 2020. AVOD platforms are enabling advertisers to reach consumers who spend more time at home and consume more media than before, although this pandemic has had a severe impact on the advertising sector.

Advertisement Position Insights

Based on advertisement position, the market is classified into pre-roll, mid-roll, and post-roll. The mid-roll advertisement position segment dominated the overall market, gaining a market share of 49.1% in 2024. Mid-roll advertising is placed in the middle of a video or audio clip, frequently interrupting the viewer's or listener's experience. Additionally, a mid-roll advertisement's position might vary based on the platform and content format. Moreover, mid-roll adverts on online video platforms such as YouTube are often put at regular intervals, such as every five minutes or at specified timestamps defined by the content provider. This maintains a balance between keeping viewer interest and allowing advertising to reach their intended group.

The pre-roll advertisement position segment is anticipated to grow with the fastest CAGR of 30.6% throughout the forecast period. Pre-roll advertising appears before the main video or audio content begins. Additionally, this advertising is widespread in online video platforms, streaming services, and podcasts. Pre-roll advertising appears at the start of the content and is usually played automatically before the viewer or listener can access the desired content. Furthermore, pre-roll commercials can run for various lengths, but they are often kept brief to minimize disturbance to the user experience. Pre-roll ad lengths can range from a few seconds to a minute, with 15 to 30 seconds being the most popular. The main aim of this sort of advertisement position is to create a favorable balance between generating ad revenue and maintaining a positive user experience.

Device Insights

Based on devices, the market is classified into laptops and tablet PCs, mobile, console, and TV. The mobile segment dominated the overall market, gaining a market share of 45.8% in 2024. The segment's growth is attributed to the increasing mobile device adoption due to its unparalleled convenience and accessibility. These devices are also portable and lightweight, allowing users to stay connected and access information on the go. The widespread availability of affordable smartphones has made them accessible to many people, including in developing countries such as India, China, and Japan. According to a report by GSMA, a global non-profit industry organization that advocates for the interests of mobile network operators worldwide, in 2023, there will be a global population of approximately 5.48 billion individuals who are currently using mobile phones.

The laptops and tablet PCs segment is anticipated to grow with the fastest CAGR of 30.6% throughout the forecast period. Laptops and tablets are popular video consumption devices owing to their bigger screens and a more immersive viewing experience than smartphones or mobile phones. Many people choose these devices for long-term viewing, such as watching films, TV series, or web videos. Moreover, laptop and tablet devices capitalize on technological advancements and enhanced connectivity. With improved screen resolutions, more robust processing capabilities, and faster internet speeds, users can enjoy a smooth and immersive experience on these devices. These technological enhancements contribute to a seamless and pleasurable viewing experience for AVOD content on laptops and tablets.

Enterprise Size Insights

Based on enterprise size, the market is bifurcated into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment dominated the overall market, retaining a market share of 63.0% in 2024. Large enterprises usually have significant resources to develop high-quality video material. They create professional videos such as advertisements, product demonstrations, brand promotions, and corporate documentaries for distribution on advertisement channels. Furthermore, large enterprises use sophisticated advertising strategies in the industry. Additionally, they employ AVOD platforms' user data and analytics to target certain demographics, interests, and watching behaviors. This allows companies to provide personalized adverts to their target demographic, increasing the efficacy of their marketing initiatives.

The small and medium enterprises (SMEs) segment is expected to grow with the fastest CAGR of 30.1% throughout the projected period. AVOD platforms provide SMEs with a low-cost advertising channel to market their products and services. Additionally, SMEs may only reach a large audience by incurring the significant expenses associated with traditional advertising channels by leveraging the AVOD industry. They may boost brand recognition by creating tailored commercials that resonate with their unique target market. Furthermore, SMEs cater to specific regional or specialty markets. They may target local or niche audiences via AVOD platforms. SMEs may maximize the relevance and efficacy of their advertising campaigns by placing their commercials on AVOD channels that are relevant to their target audience.

Industry Vertical Insights

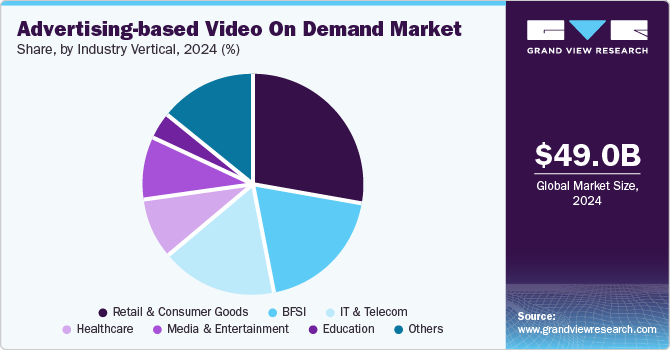

Based on industry verticals, the market is classified into BFSI, education, media & entertainment, IT & telecom, retail & consumer goods, healthcare, and others. The retail & consumer goods segment dominated the overall market, gaining a share of 28.4% in 2024. Retailers and consumer goods corporations use advertising-based video on demand platforms to market their brands and products through tailored adverts. Additionally, retail & segment often focus on advertisements that showcase their products, highlight promotional offers, or tell brand stories to capture viewers' attention and drive consumer engagement. Furthermore, AVOD platforms often offer opportunities for retailers to integrate e-commerce capabilities directly into their video content. This allows viewers to buy or learn more about the items featured in the videos without leaving the AVOD site, streamlining the purchasing process.

The media & entertainment segment is expected to grow with the fastest CAGR of 31.1% throughout the forecast period. Advertising-based video on demand platforms offer media and entertainment enterprises a large distribution network via which they may reach a large audience. They may use AVOD channels to disseminate their movies, TV shows, web series, documentaries, and other video material to audiences worldwide. Furthermore, AVOD systems allow media and entertainment firms to monetize their content by generating advertising income. They can display adverts to viewers during their content consumption by collaborating with advertisers or through programmatic advertising, collecting money depending on ad impressions or interactions.

Regional Insights

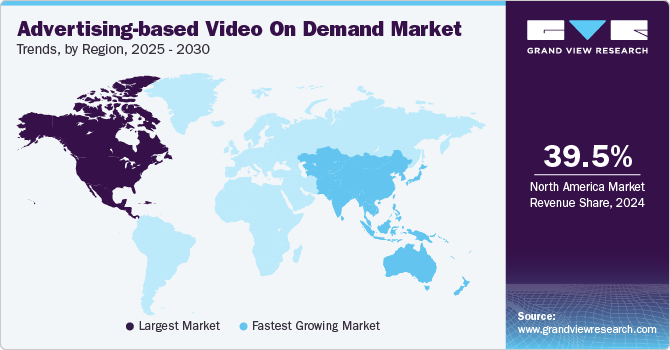

North America advertising-based video on demand (AVOD) market led the overall industry in 2024, with a revenue share of 39.5%. The regional growth can be attributed to several major AVOD platforms that have a strong presence in the North American region. Platforms like YouTube, Hulu, Tubi, Facebook, and Roku Channel have established themselves as leading players, offering viewers a wide range of free, ad-supported content. For instance, in February 2023, according to a report by Digital TV Research, the U.S. is expected to contribute USD 30 billion, with the remaining amount coming from Canada. Such trends are anticipated to propel regional growth over the forecast period.

U.S. Advertising-based Video On Demand Market Trends

The advertising-based video on demand market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The AVOD market in the U.S. is one of the largest in the world, dominated by global players like Hulu, Peacock, and Paramount+. While subscription-based services have gained popularity, AVOD remains a significant part of the market, offering a free and accessible way to consume content. However, the market is facing increasing competition from ad-free streaming services and challenges in monetizing ad inventory.

Canada advertising-based video on demand market is expected to grow at a significant CAGR from 2025 to 2030. The AVOD market in Canada is similar to the U.S., with a strong presence of global players. However, the market is smaller in size and faces challenges due to language barriers and competition from local broadcasters. To attract and retain viewers, AVOD platforms in Canada are focusing on offering a diverse range of content, including French-language programming.

Asia Pacific Advertising-based Video On Demand Market Trends

The advertising-based video on demand market in Asia Pacific is expected to witness the fastest CAGR of 30.5% over the projected period. The AVOD industry in Asia Pacific is one of the largest and fastest-growing markets in the world. It has experienced significant growth in recent years, driven by increased internet penetration, rising demand for online video content, and the shift toward digital advertising. Additionally, the affordability of smartphones has significantly increased their accessibility, particularly in developing countries like India, China, and Japan. Notably, iQiyi, MXPlayer, JioCinema, Viu, and Line TV have established themselves as key players in the Asia Pacific region. Their diverse range of AVOD content offerings has played a significant role in driving the growth of the AVOD market in the region.

Japan advertising-based video on demand market is expected to grow at a significant CAGR from 2025 to 2030. The AVOD market in Japan is dominated by established broadcasters like NHK and private networks. While subscription-based services are gaining traction, AVOD remains popular due to its free accessibility. However, the market is facing challenges due to competition from global streaming giants and a declining population.

The advertising-based video on demand market in India is expected to grow at a significant CAGR from 2025 to 2030. The AVOD market in India is rapidly growing, driven by increasing internet penetration and a large population of young consumers. Local platforms like Hotstar and Zee5 have gained significant market share, offering a wide range of content, including movies, TV shows, and sports. The market is also witnessing increased competition from international players like Netflix and Amazon Prime Video.

South Korea advertising-based video on demand market is expected to grow at a significant CAGR from 2025 to 2030. The AVOD market in South Korea is relatively mature, with a strong presence of local and international players. However, the market is facing challenges due to rising production costs and competition from subscription-based services. To maintain their position, AVOD platforms are focusing on producing original content and exploring new revenue streams, such as advertising partnerships and merchandise sales.

Key Advertising-based Video On Demand Company Insights

The market is fragmented and is anticipated to witness competition due to several players' presence. The players in the market compete based on the type of advertisements and the quality and creativity of these advertising services. Furthermore, the AVOD model is growing quickly due to its dynamic ad delivery and higher personalization and customization of the ad-delivery experience. The surge in demand for advertising videos for product and service promotions is also driving the growth of AVOD services.

Some of the key companies operating in the market include IBM, Facebook, and YouTube, among others.

-

IBM's advantage in the AVOD market stems from its cutting-edge technology infrastructure and proficiency in AI, cloud computing, and data analytics. Through IBM Watson’s AI capabilities, the company offers sophisticated ad-targeting solutions, including predictive audience insights and dynamic ad personalization, which enhance viewer engagement. IBM’s cloud services enable scalable video delivery and seamless content management for AVOD providers, ensuring high-quality streaming experiences across devices. Furthermore, IBM’s focus on secure data handling and compliance with privacy regulations makes it an attractive partner for media companies seeking robust and reliable advertising solutions. By integrating cutting-edge technologies with video platforms, IBM allows businesses to optimize their ad strategies in real time, helping them compete in a data-driven AVOD landscape where precise targeting and user experience are paramount.

-

Facebook’s competitive edge in the AVOD market is rooted in its vast user base, detailed audience data, and integrated advertising ecosystem. With billions of active users across Facebook Watch, Instagram, and Messenger, the company offers unparalleled reach for advertisers targeting specific demographics. Meta’s advanced data analytics and machine learning models provide precise audience segmentation, helping advertisers serve personalized ads that resonate with users. The platform supports a variety of ad formats, such as in-stream video ads, carousel ads, and interactive formats, enhancing engagement. Additionally, Facebook’s seamless integration across its social platforms boosts content discovery and ad delivery, driving higher viewability and conversions. Its emphasis on short-form video and user-generated content aligns with current viewing trends, ensuring Facebook remains competitive as AVOD continues to evolve.

-

YouTube’s advantage in the AVOD market comes from its unmatched scale, vast content variety, and advanced advertising ecosystem. As the largest video platform globally, it hosts an immense variety of content, from professional productions to user-generated videos, attracting billions of users monthly. Its advanced advertising system, powered by Google Ads, offers precise targeting, real-time analytics, and ad formats like skippable, non-skippable, and bumper ads, giving advertisers diverse engagement options. YouTube’s integration with Google’s ecosystem ensures seamless cross-platform campaigns, enhancing reach and effectiveness. Additionally, YouTube’s recommendation algorithm increases user engagement, leading to higher ad impressions. With strong content creator support through monetization programs, it maintains a steady stream of fresh content, further reinforcing its dominance in the AVOD space.

Brightcove and Dailymotion are some of the emerging companies in the target market.

-

Brightcove's strength as an emerging player in the AVOD market is its emphasis on enterprise-level solutions, setting it apart from mainstream platforms. By empowering media companies, broadcasters, and publishers with customizable streaming tools, Brightcove taps into a niche segment seeking more control over monetization and user experiences. Its emphasis on dynamic ad insertion (DAI) and data-driven ad targeting offers businesses a tailored approach to audience engagement, which is increasingly valued in a crowded digital landscape. Furthermore, Brightcove’s commitment to secure video delivery, reliable global content delivery networks (CDN), and API-driven integrations positions it to grow alongside the increasing demand for professional-grade AVOD platforms. This business-to-business focus helps Brightcove carve a unique path as more enterprises pivot toward video-based advertising models.

-

Dailymotion’s strength as an emerging player in the AVOD market lies in its focus on premium, curated content and its emphasis on international markets. While larger platforms like YouTube dominate with user-generated content, Dailymotion focuses on fostering partnerships with professional media houses and broadcasters, creating an attractive environment for advertisers seeking brand-safe content. Its strength in localized content and regional ad-targeting helps it tap into non-English-speaking and underserved markets, where larger competitors may have less traction. Additionally, Dailymotion’s cleaner, less cluttered platform appeals to audiences and advertisers looking for more focused engagement. As more consumers seek alternatives to large platforms, Dailymotion is well-positioned to capture a loyal user base and secure a foothold in the evolving AVOD space.

Key Advertising-based Video On Demand Companies:

The following are the leading companies in the advertising-based video on demand market. These companies collectively hold the largest market share and dictate industry trends.

- YouTube

- IBM

- Vimeo

- Brightcove

- Vidyard

- Kaltura

- Dailymotion

- Vdocipher

- SymphonyAI Media

- Muvi

- Dacast

Recent Developments

-

In October 2024, Amazon announced that Prime Video will incorporate advertisements in its content starting in 2025 for Indian viewers. This decision is due to increased competition in the streaming market and the need for more content investment. This move marks a shift away from the ad-free model that Prime Video has previously offered.

-

In May 2023, wedotv launched its core AVoD (Advertising Video on Demand) service on the LG app store. Additionally, wedotv's FAST (Free Ad-Supported TV) channels, namely wedo big stories & movies, are expanding their reach across Europe on the LG Channels smart TV platform.

-

In March 2023, Brightcove introduced Brightcove Ad Monetization, a dedicated service designed to help media companies monetize their content by leveraging advertising opportunities. The solution offers support for monetizing both live and video-on-demand content, incorporating yield optimization to fill any unsold ad inventory. It provides client-side and server-side advertising insertion capabilities across various platforms, including web players, android, iOS, and connected TV platforms.

-

In December 2021, Kaltura, the video experience cloud provider, revealed its collaboration with Astro, Malaysia's leading entertainment and content firm. Astro has selected the Kaltura TV Platform to power its new streaming service, sooka, specifically targeting millennials. By harnessing the advantages offered by Kaltura Cloud TV, sooka was successfully launched nationwide in June, with hosting support provided by Amazon Web Services (AWS).

Advertising-based Video On Demand Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 63.0 billion

Revenue forecast in 2030

USD 226.57 billion

Growth Rate

CAGR of 29.2% from 2025 to 2030

Historic year

2017 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Advertisement position, device, enterprise size, industry vertical, region

Regional scope

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, Japan, India, South Korea, Australia, Brazil, UAE, KSA, South Africa

Key companies profiled

Brightcove, Dacast, Dailymotion, Facebook, IBM, Kaltura, Muvi, SymphonyAI Media, Vdocipher, Vidyard, Vimeo, YouTube

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Advertising-based Video on Demand Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global advertising-based video on demand market report based on advertisement position, device, enterprise size, industry vertical, and region.

-

Advertisement Position Outlook (Revenue, USD Million, 2017 - 2030)

-

Pre-roll

-

Mid-roll

-

Post-roll

-

-

Device Outlook (Revenue, USD Million, 2017 - 2030)

-

Laptops and Tablet PCs

-

Mobile

-

Console

-

TV

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small and Medium Enterprise (SME)

-

Large Enterprise

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Media & Entertainment

-

BFSI

-

Education

-

Retail & Consumer Goods

-

IT & Telecom

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global advertising-based video on demand market size was estimated at USD 49.04 billion in 2024 and is expected to reach USD 63.00 billion in 2025.

b. The global advertising-based video on demand market is expected to grow at a compound annual growth rate of 29.2% from 2025 to 2030 to reach USD 226.57 billion by 2030.

b. North America dominated the AVOD market with a share of 39.5% in 2024. This is attributable to the presence of major players offering AVOD services in the region.

b. Key players of advertising-based video on demand market are YouTube, Facebook, IBM, Vimeo, Brightcove, Vidyard, Kaltura, Dailymotion, Vdocipher, SymphonyAI Media, Muvi, and Dacast.

b. The factors driving the advertising-based video on demand market include advertiser demand, user engagement, cost-effectiveness, data-driven advertising, and monetization opportunities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."