- Home

- »

- Advanced Interior Materials

- »

-

Aerosol Propellants Market Size, Share, Industry Report 2033GVR Report cover

![Aerosol Propellants Market Size, Share & Trends Report]()

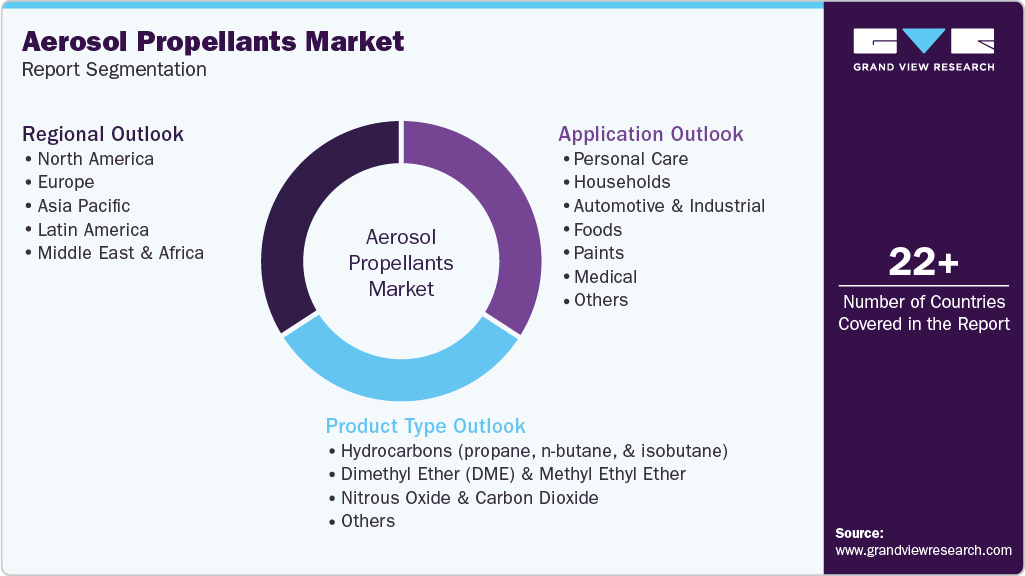

Aerosol Propellants Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Hydrocarbons, DME, Nitrous Oxide & Carbon Dioxide), By Application (Personal Care, Households), By Region, And Segment Forecasts

- Report ID: 978-1-68038-338-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerosol Propellants Market Summary

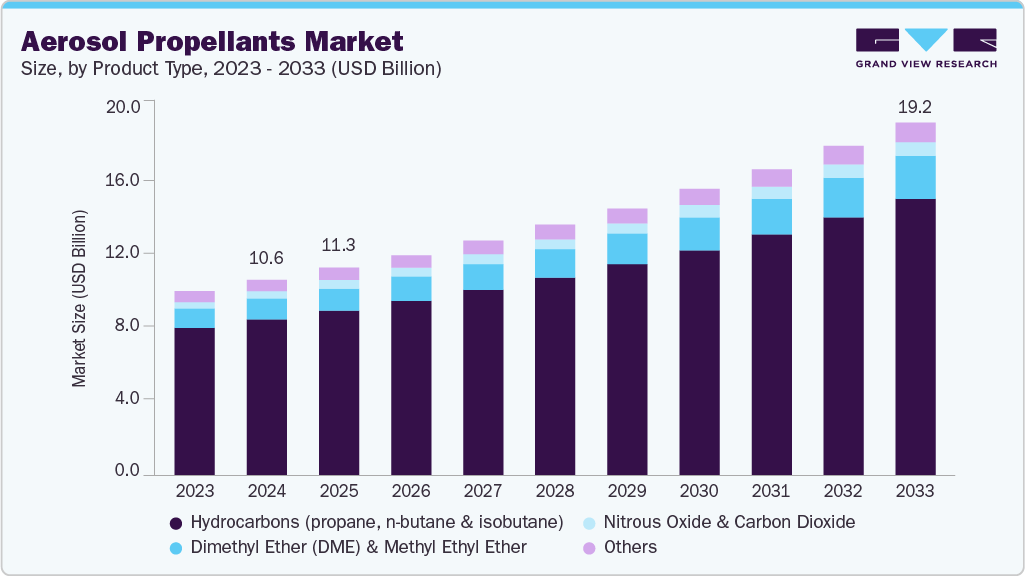

The global aerosol propellants market size was estimated at USD 10.62 billion in 2024 and is projected to reach USD 19.19 billion by 2033, growing at a CAGR of 6.9% from 2025 to 2033. The market is driven by rising demand for personal care and household products and increasing adoption of eco-friendly and low-VOC propellants due to stringent environmental regulations.

Key Market Trends & Insights

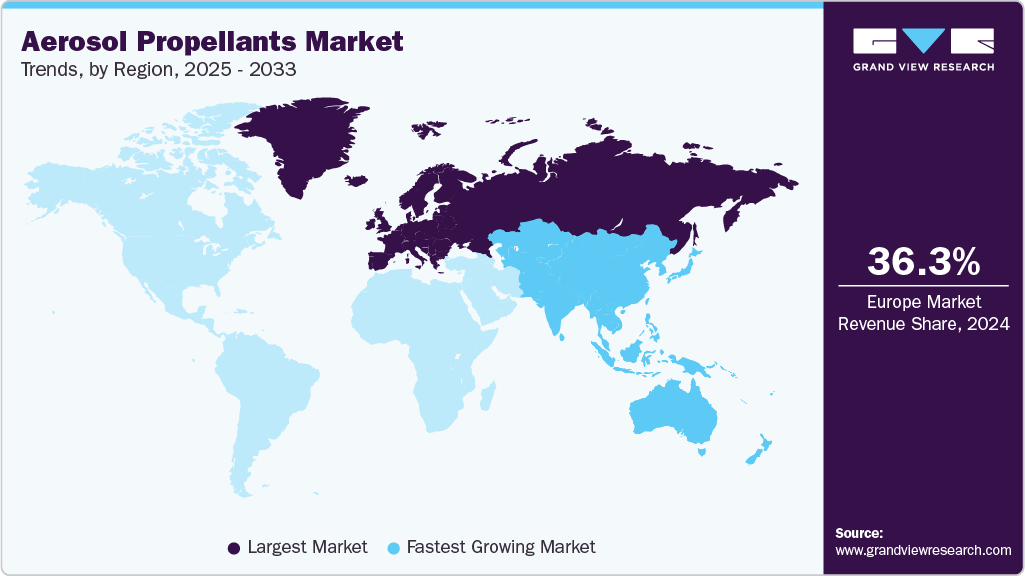

- Europe dominated the aerosol propellants market with the largest revenue share of 36.3% in 2024.

- The aerosol propellants market in Russia is expected to grow at a substantial CAGR of 8.1% from 2025 to 2033.

- By product type,the hydrocarbons segment recorded the largest revenue share of over 80.0% in 2024.

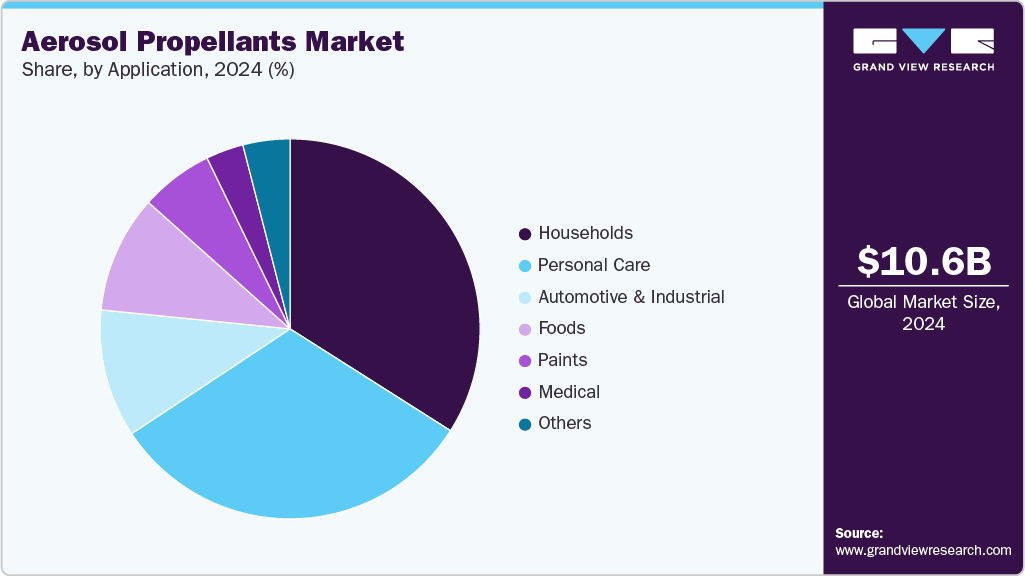

- By application, the personal care segment dominated the market with the highest revenue share of 34.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.62 Billion

- 2033 Projected Market Size: USD 19.19 Billion

- CAGR (2025-2033): 6.9%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The global demand for personal grooming products is a major driver for aerosol propellants, as they are critical components in products such as deodorants, hair sprays, shaving foams, and body sprays. Rising disposable incomes, urbanization, and changing lifestyle habits, particularly among younger consumers, are fueling demand for such convenience-based products. For instance, in regions such as Asia-Pacific and Latin America, increasing consumer awareness of personal hygiene is propelling sales of spray-based grooming products, thereby boosting the use of aerosol propellants such as hydrocarbons (propane, butane, isobutane) and dimethyl ether (DME).The healthcare sector's reliance on metered-dose inhalers (MDIs) for respiratory treatments such as asthma and chronic obstructive pulmonary disease (COPD) significantly drives the aerosol propellants market. Hydrofluoroalkanes (HFA-134a and HFA-227) are commonly used propellants in MDIs due to their non-toxic and non-flammable properties. Besides, an increasing prevalence of respiratory diseases, especially in urban regions with high pollution levels and among aging populations, is driving the demand for pharmaceutical-grade propellants.

The need for efficient and hygienic cleaning solutions in households, commercial spaces, and industries is driving demand for aerosol-based disinfectants, air fresheners, and surface cleaners. The COVID-19 pandemic amplified the focus on sanitization, leading to a surge in demand for aerosolized cleaning products. Propellants such as DME and hydrocarbons are widely used in these formulations. Additionally, industrial sectors rely on aerosol propellants for lubricants, degreasers, and maintenance sprays, where ease of application and extended shelf life are critical advantages.

Environmental regulations and sustainability concerns are pushing manufacturers to innovate with low global warming potential (GWP) and non-ozone-depleting substances. This shift is leading to the development of next-generation propellants such as hydrofluoroolefins (HFOs) and compressed gases such as nitrogen and carbon dioxide. Regulatory pressure, such as the Kigali Amendment to the Montreal Protocol, and increasing consumer demand for green products are encouraging companies to reformulate aerosol products. For example, brands in Europe and North America are investing in eco-label certifications and adopting sustainable propellants to align with both environmental goals and market differentiation strategies.

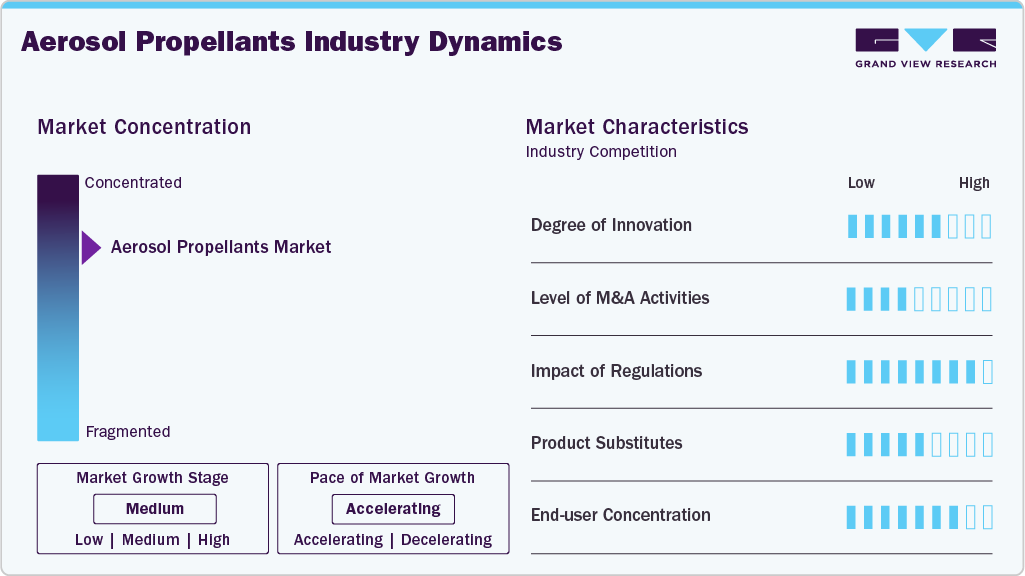

Market Concentration & Characteristics

The aerosol propellants market is closely linked to diverse industries such as personal care, pharmaceuticals, household care, automotive, and industrial maintenance. This interconnectedness means that demand for propellants is highly elastic to changes in consumer behavior, health trends, and industrial activity. For instance, growth in the personal care segment directly affects the consumption of hydrocarbon-based propellants, while advancements in inhalation therapies impact the demand for pharmaceutical-grade HFAs.

Furthermore, while the market presents significant opportunities for innovation, new entrants encounter moderate to high barriers to entry. These include the need for capital-intensive production facilities, stringent regulatory approvals, rigorous safety compliance standards, and competition with well-established players who control extensive distribution networks. Leading chemical manufacturers often maintain long-term supply agreements with major FMCG and pharmaceutical companies, making it difficult for newcomers to scale rapidly unless they pursue strategic partnerships or offer differentiated, niche solutions.

Product Type Insights

The hydrocarbons segment recorded the largest revenue share of over 80.0% in 2024. Hydrocarbons are the most used aerosol propellants due to their low cost, high vapor pressure, and compatibility with a wide range of formulations. These include propane, n-butane, and isobutane, which are highly effective in delivering consistent spray patterns. Additionally, their low toxicity makes them suitable for consumer goods. The continued growth of the personal care and home care industries, particularly in emerging economies, further propels demand.

The DME and methyl ethyl ether segment is projected to grow at the fastest CAGR of 8.7% during the forecast period. DME and methyl ethyl ether are environmentally friendlier alternatives often used in applications where partial water solubility and reduced flammability are desirable. DME is gaining traction in hair sprays, paints, and pharmaceutical aerosols due to its high solvency power, low toxicity, and biodegradability. These ethers can be used as both propellants and solvents, making them multifunctional. Increasing regulatory pressure on hydrocarbon and CFC emissions has encouraged formulators to adopt DME as a greener substitute.

Application Insights

The personal care segment dominated the market with the highest revenue share of 34.0% in 2024. Its high share is attributable to different factors such as economic growth, a growing middle-class population, and increasing per capita income. Deodorants and antiperspirants are considered daily-use products. Factors such as healthy ingredients, eye-catching packaging designs, and innovation in packaging are the factors driving demand for personal care products, especially antiperspirants and deodorants.

Furthermore, changing lifestyles and increased focus on personal hygiene are anticipated to expand the deodorant market during the coming years. The demand for shaving creams and gels has been growing on account of rising consumer awareness and grooming requirements. Shave foam manufacturers are increasingly focusing on natural and organic shaving foams due to rising consumer focus on natural personal care products. Consumers, especially men, are becoming appearance-conscious and are trying new products. This is anticipated to propel the use of aerosol propellants in shaving creams and gels.

The demand for aerosol propellants in household applications is expected to rise due to the tendency of consumers to spend more money and time creating an ideal environment at home and in vehicles using air fresheners, which is likely to drive the aerosol propellants industry’s growth. The demand for air fresheners has been increasing significantly on account of rapid urbanization, growing infrastructure, and rising demand for automobiles. Moreover, growing disposable income and the increasing significance of aromatherapy are anticipated to boost the growth of air fresheners in the future.

Region Insights

Europe aerosol propellants market dominated the global market and accounted for the largest revenue share of over 36.3% in 2024. Europe is a mature yet innovation-driven market for aerosol propellants, with stringent environmental policies shaping industry trends. The European Union’s F-Gas Regulation and REACH directives encourage the use of eco-friendly propellants such as dimethyl ether (DME) and nitrogen in aerosols. Countries such as Germany, France, and the UK lead in demand for personal care, household, and automotive aerosol products. The region’s strong focus on sustainability has led to the adoption of "green" aerosols in products such as deodorants and air fresheners. Additionally, the pharmaceutical sector utilizes aerosol propellants in metered-dose inhalers (MDIs), with companies such as GSK and AstraZeneca investing in next-generation propellants with lower environmental impact.

The growth of Germany aerosol propellants market in Europe is driven by advanced industrial applications and strict environmental standards. The country’s strong automotive sector uses aerosols for lubricants and coatings, while the personal care industry relies on them for products such as dry shampoos. Germany’s commitment to sustainability has accelerated the adoption of DME and compressed air propellants in household products. The pharmaceutical sector also plays a key role, with companies such as Boehringer Ingelheim developing next-generation inhalers with low-GWP propellants.

North America Aerosol Propellants Market Trends

North America aerosol propellants marketis a key market, driven by high consumer spending on personal care, pharmaceuticals, and household products. The U.S. and Canada have well-established aerosol industries, with strong demand for products such as spray paints, medical aerosols (e.g., inhalers), and cleaning sprays. Strict environmental regulations, such as the U.S. EPA’s restrictions on ozone-depleting substances, have led to innovations in propellant technologies, including hydrocarbon-based and compressed air systems. The region also sees growth in industrial applications, such as automotive aerosol lubricants and coatings.

Asia Pacific Aerosol Propellants Market Trends

Asia Pacific aerosol propellants marketis expected to grow at the fastest CAGR of 8.2% over the forecast period. This positive outlook is due to rapid industrialization, urbanization, and increasing consumer demand for personal care and household products. Countries such as China, India, and Japan are witnessing significant growth in aerosol-based products such as deodorants, hair sprays, and insecticides. The expanding middle class, rising disposable incomes, and changing lifestyles are fueling demand. Additionally, the region’s strong manufacturing base and cost-effective production capabilities attract global aerosol manufacturers. For example, India’s growing personal care industry relies heavily on aerosol propellants for products such as shaving foams and air fresheners.

Key Aerosol Propellants Company Insights

The aerosol propellants market features a moderately consolidated competitive environment, dominated by a mix of multinational chemical corporations and specialized manufacturers. Key players such as Honeywell International Inc., Arkema, The Chemours Company, Shell, MITSUBISHI GAS CHEMICAL COMPANY, INC., and Evonik leverage their extensive R&D capabilities, global distribution networks, and long-standing partnerships with FMCG, personal care, and pharmaceutical brands to maintain market leadership.

Competition is driven by innovation in eco-friendly and low-GWP propellants, regulatory compliance with environmental standards, and customized formulations for diverse end-use industries. Emerging players face high entry barriers due to capital-intensive infrastructure, stringent safety regulations, and established supplier-customer relationships in high-volume sectors such as personal care and household products.

-

In April 2025, Nouryon announced the launch of Demeon ReNu100, a versatile, high-performing, and biobased propellant for aerosol applications, at in-cosmetics Global in Amsterdam, Netherlands. It is clear, virtually odorless, water-miscible, and chemically stable, offering the same performance as conventional DME with lower global warming potential. It is suitable for various personal care aerosol products such as hair sprays, antiperspirants, deodorants, dry shampoos, mousses, and shave foams.

-

In March 2025, Coster Group opened a new aerosol production facility in Cabreúva, São Paulo, Brazil, marking a significant expansion of its operations in South America. The new plant represents a strategic move to strengthen Coster's presence in the region, supporting its global position in aerosol and dispensing packaging solutions. This facility aligns with the company's broader sustainability goals and innovation roadmap, enhancing its capacity to serve local and international markets with advanced aerosol products.

Key Aerosol Propellants Companies:

The following are the leading companies in the aerosol propellants. These companies collectively hold the largest market share and dictate industry trends.

- The Chemours Company

- Arkema

- Shell

- Bharat Petroleum Corporation Limited

- Honeywell International Inc.

- National Gas Company

- Orbia Fluor & Energy Materials

- Evonik

- AvantiGas

- Harp International Ltd.

- Nouryon

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Emirates Gas

- Sara Chem India

Global Aerosol Propellants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.26 billion

Revenue forecast in 2033

USD 19.19 billion

Growth rate

CAGR of 6.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada, Mexico, Germany,

Key companies profiled

The Chemours Company; Arkema; Shell; Bharat Petroleum Corporation Limited; Honeywell International Inc.; National Gas Company; Orbia Fluor & Energy Materials; Evonik; AvantiGas; Harp International Ltd.; Nouryon; MITSUBISHI GAS CHEMICAL COMPANY, INC.; Emirates Gas; Sara Chem India.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerosol Propellants Market Report Segmentation

This report forecasts revenue growth at a global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aerosol propellants market report based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Hydrocarbons (propane, n-butane, and isobutane)

-

Dimethyl Ether (DME) and Methyl Ethyl Ether

-

Nitrous oxide and carbon dioxide

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Personal Care

-

Households

-

Automotive & Industrial

-

Foods

-

Paints

-

Medical

-

Others

-

-

Region Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aerosol propellants market size was estimated at USD 10.62 billion in 2024 and is expected to reach USD 11.26 billion in 2025.

b. The global aerosol propellants market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 19.19 billion by 2033.

b. Europe dominated the aerosol propellants market with a share of 36.3% in 2024. This is attributable to the increasing demand for hair care products on account of the geriatric population in the region.

b. Some key players operating in the aerosol propellants market include Royal Dutch Shell, Nouryon, Honeywell International Inc., BOC Limited, Mitsubishi Gas Chemical Company, Inc., and others.

b. Key factors that are driving the market growth include the increasing demand for aerosol products such as deodorants, air fresheners and paints. In addition, growing application of aerosol propellants in personal care products, mainly cosmetics, is further expected to drive demand over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.