- Home

- »

- Advanced Interior Materials

- »

-

Aerospace Forging Market Size, Share, Industry Report 2030GVR Report cover

![Aerospace Forging Market Size, Share & Trends Report]()

Aerospace Forging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Aluminum, Steel, Titanium), By Aircraft (Commercial, Military), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-698-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace Forging Market Summary

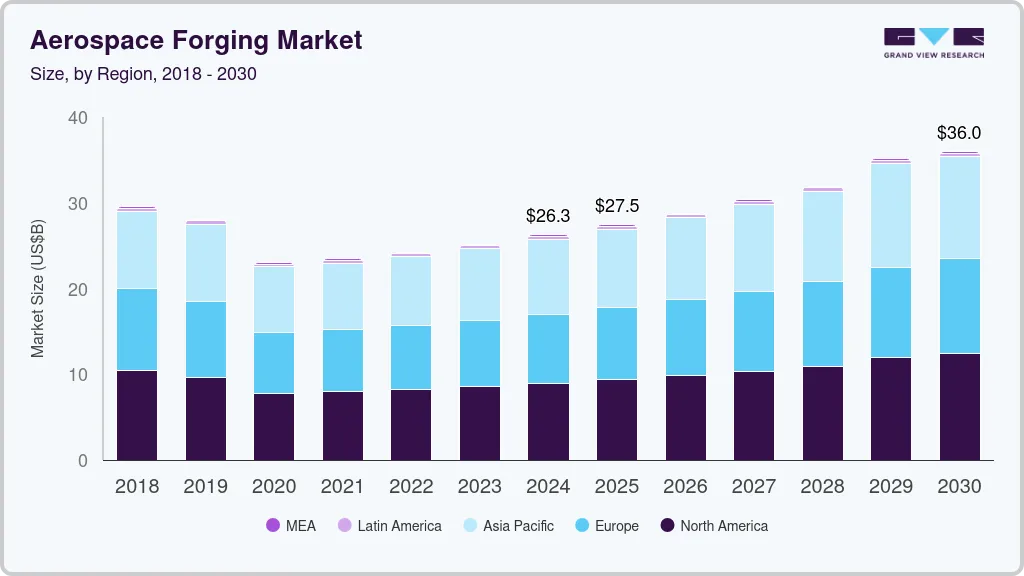

The global aerospace forging market size was estimated at USD 26.3 billion in 2024 and is projected to reach USD 36.0 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The surging demand for lightweight and durable materials in the aerospace industry, particularly for components such as landing gear and engine parts, is expected to favor the market growth.

Key Market Trends & Insights

- North America aerospace forging market held the largest revenue share of 34.0% in 2024.

- The aerospace forging market in U.S. dominated North America with the largest revenue share in 2024.

- Based on material, the Aluminum dominated the market with the largest revenue share of 60.2% in 2024

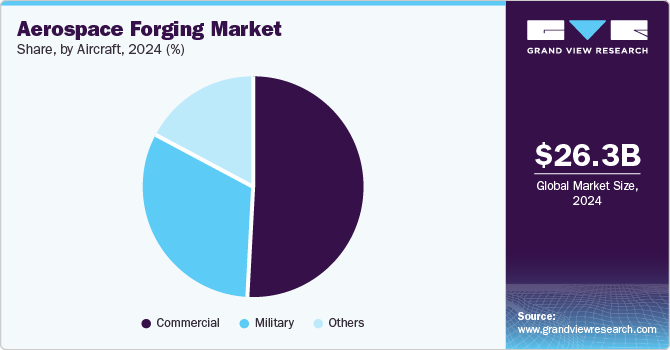

- Based on aircraft, the commercial aircraft segment dominated the market, with a revenue share of 49.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.3 Billion

- 2030 Projected Market Size: USD 36.0 Billion

- CAGR (2025-2030): 5.5%

- North America: Largest Market in 2024

- Europe: Fastest growing market

Technological advancements, such as induction heating, isothermal forging, and the development of titanium-aluminides and nickel-based superalloys, enhance the manufacturing process and its efficiency, benefitting the aerospace forging market. According to an article published by The Manufacturer in October 2024, the Advanced Forming Research Centre (AFRC) partnered with ATI with the aim of material advancement in aerospace. This is expected to support sustainable air travel by creating lighter, stronger, and more heat-resistant components that will improve the performance and fuel-efficiency of aircraft. ATI is expected to use AFRC's FutureForge facility to develop next-generation materials, such as metallic alloys, to enhance jet engine efficiency and reduce fuel consumption.Manufacturers such as Airbus and Boeing are increasing production capacities to meet the rising demand for air travel. For instance, an article published by TravelBiz Monitor in February 2024 stated that Airbus is expected to deliver 800 commercial aircraft in 2024. The company aims to speed up its production to meet the increasing demand for air travel. It focuses on strengthening supplier relationships and enhancing production capabilities while maintaining safety standards.

According to an article published by the Arab News in December 2024, Saudi Aramco has partnered with Saudi Investment Recycling Company and TotalEnergies to develop the SAF plant in Saudi Arabia's Eastern Province. Sustainable Aviation Fuel (SAF) is a biofuel derived from biomass and waste resources, which offers a low carbon footprint and reduces greenhouse gas emissions from aviation. The collaboration is expected to focus on recycling local waste, such as cooking oils and animal fats, to produce SAF, aligning with Saudi Arabia's Vision 2030 sustainability goals.

Material Insights

Aluminum dominated the market with the largest revenue share of 60.2% in 2024, owing to the increasing demand for lightweight and fuel-efficiency aircraft. Aluminum forgings are used in aircraft components such as wings, fuselage sections, and landing gear. Innovations in aluminum forging techniques have improved the quality and performance of aluminum components. In addition, technological advancements in aluminum alloys and the forging process are enhancing the performance and durability of these components, making them more suitable for modern aircraft.

Titanium is expected to grow at the fastest CAGR of 6.3% over the forecast period, owing to its corrosion resistance and ability to endure harsh temperatures. It is suitable for components such as flap tracks and landing gear. Its durability also enhances the lifespan of aircraft parts, including landing gear, airframes, and fuselage parts. Titanium is also preferred in military aircraft due to its heat resistance and high strength-to-weight ratio. For instance, an article published by Business Standard in December 2024 stated that the Defence Research and Development Organisation (DRDO) is expected to develop titanium alloy for aerospace applications.

Aircraft Insights

The commercial aircraft segment dominated the market, with a revenue share of 49.5% in 2024. This can be attributed to the growing demand for lightweight and fuel-efficient aircraft. Advanced materials such as titanium and aluminum alloys are suitable for forging processes to produce lightweight and rigid parts that align with the safety standards required in aviation. According to an article published by ET Infra in July 2024, Boeing is expected to deliver nearly 44,000 new commercial airplanes over the next 20 years, driven by the increasing demand for air travel.

The military aircraft segment is expected to grow at the fastest CAGR of 6.0% over the forecast period, driven by the surging demand for high-performance forged components. Advanced materials such as aluminum alloys, titanium, and nickel-based superalloys are used to improve the efficiency and effectiveness of military aircraft. Furthermore, the focus on developing new technologies, such as unmanned aerial vehicles and stealth capabilities, is expected to drive the need for specialized forged materials in military applications.

Regional Insights

North America aerospace forging market held the largest revenue share of 34.0% in 2024. The adoption of cutting-edge technologies and the presence of robust defense & aerospace sectors are key factors driving the market in this region. The high demand for lightweight and fuel-efficient aircraft has significantly influenced manufacturers, such as Boeing and Airbus, to incorporate strong forged components, such as turbine disks and blades, into their designs. In addition, the growing demand for air travel has led to increased aircraft production, which in turn boosted the need for engine components such as turbine disks, blades, fan cases, and landing gear.

U.S. Aerospace Forging Market Trends

The aerospace forging market in U.S. dominated North America with the largest revenue share in 2024. Increasing need for commercial and military aircraft in the country has led to a surge in demand for forged aircraft components. Advancements in forging technologies in the U.S., such as isothermal forging and aluminum alloys, are resulting in the production of high-quality forged parts, which are critical in aerospace applications. Titanium is also primarily used in military aircraft components, such as firewalls and landing gear, which are necessary for enduring high temperatures.

The aerospace forging market in Canada is expected to grow at the fastest CAGR over the forecast period due to improvements and advancements in the manufacturing process and a surge in aircraft production. The increase in aircraft production has been led by the growing demand for air travel, which necessitates a consistent supply of fosrged components such as engine parts and landing gear. Moreover, the country has a strong base in aviation technologies, such as civil flight simulators and aircraft engines. This supports effective production capabilities and fosters innovation, further driving market growth.

Europe Aerospace Forging Market Trends

Europe aerospace forging market is expected to register growth at the fastest CAGR of 5.6% in 2024 with innovations and advancements in material science. Advancements in material science have led to the development of high-strength alloys that enhance the performance of forged parts while minimizing their weight. The emphasis on technological innovations, such as isothermal forging and precision-forging techniques, has enabled the producing of more complex and reliable components. Moreover, increasing investments in the defense and space exploration sectors in the region are driving the demand for strong forged components.

France aerospace forging market is expected to register growth at the fastest CAGR over the forecast period, contributing to increased focus of market players on research and innovation. The country focuses on improving its research in aerospace technology, which promotes the development of advanced materials and enhances the performance and efficiency of forged components such as engine parts and braking systems. According to an article published by AMG Engineering in April 2024, Safran Aircraft Engines selected ALD Vacuum Technologies GmbH to provide an isothermal forging module to be integrated into a hydraulic press. Furthermore, this system is expected to enable Safran to create aerospace parts, ensuring temperature control and vacuum maintenance.

Key Aerospace Forging Company Insights

The global aerospace forging market is driven by several key companies, including Arconic; ATI; Bharat Forge; ELLWOOD Group Inc.; Jiangyin Hengrun Heavy Industries Co., Ltd.; LARSEN & TOUBRO LIMITED.; PACIFIC FORGE, INC.; Precision Castparts Corp.; and Scot Forge Company.

-

Arconic is known for its expertise in manufacturing high-performance engineered products. The company specializes in forging aluminum and titanium components used in various aircraft components, such as engines and landing gear. The company also offers a range of forged aircraft products, such as fuselage panels, wing skins, and structural components, which enhance strength and reduce the weight of aircraft.

-

ATI manufactures forged products from advanced materials such as titanium and nickel-based alloys. The company offers many components, such as fan disks, turbine shafts, and compressor hubs, which are essential for jet engines and other aerospace components, including fuselage frames and wing skins.

Key Aerospace Forging Companies:

The following are the leading companies in the aerospace forging market. These companies collectively hold the largest market share and dictate industry trends.

- Arconic

- ATI

- Bharat Forge

- ELLWOOD Group Inc.

- Jiangyin Hengrun Heavy Industries Co., Ltd.

- LARSEN & TOUBRO LIMITED.

- PACIFIC FORGE, INC.

- Precision Castparts Corp.

- Scot Forge Company

Recent Developments

-

In March 2024, ATI launched its 12,500-ton billet forging press in North Carolina, critical for producing titanium used in aerospace and defense applications. The new media, namely BSOII, offers 25.0% greater tonnage capacity and is expected to enhance ATI's ability to manufacture high-performance alloys necessary for jet engines.

-

In January 2023, Bharat Forge partnered with General Atomics Aeronautical Systems, Inc. (GA-ASI) to manufacture aerostructures, including fuselages, wings, and flight control surfaces. This collaboration was aimed at enhancing the manufacturing capabilities and supporting growth of the aerospace sector in India. The partnership leveraged the former’s expertise in engineering and manufacturing to produce critical components for GA-ASI's UAV programs.

Aerospace Forging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.5 billion

Revenue forecast in 2030

USD 36.0 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, aircraft, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Japan, China, India, Brazil

Key companies profiled

Arconic; ATI; Bharat Forge; ELLWOOD Group Inc.; Jiangyin Hengrun Heavy Industries Co., Ltd.; LARSEN & TOUBRO LIMITED.; PACIFIC FORGE, INC.; Precision Castparts Corp.; Scot Forge Company

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Forging Market Report Segmentation

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerospace forging market report based on material, aircraft, and region:

-

Material Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2030)

-

Aluminum

-

Steel

-

Titanium

-

Others

-

-

Aircraft Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2030)

-

Commercial

-

Military

-

Others

-

-

Regional Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

India

-

Japan

-

China

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.