- Home

- »

- Next Generation Technologies

- »

-

Aerostructures Market Size, Share & Growth Report, 2030GVR Report cover

![Aerostructures Market Size, Share & Trends Report]()

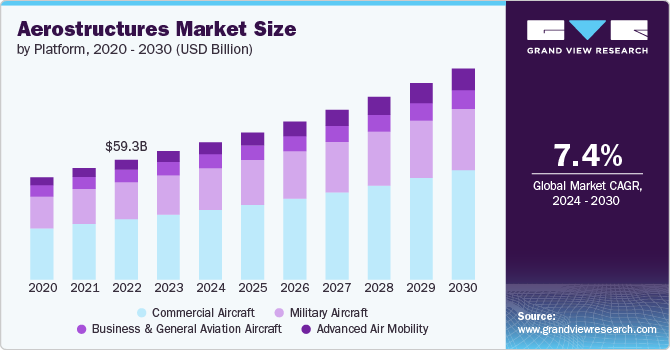

Aerostructures Market (2024 - 2030) Size, Share & Trends Analysis Report By Platform (Commercial Aircraft, Military Aircraft, Business & General Aviation Aircraft, Advanced Air Mobility), By Component, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-363-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerostructures Market Summary

The global aerostructures market size was estimated at USD 82,630.2 million in 2023 and is projected to reach USD 133,377.9 million by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The global rise in both passenger and cargo air travel has escalated demand for new aircraft, directly influencing the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, composites accounted for a revenue of USD 82,630.2 million in 2023.

- Composites is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 82,630.2 Million

- 2030 Projected Market Size: USD 133,377.9 Million

- CAGR (2024-2030): 7.1%

- North America: Largest market in 2023

As airlines seek to expand their existing fleet size with more fuel-efficient and advanced aircraft, manufacturers are pushed to speed up production, benefiting suppliers of essential aerostructure components. This increase is driven by the expansion of emerging markets and the need to replace older aircraft with newer, eco-friendly models, promoting sustainable aviation.

Moreover, the continuous innovation in materials science and manufacturing processes, such as the use of composite materials and 3D printing, is revolutionizing the aerostructures market. These technologies offer significant advantages, including weight reduction, enhanced durability, and lower maintenance costs, leading to improved fuel efficiency and overall performance of aircraft. Adoption of such advancements allows manufacturers to meet stringent regulatory standards and customer expectations, fueling the market growth.

A substantial increase in defense budgets globally is another significant market growth driver. Many countries are investing in the enhancement of their defense capabilities, leading to a higher demand for military aircraft equipped with the latest aerostructures. This shift is particularly noticeable in regions with rising geopolitical tensions, where the modernization of air forces is a strategic priority, thus driving the market expansion.

Additionally, the trend towards outsourcing aerostructure manufacturing to third-party specialists is gaining importance among aircraft OEMs. This strategy allows OEMs to leverage the advanced capabilities, efficiency, and cost-effectiveness of dedicated aerostructure companies. Such collaborative partnerships enable faster production times, access to specialized expertise, and focusing on core competencies, collectively driving the growth of the aerostructure market.

Furthermore, with growing concerns over environmental impact and fuel efficiency, there is a rising trend for retrofitting and upgrading existing aircraft. Implementing new aerostructure technologies in older fleets can significantly enhance their performance and extend their operational lifespan. This demand for retrofits and upgrades presents a lucrative opportunity for aerostructure manufacturers, contributing to market growth as airlines look to comply with evolving regulatory standards and passenger expectations, propelling the market forward.

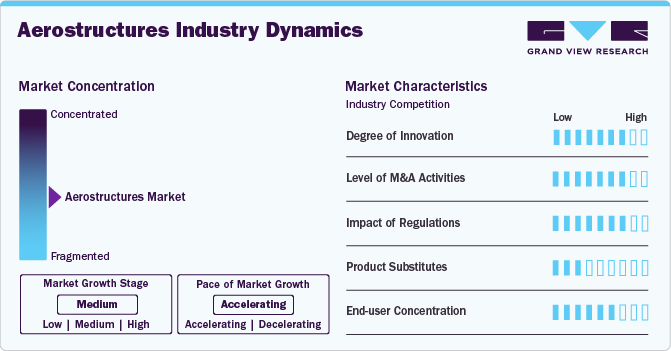

Market Concentration & Characteristics

The degree of innovation significantly influences the aerostructures market, driving advances in materials and manufacturing processes. High innovation levels lead to lighter, more efficient aircraft designs, enabling better fuel efficiency and reduced emissions, thus profoundly impacting market dynamics and future growth.

Regulations play a significant role in shaping the market for aerostructures, imposing standards that ensure safety, environmental compliance, and quality in aircraft manufacturing. Stringent regulatory frameworks can drive innovation but also increase production costs and extend time-to-market for new aerostructures.

The market is also being influenced by the rising number of mergers and acquisitions, which help companies increase market share, expand the customer base, and strengthen product portfolios.

The availability of product substitutes in the market significantly influences competitiveness and innovation. These alternatives often lead to cost-effective solutions, pushing companies to enhance their offerings, either by improving quality or reducing prices, ultimately shaping the market dynamics.

The high concentration of end users in the market includes intense competition among suppliers, who aim to secure large, lucrative contracts. This dynamic often leads to a push for innovation, customization, and improved service levels to meet the specific needs of a few powerful buyers, significantly influencing market trends and strategies.

Platform Insights

The commercial aircraft segment dominated the market in 2023 with a share of around 52%, primarily driven by increasing air travel demand worldwide. With an expanding middle class, especially in emerging economies, there's a surge in domestic and international tourism, necessitating more commercial aircraft. Additionally, airlines are focusing on fleet modernization to enhance fuel efficiency and reduce operational costs, leading to higher demand for advanced aerostructures, thereby driving the segment growth.

The advanced air mobility segment is expected to record the fastest CAGR of over 10% from 2024 to 2030. The advanced air mobility (AAM) platform segment is driven by technological advancements and increasing investments in urban air mobility solutions. Innovations in lightweight materials and composite structures are enabling the development of efficient and sustainable AAM vehicles. As cities look for new ways to improve traffic congestion and reduce emissions, the demand for these advanced aerial vehicles is rising. This surge in interest and funding is propelling the market growth, with a focus on designing and manufacturing components that meet the unique requirements of AAM platforms, which is further driving the segment growth.

Component Insights

The fuselages segment held the highest revenue share in 2023, driven by the increasing demand for more fuel-efficient and aerodynamically advanced aircraft. Innovations in composite materials and manufacturing technologies have enabled lighter and stronger fuselage designs, thus improving aircraft performance and fuel efficiency. Additionally, the rise in global air traffic and the subsequent need for new aircraft to meet this demand further propel the growth of the fuselage component segment.

The nacelles & pylons segment is estimated to register the fastest CAGR from 2024 to 2030, primarily driven by the increasing demand for fuel-efficient aircraft. As the aviation industry focuses on reducing environmental impact and operational costs, manufacturers are investing in advanced nacelles and pylons that contribute to improved aerodynamics and engine efficiency. Moreover, the expansion of both commercial and military aviation sectors globally further propels the demand for these components, underlining their critical role in modern aircraft design and sustainability initiatives.

End-use Insights

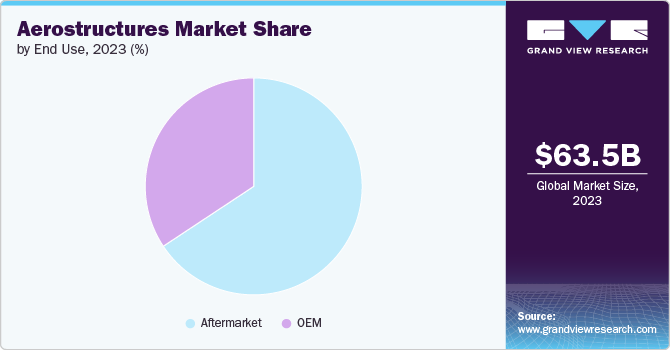

The aftermarket segment held the highest revenue share in 2023, driven primarily by the increasing need for maintenance, repair, and overhaul (MRO) services. This growth is propelled by the aging global aircraft fleet, which requires frequent updates and refurbishments to meet stringent safety regulations and operational efficiency standards. Moreover, advancements in technology and materials are also encouraging airlines and service providers to upgrade existing aerostructures, further fueling this segment's expansion.

The OEM segment is estimated to register the fastest CAGR from 2024 to 2030, primarily fueled by the increasing demand for new aircraft amidst a sharp rise in global passenger traffic. Advances in technology and the push for more fuel-efficient and environmentally friendly aircraft designs are compelling OEMs to innovate and refine their aerostructure components. Furthermore, the expansion of emerging markets and the need for fleet modernization in developed regions are acting as critical growth drivers, ensuring a robust pipeline for OEMs in the aerostructures space.

Regional Insights

The aerostructures market in North America accounted for the highest revenue share of nearly 34% in 2023. The growth of the North American market is primarily driven by technological advancements and a robust financial sector that facilitates substantial investments in R&D activities. Moreover, a strong emphasis on innovation and the adoption of new technologies across various industries, including healthcare, IT, and manufacturing, fuels economic expansion in this region.

U.S. Aerostructures Market Trends

The aerostructures market in the U.S. is anticipated to grow at a CAGR of over 6% from 2024 to 2030. The U.S. sees significant growth drivers in technological innovation and digital economy expansion, reinforcing its global economic dominance.

Asia Pacific Aerostructures Market Trends

The aerostructures market in Asia Pacific is anticipated to grow at the highest CAGR of over 9% from 2024 to 2030. Asia Pacific's remarkable growth trajectory is held in its significant manufacturing base and export-oriented economies. Rapid urbanization, increasing technological adoption, and a burgeoning middle class with growing disposable incomes contribute to the region's economic dynamism. Additionally, government initiatives aimed at infrastructure development and digital transformation further propel the region towards substantial growth.

The aerostructures market in India is estimated to record a significant growth rate from 2024 to 2030. India's growth is propelled by its burgeoning service sector and rapid digitalization, coupled with a young and increasingly skilled workforce.

The China aerostructures market is expected to grow considerably from 2024 to 2030. China's economic expansion is driven by massive investments in infrastructure, a strong focus on manufacturing and exports, and a growing consumer market.

The aerostructures market in Japan is projected to witness a considerable growth rate from 2024 to 2030. Japan's growth is stimulated by its advanced technology and robotics sectors, alongside strategic investments in renewable energy and sustainability.

Europe Aerostructures Market Trends

The aerostructures market in Europe accounted for a notable revenue share in 2023. Europe's growth is significantly influenced by its strong regulatory framework, which promotes innovation while ensuring sustainability and environmental preservation. The region benefits from a highly skilled workforce and substantial investments in technological advancements, particularly in renewable energy, digitalization, and healthcare. These factors collectively enhance Europe's competitive edge in the global market.

The aerostructures market in the UK is projected to grow considerably from 2024 to 2030. The U.K.'s economic growth is maintained by its strong financial services sector, alongside emerging tech and creative industries.

The Germany aerostructures market is expected to record significant growth from 2024 to 2030. Germany's economic strength lies in its robust manufacturing and engineering sectors, with a keen focus on high-quality exports and sustainable energy solutions.

Middle East & Africa Aerostructures Market Trends

The aerostructures market in the Middle East and Africa (MEA) region is anticipated to grow at a significant CAGR of around 8% from 2024 to 2030. The MEA region witnesses growth driven by diversification efforts aimed at reducing dependency on oil revenues, particularly through investments in infrastructure, tourism, and renewable energy. Additionally, the rapid adoption of digital technologies across various sectors, coupled with a young and growing population, presents substantial opportunities for economic expansion in this region.

The aerostructures in energy market in Saudi Arabia accounted for a considerable revenue share in 2023. Saudi Arabia's growth is heavily influenced by its Saudi Vision 2030 program, aiming to diversify its economy beyond oil through investments in tourism, entertainment, and renewable energy.

Key Aerostructures Company Insights

Some of the key players operating in the market are Airbus SE; Spirit AeroSystems Inc.; and Saab AB.

-

Airbus SE is a global pioneer in the aerospace industry, renowned for its extensive range of highly advanced commercial aircraft, military, space, and helicopter products. Headquartered in Leiden, Netherlands, Airbus has grown into a leader in designing, manufacturing, and delivering innovative solutions for the aviation sector, consistently pushing the boundaries of technology to connect and protect people around the globe.

-

Saab AB stands as a key player in the defense and security sector, offering an impressive portfolio that spans from military aircraft to submarines and radar systems. Founded in 1937 and headquartered in Linköping, Sweden, Saab AB is dedicated to meeting global security challenges with innovative solutions, thus ensuring a safer and more secure world.

Bombardier Inc.; Cyient Limited; and Triumph Group, Inc. are some of the emerging participants in the aerostructures market.

-

Bombardier Inc., once a leading manufacturer in both the aerospace and transportation industries, has honed its focus to become a front-runner in the production of business jets. Headquartered in Montréal, Canada, and established in 1942, Bombardier has a reputation for innovation and quality, delivering luxurious and high-performance aircraft to meet the demands of global businesses and discerning individuals alike.

-

Cyient Limited is a global engineering and technology solutions company that specializes in digital transformation and end-to-end outsourced services across industries such as aerospace and defense, telecommunications, rail transportation, semiconductor, geospatial, industrial, and energy. Established in 1991 and headquartered in Hyderabad, India, Cyient Limited leverages cutting-edge technology and deep domain expertise to solve complex challenges and enable clients to achieve their digital evolution objectives.

Key Aerostructures Companies:

The following are the leading companies in the aerostructures market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus SE

- Spirit AeroSystems Inc.

- Saab AB

- AAR CORP.

- Bombardier Inc.

- Triumph Group, Inc.

- Elbit Systems Ltd.

- The Boeing Company

- Leonardo SpA

- Cyient Limited

Recent Developments

-

In January 2024, Airbus SE entered into an agreement with Mahindra Aerospace Structures Private Limited and Tata Advanced Systems Limited for the sourcing and production of components and parts for its commercial planes. Under this agreement, TATA and Mahindra Aerospace Structures are set to produce components, parts, and assemblies for several of Airbus's aircraft models, including the A320neo, A330neo, and A350.

-

In April 2023, Leonardo SpA, announced a collaboration with Cisco Technology. This alliance is focused on launching combined technology initiatives. Their goal is to work together on producing innovative products and solutions that support a sustainable shift towards safer logistics and transportation systems.

-

In February 2023, Heart Aerospace, a company from Sweden that specializes in electric aircraft, was chosen as a key partner by Air New Zealand for their future mission aircraft partnership. This collaboration will enhance the renewal of the airline's domestic fleet, referred to as Q300.

Aerostructures Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 68.00 billion

Revenue forecast in 2030

USD 104.30 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Airbus SE; Spirit AeroSystems Inc.; Saab AB; AAR CORP; Bombardier Inc.; Triumph Group, Inc.; Elbit Systems Ltd.; The Boeing Company; Leonardo SpA; Cyient Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerostructures Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global aerostructures market report based on platform, component, end use, and region:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial Aircraft

-

Military Aircraft

-

Business and General Aviation Aircraft

-

Advanced Air Mobility

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fuselages

-

Empennages

-

Nose

-

Wings

-

Flight Control Surfaces

-

Doors & SKIDs

-

Nacelles & Pylons

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aerostructures market size was estimated at USD 63.48 billion in 2023 and is expected to reach USD 68.00 billion in 2024.

b. The global aerostructures market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 104.30 billion by 2030.

b. The North America region accounted for the largest share of over 34% in the aerostructures market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the aerostructures market include Airbus SE, Spirit AeroSystems Inc., Saab AB, AAR CORP., Bombardier Inc., Triumph Group, Inc., Elbit Systems Ltd., The Boeing Company, Leonardo SpA, Cyient Limited.

b. Key factors that are driving the aerostructures market growth include the global rise in both passenger and cargo air travel that has escalated demand for new aircraft.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.