- Home

- »

- Plastics, Polymers & Resins

- »

-

Africa Flexitank Market Size & Share, Industry Report, 2030GVR Report cover

![Africa Flexitank Market Size, Share & Trends Report]()

Africa Flexitank Market (2025 - 2030) Size, Share & Trends Analysis Report By Loading Type (Top Loading, Bottom Loading), By Layer Type, By Application, By Region (North Africa, East Africa, West Africa, Central & Southern Africa), And Segment Forecasts

- Report ID: GVR-4-68040-151-4

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Africa Flexitank Market Size & Trends

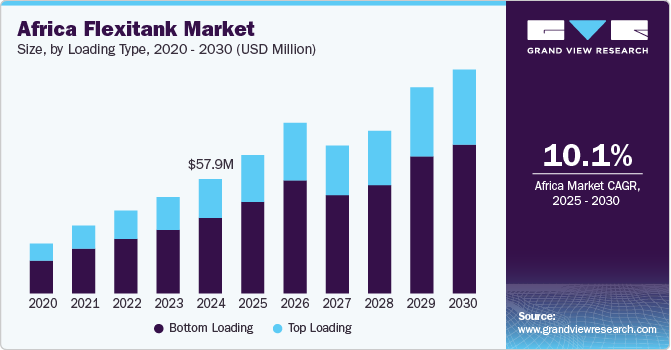

The Africa flexitank market size was estimated at USD 57,891 thousand in 2024 and is projected to grow at a CAGR of 10.1% from 2025 to 2030. Increased production the edible oils, particularly palm oil, across Africa is one of the key drivers that is expected to accelerate demand for flexitank in the region.

The market is gaining traction due to several driving factors, with the continent’s expanding trade and agriculture sectors playing pivotal roles. Flexitank, which are highly efficient liquid bulk containers, offers cost savings and versatility for transporting non-hazardous liquids in bulk. Africa’s agricultural sector, particularly in countries such as South Africa, Kenya, and Nigeria, has seen rising exports of products such as edible oils, wine, fruit juices, and other liquid commodities.

Africa's booming mining and chemical industries are propelling flexitank demand, especially for the transportation of non-hazardous liquid chemicals and lubricants. Flexitank helps streamline the supply chain for chemicals by offering a lightweight, single-use alternative that reduces the risk of contamination and lowers overall shipping costs. For example, countries such as Zambia and the Democratic Republic of Congo, known for their substantial copper mining operations, rely on chemicals for processing and refining metals. Flexitank offers a more economical means of shipping chemicals, addressing both cost constraints and logistical challenges prevalent in Africa’s landlocked regions.

Sustainability is another significant factor driving market growth as companies increasingly prioritize eco-friendly logistics solutions. Flexitank, which is disposable and often recyclable, reduces the need for cleaning and maintenance associated with traditional bulk containers and minimizes the environmental impact of shipping. This aligns with the growing emphasis on sustainable business practices in Africa, especially in industries targeting export markets with stringent environmental standards, such as the European Union. For example, South African wine producers exporting to Europe and North America find flexitank an attractive option, as they not only meet international standards but also reduce the carbon footprint of their logistics operations by reducing container weight and allowing for single-use disposal.

Loading Type Insights

Based on the loading type, the market is categorized into top loading and bottom loading. The bottom loading segment led the market with the largest revenue share of 66.0 % in 2024 and is expected to grow at a significant CAGR during the forecast period. This positive outlook is due to the reduction of the risk of spills and the elimination of the risk of accidents associated with working at heights in the case of top loading.

The top-loading flexitank is tailored for loading them from the upper side, providing a practical and effective solution for transporting large quantities of liquid in bulk. The procedure for loading a top-loading flexitank involves attaching the loading hose or pipe to the upper valve of the flexitank to fill and empty the bulk liquid. The top loading requires additional manpower to be delegated at the top side to monitor the filling process and for assembling and disassembling of coupling to the valve during the filling process.

Layer Type Insights

Based on layer type, the market is segmented into monolayer and multilayer. The multilayer segment led the market with the largest revenue share of 51.90% in 2024. Each layer of multilayer flexitank is very thin, which makes it more flexible compared to monolayer flexitank, and the inclusion of multilayers provides additional protection against puncture. Multilayer flexitank provides an effective barrier against oxygen and moisture, making it suitable for transportation of food-grade liquids.

The monolayer flexitank is made of a single layer of polyethylene (PE) and is thick compared to a multilayer. It is less flexible compared to multilayer flexitank and has a potential risk of rupturing.

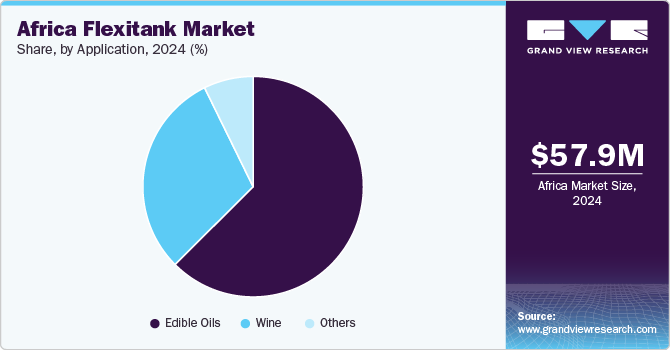

Application Insights

Based on application, the market is segmented into edible oil and wines. The edible oil segment led the market with the largest revenue share of 62.54 % in 2024. The African regions such as North Africa, East Africa, West Africa, and Central & Southern Africa have significant palm trees, sunflower, and olives plantations. These regional parts have limited edible oil production capacity compared to Asia Pacific but have still witnessed demand from North America and European Union countries.

The Palm oil is a major global commodity as it is used in the manufacturing of shampoos, face washes, face creams, etc. It is utilized for enhancing the taste of processed food products. Palm oil also acts as a natural preservative in frozen meals as it prevents the formation of sticky clusters in them. Although the global production of palm oil is dominated by Southeast Asian countries, especially Indonesia and Malaysia. The European new law emphasizing the suspension of edible oil imports from Asia Pacific countries due to rapid deforestation has led the European Union to consider Africa as a potential market for edible oil which can positively influence the market growth in Africa.

The wine segment within the market has been gaining traction due to the region's emerging status as both a producer and importer of wines. The use of flexitank has enabled African wineries and importers to streamline operations and reduce transportation expenses, contributing to the growth of the local wine industry. The growing popularity of wine consumption in Africa, fueled by changing consumer preferences and an expanding middle class, drives the need for bulk wine transportation solutions.

Country Insights

The Central & Southern Africa region dominated the Africa flexitank market with the largest revenue share of 86.78% in 2024. In South Africa, sunflower oilseed is the most vital oilseed crop as it is the largest source of vegetable oil, followed by canola and soybeans. Sunflower seed is mainly utilized to produce oilcake and sunflower oil. According to the Bureau for Food and Agricultural Policy (BFAP), each year, nearly the entire local sunflower harvest in South Africa is dedicated to the processing industry, where it is transformed into sunflower oil. Sunflower production in the country typically ranges from 600,000 tons to 800,000 tonnes annually. This production scenario can improve the sunflower oil export opportunities in the country, which in turn is anticipated to increase the demand for the flexitank in the country, driving the market growth over the forecast period.

The market is segmented into North Africa, East Africa, West Africa, and Central & Southern Africa. According to the U.S. Department of Agriculture (USDA), the countries of North Africa are the third largest importers of soybean oil in the world, preceded by India and Bangladesh. They imported approximately 604,000 tons of soybean oil in 2021 - 2022. However, these countries also re-export edible oil, thereby driving the demand for flexitank in North Africa over the forecast period. According to the U.S. Department of Agriculture (USDA), the countries of North Africa are the third largest importers of soybean oil in the world, preceded by India and Bangladesh. They imported approximately 604,000 tons of soybean oil in 2021 - 2022. However, these countries also re-export edible oil, thereby driving the demand for flexitank in North Africa over the forecast period.

Cooking oil is one of the preferred imported food products in Algeria. However, the limited domestic capacity of Algeria to produce edible oil has driven agro-industrial companies to set up their production plants to enhance domestic cooking oil production in the country. For instance, in June 2023, Cevital Food established its cooking oil production plant in Wilaya de Béjaïa. This initiative aims at reducing the cooking oil imports of Algeria which can create future export opportunities, thus presenting a positive market for the flexitank market.

The flexitank market in the East Africa region consists of countries, namely Kenya, Tanzania, Djibouti, Uganda, Ethiopia, Rwanda, Madagascar, Mauritius, Sudan, and others. These countries are producers and exporters of edible oils such as sunflower oil, safflower oil, palm oil, olive oil, and others. The flexitank for the edible oil market is mainly driven by the increasing vegetable oil production and subsequently improving exporting opportunities in the East African countries. For instance, according to the Observatory of Economic Complexity (OEC), in 2021, Kenya exported vegetable oils for USD 17.8 million on the global level.

Key Africa Flexitank Company Insights

Companies such as MYFLEXITANK, Qingdao LAF Technology Co., Ltd., Techno Group USA, and SIA FLEXITANKS have a presence in the Africa region via their distributors or their subsidiary companies. The companies operate a large product portfolio comprising products across multiple application segments. Companies resort to expansion, collaboration, mergers, and acquisitions in a bid to gain market share in the African region.

Key Africa Flexitank Companies:

- MYFLEXITANK

- Qingdao LAF Technology Co., Ltd.

- Techno Group USA

- SIA FLEXITANKS

- Bulk Liquid Solutions

- Bulk Liquid Transport

- Büscherhoff Packaging Solutions GmbH

- Hillebrand Gori Group GmbH

- FLUIDTAINER FLEXITANK SDN BHD

- Qingdao Hengxin Plastic Co., Ltd.

- TRUST Flexitanks

- Philton Polythene Converters Ltd

- Anthente International

- LSM S.A. - FLEXPACK

- Kricon Group

- Transocean Forwarding and Commerce E.S.C

Recent Developments

-

In May 2022, SIA FLEXITANKS launched its operations across Africa with the opening of SIA Africa in Kwazulu Natal/Durban. This expansion would enable the company to expand its footprint across the African region for bulk liquid transportation.

-

In March 2022, SIA FLEXITANKS introduced The Trinity Tank to its existing portfolio of flexitank which was expected to enable the transportation of three distinct liquids in one container. Each triple tank can hold 9,000 liters of liquid, amounting to a total transportation of 27,000 liters in one container

Africa Flexitank Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 70,059.9 thousand

Revenue forecast in 2030

USD 113,419.2 thousand

Growth rate

CAGR of 10.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in units, revenue in USD thousand and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Loading Type, layer type, application, country

Regional scope

North Africa; East Africa; West Africa; Central & South Africa

Key companies profiled

MYFLEXITANK; Qingdao LAF Technology Co., Ltd.; Techno Group USA; SIA FLEXITANKS; Bulk Liquid Solutions; Bulk Liquid Transport; Büscherhoff Packaging Solutions GmbH; Hillebrand Gori Group GmbH; FLUIDTAINER FLEXITANK SDN BHD; Qingdao Hengxin Plastic Co., Ltd.; TRUST Flexitanks; Philton Polythene Converters Ltd; Anthente International; LSM S.A. - FLEXPACK; Kricon Group; and Transocean Forwarding and Commerce E.S.C

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Flexitank Market Report Segmentation

This report forecasts revenue growth at Africa regional level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Africa flexitank market report based on loading type, layer type, application, and country:

-

Loading Type Outlook (Volume, Units; Revenue, USD Thousand; 2018 - 2030)

-

Top Loading

-

Bottom Loading

-

-

Layer Type Outlook (Volume, Units; Revenue, USD Thousand; 2018 - 2030)

-

Monolayer

-

Multilayer

-

-

Application Outlook (Volume, Units; Revenue, USD Thousand; 2018 - 2030)

-

Edible Oil

-

Wine

-

Others

-

-

Country Outlook (Volume, Units; Revenue, USD Thousand; 2018 - 2030)

-

North Africa

-

Algeria

-

Egypt

-

Tunisia

-

Morocco

-

-

East Africa

-

Kenya

-

Tanzania

-

Djibouti

-

-

West Africa

-

Nigeria

-

Senegal

-

Ghana

-

Ivory Coast

-

-

Central & Southern Africa

-

South Africa

-

Zambia

-

Cameroon

-

Equatorial Guinea

-

-

Frequently Asked Questions About This Report

b. The Africa flexitank market was valued at USD 57,891.4 thousand in the year 2024 and is expected to reach USD 70,059.9 thousand in 2025.

b. The Africa flexitank market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2030 to reach USD 113,419.2 thousand by 2030.

b. Bottom loading emerged as a dominating loading type segment, with a value share of over 66.0% in 2024, due to the ease of filling liquid products into the flexitank, the ease of discharging liquid products, reduced manpower hours and costs, and the safety involved in filling and discharging operations.

b. The key players in the Africa Flexitank Market are MYFLEXITANKS, Qingdao LAF Packaging Co., Ltd., Techno Group USA, SIA AFRICA FLEXITANKS, Bulk Liquid Transport, and Hillebrand Gori Group GmbH among others.

b. The factors driving the Africa flexitank market include increased palm oil production across Africa and cost efficiency offered by flexitanks compared to their counterparts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.