- Home

- »

- Agrochemicals & Fertilizers

- »

-

Agricultural Biologicals Market Size, Industry Report, 2033GVR Report cover

![Agricultural Biologicals Market Size, Share & Trends Report]()

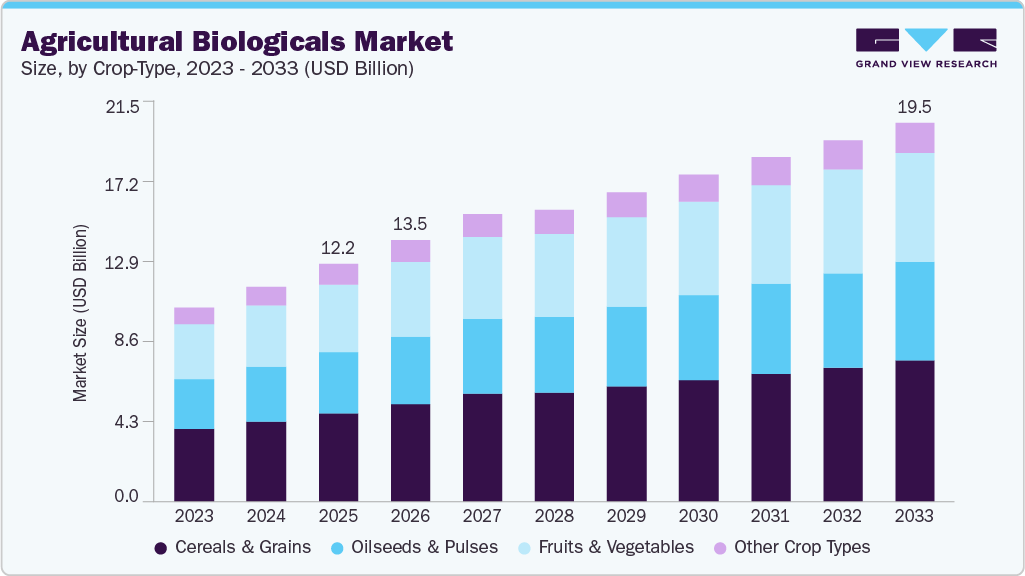

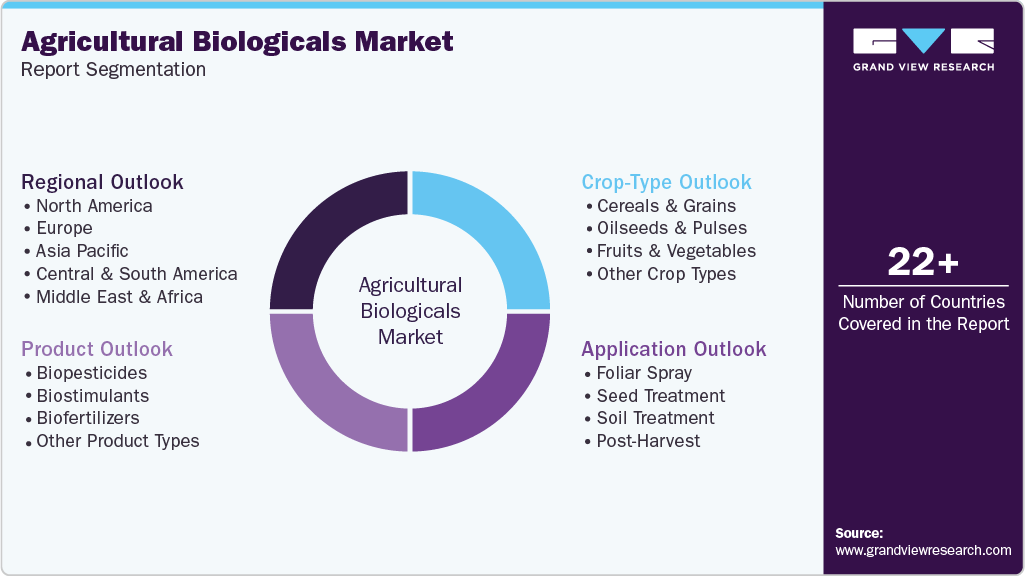

Agricultural Biologicals Market (2026 - 2033) Size, Share & Trends Analysis Report By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Other Crop Types), By Product (Biopesticides, Biostimulants, Biofertilizers, Other Product Types), By Application Method, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-499-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Biologicals Market Summary

The global agricultural biologicals market size was estimated at USD 12,209.7 million in 2025 and is projected to reach USD 19,466.7 million by 2033, growing at a CAGR of 5.4% from 2026 to 2033. Market expansion is largely driven by the increasing demand for organically cultivated food products, supported by growing consumer preference for sustainable agricultural practices and reduced reliance on synthetic crop protection inputs.

Key Market Trends & Insights

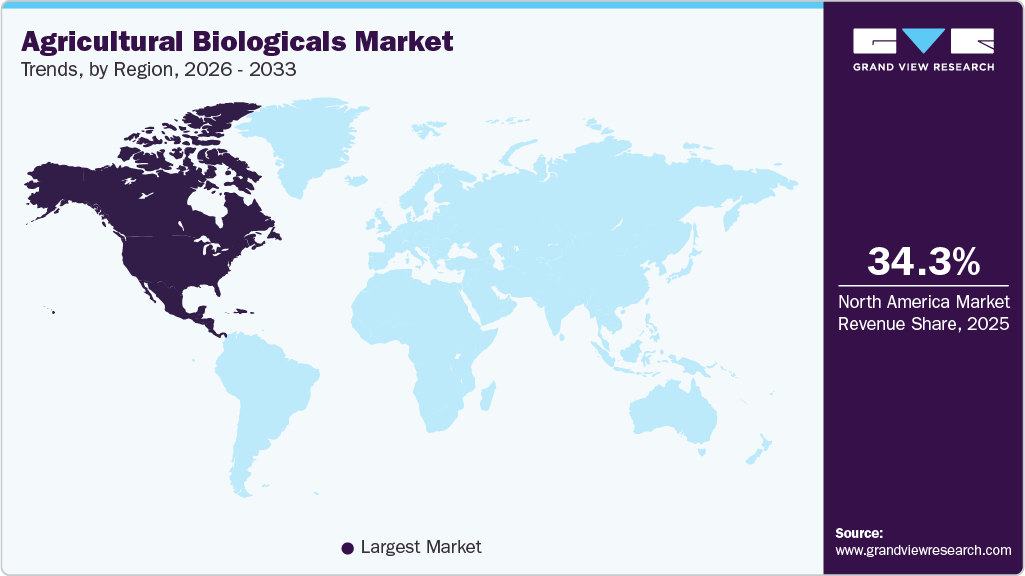

- North America dominated the global agricultural biologicals market with the largest revenue share of 34.3% in 2025.

- By product, the cereals & grains segment held the largest market share of 37.1% in 2025 in terms of revenue.

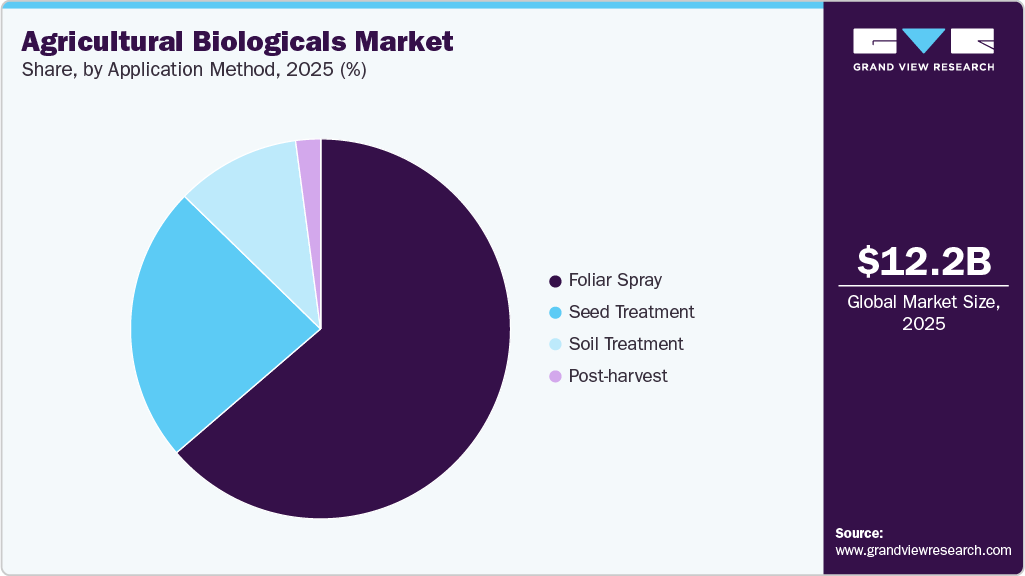

- By application, the foliar spray is expected to grow at a significant CAGR of 5.5% from 2026 to 2033 during the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 12,209.7 Million

- 2033 Projected Market Size: USD 19,466.7 Million

- CAGR (2026-2033): 5.4%

- North America: Largest market in 2025

Agricultural biologicals, often referred to as biologics, are essential inputs for both crop protection and crop productivity and are sourced from naturally occurring materials. These products support plant health by protecting crops from pests and diseases and have increasingly become a core component of modern agricultural practices. Farming communities across multiple regions have long adopted agricultural biologicals as part of efforts to promote sustainable and environmentally responsible farming systems.

The U.S. represents one of the largest global consumers of crops and grains, driven by increasing demand for safer and greener crop protection solutions. Regulatory authorities in the country have demonstrated stronger engagement through accelerated product approvals and evolving regulatory frameworks, supporting wider market penetration. In addition, growing collaboration activities focused on research and new product development are expected to strengthen the market growth further. For instance, in April 2023, Syngenta and Biotalys announced a strategic partnership to advance biological innovation in sustainable agriculture. The collaboration leverages Biotalys’ AGROBODY technology to develop a novel solution with a new mode of action, enabling farmers to address pest resistance challenges while expanding access to innovative and sustainable technologies.

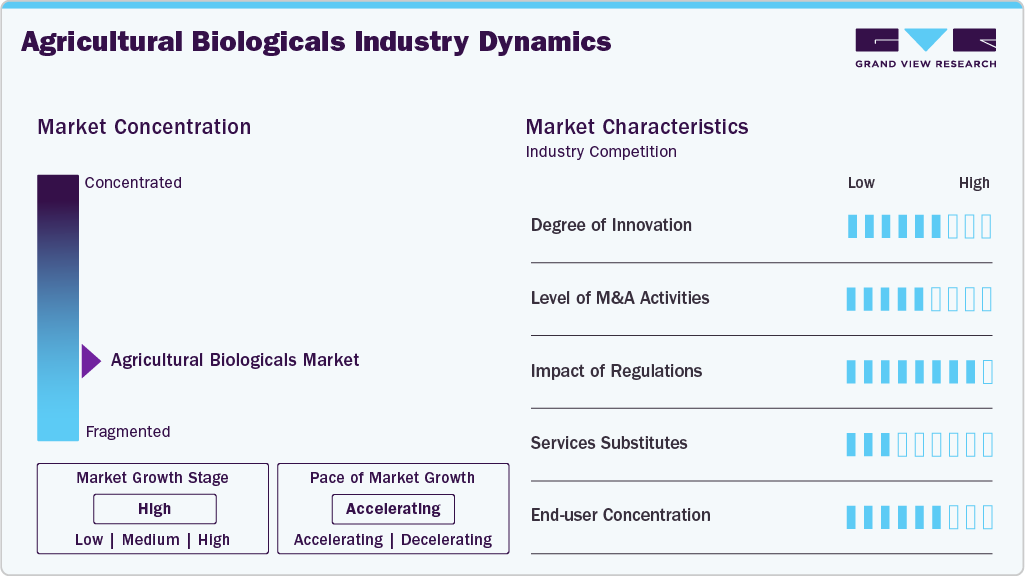

Key strategies adopted by market participants include increased investment in research and development and a strategic focus on emerging economies as future growth markets. While the industry remains at a relatively early stage of development, merger and acquisition activity has remained moderate. Meanwhile, the rising number of product approvals and growing investments in bio-based ingredients are expected to intensify competitive dynamics over the coming years.

According to the European Biomass Industry Association, the market is expected to experience robust growth over the forecast period, as agricultural biologicals significantly reduce reliance on synthetic chemicals while supporting improved crop productivity. Among various biological product categories, biofertilizers are witnessing strong uptake due to their ability to enhance phosphorus and zinc absorption in plants and improve resistance to pathogen attacks. In addition, the application of biofertilizers facilitates the decomposition of organic residues and supports the overall growth and development of crops.

Market Concentration & Characteristics

The agricultural biologicals market comprises a diverse set of players claiming strong capabilities in delivering innovative biological solutions across a wide range of crops globally. Although the market remains highly fragmented, industry participants are unified by a shared focus on developing advanced technologies and strategies that enhance agricultural sustainability and long-term productivity.

Market participants are increasingly pursuing both organic and inorganic growth strategies to strengthen their market presence. While multinational companies continue to hold a dominant position, a growing number of small and medium-sized enterprises are gaining traction by leveraging advanced technologies and offering niche, crop-specific solutions. As a result, the market landscape is characterized by intense competition, with players actively seeking differentiation to secure a distinct competitive position.

Also, agricultural biologicals manufacturers benefit from significant support from local governments in the form of subsidies, customized regulatory clearances, and a range of economic incentives, as steel production is regarded as a critical pillar of national development. For instance, in July 2023, the Government of India’s Union Ministry of Steel introduced a new policy centered on agricultural biologicals, to expand the country’s domestic capacity from the existing 6.6 million tons per year to 30 million tons annually.

Crop-Type Insights

The cereals and grains segment accounted for the largest share of the agricultural biologicals market in 2025, capturing 37.1% of total revenue. This dominance is driven by rising global consumption of staple crops such as wheat, rice, corn, barley, and millet. Moreover, ongoing microbiological advancements focused on optimizing formulations and application methods in wheat cultivation have accelerated biologics adoption, supporting segment growth.

Cereals and grains rely on a wide range of biological inputs, particularly biofertilizers, to achieve optimal productivity. Global studies indicate that azotobacter application significantly reduces nitrogen requirements while enhancing crop performance. Moreover, the combined use of phosphate-solubilizing bacteria and azotobacter has proven effective in improving wheat yields, reinforcing their role as key biofertilizers in cereal and grain farming systems.

Developing economies across Asia Pacific and the Americas, including Japan, Thailand, India, Indonesia, and several Central and South American countries, are witnessing rising demand for advanced technologies based on biological materials. These innovations are critical not only for cereals but also for expanding oilseeds and pulses production and addressing growing regional food demand.

Product Insights

Biopesticides dominated the agricultural biologicals market, accounting for the largest revenue share of 56.7% in 2025. The rapid growth in biopesticide adoption is primarily driven by their widespread application across soil, foliage, and lawn treatments, particularly in regions such as North America and Europe. Commonly used biopesticides include insect sex pheromones and aromatic plants that attract and trap pests. In addition, microbial pesticides containing active ingredients designed to control a broad spectrum of pests are extensively utilized, with Bacillus thuringiensis serving as a notable example due to its ability to produce protein complexes lethal to target pests.

Bacterial strains such as azotobacter, rhizobium, and azospirillum are widely used for nitrogen fixation in seed and soil treatment applications. Rhizobium, in particular, forms a symbiotic association with the roots of leguminous plants, making it an important biofertilizer for legume cultivation. The aerobic characteristics and tolerance of azotobacter to alkaline soil conditions enable its application across a variety of crops, including maize, wheat, cotton, mustard, and potato.

Also, agricultural biostimulants such as natural supplements used alongside fertilizers are gaining increasing importance within modern farming systems. These products contribute to improved crop yield, enhanced growth, and better overall plant health. Biostimulants also play a key role in strengthening plant resistance to environmental stress, improving nutrient uptake efficiency, and enhancing physical attributes such as crop size, appearance, and shelf life.

Application Method Insights

The foliar spray method held the largest share of the agricultural biologicals market in 2025, accounting for a revenue share of 63.7%. Strong demand for foliar applications is driven by their effectiveness in enhancing crop yields and improving nutrient absorption efficiency. By delivering essential nutrients directly to plant leaves, foliar sprays enable optimal nutrient utilization, support healthy plant development, and offer a rapid corrective response to nutrient deficiencies.

In parallel, growing demand for biological inputs aimed at improving seed quality and increasing crop productivity has led to rising adoption of seed treatment applications. Biofertilizers are extensively applied in both seed and soil treatments. However, prolonged dependence on synthetic fertilizers and other chemical inputs, including pesticides and insecticides, has contributed to the deterioration of soil health across key agricultural regions, reinforcing the shift toward biological alternatives.

Governments across the globe are increasingly enforcing regulations to mitigate the environmental impact associated with excessive use of chemical inputs in agriculture. This regulatory shift has accelerated demand for biofertilizers in both seed and soil applications. Countries such as China, India, and Pakistan have taken the lead by introducing initiatives that encourage the adoption of environmentally sustainable seed treatment solutions. For instance, India’s National Action Plan on Climate Change incorporates the National Mission for Sustainable Agriculture, which focuses on developing climate-resilient farming strategies, including the expanded use of biofertilizers.

Complementing the National Mission for Sustainable Agriculture, the Indian Council of Agricultural Research (ICAR), in collaboration with the Ministry of Agriculture and Farmers Welfare and the Government of India, has implemented the National Innovations in Climate Resilient Agriculture (NICRA) program. The NICRA initiative is designed to develop and disseminate technologies that enable farmers to manage climate-related challenges such as floods, droughts, and heatwaves. ICAR also promotes balanced fertilizer management practices, emphasizing soil testing, integrated use of organic and inorganic fertilizers, and advanced techniques such as split nitrogen application and nitrification inhibitors to minimize environmental pollution.

In addition, governments across the Middle East and Africa, including South Africa, Nigeria, and Kenya, have introduced agricultural loan schemes aimed at supporting farmers and enhancing domestic crop output. These financial support mechanisms have contributed to increased adoption of agricultural biologicals for seed treatment across the region.

The Metschnikowia pulcherrima has emerged as a key biocontrol agent in post-harvest applications. Rising incidences of crop loss and post-harvest spoilage in recent years have driven greater utilization of agricultural biologicals in post-harvest treatments, a trend that is expected to continue supporting product demand over the forecast period.

Regional Insights

The North America agricultural biologicals market accounted for a significant revenue share of 34.3% in 2025, supported by the region’s well-established agricultural sector and strong adoption of sustainable farming practices. Market growth is driven by increasing demand for organic food products, widespread awareness of soil health management, and early adoption of biological crop protection solutions. The U.S. and Canada dominate regional consumption, supported by advanced farming technologies, favorable regulatory frameworks, and strong research and development activity focused on biopesticides, and biostimulants.

U.S. Agricultural Biologicals Market Trends

The U.S. leads the North America agricultural biologicals market, holding a substantial revenue share of 76.8% in 2025. The country is one of the largest global consumers of agricultural biologicals, driven by its advanced farming infrastructure, high adoption of sustainable agriculture practices, and growing demand for organically cultivated crops. Government initiatives promoting soil health, eco-friendly crop protection, and climate-resilient farming are further supporting the widespread use of biofertilizers, biopesticides, and biostimulants across the country.

Asia Pacific Agricultural Biologicals Market Trends

The Asia Pacific agricultural biologicals market is supported by increasing regulatory emphasis on sustainable farming practices and the growing adoption of eco-friendly crop protection and nutrient management solutions across major agricultural economies. Countries such as China, India, Japan, and Australia play a significant role in regional growth, driven by large-scale agricultural production, rising food demand, and expanding awareness of soil health and environmental protection.

China agriculture biologicals marketis driven by ongoing technological advancements in agricultural inputs, supportive government initiatives promoting sustainable farming, and strong demand from staple crop cultivation, including cereals, grains, fruits, and vegetables. Increasing emphasis on reducing chemical pesticide use, enhancing crop productivity, and strengthening climate-resilient agriculture is influencing product innovation and accelerating the adoption of biopesticides and biostimulants across key agricultural applications in the country

Europe Agricultural Biologicals Market Trends

Europe’s agricultural biologicals market is strongly shaped by stringent environmental and sustainability regulations, including the EU Green Deal, Farm to Fork Strategy, and restrictions on chemical pesticide usage. These frameworks are accelerating the shift toward bio-based and environmentally sustainable crop protection and nutrient management solutions. Demand remains robust across key agricultural segments such as cereals, fruits, vegetables, and specialty crops, with countries including Germany, France, and Spain prioritizing sustainable farming practices, soil health improvement, and reduced chemical dependency.

Agricultural biologicals market in Germany represents one of the most mature agricultural biologicals markets in Europe, supported by its well-developed agricultural sector, strong research infrastructure, and proactive regulatory environment. The country places significant emphasis on biofertilizers, biopesticides, and biostimulants to comply with strict EU environmental and safety standards. German producers and research institutions lead in biological formulation development and integrated crop management solutions, delivering high-performance products that enhance crop productivity while supporting long-term soil fertility and environmental sustainability.

Latin America Agricultural Biologicals Market Trends

The Latin America agricultural biologicals market is experiencing steady growth, supported by expanding agricultural activity and increasing adoption of sustainable farming practices across key countries such as Brazil and Mexico. Rising awareness of soil health management, crop productivity, and environmental protection is encouraging the use of agricultural biologicals across major crop segments, including cereals, oilseeds, fruits, and vegetables.

Middle East and Africa Agricultural Biologicals Market Trends

In the Middle East and Africa, growth of the agricultural biologicals market is primarily supported by increasing investments in agricultural development and food security initiatives, particularly across Gulf countries and key African economies. Rising focus on improving crop productivity, soil health, and water-use efficiency is encouraging the gradual adoption of biological inputs across the region.

Key Agricultural Biologicals Company Insights

Some of the key players operating in the market include Agricen; CBF China Bio-Fertilizer AG, Novozymes A/S; and Biomax

-

Novozymes A/S is a global biotechnology company specializing in the research, development, and production of industrial microorganisms, enzymes, and biopharmaceutical components. With operations spanning India, Brazil, China, Argentina, the UK, the U.S., and Canada, the company maintains a worldwide presence.

-

Agricen specializes in developing innovative, biochemical-based solutions that enhance plant health, quality, and yield. Their technology is applied not only in agriculture but also in the turf and ornamental plant industry, helping nursery operators, turf managers, and landscapers improve plant performance and optimize fertilizer effectiveness.

Mapleton Agri Biotec; Rizobacter Argentina SA; Lallemand Inc; Sigma Agri-Science, LLC. are some of the emerging market participants in the agricultural biologicals market.

-

Mapleton Agri Biotec offers a select range of high-quality agricultural products developed through rigorous in-house research and testing. These versatile products are designed to enhance yields across various crops and farming systems. Suitable for both conventional and organic farmers, they support sustainable agricultural practices.

-

Lallemand Inc. is a global leader in developing, producing, and marketing bacteria, yeast, and their byproducts. Their microbial solutions serve a wide range of industries including nutrition, human and animal health, winemaking, baking, brewing, food production, probiotics, and biofuels.

Key Agricultural Biologicals Companies:

The following are the leading companies in the agricultural biologicals market. These companies collectively hold the largest market share and dictate industry trends.

- CBF China Bio-Fertilizer AG

- Novozymes A/S

- Mapleton Agri Biotec

- Biomax

- Rizobacter Argentina SA

- Symborg S.L.

- National Fertilizers Ltd.

- Lallemand Inc.

- Agricen

- Sigma Agri-Science, LLC

- Agrinos Inc.

- Kiwa Bio-Tech Products Group Corporation

Recent Developments

- In September 2022, Bioceres Crop Solutions, a major shareholder of Rizobacter merged with Marrone Bio with an aim to expand its portfolio of bio protection and plant health products with Rizobacter’s prosperous line.

Agricultural Biological Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 13,457.6 million

Revenue forecast in 2033

USD 19,466.7 million

Growth Rate

CAGR of 5.4% from 2026 to 2033

Base year of estimation

2025

Historical data

2018 – 2024

Forecast period

2026 – 2033

Quantitative units

Volume in Kilotons, Revenue in USD Million/Billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Crop-Type, product, application method, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

CBF China Biofertilizer AG; Novozymes A/S; Mapleton Agri Biotec; biomax; Rizobacter Argentina SA; Symborg S.L.; National Fertilizers Ltd; Lallemand Inc; Agricen; Sigma Agri-Science, LLC; Agrinos Inc.; Kiwa Bio-Tech Products Group Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Biological Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global agricultural biological market report based on crop-type, product, application method, and region.

-

Crop-Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Other Crop Types

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Biopesticides

-

Biochemicals

-

Microbials

-

-

Biostimulants

-

Acid based

-

Seaweed extract

-

Microbials

-

Other Biostimulants

-

-

Biofertilizers

-

Nitrogen Fixation

-

Phosphate Solubilizing

-

Other Biofertilizers

-

-

Other Product Types

-

- Application Method Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2033)

-

Foliar Spray

-

Seed Treatment

-

Soil Treatment

-

Post-Harvest

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agricultural biologicals market size was estimated at USD 12,209.7 million in 2025 and is expected to reach USD 13,457.6 million in 2026.

b. The agricultural biologicals market is expected to grow at a compound annual growth rate of 5.4% from 2025 to reach USD 19,466.7 million by 2033.

b. The cereals and grains segment represents a major share of the agricultural biologicals market, driven by the large-scale cultivation of staple crops such as wheat, rice, maize, barley, and millet across both developed and emerging economies. High nutrient demand, extensive acreage under cultivation, and the need to improve yield stability are key factors supporting the adoption of agricultural biologicals in this segment

b. Some of the key players operating in the agricultural biologicals market include CBF China Biofertilizer AG; Novozymes A/S; Mapleton Agri Biotec; biomax; Rizobacter Argentina SA; Symborg S.L.; National Fertilizers Ltd; Lallemand Inc; Agricen; Sigma Agri-Science, LLC; Agrinos Inc.; and Kiwa Bio-Tech Products Group Corporation.

b. Key factors driving the agricultural biologicals market include the increasing need for sustainable and efficient crop nutrition and protection solutions to support rising global food demand. The growing adoption of precision farming practices, along with expanding use across horticulture, greenhouse cultivation, and high-value crops, is accelerating demand for biological inputs that enhance nutrient uptake, improve crop resilience, and reduce reliance on synthetic agrochemicals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.