- Home

- »

- Petrochemicals

- »

-

Biofertilizers Market Size, Share And Trends Report, 2030GVR Report cover

![Biofertilizers Market Size, Share & Trends Report]()

Biofertilizers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Nitrogen Fixation, Phosphate Solubilizing), By Application (Seed Treatment, Oil Treatment), By Crop Type, By Region, And Segment Forecasts

- Report ID: 978-1-68038-038-5

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biofertilizers Market Summary

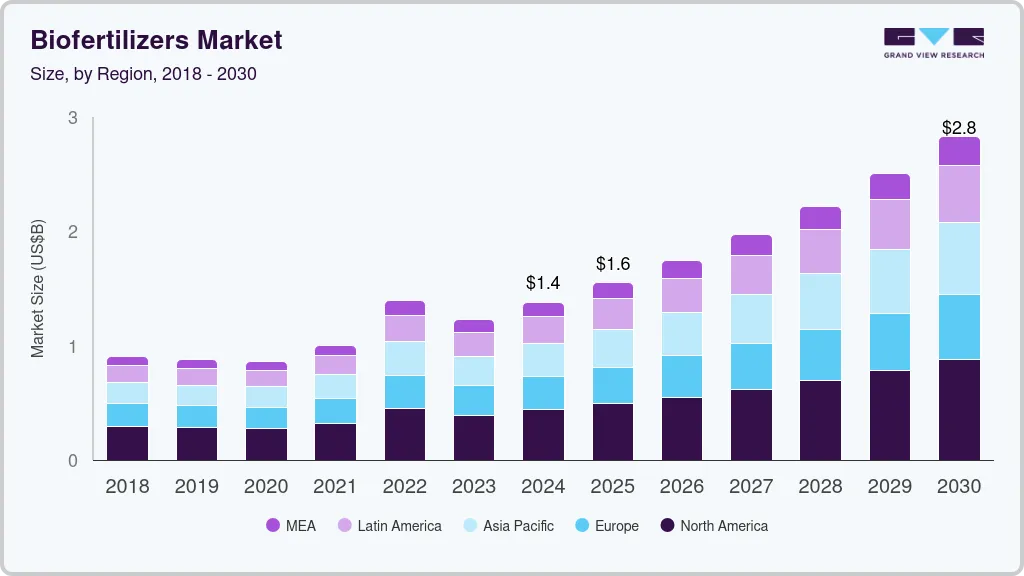

The global biofertilizers market size was estimated at USD 1.38 billion in 2024 and is projected to reach USD 2.83 billion by 2030, growing at a CAGR of 12.8% from 2025 to 2030. The increasing use of microbial biofertilizers demonstrates their potential for promoting sustainable farming practices and ensuring food safety.

Key Market Trends & Insights

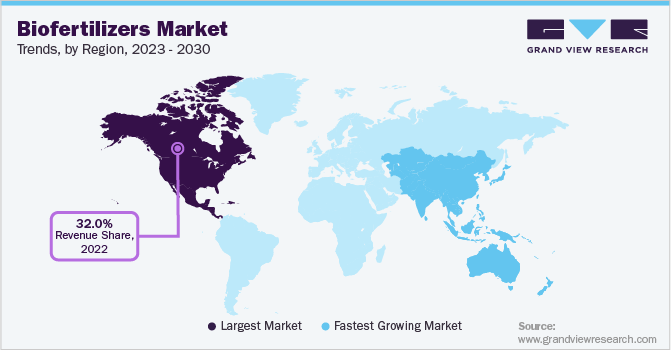

- North America was the largest revenue generating market in 2024.

- U.S. held over 62.0% revenue share of the overall North America Biofertilizers market.

- By product, the nitrogen fixation segment accounted for the largest revenue market share, 74.2%, in 2024.

- By application, seed treatment segment held the revenue share of over 71.2% in 2024.

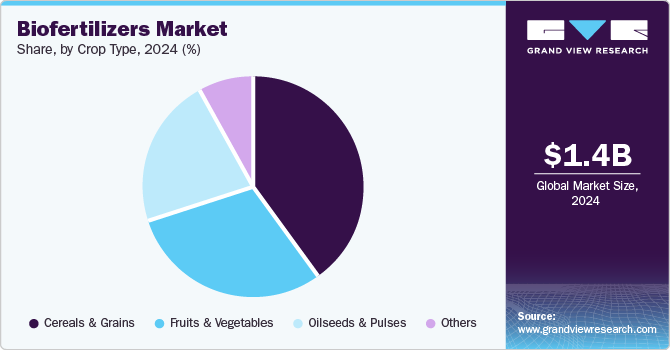

- By crop type, cereals & grains segment held the revenue share of over 40.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.38 Billion

- 2030 Projected Market Size: USD 2.83 Billion

- CAGR (2025-2030): 12.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market's growth is driven by a favorable regulatory environment in Europe and North America and significant technological innovations to enhance biofertilizer production. The growing awareness of the environmental impact of synthetic fertilizers has led manufacturers worldwide to dedicate more resources to research and development for biofertilizers. This heightened focus is expected to drive the demand for biofertilizers shortly. Furthermore, a rising demand for organic food products, especially in North America and Europe, will positively influence the market in the coming years. Furthermore, the increasing recognition of the benefits of bio-based agricultural inputs, such as biofertilizers, is expected to support market growth throughout the forecast period.

The market comprises feedstock manufacturers & suppliers, biofertilizer formulators, product suppliers & distributors, and agricultural communities as end users, primarily domestic crop cultivators and farmers. Biofertilizer manufacturing essentially requires feedstocks such as potato peels, ley crops, slaughterhouse dumps, manures, frying oil, food processing industry wastes, and organic domestic wastes, among others.

Drivers, Opportunities & Restraints

The production and consumption of organic food products are increasing due to a growing preference for naturally derived items free from food additives and synthetic chemicals. This market encompasses a variety of items, including organic meat, dairy, fruits, vegetables, and alcoholic and non-alcoholic beverages. The rising demand for these products can be attributed to a global trend towards healthier eating habits and increased disposable income, especially in emerging economies such as Indonesia, Japan, India, and Thailand. As the use of organic farming grows, leading to the demand for biofertilizers is also expected to increase.

Challenges persist in the market primarily due to the dominance of synthetic fertilizers. Moreover, the expansion of North America's natural gas and crude oil industries is expected to limit the demand for biofertilizers further. Companies heavily invest in developing and researching fertilizers to cater to a broad market. Farmers tend to rely on synthetic fertilizers because they trust multinational brands, which impedes the growth of bio-based fertilizers, especially in emerging economies.

Market opportunity can be assessed based on various initiatives that industry participants can take with governmental aid to increase the consumption and implementation of biofertilizers in agriculture in the foreseeable future. Lack of human resources, including skilled working professionals and training facilitators, should be taken into consideration as soon as possible. With proper knowledge imparted to the agricultural committees globally, the inclination toward biofertilizer consumption is expected to rise exponentially compared to that of synthetically manufactured products.

Product Insights

“Nitrogen Fixation held the revenue share of over 74.2% in 2024.”

The nitrogen fixation segment accounted for the largest revenue market share, 74.2%, in 2024 and is expected to continue to dominate the industry over the forecast period. Nitrogen-fixing bacteria like Rhizobium, Azotobacter, and Azospirillum are commonly used as biofertilizers since plants cannot convert atmospheric nitrogen into the fixed nitrogen essential for their growth. Azotobacter thrives in aerobic conditions and can tolerate alkaline soil, making it suitable for various crops, including wheat, maize, mustard, cotton, and potatoes. Rhizobium forms an endosymbiotic relationship with the roots of legume plants, making it especially valuable for cultivating leguminous crops.

Soil often contains inorganic phosphorus or insoluble organic, and a deficiency of this nutrient can limit plant growth. To address this issue, agricultural organizations and microbiologists are introducing phosphate-solubilizing microorganisms as biofertilizers to promote plant development. Commonly used bacteria include Pseudomonas, Bacillus, and fungi like Aspergillus.

Crop Type Insights

“Cereals & Grains held the revenue share of over 40.1% in 2024.”

In cultivating cereals and grains, the product market plays an important role by enhancing the effectiveness of crop protection products. These surfactants improve spray coverage, ensuring that herbicides, fungicides, and insecticides spread evenly across the plant surfaces. This leads to better absorption and penetration of the active ingredients, promoting healthier crops and more effective pest control. In addition, bio-based surfactants are particularly beneficial, as they are environmentally friendly, biodegradable, and support sustainable agricultural practices, meeting the growing demand for eco-conscious solutions in farming. Their use can ultimately contribute to higher yields and improved crop quality.

The product market plays a significant role in cultivating fruits and vegetables by enhancing the efficacy of crop protection products. They facilitate better coverage of pesticides and fungicides on plant surfaces, ensuring that these solutions spread uniformly and adhere effectively. This improved application leads to better absorption of active ingredients, resulting in stronger plants and more effective pest and disease management. Moreover, bio-based surfactants in this segment support sustainable farming practices, as they are biodegradable and environmentally friendly. Overall, their application contributes to healthier crops and increases the productivity of fruit and vegetable farming.

Application Insights

“Seed Treatment held the revenue share of over 71.2% in 2024.”

Seed treatment is a vital process for applying biofertilizers globally. It involves immersing seeds in a mixture of phosphorus and nitrogen fertilizers, allowing them to dry in the sun, and then sowing them in the field. The biofertilizer coating helps promote rapid and healthy plant growth. As the demand for organic food continues to grow, the use of biofertilizers in seed treatment is expected to increase.

In soil treatment, biofertilizers are recognized for improving soil conditions and enhancing plants' absorption of essential minerals. When applied to the soil, they play a crucial role in fixing, aiding in phosphate and nitrogen absorption, and improving soil mineralization. This results in better soil properties for cultivation. As a result of these advantages, biofertilizers have led to an increase in crop yield of approximately 15% to 25%.

Regional Insights

“U.S. held over 62.0% revenue share of the overall North America Biofertilizers market.”

North America produces various crops, including specialty crops, vegetables, fruits, oilseeds, and cereals. Agribusinesses and farmers in the region are at the forefront of effective chemical application and employ advanced agricultural techniques.

U.S. Biofertilizers Market Trends

The biofertilizers market in the U.S. is improving the efficiency of crop safety activities is crucial, especially when dealing with disease challenges and evolving pests. This focus is a key factor driving market growth. In addition, the United States has a significant trend towards sustainable surfactants and an increasing demand for bio-based products.

Asia Pacific Biofertilizers Market Trends

The biofertilizers market in Asia Pacific is expected to grow fastest during the forecast period. This is due to several factors, including countries with vast arable lands, rising populations, and a high demand for developed crops. Furthermore, rapid industrialization and urbanization are contributing to this growth. Key emerging Asian Pacific countries include India, Japan, China, and South Korea.

Europe Biofertilizers Market Trends

The biofertilizers market in Europe is expected to grow significantly due to the growing agricultural industry, advancement in farming practices, and increased awareness of healthy eating. The growing need to improve crop yield and production efficiency drives the market due to the increasing population and diminishing farmlands. This has led to increased demand for product markets in the region.

Latin America Biofertilizers Market Trends

The biofertilizers market in Latin America is experiencing significant growth in the agriculture sector, mainly in Brazil. The increasing demand for agrochemicals in Brazil to enhance the production of Brazilian soybeans is the key driving factor for the growth of the agricultural adjuvants market in Latin America.

Middle East & Africa Biofertilizers Market Trends

The biofertilizers market in the Middle East and Africa is expected to grow significantly over the forecast period. Pesticide consumption is increasing in Saudi Arabia and Oman, and the trend is steady for South Africa, Kuwait, and Qatar. In addition, there is tremendous growth in the consumption of pesticides in Ghana.

Key Biofertilizers Company Insights

Some of the key players operating in the market include CBF China Bio-Fertilizer AG, AgriLife, and Biomax.

-

CBF China Bio-Fertilizer AG is a Germany-based holding group that sells biofertilizers through its fully owned subsidiary, Shandong Chengwu Jiuzhou Science & Technology Development Company Limited. Biofertilizers offered by the company are marketed in two forms: liquid and powder. The products are directly sold to agricultural co-operatives, distributors, and plantations under the Xin Sheng Li brand name. The company’s products are used to increase crop yield and reduce the use of conventional fertilizers. It is licensed by the Ministry of Agriculture of the Government of China.

-

Novozymes A/S, based in Denmark, is a biotechnology company involved in researching, developing, producing, and selling industrial enzymes, biopharmaceutical ingredients, and microorganisms. The company operates in household care, food & beverages, bioenergy, agriculture & feed, and technical & pharma segments. Novozymes is also part of The BioAg Alliance with Monsanto, aiming to develop improved products from natural sources. The company operates in China, India, Brazil, Argentina, the UK, the US, and Canada.

Key Biofertilizers Companies:

The following are the leading companies in the biofertilizers market. These companies collectively hold the largest market share and dictate industry trends.

- CBF China Bio-Fertilizer AG

- Novozymes A/S

- AgriLife

- Mapleton Agri Biotec

- Biomax

- Rizobacter Argentina SA

- Symborg S.L

- National Fertilizer Ltd.

- Antibiotice S.A

- Lallemand Inc.

- Labiofam SA

- Sigma Agri-Science, LLC

- Agrinos Inc.

- Fertilizers USA LLC

- Kiwa Bio-Tech Products Group Corporation

Recent Developments

-

In May 2024, Fresh Del Monte partnered to produce biofertilizers using fruit residues. A new biofertilizer plant is located near Del Monte Kenya Ltd., a subsidiary of Fresh Del Monte. This facility will utilize residues from the company’s pineapple cannery to create a range of biofertilizers for internal use and potential sale to other growers in Kenya and neighboring East African countries.

-

In August 2023, Bionema recently announced the launch of two innovative products at the annual SEPAWA Congress and Exhibition in Germany. The new offerings are Berol Nexxt, a next-generation surfactant and multifunctional hydrotrope, and Dissolvine GL Premium, which is recognized as the industry’s most concentrated GLDA-based chelating agent.

Biofertilizers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.55 billion

Revenue forecast in 2030

USD 2.83 billion

Growth rate

CAGR of 12.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

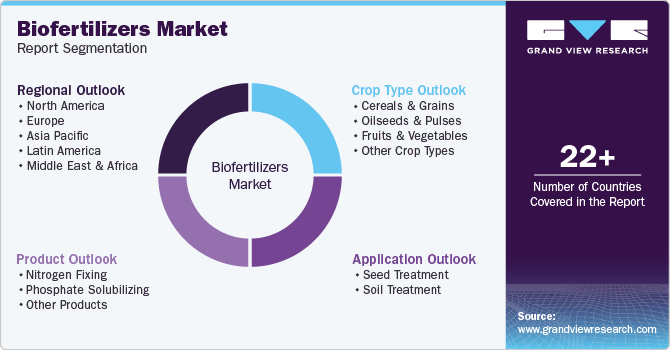

Product, application, crop type, region

Regional scope

North America; Europe; Asia Pacific; Latin Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

CBF China Bio-Fertilizer AG; Novozymes A/S; AgriLife; Mapleton Agri Biotec; Biomax; Rizobacter Argentina SA; Symborg S.L; National Fertilizer Ltd.; Antibiotice S.A; Lallemand Inc.; Labiofam SA; Sigma Agri-Science, LLC; Agrinos Inc.; Fertilizers USA LLC; Kiwa Bio-Tech Products Group Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biofertilizers Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biofertilizers market report based on product, application, crop type, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Nitrogen Fixing

-

Phosphate Solubilizing

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Seed Treatment

-

Soil Treatment

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Other Crop Types

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biofertilizers market size was estimated at USD 1.38 billion in 2024 and is expected to reach USD 1.55 billion in 2025.

b. The global biofertilizers market is expected to grow at a compound annual growth rate of 12.8% from 2025 to 2030 to reach USD 2.83 billion by 2030.

b. Seed treatment applications dominated the market with a share of over 71.2% in 2024. This is attributable to the benefits of induced nutritional values in the seeds.

b. Some key players operating in the biofertilizers market include CCBF China Biofertilizers, Novozymes A/S, AgriLife, Mapleton Agri Biotec, Biomax, Rizobacter Argentina SA, Symborg S.L., National Fertilizers Ltd., Antibiotice S.A., Lallemand Inc., Labiofam SA, Sigma Agri-Science, LLC, Agrinos Inc., Fertilizers USA LLC, Kiwa Bio-Tech Products Group Corporation

b. Key factors that are driving the biofertilizers market growth include increasing awareness and adoption of organically produced food products across emerging economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.