- Home

- »

- Agrochemicals & Fertilizers

- »

-

Agricultural Biologicals Market Size And Share Report, 2030GVR Report cover

![Agricultural Biologicals Market Size, Share & Trends Report]()

Agricultural Biologicals Market Size, Share & Trends Analysis Report By Crop-type (Cereals & Grains, Oilseeds & Pulses), By Product (Biopesticides, Biostimulants), By Application Method, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-499-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Agricultural Biologicals Market Size & Trends

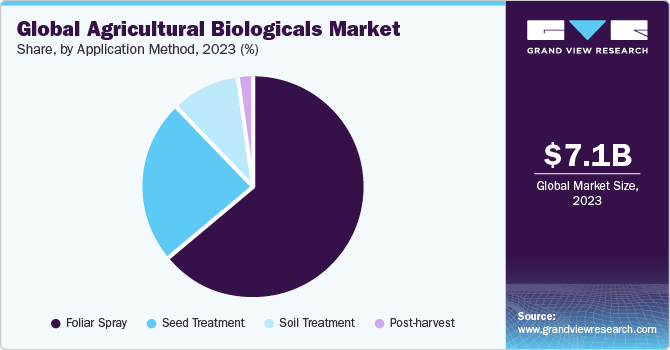

The global agricultural biologicals market size was estimated at USD 7.13 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030. Rising demand for organically cultivated food products is projected to be a key driving factor for market growth. Agricultural biologicals, also commonly known as biologics, crucial tools for crop protection as well as production, are derived from natural materials. These products help protect plants against pests and are increasingly becoming an integral part of modern farming practices. Multiple agricultural communities globally have been using these products to establish sustainable farming.

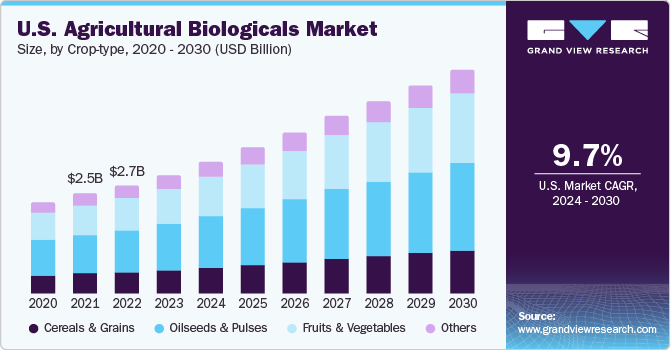

The U.S. is one of the largest consumers of crops and grains across the globe on the account of the growing demand for greener and safer crop protection technologies. The regulatory agencies in the country have shown greater involvement, in terms of product approvals and changing regulations to increase market penetration. The rising number of partnerships for research and new product development are also expected to benefit the market growth in the country. For instance, in April 2023, Syngenta and Biotalys announced a strategic partnership to promote biological innovation in sustainable agriculture. The partnership will utilize Biotalys AGROBODY technology to create a new solution that provides a novel mode of action. This solution will help farmers to counter the threat of pest resistance and advance sustainable agriculture by broadening their access to innovative technologies.

Major strategies adopted by industry participants include investment in research & development and targeting emerging economies for their next growth opportunity. The industry development is still in its nascent stage and the merger & acquisition activities are moderate. The number of product approvals and investments in bio-ingredients is growing rapidly, and may result in intense market competition in the future.

Moreover, with multiple companies working for developing high-performance agricultural products, such as fertilizers and pesticides, the need for alternative eco-friendly products is at its peak. Decades of cultivation practices using synthetic products for aggressive crop yields globally have led to a massive impact on underground water reserves and soil fertility. These factors have led to the increasing adoption of sustainable farming, which led to the high penetration of organic products.

According to the European Biomass Industry Association, the market is anticipated to witness significant growth over the forecast period as biologicals substantially decrease the consumption of synthetic chemicals for attaining increased crop yields. Among the biological products, biofertilizers are gaining significant traction as they enhance the phosphorus and zinc absorption properties of plants as well as resist pathogen attacks. Furthermore, the use of biofertilizers in agricultural fields significantly helps in the decomposition of organic residue and aids the overall growth & development of plants & crops.

In terms of price, the prices for bio-based agricultural products are marginally higher than synthetically formulated products. However, rising prices of synthetic fertilizers are projected to remain a key factor in boosting the consumption of agricultural biologicals in the coming years. With a rapidly rising global population, food scarcity remains a critical issue for governments around the globe. This has led to chemical innovations as well as product development and promotion of eco-friendly agricultural solutions in the major agrarian economies. This, in turn, is anticipated to augment the demand for agricultural biologicals across the globe.

Market Concentration & Characteristics

The agricultural biologicals market comprises a diverse array of companies, each claiming to possess the necessary expertise to provide innovative biological solutions for crops of all types across the globe. Despite this fragmentation, these companies are united in their dedication to developing cutting-edge technologies and strategies that help ensure agriculture's sustainability and productivity for years to come.

Companies seek to gain a higher market share in the agriculture biologicals market through organic and inorganic growth strategies. While multinational corporations compete in this space, several small-to-medium-sized companies also make their presence felt by deploying cutting-edge technology and specialized products. The resulting competition is intense, with each player striving to carve out a niche in the market.

In addition, agricultural biologicals manufacturers are largely supported by their local governments in the form of subsidies, specialized policies for clearances, and other economic incentives, as steel manufacturing acts as a strategic tool for nation building. For example, in July 2023, Govt. of India’s Union Ministry of Steel has announced a new agricultural biologicals policy with an aim to increase the country's domestic capacity to 30 million tons per year from the current levels of 6.6 million tons.

Crop-type Insights

Cereals & grains application dominated the market with a share of 37.2% in 2023. This is attributed to the growing demand for wheat, rice, corn, barley, and millet across the globe. Furthermore, multiple microbiological advancements in determining the suitable composition of agricultural biologicals for application in wheat cultivation have resulted in high demand for biologics, thereby boosting segment growth.Cereals & grains cultivation requires a substantial quantity of variety of biologics, especially biofertilizers, for healthy growth. Studies conducted worldwide indicated that cereal & grain crops reflected high development with azotobacter inoculation, which aided in reducing nitrogen requirement by crops. Furthermore, for the healthy growth of wheat, phosphate solubilizing bacteria and azoteobacter inoculation proved highly efficient biofertilizers in terms of crop yield.

In several agriculturally developing Asia Pacific countries, such as Thailand, India, Indonesia, and multiple Central and South American countries, there is a high demand for effective technology related to bio-based product development. This is crucial to enhance the growth of various oilseeds and pulses in these regions and meet the rapidly growing demand for them.

Product Insights

Biopesticides led the market accounting for the largest share of over 56.7% in 2023. This high share is attributed to the increasing usage of biopesticides in soil, foliage, and turfs, especially across North American and European countries. Some of the key products in this category include insect sex pheromones and scented plants, which attract pests to trap. Microbial pesticides, however, contain active ingredients, which control several types of pests. The highly utilized microbial pesticide includes strains of bacillus thuringiensis, which forms a protein mix to kill the pests.

Azotobacter, rhizobium, and azospirillum have majorly used bacteria for nitrogen fixation in seed and soil treatment applications. Nitrogen-fixing rhizobium has the ability to develop an endosymbiotic association with the roots of legumes, which paves its way for use as biofertilizers in the cultivation of leguminous crops. The aerobic nature of azotobacter along with its neutrality in alkaline soil has increased its application scope in the cultivation of crops including maize, wheat, cotton, mustard, and potato.

In addition, agricultural biostimulants, which are fertilizer additives derived biologically, are also gaining significance. These are used for enhancing crop productivity, growth, and health. Biostimulants aid in effectively improving abiotic stress tolerance, nutrient-use efficiency, and also physical attributes, such as size and appearance along with longer shelf-life.

Application Method Insights

The foliar spray method accounted for the largest market share of 64.3% in 2023. The demand for foliar sprays in the agricultural market is experiencing robust growth due to their ability to significantly enhance crop yields, improve nutrient efficiency, and provide quick responses to nutrient deficiencies. Foliar sprays provide a highly efficient method of delivering essential nutrients directly to plant leaves. This targeted approach ensures that plants receive nutrients precisely where they are needed, promoting healthy growth, and optimizing nutrient utilization.

The widespread demand for biologicals in advancing seed properties to increase crop yield, and thus positively influencing the demand for seed treatment. Biofertilizers are majorly utilized in seed treatment as well as soil treatment applications. Aggressive consumption of synthetic fertilizers and a multitude of other crop care chemicals, such as pesticides and insecticides, over the past couple of years, has led to a substantial deterioration in soil quality across all major agrarian economies.

Many governments have imposed regulations on the agricultural sector taking into consideration the environmental hazards caused due to excessive use of chemical products in farming, which is projected to reflect a growth trend for biofertilizers in various seed and soil applications across the globe. The governments of China, India, and Pakistan have framed numerous initiatives to promote the application of eco-friendly products for seed treatment at domestic levels. For instance, in March 2023, according to ministry of agriculture & farmers’ welfare organization report, The Government of India promotes green and sustainable agriculture practices, focusing on environmental concerns. The National Action Plan on Climate Change (NAPCC) launched the National Mission for Sustainable Agriculture (NMSA) to achieve the aim.

The primary objective of NMSA is to develop and implement strategies to make agriculture in India more resilient to the changing climate. In addition to NMSA, the Indian Council of Agricultural Research (ICAR), the Ministry of Agriculture and Farmers Welfare, and the Government of India have launched the National Innovations in Climate Resilient Agriculture (NICRA) project. The aim of the project is to promote and develop climate-resilient technologies to address the country's vulnerable areas and help regions prone to extreme weather conditions such as floods, droughts, heatwaves, frost, etc. ICAR recommends soil test-based integrated and balanced nutrient management practices through the conjunctive use of inorganic and organic sources, placement of other fertilizers, and split application of nitrogen, nitrification inhibitors, use of slow-releasing fertilizers, and neem-coated urea to reduce excessive use of fertilizers and pollution of water, soil and the environment.

In the Middle East & Africa, the governments of South Africa, Nigeria, and Kenya initiated loan programs for farmers to boost crop yield at domestic levels. As a result, farmers in the region increased the application of agricultural biologicals in seed treatment. Among several microbes, metschnikowia pulcherrima strains are observed to be the most widely utilized biocontrol agent for post-harvest applications. The application of agricultural biologicals in the post-harvest phase is increasingly gaining traction due to multiple cases of crop loss and spoilage observed over the past decade. and may increase product demand over the forecast period.

Regional Insights

North America led the market in 2023 and held a major share of over 36.2%. This growth is attributable to the strong presence of global agricultural product manufacturing companies, with a majority of the producers concentrated in the U.S. The growth is also attributed to the constantly evolving agricultural practices in the region with respect to farming techniques, technological adaptations, constant research & development, and government regulations promoting sustainable farming methods. For instance, in April 2023, according to report, Agtech, short for Agricultural technology, is a modern solution incorporating technology in farming and agricultural practices.

The primary objective of agtech is to boost efficiency, increase productivity, and ensure sustainability in food production. Agtech involves several types of technology, such as precision agriculture, smart irrigation, biotechnology, and automation. With agtech, farmers can overcome several challenges ranging from the rising cost of supplies to labor shortages, changes in consumer preferences for transparency, and sustainability. North Dakota, California, Montana, Wisconsin, and New York are among the largest states practicing organic cultivation. The demand for agricultural biologicals in the U.S. rose significantly as agricultural communities recognized the degrading underground water reserves and soil quality due to the aggressive use of chemical-based fertilizers and other agricultural inputs for decades.

The southern areas of the country had a comparatively lower number of certified organic farmlands; however, it reflected a heavy adaptation of organic practices since 2000. For instance, according to the U.S. Department of Agriculture (USDA), the total area of organic-certified land in the U.S. increased since 2000. It has now reached 4.89 million acres as of 2021. With the growth of organic agriculture, organic producers have gained greater market access. The natural food stores were surpassed by conventional grocery retailers as the most popular outlet for organic food, accounting for 55.6 percent of sales in 2021. Over the last two decades, the authorized federal funds to support organic research through USDA projects have increased significantly. The mandatory spending authorization for the Organic Agriculture Research and Extension Initiative has grown from USD 3 million in 2002 to USD 50 million in 2023.

Asia Pacific is projected to register the fastest growth rate over the forecast period as the region is a hub for the majority of the agrarian economies, such as India, Thailand, Japan, Malaysia, South Korea, and the Philippines, that follow more sustainable form of agriculture practices. This trend is backed by increasing consumer preference for organic food coupled with regulatory initiatives and agricultural reforms undertaken by various governments.

Organic farming in Europe covered 15.9 million hectares of agricultural land in the European Union, equivalent to 9.9% of the total agricultural area utilized in 2021. This shows increased organic production from 9.5 million hectares of agricultural land in 2012. In 14 EU countries, organic arable land crops accounted for more than half of the total organic agricultural area. Out of the EU's herd of 75.7 million bovine animals, 5 million bovines (6.6%) were reared using organic methods in 2021.

Key Agricultural Biologicals Company Insights

Some of the key players operating in the market include Agricen; CBF China Bio-Fertilizer AG, Novozymes A/S; and Biomax

-

Novozymes A/S is a global biotechnology company that researches, develops, and produces industrial microorganisms, enzymes, and biopharmaceutical ingredients. It operates worldwide with operations in India, Brazil, China, Argentina, the UK, U.S., and Canada

-

Agricen is a company specializing in plant health technology, offering innovative biochemical-based products to improve plant health, quality, and yield sustainably. The company's plant health technology is also utilized in the turf and ornamental plant market, assisting nursery operators, turf managers, and landscape professionals in improving plant health, quality, and performance while maximizing the benefits of fertilizer programs

-

Mapleton Agri Biotec; Rizobacter Argentina SA; Lallemand Inc; Sigma Agri-Science, LLC. are some of the emerging market participants in the agricultural biologicals market.

-

Mapleton Agri Biotec offers a limited selection of premium quality agricultural products they have developed. Each product is made after thorough in-house R&D and rigorous trials. This ensures that each product can be used effectively across multiple crops and cropping systems. These products are used by conventional farmers who want to improve their yields while promoting sustainable practices and biological and organic farmers

-

Lallemand Inc. is a company that focuses on developing, producing, and marketing bacteria, yeasts, and their derivatives. They also provide microbiological solutions for various industries, including nutrition, human and animal health, oenology, baking, brewing, food ingredients, probiotics, and biofuels

Key Agricultural Biologicals Companies:

The following are the leading companies in the agricultural biologicals market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these agricultural biologicals companies are analyzed to map the supply network.

- CBF China Bio-Fertilizer AG

- Novozymes A/S

- Mapleton Agri Biotec

- Biomax

- Rizobacter Argentina SA

- Symborg S.L.

- National Fertilizers Ltd.

- Lallemand Inc.

- Agricen

- Sigma Agri-Science, LLC

- Agrinos Inc.

- Kiwa Bio-Tech Products Group Corporation

- Zebra Medical Vision, Inc.

Recent Developments

-

In September 2022, Bioceres Crop Solutions, a major shareholder of Rizobacter merged with Marrone Bio with an aim to expand its portfolio of bio protection and plant health products with Rizobacter’s prosperous line.

-

In March 2021, BASF collaborated with AgBiome on a novel biological fungicide for Europe, Middle East and Africa. The collaboration was made with an aim to broaden BASF’s BioSolutions portfolio for vegetables, ornamentals, and turf applications.

Agricultural Biologicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.80 billion

Revenue forecast in 2030

USD 12.62 billion

Growth Rate

CAGR of 9.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Volume in kilotons, revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Crop-type, product, application method, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

CBF China Biofertilizer AG; Novozymes A/S; Mapleton Agri Biotec; biomax; Rizobacter Argentina SA; Symborg S.L.; National Fertilizers Ltd; Lallemand Inc; Agricen; Sigma Agri-Science, LLC; Agrinos Inc.; Kiwa Bio-Tech Products Group Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

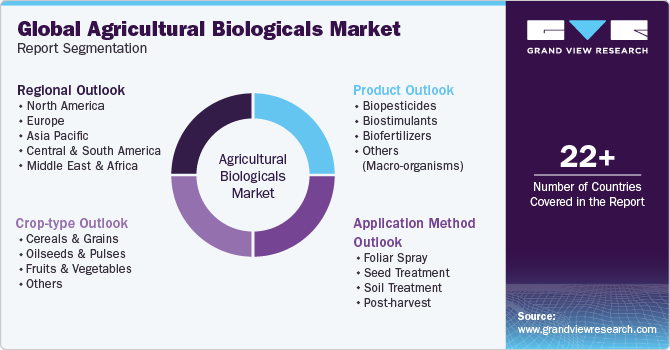

Global Agricultural Biologicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural biologicals market report based on crop-type, product, application method, and region.

-

Crop-type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Biopesticides

-

Biochemicals

-

Microbials

-

-

Biostimulants

-

Acid based

-

Seaweed extract

-

Microbials

-

Others

-

-

Biofertilizers

-

Nitrogen Fixation

-

Phosphate Solubilizing

-

Others

-

-

Others (Macro-organisms)

-

-

Application Method Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Foliar Spray

-

Seed Treatment

-

Soil Treatment

-

Post-harvest

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agricultural biologicals market size was estimated at USD 7.13 billion in 2023 and is expected to reach USD 7.80 billion in 2024.

b. The global agricultural biologicals market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 12.62 billion by 2030.

b. Biopesticides dominated the agricultural biologicals market with a share of 56.7% in 2023. This is attributable to the increasing consumption of biopesticides in soil, foliage, and turfs, especially across North American and European countries.

b. Some key players operating in the agricultural biologicals market include Bayer CropScience, BASF, Novozymes, CBF China Biofertilizers, and Lallemand Inc.

b. Key factors that are driving the market growth include increasing demand for organically cultivated food products globally and favorable government initiatives undertaken across the major agrarian economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."