- Home

- »

- Next Generation Technologies

- »

-

Agriculture Analytics Market Size And Share Report, 2030GVR Report cover

![Agriculture Analytics Market Size, Share & Trends Report]()

Agriculture Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Solutions and Aquaculture Farming), By Application, By Field Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-187-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Agriculture Analytics Market Summary

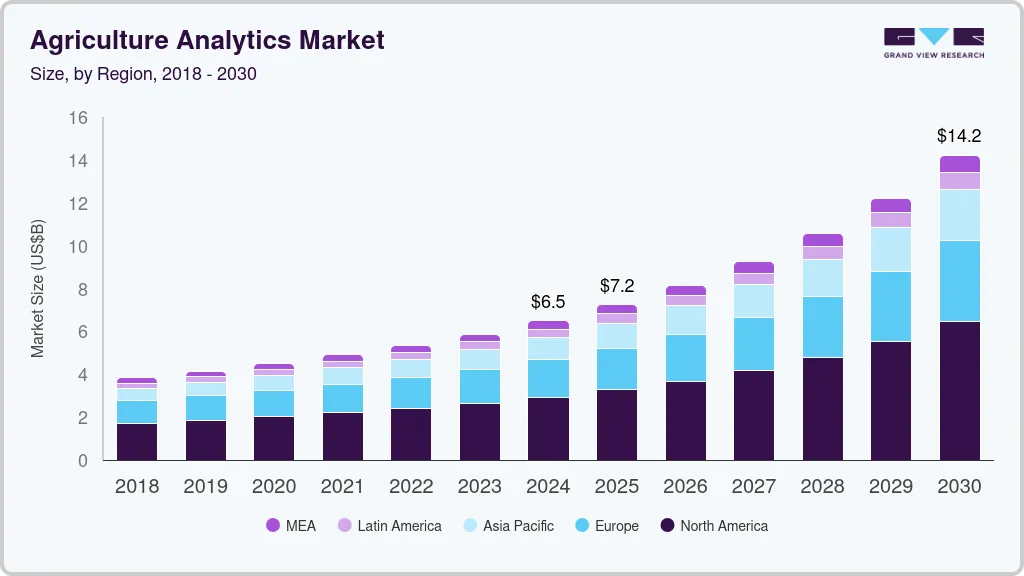

The global agriculture analytics market size was estimated at USD 6.49 billion in 2024 and is projected to reach USD 14.22 billion by 2030, growing at a CAGR of 14.4% from 2025 to 2030. The increasing use of predictive analytics and machine learning (ML) in agriculture drives the market.

Key Market Trends & Insights

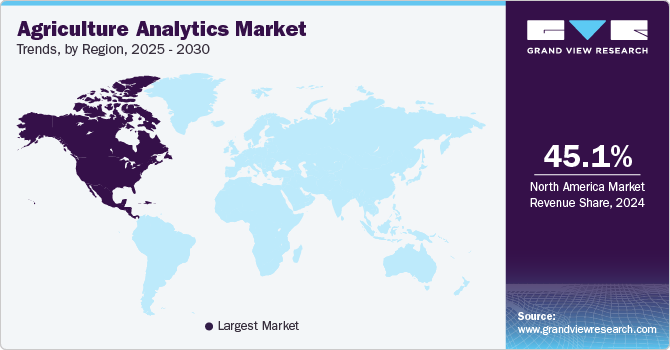

- North America agriculture analytics market held a significant share of 45.1% in 2024.

- By offering, the solution segment dominated the market with a revenue share of 58.6% in 2024.

- By application, the precision farming segment dominated the market with a revenue share of 47.6% in 2024.

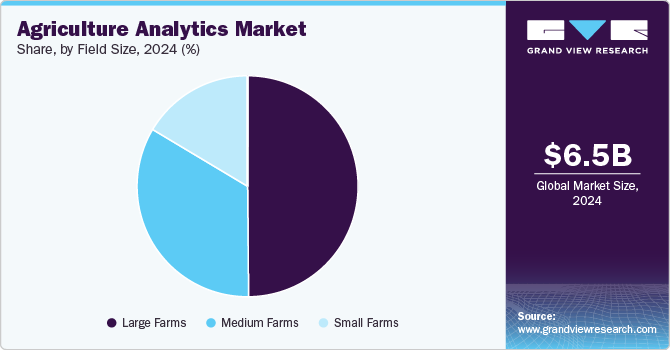

- By field size, the large field size segment dominated the market in terms of revenue, with a revenue share of 49.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.49 Billion

- 2030 Projected Market Size: USD 14.22 Billion

- CAGR (2025-2030): 14.4%

- North America: Largest market in 2024

These advanced technologies enable farmers to anticipate future outcomes based on historical and real-time data. By using ML algorithms, analytics platforms detect patterns and trends in data, allowing farmers to forecast yields, predict weather impacts, and identify potential risks such as disease outbreaks or pest infestations. Predictive analytics also help farmers plan their planting and harvesting schedules to optimize crop performance and market timing. This proactive approach improves operational efficiency and enhances profitability by reducing uncertainties in farming.

The rise of digital farming ecosystems drives the agriculture analytics market growth. This ecosystem combine various technologies, including sensors, IoT devices, drones, and software platforms, to create a fully integrated and automated farm management system. Within this ecosystem, agriculture analytics plays a central role in processing and analyzing data from different sources to provide actionable insights. Farmers can monitor field conditions, track equipment performance, and analyze market trends in real-time, all from a single platform. This digital transformation enables farmers to make smarter, data-driven decisions, improve efficiency, and respond quickly to changing conditions.

Additionally, the rapid adoption of smart farming technologies, such as autonomous tractors, drones, and robotic harvesters, drives the agriculture analytics market growth. These technologies generate massive amounts of data that are analyzed to improve farm management practices. For instance, data from sensors in autonomous equipment or drones flying over fields can be used to assess crop conditions, detect variations in growth patterns, and monitor soil health. The analytics derived from these smart farming tools enable farmers to make timely and accurate decisions, enhancing crop yields and reducing resource waste. Integrating smart farming technologies with analytics transforms traditional farming into a more precise, efficient, and automated operation.

Furthermore, climate-smart agriculture (CSA) is gaining traction as farmers seek to adapt to the challenges posed by climate change. Agriculture analytics is a critical application of CSA, helping farmers monitor environmental conditions and implement practices that improve climate resilience. Analytics tools assess the impact of climate variability on crop performance, allowing farmers to adjust their practices to mitigate risks associated with extreme weather events such as droughts, floods, or temperature fluctuations. Additionally, analytics support adopting climate-friendly practices such as carbon sequestration, reduced greenhouse gas emissions, and sustainable land management. As climate-smart agriculture grows, the demand for analytics solutions that support adaptation and resilience will rise. According to an article published by the United States Department of Agriculture (USDA) stated that, over 60,000 farms have adopted climate-smart production practices, covering more than 25 million acres of active farmland. These practices include covering crops, no-till farming, nutrient management, and pasture and forestry management.

Offering Insights

The solution segment dominated the market with a revenue share of 58.6% in 2024. The growing demand for easy-to-use, mobile-compatible solutions is a key factor in driving the growth of solution segment. Farmers increasingly seek solutions that provide real-time insights through intuitive interfaces accessible via smartphones and tablets. These mobile applications allow farmers to monitor field conditions, track equipment performance, and analyze crop health. The user-friendly design of these solutions makes it easier for farmers to adopt analytics tools without requiring extensive technical expertise. By simplifying the data collection and analysis process, mobile and user-friendly solutions are helping to expand the reach of agriculture analytics across different farm sizes and regions.

The service segment is anticipated to register the fastest growth from 2025 to 2030. The shift towards subscription-based and managed services is another major driver for the service segment. Many agriculture analytics providers offer their services through subscription models, where farmers pay a recurring fee for access to analytics tools, support, and regular updates. This model provides flexibility for farmers who may not have the resources to invest in expensive upfront costs for analytics solutions. Managed services offer complete end-to-end management of analytics platforms, including data collection, analysis, and reporting. These services allow farmers to outsource their analytics needs to experts, enabling them to focus on core farming activities while still benefiting from advanced data insights.

Application Insights

The precision farming segment dominated the market with a revenue share of 47.6% in 2024. Precision fertilization and variable rate technology (VRT) are becoming increasingly prevalent in the precision farming segment. VRT allows farmers to apply fertilizers and other inputs at variable rates across different areas of a field based on soil and crop conditions. This approach ensures that inputs are used more efficiently, reducing costs and environmental impact. Analytics platforms are crucial in analyzing field data and determining the optimal rates for applying fertilizers, herbicides, and pesticides. The growing awareness of the benefits of VRT in improving resource efficiency and boosting crop yields is driving the demand for analytics tools that support precision fertilization. According to the Association of Equipment Manufacturers, precision farming technologies in 2021 led to a 4% increase in farmers' production, a 7% reduction in fertilizer usage, a 9% decrease in herbicide applications, a 6% reduction in fossil fuel consumption, and a 4% savings in water usage.

The livestock farming segment is expected to grow significantly with a CAGR of 14.6% over the forecast period. Productivity is a major concern in livestock farming, and analytics integration helps farmers optimize feed management, water usage, and overall resource allocation. By analyzing data on animal growth rates, feeding habits, and environmental conditions, analytics platforms provide insights that enable farmers to adjust feeding schedules, optimize the nutrient content of feed, and ensure that animals are growing at an optimal rate. This data-driven approach improves feed efficiency, weight gain, and higher milk or meat production. As the global demand for meat and dairy products rises, the need for analytics solutions that boost productivity and optimize resource use is becoming a significant driver for the livestock farming segment. According to the Brazilian Institute of Geography and Statistics, the value of production reported by parts per million in 2023 reached USD 22.34 billion, a 5.4% increase compared to 2022. Livestock products accounted for USD 20.50 billion, reflecting a 4.5% rise from 2022.

Field Size Insights

The large field size segment dominated the market in terms of revenue, with a revenue share of 49.8% in 2024. The increased investment in IoT-enabled farm management systems drives the large field size segment. IoT devices, such as soil sensors, weather stations, and moisture probes, are deployed across large fields to collect real-time data on environmental conditions. These devices are connected to agriculture analytics platforms that aggregate and analyze the data, providing insights into when to irrigate, apply fertilizers, or harvest crops. IoT systems offer a scalable solution for managing resources efficiently in large fields where manual monitoring is impractical. As the cost of IoT devices decreases and their capabilities improve, more large-scale farms are adopting these technologies to gain real-time insights and improve field management.

The medium field size segment is expected to register the fastest growth rate over the forecast period. The increasing consumer interest in organic and specialty crops is influencing agriculture analytics’ medium field size segment. Medium-sized farms often have the flexibility to diversify their crop offerings, including organic produce and niche market products. Agriculture analytics provides valuable insights into market demand, pest management, and sustainable farming practices, enabling these farms to cultivate and market specialty crops successfully. As consumer preferences continue to evolve toward healthier and more sustainable options, medium-sized farmers are leveraging analytics to adapt their production strategies, which fuels the growth of the agriculture analytics market.

Regional Insights

North America agriculture analytics market held a significant share of 45.1% in 2024. North America has large farming operations, particularly in regions such as the Midwest, the Great Plains, and the Canadian Prairies. These large-scale farms need advanced analytics to manage their extensive operations efficiently. Agriculture analytics platforms allow farmers to monitor and optimize thousands of acres of land, analyze crop performance, and predict yield outcomes. The ability to scale data-driven farming practices across large fields is a key driver for the agriculture analytics market, as large-scale farms increasingly rely on these tools to remain competitive and profitable.

U.S. Agriculture Analytics Market Trends

The demand for agriculture analytics in the U.S. is experiencing significant growth due to the rise of vertical farming and urban agriculture. These innovative farming methods rely heavily on technology and data analytics to maximize yields and resource efficiency. Agriculture analytics solutions are essential for monitoring and managing conditions in vertical farms, such as light, temperature, and humidity. As urban agriculture grows, the need for analytics solutions supporting these systems will also increase. This trend highlights the potential for analytics to drive innovation in non-traditional farming environments, contributing to the overall growth of the agriculture analytics market.

Asia Pacific Agriculture Analytics Market Trends

Asia Pacific region agriculture analytics market is expected to achieve the fastest CAGR of 15.6% during the forecast period in the market. The Asia Pacific region is witnessing rapid urbanization and population growth, leading to increased demand for food production. As more people move to urban areas, the pressure on agricultural systems to produce sufficient food increases. Agriculture analytics is crucial in enhancing productivity and efficiency in farming practices, enabling farmers to maximize yields from limited land. With advanced data analytics, farmers make informed decisions regarding crop selection, planting schedules, and resource allocation. As urban populations continue to rise, the need for efficient agricultural practices supported by analytics will drive growth in the agriculture analytics market.

Key Agriculture Analytics Company Insights

Some of the key players operating in the market include Trimble Inc., IBM Corporation, Wipro, SAP SE, Iteris, Taranis, Oracle Corporation, Conservis Corporation, and Geosys Inc., among others.

-

Trimble Inc. is a global technology solution provider that offers solutions and services such as land preparation, crop protection and spraying, and water management, among others, providing customers with the ability to improve their work quality while being safe, efficient, and sustainable.

-

International Business Machines Corporation is a technology company that provides comprehensive solutions pertaining to agriculture. The company helps overcome obstacles by combining the power of Artificial Intelligence (AI), analytics, and predictive insights with unique agricultural Internet of Things (IoT).

Wolkus Technology Solutions Private Limited and AGEYE Technologies. are some of the emerging market participants in the target market.

-

Wolkus Technology Solutions Private Limited plays a crucial role in water management, crop protection and particularly in providing a farm-specific micro-climatic forecast and providing solutions for weather risks of the future.

-

AGEYE Technologies is a global agriculture technology solution provider. The company uses computer machine vision, deep learning neural networks and IoT-connected devices to create the next generation of autonomous indoor farms.

Key Agriculture Analytics Companies:

The following are the leading companies in the agriculture analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Trimble Inc.

- IBM Corporation

- Wipro

- SAP SE

- Iteris

- Taranis

- Oracle Corporation

- Conservis Corporation

- Geosys Inc.

- Xylem Inc.

- PrecisionHawk

- Gro Intelligence

Recent Development

-

In February 2023, John Deere partnered with Nutrien Ag Solutions Inc., a division of Nutrien, to launch an advanced digital connectivity feature linking the John Deere Operations Center with Nutrien Ag Solutions' Digital Hub. This integration aims to enhance logistics and facilitate the seamless transfer of variable rate agronomic recommendations to equipment, helping growers optimize their operations. The companies have also committed to further integration and developing streamlined solutions to support better growers adopting precision agriculture technology. Growers can control their data access and share it with Nutrien Crop Consultants for tailored recommendations, leading to improved agronomic outcomes.

-

In February 2022, Trimble launched Virtual Farm, an engaging online platform that allows farmers worldwide to explore precision agriculture. In this interactive tool, users can navigate a digital farm and pinpoint common challenges they face daily. Subsequently, farmers are guided to Trimble’s user-friendly, connected solutions tailored to address each challenge. They are connected with a Trimble Ag representative to help determine the best options for their farm.

Agriculture Analytics Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 7.25 billion

Revenue Forecast in 2030

USD 14.22 billion

Growth rate

CAGR of 14.4% from 2025 to 2030

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

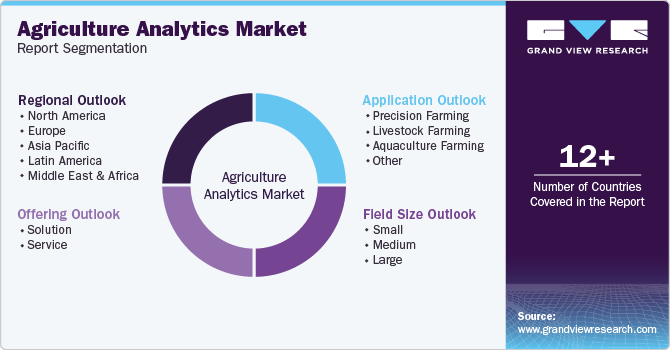

Offering, application, field size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Trimble; IBM Corporation; Wipro; SAP; Iteris; Taranis; Oracle Corporation; Conservis Corporation; Geosys Inc.; Xylem Inc.; PrecisionHawk; Gro Intelligence.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agriculture Analytics Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global agriculture analytics market based on offering, application, field size, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Service

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Precision Farming

-

Yield Monitoring

-

Field Mapping

-

Crop Scouting

-

Weather Tracking & Forecasting

-

Irrigation Management

-

Inventory Management

-

Farm Labor Management

-

-

Livestock Farming

-

Milk Harvesting

-

Breeding Management

-

Feeding Management

-

Animal Comfort Management

-

Farm Labor Management

-

-

Aquaculture Farming

-

Other

-

-

Field Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small

-

Medium

-

Large

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agriculture analytics market size was estimated at USD 6.49 billion in 2024 and is expected to reach USD 7.25 billion in 2025.

b. The global agriculture analytics market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2030 to reach USD 14.22 billion by 2030.

b. North America, led by the U.S., dominated the agriculture analytics market with a revenue share of 45.1% in 2024, driven by increasing demand from farmers for advanced analytical solutions for water management and crop protection.

b. Prominent participants in the agriculture analytics market comprise Trimble Inc., IBM Corporation, Wipro, SAP SE, Iteris, Taranis, Oracle Corporation, Conservis Corporation, and Geosys Inc.

b. The agriculture analytics market is driven by various factors, such as the increasing demand from farmers for advanced solutions for water management and crop protection, along with the rising need for optimal resource utilization.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.