- Home

- »

- Next Generation Technologies

- »

-

Agriculture Analytics Market Size And Share Report, 2030GVR Report cover

![Agriculture Analytics Market Size, Share & Trends Report]()

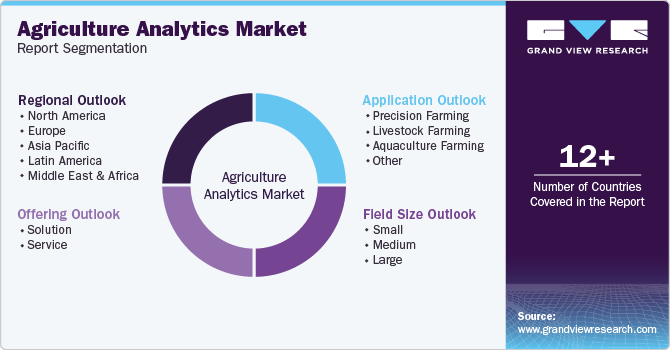

Agriculture Analytics Market Size, Share & Trends Analysis Report By Offering (Solutions And Services), By Application, By Farm Size, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-187-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Agriculture Analytics Market Size & Trends

The global agriculture analytics market size was estimated at USD 5.35 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.5% from 2023 to 2030. The global agricultural sector is experiencing a surge in investment and rapid technological advancements, reflecting a collective effort to enhance farm offering. Moreover, farmland owners are increasingly inclined towards adopting analytics solutions encompassing weather data analytics, crop growth monitoring, land preparation, and more that help them optimize agriculture operations.

Analytics tools aid farmland owners in enhancing overall farm output and efficiency as these solutions empower them to make more informed and relevant decisions. Thus, increasing investment in the agriculture sector, coupled with farmland owners’ approach towards the adoption of advanced solutions to increase farm output, are major factors expected to drive global market growth.

The escalating demand for food, driven by a growing global population, is responsible for putting significant pressure on farmland owners to enhance food offerings. Furthermore, challenges such as changing climatic conditions and soil degradation are impeding the ability of farm owners to achieve optimal crop yields. Thus, to tackle this complex scenario, there is a noticeable increase in the adoption of farm analytical solutions from farmland owners as these solutions use technologies such as global positioning systems (GPS), global navigation satellite systems (GNSS), and unmanned aerial vehicles (drones) that aid in taking a more informed decision and enhancing overall efficiency in farm operations and management.

These analytical solutions empower farm owners with valuable insights, allowing them to optimize resource allocation, crop planning, and precision farming techniques. The integration of technology in agriculture is becoming indispensable, offering sustainable and efficient practices to meet the rising food demand. As farmland owners increasingly recognize the benefits of these advanced analytical tools, the agricultural sector is poised to transform, ensuring more effective and environmentally sustainable farming practices for the future. The table below provides some insights into the adoption of agriculture analytics across countries.

Company

Region/Country

Value Proposition

Description

Saudi Greenhouses Management and Agri Marketing Co.

Saudi Arabia

- Greenhouse Farm Applications

- Support Service

- Greenhouse Farming Advisory

The company has undertaken turnkey greenhouse projects in Saudi Arabia. It provides smart farming techniques and advisory and support services.

Libelium

Colombia

Crop Monitoring System (Backed by a wireless sensor network)

Red Tecnoparque Colombia deployed the crop monitoring system developed by Libelium, which will aid them in monitoring humidity, temperature, soil moisture, etc.

In developing countries, farmland owners situated in remote areas encounter significant challenges due to the limited access to essential amenities, including roads, water, and electricity. This infrastructural deficit poses an obstacle to the effective deployment of agriculture analytics solutions in these regions. In addition, a notable percentage of farmers in developing countries face challenges in adopting advanced farming devices/solutions due to a lack of knowledge and understanding. This knowledge gap becomes a critical factor impeding the widespread adoption of smart solutions among farmers.

Moreover, the low awareness levels among farmers regarding the utility and advantages of farm analytics pose a major obstacle to the growth of the agriculture analytics market. The shortage of skilled workers capable of effectively implementing and managing these advanced technologies adds another layer of complexity to the growth prospects of the global market.

Furthermore, concerns over data privacy and security add another aspect that lowers the adoption of advanced farm analytical solutions. Addressing these challenges requires a comprehensive approach that involves not only the technological advancement of analytics solutions but also targeted initiatives to enhance awareness, education, and infrastructure development in remote farming communities.

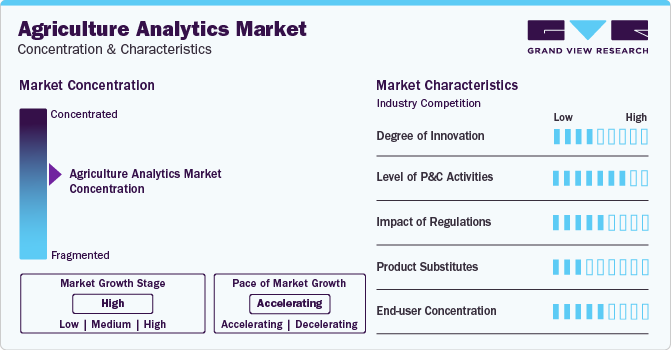

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of market growth is accelerating. The target market is characterized by a moderate degree of innovation, owing to the technological advancements driven by factors such as the integration of sensors and cameras into the equipment to enhance operational efficiency and efficient utilization of resources. Farm sensors provide the required data such as soil moisture, farm temperature, etc. that farmers can integrate with data collected from other sources. Using this combined data and analytical tools, farmers can efficiently optimize resource allocation.

The target market is also characterized by a high level of partnerships and collaborations by the leading players. This is due to several factors, including the need to gain access to advanced monitoring, analytical, and visualization equipment, and increase farm and farmer efficiency.

Regulatory frameworks and scrutiny wield substantial influence over the agriculture analytics market, particularly concerning data privacy, security, and ethical considerations. Rigorous data protection laws can compel companies within the agriculture analytics sector to implement robust measures safeguarding sensitive information belonging to farmers, potentially impacting the ease of data collection and sharing. Regulatory requirements regarding the utilization of emerging technologies, such as artificial intelligence (AI) in agriculture analytics, play a pivotal role in shaping the market landscape. These regulations can either foster innovation or impose restrictions that hinder the widespread adoption of advanced analytics solutions.

The evolving regulatory environment further extends its reach to affect the accessibility and affordability of analytics solutions for farmers, thereby influencing the overarching growth and dynamics of the agriculture analytics market. Keeping abreast of these regulatory changes becomes imperative for industry players, as compliance and adaptability to evolving standards are integral to sustaining a competitive edge in this dynamic market.

The availability of offering substitutes in the market can exert a significant impact by influencing competition and market dynamics. For instance, the emergence of alternative technologies or platforms that offer similar analytical capabilities may lead to increased competition and pricing pressures within the sector. Moreover, the adoption of substitute offerings could influence the market share of existing analytics solutions, affecting the growth trajectories of established providers. The presence of viable substitutes may also drive innovation and compel companies to enhance their offerings to maintain a competitive edge in the evolving landscape of agriculture analytics.

End-user concentration in the agriculture analytics market involves the allocation of market share among a limited number of key customers or clients. A high level of end-user concentration presents risks for analytics providers, as their revenue becomes heavily reliant on a select few entities. If, for instance, a small number of large farming corporations dominate the market, any changes in their preferences or economic challenges could disproportionately impact the analytics providers catering to them.

Conversely, low end-user concentration helps diversify risk, providing more stability to the market. In this scenario, the market is less vulnerable to the decisions or challenges faced by any single end-user. Understanding and effectively managing end-user concentration is crucial for sustainability and growth within the agriculture analytics sector. This requires analytics providers to employ strategies that mitigate risks associated with high concentration, such as diversification efforts, ensuring a broader client base, and adapting to the evolving needs of end-users.

Offering Insights

The service segment accounted for a market share of 42.81% in 2022. The growth is driven by a lack of knowledge and understanding among end-users regarding the utilization of advanced farm analytical devices. This deficiency in expertise is expected to contribute to the expansion of the service segment within the market. Analytical solution providers play a pivotal role in facilitating the growth of this segment by offering essential services, including training, consulting, and system integration and implementation. These services aid in alleviating the complexity associated with the deployment of advanced farm analytics solutions, thereby addressing the knowledge gap and ensuring more effective utilization of these technologies.

By providing end-users with comprehensive training and support, these service providers empower them to harness the full potential of farm analytics solutions. This strategic approach not only enhances user proficiency but also promotes the seamless integration of these advanced technologies into agricultural operations. As the demand for farm analytics continues to rise, the service segment is positioned as a critical enabler for ensuring successful adoption and maximizing the benefits derived from these innovative solutions.

Application Insights

The precision farming segment dominated the overall market in 2022, with a market share of 46.96% in the agriculture analytics market. The growth is driven by increasing demand from farm owners for comprehensive farm analytical solutions that encompass solutions such as crop management, field planning, weather data analytics, and irrigation and water management. The deployment of sensors on farms delivers granular data on soil conditions, water content, and fertilizer requirements. This data empowers farmers to make informed decisions regarding crop selection and management, contributing to optimal agricultural practices. Furthermore, the analytical insights derived from analytical solutions play a vital role in running diagnostics to monitor crop growth. By leveraging this data, farmers can implement real-time adjustments to their agricultural practices, ensuring enhanced efficiency and offering.

The livestock farming segment is poised to secure a substantial revenue share within the target market. This growth is driven by a notable trend among livestock farm owners who are increasingly adopting analytics solutions to enhance overall farm output. The right amount of nutrition is required for animal health for proper growth. This increasing diet concern among farmer is resulting in their approach toward the integration of solutions such as feeding management, milk harvesting, and breeding management for better animal health, which is expected to impact the segment growth positively. Livestock farm business owners are leveraging analytics to optimize these critical aspects of their operations, thereby improving efficiency.

Farm Size Insights.

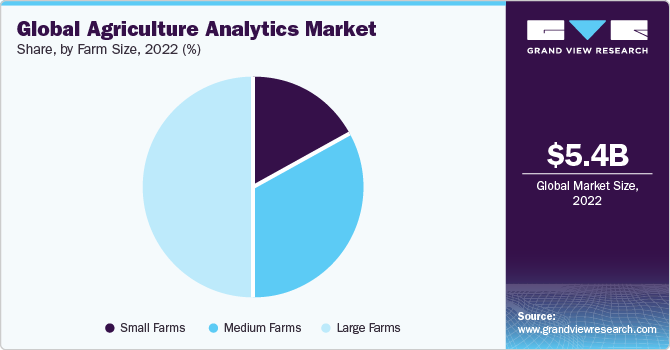

The large farms segment dominated the overall market, gaining a market share of 50.18% in 2022. The high income level of large farm owners positions them favorably for the seamless integration of advanced analytical solutions. This financial capacity facilitates their ability to adopt and leverage advanced analytical solutions, enabling large farm owners to enhance farm yield and optimize agricultural operations effectively.

Medium-size farm owners hold a noticeable revenue share in the target segment. The adoption of advanced analytical solutions is challenged in the segment by low spending capacity and lack of awareness. Recognizing this challenge, offering and solution providers are strategically forging tie-ups and agreements with non-governmental organizations (NGOs) and Self-Help Groups to raise awareness among medium-sized farm owners. These collaborative efforts are aimed at educating and informing medium-size farm owners about the benefits and applications of advanced analytical solutions in agriculture, which is expected to support the target segment's growth.

Regional Insights.

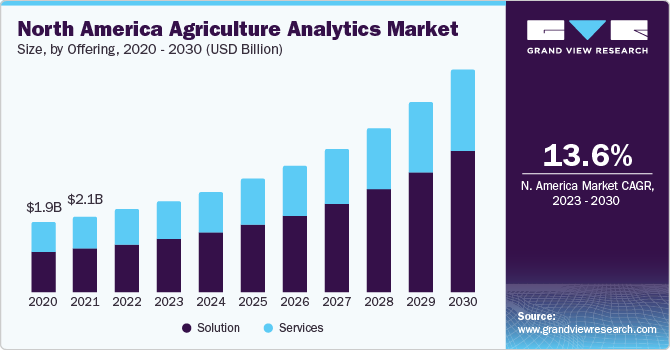

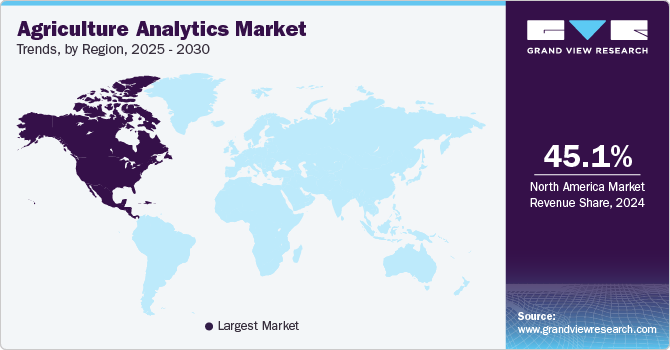

The North America segment led the market, gaining a market share of 42.36% in 2022, owing to the region’s well-established infrastructure that facilitates the seamless integration of analytical services. The availability of robust and developed infrastructure aids in easily accessing and incorporating advanced analytics solutions in agricultural practices. Additionally, the increasing awareness among farmers in North America regarding the benefits of analytics and sensor technologies is expected to drive the demand for agriculture analytics solutions. This heightened awareness empowers farmers to leverage these technologies for enhancing operational efficiency and maximizing farm yields, contributing to the sustained growth of the agriculture analytics market in the region.

The Asia Pacific region is expected to achieve the fastest CAGR over the forecast period. The surging population in the Asia Pacific region and rising food demand have intensified the pressure on farmers to enhance farm output. This heightened demand, coupled with increased government spending in the agriculture sector, is driving a notable inclination among farmers and agribusinesses to adopt advanced analytical solutions. These analytical solutions play a crucial role in addressing the challenges and help in improved monitoring, enhanced farm management, and increased traceability within agricultural operations. As farmers strive to meet the challenges of increasing offering, advanced analytics provides valuable insights for making informed decisions and optimizing resource allocation.

Likewise, the governments of China and India have begun modernizing and digitizing the agricultural landscape, along with farmers recognizing the potential benefits, resulting in the adoption of advanced analytics as a strategic imperative for ensuring sustainable and efficient agricultural practices. This is another factor expected to support the growth of agriculture analytics in Asia Pacific region.

Key Agriculture Analytics Share Insights

Some key players operating in the market include Trimble Inc.; IBM Corporation; Wipro; SAP; Iteris; Taranis; Oracle Corporation; Conservis Corporation; and Geosys Inc.; among others.

-

Trimble Inc. is a global technology solution provider that offers solutions and services such as land preparation, crop protection and spraying, and water management, among others, providing customers with the ability to improve their work quality while being safe, efficient, and sustainable.

-

International Business Machines Corporation is a technology company that provides comprehensive solutions concerning agriculture. The company helps overcome obstacles by combining the power of AI, analytics, and predictive insights with the unique platforms offered by the agricultural Internet of Things (IoT).

Wolkus Technology Solutions Private Limited and AGEYE Technologies are some of the emerging market participants in the target market.

-

Wolkus Technology Solutions Private Limited plays a crucial role in water management and crop protection. Their solutions particularly provide farm-specific micro-climatic forecasts and solutions for futuristic weather risks.

-

AGEYE Technologies is a global agriculture technology solution provider. The company uses computer machine vision, deep learning neural networks, and IoT-connected devices to create the next generation of autonomous indoor farms.

Key Agriculture Analytics Companies:

The following are the leading companies in the agriculture analytics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these agriculture analytics companies are analyzed to map the supply network.

- Trimble Inc.

- IBM Corporation

- Wipro

- SAP

- Iteris

- Taranis

- Oracle Corporation

- Conservis Corporation

- Geosys Inc.

- Xylem Inc.

- PrecisionHawk

- Gro Intelligence

Recent Development

-

In March 2023, IBM, a global technology solution provider, announced a strategic partnership with The Climate Corporation. The partnership was focused on the development of a new agriculture analytics solution that will use IBM’s Watson IoT platform to collect and analyze data from multiple sources and aid farmers in better decision-making. The partnership is expected to help IMB enhance its agriculture offering portfolio.

-

In January 2023, John Deere, a global farm equipment provider, announced its partnership with Nutrien Ag Solutions. The partnership is expected to help both companies to better serve growers by optimizing logistics.

-

In January 2023, SAP, a global technology solution provider announced its partnership with DeHaat. DeHaat is expected to use SAP’s cloud enterprise ERP solution to provide end-to-end agricultural services to farmers in India. The partnership is expected to help DeHaat increase its customer base.

-

In February 2022, Trimble, a global agriculture analytical solution provider, announced the launch of Virtual Farm, which aids farmers in identifying common challenges through digital farms. The launch of a new digital platform is expected to enhance its customer base.

-

In February 2022, Trimble Inc., a global agriculture solution provider announced the launch of its Virtual Farm. The new virtual farm will help users address concerns related to water management, input management, etc., through Trimble’s services.

Agriculture Analytics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.87 billion

Revenue forecast in 2030

USD 14.22 billion

Growth rate

CAGR of 13.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Offering, application, farm size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Trimble Inc.; IBM Corporation; Wipro; SAP; Iteris; Taranis; Oracle Corporation; Conservis Corporation; Geosys Inc.; Xylem Inc.; PrecisionHawk; Gro Intelligence

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agriculture Analytics Market Report SegmentationThis report forecasts revenue growth at global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the agriculture analytics market report based on offering, application, farm size, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Precision Farming

-

Yield Monitoring

-

Field Mapping

-

Crop Scouting

-

Weather Tracking & Forecasting

-

Irrigation Management

-

Inventory Management

-

Farm Labor Management

-

-

Livestock Farming

-

Milk Harvesting

-

Breeding Management

-

Feeding Management

-

Animal Comfort Management

-

Others

-

Aquaculture Farming

-

Others

-

-

-

Farm Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small Farms

-

Medium Farms

-

Large Farms

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agriculture analytics market size was estimated at USD 5.35 billion in 2022 and is expected to reach USD 5.87 billion in 2023.

b. The global agriculture analytics market is expected to grow at a compound annual growth rate of 13.5% from 2023 to 2030 to reach USD 14.22 billion by 2030.

b. North America, led by the U.S., dominated the agriculture analytics market with a revenue share of 42.3% in 2022, driven by increasing demand from farmers for advanced analytical solutions for water management and crop protection.

b. Prominent participants in the agriculture analytics market comprise Trimble Inc., IBM Corporation, Wipro, SAP, Iteris, Taranis, Oracle Corporation, Conservis Corporation, and Geosys Inc.

b. The agriculture analytics market is driven by various factors, such as the increasing demand from farmers for advanced solutions for water management and crop protection, along with the rising need for optimal resource utilization.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."