- Home

- »

- Smart Textiles

- »

-

Global Agro Textile Market Size, Share & Growth Report, 2030GVR Report cover

![Agro Textile Market Size, Share & Trends Report]()

Agro Textile Market Size, Share & Trends Analysis Report By Type (Woven, Knitted), By Material (Synthetic, Natural), By End-use (Fishing Nets, Shade Nets), By Application (Agriculture, Aquaculture), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-272-3

- Number of Report Pages: 118

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

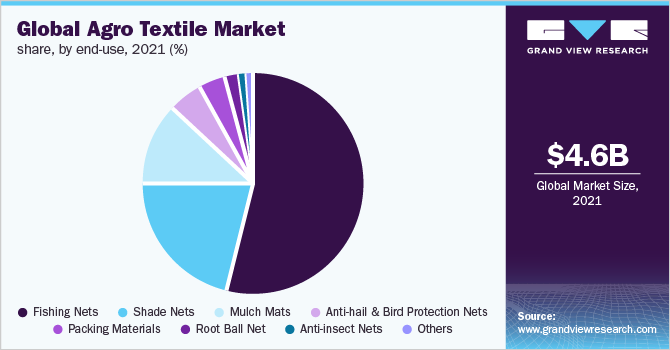

The global agro textile market size was estimated at USD 4.62 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% during the forecast period. The rising need to increase agro productivity to fulfill the daily demand of the growing population coupled with the rising product demand, as it aids in improving crop quality & helps in increasing the overall productivity, is anticipated to drive the industry growth during the forecast period. The COVID-19 pandemic posed various issues, in terms of plant management, logistics, and supply chain, in some countries of the OPEC region. However, favorable government policies promoting sustainable practices in agriculture and associated sectors are anticipated to boost the product demand during the forecast years.

The multiple uses of agro textiles to boost germination in nurseries, protection of soil from moisture evaporation & erosion, and safety from environmental & climatic factors, such as hail, rain, and sunlight, support the industry growth. Protection from birds, insects, fungus, and other pests has helped increase product adoption in the U.S. Woven agro textiles are developed on weaving machines. Woven fabrics are resistant to shrinkage or weathering due to water, making them ideal for applications where the textile is likely to be in contact with moisture.

Woven fabrics are thicker and sturdier than other textiles, which is why they are useful in protective applications, such as packaging or ground covers. The products are used in forestry, horticulture, aquaculture, landscape, and animal husbandry applications. They are used for safeguarding livestock and crops during their transportation, as well as for protecting them from animals, insects, fungus, weeds, etc. These agro textiles are also used in capturing and shading applications, as well as for irrigation purposes. The production of agro textile is a cost-intensive process owing to expensive and extensively used raw materials, such as petroleum, and advanced manufacturing technologies used to obtain yarn from these raw materials. The high cost of production of synthetic fibers starts from raw material procurement. This may hinder the growth to some extent.

Material Insights

The synthetic fiber segment accounted for the maximum share of more than 70.30% of the overall revenue in 2021. The segment dominated the market on account of the high demand for synthetic fibers as they are highly durable, strong, resilient, and resistant to most environmental problems, such as moisture and fungi. They are also easier to handle & manufacture and are cheaper than their natural counterparts. Nylon is made of monomers extracted from crude oil. It is then reacted with other substances, such as acids, to form polymers that are further extruded and finally spun into nylon fabric. The dependence on crude oil for the production of these fibers is expected to affect its demand due to the diminishing reserves.

The natural fibers segment is anticipated to witness the fastest CAGR, in terms of revenue, from 2022 to 2030. The rising focus on healthy living has led to an increase in the demand for organic produce in all types of consumer products. This has led to an increase in the demand for agro products for manufacturing products in all industries. The consumer focus on sustainability of manufacturing processes and the environmental impact of synthetic fibers has increased the use of natural fibers in agro textiles. Natural fibers are biodegradable and have high wet strength & moisture retention. The easy & safe disposal of these textiles is expected to positively impact the segment growth.

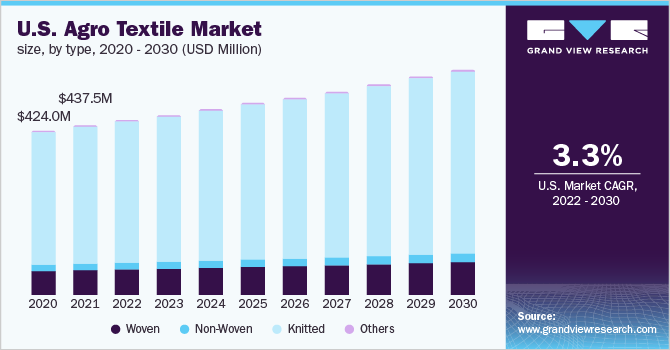

Type Insights

The knitted agro textile segment led the global industry in 2021 and accounted for the maximum share of more than 47.80% of the overall revenue as the fabric is used in a wide variety of applications, such as impact protection in the form of wind control, hail protection, and bird nets. The ease of handling knitted fabric and the versatility, in terms of usage of textiles made by knitting methods, has led to an increase in product demand. Non-woven fibers are made from various methods, such as chemical bonding, thermally fusion, and mechanical entanglement. The manufacturing process consists of a web formation that imparts mechanical strength and later adds further properties according to the end-use of the fiber.

Woven agro textile are developed on weaving machines, such as the Sulzer projectile machines. Woven fabrics are resistant to shrinkage or weathering due to water, making them ideal for applications where the textile is likely to be in contact with moisture. Woven fabrics are thicker and sturdier than other textiles, making them useful in protective applications, such as the packaging of agro products. The long-term durability of woven textiles and higher strength compared to knitted products are expected to drive the segment growth during the forecast period. However, the production of woven fabrics is more time-intensive and expensive than other types of materials used, which may limit growth.

End-use Insights

Fishing nets led the global industry in 2021 and accounted for the largest share of more than 54.00% of the overall revenue. The increasing use of aquatic life in various industries, such as nutraceuticals, pharmaceuticals, and cosmetics, along with the rising seafood consumption has helped in the growth of aquaculture, thereby boosting the fishing net segment growth. Shade nets are chosen based on the crops grown under them, depending on how much light the crop can withstand. In addition, they help increase agro yield in summer and reduce damage due to excessive heat. They are used in various applications, such as floriculture, nursery, and vermicompost production.

Mulch mats made of natural fibers are highly preferred by farmers as the biodegradability of natural mulch mats helps in the restoration of soil nutrients at the end of the life cycle of these mats. This helps in making farming sustainable and reduces the negative impact caused by the disposal of synthetic fibers. Anti-hail nets are used in areas prone to hail falls, such as high altitude and cold areas. They are generally used in tall fruit trees that grow in hail-prone areas, where each tree requires an individual net for protection. These nets are made of HDPE yarn is woven or knitted forms, which are UV stabilized to withstand the effect of falling hail.

Regional Insights

The Asia Pacific dominated the global industry in 2021 and accounted for the maximum share of more than 48.10% of the overall revenue. The region’s high share can be attributed to the increasing demand for agro products, which is attributed to the rising population and changing consumer preferences. The presence of developed economies, such as the U.S. and Canada, supports the North American economy in showcasing high diversity. Research & development into more sustainable agricultural practices and increasing affinity toward organic products are expected to drive the industry during the forecast period.

The product demand in the agriculture industry in Europe is expected to increase owing to the rising governmental efforts to boost the total agricultural yield. Climate change, environmental sustainability concerns, and competition with other economic activities to procure scarce resources, such as water, are some of the factors limiting agricultural productivity in Europe. The Central & South America region is likely to grow significantly during the forecast period owing to the rising product demand from the agriculture and fishing industries. Moreover, high consumer awareness regarding agro products is expected to have a positive impact on the regional market during the forecast period.

Key Companies & Market Share Insights

Major players in the market are entering into agreements with emerging and small-scale players to expand their distribution capacities and increase the market reach of their products. Furthermore, manufacturers are focusing on other efficient and effective distribution channels to ensure that buyers have timely access to such products. Prominent market players have been benchmarked based on their geographical reach, distribution networks, product portfolio, innovation, strategic developments, operational capabilities, and the market presence of their brands. Some prominent players in the global agro textile market include:

-

TenCate Industrial Fabrics

-

Garware Technical Fabrics

-

Freudenberg Performance Materials

-

Beaulieu Technical Textiles

-

Belton Industries, Inc.

-

Diatex SAS

Agro Textile Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.82 billion

Revenue forecast in 2030

USD 6.98 billion

Growth rate

CAGR of 4.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; Indonesia; Brazil; Argentina

Key companies profiled

TenCate Industrial Fabrics; Garware Technical Fibers Ltd.; Beaulieu Technical Textile; Belton Industries, Inc.; Meyabond Industry &Trading Co., Ltd.; Diatex SAS; Mogul Co. Ltd.; Karatzis Group of Companies; Zhongshan Hongjun Nonwovens Co., Ltd.; ACE Geosynthetics; Freudenberg Performance Materials; Hy-Tex (U.K.) Ltd.; Aduno SRL; Agro-Jumal Sp; Siang May Pte Ltd.; AB Ludvig Svensson; Phormium; HELIOS GROUP S.r.l.; Egersund Group AS; Tama CE; Morenot

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agro Textile Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global agro textile market report based on material, type, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Synthetic Fibers

-

Natural Fibers

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Woven

-

Non-Woven

-

Knitted

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Shade Nets

-

Mulch Mats

-

Anti-hail and Bird Protection Nets

-

Anti-insect Nets

-

Fishing Nets

-

Packing Materials

-

Root Ball Net

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global agro textile market size was estimated at USD 4.62 billion in 2021 and is expected to reach USD 4.82 billion in 2022.

b. The global agro textile market is expected to grow at a compound annual growth rate a CAGR of 4.7% from 2022 to 2030 to reach USD 6.98 billion by 2030.

b. Synthetic fiber material segment accounts for the largest material segment and is projected to increase at a significant rate over the forecast period due to the growing demand for agricultural products in various industries and the need to increase their production are expected to help the market growth.

b. Some key players operating in the agro textile market include TenCate Industrial Fabrics, Garware Technical Fibers Ltd., Beaulieu Technical Textile, Belton Industries, Inc., Meyabond Industry &Trading Co., Ltd., Diatex SAS, Mogul Co. Ltd., Karatzis Group of Companies, Zhongshan Hongjun Nonwovens Co., Ltd., ACE Geosynthetics.

b. Key factors that are driving the agro textile market growth include the rising need to increase agricultural productivity to fulfill the daily demand of the growing population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."