- Home

- »

- Next Generation Technologies

- »

-

AI In Accounting Market Size & Share, Industry Report, 2033GVR Report cover

![AI In Accounting Market Size, Share & Trends Report]()

AI In Accounting Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Technology (Machine Learning and Deep Learning, Natural Language Processing), By Application, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-658-9

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Accounting Market Summary

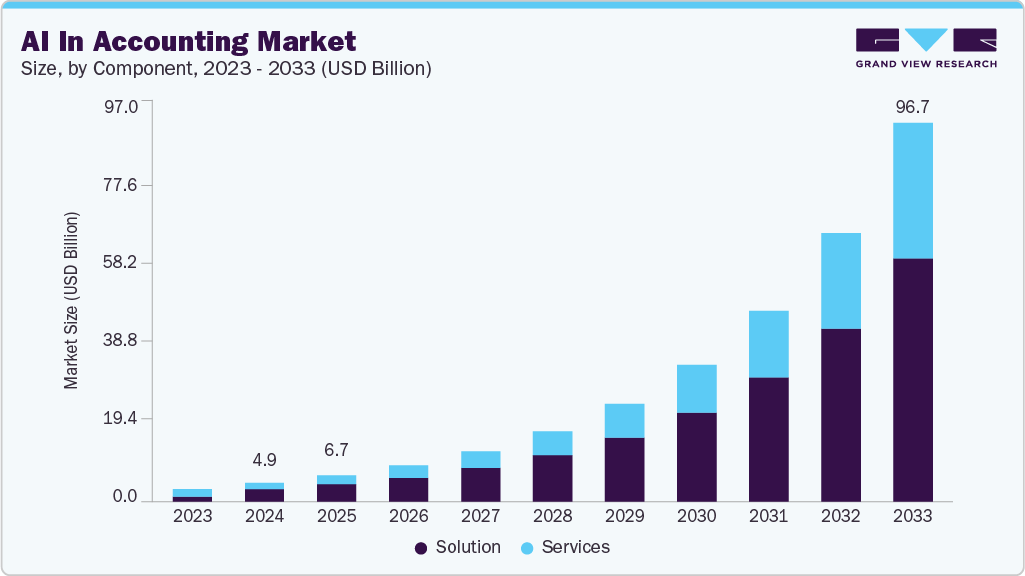

The global AI in accounting market size was estimated at USD 4,872.7 million in 2024 and is projected to reach USD 96,686.1 million by 2033, growing at a CAGR of 39.6% from 2025 to 2033. The AI in accounting market is experiencing rapid growth due to increasing demand for automation in financial operations and compliance tasks.

Key Market Trends & Insights

- North America AI in accounting dominated the global market with the largest revenue share of 37.5% in 2024.

- The AI in Accounting market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, solution led the market and held the largest revenue share of 67.2% in 2024.

- By technology, the machine learning and deep learning technologies dominated the AI in accounting market in 2024.

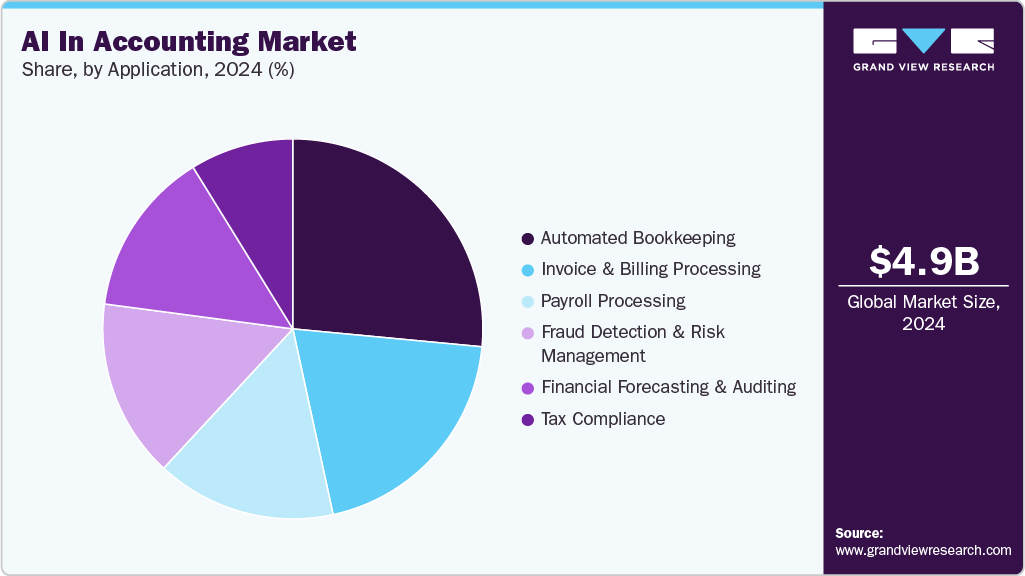

- By application, automated bookkeeping dominated the ai in accounting market in 2024 as businesses prioritize efficiency in routine financial tasks.

Market Size & Forecast

- 2024 Market Size: USD 4,872.7 Million

- 2033 Projected Market Size: USD 96,686.1 Million

- CAGR (2025-2033): 39.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Businesses are adopting AI-powered tools for tasks such as bookkeeping, invoicing, fraud detection, and forecasting to improve accuracy and efficiency. Infrastructure partnerships are becoming essential for accelerating AI adoption in accounting. Using advanced cloud platforms gives accounting firms access to scalable processing power and specialized artificial intelligence (AI) tools. This helps teams build, test, and deploy accounting-specific AI models with greater speed and accuracy.Faster development cycles allow firms to launch automation and analytics solutions more quickly. These collaborations also support the storage and handling of sensitive financial data securely. As a result, organizations are integrating AI into core accounting functions such as bookkeeping, auditing, and compliance monitoring. Cloud-based environments make it easier to update and maintain intelligent features.

Companies are actively forming cloud alliances to advance AI integration in accounting. For instance, in May 2025, Sage Group plc, a UK-based software company, advanced its AI capabilities for small and medium businesses through a collaboration with Amazon Web Services, Inc., utilizing tools such as Amazon Bedrock and AWS Trainium to accelerate the development of AI models. These innovations, including enhancements to Sage Copilot, aim to improve financial decision-making, automate workflows, and provide real-time accounting and compliance insights.

AI is transforming the accounting sector by simplifying routine tasks through automation. It enables more tailored financial processes, allowing businesses to adapt tools to specific needs. Real-time insights help decision-makers respond faster and more accurately to financial changes. The focus is also shifting toward unified platforms that connect various accounting functions in one system. As these technologies evolve, they are becoming more accessible to firms of all sizes.

Cloud integration is further accelerating AI adoption by improving scalability and remote access to accounting systems. Generative AI tools are enhancing productivity by automatically generating reports, invoices, and recommendations. Companies are increasingly investing in AI partnerships to expand their capabilities. For instance, in November 2024, KPMG LLP announced a $100 million investment in its U.S. Google Cloud practice to develop AI-driven solutions such as Vertex AI and Gemini-powered tools that support automated, insight-rich financial processes across sectors.

AI is changing the way firms handle compliance in accounting. Real-time systems are built into daily workflows to keep track of financial activity. These tools constantly monitor transactions and records as they happen. They check everything against the latest rules and regulations. If something looks off, the system sends out an alert right away. That gives teams a chance to fix issues before an audit. The AI also updates itself with new regulatory changes as they come in. Instead of relying on manual checks, firms are using automated rule engines. This helps avoid fines, errors, and compliance gaps. With these tools, companies feel more in control of their compliance process. Auditors are also benefiting from quicker access to clean and organized data. Real-time insights make it easier to catch irregularities early. Firms are using these systems across different regions to manage varying local laws. AI is turning compliance into a more proactive and strategic function

Component Insights

The solution segment dominates the AI in accounting market with a revenue share of 67.2% in 2024, due to widespread adoption of software platforms for tasks like automated bookkeeping, invoice processing, and financial forecasting. These solutions integrate advanced technologies such as machine learning and natural language processing, enhancing accuracy and operational speed. Enterprises prefer ready-to-deploy platforms that can be scaled across departments with minimal customization. The cost-effectiveness and long-term ROI of software solutions make them a preferred choice for large and mid-sized firms. Integration with existing ERP and accounting systems further supports market dominance. As digital transformation accelerates, solution providers continue to release updates that increase functionality and compliance features.

The services segment is growing rapidly as businesses seek support for AI implementation, integration, and ongoing optimization. Demand for consulting and managed services is increasing, especially among small and medium enterprises that lack in-house AI expertise. Service providers are helping firms train models, migrate data, and customize solutions for industry-specific requirements. As AI applications become more complex, the need for technical support and strategy development is expanding. Growth in subscription-based and cloud-delivered models is also fueling demand for continuous service engagement. This rising need for hands-on assistance is driving steady expansion in the services portion of the market.

Technology Insights

Machine learning and deep learning technologies dominated the AI in accounting market in 2024, due to their advanced capabilities in handling large volumes of financial data. These technologies enable automated decision-making, anomaly detection, and predictive analytics with high accuracy. Enterprises use them extensively for financial forecasting, fraud detection, and audit trail analysis. Their ability to learn from data patterns without explicit programming increases efficiency across accounting functions. Integration with core accounting systems has made adoption seamless for large organizations. As accuracy and performance improve, machine learning and deep learning continue to lead technological adoption in the sector.

Natural language processing is gaining traction as firms look to automate the interpretation of unstructured text, such as invoices, receipts, and email communications. NLP is enabling conversational interfaces, voice-driven accounting, and smarter document classification. As accounting workflows incorporate chatbots and virtual assistants, demand for NLP-based solutions is increasing. Its role in extracting insights from natural language documents enhances compliance and decision-making. While currently smaller in share, NLP's relevance is expanding with the rise of AI-driven reporting and query resolution. This growing importance positions NLP as a key growth technology in the evolving accounting.

Application Insights

Automated bookkeeping dominated the AI in accounting market in 2024 as businesses prioritize efficiency in routine financial tasks. AI tools are widely used to handle data entry, transaction classification, and ledger management with minimal human intervention. This automation reduces errors, saves time, and allows accountants to focus on higher-value activities. The demand for scalable and cost-effective solutions among SMEs has further driven the dominance of automated bookkeeping. Cloud-based platforms integrated with AI are making it easier to adopt and manage bookkeeping functions remotely. This application has become the foundation of AI adoption in accounting workflows.

Financial forecasting and auditing are growing steadily as organizations recognize the value of AI in improving accuracy and oversight. Predictive analytics is being used to generate data-driven forecasts that help companies plan more effectively. AI-powered audit tools enable continuous monitoring, anomaly detection, and faster risk identification. Enterprises are adopting these solutions to comply with evolving regulatory standards and to enhance financial transparency. The growing need for strategic insights and automated audit trails is fueling interest in this application. This trend indicates a shift toward more intelligent and proactive financial management practices.

Regional Insights

North America AI in accounting market dominated the global market and accounted for a 37.5% revenue share in 2024. The North American market is growing steadily due to rising digital adoption in finance. Companies are using AI to increase accuracy and minimize manual tasks. Automated Bookkeeping dominates as businesses focus on streamlining operations and cutting costs. AI tools are helping firms handle large volumes of financial data more efficiently. This shift shows a broader trend toward real-time, automated accounting solutions.

U.S. AI In Accounting Market Trends

The AI in accounting market in the U.S. is mature and innovation-driven, with strong adoption across enterprises and startups. Companies are using AI for real-time financial analysis, fraud detection, and operational efficiency. Automated Bookkeeping leads due to a focus on cost control and digital workflow integration. Financial Forecasting and Auditing is expanding with demand for predictive insights and compliance tools. The presence of major AI providers is supporting rapid deployment across sectors.

Europe AI In Accounting Market Trends

The Europe AI in accounting is growing steadily, supported by regulatory pressures and digital finance initiatives. Businesses are implementing AI to enhance transparency, accuracy, and audit readiness. Automated Bookkeeping is widely adopted among SMEs due to cost efficiency. Financial Forecasting and Auditing is gaining momentum as firms focus on financial planning and risk management. Government support and data protection regulations are shaping AI implementation strategies.

Asia Pacific AI In Accounting Market Trends

Asia Pacific AI in accounting market is witnessing rapid growth, driven by digital transformation and a large base of tech-savvy SMEs. Companies in China, India, and Southeast Asia are adopting AI for bookkeeping automation and transaction management. Automated Bookkeeping dominates due to the high demand for scalable, low-cost solutions. Financial Forecasting and Auditing is growing with increased enterprise investment in AI-based analytics. Regional economic expansion and cloud adoption are accelerating market development.

Key AI In Accounting Company Insights

Some key companies in the AI in accounting industry include Deloitte Touche Tohmatsu Limited, Ernst & Young Global Limited, Intuit Inc., KPMG International Limited, Microsoft Corporation, Oracle Corporation, PricewaterhouseCoopers International Limited, Sage Group plc, Xero Limited, Zoho Corporation Pvt. Ltd and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Microsoft is advancing AI in accounting through its Dynamics 365 platform, integrating features for financial forecasting and anomaly detection. The system uses AI to automate processes such as cash flow analysis and invoice matching. It also supports natural language processing for financial queries and insights. These developments help businesses make faster, data-driven accounting decisions.

-

Oracle is embedding AI in its Fusion Cloud ERP to enhance accounting automation and financial accuracy. Its tools use machine learning to identify trends, detect anomalies, and streamline audit workflows. Oracle’s AI also assists in automating journal entries and improving reconciliation speed. These innovations aim to increase efficiency and reduce manual effort in finance departments.

Key AI In Accounting Companies:

The following are the leading companies in the ai in accounting market. These companies collectively hold the largest market share and dictate industry trends.

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- Intuit Inc.

- KPMG International Limited

- Microsoft

- Oracle

- PricewaterhouseCoopers International Limited

- Sage Group plc

- Xero Limited

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In November 2024, Intuit Inc. launched Intuit Assist for QuickBooks, a generative AI-powered assistant that automates tasks such as invoicing, billing, and payment reminders to streamline operations for U.S. small and mid-sized businesses. Built on Intuit’s GenOS platform, it enables users to convert emails, notes, and documents into financial transactions while offering real-time insights, personalized suggestions, and access to AI-powered human experts.

-

In August 2024, Xero Limited launched its GenAI-powered assistant, Just Ask Xero (JAX), designed to automate tasks like invoicing and provide personalized financial insights through mobile, email, and messaging platforms. The platform uses proprietary technology, JAX Assure, to ensure high accuracy by filtering data before large language models process it.

-

In June 2024, KPMG International Limited announced a collaboration with Microsoft to enhance its internal generative AI tool, Advisory Content Chat, by integrating Microsoft Azure AI Search to access and retrieve approved internal data securely. This upgrade supports KPMG’s broader GenAI strategy, embedding AI across operations and enabling more efficient knowledge management and client service for over 40,000 employees.

Artificial Intelligence In Accounting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,708.6 million

Revenue forecast in 2033

USD 96,686.1 million

Growth rate

CAGR of 39.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Component, technology, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia, South Korea, Brazil, KSA, UAE, South Africa

Key companies profiled

Deloitte Touche Tohmatsu Limited; Ernst & Young Global Limited; Intuit Inc.; KPMG International Limited; Microsoft; Oracle; PricewaterhouseCoopers International Limited; Sage Group plc; Xero Limited; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Accounting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global artificial intelligence in accounting market report based on component, technology, application, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural Language Processing

-

Robotic Process Automation (RPA)

-

Machine Learning and Deep Learning

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Invoice and Billing Processing

-

Automated Bookkeeping

-

Fraud Detection and Risk Management

-

Payroll Processing

-

Financial Forecasting and Auditing

-

Tax Compliance

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in accounting market size was estimated at USD 4,872.7 million in 2024 and is expected to reach USD 6,708.6 million in 2025.

b. The global AI in accounting market is expected to grow at a compound annual growth rate of 39.6% from 2025 to 2033 to reach USD 96,686.1 million by 2033.

b. North America dominated the AI in accounting market with a share of 37.5% in 2024. This is attributable to early technology adoption, strong presence of accounting software providers, and increased investment in AI-driven financial tools across the region.

b. Some key players operating in the AI in accounting market include Deloitte Touche Tohmatsu Limited, Ernst & Young Global Limited, Intuit Inc., KPMG International Limited, Microsoft, Oracle, PricewaterhouseCoopers International Limited, Sage Group plc, Xero Limited, Zoho Corporation Pvt. Ltd.

b. Key factors driving the market growth include the digitization of financial operations, increasing demand for automation in accounting processes, and rising adoption of AI technologies by enterprises to enhance accuracy and efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.