- Home

- »

- Next Generation Technologies

- »

-

AI In Drone Market Size And Share, Industry Report, 2033GVR Report cover

![AI In Drone Market Size, Share & Trends Report]()

AI In Drone Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Station Based, Cloud Based), By Component (Hardware, Software, Services), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-645-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Drone Market Summary

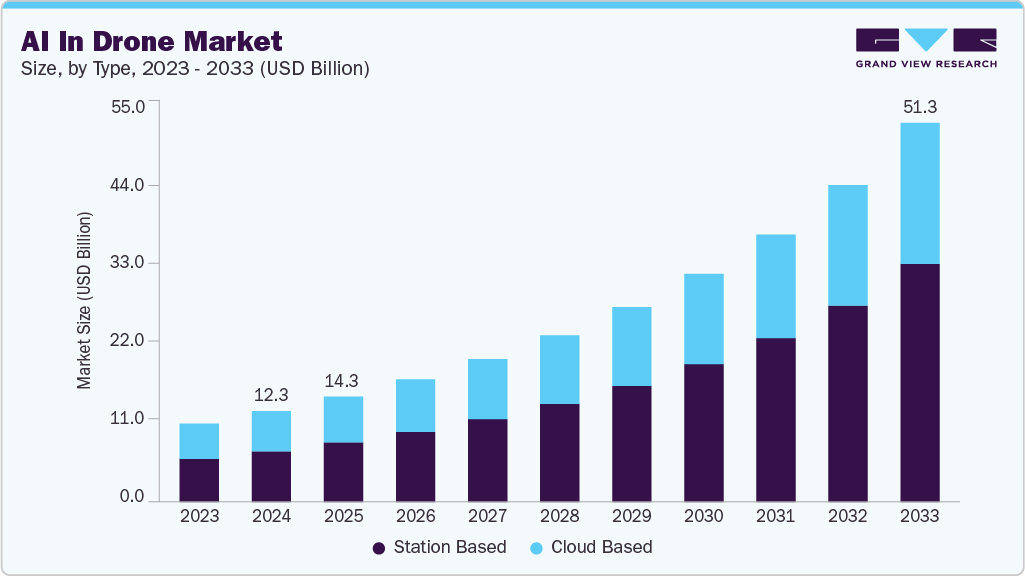

The global AI in drone market size was estimated at USD 12,292.6 million in 2024 and is projected to reach USD 51,328.7 million by 2033, growing at a CAGR of 17.9% from 2025 to 2033. The market growth is primarily driven by the increasing adoption of autonomous drones for surveillance and inspection, rising demand for real-time data analytics across sectors, growing use of AI in military and defense applications, advancements in onboard processing and sensor technologies, and expanding investments in smart agriculture and infrastructure monitoring.

Key Market Trends & Insights

- North America dominated the global AI in drone market with the largest revenue share of over 36% in 2024.

- The AI in drone market in the U.S. led the North America market and held the largest revenue share in 2024.

- By type, the station-based segment led the market and held the largest revenue share of over 55% in 2024.

- By component, the hardware segment led the market and held the largest revenue share of 46.4% in 2024.

- By application, the security & surveillance segment dominates the market and holds the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12,292.6 Million

- 2033 Projected Market Size: USD 51,328.7 Million

- CAGR (2025-2033): 17.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising need for automation, heightened focus on operational efficiency, and increasing safety concerns are accelerating the demand for AI in drone industry. The AI in drone industry leverages advanced technologies such as computer vision, edge AI, real-time data analytics, and autonomous navigation to enable precision monitoring, predictive maintenance, and remote operation. Enterprises across sectors like agriculture, logistics, energy, and defense are investing heavily in drone-based solutions to optimize costs, reduce risks, and enhance decision-making capabilities, driving significant market expansion.Innovations in artificial intelligence, edge computing, and real-time data processing are greatly enhancing the operational efficiency and autonomy of AI in drones. AI-powered drones can identify and track objects, avoid obstacles, and adapt flight paths dynamically, making them ideal for applications such as infrastructure inspection, search and rescue, and precision agriculture. This growing intelligence is enabling drones to handle more complex tasks, reducing the need for human oversight and driving widespread market adoption across sectors.

In addition, the global emphasis on environmental protection and climate resilience, AI in drones is increasingly being used for environmental monitoring, wildlife tracking, forest fire detection, and pollution assessment. Governments and environmental agencies are investing in drone-based monitoring solutions to meet regulatory compliance and achieve sustainability goals. The ability of these systems to offer accurate, real-time environmental intelligence is strengthening their role in global sustainability efforts and propelling market growth.

Furthermore, the growing demand for rapid, contactless delivery, especially accelerated by e-commerce and healthcare logistics, is fueling the adoption of AI in drone industry. Equipped with AI algorithms, these drones can autonomously plan optimal delivery routes, adjust paths in real time based on environmental data, and ensure secure package handling. This expansion into logistics represents a significant opportunity for market growth as drones become an integral part of smart supply chains.

Moreover, government initiatives supporting drone innovation, combined with evolving aviation regulations, are creating a favorable business environment for AI in drone industry. Policies promoting drone corridors and air traffic integration for unmanned systems are accelerating commercial adoption. These strategic measures lower entry barriers for new players and increase trust in the technology, enabling safer and broader implementation of the AI in drone industry across industries.

Type Insights

The station based segment led the market with the largest revenue share of 55.8% in 2024, owing to the rising demand for autonomous, continuous monitoring in fixed locations such as industrial sites, critical infrastructure, and secured facilities. These systems, often known as “drone-in-a-box” solutions, enable fully automated takeoff, landing, and charging, significantly reducing the need for manual intervention. The ability to deploy drones on scheduled patrols or trigger flights based on real-time alerts enhances surveillance, inspection, and response capabilities. Their reliability and scalability make them ideal for applications requiring regular data collection from a fixed point, thereby driving segmental growth.

The cloud-based segment is expected to witness at the fastest CAGR of 15.5% from 2025 to 2033. This growth is primarily driven by the increasing need for scalable, remote, and data-driven drone operations across industries. Businesses and public agencies adopt AI-powered drones for infrastructure inspection, agriculture, environmental monitoring, and emergency response. Cloud platforms enable centralized data processing, real-time analytics, and fleet management from any location. The integration of cloud-based AI systems allows for faster decision-making, improved collaboration, and reduced on-site hardware dependency. The growing reliance on cloud infrastructure supports automated updates, machine learning model deployment, and seamless integration with IoT ecosystems, making the AI-based drones industry the preferred choice for organizations.

Component Insights

The hardware segment led the market with the largest revenue share of 46.4% in 2024, driven by rising demand for high-performance sensors, advanced cameras, onboard AI chips, and autonomous navigation systems. The growing use of AI in drones in infrastructure inspection, defense surveillance, and precision agriculture has increased the need for durable and high-quality hardware capable of operating under challenging conditions. Investments in drone docking stations, thermal imaging units, and lightweight composite materials are enhancing the efficiency, reliability, and deployment capabilities of the AI-powered drone industry, contributing to the dominance of the hardware segment in the market.

The software segment is expected to witness at the fastest CAGR from 2025 to 2033. The increasing demand for real-time data analytics, autonomous navigation, and advanced image processing. AI-powered software enables drones to perform complex tasks such as object detection, route optimization, predictive maintenance, and automated decision-making with minimal human intervention. The rising integration of cloud-based platforms and edge computing allows seamless data sharing, mission planning, and fleet management, making software the core enabler of intelligent drone operations. These advancements are fueling rapid growth in the software segment.

Application Insights

The security & surveillance segment accounted for the largest market revenue share in 2024, driven by increasing concerns around public safety, border control, and critical infrastructure protection. AI-enabled drones enhance situational awareness by providing real-time video surveillance, facial and object recognition, and automated tracking of suspicious activities. These drones can operate in challenging environments and remote areas, supporting law enforcement, military operations, and disaster response with minimal human intervention. The ability to conduct 24/7 monitoring, rapid threat detection, and data-driven decision-making significantly improves operational efficiency and response times, making AI-powered surveillance systems essential and fueling the dominance of this segment in the market.

The agriculture segment is expected to witness at the fastest CAGR from 2025 to 2033, driven by the growing demand for precision farming and smart agricultural practices. AI-enabled drones support farmers by providing real-time aerial insights into crop health, soil conditions, and irrigation efficiency. These systems enable early detection of diseases, pests, and nutrient deficiencies, allowing for timely intervention and reducing crop loss. Automated spraying and mapping using AI-powered drones minimize input costs and optimize resource usage, leading to higher productivity and sustainability. These advantages significantly contribute to the rapid growth of the agriculture segment in the market.

End Use Insights

The military segment accounted for the largest market revenue share in 2024, owing to the increasing adoption of AI in drones for advanced surveillance and combat support operations. These drones are equipped with autonomous navigation, real-time target recognition, and threat detection capabilities, reducing the need for human presence in high-risk environments. Their ability to operate battlefield data on the edge and coordinate in swarms enhances operational efficiency and situational awareness. Continuous government investments in defense modernization, along with rising demand for unmanned systems in national security missions, are significantly increasing the dominance of the military segment in the AI in drone industry.

The commercial segment is expected to witness at the fastest CAGR from 2025 to 2033. Businesses are increasingly turning to AI in drones to perform routine inspections, monitor large assets, and collect high-resolution data with minimal human intervention. These systems reduce costs, enhance safety, and improve accuracy in operations, making them highly attractive to commercial users. The scalability and adaptability of AI-powered drone solutions align well with the digital transformation goals of modern enterprises, further driving rapid growth in this segment.

Regional Insights

North America dominated the AI in drone market with the largest revenue share of 35.53% in 2024, primarily driven by its strong technological infrastructure, defense, and public safety, and the rapid expansion of commercial drone applications. The region is home to major players in AI and drone manufacturing that are continuously innovating in autonomous systems and AI-powered analytics. Regulatory support from bodies like the Federal Aviation Administration (FAA) has facilitated wider experimentation and commercial deployment of drones across sectors. This widespread integration of smart drone technologies, combined with public-private partnerships in R&D, is significantly contributing to the dominance of North America in the AI in drone industry.

U.S. AI in Drone Market Trends

The AI in drone market in the U.S. accounted for the largest market revenue share of 83.46% in North America in 2024, driven by the country’s expanding smart agriculture practices and increasing federal support. American farmers face rising labor shortages and unpredictable climate conditions, and there is a growing shift toward automated, data-driven farming methods. AI in drones offers real-time insights into crop health, soil conditions, and irrigation needs, enabling more sustainable and profitable operations. The private Agri-tech firms are investing in drone technology to improve yield forecasting and minimize input waste, accelerating adoption in rural and agricultural regions.

Europe AI in Drone Market Trends

The AI in drone in Europe is expected to grow at a substantial CAGR of 16.6% from 2025 to 2033. In Europe, the market is driven by the need for real-time data, and AI in drones is being used for precision farming and disaster response. European cities are also leveraging drones for smart city initiatives, enhancing urban planning and public safety operations. Europe’s rigorous environmental policies are encouraging the adoption of drones for monitoring air quality, biodiversity, and natural resources. The combination of supportive regulations, digital readiness, and sustainability commitments is accelerating the deployment of AI in drones, thereby contributing to the robust growth of the market in the European region.

The UK AI in drone industry is expected to grow at a significant CAGR during the forecast period. The country benefits from a mature regulatory ecosystem, a growing demand for advanced automation in public services, and strong investments in drone technology. The UK's Civil Aviation Authority (CAA) has established clear guidelines for UAV operations, which have encouraged wider adoption of AI in drone industry. The integration of AI enhances drone capabilities for real-time analytics, predictive maintenance, and autonomous decision-making, making them a critical tool in the UK's broader digital transformation strategy.

The AI in drone market in Germany is driven by the country’s commitment to digital transformation and infrastructure modernization. Germany’s strong industrial base and highly organized water sector provide fertile ground for integrating smart technologies. Utilities and municipalities are increasingly adopting IoT-enabled AI in drone systems to improve efficiency and reduce operational costs. Government support for Industry 4.0 initiatives further encourages the digitalization of water utilities, driving AI in drone industry adoption across the country.

Asia Pacific AI in Drone Market Trends

The AI in drone market in Asia Pacific is expected to grow at the fastest CAGR of 20.2% from 2025 to 2033, driven by the region’s aggressive digital transformation strategies, government funding, and urban infrastructure development. Investing heavily in AI and drone technologies to modernize critical sectors, including agriculture, surveillance, and water resource management. Leveraging AI in drones to enhance service delivery, ensure environmental sustainability. Public-private partnerships and localized manufacturing are further reducing deployment costs and enhancing accessibility, making Asia Pacific a global hotspot for AI in drone growth.

The China AI in drone market is witnessing robust growth driven by rapid technological advancements and expanding industrial applications. The Chinese government’s emphasis on smart city development, infrastructure modernization, and environmental monitoring is accelerating drone adoption. Investments in AI, 5G, and edge computing are enhancing the capabilities of domestic drone manufacturers. The increasing use of AI-powered drones in agriculture, logistics, and public safety aligns with China’s push for automation and sustainability, significantly propelling the market forward.

The AI in drone market in Japan is gaining traction, driven by the country’s leadership in robotics and automation. National focus on smart infrastructure and disaster resilience, Japan is increasingly deploying AI-powered drones for water management, infrastructure inspection, and emergency response. Government-led initiatives like Society 5.0 and investments in smart city development are further accelerating adoption. Japan’s aging population and shrinking workforce also make autonomous systems vital for maintaining essential services, enhancing the strategic importance of AI in drone industry across sectors.

Key AI In Drone Company Insights

Some of the key players operating in the market include Skydio, Inc. and DJI, among others.

-

DJI is a global leader in the AI in drone industry, offering advanced unmanned aerial systems equipped with intelligent flight modes, real-time object recognition, and autonomous navigation capabilities. The company’s AI-driven platforms support applications in infrastructure inspection, agriculture, public safety, and environmental monitoring. DJI’s integration of edge AI, computer vision, and high-resolution imaging technologies enables drones to perform complex tasks with minimal human intervention, making it a dominant force in the commercial and industrial UAV landscape.

-

Skydio, Inc. provides cutting-edge autonomous drone solutions powered by AI and computer vision technologies, specializing in obstacle avoidance, real-time 3D mapping, and automated mission planning. Widely adopted for defense, infrastructure inspection, and public safety, Skydio’s drones are designed to operate independently in GPS-denied environments. Their Skydio X10 platform incorporates AI for situational awareness and real-time analytics, positioning the company as a key innovator in the high-performance AI drone segment.

Dronehub.ai and Skycatch, Inc. are some of the emerging market participants in the AI in drone industry.

-

Dronehub.ai is an emerging player gaining traction with its fully autonomous drone-in-a-box systems designed for real-time monitoring, industrial inspections, and security operations. The company combines AI-driven flight control, data analytics, and edge computing to enable round-the-clock aerial intelligence without human intervention. Its modular platform supports seamless integration with smart infrastructure, making it an attractive solution for energy, logistics, and environmental applications.

-

Skycatch, Inc. is rapidly emerging as a key provider of AI in drone industry tailored for construction, mining, and large-scale industrial environments. The company’s drones use machine learning algorithms and 3D data processing to deliver actionable insights on site safety, progress tracking, and resource management. Skycatch’s high-accuracy drone mapping technology and AI-based analytics help improve operational efficiency, making it a growing contender in the industrial automation space.

Key AI In Drone Companies:

The following are the leading companies in the AI in drone market. These companies collectively hold the largest market share and dictate industry trends.

- DroneShield Ltd

- Skycatch, Inc.

- Dronehub.ai

- Applied Aeronautics

- AeroVironment, Inc.

- Skydio, Inc.

- DJI

- Parrot Drones SAS.

- Delair.

- EHang

Recent Developments

-

In June 2025, Skydio introduced the Skydio X10, its most advanced enterprise drone designed to elevate AI in drone operations. Equipped with cutting-edge autonomous navigation systems and integrated Teledyne FLIR thermal imaging, the X10 enhances real-time situational awareness and intelligent data capture. This launch strengthens Skydio’s position in the AI in drone industry by offering enhanced capabilities for critical applications such as infrastructure inspection, public safety, and defense operations.

-

In May 2025, DroneShield Ltd launched an AI-powered 3D planning tool designed to enhance the deployment of intelligent drone systems. This tool allows operators to simulate and design layered defense strategies using real-world data, improving mission planning and situational awareness. Integrated into the DroneShield Access Portal, it leverages AI to optimize drone positioning and coverage, supporting critical applications such as infrastructure security, surveillance, and airspace management. This innovation reflects growing industry demand for smart, automated drone deployment solutions in the AI in drone industry.

-

In January 2025, DJI released a major firmware update for its enterprise AI in drone-in-a-box systems, Dock 3, and Matrice 4D. This update introduced smarter patrol routines, enhanced infrared recognition, advanced obstacle avoidance, and AI-based route automation. These improvements aim to boost autonomous flight efficiency and reliability in industrial and security applications, reinforcing DJI’s position in the AI in drone industry and supporting the broader push toward intelligent, automated aerial operations.

AI In Drone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14,273.0 million

Revenue forecast in 2033

USD 51,328.7 million

Growth rate

CAGR of 17.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy ;Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

DroneShield Ltd; Skycatch, Inc.; Dronehub.ai; Applied Aeronautics; AeroVironment, Inc.; Skydio, Inc.; DJI; Parrot Drones SAS.; Delair.; EHang

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Drone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI in drone market report based on type, component, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Station Based

-

Cloud Based

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail

-

Construction

-

Agriculture

-

Search and Rescue

-

Security & Surveillance

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government

-

Commercial

-

Military

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The AI in drone market was estimated at USD 12.29 billion in 2024 and is expected to reach USD 14.27 billion in 2025.

b. The AI in drone market is expected to grow at a compound annual growth rate of 17.9% from 2025 to 2033 to reach USD 51.32 billion by 2033.

b. The Asia Pacific AI in drone is expected to grow at a CAGR of over 20.2% from 2025 to 2033, driven by rising adoption across defense, agriculture, and infrastructure sectors. Governments are investing in AI-powered UAVs for surveillance and disaster response, while industries leverage them for precision farming, inspection, and logistics. Advancements in onboard AI and computer vision further enhance drone autonomy and efficiency across applications.

b. The key players in the AI in drone market are DroneShield Ltd, Skycatch, Inc., Dronehub.ai, Applied Aeronautics, AeroVironment, Inc., Skydio, Inc., DJI, Parrot Drones SAS., Delair., EHang.

b. Key drivers of AI in drone market include growing demand for autonomous surveillance, precision agriculture, infrastructure inspection, and advancements in edge AI, computer vision, smart city initiatives, and logistics applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.