- Home

- »

- Healthcare IT

- »

-

AI-enabled Medical Devices Market Size, Share Report, 2033GVR Report cover

![AI-enabled Medical Devices Market Size, Share & Trends Report]()

AI-enabled Medical Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Hardware), By Technology (Machine Learning, NLP), By Therapeutic Area, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-731-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI-Enabled Medical Devices Market Summary

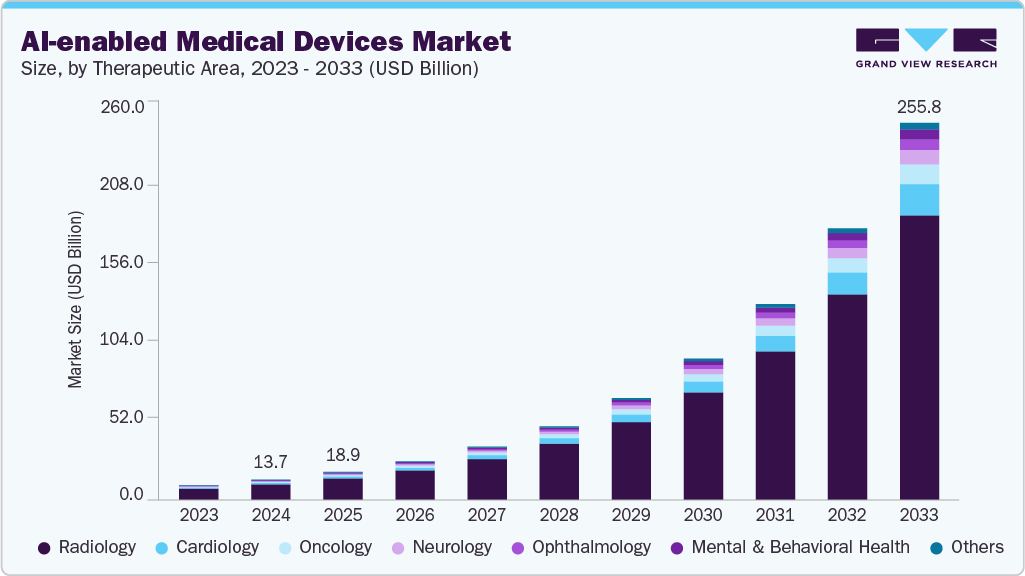

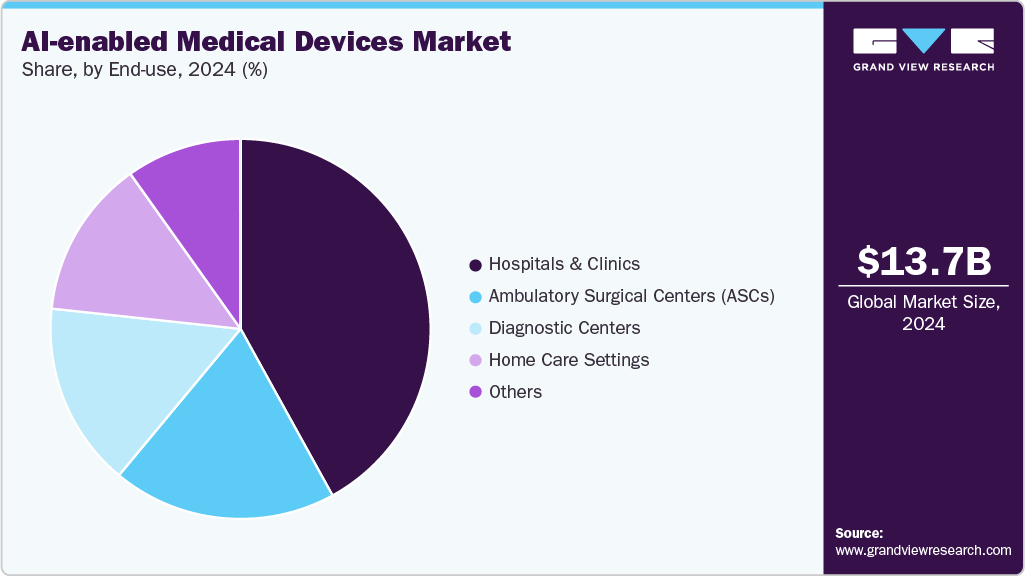

The global AI-enabled medical devices market size was estimated at USD 13.67 billion in 2024 and is projected to reach USD 255.76 billion by 2033, growing at a CAGR of 38.5% from 2025 to 2033. Growing adoption of personalized and precision medicine, medical imaging and diagnostics advancements, and a supportive regulatory and reimbursement landscape contribute to market growth.

Key Market Trends & Insights

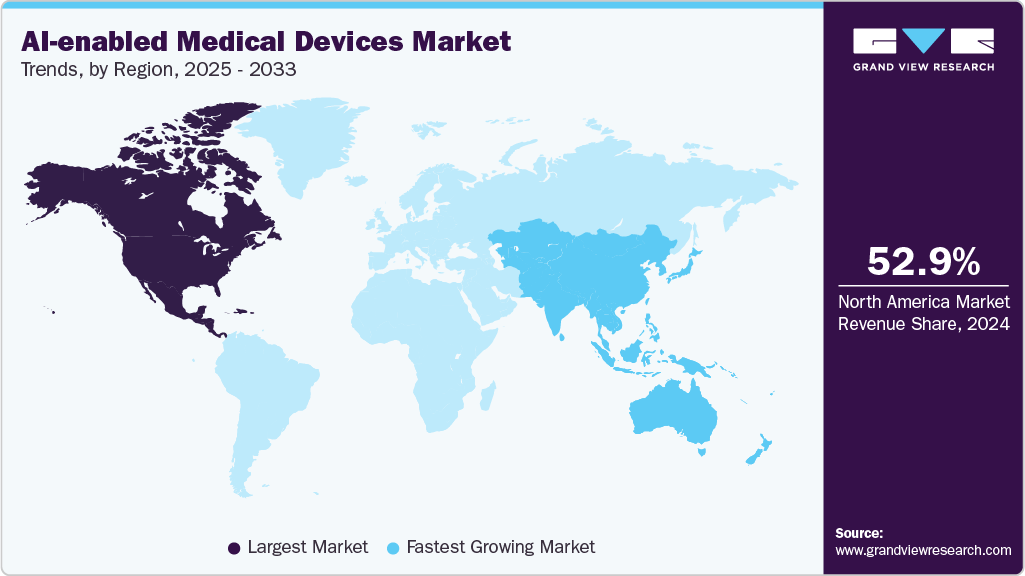

- North America dominated the market, accounting for a 52.86% share in 2024.

- Asia Pacific is anticipated to register the fastest growth rate of 40.84%.

- By component, the software segment dominated the market with a revenue share of 51.15% in 2024.

- By technology, context-aware computing segment is anticipated to register the fastest growth over the forecast period.

- By therapeutic area, radiology segment held the largest market share in 2024.

- By end use, hospitals and clinics segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.67 Billion

- 2033 Projected Market Size: USD 255.76 Billion

- CAGR (2025-2033): 38.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, increasing healthcare digitalization and rising investments and industry collaborations are some other factors fueling market growth further. Personalized medicine drives the adoption of AI-enabled medical devices by enabling tailored healthcare based on individual genetics, environment, and lifestyle. By analyzing genomic data, imaging scans, and clinical records, AI systems deliver actionable insights for precision therapies. These technologies facilitate early disease detection, risk stratification, and treatment monitoring aligned with personalized medical protocols.

Furthermore, advanced predictive analytics empower clinicians to manage patient health, proactively improving clinical outcomes. For instance, in January 2025, Lunit received FDA 510(k) clearance for its Lunit SCOPE IO, an AI-powered tissue analysis software designed for immuno-oncology. The solution helps identify tumor-infiltrating lymphocytes (TILs) in cancer tissues, supporting precision immunotherapy decisions.

Moreover, the evolution of AI algorithms, including deep learning, natural language processing, and computer vision, propels AI medical device capabilities. Improved algorithm accuracy enhances diagnostic precision and reduces error rates. These technological improvements facilitate expanded applications, including AI-assisted imaging, predictive risk modeling, and automated patient monitoring. For instance, in June 2025, Clairity, Inc. became the first FDA-authorized AI platform for breast cancer prediction, receiving De Novo authorization for CLAIRITY BREAST. This innovative platform predicts a woman’s five-year risk of developing breast cancer using only routine screening mammograms.

Recent Strategic Initiatives in AI-Enabled Medical Devices by Therapeutic Area (2024-2025)

Therapeutic Areas

Company/ Institute

Month and Year

Strategic Initiative

Radiology

Radiology Partners

July 2025

Radiology Partners launched MosaicOS, a cloud-based AI-native radiology operating system designed to streamline workflows and unite diagnostic AI tools in one scalable platform.

Philips

May 2025

Philips partnered with NVIDIA to develop a foundational AI model for MRI, leveraging NVIDIA’s advanced AI computing platform.

NVIDIA

March 2025

NVIDIA and GE HealthCare announced a collaboration to advance autonomous diagnostic imaging using physical AI. The partnership integrates NVIDIA’s AI computing with GE HealthCare’s imaging expertise to develop next-generation tools.

Oncology

Myriad Genetics

February 2025

Myriad Genetics collaborated with PATHOMIQ to license PATHOMIQ_PRAD, an AI technology platform for prostate cancer care. The collaboration focuses on advancing AI-driven diagnostic and treatment planning tools to improve accuracy and efficiency.

Roche

April 2025

In April 2025, Roche announced that the U.S. FDA granted Breakthrough Device Designation for its VENTANA TROP2 (EPR20043) RxDx Device, the first AI-driven computational pathology companion diagnostic for non-small cell lung cancer (NSCLC). The device combines AI algorithms and digital pathology systems to quantitatively analyze TROP2 expression in NSCLC tissue, aiding personalized treatment decisions for patients likely to benefit from DATROWAY therapy.

Cardiology

Exo

April 2024

Exo launched FDA-cleared AI applications for heart failure diagnosis and lung assessment on its Exo Iris handheld ultrasound device.

Rudolf Riester GmbH

January 2024

Rudolf Riester GmbH announced the global launch of its telemedicine solution at Arab Health 2024. The solution features the ri-sonic electronic stethoscope integrated with eMurmur AI. This innovation enables accurate remote detection of heart murmurs, enhancing clinical decision-making and expanding telehealth capabilities in cardiovascular diagnostics worldwide.

Neurology

Natus Neuro

May 2025

Natus Neuro launched Brainwatch AI, an artificial intelligence-powered EEG analysis platform. The solution is designed to assist clinicians in detecting and interpreting abnormal brainwave patterns with greater accuracy and efficiency.

Philips

November 2024

Philips and icometrix announced a collaboration at RSNA 2024 to advance precision diagnosis in neurology through AI-based imaging solutions. The partnership integrates icometrix’s AI technology with Philips’ imaging systems to improve detection and monitoring of neurological conditions.

Moreover, regulatory agencies are significantly establishing structured approval pathways for AI-enabled medical devices, fostering innovation. Streamlined approval processes and guidance documents clarify safety, efficacy, and data privacy requirements. Examples include the FDA’s Digital Health Innovation Action Plan and the European Union’s AI Act. Regulatory encouragement incentivizes innovation while ensuring patient safety and device reliability. For instance, in May 2025, Neurocast AI completed FDA device registration, enabling the U.S. launch of its brain health platform. The solution uses AI to monitor cognitive and neurological function through digital biomarkers collected from daily smartphone interactions.

Growing investments from both the public and private sectors also drive the market. Venture capital funding in AI healthcare startups has surged, enabling imaging, monitoring, and diagnostic device innovation. Collaboration between technology companies and healthcare providers creates robust ecosystems for AI deployment. These alliances advance innovation and ensure faster commercialization of AI-enabled devices.

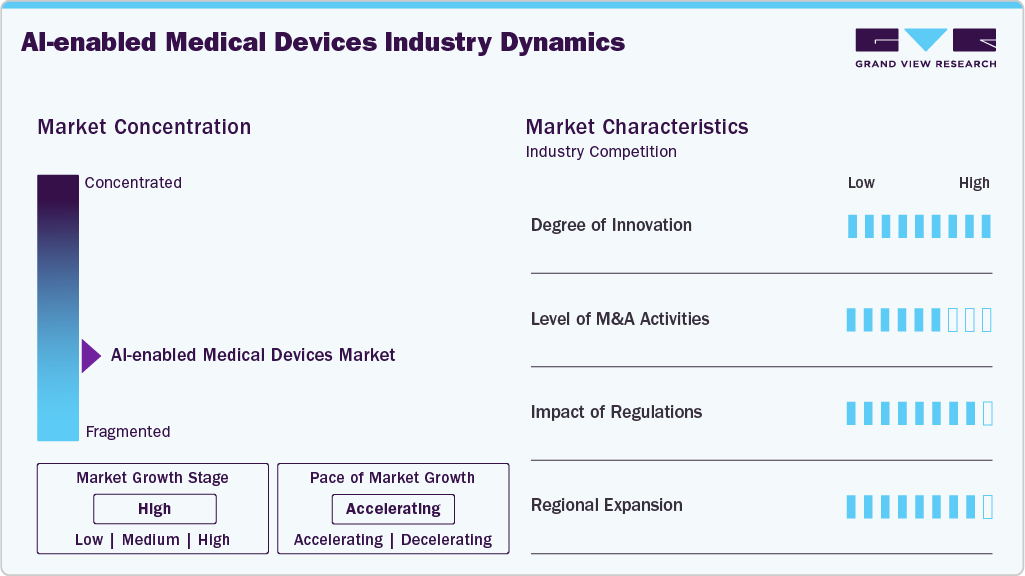

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The AI-enabled medical devices industry is fragmented, with several emerging players entering the market. The degree of innovation, the impact of regulations on industry, and the regional expansion of the industry are high. Moreover, the level of merger & acquisition activities is moderate.

The AI-enabled medical devices industry experiences a high degree of innovation driven by technological advancements. The increasing adoption of artificial intelligence in smart health monitoring devices supports innovations in the market. For instance, in July 2025, Fasikl received FDA clearance for Felix NeuroAI Wristband, the first AI-powered wearable treatment for essential tremors. The device delivers personalized, non-invasive neuromodulation therapy guided by AI algorithms.

The industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in April 2025, Sun Nuclear, a Mirion Medical company, acquired Oncospace, a cloud-based, AI-powered radiation oncology software provider.

In the U.S., the Food and Drug Administration (FDA) regulates these solutions under its Software as a Medical Device (SaMD) framework. The FDA emphasizes performance transparency, clinical validation, and risk management for AI-based tools. Moreover, in the European Union (EU), AI-enabled medical devices fall under the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR). The EU is also pioneering the AI Act, which classifies AI applications in healthcare as high-risk, subjecting them to rigorous compliance checks.

The industry is witnessing high geographical expansion. Companies within the AI-enabled medical devices industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions. With the growing adoption of digital healthcare solutions, the market is expected to grow significantly in the coming years.

Case Study: AI-Powered Wearable for Cardiovascular Monitoring

Background: A leading U.S.-based HealthTech company with over 5 million app installs aimed to transform cardiovascular health monitoring by leveraging AI and wearable technology.

Challenge: The client needed a HIPAA-compliant, real-time monitoring platform capable of accurately detecting atrial fibrillation (AFib) and providing users with actionable health insights. The goal was to improve early detection, reduce reliance on manual processes, and increase user engagement with cardiovascular health.

Solution: In collaboration with DNAMIC, the company developed an AI-powered wearable health platform using Databricks on AWS. The solution integrated machine learning algorithms for real-time AFib detection, seamless data integration, and personalized reporting.

Results:

-

Achieved 92% accuracy in detecting atrial fibrillation.

-

Increased cardiovascular health awareness among users by over 80% within three months.

-

Reduced time-to-detection by 25%.

-

Lowered manual processing by 40%.

Impact: The AI-powered wearable platform improved patient outcomes and demonstrated the potential of AI-driven, real-time monitoring in revolutionizing preventive healthcare and chronic disease management.

Therapeutic Area Insights

Based on therapeutic area, the radiology segment held the largest revenue market share in 2024, owing to the widespread adoption of AI-driven imaging tools for early disease detection, image interpretation, workflow automation, and decision support. The growing volume of diagnostic imaging procedures, rising demand for improved accuracy and efficiency, and integration of AI algorithms in modalities such as CT, MRI, and X-ray have further strengthened radiology’s dominant position in the market.

The neurology segment is anticipated to grow at the fastest CAGR from 2025 to 2033, driven by the rising prevalence of neurological disorders such as Alzheimer’s disease, Parkinson’s disease, stroke, and epilepsy, coupled with the growing need for advanced diagnostic and monitoring solutions. Increasing adoption of AI-powered tools for brain imaging, neuro-monitoring, and predictive analytics, along with investments in early detection and personalized treatment approaches, has fueled the rapid growth of this segment.

Component Insights

Based on component, the software segment held the largest market share of 51.15% in 2024. Hospitals and clinics rely heavily on AI-driven software to interpret imaging scans, predict patient outcomes, and optimize treatment strategies. Software’s flexibility allows integration with existing medical devices, expanding adoption without significant infrastructure changes. Moreover, the growing emphasis on Software-as-a-Medical-Device (SaMD) has further accelerated the expansion of this segment. For instance, TeraRecon's new Intuition product line, updated in October 2024 and delivered through a robust Software-as-a-Service (SaaS) platform, offers advanced AI productivity and industry-leading cardiac magnetic resonance (MR) workflows. The platform's cloud-based deployment offers adaptive compute and storage that scales automatically, seamless clinical software updates, and comprehensive monitoring and analytics to support varied operational workflows.

The services segment is anticipated to grow at the fastest CAGR over the forecast period as healthcare providers increasingly rely on specialized support for deploying, integrating, and maintaining AI technologies. Moreover, hospitals seek partnerships with service providers for predictive analytics, real-world performance tracking, and integration of AI with cloud and on-premises infrastructures. Outsourcing these capabilities allows healthcare facilities to focus on clinical delivery while leveraging external expertise for technology management. For instance, in May 2024, Philips successfully rolled out its ambulatory cardiac monitoring service in Spain using the wearable ePatch and AI-driven Cardiologs analytics platform. 14 Spanish hospitals now use this service to detect life-threatening heart arrhythmias like atrial fibrillation (AF), improving patient comfort and care access while reducing costs.

Technology Insights

Based on technology, the machine learning segment accounted for the largest revenue share of over 35.65% in 2024, owing to the enhanced data interpretation capabilities, increased accuracy & predictive power, widespread integration in consumer and clinical devices, and its ability to support remote and continuous monitoring. Machine learning algorithms are widely used in imaging devices, ECG analysis, and remote monitoring systems, where they enhance clinical decision-making. For instance, in May 2024, Bengaluru-based iHridAI launched HarmonyCVI, an AI- and ML-based diagnostics tool designed for accurate and enhanced analysis of cardiac MRI scans. The platform uses deep learning and cardiothoracic models trained on extensive real-world cardiac imaging data to assess dynamic contours, segmentation, and various cardiac parameters.

The context-aware computing segment is expected to register the highest CAGR in the AI in medical devices market, driven by its ability to enhance clinical decision-making through real-time analysis of patient data, integration of contextual information such as environment and patient history, and support for personalized treatment pathways, ultimately improving diagnostic accuracy, operational efficiency, and patient outcomes.

End Use Insights

Based on end use, the hospitals & clinics segment held the largest market share of over 41.97% in 2024 due to its crucial role in delivering advanced, accurate, and timely care to patients with critical and chronic conditions. Hospitals and clinics are early adopters of AI-enabled monitoring systems, integrating them into existing healthcare infrastructure to enhance clinical decision-making, reduce human error, and improve patient outcomes.

Moreover, healthcare providers are leveraging patient care by combining artificial intelligence in their facilities. For instance, in July 2025, Jaslok Hospital & Research Centre, in partnership with AnginaX AI, launched Maharashtra’s first AI-powered heart disease prevention model. The system quickly assesses cardiac risk in under a minute using data from over 20 clinical and lifestyle factors.

Similarly, in June 2024, UltraSight partnered with Mayo Clinic to advance AI-driven cardiac imaging solutions. The collaboration focuses on developing algorithms that enhance point-of-care ultrasound for cardiac assessments. Thus, such broad adoption across both large-scale and mid-sized facilities drives the dominance of this segment.

The home care settings segment registered the highest CAGR in the AI in medical devices market, supported by the growing demand for remote patient monitoring, personalized care, and chronic disease management outside traditional healthcare facilities. Rising adoption of AI-powered wearable devices, connected health platforms, and virtual assistants enables real-time health tracking and early intervention, reducing hospital visits and healthcare costs, which has significantly contributed to the rapid growth of this segment.

Regional Insights

North America AI-enabled medical devices market accounted for the largest revenue share of over 52.86% in 2024. This is attributed to the advanced healthcare infrastructure, strong adoption of digital technologies, and favorable reimbursement policies. The U.S. leads with significant FDA clearances for AI-powered diagnostic and therapeutic devices, ensuring regulatory support for innovation. Moreover, rising collaborations between technology companies and healthcare providers further fuel innovation.

U.S. AI-Enabled Medical Devices Market Trends

The AI-enabled medical devices market in the U.S. is driven by strong regulatory support. The country has witnessed a surge in approvals for AI-powered imaging, diagnostics, and wearable devices, reflecting robust innovation in healthcare technology. For instance, in July 2025, Medical AI company Cardiosense received FDA 510(k) clearance for its CardioTag, a wearable sensor that noninvasively monitors heart function. CardioTag simultaneously captures electrocardiogram (ECG), photoplethysmogram (PPG), and seismocardiogram (SCG) signals, enabling comprehensive cardiac assessment.

“We’re excited for the foundational role that the CardioTag device will play in building a noninvasive cardiac AI platform, as the signals it collects provide a rich data input upon which AI models for cardiovascular parameters can be developed, such as our pulmonary capillary wedge pressure (PCWP) algorithm.”

-Andrew Carek, co-founder and CTO of Cardiosense

Europe AI-Enabled Medical Devices Market Trends

The AI-enabled medical devices market in Europe is expected to grow significantly during the forecast period. Rising investment in precision medicine and digital health innovation accelerates the integration of AI technologies. Countries like Germany, the UK, and France are leading in deploying AI-powered imaging, surgical robotics, and decision support systems. In addition, hospitals and diagnostic laboratories are increasingly adopting AI-enabled imaging and diagnostic solutions to address workforce shortages in pathology and radiology. For instance, in February 2025, Medtronic partnered with Brainomix to accelerate the adoption of Brainomix’s AI-powered stroke assessment tool across Western Europe. The Brainomix 360 Stroke platform uses AI to analyze CT brain scans, detect ischemic stroke, locate blockages, and assess brain tissue, supporting faster, more accurate treatment decisions.

The UK AI-enabled medical devices market is expected to grow over the forecast period, owing to the robust healthcare infrastructure and increasing investments in AI technologies to enhance patient care. For instance, in December 2023, DeepTek.AI partnered with AI One to enhance medical imaging analysis in the UK. The collaboration focuses on deploying DeepTek’s AI-driven radiology solutions across healthcare providers, enabling faster and more accurate image interpretation. In addition, the NHS's promotion of digital health solutions and remote monitoring services has increased the acceptance and adoption of smart health devices among healthcare providers and patients, thus fueling market growth further.

The AI-enabled medical devices market in Germany is attributed to the increasing investments in healthcare technology and robust healthcare infrastructure. AI-powered medical imaging, robotic-assisted surgery, and predictive monitoring devices are gaining widespread adoption. The country’s focus on integrating AI into nationwide healthcare systems ensures interoperability and scalability, fueling market growth.

Asia Pacific AI-Enabled Medical Devices Market Trends

The AI-enabled medical devices market in the Asia Pacific is experiencing rapid expansion, owing to the rising healthcare demand, increasing investments in AI research, and rapid adoption of digital health technologies. In addition, significant government investments in healthcare infrastructure and research foster a favorable innovation environment. Countries such as China, Japan, South Korea, and India are leading innovation through government-backed AI healthcare policies. Moreover, collaborations between key market players expedite market growth. For instance, in March 2025, Fujifilm partnered with South Korea-based Us2.ai to integrate AI-driven echocardiography analysis software into Fujifilm’s LISENDO 880 and LISENDO 800 cardiovascular ultrasound systems.

India AI-enabled medical devices market is growing due to the demand for affordable and scalable healthcare solutions. The rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer necessitates advanced diagnostic tools. AI-powered diagnostic imaging, wearable monitoring devices, and telehealth platforms are rapidly gaining traction. Furthermore, healthcare providers are investing heavily in AI integration to remain competitive. For instance, in June 2025, S L Raheja Hospital launched AI-enabled digital PET-CT, 3T MRI, and advanced NICU and PICU units. The new technologies aim to enhance precision diagnostics, improve pediatric and neonatal critical care, and strengthen clinical outcomes.

The AI-enabled medical devices market in Japan is expected to grow rapidly, owing to the growing geriatric population, increasing healthcare expenditure, and rapid adoption of artificial intelligence in healthcare. Moreover, increasing public and private funding, coupled with the rapid adoption of telehealth solutions, fuel market growth. For instance, in June 2025, MedHub-AI partnered with Terumo Corporation to market AutocathFFR, an FDA-cleared AI-powered Software as a Medical Device (SaMD) for coronary physiology assessment in Japan.

Latin America AI-Enabled Medical Devices Market Trends

The AI-enabled medical devices market in Latin America is driven by increasing healthcare digitization, rising prevalence of chronic diseases, and growing government support for telehealth. Countries such as Brazil and Argentina are adopting AI-powered diagnostic imaging, cardiac monitoring, and wearable devices to address rising healthcare demand.

Moreover, private healthcare providers are integrating AI-enabled devices to enhance patient outcomes and optimize workflows. For instance, in October 2024, Lenovo and Instituto do Coração - InCor HCFMUSP, the largest cardiology hospital in Latin America, jointly developed the Trada AI platform to advance arrhythmia detection. Powered by high-performance computing and artificial intelligence, the platform analyzes electrocardiogram data with greater accuracy and speed.

“After successful market validation in Brazil, we plan to expand our solution to new markets in Latin America over the next two years, ensuring that our system is adapted to each region's specific demographics and regulatory landscape.”

- Ricardo Bloj, President of Lenovo Brazil.

Middle East and Africa AI-Enabled Medical Devices Market Trends

The AI-enabled medical devices market in MEA is fueled by rising healthcare expenditure, expanding hospital infrastructure, and national healthcare digitization strategies. Moreover, extensive investments from both public and private sectors support AI innovations in imaging systems, predictive analytics, and robotic-assisted surgeries. For instance, in April 2025, Medtronic partnered with Methinks AI, a Barcelona-based company, to enhance stroke care across Central and Eastern Europe, Africa, Turkey, and the Middle East. Methinks AI’s CE-marked software uses AI to detect large vessel occlusions and intracranial hemorrhages from non-contrast CT scans in real-time.

Key AI-Enabled Medical Devices Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key AI-Enabled Medical Devices Companies:

The following are the leading companies in the AI-enabled medical devices market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Medtronic

- Johnson & Johnson (Ethicon)

- Stryker

- Canon Medical Systems

- Zimmer Biomet

- Abbott Laboratories

- Boston Scientific

- Exo Imaging, Inc.

- Empatica

- Aidoc

- Clew Medical

- Eko Health

- Paige AI, Inc.

Recent Developments

- In September 2024, Abbott partnered with iCardio.ai to develop artificial intelligence imaging solutions to improve cardiovascular diagnostics.

“The collaboration will take advantage of iCardio.ai’s internal capabilities and in-house talents. This work with Abbott is aligned with our mission of bringing artificial intelligence to ultrasound. This new focus reflects the continued progress of our organization.”

-iCardio.ai CEO Joseph Sokol

- In May 2024, Siemens Healthineers introduced new cardiology applications powered by artificial intelligence for the Acuson Sequoia ultrasound system, alongside a new 4D transesophageal (TEE) transducer. This system supports a shared service model, enabling a single ultrasound machine to efficiently perform radiology, obstetrics/gynecology, and cardiology exams.

“Siemens Healthineers is committed to pioneering ultrasound technology that transforms clinical care and improves patient outcomes. Adding these cardiology applications with artificial intelligence-powered features and our new 4D TEE transducer to the Acuson Sequoia will benefit clinicians who need the highest level of performance in nearly every clinical scenario.”

- Daniel Frisch, global head of Radiology Ultrasound at Siemens Healthineers.

- In February 2024, Philips launched the AI-enabled CT 5300 system at ECR 2024. The system is designed to enhance diagnostic confidence, streamline workflows, and improve patient care across cardiac, interventional, and screening applications.

“We’ve leveraged AI in virtually every aspect of the CT 5300, freeing both CT technicians and radiologists from tedious, time-consuming tasks so they can spend more time focused on their patients.”

- Frans Venker, Business Leader of CT at Philips

- In October 2023, Paige Lymph Node, an AI-based tool for detecting breast cancer metastases in lymph nodes, received FDA Breakthrough Device Designation.

“Pathologic assessment of lymph nodes in patients [with breast cancer] is critically important for prediction of outcome and treatment, yet the process is time-consuming and error prone.”

- David S. Klimstra, MD, founder and chief medical officer at Paige

AI-enabled Medical Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.89 billion

Revenue forecast in 2033

USD 255.76 billion

Growth rate

CAGR of 38.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, therapeutic area, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Siemens Healthineers; GE Healthcare; Philips Healthcare; Medtronic; Johnson & Johnson (Ethicon); Stryker; Canon Medical Systems; Zimmer Biomet; Abbott Laboratories; Boston Scientific; Exo Imaging, Inc.; Empatica; Aidoc; Clew Medical; Eko Health; Paige AI, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI-enabled Medical Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI-enabled medical devices market report based on component, technology, therapeutic area, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Hardware

-

AI-enabled Medical Devices

-

Smart Wearables

-

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning

-

Deep learning

-

Supervised

-

Unsupervised

-

Others

-

-

Natural Language Processing (NLP)

-

Computer Vision

-

Context-Aware Computing

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiology

-

Neurology

-

Radiology

-

Oncology

-

Mental and Behavioral Health

-

Ophthalmology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Diagnostic Centers

-

Ambulatory Surgical Centers (ASCs)

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global AI-enabled medical devices market size was estimated at USD 13.67 billion in 2024 and is expected to reach USD 18.89 billion in 2025.

b. The global AI-enabled medical devices market is expected to grow at a compound annual growth rate of 38.50% from 2025 to 2033 to reach USD 255.76 billion by 2033.

b. The software segment held the largest market share of 51.15% in 2024.

b. Some key players operating in the AI-enabled medical devices market include Siemens Healthineers; GE Healthcare; Philips Healthcare; Medtronic; Johnson & Johnson (Ethicon); Stryker; Canon Medical Systems; Zimmer Biomet; Abbott Laboratories; Boston Scientific; Exo Imaging, Inc.; Empatica; Aidoc; Clew Medical; Eko Health; and Paige AI, Inc.

b. Key factors that are driving the AI-enabled medical devices market are growing adoption of personalized and precision medicine, medical imaging and diagnostics advancements, and a supportive regulatory and reimbursement landscape.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.