- Home

- »

- Next Generation Technologies

- »

-

AI-enabled Testing Market Size, Share & Trends Report, 2030GVR Report cover

![AI-enabled Testing Market Size, Share & Trends Report]()

AI-enabled Testing Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Cloud, On-premise), By End-use Industry (Government, BFSI), By Application, By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-089-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI-enabled Testing Market Summary

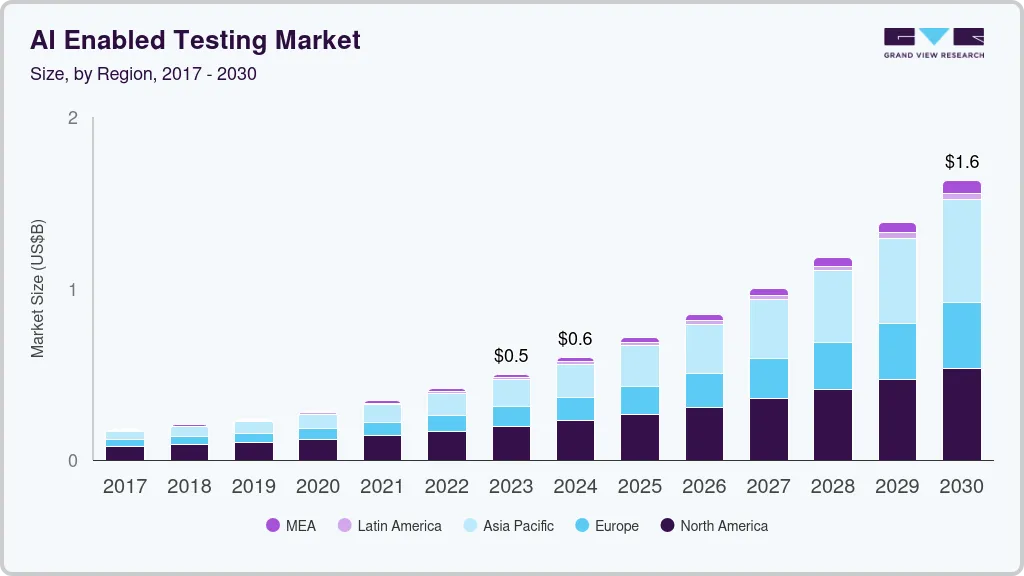

The global AI-enabled testing market size was estimated at USD 414.7 million in 2022 and is projected to reach USD 1.63 billion by 2030, growing at a CAGR of 18.4% from 2023 to 2030. Various major players are offering AI-enabled testing solutions; for instance, Google’s Deep Test is an AI-powered testing tool that uses Machine Learning (ML) to generate test cases and execute them on web applications automatically.

Key Market Trends & Insights

- North America dominated the AI-enabled testing market with the largest revenue share of over 39% in 2022.

- By component, the software segment led the market with the largest revenue share of 77% in 2022.

- By deployment, the on-premises segment led the market with the largest revenue share of 61% in 2022.

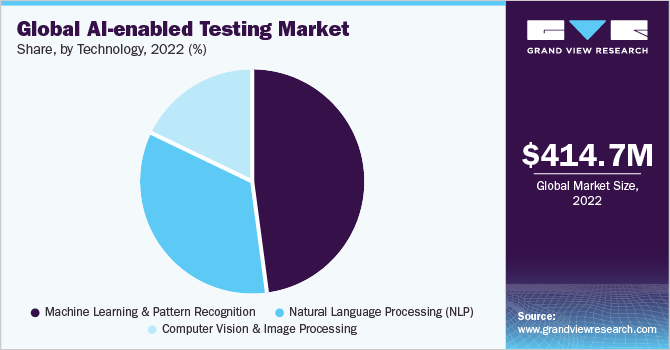

- By technology, the machine learning & pattern recognition segment led the market with the largest revenue share of 47% in 2022.

- By application, the test automation segment held the largest revenue share of over 58% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 414.7 Million

- 2030 Projected Market Size: USD 1.63 Billion

- CAGR (2023-2030): 18.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

It aims to improve test coverage and reduce the effort required to create test cases. Moreover, prominent innovations and developments in AI-enabled testing tools are fueling market growth. For instance, in May 2023, Parasoft released Jtest, a productivity tool for Java developers, and DTP in version 2023.

Parasoft Jtest with AI enhancements enhances code quality, lowers defect rates, and expedites software delivery. Significant innovations and launches in computer vision & image processing technology are anticipated to drive market growth. For instance, Applitools's visual AI for software testing technology provides accuracy using trained AI and ML algorithms. In April 2023, using text prompts, the vision AI company Chooch created Image Chat, a novel method for creating intricate computer vision models. The company introduced this Artificial Intelligence (AI) computer vision solution to enhance data dependability and accuracy, particularly in applications with object detection and precise reasoning requirements.

Small and Medium-sized Enterprises (SMEs) frequently employ AI testing services to evaluate the effectiveness of software programs. For SMEs, AI testing services offer many advantages, including lower costs, more efficiency, and improved user experience. SMEs have begun utilizing AI-based automation solutions, such as bots or other intelligent technology, to help their business activities throughout the execution phase rather than having to start from scratch each time.

Component Insights

The software segment held the highest revenue share of over 77% in 2022. SMEsfrequently employ AI testing services to evaluate the effectiveness of software programs. For SMEs, AI testing services offer many advantages, including lower costs, more efficiency, and improved user experience. Moreover, organizations streamline preparing, managing, and analyzing test data by leveraging data-wrangling software in AI-enabled testing. This integration enhances testing accuracy, efficiency, and effectiveness by ensuring that the correct data is available in a suitable format, enabling comprehensive test coverage and reliable results.The service segment is estimated to grow at the highest CAGR over the forecast period.

The significant advancement of managed and professional services accounts for this growth. AI-enabled testing tools often requires significant computational resources and infrastructure to support complex algorithms and large-scale testing. Managed services providers like QA Mentor, Testlio, Capgemini, and others offer the necessary infrastructure, such as cloud-based platforms or dedicated environments, to support AI testing initiatives. They also scale resources based on demand, ensuring optimal performance, quality monitoring, and cost-efficiency; for instance, Capgemini’s embedded quality engineering in “ADMnext,” a whole stack of Application Development and Maintenance (ADM) services, have the capabilities and solutions to address a wide array of challenges and help the user make better business decisions ensuring better performance.

Deployment Insights

The on-premises segment led the market in 2022 accounting for over 61% of the global revenue. On-premises environments require the necessary infrastructure to support AI-enabled testing. This comprises setting up servers, storage, and networking capabilities to handle the computational requirements of AI algorithms and models. Organizations collect, store, and manage the relevant data required for AI-enabled testing within their on-premises infrastructure. Data collection involves ensuring data security, privacy, and compliance with regulations governing the handling of sensitive or confidential information. Moreover, organizations must customize or develop connectors, plugins, or interfaces to integrate AI capabilities into their existing testing tools, frameworks, or processes to ensure smooth collaboration and integration of AI techniques with the on-premises testing environment fueling the market growth.

The cloud segment is estimated to grow at the highest CAGR over the forecast period. This growth is led by cloud-based solutions offering virtually unlimited scalability and resources. Organizations efficiently deliver and scale up or down their AI-enabled testing infrastructure based on demand. This flexibility allows them to handle large-scale testing requirements efficiently and cost-effectively. Moreover, cloud-based AI-enabled testing tools can seamlessly integrate with other cloud services, such as cloud-based test management tools, version control systems, bug tracking systems, and continuous integration/continuous deployment (CI/CD) pipelines. This integration streamlines the software development and testing process, enhancing efficiency and collaboration.

Technology Insights

The machine learning & pattern recognition segment held the largest revenue share of over 47% in 2022. Al-enabled testing tools integrated with machine learning and pattern recognition technologies are augmenting the development of Self-Optimizing Networks (SON), which allow operators to automatically improve network quality based on traffic statistics by time zone and location; it is made possible by these cutting-edge solutions for Communication Service Providers (CSPs). Moreover, they employ cutting-edge algorithms to spot trends in the data, allowing telecom companies to identify and anticipate network flaws and avert problems before it negatively impacts customers.

The NLP segment is witnessing rapid growth owing to the acceptance of novel technology advancements. Increased customer demands for cloud-based technology and advancements in communication infrastructure are accelerating NLP growth. NLP is the interface between humans and machines, and it comprises executing computer programs and analyzing data. Low cost, high scalability, and high usage of smart devices across industries are expected to contribute to the industry expansion over the forecast period. Moreover, the expansion of the e-commerce industry and the perception of online sales channels are projected to increase the demand for NLP to enhance the consumer experience through personal attention and query handling.

Application Insights

The test automation segment held the largest revenue share of over 58% in 2022. The growth is led by AI-testing tools, which greatly enhance test automation by leveraging Artificial Intelligence(AI) algorithms and techniques. Combined with cloud computing instances, it can bring even more scalability and flexibility to the testing process. By combining AI-enabled testing with test automation, organizations achieve higher efficiency, accuracy, and productivity in their testing processes. AI algorithms also enhance test case generation, data management, test execution, analysis, and predictive capabilities, augmenting the capabilities of test automation tools and frameworks.

This ultimately leads to improved software quality, faster time-to-market, and better overall testing outcomes fueling the market growth.The infrastructure optimization segment is anticipated to showcase significant growth over the forecast period. Organizations leveraging AI techniques improve their testing infrastructure's efficiency, scalability, and cost-effectiveness. Rapid advancement in cloud infrastructure has enabled the IT Infrastructure to be flexible, intangible, and on-demand. AI algorithms automatically generate test cases based on the system's analysis under test, reduce the manual effort required for test case creation, and ensure comprehensive test coverage. Moreover, AI prioritizes test cases based on code changes, defect history, or criticality, allowing organizations to focus their testing efforts on high-priority areas.

End-Use Industry Insight

The IT & telecommunication segment held the largest revenue share of over 18% in 2022. The rising demand for efficient customer services and operating networks in the telecommunication industry are boosting market growth. AI testing has significantly impacted the telecommunication industry, bringing numerous benefits and advancements to various aspects of telecommunications. AI testing techniques automate the testing process, enabling faster and more efficient testing of telecommunication networks, services, and systems. AI algorithms generate test cases, execute tests, and analyze results at a scale, reducing the manual effort and time required for testing. It improves the efficiency of testing cycles and enables faster time-to-market for new telecom services and features. Moreover, the algorithm analyzes network traffic patterns, identifies anomalies, and detects potential security threats. This enables telecom operators to respond quickly to security breaches, detect and mitigate vulnerabilities, and ensure the integrity and privacy of customer data.

The BFSI segment is witnessing substantial growth and significant advancements in various testing areas. It plays a crucial role in fraud detection and prevention within the BFSI Industry. AI algorithms also analyze large volumes of transactional data, customer behavior patterns, and historical fraud cases to identify potentially fraudulent activities in real time. This helps financial institutions detect and prevent fraudulent transactions, minimizing financial losses and safeguarding customer assets. Moreover, AI-enabled testing aids financial institutions in assessing risks and ensuring compliance with regulatory requirements. AI algorithms analyze vast amounts of data, including transactional records, customer profiles, and regulatory guidelines, to identify potential compliance breaches or risks and assist in conducting comprehensive compliance testing and proactively mitigating potential risks.

Regional Insights

North America dominated the market in 2022, accounting for over 39% share of the global revenue. Prominent growth of automation testing is fueling the market growth in this region. AI regression testing is increasingly being used in mobile applications, influencing AI-enabled testing in North America as they improve the product's functionality. Moreover, the United States is expected to advance significantly over the forecast period due to technology providers' presence. Increasing urbanization, changing lifestyles, rising disposable income, and advanced technologies fuel the market growth in this region.

Increasing investment in R&D activities, increasing preference for automated testing solutions, and launching new products are also driving the market growth in the U.S. Asia Pacific is anticipated to witness significant CAGR growth over the forecast period. India, China, Japan, and other countries of Asia Pacific are innovating and launching new products and platforms to fuel market growth. Major innovations of 5G in Japan are propelling market growth in this region. The usage of AI-enabled testing technologies in Japan may increase as a result of a potential spike in demand for automated and efficient telecom infrastructure testing and maintenance. Moreover, In June 2022, Singapore introduced the first AIgovernance testing framework and toolbox to assist AI developers in objectively and independently evaluating their systems.

Key Companies & Market Share Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in May 2023, Applitools launched “Applitools Execution Cloud,” a cloud-based testing platform to execute their current tests against testing infrastructure using AI. By introducing this new feature to the Applitools Ultrafast Test platform, organizations utilizing open-source frameworks like WebDriver or Selenium will access best-in-class AI features, like self-healing, presently only found in proprietary tools.Some of the prominent players in the global AI-enabled testing market include:

-

Sauce Labs Inc.

-

ReTest GmbH

-

D2L Corp.

-

Functionize Inc.

-

Diffblue Ltd.

-

Applitools

-

Capgemini SE

-

testRigor

-

Micro Focus International Plc

-

Tricentis

AI-enabled Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 498.5 million

Revenue forecast in 2030

USD 1.63 billion

Growth rate

CAGR of 18.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, technology, application, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Sauce Labs Inc.; ReTest GmbH; D2L Corp.; Functionize Inc.; Diffblue Ltd.; Applitools, Capgemini SE; testRigor; Micro FocusInternational Plc; Tricentis; Perforce Software Inc.; mabl Inc.; IBM Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI-enabled Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global AI-enabled testing market based on component, deployment, technology, application, end-user industry, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Service

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning and Pattern Recognition

-

Natural Language Processing (NLP)

-

Computer Vision and Image Processing

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Test Automation

-

Infrastructure Optimization

-

Others

-

-

End-Use Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

IT & Telecommunication

-

Energy & Utilities

-

BFSI

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI-enabled testing market size was estimated at USD 414.7 million in 2022 and is expected to reach USD 498.5 million in 2023.

b. The global AI-enabled testing market is expected to grow at a compound annual growth rate of 18.4% from 2023 to 2030 to reach USD 1.63 billion by 2030.

b. North America accounted for the highest value share in 2022 owing to Al's strong research and development capabilities in developed economies, research institutes, and several prominent Al testing providers in this region.

b. Some key players operating in the AI-enabled testing market include Sauce Labs Inc.; ReTest GmbH.; Functionize Inc.; Diffblue Ltd.; Applitools; Capgimini SE; testRigor; and Micro focus international Plc; among others.

b. Key factors that are driving the AI-enabled testing market growth include the increasing demand for AI and ML applications, the growing adoption of edge computing, IoT and AI testing across several industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.