- Home

- »

- Next Generation Technologies

- »

-

AI In Energy Distribution Market Size, Industry Report, 2033GVR Report cover

![AI In Energy Distribution Market Size, Share & Trends Report]()

AI In Energy Distribution Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Application, By Deployment (On-premises, Cloud), By End Use (Industrial, Commercial, Residential, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-728-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Energy Distribution Market Summary

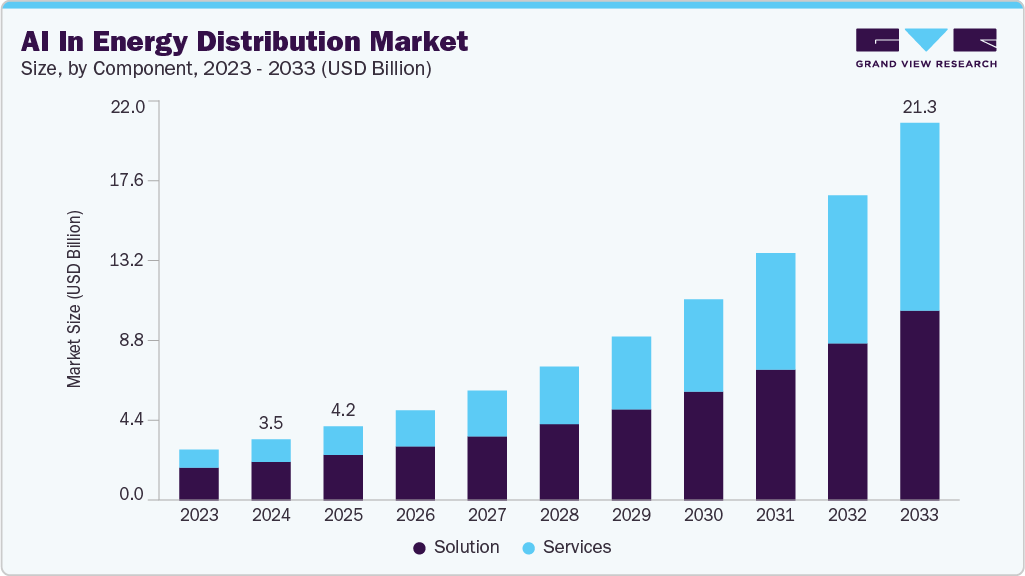

The global AI in energy distribution market size was estimated at USD 3.45 billion in 2024 and is projected to reach USD 21.27 billion by 2033, growing at a CAGR of 22.5% from 2025 to 2033. This growth is driven by increasing demand for intelligent grid management, real-time energy optimization, and seamless integration of renewable sources to enhance efficiency and sustainability, rising investments in smart infrastructure, growing energy demand, and the need to reduce carbon emissions through predictive analytics and automation.

Key Market Trends & Insights

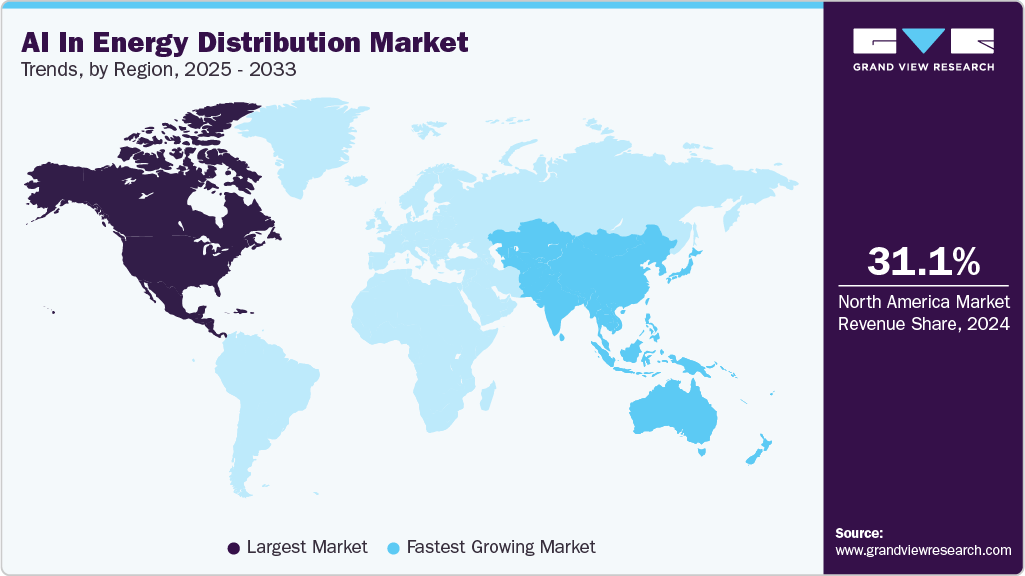

- North America dominated the global AI in energy distribution market with the largest revenue share of 31.1% in 2024.

- The U.S. AI in energy distribution industry led North America in 2024.

- By component, the solution segment held the largest revenue share of 63.1% in 2024.

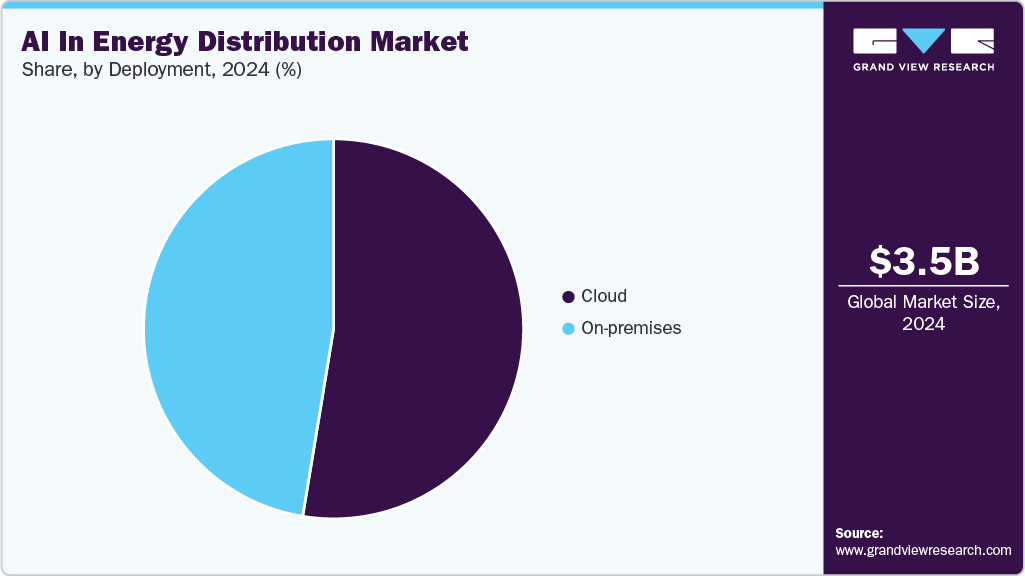

- By deployment, the cloud segment held the dominant market position in 2024.

- By end use, the industrial segment held the dominant market position in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.45 Billion

- 2033 Projected Market Size: USD 21.27 Billion

- CAGR (2025-2033): 22.5%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

The increasing complexity and decentralization of modern power grids drive the global AI in energy distribution industry’s growth. Integrating renewable energy sources such as solar and wind introduces variability in energy generation, requiring advanced AI algorithms to balance supply and demand dynamically. Utilities rely on AI to process vast amounts of sensor data, enabling real-time monitoring and swift identification of system anomalies, equipment failures, and energy losses. Furthermore, the growing adoption of distributed energy resources and microgrids demands coordination and optimization capabilities that AI provides. The push for enhanced operational efficiency, reduced maintenance costs, and improved customer service accelerates AI integration in energy distribution.

Moreover, the AI in energy distribution market is driven by continuous innovation in AI-driven predictive analytics and autonomous control systems that improve grid stability and resilience. Emerging AI technologies support advanced fault tolerance by predicting potential disruptions before they occur, reducing outage frequency and duration. Electric vehicle infrastructure expansion increases energy distribution complexity, as AI systems manage peak load demands and optimize charging schedules for grid stability. Moreover, the growing use of energy storage solutions introduces new variables in supply management, which AI helps coordinate efficiently. Cross-industry collaboration and digital twin technologies combining simulation with AI enhance system design and performance monitoring, expanding AI’s role in strategic grid management.

Furthermore, governments and international agencies emphasize decarbonization targets and grid modernization, encouraging utilities to deploy AI for smarter energy distribution. AI enables better integration of green energy while minimizing environmental footprint through improved energy efficiency and demand-side management programs. Enhanced cybersecurity protocols increasingly integrate AI to detect and mitigate cyber threats targeting energy infrastructure, safeguarding operational continuity. In addition, growing public and private investments in smart grid projects worldwide facilitate wider adoption of advanced AI tools that enhance transparency, predictive maintenance, and resilience in energy distribution networks.

Component Insights

The solution segment led the AI in energy distribution industry in 2024, accounting for over 63.0% of global revenue, driven by offering comprehensive software suites and hardware integrations that provide end-to-end automation for grid operations. These solutions integrate AI-driven analytics for load balancing, congestion management, and predictive maintenance, reducing operational costs and enhancing grid resilience. Advanced AI algorithms continuously learn from real-time data streams, enabling proactive decision-making and rapid adaptation to changing grid conditions. The growing complexity of modern energy systems necessitates holistic AI solutions, which encourage further investment and adoption in this segment.

The services segment is predicted to experience the fastest growth in the forecast years as energy companies increasingly require specialized expertise to implement, customize, and maintain AI frameworks. Professionals provide vital services such as system integration, cloud migration, AI model training, and ongoing support to optimize system performance. The evolution of AI technologies demands continuous upgrades and scalability, driving demand for managed services. In addition, change management and staff training services assist organizations in maximizing the benefits of AI deployment, while adherence to regulatory and cybersecurity standards enhances service market potential.

Application Insights

The smart grid management segment accounted for the largest revenue share of the AI in energy distribution market in 2024, driven by automating grid functions such as real-time demand forecasting, distributed energy resource coordination, and fault management through AI agents. These AI systems facilitate decentralized control architectures and enable granular visibility into grid health, allowing operators to swiftly identify and mitigate faults, optimize power flows, and enhance overall efficiency. The increasing adoption of IoT sensors integrated with AI analytics strengthens grid monitoring capabilities, ensuring reliability and reducing outage times.

The renewable energy integration segment is expected to grow at the fastest CAGR during the forecast period as AI manages the intermittency and unpredictability of renewable sources by optimizing energy storage, dispatch, and grid stabilization efforts. AI-driven forecasting models predict weather-dependent energy generation, improving supply-demand matching. In addition, AI enables dynamic scheduling and control of hybrid solar, wind, and battery storage systems. These capabilities support grid operators in meeting clean energy mandates while maintaining stability and minimizing curtailment.

Deployment Insights

The cloud segment accounted for the prominent revenue share of the AI in energy distribution industry in 2024, as it offers scalable and cost-effective platforms that support distributed AI processing, large-scale data aggregation, and seamless multi-site coordination. Cloud services facilitate continuous AI model updating via machine learning pipelines, enabling rapid responsiveness to evolving grid conditions. They also support collaboration among multiple stakeholders, such as utilities, regulators, and prosumers, enhancing transparency and system optimization. Enhanced cybersecurity frameworks in cloud environments further assure secure data handling and system reliability, driving adoption.

The on-premises segment is anticipated to grow significantly during the forecast period, driven by requirements for low-latency decision-making, stringent data privacy regulations, and mission-critical operations. This segment caters to utilities and industries needing precise control over internal energy distribution systems and AI processes. On-premises deployments offer customization suited for legacy infrastructure and integration with SCADA systems. Hybrid architectures combining on-premises and cloud elements provide flexibility, allowing organizations to address security concerns while benefiting from cloud scalability.

End Use Insights

The industrial segment accounted for the largest revenue share of the AI in energy distribution market in 2024, by leveraging AI to optimize energy usage in manufacturing, chemical processing, and other heavy industries where energy costs and reliability affect operational efficiency. AI agents analyze machinery performance, predict maintenance needs, and reschedule energy-intensive processes based on grid conditions, reducing energy waste and operational risk. In industries with complex energy demands, AI enables dynamic load management, facilitating interaction with smart grids and allowing participation in demand response programs for economic benefits.

The residential segment is anticipated to grow at the fastest CAGR during the forecast period, driven by consumer adoption of smart home devices, solar panels, battery storage, and electric vehicles. AI supports energy consumption optimization by intelligently managing appliance usage, integrating household renewable energy, and scheduling EV charging to minimize costs and balance grid load. Personalized energy insights and adaptive control improve convenience and efficiency for homeowners, promoting energy savings and participation in demand response schemes. Expanding availability of affordable smart energy products further propels AI integration in residential settings.

Regional Insights

North America dominated the AI in energy distribution market, with a revenue share of over 30% in 2024, due to a mature energy infrastructure, high technology penetration, and active government initiatives promoting grid modernization and clean energy adoption. The region’s utilities lead the implementation of AI for grid automation, predictive analytics, and cyber threat defense. Investment in innovation and widespread use of advanced metering infrastructure create conducive conditions for AI-enabled energy distribution.

U.S. AI in Energy Distribution Market Trends

The U.S. AI in energy distribution industry is expected to grow significantly in 2024, driven by federal and state-level policy incentives supporting renewable integration, smart grid deployment, and energy efficiency improvements. National programs emphasize resilience against weather-related disruptions and cybersecurity risks, catalyzing the adoption of AI for predictive maintenance and threat mitigation. Strong private sector participation and collaboration among technology firms and utilities accelerate AI technology commercialization.

Europe AI in Energy Distribution Market Trends

The AI in energy distribution industry in Europe is expected to grow significantly over the forecast period as stringent environmental regulations and ambitious decarbonization targets create demand for advanced energy management tools. Unified policies within the European Union, such as the Green Deal, incentivize utilities to invest in AI-powered grid modernization and renewable management. European countries emphasize open data sharing, interoperability, and cybersecurity standards, facilitating AI adoption.

Asia Pacific AI in Energy Distribution Market Trends

The AI in energy distribution industry in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period due to accelerated urbanization, increasing electrification, and proactive government support for smart grid and renewable energy investments. Emerging economies leverage AI technologies to address energy access, improve grid efficiency, and integrate distributed energy resources at scale. Rapid expansion of industrial and residential power demand creates opportunities for AI-driven demand response and load forecasting.

Key AI in Energy Distribution Company Insights

Some key companies in the AI in energy distribution industry are Siemens AG; Alpiq; SmartCloud Inc.; and ABB.

-

Siemens AG, Inc. is an energy technology provider offering comprehensive AI-powered solutions for energy distribution networks. The company integrates artificial intelligence into its smart grid platforms to optimize grid management, enhance predictive maintenance, and increase operational efficiency. Siemens leverages advanced analytics and automation for real-time decision-making, supporting utilities and industrial clients in managing distributed energy resources, demand response, and grid resilience initiatives. Its growing portfolio in digital energy transformation positions Siemens as a key innovator in driving intelligent energy distribution.

-

Alpiq is a prominent energy services provider specializing in digital power generation and distribution solutions. The company adopts AI-driven technologies to streamline energy flow, forecast demand, and enable efficient integration of renewable resources into grid operations. Alpiq leverages artificial intelligence for advanced load balancing, automated trading, and predictive diagnostics, serving utilities and commercial customers with smart energy management systems. Their focus on digitalization and innovation supports Alpiq’s role in enhancing reliability, sustainability, and flexibility in energy distribution networks.

Key AI in Energy Distribution Companies:

The following are the leading companies in the AI in energy distribution market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG

- Alpiq

- SmartCloud Inc.

- ABB

- General Electric

- Hazama Ando Corporation

- ATOS SE

- AppOrchid Inc.

- Zen Robotics Ltd.

- Honeywell International Inc.

Recent Developments

-

In July 2025, Dubai Electricity and Water Authority (DEWA) accelerated the integration of AI technologies throughout its operations, with a particular focus on energy distribution. This strategic initiative is designed to boost operational efficiency, enhance service quality, and improve reliability for its customers. A cornerstone of this transformation is DEWA’s smart grid infrastructure, supported by a substantial investment of approximately USD 1.9 billion allocated through 2035.

-

In June 2025, the energy department initiated efforts to leverage AI to enhance professionalism in the operations and management of electricity distribution, with the goal of improving Karnataka’s power sector. This strategic adoption of AI technologies aims to optimize grid management, increase efficiency, reduce losses, and strengthen the reliability of the power supply across the state. By integrating AI-driven solutions, the department seeks to modernize the power infrastructure, facilitate predictive maintenance, and enable data-driven decision-making, thereby contributing to Karnataka's energy landscape's overall advancement and sustainability.

-

In January 2025, ABB entered into a strategic partnership with Edgecom Energy, a Toronto-based energy management startup, to advance energy optimization solutions for industrial and commercial users. Edgecom Energy’s innovative platform leverages artificial intelligence to assist clients in managing and reducing peak power demand, thereby improving overall energy efficiency and cost-effectiveness. Distinctively, it is the first platform in the market to incorporate a generative AI copilot, enhancing the experience through intelligent, real-time optimization recommendations.

AI In Energy Distribution Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.18 billion

Revenue forecast in 2033

USD 21.27 billion

Growth rate

CAGR of 22.5% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, end use, component, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Siemens AG; Alpiq; SmartCloud Inc.; ABB; General Electric; Hazama Ando Corporation; ATOS SE; AppOrchid Inc.; Zen Robotics Ltd.; Honeywell International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Energy Distribution Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI in energy distribution market report based on component, application, deployment, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Smart Grid Management

-

Predictive Maintenance & Equipment Monitoring

-

Energy Demand Forecasting

-

Renewable Energy Integration

-

Other

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premises

-

Cloud

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Commercial

-

Residential

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in energy distribution market size was estimated at USD 3.45 billion in 2024 and is expected to reach USD 4.18 billion in 2025.

b. The global AI in energy distribution market is expected to grow at a compound annual growth rate of 22.5% from 2025 to 2033 to reach USD 21.27 billion by 2033.

b. North America dominated the AI in energy distribution market with a share of 31.1% in 2024. This is attributable to the federal and state-level policy incentives supporting renewable integration, smart grid deployment, and energy efficiency improvements. National programs emphasize resilience against weather-related disruptions and cybersecurity risks, catalyzing the adoption of AI for predictive maintenance and threat mitigation.

b. Some key players operating in the AI in energy distribution market include Siemens AG, Alpiq, SmartCloud Inc., ABB, General Electric, Hazama Ando Corporation, ATOS SE, AppOrchid Inc., Zen Robotics Ltd., and Honeywell International Inc.

b. Key factors that are driving the AI in energy distribution market growth include Siemens AG, Alpiq, SmartCloud Inc., ABB, General Electric, Hazama Ando Corporation, ATOS SE, AppOrchid Inc., Zen Robotics Ltd., and Honeywell International Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.