- Home

- »

- Next Generation Technologies

- »

-

AI Generated Content Market Size, Industry Report, 2033GVR Report cover

![AI Generated Content Market Size, Share & Trends Report]()

AI Generated Content Market (2025 - 2033) Size, Share & Trends Analysis Report By Content Type (Text, Image, Audio), By Deployment (Cloud, Hybrid), By Technology, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-776-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Generated Content Market Summary

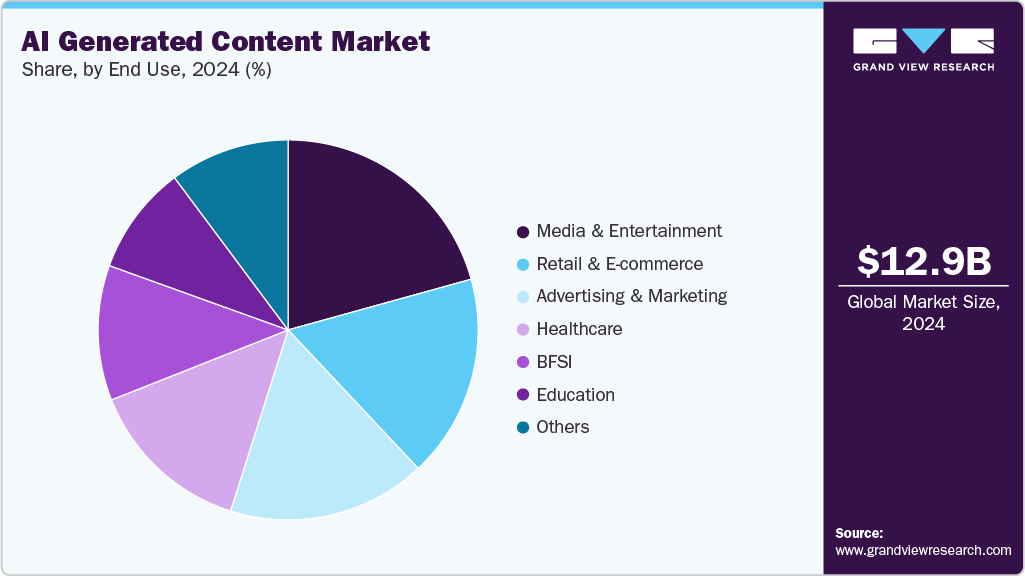

The global AI generated content market size was estimated at USD 12,879.0 million in 2024 and is projected to reach USD 53,788.8 million by 2033, growing at a CAGR of 17.3% from 2025 to 2033. The market is driven by increasing demand for automated, scalable content creation across digital platforms as growing internet penetration and digital transformation efforts require vast volumes of personalized, high-quality content to engage diverse audiences efficiently.

Key Market Trends & Insights

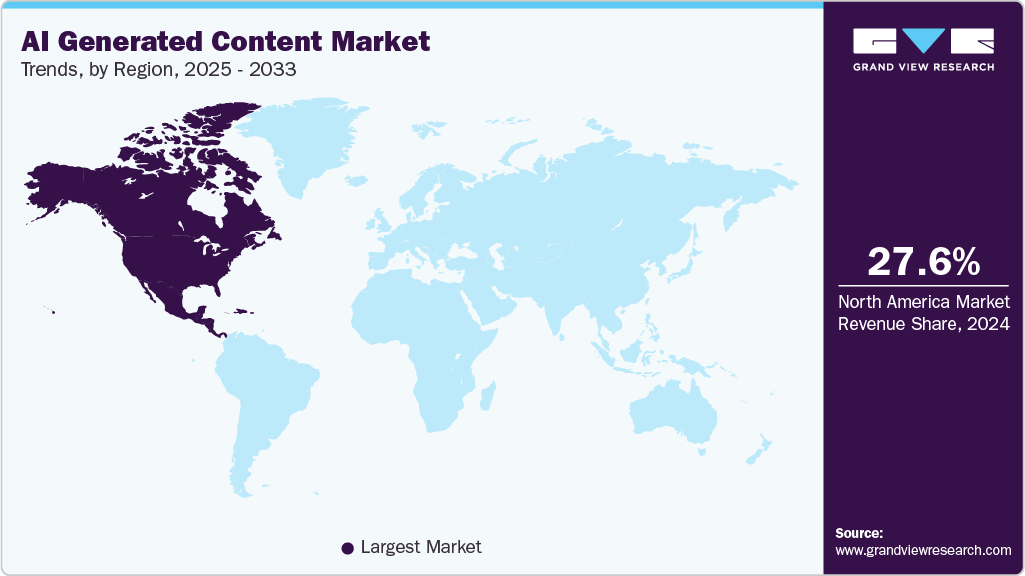

- North America dominated the global AI generated content (AIGC) market with the largest revenue share of 27.6% in 2024.

- The AI generated content (AIGC) market in the U.S. led the North America market and held the largest revenue share in 2024.

- By content type, text segment led the market and held the largest revenue share of 21.6% in 2024.

- By technology, LLMs segment held the dominant position in the market and accounted for the leading revenue share of 25.0% in 2024.

- By end use, the retail and e-commerce segment is expected to grow at the fastest CAGR of 21.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 12,879.0 Million

- 2033 Projected Market Size: USD 53,788.8 Million

- CAGR (2025-2033): 17.3%

- North America: Largest market in 2024

AIGC technologies streamline production workflows, enabling faster turnaround times and supporting enterprises in meeting dynamic market needs while maintaining brand consistency. Advancements in artificial intelligence, particularly in natural language processing, generative models, and multimodal content generation, have significantly enhanced the quality and contextual relevance of AI-created content. With reduced manual intervention, these improvements allow businesses to produce human-like text, images, audio, and video at scale. Integrating AI with other technologies, such as edge computing and semantic communication, further optimizes content creation for various industry applications.

In addition, cost efficiency and operational awareness are critical market drivers as AIGC reduces dependence on large editorial teams, lowers content production expenses, and enables rapid responsiveness to market trends. The capability to generate personalized and localized content personalized to specific audience segments improves customer engagement and satisfaction, supporting marketing efforts and expanding e-commerce, media, education, and entertainment sectors.

Furthermore, rising regulatory transparency around AI ethics and data privacy, alongside government incentives for digital innovation, also boost market adoption. Sustainable content production through AI reduces environmental impacts compared to traditional physical content methods. As enterprises align with evolving compliance frameworks, investment in AIGC solutions grows, further strengthening the technology’s role in transforming content ecosystems globally.

Content Type Insights

The text segment led the market and accounted for 21.6% of the global revenue in 2024. The market is driven by rapid advances in NLP that enable the production of clear, contextually relevant, and human-like text. The ability to automate large-scale text generation for applications and the growing demand for personalized, real-time content across digital platforms and e-commerce further increase the adoption. In addition, the cost-effectiveness of text generation tools compared to traditional content creation methods encourages widespread integration. For instance, in August 2025, OpenAI released two advanced open-weight language models, GPT-OSS, under the Apache 2.0 license. These models demonstrate competitive performance on reasoning benchmarks, support efficient deployment on consumer hardware, and provide chain-of-thought reasoning and tool use capabilities. Designed for flexibility, they operate efficiently on various infrastructure, from high-end GPUs to edge devices with limited memory. The models enable local inference, customization, and enhance privacy by allowing enterprises and developers to run AI workflows without relying on cloud-based services.

Video is predicted to foresee significant growth in the forecast period. The market is driven by advancements in AI models that enable rapid, cost-effective creation and editing of videos with minimal human effort. The technology supports multi-modal integration, combining voice, visuals, and animation to streamline production workflows and personalize content made to brand-specific styles. AI enhances real-time video analytics and automated editing, significantly reducing production time and operational costs. In addition, rising consumer demand for high-quality, customized video content across industries further advances AI video adoption and scalability in marketing and media sectors. For instance, in August 2025, Pika Labs launched the Social AI Video app on iOS, enabling users to transform selfies into AI-generated short videos with customizable elements. The app features a new video generation model that natively produces audio and hyper-real expressions in near real-time, creating HD videos of any style and length within six seconds. Users can share videos via a social feed and build on existing video setups. The platform is invite-only, with an Android version forthcoming, highlighting advancements in fast, affordable AI video creation.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024. The cloud's flexibility allows rapid experimentation, iteration, and deployment of AI models without the burden of physical infrastructure management. In addition, cloud platforms provide high-performance hardware, seamless collaboration tools, and cost-effective resource allocation, enhancing overall operational efficiency. Advanced AI-powered automation and security features in the cloud further streamline workflows, protect data, and optimize costs, making cloud deployment a preferred choice for AI content generation. For instance, in September 2023, Alibaba Cloud announced a suite of innovative AI products and services at its Global Summit. The offerings include advanced AI computing platforms, acceleration services, and AI-centric applications to enable efficient, secure, and cost-effective creation of generative AI solutions. The platform features capabilities for simplifying AI lifecycle management, accelerating model training and inference, and supporting large-scale AI deployments across regions. Partnerships with industry leaders, including a hybrid cloud platform integration with Red Hat OpenShift, further enhance enterprise productivity and digital transformation efforts.

The hybrid segment is predicted to experience significant growth in the forecast period. This model allows organizations to keep sensitive data on-premises. Hybrid environments support workload flexibility and optimized resource utilization, promoting operational continuity across diverse IT infrastructures. Enhanced integration capabilities and integrated management frameworks boost efficiency, while hybrid approaches mitigate risks associated with cloud-only or on-premises-only deployments, making hybridity a strategic approach in AI content generation. For instance, in March 2025, Lenovo introduced advancements in hybrid AI technology at MWC, introducing integrated devices and solutions designed to enhance creativity, productivity, and enterprise operations. Lenovo underlined seamless AI experiences across devices, hybrid, edge, and cloud, supported by infrastructure solutions such as the ThinkEdge SE100 server to enable affordable AI at the edge for businesses.

Technology Insights

The large language models (LLMs) segment holds the highest global revenue market share in 2024. The rising demand is driven by the increasing demand for automation to enhance efficiency and reduce operational costs across industries. The ability of LLMs to process and understand vast amounts of data quickly supports applications such as content generation, conversational AI, and multilingual translation, anticipating new business opportunities in marketing, finance, healthcare, and education sectors. In addition, adopting cloud-based deployment models facilitates scalable and flexible use of LLMs, with growing contributions from established tech companies and innovative startups advancing specialized domain expertise and innovation. For instance, in July 2023, CLPS Incorporation launched an AIGC intelligent automation solution. The solution uses LLMs for semantic understanding and logical inference, and advanced algorithms support talent acquisition by analyzing project requirements and matching skills efficiently, significantly reducing manpower needs and operational costs. CLPS plans to expand this solution to further domains, including financial management and customer acquisition, aiming to improve overall business efficiency and success rates.

The diffusion models segment is predicted to foresee significant growth in the forecast period. The demand is due to their stable training process and ability to generate high-quality, detailed images through progressive noise reduction. Their expanding application scope includes text-to-image synthesis, image restoration, super-resolution, and editing, addressing demands for diverse, realistic content. Advances focus on enhancing resolution, contextual understanding, and reducing computational loads to support real-time and resource-constrained deployments, fostering broader penetration across digital media, medical imaging, and virtual environments. For instance, in October 2024, Meta collaborated with King Abdullah University of Science and Technology, introducing MarDini, a next-generation family of video diffusion models designed to enhance AI generated video capabilities. MarDini supports complex video generation tasks such as frame interpolation, image-to-video creation, and video expansion through an innovative architecture combining masked auto-regression and diffusion processes. This model efficiently produces high-resolution and seamless videos.

End Use Insights

The media & entertainment segment accounted for the largest market revenue share in 2024. The market is anticipated to experience increased demand for personalized and immersive media experiences and an increased integration of AIGC in video production, animation, and entertainment programming. In addition, the need to reduce production costs and time prompted media platforms to incorporate AI tools for automated editing, scriptwriting, and visual effects. Regulatory and ethical considerations regarding AI-generated media also influenced market dynamics, encouraging transparent and responsible use of AI in content creation. For instance, in August 2023, iQIYI developed the Xingluo AIGC platform to automate the generation of diverse video, text, and image content, improving storyline comprehension and user navigation across popular dramas and variety shows. Tens of thousands of content albums incorporated AIGC, creating more than 700,000 operational items.

The retail & e-commerce segment is projected to grow significantly over the forecast period. The market drivers include efficiency gains in content production, reducing timelines from months to days or hours. AI enables richer interaction modes, such as natural language conversations with systems, enhancing customer engagement and data utilization. Integration of AI-powered systems tracks online and offline consumer behaviors, allowing retailers to identify and address operational and marketing gaps quickly. In addition, advanced AI tools for video and visual content creation provide dynamic, engaging marketing materials that improve customer outreach and brand differentiation in retail and e-commerce sectors. For instance, in January 2024, Firework introduced AVA, an AI-generated virtual shopping assistant designed to enhance e-commerce experiences by providing real-time sales assistance and customer support. It offers personalized guidance based on past purchase history, answers customer queries, and demos products live, maintaining consistency with each brand’s identity. This solution integrates adaptive intelligence to continuously learn from customer interactions, improving engagement and driving conversions.

Regional Insights

North America dominated the market by 27.6% revenue share in 2024. This is driven by strong investments in AI research and development, widespread adoption of cloud infrastructure, and advancements in natural language processing focused on different industries and sectors. The presence of leading technology companies and tech-savvy enterprises enhances innovation in automated or AI content generation. In addition, regulatory frameworks focusing on data privacy shape responsible AI usage in content generation.

U.S. AI Generated Content (AIGC) Market Trends

The AI generated content (AIGC) market in the U.S. has a dominant position in North America, driven by the benefits of advanced computing infrastructure and a mature technology ecosystem developing AI innovation and commercialization. Increasing use of AI to optimize marketing, personalized content delivery, and automated journalism supports demand. In addition, strong venture capital funding for AI startups accelerates development and deploying innovative content generation technologies.

Europe AI Generated Content (AIGC) Market Trends

The AI generated content (AIGC) market in Europe has seen a rise in AIGC technology, which has been improved by tough data protection policies encouraging ethical AI practices and transparency in AI-generated content. An increased focus on multilingual AI models addresses diverse linguistic requirements across member states. Public and private sector collaborations in AI innovation hubs enable scalable deployments, while rising demand for AI in media and creative industries supports market expansion.

Asia Pacific AI Generated Content (AIGC) Market Trends

The AI generated content (AIGC) market in the Asia Pacific has the highest CAGR for the forecasted period. The market expansion derives from growing digital content consumption driven by large internet user bases and rapid mobile adoption. Government initiatives promoting AI integration across e-commerce, education, and entertainment sectors inspire demand. Moreover, investments in AI startups and the availability of cost-effective AI services contribute to the widespread adoption of AI-generated content solutions.

Key AI Generated Content Company Insights

Some key companies in the AIGC industry are Microsoft, Google LLC, OpenAI, and Adobe.

-

OpenAI focuses on developing artificial general intelligence (AGI) that benefits humanity through safe and responsible innovation. The company advances AI research on model performance, alignment, and real-world applications while enhancing collaboration and tool integration in its product offerings. OpenAI operates under a unique capped-profit model governed by a nonprofit, reflecting its commitment to maximizing social and economic benefits. Its developments include recent advancements such as GPT-5 and expanded AI datacenter infrastructure through partnerships. This approach integrates comprehensive safety and ethical considerations in AGI progress.

-

Microsoft is a technology corporation recognized for its diverse portfolio spanning software development, cloud computing, artificial intelligence, and enterprise services. The company’s operations encompass major business segments including productivity software, intelligent cloud platforms, and personal computing solutions. Microsoft drives innovation through ongoing investments in AI research and development, enhancing its cloud services such as Azure and Work Suite products. It delivers comprehensive technology solutions across industries, focusing on digital transformation, security, and scalable infrastructure. Its extensive ecosystem supports developers, enterprises, and consumers with productivity, communication, and collaboration tools. Microsoft’s continuous evolution reflects its commitment to addressing emerging technology needs worldwide.

Key AI Generated Content Companies:

The following are the leading companies in the AI generated content market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Amazon Web Services, Inc.

- Baidu, Inc.

- Freepik Company S.L.

- Google LLC

- Jasper AI, INC.

- Meta

- Microsoft

- NVIDIA Corporation

- OpenAI

Recent Developments

-

In September 2025, OpenAI launched Sora 2, its advanced video and audio generation model offering improved physical accuracy, realism, and controllability over prior systems. The model supports synchronized dialogue and sound effects, enabling the creation of detailed, dynamic video content with precise audio synchronization. Launching alongside the iOS Sora app, the technology allows users to create and remix videos, including personalized digital cameos.

-

In July 2025, Baidu, Inc. launched MuseSteamer (Turbo, Pro, and Lite), an AI-driven video generator designed for business users that creates 10-second videos with visuals and audio. The model aims to enhance enterprise content production efficiency by reducing costs and workflow bottlenecks. Baidu, Inc. upgraded its search engine with a redesigned search box supporting longer queries, voice, and image searches, alongside improved content targeting through AI technology.

-

In June 2024, Meta significantly upgraded its generative AI suite for advertisers, enhancing creative output, brand consistency, and audience engagement. The new tools include AI Video Generation, which converts static images into dynamic videos, and Video Highlights, enabling viewers to skip to key ad moments using AI. Advertising brands can maintain consistent branding at scale with integrated logos, fonts, and personalized elements, complemented by interactive call-to-action stickers and virtual try-on features for apparel on AI-generated models.

-

In March 2024, Amazon Web Services, Inc. and NVIDIA Corporation extended their collaboration to advance generative AI capabilities by integrating NVIDIA Corporation’s next-generation Blackwell GPU platform with AWS’s cloud infrastructure, including Nitro System virtualization, Elastic Fabric Adapter networking, and EC2 UltraCluster hyper-scale clustering. This partnership enables faster and secure training and inference of multi-trillion-parameter large language models (LLMs) on AWS. In addition, the collaboration supports new generative AI applications in healthcare and life sciences, leveraging NVIDIA Corporation’s BioNeMo foundation models hosted on AWS HealthOmics.

AI Generated Content Market Report Scope

Report Attribute

Details

Market size in 2025

USD 14,961.6 million

Revenue forecast in 2033

USD 53,788.8 million

Growth rate

CAGR of 17.3% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content type, deployment, Technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Adobe; Amazon Web Services, Inc.; Baidu, Inc.; Freepik Company S.L.; Google LLC; Jasper AI, INC.; Meta; Microsoft; NVIDIA Corporation; OpenAI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Generated Content Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI generated content (AIGC) market report based on content type, deployment, technology, end use, and region:

-

Content Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Text

-

Image

-

Audio

-

Video

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-Premises

-

Hybrid

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Generative Adversarial Networks (GANs)

-

Large Language Models (LLMs)

-

Diffusion Models

-

Text-to-Speech (TTS)

-

Multimodal Foundation Models

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Education

-

Advertising & Marketing

-

Healthcare

-

Media & Entertainment

-

Retail and E-commerce

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI generated content market size was estimated at USD 12.88 billion in 2024 and is expected to reach USD 14.96 billion in 2025.

b. The global AI generated content market is expected to grow at a compound annual growth rate of 17.3% from 2025 to 2033 to reach USD 53.79 billion by 2033.

b. North America dominated the Artificial Intelligence generated content market with a share of 27.6% in 2024. Driven by the strong investments in AI research and development, widespread adoption of cloud infrastructure, and advancements in natural language processing focused for diffrent industries and sectors.

b. Some key players operating in the AI generated content market include Adobe; Amazon Web Services, Inc.; Baidu, Inc.; Freepik Company S.L.; Google LLC; Jasper AI, INC.; Meta; Microsoft; NVIDIA Corporation; OpenAI

b. Key factors that are driving the market growth include AIGC technologies streamline production workflows, enabling faster turnaround times and supporting enterprises in meeting dynamic market needs while maintaining brand consistency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.