- Home

- »

- Next Generation Technologies

- »

-

AI Governance Market Size & Share, Industry Report, 2033GVR Report cover

![AI Governance Market Size, Share & Trend Report]()

AI Governance Market (2026 - 2033) Size, Share & Trend Analysis Report By Component (Solution, Services), By Deployment (On-Premises, Cloud), By Organization Size, By Verticals, By End-Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-081-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Governance Market Summary

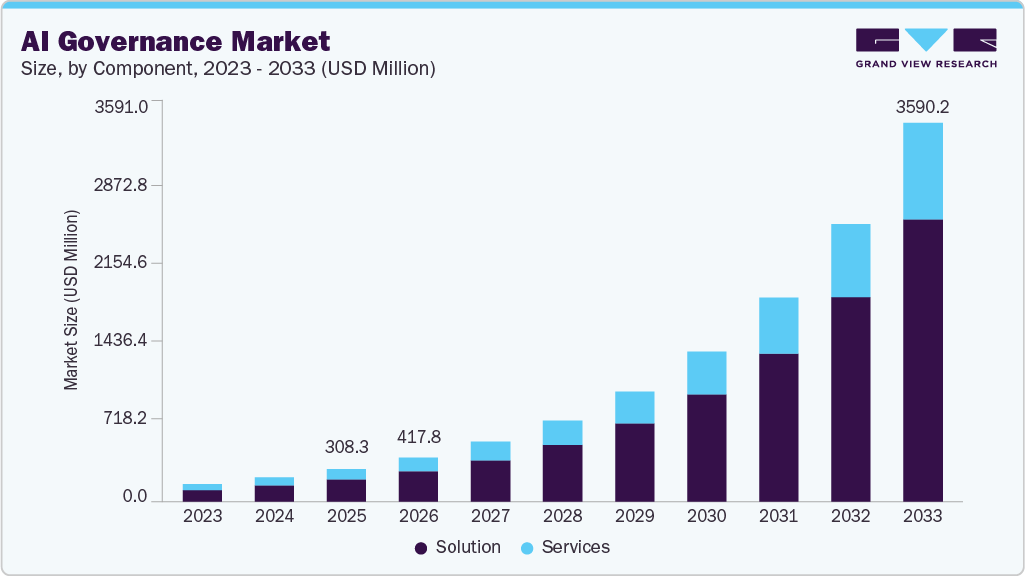

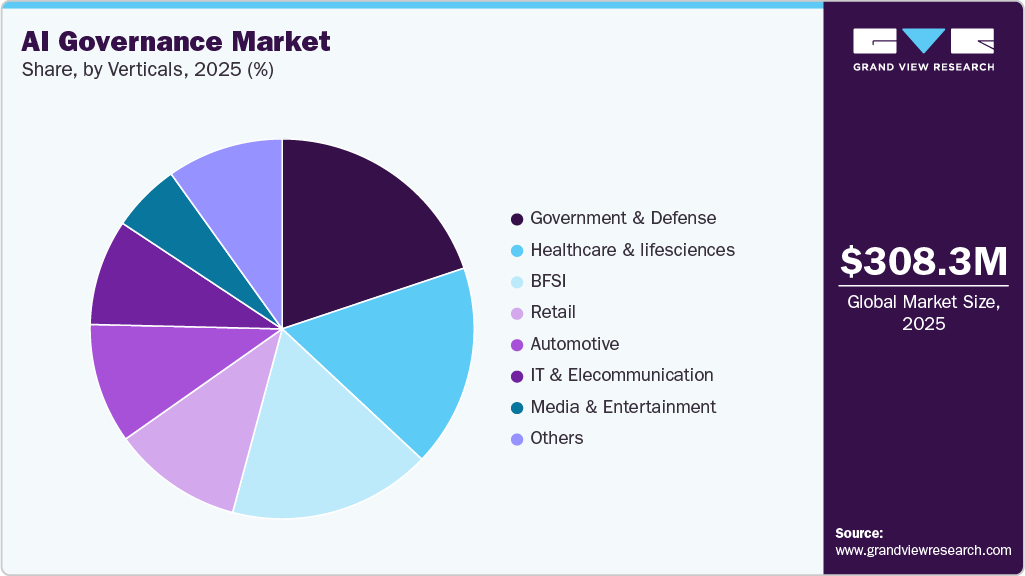

The global AI governance market size was valued at USD 308.3 million in 2025 and is projected to reach USD 3,590.2 million by 2033, growing at a CAGR of 36.0% from 2026 to 2033. The AI governance market is experiencing significant growth due to the rising awareness of the ethical, legal, and regulatory challenges associated with artificial intelligence.

Key Market Trends & Insights

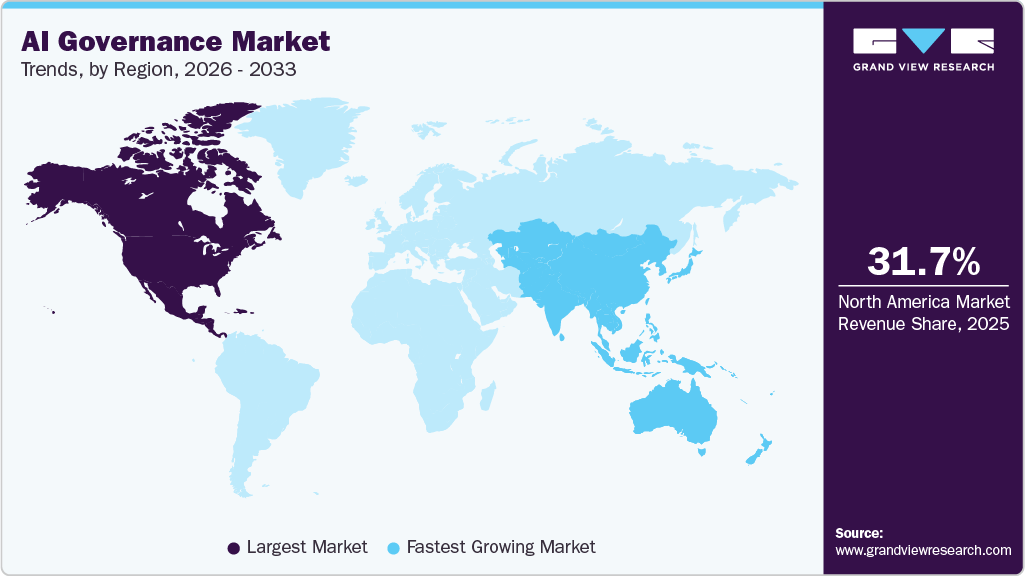

- North America dominated the global AI governance market with the largest revenue share of 31.73% in 2025.

- The AI governance market in the U.S. led the North America market and held the largest revenue share in 2025.

- By component, the solution segment led the market and held the largest revenue share of 67.48% in 2025.

- By organization size, the large enterprise segment held the dominant position in the market and accounted for the leading revenue share of 68.28% in 2025.

- By verticals, the healthcare and life sciences segment is expected to grow at the fastest CAGR of 39.9% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 308.3 Million

- 2033 Projected Market Size: USD 3,590.2 Million

- CAGR (2026-2033): 36.0%

- North America: Largest Market in 2025

As AI systems become more integrated into industries and public life, the need for frameworks that ensure their responsible use has increased. Various sectors such as finance, healthcare, and manufacturing are increasingly relying on AI, making it crucial to establish governance models that address transparency, accountability, and fairness. Companies are now focusing on embedding governance mechanisms within their AI development pipelines to mitigate risks like bias, discrimination, and privacy violations. Regulatory bodies around the world are also stepping up efforts to create standards that can guide organizations in managing AI responsibly.

Firms are increasingly deploying AI audit tools, explainability frameworks, and fairness monitoring systems to ensure their AI models comply with both local and international laws. This has created opportunities for startups and established firms alike to develop specialized AI governance solutions tailored to different industries. These tools enable organizations to assess and control risks associated with AI deployment, ensuring they align with ethical guidelines and legal frameworks. Moreover, stakeholders are now paying more attention to the social impact of AI, urging companies to demonstrate how their technologies promote inclusivity and prevent harm. This growing concern is pushing the AI governance market to evolve rapidly, with new innovations and products emerging to meet the unique needs of diverse sectors.

The market is also seeing increased collaboration between governments, private companies, and academic institutions to develop robust AI governance frameworks.This trend of introducing policies by government, research and development of ethical AI practices and initiating the advancements by investing which leads this market to a dynamic ecosystem where public policy, academic research, and corporate responsibility intersect to shape the future of AI governance.

Component Insights

The solution segment led the market and accounted for 67.48% of the global revenue in 2025. The market is driven by its comprehensive offerings that address key challenges such as transparency, accountability, and compliance. For instance, in July 2025, Riskonnect launched an AI governance solution integrated into its risk management platform to address AI-related risks and compliance needs. The solution drive in AI governance within Riskonnect’s GRC platform, enabling management of AI risks alongside cybersecurity, third-party, and operational risks.

The services segment is expected to grow significantly over the forecast period. The services segment offers significant benefits, particularly through consulting, implementation support, and ongoing monitoring. For instance, in January 2026, Corner Alliance introduced its AI governance service offering. This model helps central agencies use and manage AI responsibly and transparently, in line with national policy requirements. The service helps agencies reduce risks, keep data accurate, and stay accountable throughout the AI process.

Deployment Insights

The on-premises segment accounted for the largest market revenue share 51.4% in 2025. On-premises AI governance solutions offer superior performance and lower latency than cloud-based alternatives. This is crucial for applications requiring real-time processing and decision-making, such as autonomous systems and high-frequency trading platforms. By minimizing latency, organizations ensure AI models operate efficiently and effectively, maintaining high performance.

The cloud segment is predicted to foresee significant growth in the forecast period, driven by the scalability, flexibility, and cost-effectiveness it offers. Cloud-based AI governance platforms support rapid deployment, enabling organizations to implement and scale their governance frameworks quickly. Speed is crucial for businesses looking to stay ahead in the fast-paced AI landscape, where new technologies and methodologies are constantly emerging. Cloud providers frequently update their AI governance cloud services with the latest features and innovations, ensuring that organizations have access to cutting-edge tools and best practices. Rapid deployment also facilitates quicker responses to regulatory changes and emerging governance challenges. By leveraging the agility of cloud solutions, organizations can maintain a competitive edge and continuously enhance their AI governance practices.

Organization Size Insights

The large enterprise segment accounted for the largest market revenue share 67.48% in 2025. The proliferation of AI applications has led to an exponential increase in data collection and processing requirements of large enterprises. The growing use of AI applications also requires large enterprises to implement stringent data governance policies, including data minimization, anonymization, and encryption, to safeguard sensitive customer data, maintain trust, and prevent data breaches. Advanced security measures, such as threat detection, intrusion prevention, and access controls, are also deployed to protect data from unauthorized access.

The SME segment is expected to grow significantly in the forecast period. SMEs often operate with lean structures and limited resources, making it challenging to introduce new systems and processes. As a result, AI governance solutions that can be seamlessly integrated into existing business workflows are popular among SMEs. These solutions minimize disruption, reduce implementation costs, and enhance user adoption. By aligning AI governance with existing practices, SMEs can achieve greater efficiency and effectiveness. By offering financial incentives and guidance, governments are encouraging SMEs to invest in AI while ensuring responsible development and deployment. The growing adoption of AI solutions among SMEs is likely to drive the demand for AI governance solutions and services.

Verticals Insights

The government and defense segment holds the highest market share of the global revenue in 2025. The defense sector is increasingly leveraging AI for applications such as surveillance, threat detection, and operational efficiency. However, the deployment of AI in defense raises critical ethical and governance issues, necessitating robust frameworks to ensure its responsible use. Governments are prioritizing the development of AI governance policies that address these concerns, focusing on accountability, transparency, and compliance. This emphasis on ethical AI usage in defense is driving the demand for specialized governance solutions tailored to meet the unique challenges of the sector.

The healthcare and life sciences segment is predicted to foresee significant growth at CAGR of 39.9% in the forecast period. The healthcare industry is rapidly embracing AI technologies to improve patient outcomes, enhance operational efficiency, and accelerate drug discovery and development. This trend is driving the demand for AI governance solutions to ensure that AI systems are deployed ethically and in compliance with industry regulations. Healthcare organizations are investing in AI governance frameworks to address issues such as data privacy, algorithmic bias, and transparency in decision-making processes. As the use of AI solutions becomes more pervasive in healthcare, the need for effective governance will continue to grow, fueling the expansion of the AI governance market in this segment.

Regional Insights

North America dominated the market by 31.73% revenue share in 2025. The North American region is witnessing a surge in regulatory developments aimed at ensuring the responsible use of AI technologies. Legislators and government agencies are actively working to create rules and guidelines for automated systems and are focused on balancing innovation with the need to prevent adverse outcomes. These developments are driving organizations to adopt Artificial Intelligence (AI) governance solutions that facilitate compliance and accountability in their AI initiatives. Hence, as new regulations emerge, companies are increasingly investing in governance frameworks to navigate these complexities and avoid potential legal and reputational risks.

U.S. AI Governance Market Trends

In the U.S., both companies and new regulations are shaping the AI governance market to address ethical issues. Major tech firms are putting significant resources into tools that promote transparency, reduce bias, and encourage responsible AI use to protect their reputation and avoid legal trouble. At the same time, consumers and advocacy groups are calling for stricter rules, especially around privacy and discrimination.

Europe AI Governance Market Trends

The AI governance market in Europe is growing as a result of strict regulations like the General Data Protection Regulation (GDPR) and new AI laws on the horizon. Many European countries are focused on making sure AI systems are ethical, transparent, and unbiased, which is driving demand for governance solutions. Governments are working with businesses and universities to create policies that support both innovation and responsible AI use. The European Union is also developing broad AI governance frameworks that will affect companies inside and outside the region.

Asia Pacific AI Governance Market Trends

Asia Pacific has the highest CAGR for the forecasted period as the market expansion is growing quickly in Asia Pacific as more countries like China, Japan, and South Korea adopt AI. Governments and businesses are starting to see the importance of having rules to manage the risks of using AI, especially in finance and healthcare. Some countries are just beginning to develop formal policies, but there is clear progress toward setting up regulations. Companies in the region are also putting money into tools for AI auditing, bias detection, and compliance to make sure they use AI responsibly.

Key AI Governance Market Company Insights

Some key companies in the AI governance industry are IBM Corporation, ABB Ltd, Microsoft Corporation, TIBCO

-

IBM Corporation leads in developing AI governance by creating frameworks and tools that support responsible AI use. Through its IBM Watson platform, the company focuses on ethical AI by building transparency, fairness, and accountability into its models. IBM also works with other organizations to set guidelines and standards for AI governance, tackling challenges like bias and data privacy.

-

Microsoft creates frameworks that focus on responsible AI practices. The company highlights transparency, fairness, and accountability in its AI solutions, especially with the Azure OpenAI Service, which is designed to support ethical use of generative AI. Microsoft also works with policymakers, industry leaders, and academic institutions to help set global standards and regulations for AI governance, addressing issues like bias and data privacy.

Key AI Governance Companies:

The following key companies have been profiled for this study on the AI governance market.

- ABB Ltd

- DXC Technology Company

- IBM Corporation

- Infosys Ltd

- Microsoft Corporation

- NTT Data

- Oracle Inc

- SAP SE

- Siemens SA

- Tata Communication Services (TCS) Ltd

- TIBCO

Recent Developments

-

In January 2026, IBM introduced IBM sovereign core, an AI-ready solution designed to help businesses, governments, and service providers create and manage secure environments with complete control. The solution uses Red Hat's open-source platform and includes features like customer-managed control planes, local identity and key management, ongoing compliance tracking, and AI oversight to keep data and workloads within selected regions.

-

In May 2025, Credo AI rolled out a new integration with Microsoft Azure AI Foundry. This tool brings developers and AI governance teams together in real time to assess AI systems for risks, safety, performance, and quality. It also converts governance policies into practical code, delivering clear technical proof to oversight teams while equipping developers with checks for issues like hallucination, bias, and groundedness.

-

In February 2024, Infosys introduced responsible AI suite as part of the Infosys topaz platform to handle the big ethical headaches of generative AI like keeping data private, staying ethical, beefing up security, and cutting out bias. It breaks things down simply with a Scan, Shield, Steer approach: scan for risks, shield with tech protections, and steer with smart governance so companies can use AI without worry.

AI Governance Market Report Scope

Report Attribute

Details

Market size in 2026

USD 417.8 million

Revenue forecast in 2033

USD 3,590.2 million

Growth rate

CAGR of 36.0% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization size, verticals, regional.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Europe; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

ABB Ltd; DXC Technology Company; IBM Corporation; Infosys Ltd; Microsoft; NTT Data; Oracle Inc; SAP SE; Siemens SA; Tata Communication Services (TCS) Ltd; TIBCO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Governance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI governance market report based on component, deployment, organization size, verticals, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premises

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprise

-

SMEs

-

-

Verticals Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Government and Defense

-

Healthcare and lifesciences

-

Media and Entertainment

-

Retail

-

IT and Telecommunication

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the AI governance market include ABB Ltd., DXC Technology Company, Infosys Ltd., Microsoft, NTT Data, Oracle Corporation, SAP SE, Siemens AG, Tata Consultancy Services (TCS) Ltd., and TIBCO.

b. The global AI governance market size was estimated at USD 308.3 million in 2025 and is expected to reach USD 417.8 million in 2026.

b. The global AI governance market is expected to grow at a compound annual growth rate of 36.0% from 2026 to 2033 to reach USD 3,590.2 million by 2033.

b. North America dominated the AI governance market with a share of 31.73% in 2025. This is attributable to its strong regulations and widespread use of AI in different industries. Many companies are putting governance solutions in place to handle ethical issues, protect data privacy, and ensure transparency.

b. Key factors driving the AI governance market growth include the rising awareness of the ethical, legal, and regulatory challenges associated with artificial intelligence.As AI systems become more integrated into industries and public life, the need for frameworks that ensure their responsible use has increased.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.