- Home

- »

- Consumer F&B

- »

-

Air-dried Food Market Size & Share, Industry Report, 2030GVR Report cover

![Air-dried Food Market Size, Share & Trends Report]()

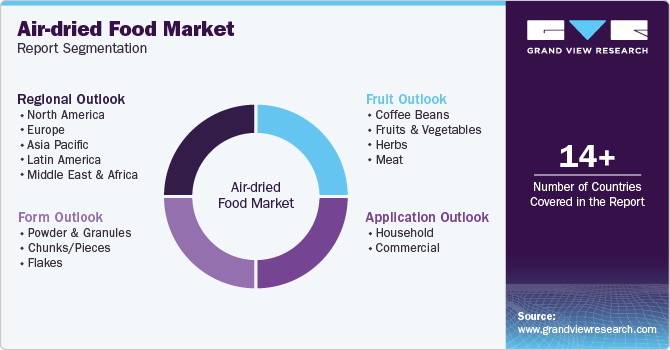

Air-dried Food Market (2025 - 2030) Size, Share & Trends Analysis Report By Fruits (Coffee Beans, Fruits & Vegetables, Meat, Herbs), By Application (Household, Commercial), By Form, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-513-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Air-dried Food Market Size & Trends

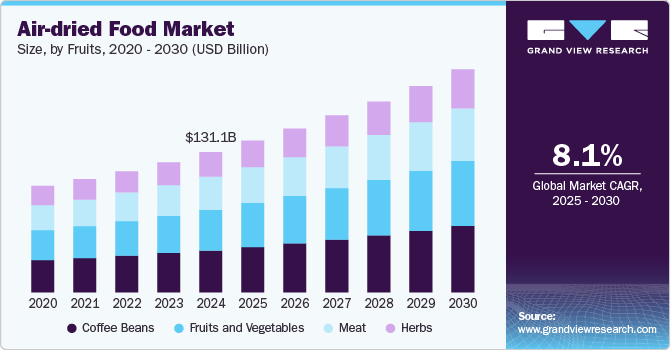

The global air-dried food market size was valued at USD 131.13 billion in 2024 and is expected to grow at a CAGR of 8.1% from 2025 to 2030. This growth is attributed to the increasing demand for convenient and healthy food options. In addition, the preservation of nutritional value, expansion of the snack and convenience food industry, and rising urbanization also contribute to the market’s growth. Furthermore, technological advancements in drying equipment and consumer preference for minimally processed foods are fueling the markets’ expansion. Moreover, the integration of exotic flavors and sustainable food processing practices further boosts market growth.

Air-dried food refers to a preservation method where moisture is slowly removed from ingredients using air circulation, thereby extending shelf life and retaining nutritional value. This technique has become increasingly popular as consumers seek convenient and healthy food options. As lifestyles become more fast-paced, the demand for easy-to-prepare meals has surged, particularly among urban dwellers and working professionals. Consequently, air-dried foods, which are lightweight and have a long shelf life, have emerged as an ideal solution for on-the-go consumption.

The rise of e-commerce further supports this trend by making these products easily accessible. In addition, the growing focus on convenience and accessibility is driving innovation in the air-dried food market, with companies developing new products to cater to changing consumer preferences. Furthermore, manufacturers are investing in advanced packaging solutions to enhance shelf stability and freshness. Meanwhile, health consciousness is also fueling growth, as consumers gravitate towards minimally processed foods that retain essential nutrients without additives.

This trend is especially prevalent among younger generations, who prioritize health and wellness. Moreover, the shift towards vegetarian and vegan diets has boosted demand for plant-based air-dried foods. New product launches are also crucial in driving market growth, as companies introduce innovative air-dried options to meet evolving consumer preferences.

Fruits and vegetables, such as carrots, peppers, sweet potatoes, and winter squash, contain high vitamin A content and can retain their nutritional value once they are packaged with an air-dried process. In addition, a positive outlook towards organic-grown foods at the global level, resulting from supportive government policies aimed at increasing organic farming at the domestic level, is expected to promote market growth.

An extensive variety of meal options has surged the application of air-dried food in the household and commercial sectors. Air-dried food products are utilized in numerous foods, including breakfast cereals, healthy snacks, ready-to-eat meals, and desserts.

Fruits Insights

Coffee beans dominated the market and accounted for the largest revenue share of 30.4% in 2024, primarily driven by increasing global coffee consumption and the convenience of spray-dried coffee powders. This method offers faster drying times and larger production scales, making it economically viable. As a result, coffee beans dominate a significant share of the air-dried food market, particularly in developing regions. Furthermore, the ease of storage and transportation supports their popularity, while advancements in drying technology further enhance their quality and availability.

The fruits and vegetables segment is expected to grow at a CAGR of 8.5% over the forecast period, owing to their nutritional value and extended shelf life. They serve as healthy snack alternatives and are used in various cuisines. In addition, the trend towards healthier eating and versatility in food processing drives their growth, enhancing their appeal globally. Furthermore, they offer convenience and are rich in essential nutrients, making them a preferred choice for consumers seeking natural and minimally processed foods.

Application Insights

The commercial application led the global air-dried foods industry and held the largest revenue share of 75.7% in 2024, attributed to the increasing demand for ready-to-eat meals and convenience foods. In addition, restaurants and food service providers benefit from the extended shelf life and ease of storage of air-dried ingredients, enhancing operational efficiency. Furthermore, the trend towards healthier options in commercial settings further boosts demand, as consumers seek nutritious and sustainable food choices. This shift supports the adoption of air-dried foods in various commercial applications.

Household is expected to be the fastest-growing segment, with a CAGR of 8.2% over the forecast period, owing to consumer preferences for healthy and convenient meal options. The ease of preparation and storage of air-dried foods appeals to busy households seeking nutritious snacks and meals. In addition, growing health consciousness and the desire for minimally processed foods also contribute to this trend. Furthermore, the versatility of air-dried foods in various recipes enhances their appeal, making them a staple in many households.

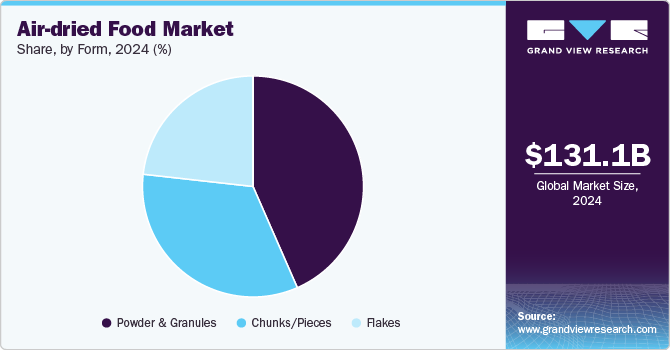

Form Insights

The powder and granules held the dominant position in the market and accounted for the largest revenue share of 42.7% in 2024, driven by their versatility and ease of integration into various products. In addition, they enhance nutritional value and flavor in baked goods and meals. The popularity of spray-dried coffee powders and fruit-based powders also contributes to their demand. Furthermore, these products are widely used in the food industry due to their convenience and ability to mix easily, making them ideal for instant soups and beverages.

Chunks/pieces are expected to grow at a CAGR of 8.5% over the forecast period due to their use in breakfast dishes and ready-to-eat meals. Consumers prefer these forms for their texture and flavor, which add variety to meals. Furthermore, chunks and pieces are often used in snack mixes, further boosting their appeal as convenient and healthy snack options. Their use in trail mixes and energy bars also supports their growth, as consumers seek nutritious and portable food choices.

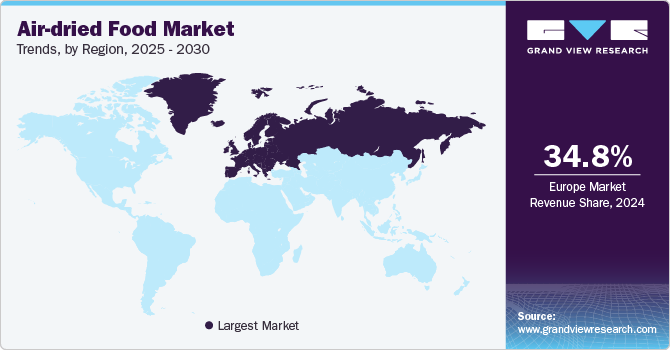

Regional Insights

Europe air-dried food market dominated the global market and accounted for the largest revenue share of 34.8% in 2024. This growth is attributed to consumer demand for natural and minimally processed foods. Strict food safety regulations and a preference for clean-label products further support this trend. In addition, the region's robust food processing industry and strong retail network also contribute to its dominance in the global market. Furthermore, European consumers are increasingly seeking sustainable food options that align with the eco-friendly aspects of air-dried foods.

UK Air-dried Food Market Trends

The air-dried food market in the UK led the European market and held the largest revenue share in 2024, driven by a growing demand for ready-to-eat meals and health-conscious consumers seeking plant-based options. In addition, the country's sophisticated retail network aids in product accessibility, while changing meal patterns drive demand for convenience foods. Furthermore, the UK's vibrant food culture encourages innovation in air-dried products, leading to a diverse range of offerings that cater to various dietary needs.

Asia Pacific Air-dried Food Market Trends

Asia Pacific air-dried food market is expected to grow at the fastest CAGR of 8.7% from 2025 to 2030, owing to urbanization and increasing disposable incomes. In addition, consumers are seeking convenient and healthy eating options, leading to a rise in demand for air-dried products. Furthermore, the region's diverse culinary traditions provide a rich backdrop for incorporating air-dried ingredients into local dishes, enhancing their appeal and versatility.

The air-dried food market in China dominated the Asia Pacific market with the largest revenue share in 2024. This is attributed to a growing middle class seeking healthier and more convenient food options. Furthermore, urbanization and changing dietary preferences contribute to this trend, as consumers increasingly opt for minimally processed foods. Moreover, China's e-commerce platforms play a significant role in making air-dried foods more accessible to a wider audience, further boosting market growth.

North America Air-dried Food Market Trends

The North American air-dried food market is expected to grow substantially in the coming years, driven by health consciousness and a preference for minimally processed foods. In addition, consumers are increasingly seeking nutrient-dense options, which air-dried foods provide by retaining more original nutrients compared to other processing methods. Furthermore, the region's strong focus on wellness and fitness also supports the demand for air-dried products as part of a balanced diet.

The growth of the air-dried food market in the U.S. is expected to be driven by a strong focus on health and wellness, coupled with a desire for convenient, on-the-go food options. The market benefits from innovative product launches and a growing demand for organic and natural foods. Furthermore, the U.S. has a well-developed distribution network, which facilitates the availability of air-dried foods across various retail channels, making them easily accessible to consumers nationwide.

Key Air-dried Food Company Insights

Key players in the global air-dried food industry include Saraf Foods Pvt. Ltd., Berrifine A, Nestle S.A., and others. These companies employ strategies such as adopting advanced drying technologies, launching new products, and engaging in mergers and acquisitions to enhance market presence and product offerings. Furthermore, they also focus on expanding distribution channels and improving packaging solutions to increase consumer appeal.

- Saraf Foods Pvt. Ltd. manufactures and supplies air-dried, freeze-dried, and IQF fruits, vegetables, herbs, lentils, and sprouts. The company operates in the food ingredients segment, providing high-quality products to global markets. Its offerings cater to various industries, including food processing and manufacturing. Saraf Foods' products are used in a variety of applications, from snacks and beverages to pharmaceuticals and cosmetics, highlighting their versatility and widespread use.

Key Air-dried Food Companies:

The following are the leading companies in the air-dried food market. These companies collectively hold the largest market share and dictate industry trends.

- Dehydrates Inc.

- Saraf Foods Pvt. Ltd.

- Berrifine A

- La Frubense, BCFoods, Inc.

- Nestle S.A.

- B-B Products (Australia) Pty Ltd.

- FREEZE-DRY FOODS

- DMH Ingredients, Inc.

- HOWENIA ENTERPRISE CO., LTD.

Recent Developments

- In April 2024, ZIWI, a New Zealand pet food manufacturer, introduced ZIWI Peak Steam & Dried, a new range for cats and dogs in the U.S. and Canada. This innovative line uses a patented Z-MicroSteam process, a new alternative to air-dried food options, to preserve nutrients and enhance palatability.

Air-dried Food Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 141.49 billion

Revenue forecast in 2030

USD 208.47 billion

Growth Rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fruits, application, form, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia

Key companies profiled

Dehydrates Inc.; Saraf Foods Pvt. Ltd.; Berrifine A; La Frubense, BCFoods, Inc.; Nestle S.A.; B-B Products (Australia) Pty Ltd.; FREEZE-DRY FOODS; DMH Ingredients, Inc.; HOWENIA ENTERPRISE CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air-dried Food Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air-dried food market report based on fruits, application, form, and region:

-

Fruits Outlook (Revenue, USD Million, 2018 - 2030)

-

Coffee Beans

-

Fruits & Vegetables

-

Herbs

-

Meat

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder & Granules

-

Chunks/Pieces

-

Flakes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.