- Home

- »

- Advanced Interior Materials

- »

-

Air Purifier Market Size And Share, Industry Report, 2033GVR Report cover

![Air Purifier Market Size, Share & Trends Report]()

Air Purifier Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (HEPA, Activated Carbon, Ionic Filters, Electrostatic Precipitator), By Application, By Coverage Range, By Sales Channel, By Type, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-406-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Purifier Market Summary

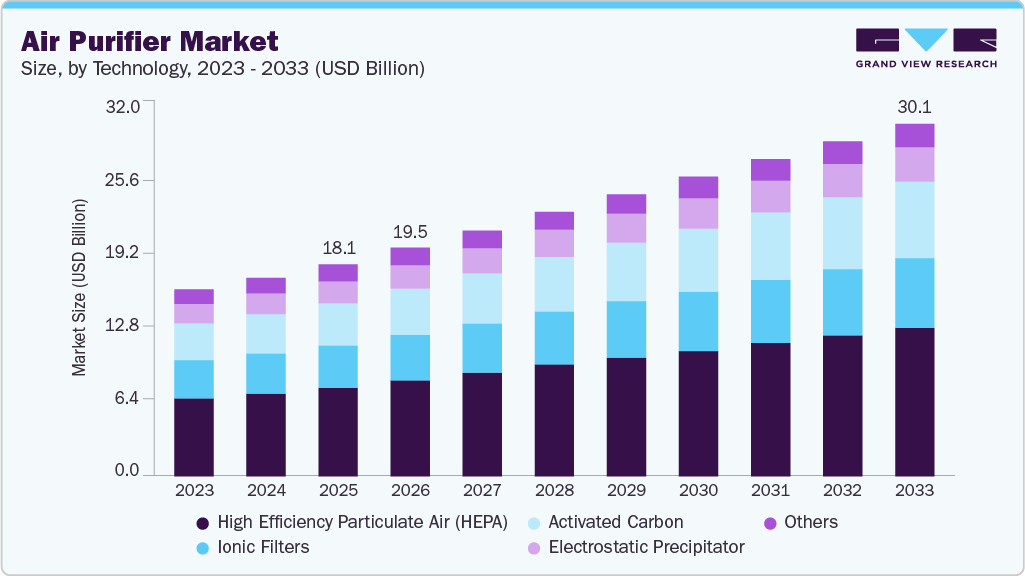

The global air purifier market size was estimated at USD 18,086.7 million in 2025 and is anticipated to reach at USD 30,078.4 million by 2033, growing at a CAGR of 6.4% from 2026 to 2033, primarily driven by increasing air pollution levels and rising awareness about indoor air quality and health. Growing urbanization and industrialization have escalated airborne contaminants, prompting consumers to invest in air purification solutions.

Key Market Trends & Insights

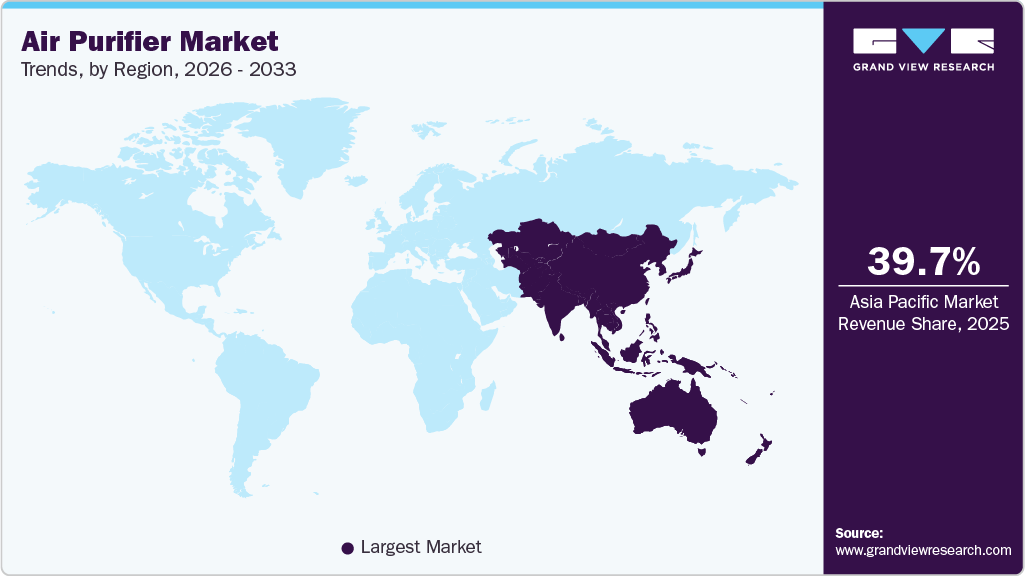

- Asia Pacific dominated the air purifier market with the largest revenue share of 39.7% in 2025.

- The China air purifier market held over 39.6% share in Asia Pacific, owing to the high health burden and ongoing air quality challenges in the country.

- By technology, activated carbon segment is expected to grow at a considerable CAGR of 7.6% from 2026 to 2033 in terms of revenue.

- By application, commercial segment is expected to grow at a considerable CAGR of 7.1% from 2026 to 2033 in terms of revenue.

- By sales channel, online segment is expected to grow at a considerable CAGR of 7.1% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 18,086.7 Million

- 2033 Projected Market Size: USD 30,078.4 Million

- CAGR (2026-2033): 6.4%

- Asia Pacific: Largest market in 2025

Technological innovation is another major growth factor shaping the market. Manufacturers are introducing smart air purifiers with features like HEPA filtration, app-based control, and real-time air quality monitoring. These advancements enhance user convenience and efficiency, making air purifiers more appealing to tech-savvy consumers. In addition, increasing integration of AI and IoT in air purification solutions supports demand in smart homes and offices. Together, these innovations are expanding the market’s reach across different user segments.

Market Concentration & Characteristics

The global air purifier market exhibits moderate market concentration, with a few dominant players such as Coway, Honeywell, Philips, and Sharp holding notable shares. These companies benefit from strong brand recognition, advanced technology, and wide distribution networks. However, the market remains relatively fragmented, allowing regional and emerging players to compete effectively by offering affordable, localized solutions. The presence of numerous small and medium manufacturers contributes to a competitive landscape. This structure encourages ongoing innovation and product differentiation across the industry.

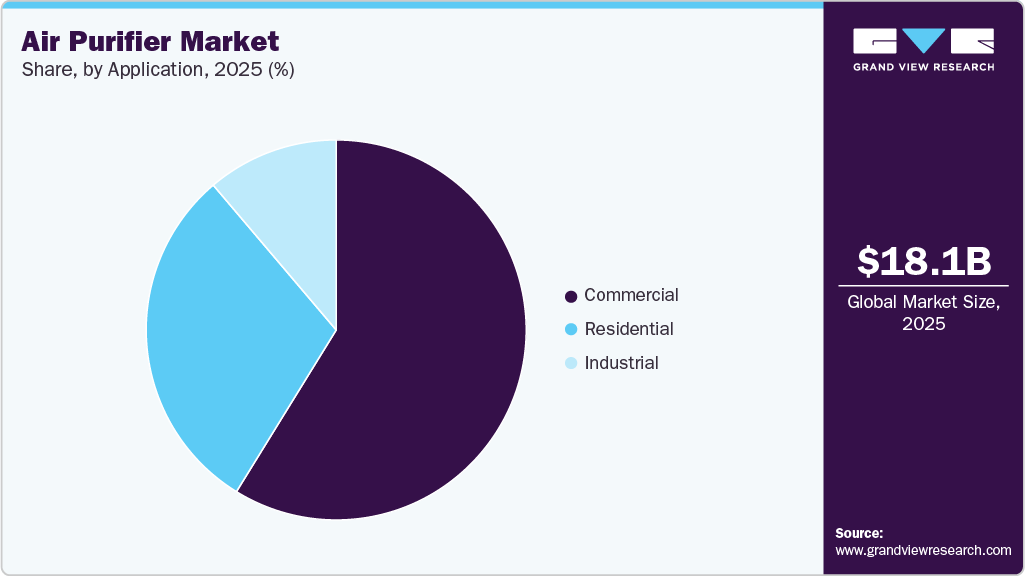

The air purifier market has witnessed a notable shift in end-user concentration, with a growing emphasis on residential consumers. As awareness regarding indoor air quality rises, individuals are increasingly investing in air purifiers for their homes. This trend is fueled by health consciousness and the desire for cleaner living spaces. While commercial and industrial segments still contribute significantly, the surge in residential adoption signifies a prominent shift in end-user preferences within the air purifier industry. Manufacturers are adapting to meet this demand, focusing on designing compact, efficient models tailored for home use.

In the market for air purifiers, the focus on product substitutes has intensified, with companies strategically acquiring or developing alternative solutions to traditional purifiers. This concentration is driven by a growing awareness of diverse air quality concerns and the demand for specialized substitutes such as advanced filtration systems, natural air purifying methods, and smart home technologies. The industry's emphasis on these substitutes reflects a nuanced approach to addressing specific consumer needs, fostering innovation, and ultimately shaping a more versatile and responsive market for air purification solutions.

The market for air purifiers is navigating a landscape characterized by increased regulatory attention, with governments globally implementing stringent standards and guidelines. These regulations focus on ensuring product safety, performance efficacy, and environmental impact. As the demand for air purifiers rises, compliance with air quality standards becomes paramount, influencing product development and market strategies. Industry players are proactively adapting to these regulatory frameworks, emphasizing the importance of adherence to standards in promoting consumer confidence, fostering innovation, and shaping a responsible and sustainable air purification market.

Drivers, Opportunities & Restraints

The primary drivers of the global air purifier market include rising air pollution levels and increasing awareness of health risks related to poor indoor air quality. Urbanization and industrialization, particularly in Asia Pacific regions, have elevated demand for clean air solutions. Growing cases of respiratory illnesses and allergies also push consumers toward air purifiers. Government initiatives to promote clean air standards further accelerate market adoption.

The growing adoption of smart homes and IoT-enabled devices presents a major opportunity for air purifier manufacturers. Emerging markets like India, Brazil, and Southeast Asia offer untapped potential due to increasing middle-class income and health consciousness. Commercial applications in offices, schools, and healthcare facilities are expanding rapidly. In addition, innovation in filter technology and energy efficiency can drive premium product demand.

High initial costs and maintenance expenses of air purifiers remain significant barriers to widespread adoption, especially in price-sensitive markets. Limited consumer awareness in rural and underdeveloped regions hampers market penetration. Some users also express skepticism about product effectiveness. Moreover, the lack of standardization and regulation across regions creates market inconsistency.

Technology Insights

High Efficiency Particulate Air (HEPA) technology segment led the market and accounted for 41.7% of the global revenue share in 2025. HEPA filters dominate the air purifier market due to their exceptional ability to capture microscopic particles such as dust, pollen, pet dander, and allergens. Their effectiveness in reducing airborne contaminants makes them highly suitable for schools, hospitals, and other sensitive environments. HEPA filters are also favored because they do not emit ozone or harmful byproducts.

Activated carbon segment is expected to grow at a considerable CAGR of 7.6% from 2026 to 2033 in terms of revenue, owing to their unique ability to absorb gases, odors, and volatile organic compounds (VOCs). They are especially useful in eliminating smoke, cooking smells, and chemical fumes from indoor environments. As awareness of indoor air quality improves, consumers increasingly seek multi-functional purifiers with odor and chemical removal capabilities. Their integration with HEPA and other technologies adds to their market appeal.

Coverage Range Insights

Air purifiers that cover an area between 250-400 sq. ft. led the market in 2025 and accounted for the 39.4% share in the market due to their suitability for average-sized rooms in urban homes and offices. This range balances performance and cost, making it a practical choice for most consumers. It’s especially popular in residential settings like bedrooms and living rooms where moderate coverage is sufficient. Additionally, many models in this category offer advanced features such as HEPA and carbon filters. Their versatility and energy efficiency make them the preferred segment for mainstream users.

Below 250 Sq. Ft. segment is expected to grow at a fastest CAGR of 7.2% from 2026 to 2033 in terms of revenue, driven by the increasing demand for compact and affordable air purifiers. Consumers in small apartments, dormitories, and personal workspaces are opting for these units due to their portability and low energy usage. Rising air quality concerns in urban areas have made people more conscious of indoor environments, even in small spaces. The growing trend of work-from-home setups also supports this demand. Manufacturers are responding with sleek, budget-friendly models tailored to individual use.

Sales Channel Insights

Offline sales channel segment led the global air purifier market and accounted for 57.2% share in 2025. Driven by consumer preference for in-person product evaluation. Retail environments such as hypermarkets, specialty stores, and electronics outlets allow customers to physically inspect products, compare models, and receive expert advice. This tactile experience builds trust, especially for high-involvement purchases such as air purifiers. In addition, immediate product availability and the ability to take items home the same day enhance the appeal of offline shopping.

Online segment is expected to grow at a fastest CAGR of 7.1% from 2026 to 2033 in terms of revenue, fueled by the convenience of e-commerce and increasing digital literacy. Consumers appreciate the ability to compare various models, read reviews, and access detailed product information from the comfort of their homes. The COVID-19 pandemic accelerated this shift, with many turning to online platforms for their purchasing needs. E-commerce giants such as Amazon and Flipkart have expanded their reach, offering a wide range of products and competitive pricing.

Type Insights

Standalone/portable type segment led the global air purifier market and accounted for the 66.9% share in 2025 due to their ease of installation, flexibility, and affordability. These units require no structural modifications and can be moved between rooms, making them ideal for residential use. Consumers prefer them for personal spaces such as bedrooms and offices, where localized air purification is needed. Their wide availability across offline and online channels also boosts sales. In addition, the variety in sizes and features caters to a broad range of consumer preferences.

In-duct or fixed segment is expected to grow at a significant CAGR of 5.4% from 2026 to 2033 in terms of revenue, especially in commercial and industrial sectors. These systems integrate directly with HVAC infrastructure, providing centralized air purification for larger areas. The rising demand for clean air in hospitals, offices, and public buildings supports their adoption. Businesses prioritize these systems for their efficiency and ability to ensure consistent air quality throughout facilities. Growing awareness of indoor air standards and health regulations is further driving their uptake.

Application Insights

The commercial segment dominates the air purifier market and accounted for 58.9% share, due to the high demand from offices, retail spaces, and hospitality sectors aiming to provide healthier indoor environments. Increasing awareness about employee productivity and customer experience is driving businesses to invest in advanced air purification systems. Moreover, stringent regulations regarding indoor air quality in commercial buildings further boost adoption. The ongoing need to mitigate airborne contaminants in crowded spaces keeps this segment at the forefront of market growth.

Industrial segment is expected to grow at a significant CAGR of 5.4% from 2026 to 2033 in terms of revenue, as factories and manufacturing units seek to control pollution and protect worker health. Rising industrial emissions and the presence of harmful airborne particles necessitate robust air purification solutions tailored for large-scale operations. In addition, regulatory compliance and corporate sustainability initiatives are compelling industries to adopt air purifiers. Innovations in heavy-duty and specialized filtration technologies are accelerating the market expansion within the industrial sector.

Regional Insights

The North America air purifier market is growing at the significant CAGR of 5.9% over the forecast period, due to rising awareness of indoor air quality and increasing health concerns related to airborne pollutants. Frequent wildfires, especially in the U.S. and Canada, have intensified demand for air cleaning solutions. Technological advancements and the popularity of smart home devices are boosting product adoption. In addition, strong distribution networks and regulatory support are driving market expansion.

U.S. Air Purifier Market Trends

U.S. air purifier market held over 73.5% share in the North America market. The U.S. dominates the North American air purifier market due to high awareness of indoor air quality and strong consumer demand for health-focused appliances. Stringent environmental regulations and a well-established healthcare infrastructure support widespread adoption. Consumers prioritize advanced features like HEPA and smart connectivity, driving premium product sales.

Canada is experiencing significant growth in the air purifier market, driven by increasing air quality concerns and rising awareness of respiratory health. Wildfires and seasonal allergies have pushed more consumers to invest in air cleaning devices for their homes and offices. Government efforts promoting cleaner indoor environments are also influencing demand. In addition, the rise of smart home technology adoption is boosting interest in modern air purifiers. Expanding online retail channels make these products more accessible across the country.

Asia Pacific Air Purifier Market Trends

Asia Pacific dominated the market and accounted for 39.7% share of global revenue in 2025, due to rapid urbanization, industrial growth, and high population density. The region faces severe air pollution challenges, especially in metropolitan areas, driving strong demand for air cleaning solutions. Rising health awareness and increasing disposable income have led consumers to prioritize indoor air quality. Government initiatives promoting cleaner environments also support market growth.

China air purifier market held 39.6% share in the Asia Pacific market owing to driven by critical air pollution levels and public health concerns. Major cities such as Beijing and Shanghai often experience hazardous air quality, prompting government action and consumer response. Rapid urban development and industrial activities increase demand for both residential and commercial air purifiers. The country also benefits from domestic manufacturing, enabling a wide range of product availability and pricing.

Singapore is emerging as the fastest-growing air purifier market in Asia Pacific, fueled by growing awareness of indoor air quality and a rising focus on wellness. While outdoor pollution is relatively low, concerns over indoor contaminants, allergens, and haze from neighboring regions drive demand. The city's high population density and prevalence of smart homes also support adoption of compact, tech-enabled air purifiers. Government-led public health campaigns and a strong retail ecosystem further accelerate market growth.

Europe Air Purifier Market Trends

Europe holds a strong position in the global air purifier market due to strict environmental regulations and heightened awareness of air quality. Public health initiatives and indoor air quality standards across the EU promote the adoption of purification technologies. Urbanization and concerns over allergens and pollutants are driving both residential and commercial demand.

Germany air purifier market held over 17.7% share in the Europe market owing to its strong regulatory framework and environmentally conscious consumer base. High air quality standards and energy efficiency requirements encourage adoption of advanced filtration systems. German consumers prioritize health, sustainability, and high-performance technology in home appliances. The country also leads to smart home integration, which aligns with demand for connected air purifiers.

France is the fastest-growing air purifier market in Europe, driven by increasing concerns over urban pollution and seasonal allergens. The rise in asthma and respiratory issues has heightened demand for air quality solutions in homes and schools. Government awareness campaigns and a growing focus on wellness and lifestyle improvements support this trend. The popularity of compact and stylish purifiers among urban consumers is also fueling growth. Expanding e-commerce channels further enhance product reach across the country.

Middle East & Africa Air Purifier Market Trends

The Middle East & Africa region is an emerging market for air purifiers, driven by increasing urbanization and rising awareness of air quality issues. Growing construction activities and desert climates contribute to high levels of indoor dust and pollutants. Health concerns, particularly around respiratory conditions, are prompting greater interest in air purification technologies.

Saudi Arabia is a key contributor to the air purifier market in the Middle East, mainly due to frequent dust storms and extreme desert conditions. These environmental factors lead to poor indoor air quality, increasing demand for purification solutions in homes and offices. The country’s focus on modern infrastructure and smart city projects supports the adoption of advanced technologies. Rising health awareness and a shift toward wellness-focused living further drive market growth.

Central & South America Air Purifier Market Trends

The air purifier market in Central & South America is developing steadily, driven by rising urban pollution and growing public awareness of air quality. Economic improvements and expanding middle-class populations are contributing to increased demand for health and wellness products. Educational campaigns and a gradual shift toward healthier lifestyles support market growth. However, high product costs and limited access in rural areas still pose challenges. Urban centers are leading the adoption trend across the region.

Brazil is the largest and most influential market for air purifiers in Central & South America. Rapid urbanization, industrial activities, and traffic congestion contribute to air pollution in major cities such as São Paulo and Rio de Janeiro. Growing awareness of respiratory health and an increase in allergy-related conditions are driving demand for air purification systems. The expansion of online retail and availability of affordable units are helping broaden consumer access.

Key Air Purifier Company Insights

Some of the key players operating in the market include Honeywell International, Inc., IQAir, Kelvion Holding GmbH

-

Honeywell is a leading global technology company offering a wide range of air purifiers for residential, commercial, and industrial use. It is known for integrating smart features such as HEPA filters and real-time air quality monitoring. The company holds a strong position in the global air purifier market due to its brand trust and wide distribution. Honeywell’s products are especially popular in North America and Asia. Its air purifiers cater to both general consumers and specialized environments such as healthcare.

-

IQAir is a premium air quality technology company specializing in high-performance air purifiers and air monitoring systems. It is renowned for producing medical-grade air purifiers that are widely used in hospitals, laboratories, and pollution-heavy regions. IQAir holds a strong position in the luxury and professional segment of the air purifier market. The brand is recognized globally for its advanced filtration technology and accuracy in air quality data. It is especially dominant in Asia and parts of Europe.

Key Air Purifier Companies:

The following key companies have been profiled for this study on the air purifier market.

- IQAir

- Honeywell International, Inc.

- LG Electronics

- Unilever PLC

- Koninklijke Philips N.V

- Hamilton Beach Brands, Inc.

- Panasonic Corporation

- Whirlpool Corporation

- Carrier

- Camfil

- Sharp Electronics Corporation

- COWAY Co., Ltd

- Molekule

- Samsung Electronics Co., Ltd.

- Dyson

Recent Developments

-

In January 2025, LG has rolled out the PuriCare AeroBooster, a compact air care solution that blends modern design with strong purification performance. It uses a multi-layer filtration system and dual airflow to effectively remove fine dust, odors, and airborne pollutants. Hygiene features like UV-based cleaning and ion support help maintain cleaner internal airflow. Smart controls and energy-efficient operation make it suitable for everyday indoor use.

-

In January 2024, COWAY CO., LTD. launched Airmega 100. It has a 360° air intake and a 3-stage HEPA filtration system that effectively removes harmful pollutants and purifies the air within an 810- square-foot space every hour. The product has a real-time air quality indicator, energy-saving technology, auto mode, and a precise particle sensor, which are some of the important features of this new air purifier.

Air Purifier Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 19,512.6 million

Revenue forecast in 2033

USD 30,078.4 million

Growth rate

CAGR of 6.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, coverage range, sales channel, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; China; Japan; South Korea; Singapore; Malaysia; Brazil; Saudi Arabia

Key companies profiled

IQAir; Honeywell International, Inc.; LG Electronics, Inc.; Unilever PLC; Koninklijke Philips N.V.;Panasonic Corporation; Hamilton Beach Brands, Inc.; Whirlpool Corporation; Carrier; Camfil; Sharp Electronics Corporation; COWAY Co. Ltd.; Samsung Electronics Co.; Ltd., Camfil; Dyson; Molekule; Hamilton Beach Brands, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Purifier Market Report Segmentation

This report forecast revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global air purifier market report on the basis of technology, application, coverage range, sales channel, type, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

High Efficiency Particulate Air (HEPA)

-

Activated Carbon

-

Ionic Filters

-

Electrostatic Precipitator

-

Others

-

-

Coverage Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 250 Sq. Ft.

-

250-400 Sq. Ft.

-

401-700 Sq. Ft.

-

Above 700 Sq. Ft.

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

Hypermarkets/Supermarkets

-

Retail Stores

-

Specialty Stores

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Standalone/Portable

-

In-duct/Fixed

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Retail Shops (Mercantile)

-

Offices

-

Healthcare Facilities

-

Hospitality

-

Schools & Educational Institutions

-

Laboratories

-

Transport (railway stations, metros, bus stops, airports)

-

Others

-

-

Residential

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the air purifier market include IQAir, Honeywell International, Inc., LG Electronics, Inc., Unilever PLC, Koninklijke Philips N.V., Dyson, Sharp Electronics Corporation, Samsung Electronics Co., Ltd., Panasonic Corporation, Hamilton Beach Brands, Inc., Whirlpool Corporation, and Carrier among others

b. The growth of the market is driven by rising instances of airborne diseases and increasing pollution levels in urban areas. Moreover, growing health awareness, improving standard of living, and rising disposable income of the masses are expected to fuel the growth of the market over the forecast period.

b. The global air purifier market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2026 to 2033 to reach USD 30,078.4 million by 2033

b. Asia Pacific dominated the market and accounted for 39.7% share of global revenue in 2025, due to rapid urbanization, industrial growth, and high population density. The region faces severe air pollution challenges, especially in metropolitan areas, driving strong demand for air cleaning solutions.

b. The global air purifier market size was estimated at USD 18,086.7 million in 2025 and is expected to reach USD 19,512.6 million in 2026

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.