- Home

- »

- Next Generation Technologies

- »

-

Aircraft Lighting Market Size & Share, Industry Report, 2033GVR Report cover

![Aircraft Lighting Market Size, Share & Trends Report]()

Aircraft Lighting Market (2025 - 2033) Size, Share & Trends Analysis Report By Aircraft Type, By Light Type (Interior Lights, Exterior Lights), By Technology, By End Use (OEM, Aftermarket), By Region And Segment Forecasts

- Report ID: GVR-4-68040-683-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aircraft Lighting Market Summary

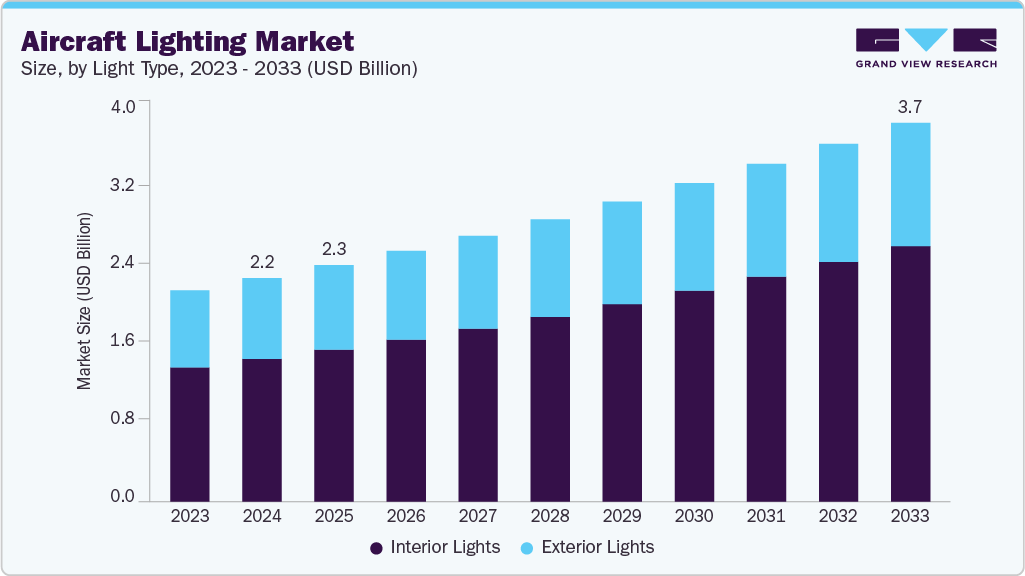

The global aircraft lighting market size was estimated at USD 2.17 billion in 2024 and is projected to reach USD 3.67 billion by 2033, growing at a CAGR of 6.1% from 2025 to 2033. The market growth is mainly fueled by the adoption of smart lighting systems integrated with cabin management, expansion of retrofit programs for older aircraft, increasing use of lightweight materials to reduce fuel consumption, and regulatory push for sustainable aviation technologies are shaping the aircraft lighting market.

Key Market Trends & Insights

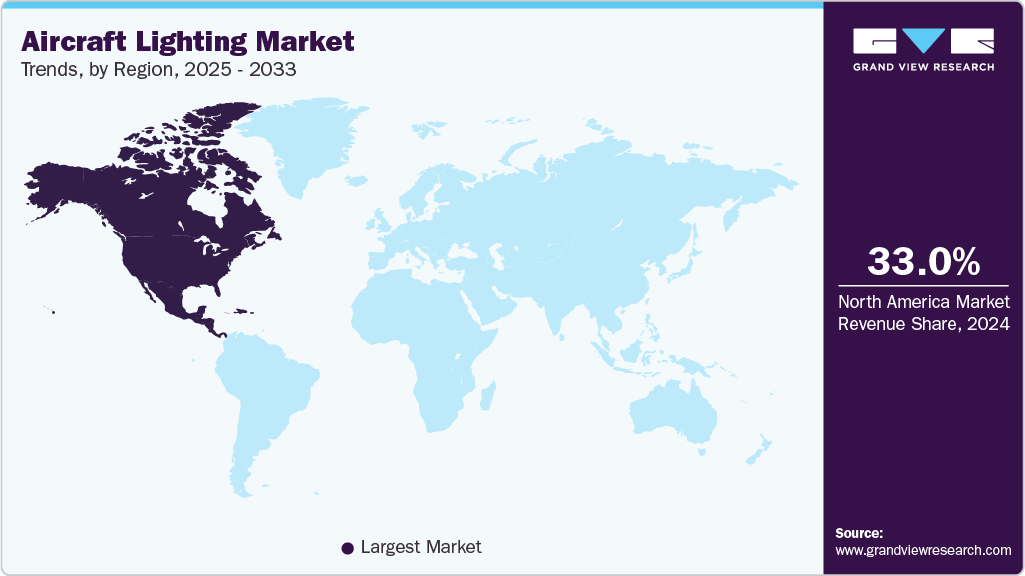

- North America dominated the global aircraft lighting market with the largest revenue share of 33% in 2024.

- The aircraft lighting market in the U.S. led the North America market and held the largest revenue share in 2024.

- By aircraft type, the commercial aviation segment led the market, holding the largest revenue share of over 55% in 2024.

- By light type, the interior lights segment held the dominant position in the market and accounted for the leading revenue share of over 63% in 2024.

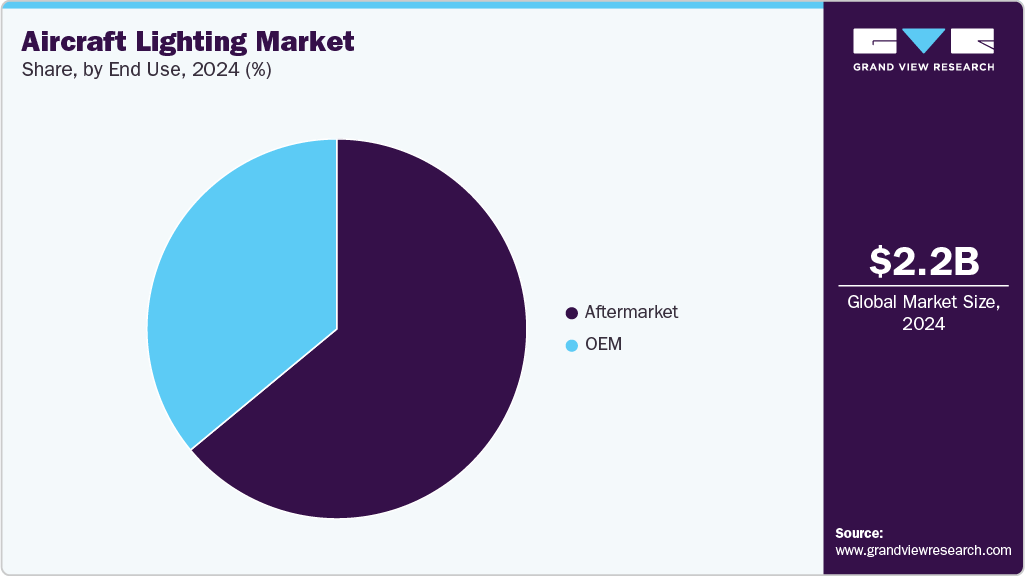

- By end use, the OEM segment is expected to grow at the fastest CAGR of over 7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 2.17 Billion

- 2033 Projected Market Size: USD 3.67 Billion

- CAGR (2025-2033): 6.1%

- North America: Largest market in 2024

As airlines intensify their focus on passenger satisfaction, lighting is becoming a key enabler of onboard experience transformation. No longer merely functional, it now plays a vital role in creating a comfortable, visually appealing, and brand-consistent cabin environment. Innovations in ambient and mood lighting, particularly in ceiling, wall, and reading fixtures, are being developed to align with time zone changes, sleep patterns, and premium cabin expectations. Dynamic lighting is increasingly used not only to enhance comfort but also to reinforce brand identity, reflecting a broader shift toward emotionally engaging and sensory-rich interior design within the aircraft lighting industry.The growing demand for sustainability in aviation is directly driving innovation in aircraft lighting. Airlines and OEMs are focusing on lightweight, energy-efficient solutions to cut fuel use and reduce carbon emissions. As part of larger environmental efforts, lighting systems are being upgraded with advanced LED modules that have longer lifespans and use less power. This change is especially visible in widebody and regional aircraft fleets that are being retrofitted, aligning lighting improvements with aviation’s decarbonization goals.

The increasing demand for luxury flying experiences is prompting lighting providers to create more personalized and immersive cabin environments. Business and first-class cabins now feature multi-zone lighting, mood-enhancing ambiance systems, and user-controlled settings. These innovations are strengthening airline brand identity and setting new standards in passenger comfort. Aircraft manufacturers are more often adding customizable lighting as a key feature in their cabin design options, emphasizing the strategic importance of smart lighting systems.

The demand for improved flight safety and nighttime operational efficiency is driving strong growth in exterior lighting applications. Anti-collision lights, navigation lights, and high-intensity landing lights are being upgraded across commercial, business, and military fleets. The integration of LED and smart lighting technologies provides better visibility, durability, and compliance with international aviation standards. This has strengthened collaboration between OEMs and lighting technology providers, as exterior lighting remains a vital investment to ensure safe and efficient operations.

Aircraft Type Insights

The commercial aviation segment led the market with over 55% share in 2024, mainly driven by the rise in global air travel and more commercial aircraft deliveries. Airlines are investing in advanced LED lighting systems to cut fuel use, improve operational efficiency, and enhance passenger experience. Dynamic ambient lighting and mood-enhancing options are now common in both new aircraft and retrofit projects. This ongoing focus on comfort, performance, and brand identity solidifies commercial aviation as the main driver of growth in the aircraft lighting industry.

The business and general aviation segment is expected to achieve a significant CAGR of over 5% from 2025 to 2033, mainly driven by the rise in global air travel and increased commercial aircraft deliveries. The growing preference for personalized travel and the expansion of the private jet market are fueling innovation in cabin lighting solutions. Operators and OEMs are focusing on customizable lighting systems, including dimmable LEDs and tailored color schemes, to improve the luxury travel experience. As aesthetic appeal and operational efficiency become key value propositions, lighting technologies in this segment are advancing to meet the high expectations of discerning clients.

Light Type Insights

The interior lights segment led the market in 2024 due to the growing adoption of smart cabin technologies and rising demand for touchless, sensor-based systems. This segment is undergoing significant change as airlines and aircraft OEMs implement lighting systems that adapt dynamically to cabin occupancy, ambient conditions, and flight phases-improving both energy efficiency and passenger comfort. Human-centric lighting and IoT-enabled control interfaces are enabling new levels of personalization and operational flexibility. As digitalization progresses in aircraft cabins, interior lighting is becoming a key part of the connected, smart in-flight experience.

The exterior lights segment is expected to grow at a significant CAGR in the coming years, due to the increasing adoption of smart cabin technologies and rising demand for touchless, sensor-based systems. Regulatory focus on nighttime visibility and ground safety is speeding up the deployment of high-performance, intelligent exterior lighting systems. Modern aircraft now include adaptive lighting technologies that adjust intensity based on operational context-such as takeoff, landing, and taxiing-while advances in waterproofing and thermal management improve the durability of critical lighting components. As the industry shifts toward autonomous electric aviation, exterior lighting is becoming more sensor-driven and vital to next-generation flight operations.

Technology Insights

The LED segment dominated the market in 2024, driven by the aviation sector’s push toward greater operational efficiency and reduced environmental impact. LEDs continue to outperform legacy lighting technologies in both innovation and adoption, as airlines increasingly replace halogen and HID systems with lightweight, energy-efficient, and low-maintenance LED alternatives. Aircraft OEMs are also incorporating LEDs into smart lighting systems that enable real-time automation, control, and personalization. With rising demand for digital cabin experiences and stricter regulatory standards, LED technology is firmly established as the foundation of next-generation aircraft lighting solutions.

The HID segment is projected to grow at a significant CAGR in the coming years, driven by the aviation sector’s push for greater operational efficiency and reduced environmental impact. Despite the widespread adoption of LEDs, HID systems remain important in specific high-lumen applications such as landing and taxi lights, especially in older aircraft and fleets with retrofit constraints. HIDs provide superior brightness and long-range visibility, making them suitable for certain exterior functions. However, as LED performance continues to improve and costs decrease, the HID segment is likely to gradually lose market share while still serving niche, high-output operational needs.

End Use Insights

The aftermarket segment dominated the market in 2024 due to the aging global aircraft fleet and the increasing focus on cost-effective modernization. There is strong demand for lighting system upgrades and replacements as airlines and MRO providers increasingly prioritize LED retrofits to improve energy efficiency, reduce maintenance-related downtime, and meet evolving safety regulations. This trend is especially noticeable in narrow-body and regional aircraft, where lighting upgrades provide immediate operational and aesthetic benefits without major cabin renovations. As fleet utilization improves in the post-pandemic environment, the aftermarket segment continues to be a key driver of recurring revenue and innovation in the aircraft lighting industry.

The OEM segment is projected to grow at the fastest CAGR in the upcoming years, due to the aging global aircraft fleet and the increasing focus on cost-effective modernization. Fueled by a rise in new aircraft production and the growing airline preference for factory-installed, advanced lighting systems, the segment is experiencing steady growth in both commercial and business aviation. Aircraft manufacturers are adopting intelligent LED solutions that support ambient lighting control, mood enhancement, and seamless integration with digital cabin systems. Strategic partnerships between OEMs and lighting technology companies are speeding up the development of lightweight, energy-efficient, and highly customizable solutions-making the OEM channel a key driver of next-generation aircraft lighting innovation.

Regional Insights

The North America aircraft lighting market dominated the market with a share of over 33% in 2024, owing to the rising adoption of energy-efficient LED lighting systems. The region is witnessing consistent growth in the market. Airlines and OEMs are actively replacing older lighting systems with lightweight, power-saving alternatives to improve operational efficiency and sustainability. Additionally, increased defense spending and the retrofitting of military aircraft are bolstering demand for advanced lighting technologies.

U.S. Aircraft Lighting Market Trends

The U.S. aircraft lighting market dominated the market with a share of over 77% in 2024, driven by investments in aerospace innovation and a strong presence of major aircraft manufacturers, the U.S. remains at the forefront of the aircraft lighting industry. Technological advancements in smart and adaptive lighting are being rapidly implemented across both commercial and defense aviation sectors. Moreover, regulatory emphasis on passenger comfort and energy efficiency is encouraging the shift toward intelligent lighting systems.

Europe Aircraft Lighting Market Trends

The Europe aircraft lighting market is expected to grow at a CAGR of 5.0% from 2025 to 2033, primarily driven by strict environmental regulations and a growing emphasis on reducing carbon emissions. The region is accelerating the adoption of sustainable aircraft lighting solutions. European airlines are prioritizing lightweight, low-emission lighting technologies to align with the EU’s green aviation initiatives. The region also benefits from strong cross-border collaboration in R&D for aerospace lighting innovation.

The Germany aircraft lighting market is expected to grow at a significant rate in the coming years, fueled by its strong engineering base and increasing investments in aviation technology. Germany is emerging as a key player in the aircraft lighting market. Domestic aerospace suppliers are focusing on developing durable, low-maintenance lighting systems that meet international safety standards. Additionally, collaboration between OEMs and lighting technology firms is driving innovation in both interior and exterior aircraft lighting.

The UK aircraft lighting market is expected to grow at a significant rate in the coming years, owing to rising consumer expectations for personalized and enhanced in-flight experiences, the UK is seeing increased demand for premium cabin lighting solutions. Airlines are integrating dynamic mood lighting systems to improve passenger well-being on long-haul flights. The country's strong aviation design capabilities are also contributing to customized lighting innovations across various aircraft types.

Asia Pacific Aircraft Lighting Market Trends

Asia Pacific aircraft lighting market is expected to grow at the fastest CAGR of over 8% from 2025 to 2033. driven by rapid urbanization, a surge in air passenger traffic, and growing aircraft procurement across emerging economies, Asia Pacific is a major growth region for aircraft lighting. Regional carriers are upgrading fleets with modern lighting systems to compete with passenger comfort and fuel efficiency. The presence of fast-developing aerospace hubs in countries like India and Southeast Asia further accelerates market expansion.

The China aircraft lighting market is primarily driven by national aviation strategies and large-scale government support. China is rapidly scaling its aircraft production capabilities, including the integration of advanced lighting systems. COMAC’s aircraft programs and rising MRO activities are pushing demand for efficient and locally sourced lighting technologies. Additionally, domestic airlines are embracing smart lighting to align with global safety and comfort standards.

The Japan aircraft lighting market is fueled by Japan’s culture of precision engineering and a strong commitment to safety and quality. The country is investing heavily in high-performance aircraft lighting solutions. Japanese manufacturers are pioneering developments in compact, durable, and intelligent lighting systems suited for both domestic and international aviation markets. The push toward automation and connectivity in aviation systems is further enhancing demand for integrated lighting technologies.

Key Aircraft Lighting Company Insights

Some of the key players operating in the market include RTX Corporation, and Astronics Corporation and among others.

-

RTX Corporation, through its subsidiary Collins Aerospace, is one of the most dominant players in the aircraft lighting market. The company specializes in advanced interior and exterior lighting systems that emphasize energy efficiency, passenger comfort, and safety compliance. It offers smart cabin lighting solutions that integrate seamlessly with modern avionics and inflight entertainment systems. With a global customer base and strong R&D capabilities, RTX continues to lead the market in lighting innovation for both commercial and military aircraft.

-

Astronics Corporation is a recognized authority in aircraft lighting and power systems, especially in the commercial aviation segment. It offers a full suite of lighting solutions including reading lights, emergency lighting, exterior lighting, and customizable mood lighting systems. The company is known for innovation in lightweight and energy-efficient products tailored to both OEMs and retrofit programs. Its flexible manufacturing and global partnerships help maintain its competitive edge in delivering high-quality lighting technologies.

STG Aerospace Limited. and Cobalt Aerospace Group Limited are some of the emerging market participants in the aircraft lighting market.

-

STG Aerospace is gaining traction with its innovative photoluminescent LED lighting systems for aircraft cabins. The company focuses on emergency floor path marking systems and mood lighting that enhances passenger well-being and meets regulatory standards. Its solutions are widely adopted for retrofitting older aircraft, offering airlines cost-effective upgrades without compromising safety or aesthetics. With a focus on human-centric design and efficiency, STG Aerospace is expanding its presence globally.

-

Cobalt Aerospace is a rising player in the aircraft interior lighting domain, specializing in plug-and-play LED systems and PSU (Passenger Service Unit) lights. The company is particularly known for its Cobalt Spectrum lighting system, which offers color-customizable ambient lighting for aircraft cabins. It caters to both new aircraft programs and aftermarket retrofits, allowing flexible lighting upgrades. Cobalt’s focus on customization, ease of installation, and reliability positions well among emerging lighting solution providers.

Key Aircraft Lighting Companies:

The following are the leading companies in the aircraft lighting market. These companies collectively hold the largest market share and dictate industry trends.

- RTX Corporation

- Astronics Corporation

- Diehl Stiftung & Co. KG

- Honeywell International Inc.

- Thales

- Luminator Aerospace

- Oxley Group

- STG Aerospace Limited

- Soderberg Manufacturing Company Inc.

- Heads Up Technologies

- Aveo Engineering Group, s.r.o.

- Cobalt Aerospace Group Limited.

Recent Developments

-

In April 2025, Airbus launched its new A220 Airspace cabin in partnership with Air Canada, marking a significant enhancement in passenger comfort and interior design. The upgraded cabin features advanced mood lighting, including a third LED strip beneath the overhead bins and refined ceiling lighting. This development underscores the growing emphasis on energy-efficient and customizable LED lighting solutions within the aircraft lighting market, particularly in the interior segment.

-

In March 2025, Luma Technologies introduced advanced LED retrofit solutions for Cessna Conquest I (425) and Conquest II (441) aircraft, addressing legacy issues related to dimming circuits and annunciator reliability. The LT‑4250 and LT‑4441 systems offer plug-and-play upgrades with enhanced visibility, reduced maintenance requirements, and improved safety features, including integrated gear and master warning indicators. These FAA-certified solutions are engineered for rapid installation, minimizing aircraft downtime and aligning with operators' efficiency and safety priorities.

-

In March 2025, Robinson Helicopter Company launched the upgraded R66 NxG with an all-glass cockpit, Garmin avionics, and integrated autopilot as standard. The helicopter also features pulse-mode LED landing lights, enhancing visibility and flight safety. This update reflects the ongoing shift toward advanced and energy-efficient lighting solutions in the aircraft lighting market.

Aircraft Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.29 billion

Revenue forecast in 2033

USD 3.67 billion

Growth rate

CAGR of 6.1% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Aircraft type, light type, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

RTX Corporation; Astronics Corporation; Diehl Stiftung & Co. KG; Honeywell International Inc.; Thales; Luminator Aerospace; Oxley Group; STG Aerospace Limited; Soderberg Manufacturing Company Inc.; Heads Up Technologies; Aveo Engineering Group, s.r.o.; Cobalt Aerospace Group Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Aircraft Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aircraft lighting market report based on aircraft type, light type, technology, end use, and region.

-

Aircraft Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Aviation

-

Narrow-Body Aircraft (NBA)

-

Wide-Body Aircraft (WBA)

-

Regional Transport Aircraft (RTA)

-

Business & General Aviation

-

-

Business Jet

-

Light and Ultralight Aircraft

-

Commercial Helicopters

-

-

Military Aviation

-

Fighter Aircraft

-

Transport Aircraft

-

Special Mission Aircraft

-

UAVs

-

-

-

Light Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Interior Lights

-

Interior Lights

-

Ceiling and Wall Lights

-

Signage Lights

-

Reading Lights

-

Lavatory Lights

-

Floor Lighting Strip

-

Cockpit lights

-

-

Exterior Lights

-

Navigation Lights

-

Anti-collision lights

-

Landing Lights

-

Taxi Lights

-

Engine & Wing inspection lights

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Light Emitting Diode (LED)

-

High-intensity discharge (HID)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aircraft lighting market size was estimated at USD 2.17 billion in 2024 and is expected to reach USD 2.29 billion in 2025.

b. The global aircraft lighting market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach USD 3.67 billion by 2033.

b. North America dominated the aircraft lighting market with a share of over 33.0% in 2024, owing to the presence of major aircraft manufacturers, rising demand for advanced cabin aesthetics, and increasing investments in fleet modernization and retrofit programs.

b. Some key players operating in the aircraft lighting market include RTX Corporation, Astronics Corporation, Diehl Stiftung & Co. KG, Honeywell International Inc., Thales, Luminator Aerospace, Oxley Group, STG Aerospace Limited, Soderberg Manufacturing Company Inc., Heads Up Technologies, Aveo Engineering Group, s.r.o., and Cobalt Aerospace Group Limited.

b. Key factors that are driving the market growth include the rising adoption of LED lighting systems for energy efficiency, increasing aircraft production and deliveries, and growing emphasis on enhancing passenger experience through mood and ambient lighting.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.