- Home

- »

- Advanced Interior Materials

- »

-

Aircraft Tire Market Size, Share, And Growth Report, 2030GVR Report cover

![Aircraft Tire Market Size, Share & Trends Report]()

Aircraft Tire Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Radial, Cross-ply), By End-use (Commercial, Business, Military), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-332-5

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aircraft Tire Market Summary

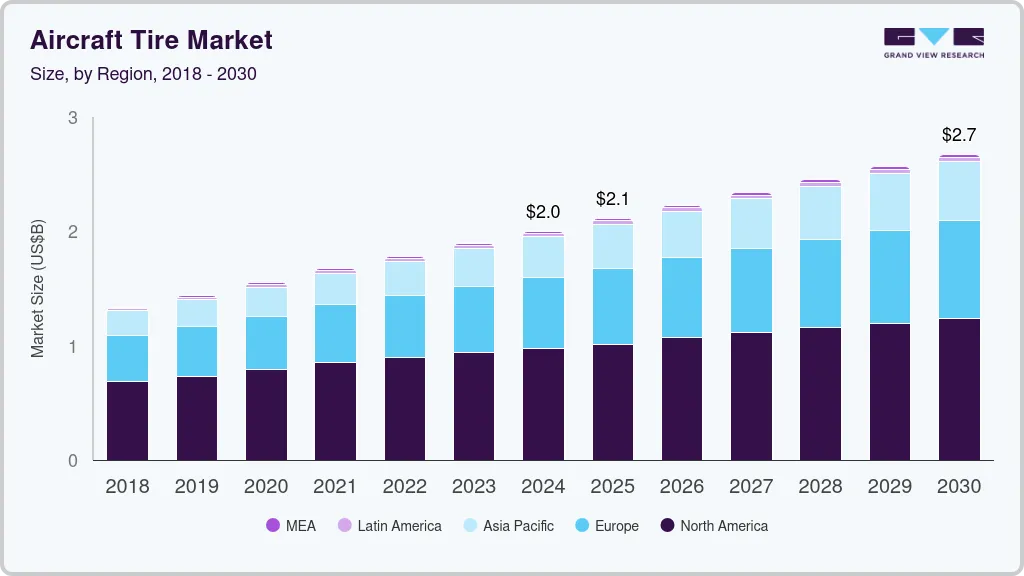

The global aircraft tire market size was estimated at USD 2,002.9 million in 2024 and is projected to reach USD 2,675.2 million by 2030, growing at a CAGR of 4.8% from 2025 to 2030. This growth is attributed to the importance of aircraft tires in maintaining the overall weight of an aircraft at the time of takeoff, landing, and taxiing.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 49.64% in 2023.

- The U.S. is expected to grow at a CAGR of 3.2% over the forecast period.

- Based on product, the radial segment dominated the market with a revenue share of 69.96% in 2023.

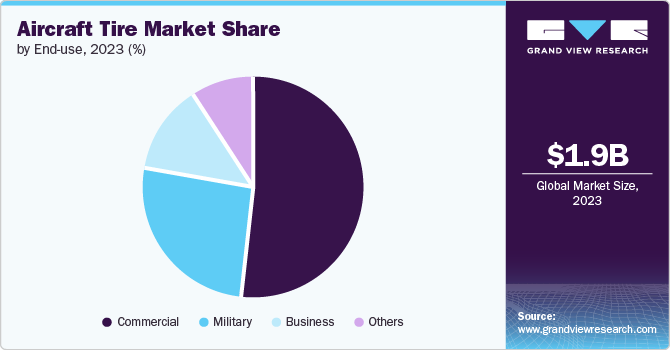

- Based on end use, the commercial segment dominated the market with a revenue share of 51.66% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 2,002.9 Million

- 2030 Projected Market Size: USD 2,675.2 Million

- CAGR (2025-2030): 4.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These tires are manufactured to meet the operating requirements of an aircraft, thereby exhibiting more strength as compared to automotive tires. Aircraft tires ensure safe ground contact by absorbing vibrations and impact forces. They also provide cushioning to the aircraft to support the structure and offer enhanced comfort to passengers.

The market is witnessing technological advancements in production techniques and raw materials. Aircraft tire manufacturers are looking for eco-friendly raw materials to produce sustainable, fuel-efficient, and lower-carbon emission tires to meet the rising consumer demand for environmentally friendly travel options. In addition, with growing awareness regarding environmental health in government and consumers, the pressure on the aviation industry is increasing to reduce carbon footprints. This will drive the demand for eco-friendly aircraft tires over the coming years.

The market is also witnessing stringent rules and regulations related to regular maintenance and inspection of aircraft, which drives the replacement of tires. Furthermore, global cargo and passenger air traffic are major product drivers. Consumers' increasing per capita income worldwide is growing in demand for air travel, thus requiring more tires for replacement and new flights. Moreover, as companies are expanding their number of fleets to meet growing air travel demand, this is expected to fuel product use.

Defense and military budgets are increasing worldwide due to the rising threat of war because of ongoing conflicts between countries. These aircraft require high-performance tires to ensure safety in harsh environments, driving demand for the product. In addition, airlines are focusing on research and development activities to reduce their overall cost by using efficient fleet parts. This is further expected to increase their adoption due to their fuel-efficient characteristic.

Product Insights

Based on product, the radial segment dominated the market with a revenue share of 69.96% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Radial tires provide enhanced performance characteristics compared to cross-ply tires, including better fuel efficiency, longer tread life, and improved durability under higher loads. Moreover, the rising travel expenditure due to the growing population and increasing connectivity leads to higher aircraft production and maintenance activities. As aircraft manufacturers seek to reduce operating costs and improve performance, adopting radial tires is anticipated to increase, further boosting their demand over the forecast period.

Cross-ply is anticipated to grow significantly over the forecast period because of its proven durability and ability to handle rough and unpaved runways, which are common in emerging economies and remote areas. Cross-ply tires are popular for their robust construction that offers improved resistance to cuts and impacts, making them an ideal choice for military, cargo, and regional aircraft that operate in challenging conditions. In addition, these tires have lower initial cost as compared to radial, making them cost-effective options for cost-sensitive airline operators. These factors are expected to drive the demand for the market in the coming years.

End-use Insights

Based on end use, the market is segmented into commercial, business, military, and others. Commercial dominated the market with a revenue share of 51.66% in 2023 and is further expected to grow at a significant rate over the forecast period. The demand for commercial aircraft is anticipated to be the highest owing to the growth in passenger and freight traffic. With improved trade relations globally, there is an increase in the demand for new aircraft and cargo services, which is expected to drive the market for commercial aircraft and further support the growth of the aircraft tires industry.

The business segment is expected to grow at the fastest CAGR during the forecast period. Business aircraft commonly include jet airplanes used for passenger aviation, police, ambulance, agricultural, business jets, recreational airplanes, aerial surveys, and patrol services. The demand for business aircraft is expected to rise owing to low prices and an increase in the size of the aircraft. The growing market for business aircraft can be attributed to the benefits mentioned by the National Business Aviation Association, such as increased mobility, productivity, increased efficiency, and benefits in taxation. As a result, the demand for aerospace tires is likely to increase over the forecast period.

Regional Insights

North America dominated the aircraft tire market with a revenue share of 49.64% in 2023. North America is driven by the high demand for passenger transportation. In addition, rising environmental concerns due to increased carbon emissions have led to the demand for fuel-efficient aircraft. The use of lightweight materials in aircraft manufacturing helps to reduce the overall weight of an aircraft, boosting its fuel efficiency. This, in turn, is expected to bolster the demand for products over the forecast period. Moreover, the region is characterized by the presence of major airline manufacturers, such as Boeing, Northrop Grumman, and Lockheed Martin, which is anticipated to fuel the demand for aircraft tires over the forecast period.

U.S. Aircraft Tire Market Trends

The aircraft tire market in the U.S. is expected to grow at a CAGR of 3.2% over the forecast period. Legislative authorities such as the FAA and AIA's adoption of new policies and enforcement of stringent aircraft safety standards will accelerate the demand for aircraft tires and their regular maintenance in the country.

Europe Aircraft Tire Market Trends

The aircraft tire market in Europe is expected to grow lucratively during the forecast period. Europe is one of the most liberalized regions in terms of civil aviation regulations and activities undertaken by the European Union member states. Furthermore, air travel in Europe is expected to grow at a rapid pace with increasing demand for more fuel-efficient and cost- and energy-saving flights. This is expected to increase the use of eco-friendly aircraft tires in the region.

Asia Pacific Aircraft Tire Market Trends

The aircraft tire market in Asia Pacific is expected to grow at the fastest rate of 5.6% over the coming years. Growing demand for commercial aircraft, leading to the development of MRO services and extensive establishment of maintenance facilities and joint ventures between companies in the region, is estimated to drive the market in the coming years. Moreover, government initiatives to increase domestic manufacturing capabilities in China and overall export to the U.S. are likely to boost demand for aircraft tires over forecast period.

Key Aircraft Tire Company Insights

Some of the key players operating in the market include MICHELIN and Bridgestone Corporation:

-

MICHELIN was established in 1889 and is headquartered in Clermont-Ferrand, France. It is a leading tire company engaged in manufacturing and servicing tires for airplanes, earthmovers, automobiles, trucks, and farm equipment. The company has a presence in more than 170 countries and employs over 111,000. MICHELIN has about 67 production plants spread across 17 countries.

-

Bridgestone Corporation is a Japan-based manufacturer of tires for passenger vehicles, motorcycles, aircraft, commercial vehicles, and off-road vehicles. The company also offers various products other than tires. This includes, conveyer belt, rubber track and pad, golf equipment, hydraulic hose, and seismic isolator for buildings. The company has about 130 manufacturing plants and research facilities which are spread across the globe.

Petlas and Qingdao Sentury Tire Co., Ltd., are some of the emerging market participants in the market.

-

Petlas was established in 1976 and manufactures tires for passenger cars, off-highway agricultural vehicles, aircraft, and construction/earthmoving vehicles. It produces around 13 million tires per year and employs 4600 people. Furthermore, it has a presence in 130 countries and a stable and large distribution network.

-

Established in 2009, Qingdao Sentury Tire Co., Ltd. manufactures commercial, aircraft, and consumer tires. Its distribution network extends to around 150 countries in South, Central, North America, Africa, Europe, Asia, and Oceania. Furthermore, the company manufactures tires for Boeing 737-700/800/900 aircraft.

Key Aircraft Tire Companies:

The following are the leading companies in the aircraft tire market. These companies collectively hold the largest market share and dictate industry trends.

- Qingdao Sentury Tire Co., Ltd.

- Petlas

- Specialty Tires of America

- Dunlop aircraft tires

- Compagnie Generale Des Etablissements Michelin

- Bridgestone Corporation

- Desser Holdings LLC

- Aviation Tires & Treads, LLC

- The Goodyear Tire and Rubber Company

- Wilkerson Company, Inc.

Recent Developments

-

In June 2023, Michelin launched a new aircraft tire under the "Michelin Air X Sky Light tyre" segment. This is a new generation of tires with enhanced features such as durability, lightweight, fuel savings, and lower CO2 emissions. Michelin's new tires also have increased the life span of tires by an additional 10-20% from previous generations.

Aircraft Tire Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.00 billion

Revenue forecast in 2030

USD 2,675.2 million

Growth rate

CAGR of 4.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Qingdao Sentury Tire Co., Ltd.; Petlas; Specialty Tires of America; Dunlop aircraft tires; Compagnie Generale Des Etablissements Michelin; Bridgestone Corporation; Desser Holdings LLC; Aviation Tires & Treads, LLC; The Goodyear Tire and Rubber Company; Wilkerson Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft Tire Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aircraft tire market based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Radial

-

Cross-ply

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Business

-

Military

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global aircraft tire market size was estimated at USD 1.89 billion in 2023 and is expected to reach USD 2.0 billion in 2024.

b. The global aircraft tire market is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030 to reach USD 2.68 billion by 2030.

b. The commercial aircraft tire accounted for the largest revenue share of over 52.0% in 2023. With improved trade relations globally, there is an increase in the demand for new aircrafts and cargo services, which is expected to drive market for commercial aircraft and further support the growth of aircraft tires industry.

b. Some key players operating in the aircraft tire market include Qingdao Sentury Tire Co., Ltd., Petlas, Specialty Tires of America, Dunlop aircraft tires, Compagnie Generale Des Etablissements Michelin, Bridgestone Corporation, Desser Holdings LLC, Aviation Tires & Treads, LLC, The Goodyear Tire and Rubber Company, and Wilkerson Company, Inc.

b. The key factors that are driving the aircraft tire market growth is the importance of aircraft tires in maintaining the overall weight of an aircraft at the time of takeoff and landing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.