Albumin Market Size & Trends

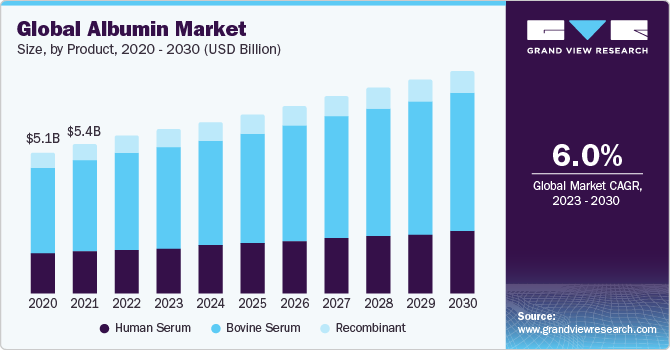

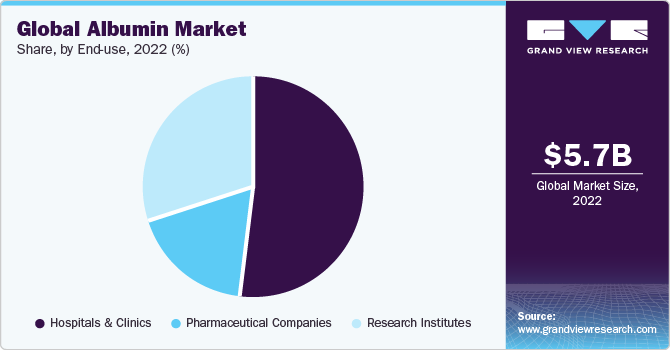

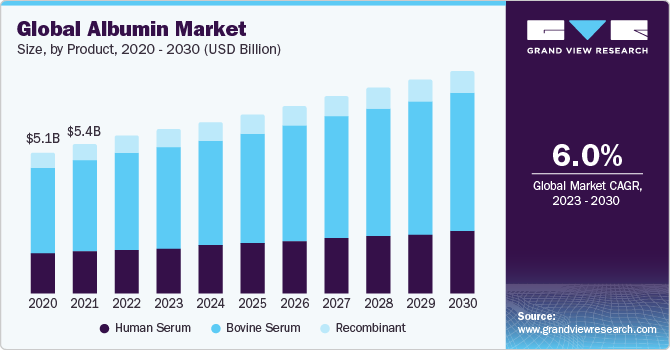

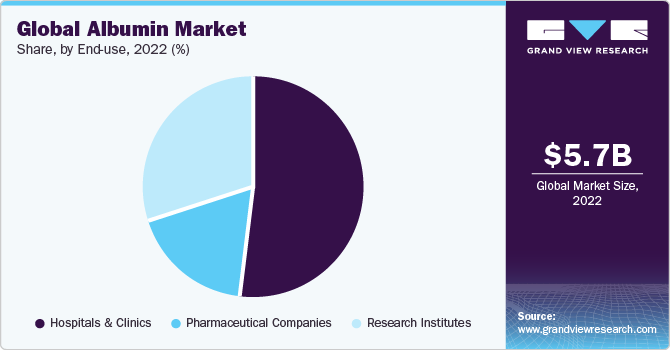

The global albumin market was valued at USD 5.7 billion in 2022 and is expected to grow at a CAGR of 6.0% over the forecast period. Albumin is primarily synthesized in the liver and assumes a crucial role in a variety of physiological processes. It stands as a major protein component within blood plasma of humans and plays an important role in upholding osmotic pressure, thereby regulating blood volume. Additionally, it serves as a carrier for various molecules, including hormones, fatty acids, and medications, facilitating their distribution throughout the body.

The global market is experiencing significant growth primarily due to the rising incidence of life-threatening illnesses, specific liver conditions, infections, and cardiac surgeries. Furthermore, the continuous introduction of new products by numerous prominent industry players is a substantial driving force behind this growth. The increasing number of surgical procedures in the world are an important source of consumption of albumin. According to national library of medicine a total of 310 million major surgeries were performed in 2022 with 40-50 million of them in the U.S. and around 20 million in Europe.

Other factors propelling the expansion of the market include its heightened demand in research and development endeavors, an increase in non-therapeutic applications of albumin and an uptick in the production of immunoglobulins and plasma collection.Albumin nanoparticles have been extensively studied for drug delivery systems. By encapsulating drugs within nanoparticles, researchers can improve drug solubility, stability, and circulation time in the body. For instance, Abraxane, a widely used chemotherapy drug for breast cancer, is formulated using albumin nanoparticles to enhance the delivery of paclitaxel, a potent anti-cancer agent. Other important applications of albumin are in the field of crystallography, cell culture, diagnostic assays and stabilization of enzymes and biomolecules.

Government regulations and guidelines have a major impact on this market. Regulatory authorities give out directives for ensuring the secure manufacturing, stringent quality checks, and the efficient dissemination of commodities. These regulations play an important role in fostering consumer confidence and also stimulate pharmaceutical enterprises to allocate resources towards the development of top-notch products. Swift endorsements for novel albumin-based items or treatments hold the potential to significantly expedite their market adoption, thereby serving as a catalyst for the sector.

Covid-19 had a positive impact on the albumin market because of a significant increase in pharmaceutical and medicinal research activities, studying the effects of albumin on Covid affected patients during the pandemic period. The usage of albumin for the production of vaccines such as Covaxin and Covishield also resulted in a rise in albumin consumption.

Product Insights

Based on the product, the market is divided into human, bovine and recombinant albumin. T Human serum segment held the largest market share in 2022. The increasing frequency of surgical interventions that rely on human serum albumin for fluid regulation drive the demand for human albumin. Progress in biotechnological techniques has simplified the production and purification of human serum albumin, making it more readily available and cost-efficient. Consequently, its use has expanded across various medical and non-medical domains, including drug development and vaccine preservation. Furthermore, the industry relies on regulatory backing from agencies such as the European Medicines Agency (EMA) in Europe and the Food & Drug Administration (FDA) in the U.S. to guarantee product quality and safety, thereby enhancing consumer confidence.

Application Insights

On the basis of application, the market is divided into drug formulation, therapeutics and others. Therapeutics is the largest application segment in 2022. Its unique properties make it a versatile tool in healthcare. One of its primary therapeutic applications is as a volume expander, where it is used as a volume expander to restore and maintain blood volume, especially when there is a risk of hypovolemia (low blood volume). The colloid osmotic pressure created by albumin helps retain water within the blood vessels, preventing it from leaking into surrounding tissues, which can lead to edema. This fluid management can improve cardiac output, blood pressure, and tissue perfusion.

End-User Insights

Based on end use, the market is segmented into hospitals & clinics, pharmaceutical companies, and research institutions. Hospitals & clinics are the largest end-users of albumin due to its diverse applications in patient care and medical treatments. Hospitals frequently use albumin in intravenous (IV) fluid therapy, especially for critically ill patients. For example, a patient admitted with severe sepsis may require albumin administration to restore blood volume and improve blood pressure. Hospitals and cancer clinics use albumin-based formulations in oncology care. For instance, chemotherapy drugs like Abraxane are administered to cancer patients to enhance drug delivery, improve efficacy, and reduce side effects. They are also used in other applications such as the management of liver diseases, trauma care, and surgical procedures.

Regional Insights

North America dominated the largest market share in 2022, driven by several key factors, including a robust healthcare infrastructure, a significant patient population, and a high level of research and development activities.The region is home to some of the world's leading medical institutions, hospitals, and research centers. This infrastructure provides a conducive environment for the utilization of albumin in various medical applications.North America is also experiencing a demographic shift with an increasingly aging population. The elderly are more susceptible to health issues that necessitate the use of albumin, such as surgery, trauma care, and chronic disease management, leading to a sustained demand in the region.

Key Companies & Market Share Insights

Key players operating in the market are Octapharma AG, Albumedix Ltd., Biotest AG, Grifols SA, HiMedia Laboratories, Medxbio Pte Ltd., CSL Limited, Merck KGaA, Takeda Pharmaceutical Company Limited, and Ventria Bioscience Inc. Companies are venturing into emerging markets characterized by growing healthcare expenditures and an expanding patient demographic. This strategic expansion serves as a risk mitigation strategy to reduce reliance on well-established markets.

In June 2023, Albumedix Ltd announced the expansion of its ongoing collaboration with Valneva SE, a dedicated vaccination company focused on addressing critical unmet medical requirements in the prevention of infectious diseases. The announcement came in the backdrop of approval of Valneva’s inactivated Covid-19 vaccine by the Medicines & Healthcare products Regulatory Agency in UK.