- Home

- »

- Renewable Chemicals

- »

-

Fatty Acids Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Fatty Acids Market Size, Share & Trends Report]()

Fatty Acids Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Saturated, Unsaturated), By Form (Oil, Powder, Capsule), By End-use (Industrial, F&B), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-998-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fatty Acids Market Summary

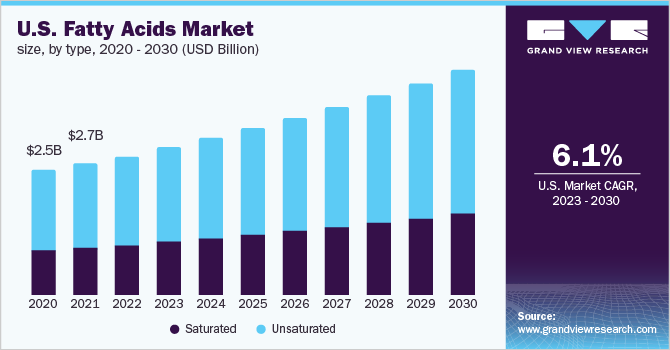

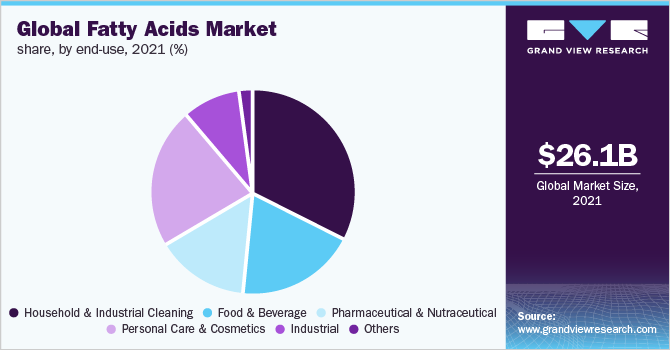

The global fatty acids market size was valued at USD 26.13 billion in 2021 and is expected to expand at a CAGR of 4.9 % from 2022 to 2030. The growing utilization of fatty acids in household & industrial cleaning, and pharmaceutical & nutraceutical products is expected to drive the market growth.

Key Market Trends & Insights

- Asia Pacific dominated the fatty acids growth trajectory with the highest revenue share of 41.9% in 2021.

- By type, the unsaturated type dominated the market with the highest revenue share of 75.3 % in 2021.

- By form, the oil form dominated the market with the highest revenue share of 54.2 % in 2021.

Market Size & Forecast

- 2021 Market Size: USD 26.13 Billion

- 2030 Projected Market Size: USD 40.05 Billion

- CAGR (2022-2030): 4.9%

- Asia Pacific: Largest market in 2021

Additionally, factors such as new product launches in dish care, floor care, fabric care, and surface care are expected to create new growth opportunities over the forecast period.

Fatty acids are formed from animal carbohydrates, converted into methyl ester, and hydrogenated into fatty alcohols. Methyl esters can be produced from either natural oil (coconut, palm kernel, tallow) or fatty acids, and the process involves the reaction of oils with methanol in the presence of a base or acid catalyst. These are used as raw materials in different cleaning and personal care products.

Growing demand for fatty acids in various personal care & cosmetics products including soap, detergent, moisturizers, and others is expected to propel industry growth over the forecast period. Furthermore, changing consumer lifestyles along with increasing urbanization and rising disposable incomes have led to increasing consumption of cosmetics & personal care products which in turn drive the demand for fatty acids.

After the outbreak of the COVID-19 pandemic, there was a shift in consumer preference for a healthier and hygienic lifestyle, leading to a rise in the demand for cleaning products and immunity-boosting supplements. This, in turn, positively impacted the demand for the fatty acids industry across regions.

Health awareness among customers across geographies such as India, China, and the U.S. is growing, which, in turn, is augmenting the demand for nutrient-rich food and beverages. Rising income levels and increasing urban population further drive the demand for fortified convenience healthy foods. Rising awareness about the advantages of a healthier diet and healthy lifestyle continues to trigger the demand for omega-6 and omega-3 fatty acids in the food & beverage industry which is anticipated to accelerate the market growth. However, fluctuating prices and supply of raw materials are likely to obstruct the market during the forecast period.

Manufacturers of fatty acids are actively involved in the enhancement of their product offerings. Manufacturers continue to use advanced technologies for the efficient removal of environmental pollutants from their products. This minimizes oxidation in the manufacturing process and ensures optimal delivery of nutrients of the product. The global fatty acids market is significantly fragmented with players such as Akzo Nobel, BASF SE, Ashland Inc., and Croda International Plc which are among some of the top market shareholders in terms of production capacity across the globe.

Type Insights

The unsaturated type dominated the market with the highest revenue share of 75.3 % in 2021. Its high share is attributable to its increasing penetration in the pharmaceutical industry. It helps in improving blood cholesterol levels, stabilizing heart rhythms, and can ease inflammation. The unsaturated fats are extracted from nuts, avocados, canola, olive oil, and soybean among others. It helps in the production of chemokines, which attract the immune cells to the infected area and subsequently, improve the immune system. This has led to increased demand for dietary supplement applications across the globe.

However, the penetration of saturated type remains on the rise among certain end-use applications compared to unsaturated fatty acids. These include waxes, metals, rubbers, and crayons. This is due to the relatively low melting point of the unsaturated type which reduces the shelf life and heat stability of fatty acids. It contains a double bond present per molecule which makes it more chemically reactive, making it a better choice among the two.

Saturated fatty acids are extracted from animal fats and plant oils. They are naturally present in animal species. It helps in lowering the good (HDL) cholesterol and not-so-good (LDL) cholesterol, and it benefits weight loss. The rising usage of saturated type in the food & beverage industry is expected to positively impact market growth in the coming years.

Form Insights

Oil form dominated the market with the highest revenue share of 54.2 % in 2021. Its high share is attributable to its increasing utilization in the food & beverage and pharmaceutical industries. It is used as an ingredient in the end-use industries in different forms, mainly oil, powder, and capsule. The different types of fatty acids such as omegas are extracted from animals majorly in the oil form and are then used in numerous end-use applications such as pharmaceutical, food & beverage, and cleaning products.

The powder form of the product is mainly used in household cleaning, pharmaceutical, food & beverage, and industrial end-use applications. The usage of a particular form depends on the product where it is used. Pharmaceutical drugs mainly contain fatty acids in the form of powder in tablets. Further, in the food & beverage application, it is used in the powdered form in sports drinks, energy bars, and bakery products among others.

The product is widely used in the form of capsules mainly in pharmaceutical nutraceutical and personal care applications. The usage of capsules remains on the rise as it acts faster than tablets, have no taste, and have better absorption. It also has better bioavailability, which means more quantity of medication enters the bloodstream of a human body and thus, making the medication far more effective. Today, consumers look for faster results when it comes to health or skincare, and thus, increasingly prefer capsule forms of fatty acids across different regions.

End-use Insights

Household & industrial cleaning dominated the market with the highest revenue share of 32.5% in 2021. Its high share is attributable to the exceptional properties of fatty acids including antifungal, antiviral, and antibacterial which make them popular for usage in household cleaning application. They also help in increasing the thickness of liquid products which is why it is widely used in household applications. Furthermore, the outburst of COVID-19 led to a significant rise in the demand for cleaning products such as surfactants, soaps, and detergents among others. This, in turn, positively influenced the demand for fatty acids.

Fatty acids provide nutritional support for decreasing body fat and increasing lean muscle mass. There is a shift in the preference of consumers for healthier diet intake and the rising demand for weight loss programs is projected to trigger product growth in nutraceutical applications. The rise in innovative production technologies and the requirement for essential fatty acids in foods and beverages continues to escalate the demand for fatty acids globally.

Supplement and functional foods are primarily consumed to ensure the intake of nutritional constituents important to the human body. Growing awareness regarding a reduction in calorie intake among gym professionals and athletes in several countries including China, Italy, India, and the U.S. is likely to promote the use of omega-3 in sports supplements and functional food products. Furthermore, the increasing importance of fatty acids on a global level owing to the implementation of new advertising campaigns by companies such as Koninklijke DSM N.V. and BASF SE is anticipated to have a significant impact on the market growth.

Regional Insights

Asia Pacific dominated the fatty acids growth trajectory with the highest revenue share of 41.9% in 2021. This is attributed to the presence of several product manufacturers across the region such as Akzo Nobel, BASF SE, and Croda International Plc among others. Favorable regulatory policies by Registration, Evaluation, and Authorization of Chemicals (REACH) to promote sustainable chemicals are expected to drive the growth of fatty acids in Europe.

Asia Pacific is among the largest market for fatty acids owing to the presence of key raw material producers across the region. The easy availability of raw materials coupled with huge captive consumption in the region encourages manufacturers to increase their capacities in the region. The trend is expected to boost the market growth in the region over the forecast period. Moreover, the growing importance of hygiene and immunity booster products across key countries is expected to further augment the market growth over the forecast period.

Rising demand from several end-use industries including household cleaning, pharmaceutical, and food & beverage among others is expected to augment product consumption in North America. The U.S. is one of the key consumers of fatty acids. It is also home to well-established players such as BASF SE, Cargill incorporated, and Eastman Chemical Company. The abundant availability of raw materials coupled with the rising demand for nutraceutical products is expected to drive the market demand over the forecast period.

Key Companies & Market Share Insights

Key industry participants are inclined toward new product launches coupled with mergers & acquisitions. In order to strengthen their market position and revenues, the market participants are collaborating with the distributors which might help them achieve greater penetration into the market. Furthermore, compliance with national and international regulatory norms is one of the key concerns for manufacturers. Compliance with these norms for sustainable production and deep pockets of distribution pockets remains a promising growth driver. Furthermore, the acquisition of certifications from key government bodies such as USDA has led to new opportunities in various segments, becoming a driving force for the product. Some prominent players in the global fatty acids market include:

-

Akzo Nobel

-

BASF SE

-

Ashland Inc.

-

Eastman Chemical Company

-

DOW

-

Croda International Plc

-

Cargill Incorporated

-

Arizona Chemicals

-

Koninklijke DSM NV

-

Oleon N.V.

Fatty Acids Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 27.39 billion

Revenue forecast in 2030

USD 40.05 billion

Growth rate

CAGR of 4.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Akzo Nobel; BASF SE; Ashland Inc.; Eastman Chemical Company; DOW; Croda International Plc; Cargill Incorporated; Arizona Chemicals; Koninklijke DSM NV; Oleon N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

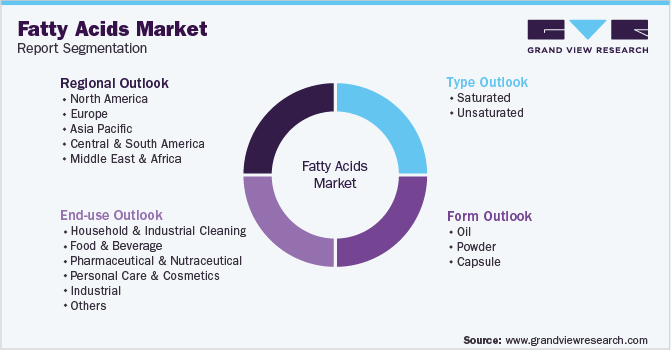

Global Fatty Acids Market Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fatty acids market report based on type, form, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Saturated

-

Unsaturated

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil

-

Powder

-

Capsule

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Household & Industrial Cleaning

-

Food & Beverage

-

Pharmaceutical & Nutraceutical

-

Personal Care & Cosmetics

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fatty acids market size was estimated at USD 26.1 billion in 2021 and is expected to reach USD 27.4 billion in 2022.

b. The global fatty acids market is expected to grow at a compound annual growth rate of 4.9% from 2022 to 2030 to reach USD 40.05 billion by 2030.

b. Asia Pacific dominated the fatty acids market with a share of 41.9% in 2021. This is attributable to the presence of several product manufacturers across the region such as Akzo Nobel, BASF SE, and Croda International Plc among others. Asia Pacific is among the largest market for fatty acids owing to the presence of key raw material producers across the region.

b. Some key players operating in the fatty acids market include Akzo Nobel, BASF SE, Ashland Inc., Eastman Chemical Company, DOW, Croda International Plc, Cargill Incorporated, Arizona Chemicals, Koninklijke DSM NV, Oleon N.V.

b. Key factors that are driving the fatty acids market growth include the growing utilization of fatty acids in household & industrial cleaning, and pharmaceutical & nutraceutical products, and new product launches in dish care, floor care, fabric care, and surface care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.