- Home

- »

- Pharmaceuticals

- »

-

Allergy Diagnostics & Therapeutics Market Size Report, 2033GVR Report cover

![Allergy Diagnostics And Therapeutics Market Size, Share & Trends Report]()

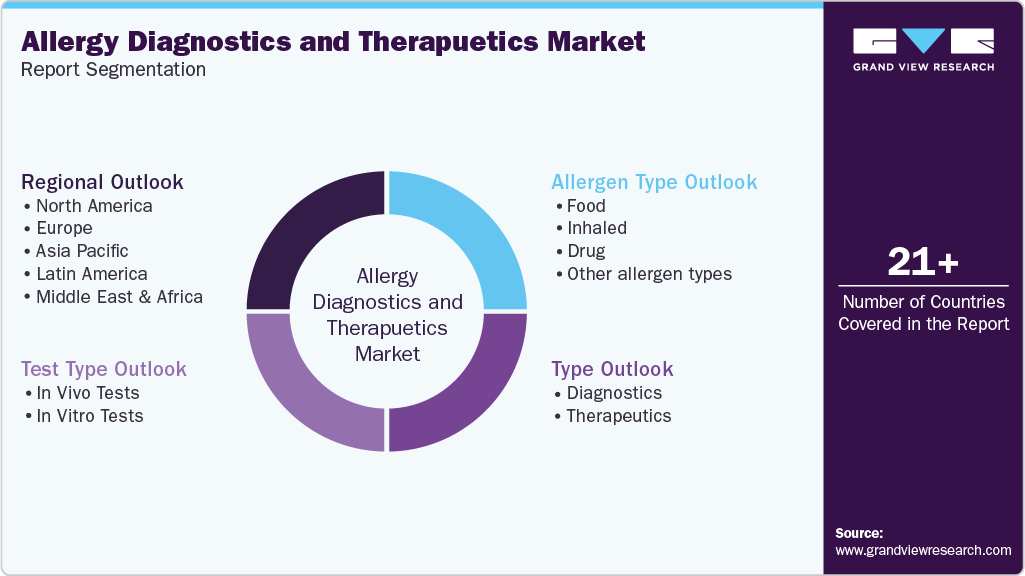

Allergy Diagnostics And Therapeutics Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Diagnostics, Therapeutics), By Allergen Type (Food, Inhaled, Drug), By Test Type (In Vivo Tests, In Vitro Tests), By Region, And Segment Forecasts

- Report ID: 978-1-68038-701-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Allergy Diagnostics And Therapeutics Market Summary

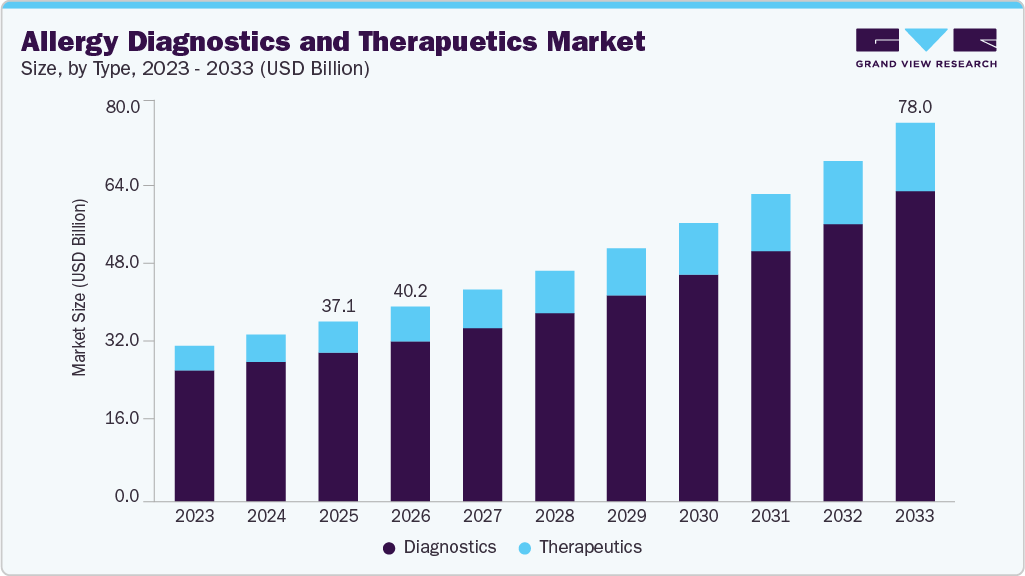

The global allergy diagnostics and therapeutics market size was estimated at USD 37.10 billion in 2025 and is expected to reach USD 78.00 billion by 2033, projected to grow at a CAGR of 9.95% from 2026 to 2033. Some of the major factors driving the market are the rising prevalence of allergies, advancements in technology, the launch of new products, and the high adoption of immunotherapy drugs.

Key Market Trends & Insights

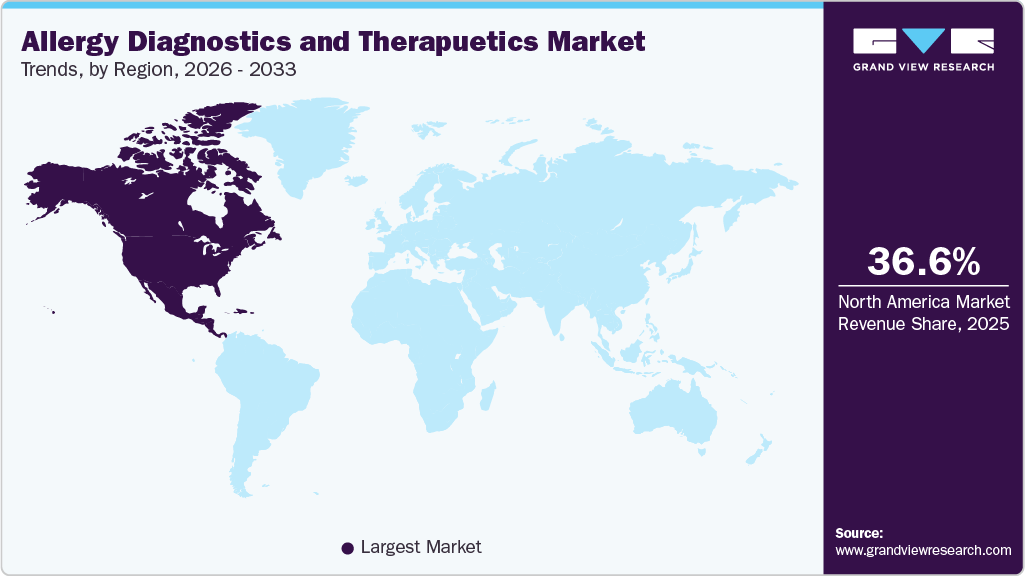

- North America allergy diagnostics and therapeutics market dominated the global market and accounted for the largest revenue share of 36.62% in 2025.

- The U.S. led the North American market and held the largest revenue share in 2025.

- Based on type, the therapeutics segment dominated the global market, and diagnostics accounted for the largest revenue share of 82.86% in 2025.

- Based on allergen type, the inhaled segment held the largest revenue share of 49.86% in 2025.

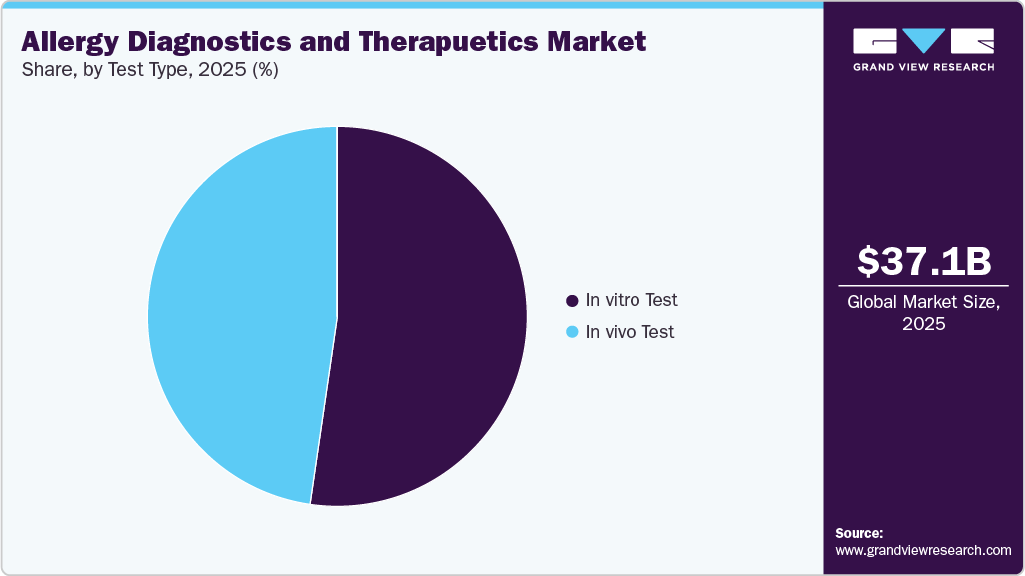

- On the basis of test type, in vivo test segment held the largest revenue share of 52.30% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 37.10 Billion

- 2033 Projected Market Size: USD 78.00 Billion

- CAGR (2026-2033): 9.95%

- North America: Largest Market in 2025

According to the FDA, the most common food allergies in the U.S. include milk, eggs, fish, shellfish, tree nuts, peanuts, wheat, soybeans, and sesame. The CDC reported that 10% of patients in the U.S. claim to be allergic to penicillin; less than 1% are truly allergic. Changing lifestyle and growing pollution are some of the key factors contributing to the increasing incidence of allergic conditions. The introduction of therapeutically advanced drugs, namely immunotherapy, which solves unmet patient needs, is expected to boost market growth over the forecast period. For instance, in February 2024, the U.S. Food and Drug Administration approved Xolair (omalizumab) injection for immunoglobulin E-mediated food allergy in certain adults and children 1 year or older for the reduction of allergic reactions (Type I), including reducing the risk of anaphylaxis, that may occur with accidental exposure due to more than one food. In addition, Xolair is intended for repeated use to reduce the risk of allergic reactions and is not approved for the immediate emergency treatment of allergic reactions, including anaphylaxis.

The rising prevalence of allergies is one of the important reasons driving the growth of the allergy therapeutics market over the predicted period. High risk factors for chronic respiratory disorders include increased exposure to outdoor and indoor air pollution, as well as occupational exposure. Allergies are far more common in cities than in rural areas, owing to increased exposure to environmental contaminants as a result of industrial activity and urbanization. According to statistics published by the WHO in January 2024, around 1 in 4 children and 1 in 3 adults have a seasonal allergy in the U.S. Nearly 6% of children and adults in the U.S. suffer from a food allergy, with the rate being highest among black, Asian, and Hispanic individuals.

Increasing demand for IVD testing is likely to drive the market over the forecast period. In vitro blood tests are used to diagnose food, inhalation, skin, and medication allergies. These tests have several advantages, including the fact that they are minimally invasive, cost-effective, and user-friendly, which is expected to provide profitable growth prospects in this market. Furthermore, the development of low-cost and effective in vitro diagnostic tests for allergy detection, increased lab automation, and an increase in reagent rental agreements are all projected to contribute to market expansion in the future years.

In addition, rising funding for the development of IVD allergy tests is driving strong market growth. For instance, in October 2024, Allergios received a HealthHolland grant to strengthen a public-private partnership with Wageningen University & Research focused on verifying the GranulEye test, a cutting-edge food allergy diagnosis tool. The study, conducted by Dr. Janneke Ruinemans-Koerts, used both clinical and analytical methods to validate GranulEye for peanut allergy, comparing its basophil-activation visualization method to existing basophil activation tests. Unlike skin-prick tests, IgE tests, or the difficult double-blind placebo-controlled food challenge, GranulEye aims to diagnose actual clinical allergy rather than mere sensitization reliably.

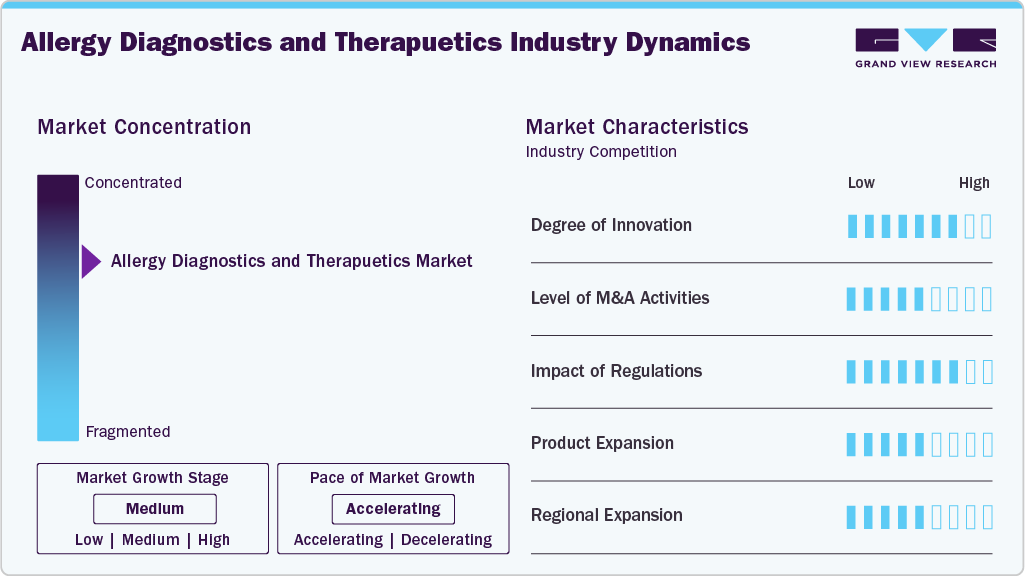

Market Concentration & Characteristics

The allergy diagnostics and therapeutics industry shows high innovation, driven by AI/digital health in diagnosis, molecular diagnostics, and multiplex assays. Metropolis Healthcare Limited (India) launched a novel testing platform based on component resolved diagnostics (CRD) to support India’s population in diagnosing various forms of allergies. This platform is a fourth-generation allergy testing technology that uses artificial intelligence (AI) in order to assist clinicians in making sound clinical decisions as well as provide great insights into selecting and optimizing the course of treatment regarding an individual’s allergic disease.

The market has medium mergers and acquisitions (M&A) activities, which are increasingly shaping the allergy diagnostics and therapeutics industry by consolidating major players, driving innovation, and expanding capabilities. For instance, in January 2024, ALK acquired AllerQuest's (U.S.) business holdings, a manufacturer of PRE-PEN (benzylpenicilloyl polylysine injection USP) Skin Antigen Test. ALK became the exclusive manufacturer and distributor of PRE-PEN in the U.S. and Canada, as well as the global owner of all of AllerQuest's businesses, following this purchase. Moreover, PRE-PEN is the only FDA-approved skin test for diagnosing penicillin allergies and is intended for evaluating penicillin sensitivity.

The market has a significant regulatory influence because it takes care of product efficacy, manufacturing quality, and patient safety. Further, regulatory agencies such as the European Medicines Agency, the FDA, the Japan Pharmaceutical and Medical Devices Authority, and other global healthcare authorities enforce stringent standards for both therapeutics and diagnostics.

Product expansion in the global allergy diagnostics and therapeutics industry is medium, reflecting steady growth. In diagnostics, product expansion is driven by the development of multiplex testing systems, molecular-based assays, and point-of-care devices. On the therapeutics side, the market is seeing gradual growth in immunotherapy, target desensitization protocols, and biologic treatment for severe allergies. However, innovation is largely centered on improving existing therapies rather than launching new molecules.

North America plays a leading role in the allergy diagnostics and therapeutics industry owing to the strong regulatory frameworks, well-established healthcare infrastructure, and high prevalence of allergic conditions. Moreover, the region benefits from many clinical trials, significant investment in R&D, and widespread adoption of innovative technologies. The regions are experiencing a swift adoption of AI-driven diagnostic tools and digital health platforms that improve testing precision and patient supervision. Growing awareness of food allergies, environmental allergens, and the management of allergies in children is driving an increase in testing volumes.

Type Insights

The therapeutics accounted for the largest revenue share of over 82.86% in 2025 due to their focus on treating allergic conditions. Therapeutics aim to alleviate symptoms and provide relief from allergies, addressing the core concern of patients. Epinephrine dominated the overall allergy therapeutics market due to its rapid and potent response. It's swift action during severe allergic reactions, such as anaphylaxis. As a natural hormone, it mimics the body's fight-or-flight response, swiftly alleviating symptoms such as respiratory distress and low blood pressure. Its ubiquity, cost-effectiveness, and decades-long established use contribute to its dominance, making it a crucial and trusted tool in emergency allergy management.

The diagnostic segment is anticipated to experience the highest CAGR during the forecast period in the market due to increasing demand for precise and early identification of allergic conditions. Diagnostics are pivotal in evaluating allergen sensitivities, enabling targeted therapeutic interventions. The growing number of product launches is supporting safer allergy research. For instance, in April 2025, Beckman Coulter Life Sciences launched a next-generation Basophil Activation Test. The test is designed solely for research purposes, and the innovation allows for the identification of food allergies via a simple blood draw, eliminating the need for direct allergen contact in test subjects.

Allergen Type Insights

Inhaled allergies held the largest revenue share of over 49.86% in 2025, owing to the growing incidence of respiratory allergies caused by industrialization and increasing air pollution. In August 2025, London Allergy Care and Knowledge hospital reported that asthma affected approximately 20% of schoolchildren in the UK, allergic rhinitis and conjunctivitis (hay fever) affected about 15% of children, eczema (atopic dermatitis) affected 10-16% of children, and food allergies affected 6-8% of children. Meanwhile, increased exposure to indoor allergens such as dust mites, pet dander, and mold spores, combined with longer pollen seasons as a result of climate change, is contributing to an increase in the incidence of inhalation allergies. Improvements in diagnostic methods, such as molecular allergen profiling and component-resolved diagnostics, are enhancing the accuracy of identifying inhaled allergen triggers. The increased healthcare awareness, early screening initiatives in educational settings, and expanded access to allergy testing facilities all contribute to higher diagnosis rates.

In addition, drug allergies are expected to experience a faster CAGR over the forecast period. Drug allergies may lead to toxic epidermal necrolysis and Stevens-Johnson syndrome in children. Chemotherapy drugs, sulfonamide drugs, and antiepileptic drugs are the most common agents of drug allergies. These allergens lead to various diseases, such as contact dermatitis, which is skin inflammation. The segment is expected to showcase positive growth during the coming years due to the increasing availability of treatment options and growing awareness about drug allergies among patients.

Test Type Insights

The in vitro test accounted for the largest market share of 52.30% in 2025. This test is utilized for identifying allergen-specific immunoglobulin E. (IgE). Serum IgE has a higher positive predictive value and better specificity for detecting aeroallergen (pollen & insect) sensitization. In addition, advancements in food allergy diagnostics accelerate precision healthcare. For instance, in October 2025, the Allergen Bureau reported that there is a growing global demand for allergy testing that is faster, more precise, and patient-friendly. Traditional procedures, such as skin prick testing and IgE blood tests, are effective yet intrusive and time-consuming. New diagnostic technologies are revolutionizing the field by enabling real-time, highly sensitive detection and personalized risk evaluations. Microfluidics, biosensor-based platforms, and lab-on-a-chip devices enable quick allergy testing at the point of treatment while requiring minimal sample volume. When these developments are combined with AI and data analytics, they can predict individual allergy reactions and allow for more accurate treatment interventions. These innovations are propelling expansion in the food market by allowing faster, more accurate, and patient-friendly testing. Better precision and ease are driving adoption, opening up new opportunities for industry growth and creative treatment solutions.

In vivo test is estimated to grow at a significant CAGR over the forecast period, attributed to increasing adoption of several in vivo tests due to its convenient, cost-effective, safe & reliable properties as compared to others. The growing demand for rapid, simple, and efficient testing has fueled the growth of in vivo diagnostic tests. These tests look at the susceptibility and reactivity of dermal mast cells, which can indicate allergic sensitivity. To ensure reliability, these procedures include skin exams with standardized allergenic extracts.

Regional Insights

The North America allergy diagnostics and therapeutics market is the leading region with a revenue share of 36.62% in 2025, owing to its strong healthcare infrastructure, tight regulatory frameworks, and high prevalence of allergic illnesses. This region benefits from strong investments in R&D, a large number of clinical trials, and the rapid adoption of ground-breaking diagnostic and therapeutic technologies. In October 2025, RAPT Therapeutics, Inc. initiated a Phase 2b clinical trial for ozureprubart (previously known as RPT904) to treat IgE-mediated food allergies. This randomized, double-blind, placebo-controlled experiment will take place at around 30 locations throughout the U.S. and Canada. The start of this trial is a significant milestone that validates our effective execution and the legitimacy of the preliminary preclinical and clinical findings we have generated. These breakthroughs are creating exciting potential for market growth in the North America region.

U.S. Allergy Diagnostics And Therapeutics Market Trends

The allergy diagnostics and therapeutics market in the U.S. is driven by rising allergy prevalence, greater healthcare spending, and a strong emphasis on early and precise diagnosis. The presence of advanced healthcare infrastructure, significant R&D investments, and a high clinical awareness all contribute to rapid market expansion. For instance, in October 2024, the FDA approved the AccuTest allergy skin testing device. This test provides smaller tine lengths and diameters, which improve precision and lessen discomfort as well. AccuTest trays feature non-slip rubber bottoms for better stability. Favorable payment schemes and the rapid adoption of new technology, such as molecular diagnostics and biologic drugs, drive demand even higher. Furthermore, FDA regulations help enable faster product approvals and market entry. The rising emphasis on tailored treatment and preventive care creates new opportunities for targeted allergy therapies. These factors make the U.S. a global leader in developing and applying allergy tests and therapies.

Europe Allergy Diagnostics And Therapeutics Market Trends

The allergy diagnostics and therapeutics market in Europe is expected to grow rapidly, driven by an increase in the prevalence of allergic disorders, increased public health awareness, and the implementation of demanding regulatory criteria such as the EU In Vitro Diagnostic Regulation (IVDR). The region has advantages from a well-established healthcare system, many global and regional market competitors, and increasing investments in new diagnostic technology. European governments promote preventive healthcare, increasing demand for early allergy identification and individualized treatments. Furthermore, increased access to biologic therapies and sublingual immunotherapy (SLIT) is driving therapeutic market expansion. With continuous research projects and cross-border cooperation, Europe remains a significant allergy care innovation and growth.

The UK allergy diagnostics and therapeutics marketis growing steadily due to the rising prevalence of allergic disorders such as asthma, hay fever, and food allergies. A strong emphasis on public health efforts and government-funded healthcare via the NHS promotes broad access to diagnostic and treatment services. The market benefits from improving clinical awareness, improved diagnostic tools, and the increased availability of targeted therapeutics such as sublingual immunotherapy and biologics. Regulatory conformity with EU and MHRA standards assures product quality and safety, while ongoing investment in research and innovation drives market growth. For instance, in August 2025, a study funded by King’s College London and Guy’s and St Thomas’ NHS Foundation Trust was conducted to research a cheaper and more accurate test to diagnose milk allergy in children. Moreover, the basophil activation test (BAT) is more accurate than standard allergy tests for detecting cow’s milk allergy in children,which can reduce the need for oral food challenges in allergy diagnosis. Furthermore, rising demand for tailored treatment and preventive allergy care contributes to the sector's continued growth.

The allergy diagnostics and therapeutics market in Germanyis expanding steadily due to the increased incidence of allergic diseases, particularly food and respiratory allergies. Early identification and efficient treatment of allergy problems are promoted by the nation's comprehensive healthcare system and a strong emphasis on preventative care. Germany leads the world in medical research and development, encouraging the use of cutting-edge immunotherapies such as biologics and sublingual medicines, as well as modern diagnostic equipment. Improved market access is a result of stringent regulatory compliance within national and EU frameworks, as well as supportive reimbursement policies. In addition, increased partnerships among pharmaceutical corporations, biotech companies, and academic institutions are accelerating the research and commercialization of new products. These characteristics make Germany a major force in the European allergy care market.

Asia Pacific Allergy Diagnostics And Therapeutics Market Trends

The allergy diagnostics and therapeutics market in the Asia Pacific is expected to grow at a lucrative rate owing to various factors, such as increasing healthcare reforms and expanding healthcare infrastructure. Other factors contributing to the market growth are a growing population, rising incidence of allergies, and an increasing number of local companies entering the market. Asia Pacific, with Japan, China, and India being notable markets in this region, is projected to boost the market within the region. For instance, in 2024, according to the Hindu newspaper, air pollution, biomass burning, and limited treatment options have all contributed to an increase in food allergies and asthma in India. Air pollution contributes significantly to the development of allergic illnesses like asthma. Asthma affects 37.9 million people in India, accounting for more than half of the UK population, fueling the food market in the Asia-Pacific countries.

Japan allergy diagnostics and therapeutics marketis steadily rising, owing to the increased prevalence of allergic disorders, particularly among urban populations. Japan's aging population, combined with increased prevalence of respiratory and food allergies, is driving the demand for precise diagnostic tools and effective treatment options. For instance, according to the Japan Times in March 2025, the terrible pollen season was peaking in Tokyo and other urban areas that week, causing millions of people to suffer from itchy eyes, runny noses, and frequent sneezing. Although rain and stormy weather have been predicted for parts of the country over the weekend, which may temporarily reduce pollen levels, this relief will not last long. Cedar pollen levels are projected to peak in Takamatsu, Osaka, Nagoya, and Kanazawa by mid-March, with cypress pollen close following. In addition, the country has an advanced healthcare system and significant government assistance for early disease detection and prevention. The expanding use of molecular diagnostics drives increased market potential, the expansion of biologic medicines, and a well-defined regulatory framework.

The allergy diagnostics and therapeutics market in Chinais witnessing strong growth, supported by an increase in allergy incidence caused by urbanization, environmental pollution, and changing lifestyles in China, which is driving the demand for allergy tests and treatments. In July 2025, the International Archives of Allergy and Immunology published results from a study in Beijing, including 402 pollinosis patients, which revealed a 30% prevalence of PFAS. The prevalence was significantly higher among those with spring pollinosis, with 68% in the spring group against 50% in the autumn group. However, all occurrences of pollen-related food-induced anaphylaxis were detected in patients who were allergic to autumn weed pollens. The need for precise diagnosis and cutting-edge therapies is being pushed by rising middle-class demand for improved healthcare and increased public awareness of allergy-related conditions. Government attempts to improve healthcare infrastructure and increase access to specialist treatment are accelerating the industry's growth. Furthermore, point-of-care testing, allergen-specific immunotherapies, and molecular diagnostics are becoming increasingly popular in China, sometimes thanks to collaborations with foreign companies. Regulatory improvements aimed at accelerating pharmaceutical and device approvals encourage international investment and innovation in the allergy sector.

Latin America Allergy Diagnostics And Therapeutics Market Trends

The allergy diagnostics and therapeutics market in Latin America is due to the growing knowledge of allergic diseases, improved healthcare facilities, and improvements in public health infrastructure, which are all contributing to the slow but steady growth of countries such as Brazil, Mexico, and Argentina. In addition, market development is being aided by government attempts to enhance primary care services and encourage early diagnosis. Restricted reimbursement processes, financial constraints, and unequal access to specialized care in rural and urban areas continue to be major problems. A greater focus on managing chronic illnesses and growing partnerships with global healthcare organizations will enable additional market expansion in the years to come, despite these obstacles.

Brazil allergy diagnostics and therapeutics marketis booming as allergy prevalence rises, healthcare infrastructure expands, and food & respiratory allergies become more widely known. Allergic conditions are on the rise due to urbanization, pollution, and lifestyle changes. However, private healthcare access and contemporary diagnostic testing are driving market expansion. The increased need for precise diagnosis and individualized management is driving the penetration of both diagnostics and medications. The recent media coverage of unusual food allergy cases, such as a nut allergy caused by intimate contact (food allergen transfer via semen), highlights the complexities of food allergies and raises public awareness of the risks. This improved awareness is anticipated to translate into increasing demand for diagnoses, treatments, and preventive solutions throughout Brazil.

Middle East & Africa Allergy Diagnostics And Therapeutics Market Trends

The allergy diagnostics and therapeutics market in the MEA is continuously growing, owing to the rising prevalence of allergic illnesses, urbanization, and greater exposure to environmental allergens. Increasing awareness of allergy-related health risks, advancement in the healthcare infrastructure, and government investments in public health encourage diagnostic tests and innovative therapeutic products. Moreover, key markets, such as South Africa, Saudi Arabia, and the UAE, are driving regional development by expanding access to specialist and private healthcare services. While obstacles such as limited healthcare access in rural areas and regulatory inconsistencies exist, increased cooperation with multinational healthcare companies and efforts to improve early disease detection are expected to maintain market momentum.

The UAE allergy diagnostics and therapeutics marketis experiencing steady growth as the prevalence of respiratory and allergy disorders rises, impacted by environmental and lifestyle changes. Dust storms, increased air pollution, severe temperatures, and urban growth are all contributing to an increase in asthma, allergic rhinitis, and other respiratory allergies, emphasizing the importance of reliable diagnosis and efficient therapies. Deteriorating air quality and extensive exposure to seasonal and perennial allergens are contributing to an increase in new diagnoses as well as the requirement for continued chronic allergy care. Patients and healthcare providers are becoming more aware of allergy dangers, which, along with improved healthcare infrastructure and more access to diagnostic services, allows for market expansion. Innovative treatment strategies such as allergen-specific immunotherapy (AIT) for illnesses such as allergic rhinitis are becoming more common, enabling long-term management choices that go beyond symptom relief.

Key Allergy Diagnostics And Therapeutics Company Insights

The allergy diagnostics and therapeutics industry is highly competitive, and market players are involved in activities such as strategic collaborations, new product launches, acquisitions, technological advancements, and regional expansion. Along with these fundamental strategies, companies are spending more funds on R&D in order to develop next-generation diagnostic kits, immunotherapy options, and biologics that address unmet patient requirements. Collaborations with hospitals, academic institutions, and biotechnology companies are accelerating research and expanding clinical validation. Companies are leveraging digital health technologies, AI-powered data analytics, and point-of-care testing platforms to improve diagnostic accuracy and patient convenience. In addition, moving into emerging regions with high allergy rates lets firms tap into new income streams and strengthen their worldwide market position, ensuring long-term growth and sustainability in the industry.

Key Allergy Diagnostics And Therapeutics Companies:

The following are the leading companies in the allergy diagnostics & therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- R-Biopharm AG

- Thermo Fisher Scientific, Inc.

- DASIT Group SPA

- EUROIMMUN Medizinische Labordiagnostika AG (PerkinElmer, Inc.)

- AESKU.GROUP GmbH

- bioMérieux

- Siemens Healthcare GmbH

- Stallergenes Greer

- HYCOR Biomedical

- Minaris Medical America, Inc.

- Omega Diagnostics Group PLC

- Lincoln Diagnostics, Inc.

- HOB Biotech Group Corp., Ltd.

- Danaher

- Alcon

- AbbVie, Inc.

- Sanofi

- Allergy Therapeutics

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Sun Pharmaceutical Industries Ltd

- F. Hoffmann-La Roche Ltd.

- Merck & Co., Inc.

- Astellas Pharma Inc.

- Epigenomics AG

Recent Developments

-

In August 2025, Sanofi launched Allegra-D, a non-drowsy allergy relief from nasal decongestion in India. Allegra-D tablets include a fixed-dose combination (FDC) of Fexofenadine Hydrochloride IP (60 mg), a non-drowsy antihistamine, and Pseudoephedrine Hydrochloride IP (120 mg), a powerful nasal decongestant. The formulation has received approval from the Drug Controller General of India (DCGI) for usage in adults and children aged 12 and older.

-

In October 2024, Astria Therapeutics, Inc. announced a license agreement with Inchon’s Sciences. The agreement covers the OX40 portfolio, particularly focusing on the development of STAR-0310 for potential treatment of atopic dermatitis (AD) and other allergic and immunological diseases.

-

In January 2024, ALK received FDA approval for expanded use of ODACTRA, a sublingual immunotherapy tablet in the treatment of house dust mite-induced allergic rhinitis for adolescents aged 12 through 17.

Allergy Diagnostics And Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 40.15 billion

Revenue forecast in 2033

USD 78.00 billion

Growth rate

CAGR of 9.95% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2023

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, allergen type, test type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand, South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

R-Biopharm AG; EUROIMMUN Medizinische Labordiagnostika AG (PerkinElmer, Inc.); DASIT Group S.p.A.; AESKU.GROUP GmbH; bioMérieux; Thermo Fisher Scientific, Inc.; Stallergenes Greer; Minaris Medical America, Inc.; Siemens Healthcare GmbH; Omega Diagnostics Group PLC; HYCOR Biomedical; Lincoln Diagnostics, Inc.; Alcon; HOB Biotech Group Corp. Ltd.; Danaher; AbbVie, Inc.; Allergy Therapeutics; Sanofi; Pfizer, Inc.; Teva Pharmaceutical Industries Ltd.; Sun Pharmaceutical Industries Ltd; GSK plc; F. Hoffmann-La Roche Ltd.; Merck & Co., Inc.; Astellas Pharma Inc.; Epigenomics AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Allergy Diagnostics And Therapeutics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global allergy diagnostics and therapeutics market report based on type, allergen type, test type, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnostics

-

Instruments

-

Consumables

-

Services

-

-

Therapeutics

-

Antihistamines

-

Decongestants

-

Corticosteroids

-

Mast Cell Stabilizers

-

Leukotriene Inhibitors

-

Nasal Anti-cholinergic

-

Immuno-modulators

-

Epinephrine

-

Immunotherapy

-

-

-

Allergen Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Food

-

Dairy Products

-

Poultry Product

-

Tree Nuts

-

Peanuts

-

Shellfish

-

Wheat

-

Soy

-

Other Food Allergens

-

-

Inhaled

-

Drug

-

Other allergen types

-

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

In Vivo Tests

-

Skin Prick Test

-

Intradermal Test

-

Patch Test

-

-

In Vitro Tests

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global allergy diagnostics and therapeutics market size was estimated at USD 37.10 billion in 2025 and is expected to reach USD 40.15 billion in 2026.

b. The global allergy diagnostics and therapeutics market is expected to grow at a compound annual growth rate of 9.95% from 2026 to 2033 to reach USD 78.00 billion by 2033.

b. North America dominated the allergy diagnostics and therapeutics market with a share of 36.62% in 2025. This is attributable to high incidence of respiratory allergic disorders along with rising awareness levels about allergy diagnostics and adoption of in vitro blood tests.

b. Some key players operating in the allergy diagnostics and therapeutics market include bioMerieux, Thermo Fisher Scientific, Danaher Corporation, Omega Diagnostics, Hitachi Chemical Diagnostics, Stallergenes Greer, Siemens Healthcare, Lincoln Diagnostics, Hycor Biomedical, HOB Biotech Group, and Alcon Laboratories.

b. Key factors driving the allergy diagnostics and therapeutics market growth include increasing incidences of allergy diseases; increasing demand for IVD tests for allergy diagnosis; and growing healthcare expenditure triggering development of effective allergy diagnostic & therapeutic products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.