- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Composite Materials Market, Industry Report, 2033GVR Report cover

![Aluminum Composite Materials Market Size, Share & Trends Report]()

Aluminum Composite Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Construction, Signage Industry, RV / Trailer Construction Skins), By Region (North America, Asia Pacific, Europe, Central & South America), And Segment Forecasts

- Report ID: GVR-4-68040-692-4

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aluminum Composite Materials Market Summary

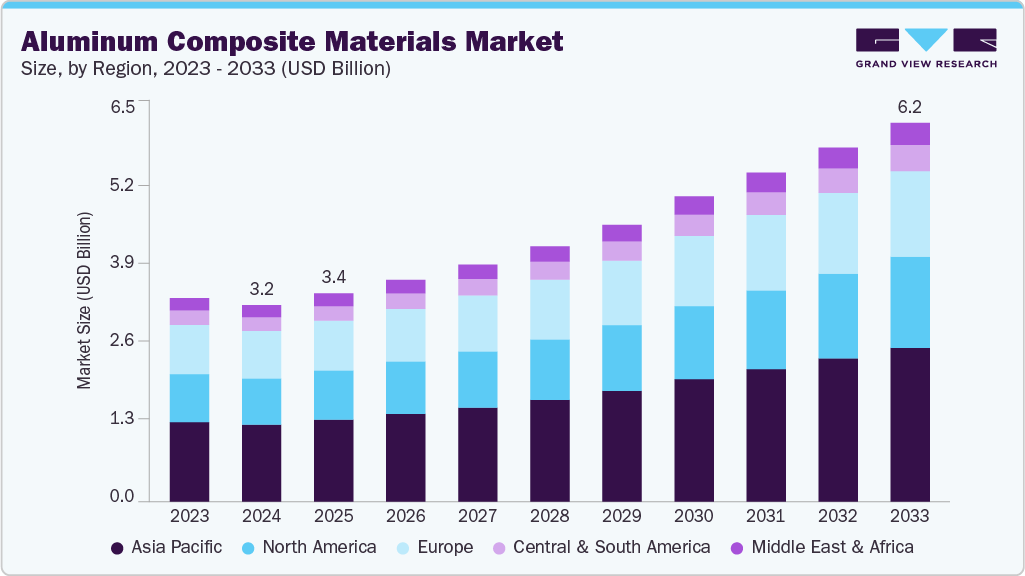

The global aluminum composite materials market size was estimated at USD 3.24 billion in 2024 and is projected to reach USD 6.25 billion by 2033, growing at a CAGR of 7.8% from 2025 to 2033. The rising demand from the construction and infrastructure sectors drives the growth.

Key Market Trends & Insights

- Asia Pacific dominated the aluminum composite materials market with the largest revenue share of 39.17% in 2024.

- The China aluminum composite materials market represents the largest individual regional share within Asia Pacific.

- By application, the signage industry segment is expected to grow at the fastest CAGR of 8.1% over the forecast period.

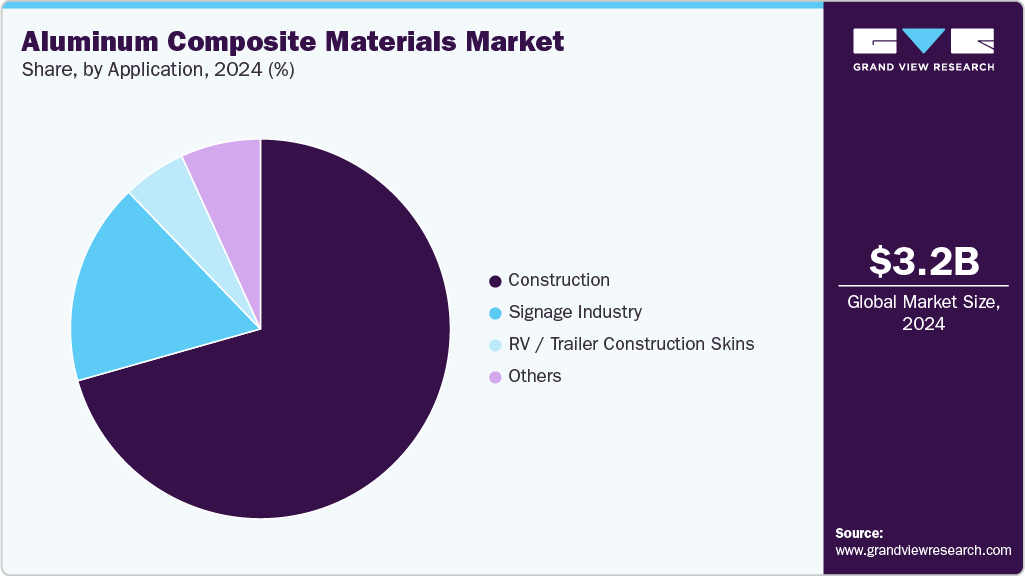

- By application, the construction segment led the market, with the largest revenue share of 70.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.24 Billion

- 2033 Projected Market Size: USD 6.25 Billion

- CAGR (2025-2033): 7.8%

- Asia Pacific: Largest market in 2024

ACM panels are extensively used in building facades, cladding, partitions, and interior decoration due to their superior durability, lightweight properties, and aesthetic appeal. Rapid urbanization and increasing investments in commercial and residential infrastructure, particularly in emerging economies such as China, India, and Brazil, are further propelling market growth. Additionally, aluminum composite materials (ACMs) offer excellent insulation, fire resistance, and weather durability, making them a preferred choice for modern architectural applications.The expansion of the automotive and transportation industry is contributing significantly to the demand for aluminum composite materials. ACMs are increasingly being utilized in vehicle body panels, signage, and display systems due to their high strength-to-weight ratio and corrosion resistance. As the automotive sector moves towards lightweight materials to enhance fuel efficiency and reduce emissions, ACMs serve as an ideal alternative to traditional metals. The growing trend of electric vehicles (EVs) and demand for innovative, lightweight components also supports the incorporation of ACMs in automotive manufacturing processes.

Technological innovations and continuous product development are important drivers for the ACM market. Manufacturers are investing in research to develop high-performance ACMs with improved fire resistance, enhanced thermal insulation, and recyclability. The introduction of nanocomposites and eco-friendly ACMs has expanded the material’s application base while aligning with sustainability goals. Additionally, customization options in terms of color, texture, and finish are attracting consumers from various sectors, including advertising, signage, and retail, thereby fostering the expansion of the aluminum composite materials industry.

Market Concentration & Characteristics

The global aluminum composite materials (ACM) market is moderately concentrated, with a mix of well-established multinational players and regional manufacturers competing based on product quality, innovation, and pricing. The degree of innovation in the market is significant, as companies focus on developing advanced ACM panels with enhanced fire resistance, recyclability, and aesthetic flexibility to meet evolving industry standards and customer preferences. There is a notable level of merger and acquisition activity, with leading firms acquiring smaller companies or forming strategic alliances to expand their geographic presence and technological capabilities. These consolidations aim to strengthen supply chain efficiency, product portfolios, and distribution networks in both developed and emerging markets.

Regulations play a critical role in shaping the aluminum composite materials (ACM) industry, especially concerning fire safety, environmental impact, and construction standards. In response, manufacturers are increasingly investing in compliance and certification to meet international building codes and safety norms. While direct product substitutes such as fiber cement panels, high-pressure laminates, and traditional metal sheets exist, they often lack the same balance of cost-efficiency, weight advantage, and design versatility offered by ACMs. The end-use concentration remains high in the building and construction sector, particularly in exterior cladding applications. However, diversification into transportation, signage, and industrial uses is gradually increasing, driven by material adaptability and performance benefits.

Application Insights

The construction segment held the highest revenue share of 70.6% in 2024, driven by the rising demand for durable, lightweight, and aesthetically versatile cladding and façade solutions in modern architecture. ACM panels are widely used in commercial, residential, and institutional buildings due to their superior weather resistance, thermal insulation properties, and ease of installation. The increasing focus on sustainable and energy-efficient construction, along with rapid urbanization and infrastructure development-particularly in emerging economies-is further accelerating the adoption of ACMs. Additionally, strict building safety codes and fire resistance requirements are prompting the use of advanced ACM variants, supporting sustained growth in the construction sector.

The signage industry segment is expected to grow at the fastest CAGR of 8.1% over the forecast period, driven by the material’s excellent printability, smooth surface finish, and durability in varying weather conditions. ACM panels are widely preferred for indoor and outdoor signage, retail displays, wayfinding systems, and advertising boards due to their lightweight structure, corrosion resistance, and ease of fabrication. The growing demand for vibrant, customizable, and long-lasting signage in sectors such as retail, transportation, hospitality, and public infrastructure is fueling the adoption of ACMs. Additionally, advancements in digital printing technology and the rising focus on brand visibility and aesthetics are further propelling market growth in this segment.

Regional Insights

Asia Pacific dominated the aluminum composite materials market in 2024 with a revenue share of 39.17% and is further expected to grow at a significant CAGR over the forecast period. The growth is driven by rapid urbanization, robust infrastructure development, and expanding construction activities across emerging economies such as India, Japan, and Vietnam. The increasing demand for modern architectural solutions in commercial and residential buildings, coupled with government-led smart city initiatives, is boosting the adoption of ACM panels. Additionally, the rising automotive manufacturing sector and the growing use of lightweight materials in transportation further support regional market expansion. The availability of cost-effective raw materials and manufacturing capabilities also positions Asia Pacific as a key hub for ACM production.

China Aluminum Composite Materials Market Trends

The China aluminum composite materials market represents the largest individual regional share within Asia Pacific, due to its massive construction sector and dominance in manufacturing. Strong government investment in real estate, transportation infrastructure, and urban development projects continues to fuel demand for ACMs. Moreover, domestic manufacturers benefit from advanced production technologies and economies of scale, allowing for a wide variety of product offerings. Environmental regulations have also led to a shift toward eco-friendly and fire-resistant ACM variants, further driving innovation and adoption across public and private projects.

North America Aluminum Composite Materials Market Trends

In North America, the aluminum composite materials industry’s growth is primarily driven by the renovation and modernization of aging infrastructure, alongside growing commercial construction activities. ACMs are increasingly preferred for exterior cladding, signage, and corporate identity applications due to their aesthetic versatility and durability. Technological advancements and strict fire safety regulations have led to the adoption of high-performance, code-compliant ACM products. Additionally, the push for sustainable construction practices has increased the demand for recyclable and energy-efficient materials, supporting the growth of ACM usage across various sectors.

The U.S. aluminum composite materials industry benefits from a well-established construction sector, with a particular emphasis on commercial and institutional buildings. The rise in demand for energy-efficient and sustainable building materials, coupled with regulatory compliance for fire-rated and environmentally friendly products, is accelerating the use of ACM panels. Moreover, the presence of leading manufacturers, investments in R&D, and widespread adoption in the signage and automotive sectors contribute to the country's sustained market growth. The shift toward green building certifications such as LEED also fosters the increased integration of ACMs in architectural projects.

Europe Aluminum Composite Materials Market Trends

Stringent environmental regulations, energy efficiency standards, and a strong focus on sustainable building practices drive the Europe aluminum composite materials industry’s growth. Demand for ACM panels is rising across commercial, residential, and industrial applications, particularly in façade systems and ventilated cladding. Countries in Western Europe are investing in modernizing existing infrastructure while adhering to strict fire safety and insulation standards, which is bolstering the demand for fire-rated and recyclable ACM solutions. Additionally, technological innovation and growing trends in modular construction are supporting the market’s expansion across the region.

The Germany aluminum composite materials market is expected to grow over the forecast period. Germany, as a leading construction and manufacturing hub in Europe, plays a pivotal role in driving the regional ACM market growth. The country’s emphasis on energy-efficient buildings and adherence to rigorous fire protection and sustainability standards are key growth drivers. The integration of ACMs in green building projects, coupled with increasing use in transportation and industrial applications, reflects the growing versatility of these materials. Additionally, strong innovation capabilities and the presence of several global and regional manufacturers enable the development of advanced ACM products tailored to evolving architectural and environmental requirements.

Latin America Aluminum Composite Materials Market Trends

The Latin American aluminum composite materials industry is growing steadily, supported by urban development and infrastructure modernization in countries like Brazil, Mexico, and Chile. Economic recovery and increasing foreign investments in real estate and commercial construction are enhancing the demand for ACM panels. The material's cost-effectiveness, weather resistance, and aesthetic flexibility make it suitable for the region’s diverse climatic and design needs. While the market faces challenges such as limited local production and regulatory inconsistencies, rising awareness about modern construction materials and the demand for energy-efficient buildings offer promising growth prospects.

Middle East & Africa Aluminum Composite Materials Market Trends

The Middle East & Africa aluminum composite materials industry’s growth is driven by large-scale infrastructure and construction projects, particularly in the Gulf Cooperation Council (GCC) countries. Ambitious urban development programs, tourism-driven real estate growth, and government investments in smart cities are fueling demand for modern, durable, and fire-resistant façade materials. ACMs are extensively used in high-rise buildings and commercial complexes due to their design versatility and performance in harsh climates. Additionally, the focus on sustainable construction and the integration of green building practices are expected to further drive ACM adoption across the region.

Key Aluminum Composite Materials Company Insights

Some of the key players operating in the market include 3A Composites GmbH and Arconic Corporation:

-

3A Composites GmbH is a Germany-based company known for its premium aluminum composite panels under brand names such as ALUCOBOND. Its product offerings cater to architecture, transportation, and display sectors, with panels featuring fire resistance, weather durability, and design flexibility.

-

Arconic Corporation, headquartered in the United States, offers high-performance aluminum sheet and coil products, including composite panels used in building façades and architectural structures. Its Reynobond aluminum composite material is widely used for exterior cladding and signage applications.

Alstrong Enterprises India Pvt. Ltd and Mitsubishi Chemical Corporation are some of the emerging participants in the market.

-

Alstrong Enterprises India Pvt. Ltd. is a leading Indian manufacturer specializing in aluminum composite panels for the architectural and interior design markets. The company provides ACPs in a variety of colors, textures, and finishes, tailored for exterior facades, partitions, and false ceilings.

-

Mitsubishi Chemical Corporation, through its ALPOLIC brand, delivers a broad range of aluminum composite panels for use in high-end architecture and signage. The company's offerings are known for their superior surface flatness, coating durability, and fire-retardant core technologies.

Key Aluminum Composite Materials Companies:

The following are the leading companies in the aluminum composite materials market. These companies collectively hold the largest market share and dictate industry trends.

- 3A Composites GmbH

- Arconic Corporation

- Alstrong Enterprises India Pvt. Ltd.

- Mitsubishi Chemical Corporation

- Alubond U.S.A. (a brand of Mulk Holdings International)

- Yaret Industrial Group Co., Ltd.

- Shanghai Huayuan New Composite Materials Co., Ltd.

- Jyi Shyang Industrial Co., Ltd.

- Interplast Co. Ltd.

Recent Developments

-

In March 2024, Kyocera Corporation revealed its intention to expand the production capacity of its fine ceramics operations at its Kagoshima facility in Japan. The expansion aims to enhance the company’s ability to produce advanced ceramic components used in 5G telecommunications and semiconductor manufacturing equipment.

Aluminum Composite Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.44 billion

Revenue forecast in 2033

USD 6.25 billion

Growth rate

CAGR of 7.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; South Korea; Japan

Key companies profiled

3A Composites GmbH; Arconic Corporation; Alstrong Enterprises India Pvt. Ltd.; Mitsubishi Chemical Corporation; Alubond U.S.A.; Yaret Industrial Group Co., Ltd.; Shanghai Huayuan New Composite Materials Co., Ltd.; Jyi Shyang Industrial Co., Ltd.; Interplast Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Composite Materials Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the segments from 2021 to 2033. For this study, Grand View Research has segmented the aluminum composite materials market report based on application and region:

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Construction

-

Signage Industry

-

RV / Trailer construction skins

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

South Korea

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global aluminum composite materials market size was estimated at USD 3.24 billion in 2024 and is expected to reach USD 3.44 billion in 2025

b. The global aluminum composite materials market is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2025 to 2033 to reach USD 6.25 billion by 2033.

b. Construction segment held the highest revenue share of 70.6% in 2024, driven by the rising demand for durable, lightweight, and aesthetically versatile cladding and façade solutions in modern architecture.

b. Some key players operating in the aluminum composite materials market include 3A Composites GmbH, Arconic Corporation, Alstrong Enterprises India Pvt. Ltd., Mitsubishi Chemical Corporation, Alubond U.S.A., Yaret Industrial Group Co., Ltd., Shanghai Huayuan New Composite Materials Co., Ltd., Jyi Shyang Industrial Co., Ltd., Interplast Co. Ltd.

b. The key factors that are driving the aluminum composite materials market growth include increasing demand from the construction and signage industries, rising focus on lightweight and durable materials, and advancements in fire-resistant and sustainable panel technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.