- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Composite Panels Market, Industry Report, 2030GVR Report cover

![Aluminum Composite Panels Market Size, Share & Trends Report]()

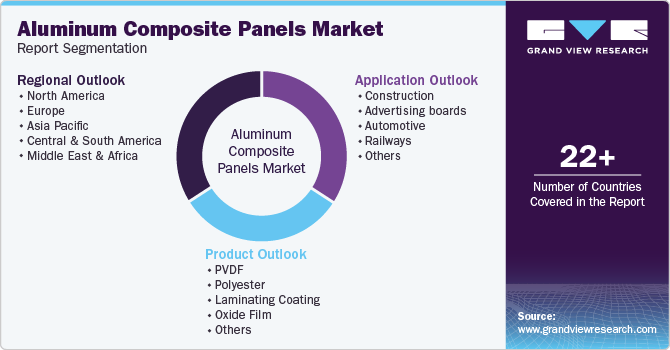

Aluminum Composite Panels Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (PVDF, Polyester, Laminating Coating, Oxide Film), By Application (Construction, Automotive, Advertising Boards, Railways), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-437-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aluminum Composite Panels Market Summary

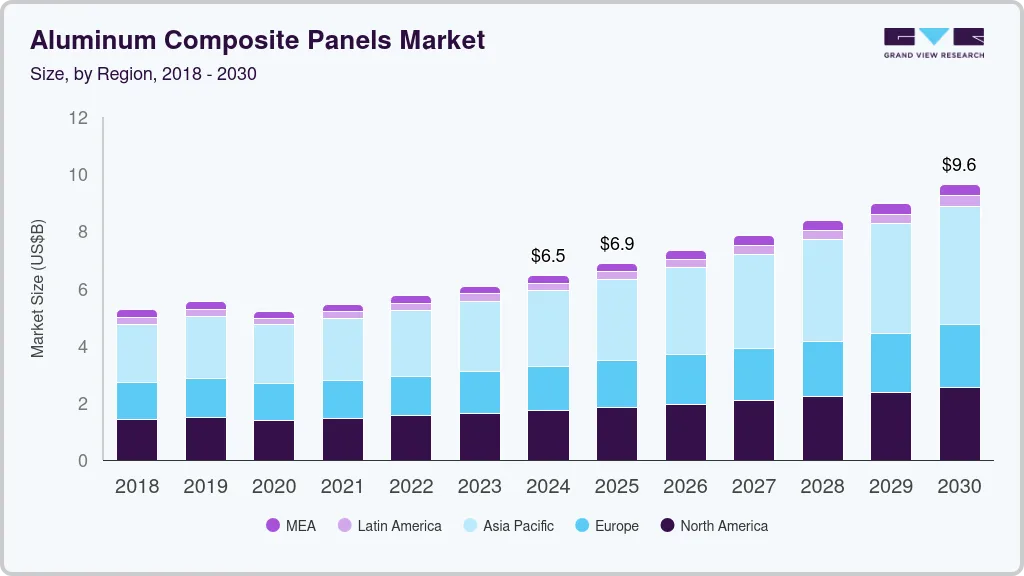

The global aluminum composite panels market size was estimated at USD 6.46 billion in 2024 and is projected to reach USD 9.65 billion by 2030, growing at a CAGR of 7.0% from 2025 to 2030. The increasing the application scope of lightweight aluminum composite panels in the construction industry for insulation is projected to drive the market growth.

Key Market Trends & Insights

- The North America aluminum composite panels industry accounted for a substantial revenue share of 26.8% in 2024.

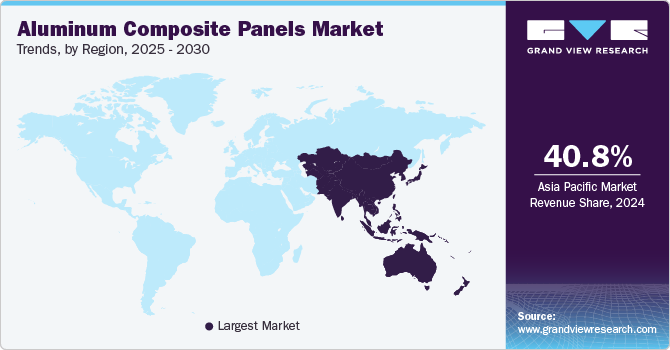

- Asia Pacific dominated the market and accounted for the largest revenue share of 40.8% in 2024.

- The Europe aluminum composite panel industry is anticipated to grow at a CAGR of 6.1% over the forecast period.

- Based on product, the polyvinylidene fluoride (PVDF) segment accounted for the largest revenue share of 36.1% in 2024.

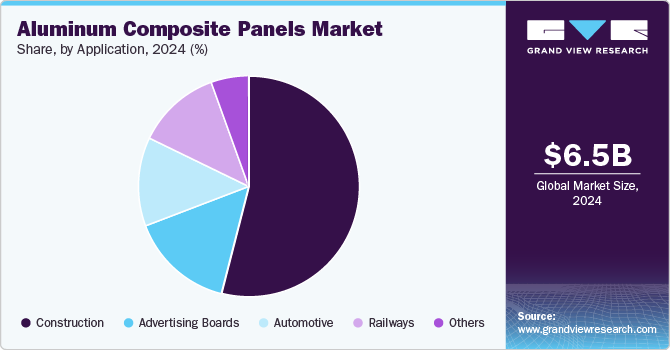

- In terms of application, the construction segment held the largest revenue share of 54.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.46 Billion

- 2030 Projected Market Size: USD 9.65 Billion

- CAGR (2025-2030): 7.0%

- Asia Pacific: Largest market in 2024

These composite panels provide features, such as lower thickness, high insulation, and superior sealing, which are crucial for building structures. Also, ACPs offer excellent air and water barriers, flexibility, high load performance, and durability, which is expected to positively impact market growth over the forecast period. The U.S. government has set regulations in which light-duty automobiles should achieve Corporate Average Fuel Efficiency (CAFE) standards of 54.5 mpg by 2025. The federal proposal to improve CAFE standards is thus expected to serve as a major impetus for the incorporation of lightweight materials, such as aluminum composites, into automobiles, thereby driving the market.

Sandwich panels are majorly used in the design and construction of transportation systems, such as aircraft, satellites, missiles, and high-speed trains, to reduce the structural weight. Aluminum composites are used for the manufacturing of sandwich panels, thereby propelling the market growth over the forecast period. Furthermore, technological advancements in the manufacturing process of ACP sheets and panels are expected to have a significant impact on the overall market.

The growing popularity of green buildings is also projected to fuel product demand on account of eco-friendly characteristics of these materials. Several regulations and safety standards, such as LEED and British Safety Standards, govern the building and structure and also favor the incorporation of ACPs. Also, ACPs provide high tensile strength and reduce the overall weight of the building structure, which makes them one of the potential materials for the modern construction industry.

Product Insights

The polyvinylidene fluoride (PVDF) segment accounted for the largest revenue share of 36.1% in 2024, owing to a wide range of applications including lightweight construction, high-speed trains, and advertisement boards. Also, their features, such as corrosion and wear resistance and durability, are expected to benefit the segment growth. PE panels are also among the majorly used products owing to properties, such as extreme rigidity, surface flatness, smoothness, and thermal as well as acoustical insulation. It is expected to register notable growth in the future due to benefits, such as easy fabrication and processing.

The laminating coating segment is expected to grow at a CAGR of 6.4% during the forecast period. Laminating coating ACPs are manufactured through multi-layer extrusion lamination and primarily used for lamination applications in the construction industry. The use of oxide film in the production of ACPs provides several advantages, such as fire protection and UV, corrosion, and acid resistance. These properties are crucial in the construction and automotive industries. Thus, this is also estimated to boost market development.

Application Insights

The construction segment held the largest revenue share of 54.0% in 2024. Eco-friendly characteristics offered by the product are expected to increase its demand for green buildings, thereby propelling the growth of the aluminum composite panel industry. Benefits, such as thermal & acoustic insulation and corrosion resistance offered by the product are also expected to fuel their demand in the modern construction industry. Also, rising product use in decorative and cladding applications to meet transition energy and building standards is likely to augment the segment growth product over the next few years.

The advertising boards segment is expected to grow a CAGR of 6.5% over the forecast period. Rapidly expanding advertising, marketing, and mass media industry worldwide has resulted in increased expenditure on advertising boards. ACPs are broadly used for these boards as they are subjected to extreme environmental conditions, such as humidity, moisture, temperature fluctuations, and pollution. The railway application segment is also projected to witness considerable growth. Moreover, these composites help reduce the overall weight of trains resulting in improved speed and reduced power consumption.

Regional Insights

The North America aluminum composite panels industry accounted for a substantial revenue share of 26.8% in 2024. The industry is expected to grow as a result of the region's growing number of green buildings. The expansion of North America is being aided by an increase in governmental programs and initiatives to foster better infrastructure. In addition, the increase is anticipated to be boosted by the increasing usage of panels in cladding and ornamental applications to meet evolving architectural and energy standards. Increased manufacturing of hybrid and electric cars in North America will also bode well for the market's expansion.

U.S. Aluminum Composite Panels Market Trends

The U.S. construction industry has been experiencing a resurgence fueled by urbanization trends, population growth, and increased investments in infrastructure development. Aluminum composite panels are increasingly used for facades, interior applications, and signage due to their aesthetic appeal and durability. Moreover, with a growing emphasis on sustainable building practices, ACPs are gaining traction as they are recyclable and can contribute to energy-efficient building designs.

Asia Pacific Aluminum Composite Panels Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of 40.8% in 2024. The rapidly growing construction industry, especially in emerging economies like China, India, Indonesia, and Vietnam, is anticipated to have a positive impact on the regional market. The rising population coupled with government schemes promoting basic amenities and high demand for affordable housing are also among the major factors driving the region’s growth.

The aluminum composite panels market in China has grown substantially over the past decade due to the rapid urbanization and infrastructural development across the country. As the country continues its urban expansion, there is a rising demand for modern and sustainable construction materials.

Europe Aluminum Composite Panels Market Trends

The Europe aluminum composite panel industry is anticipated to grow at a CAGR of 6.1% over the forecast period. Many European countries are tightening regulations regarding energy efficiency in buildings, particularly in the wake of the European Union’s environmental goals. ACPs are known for their excellent insulation properties, which help improve the thermal efficiency of buildings. Combining energy efficiency, reduced environmental impact, and longevity makes ACPs attractive for developers looking to meet sustainability targets while reducing operational costs.

Key Aluminum Composite Panels Company Insights

Some of the key players operating in the market include Arconic, Alcoa Corporation, and others. The global aluminum composite panels market is highly competitive as major companies focus on the development of advanced products with superior characteristics and also demonstrate their brand strength through well-known trademarked products. Production capacity expansion and product customizations are also expected to be among the key strategic initiatives adopted by these companies to gain competitive advantages. Global companies in developed regions like North America and Europe are facing strong price competition from Chinese manufacturers.

Key Aluminum Composite Panels Companies:

The following are the leading companies in the aluminum composite panels market. These companies collectively hold the largest market share and dictate industry trends.

- Arconic

- Mitsubishi Engineering-Plastics Corporation

- Alcoa Corporation

- Fairfield Metal

- Shanghai Yaret Industrial Group Co., Ltd.

Recent Developments

-

In June of 2023, Alumaze, a company specializing in aluminum composite panels (ACP), unveiled a fresh lineup of offerings. This included ACP sheets that were produced within their recently established facility situated in the Vizianagaram district. The swift construction of this manufacturing plant, accomplished within a span of eight months, was underpinned by a significant investment totaling USD 6 million. This strategic expansion was prompted by the escalating market demand for aluminum panels, particularly for applications in interior design and signage.

-

In January 2021, Alucopanel, a UAE-based manufacturer of aluminum composite panels, announced the launch of the country’s first government-approved non-combustible grade aluminum composite panel recommended for building projects with high levels of fire protection. The launch makes Alucopanel the first civil A1-grade aluminum composite panel with defense certification in the world.

Aluminum Composite Panels Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.88 billion

Revenue forecast in 2030

USD 9.65 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Actual estimates

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in million sq. ft., revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; Spain; China; India; Japan; South Korea; Thailand; Australia; Brazil; Saudi Arabia

Segments covered

Product, application, region

Key companies profiled

Arconic; Mitsubishi Engineering-Plastics Corporation; Alcoa Corporation; Fairfield Metal; Shanghai Yaret Industrial Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Composite Panels Market Report Segmentation

This report forecasts volume & revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global aluminum composite panels market report based on product, application, and region:

-

Product Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

PVDF

-

Polyester

-

Laminating Coating

-

Oxide Film

-

Others

-

-

Application Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Automotive

-

Cars

-

Doors

-

Hoods

-

Wings

-

Side Panels

-

Others

-

-

Commercial Vehicle

-

Trailers

-

-

Advertising Boards

-

Railways

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global aluminum composite panels market size was estimated at USD 6.47 million in 2024 and is expected to reach USD 6.88 million in 2025.

b. The global aluminum composite panels market is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2025 to 2030, reaching USD 9.65 million by 2030.

b. PVDF dominated the aluminum composite panel market with a share of 36.1% in 2024 owing to its lightweight material, high mechanical quality, and low cost.

b. Some of the key players operating in the aluminum composite panel market include 3M, ALUBOND U.S.A., ALUMAX COMPOSITE MATERIAL (JIANGYIN) CO., LTD., Mitsubishi Chemical Corporation., and Maxbond.

b. The key factors driving the aluminum composite panels market include the rising popularity of antibacterial and anti-toxic panels in commercial and industrial construction activities around the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.