- Home

- »

- Next Generation Technologies

- »

-

Ambient Assisted Living & Smart Home Market Report, 2030GVR Report cover

![Ambient Assisted Living And Smart Home Market Size, Share & Trends Report]()

Ambient Assisted Living And Smart Home Market Size, Share & Trends Analysis Report By Type (Smart Home Products, Ambient Assisted Living), By Service (Installation And Repair Service, Customization And Renovation), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-041-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

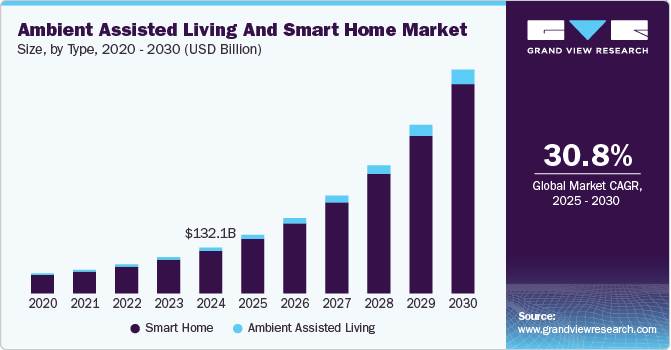

The global ambient assisted living and smart home market size was valued at USD 132.12 billion in 2024 and is anticipated to grow at a CAGR of 30.8% from 2025 to 2030. Growing demand for energy-saving and low-carbon emission-oriented solutions is driving the demand for ambient assisted living and smart homes. Energy conservation is one of the crucial factors expected to drive the growth of the industry over the forecast period. Lighting controllers outperform traditional lighting and switching systems. It offers an automatic turn off function when not in use, allowing energy saving. The main advantage of dimming systems is that they adjust the intensity of light based on the needs, resulting in lower energy consumption, electricity costs, and greenhouse gas emissions.

In addition, rising demand for remote patient monitoring devices and telehealth is driving the growth of the industry. Remote Patient Monitoring (RPM) Smart Home, sensors, and Ambient Assisted Living (AAL) systems are becoming more popular. Rising awareness of health systems and concepts such as electronic medical records, mobile health apps, and others are driving the demand for RPM Smart Home. According to an MSI International survey conducted in June 2021, 80% of Americans support remote patient monitoring, and nearly half of them prefer its incorporation into medical treatment. With the deployment of pervasive in-home monitoring and smart technologies, taking care of older people becomes increasingly autonomous and further helps in enhancing access to better medical services.

In January 2023, Lucira Health, Inc., a bioService company, announced the launch of Lucira Connect in Canada. Lucira Connect is a new virtual care program that enables Lucira test patients to test, learn about possible treatments, connect directly to a telehealth consultation, and, if necessary, receive a prescribed medication all from the convenience of their own home.

Type Insights

Based on type, the market is segmented into smart home products and ambient assisted living. The smart home products segment accounted for a dominating share of 93.3% in 2024. This dominance reflects a growing preference for connected devices that enhance convenience, security, and energy efficiency in homes. Key trends driving this growth include the rapid adoption of IoT-enabled solutions, increasing consumer awareness of smart home benefits, and the integration of AI-powered automation in everyday living. Additionally, the rising demand for smart thermostats, lighting, and voice-controlled assistants underscores the segment's appeal across diverse demographics, positioning it as a cornerstone of modern assisted living environments.

Smart Home Products Insights

Based on smart home products, the entertainment control segment accounted for the largest revenue share of 42.6% in 2024 and is expected to continue to dominate the market over the forecast period. The growing popularity of Artificial Intelligence (AI) assistants such as Alexa and Siri is increasing the utilization of smart home technologies. Several companies are introducing smart home devices compatible with voice assistants such as Amazon Alexa or Google Home. For instance, the Kono Smart Thermostat Lux Products Corporation is compatible with both Amazon Alexa and Google Home. Additionally, there has been a shift in recent years toward streaming video and audio content, which is likely to continue. As a result, demand for devices such as smart TVs and streaming services is anticipated to increase.

The HVAC control segment is projected to grow at the highest CAGR of 34.5% over the forecast period. The growth is driven by the increasing demand for advanced solutions that enhance operational efficiency and data management. As organizations continue to embrace digital transformation, investments in cloud services, particularly in areas such as AI integration and serverless computing, are expected to escalate. This growth is underpinned by the rising complexity of workloads and the need for scalable, agile solutions that support real-time data processing and analytics. Furthermore, the proliferation of IoT devices and the shift towards multi-cloud strategies will further amplify the demand for innovative service offerings, positioning businesses to leverage next-gen technologies effectively.

Ambient Assisted Living Insights

Based on the ambient assisted living, the safety & security segment held the largest revenue share of 21.1% in 2024 over the forecast period. The primary objective of Ambient Assisted Living (AAL) Service is to improve the safety and security of people who live at home, allowing them to maintain their independence and quality of life. AAL helps individuals live more comfortably and securely by using services to support and enhance daily living. Factors such as increasing demand for smart fall detection sensors and medical alert systems coupled with rising incidences of falls are favoring the growth of the segment. As per the World Health Organization (WHO), there are around 684,000 falls globally per year, with a majority of victims above the age of 60.

On the other hand, the compensatory impairment segment is expected to witness the highest CAGR rate during the forecast period. Compensatory impairments play an important role in helping individuals or older adults with a disability to live independently. As per the World Health Organization (WHO), 15% of the global population suffers from some form of disability. The prevalence of disability tends to increase among older patients, thereby driving the need for assistive technologies. In September 2021, LADD Inc., a non-profit organization based in the U.S., launched the “Smart Living Pilot”. The pilot uses smart home technologies such as wearables and virtual remote support to keep people with disabilities safe.

Service Insights

Based on service, the installation and repair service segment accounted for the largest revenue share in 2024. The growth of installation and repair services in Ambient Assisted Living (AAL) and Smart Homes is driven by the increasing demand for aging-in-place solutions and home automation technologies. As the global population ages, there is a rising need for homes equipped with smart devices that enhance safety, health monitoring, and convenience. This creates a burgeoning market for professional installation and ongoing maintenance of interconnected systems, including sensors, alarms, lighting, and health-tracking devices. Additionally, the complexity of integrating various technologies demands skilled repair services. With advancements in IoT (Internet of Things) and AI, businesses in this sector are expanding, offering opportunities for specialized technicians and service providers to cater to this growing niche. As consumer adoption increases, both residential and commercial markets are likely to see continued expansion in demand for high-quality installation and repair services.

The customization and renovation segment is likely to grow to the highest CAGR over the forecast period. The growth of customization and renovation in Ambient Assisted Living (AAL) and smart homes is being driven by the increasing demand for personalized and adaptive environments that enhance the quality of life, particularly for aging populations and people with disabilities. Technological advancements, such as IoT devices, AI-driven systems, and advanced home automation, enable tailored solutions for safety, comfort, and accessibility. Customization in these spaces allows for the integration of unique needs, like voice-controlled interfaces, automated health monitoring, and personalized lighting or temperature settings. Renovation trends focus on retrofitting existing homes with smart technologies to accommodate mobility aids, emergency response systems, and energy-efficient solutions.

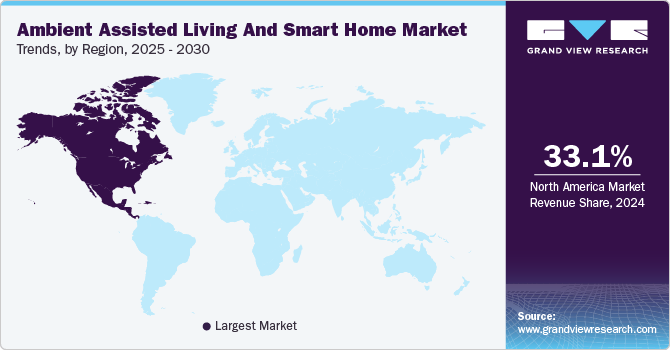

Regional Insights

North America ambient assisted living and smart home market dominated the global industry with a share of 33.1% in 2024. The growth is driven by the increasing demand for solutions that enhance the quality of life for aging populations and individuals with disabilities. With the region's aging demographic, particularly the baby boomer generation, there's a growing emphasis on technologies that provide remote monitoring, safety, health management, and convenience. Integration of IoT devices, voice assistants, and AI-driven systems has made smart homes more accessible and user-friendly, further accelerating adoption.

U.S. Ambient Assisted Living and Smart Home Market Trends

The ambient assisted living and smart home market in U.S. held a dominant position in 2024. The growth of Ambient Assisted Living (AAL) and Smart Home technologies in the U.S. is driven by the aging population and the increasing demand for independent living solutions. As the number of elderly Americans continues to rise, there is a growing need for technologies that enhance safety, health monitoring, and convenience in home environments. Innovations such as smart sensors, voice-activated systems, and AI-powered health trackers are becoming integral in supporting aging individuals at home. Additionally, the expanding adoption of Internet of Things (IoT) devices and the push for more accessible healthcare services further fuel this market.

Europe Ambient Assisted Living and Smart Home Market Trends

The ambient assisted living and smart home market in Europe is driven by an aging population, increasing demand for independent living solutions, and advancements in Internet of Things (IoT) technologies. Governments and healthcare systems are increasingly investing in solutions that integrate smart technologies to enhance elderly care, improve quality of life, and reduce healthcare costs. The rise of connected devices, from sensors to home automation systems, is fostering a more seamless, efficient living environment. In particular, countries like Germany, France, and the UK are leading the way in adopting AAL technologies, with a focus on remote monitoring, fall detection, and home-based healthcare services.

Asia Pacific Ambient Assisted Living and Smart Home Market Trends

The ambient assisted living and smart home market in Asia Pacific is driven by an aging population, urbanization, and increasing technological adoption. Countries like Japan, South Korea, and China are at the forefront, where demand for elderly care solutions and smart home technologies is rapidly rising. The integration of IoT, AI, and sensors in home environments is enhancing convenience, safety, and healthcare for seniors and people with disabilities. Moreover, government initiatives and rising awareness around smart healthcare solutions are further accelerating the market expansion.

Key Ambient Assisted Living And Smart Home Company Insights

The industry is characterized by strong competition, with a few major worldwide competitors owning a significant share. The major focus is on developing new products and collaborating among the key players.

Johnson Controls is a global leader in smart building services and integrated solutions, focusing on enhancing the performance of buildings and ensuring the safety and comfort of occupants. The company emphasizes Ambient Assisted Living (AAL) through innovative technologies that support independent living for the elderly and those with disabilities, integrating health monitoring and environmental controls to enhance quality of life. Their Smart Home services leverage IoT Service to create connected environments that optimize energy efficiency, security, and convenience for homeowners. By combining advanced automation systems with data analytics, Johnson Controls aims to create sustainable living spaces that adapt to the needs of users, fostering a seamless blend of comfort and functionality. Their commitment to sustainability also aligns with broader goals of reducing carbon footprints while improving operational efficiency across various sectors.

Siemens is a global company that focuses on digital industries, smart infrastructure, mobility, and healthcare. The company aims to drive digital transformation across various sectors, enhancing efficiency and sustainability. Among its innovative solutions, Siemens emphasizes Ambient Assisted Living (AAL) and Smart Home offerings. AAL solutions are designed to support elderly individuals in living independently by integrating smart technologies that monitor health and safety while ensuring comfort. Meanwhile, Siemens' Smart Home solutions enable homeowners to manage energy consumption, security, and overall home automation seamlessly through connected devices, enhancing convenience and efficiency in daily living. These initiatives reflect Siemens’ commitment to creating intelligent environments that improve quality of life through advanced services.

Key Ambient Assisted Living And Smart Home Companies:

The following are the leading companies in the ambient assisted living and smart home market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson Controls

- Heila Technologies

- Medic4all

- GETEMED Medizin- und Informationstechnik AG

- House Intelligence GmbH

- Televic

- Telbios

- Loxone Electronics GmbH

- EnOcean Alliance Inc.

- Caretech Group

- Koninklijke Philips N.V.

- Tunstall Group

- Siemens

View a comprehensive list of companies in the Ambient Assisted Living and Smart Home Market

Recent Developments

-

In August 2024, Siemens Smart Infrastructure announced enhancements to its Gridscale X offering, aimed at enabling Transmission System Operators (TSOs) to expedite the energy transition. This initiative addresses critical challenges posed by urbanization and climate change by integrating energy systems, buildings, and industries into a cohesive framework. With a comprehensive portfolio that spans from power generation to consumption, Siemens provides innovative solutions that support sustainability and efficiency. The company continues to leverage digitalization to empower customers and foster community development, reflecting its commitment to creating intelligent infrastructure for a sustainable future.

Ambient Assisted Living And Smart Home Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 168.51 billion

Revenue forecast in 2030

USD 645.19 billion

Growth rate

CAGR of 30.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Chile; Argentina; UAE; KSA; South Africa

Key companies profiled

Johnson Controls; Heila Technologies; Medic4all ; GETEMED Medizin- und Informationstechnik AG; House Intelligence GmbH; Televic ; Telbios; Loxone Electronics GmbH; EnOcean Alliance Inc.; Caretech Group; Koninklijke Philips N.V.; Tunstall Group; Siemens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ambient Assisted Living And Smart Home Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global ambient assisted living and smart home market report based on type, service, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Smart Home Products

-

Energy Management Systems

-

Entertainment Control

-

Security & Access Control

-

HVAC Control

-

-

Ambient Assisted Living

-

Safety & Security

-

Communication

-

Medical Assistive

-

Mobility

-

Telemedicine

-

Compensatory Impairment

-

Consumer Electronics

-

Others

-

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Installation and Repair Service

-

Customization and Renovation

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the ambient assisted living and smart home market include Johnson Controls, Heila Technologies, Medic4all, Informationstechnik AG, House Intelligence GmbH, Televic, Telbios, Loxone Electronics GmbH, EnOcean Alliance, CareTech Solutions, Koninklijke Philips N.V, Tunstall Group, Siemens

b. Key factors driving the market growth include growing demand for energy-saving and low-carbon emission-oriented solutions and rising demand for remote patient monitoring devices and telehealth

b. The global ambient assisted living and smart home market size was estimated at USD 132.12 billion in 2024 and is expected to reach USD 168.51 billion in 2025

b. The global ambient assisted living and smart home market is expected to grow at a compound annual growth rate of 30.8% from 2025 to 2030 to reach USD 645.19 billion by 2030

b. North America dominated the ambient assisted living and smart home market with a market share of 33.1% in 2024. This is attributed to rise in the old-age dependency ratio, coupled with an increase in the usage of smart devices among the elderly population

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."