- Home

- »

- Healthcare IT

- »

-

Ambulatory Surgery Centers IT Services Market Report, 2030GVR Report cover

![Ambulatory Surgery Centers IT Services Market Size, Share & Report]()

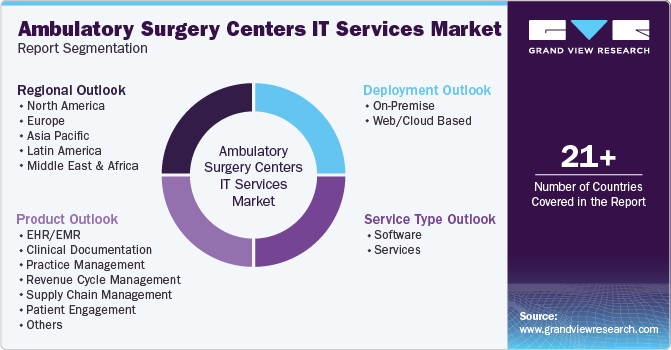

Ambulatory Surgery Centers IT Services Market Size, Share & Analysis Report By Product (Clinical Documentation, EHR/EMR), By Service Type (Software, Services), By Deployment, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-066-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

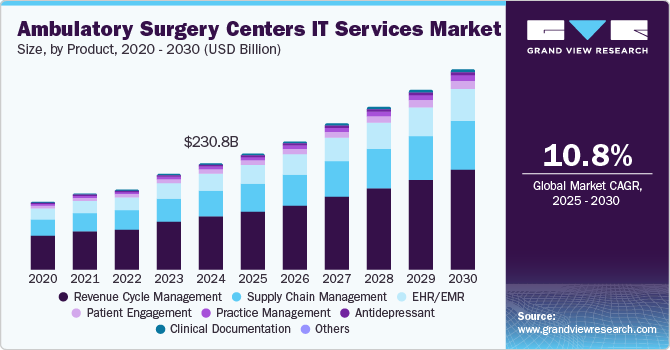

The ambulatory surgery centers IT services market size was valued at USD 230.8 billion in 2024 and is anticipated to grow at a CAGR of 10.8% from 2025 to 2030. The market growth is attributed to an increasing shift towards outpatient surgical procedures, advancements in healthcare technology, and the growing demand for efficient healthcare delivery systems. Both healthcare suppliers and patients are looking for cost-effective alternatives to traditional hospital settings due to increasing healthcare costs and preference for outpatient surgeries. ASCs provide affordable, convenient, and effective surgical procedures, including orthopedic surgeries and gastroenterology procedures, improving patient satisfaction and making them prior options for both healthcare providers and patients.

Advancements in healthcare technology, such as integrating electronic health records (EHR), telemedicine, and advanced surgeries by expanding ASC IT services, have transformed the market. EHR provides detailed patient data, allowing seamless information sharing among healthcare providers, which enhances patient safety and quality of care. In addition, the rise of telehealth services after the COVID-19 pandemic has expanded ASCs' reach to provide pre-and post-operative consultations remotely, thus improving resource utilization.

The increasing regulatory emphasis on patient data security and compliance is a significant factor driving the market. ASCs invest heavily in IT solutions to ensure data protection and compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA), with the rise of cyber threats and data breaches in healthcare. Standard practices in ASCs, such as robust cybersecurity measures and secure data management systems, have come in demand, enhancing patient trust and improving operational efficiency.

Moreover, the growing focus on value-based care encourages ACSs to adopt IT solutions that enable better tracking of patient outcomes and provide data analytics to identify areas for improvement in surgical procedures and post-operative care. In addition, service quality and better reimbursement rates from insurance providers are also increased due to advanced analytics platforms, surgical success rates, and patient satisfaction metrics being monitored by ASCs.

Product Insights

Revenue cycle management led the product segment, dominating the market with the largest revenue share of 49.6% in 2024, encompassing processes to manage claims, payments, and revenue generation data. RCM solutions help ASCs streamline operations, reduce billing errors, track patient payments, provide analytics to identify revenue leakage, and enable centers to improve their financial strength. In addition, Electronic Health Records (EHR) and Practice Management Systems (PMS), products of RCM, are gaining attention due to their ability to showcase patients' complete medical history, digitally manage patient records, manage daily operations, including scheduling, patient registration, and staff allocation, contribute to the growth of ASCs in the healthcare sector.

The patient engagement segment is expected to grow at a CAGR of 15.7% over the forecast period. It is driven by leveraging IT solutions such as patient portals, mobile applications, and telehealth services to facilitate real-time patient and provider interactions. Moreover, MyChart enables patients to schedule appointments, access medical records, and connect directly with healthcare professionals, fostering a more engaging, value-based care and an informed patient population. Furthermore, integrating artificial intelligence and data analytics enables ASCs to personalize communication and plan based on individual patient data, eventually enhancing engagement.

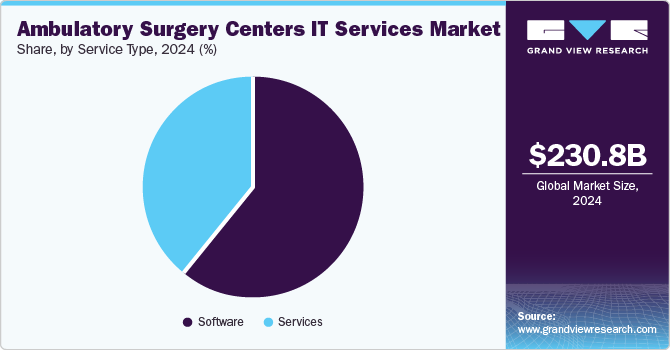

Service Type Insights

Software dominated the market and accounted for the largest revenue share of 61.2% in 2024 due to an increase in all-inclusive management solutions that enhance several clinical and administrative procedures in ASCs. In addition, the help of IT solutions such as electronic health records (EHR) and practice management systems, which have platforms such as NextGen and Athenahealth, enable ASCs to manage patient information, increase operational efficiency, and improve patient data.

The services sector is expected to grow at a CAGR of 3.1% over the forecast period from 2024 to 2030. This growing trend can be attributed to the increased demand for specialized services that enhance operational efficiency and patient care. ASCs require more advanced IT support services, such as system integration, data management, and IT consulting, due to the wide range of services required to cover a greater range of surgical procedures.

Deployment Insights

Web/Cloud Base contributed the largest revenue share of 78.3% in 2024 due to wide cloud computing offerings, including scalability, cost-effectiveness, and accessibility. Cloud-based services are similarly appealing due to their ability to quickly implement updates and new features, enabling healthcare providers to access patient information securely and enhancing efficiency and collaboration among patients and staff.

On-premise is expected to grow at a significant CAGR over the forecasted period due to the demand for greater control over data security and compliance with keeping sensitive data inside their infrastructure, avoiding data breaches, and guaranteeing compliance with strict legal standards. Furthermore, many ASCs invest in on-premise solutions that support their long-term strategic goals, improving data security, customization options, and performance benefits.

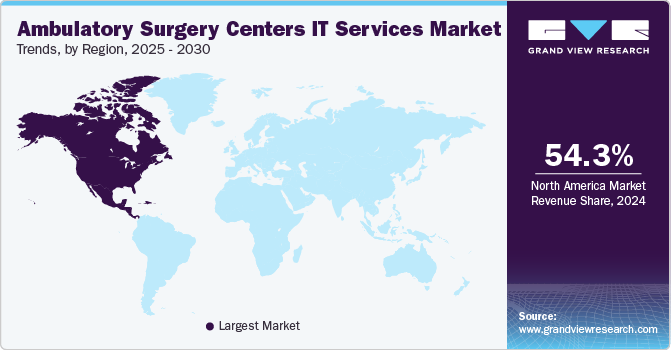

Regional Insights

North American ambulatory surgery centers IT services market dominated the global market and accounted for the largest revenue share of 54.3% in 2024 due to the advanced healthcare sector and significant investment in healthcare technology. The rapid adoption of electronic systems, with companies such as Epic and Cerner, has established a stronghold in this segment, providing wide IT solutions tailored to the unique needs of ASCs. The combination of technological advancements, favorable regulations, and changing patient preferences have positioned North America as a leader in this sector.

U.S. Ambulatory Surgery Centers IT Services Market Trends

The ambulatory surgery centers IT services market in the U.S. dominated North America, with the largest revenue share in 2024. U.S. is at the forefront of integrating IT solutions in healthcare with advanced ASCs such as electronic health record (EHR) systems, practice management software, and telehealth platforms. So, the focus on patient-centered care, technological advancements, and favorable reimbursement policies position the U.S. ASC IT services market as a leader in North America.

Asia Pacific Ambulatory Surgery Centers IT Services Market Trends

Asia Pacific ambulatory surgery centers IT services market is expected to grow at a CAGR of 13.1% over the forecast period. This growth is driven by several factors, such as development in healthcare infrastructure and increasing demand for outpatient treatments as people become more health conscious. There is a surge in ASCs in countries such as India and China, which are designed to provide surgical options with shorter recovery times. Innovative IT solutions, such as mobile health applications facilitating remote monitoring and patient communication, are being integrated into ASCs due to diverse populations and varying healthcare needs.

China Ambulatory Surgery Centers IT Services Market Trends

The ambulatory surgery centers IT services market in China is expected to grow significantly due to its rapid healthcare reforms and increasing investment in outpatient services. The Chinese government is promoting the development of ASCs to ease the burden on hospitals and improve access to healthcare, with initiatives such as Healthy China 2030 driving demand for IT solutions that streamline operations and plan to emphasize the importance of enhancing healthcare infrastructure.

Europe Ambulatory Surgery Centers IT Services Market Trends

The growth of Europe ambulatory surgery centers IT services market is driven by an increasing shift towards value-based care models, outpatient surgical operations, and is supported by various government initiatives. Countries such as the UK and Germany are investing in digital health technologies (IT solutions) to improve patient flow, streamline administrative tasks, and ensure compliance with regulatory requirements. Platforms such as Doctolib in France allow patients to schedule appointments, access healthcare services online, and improve overall experience. Moreover, the ASC IT services market is expected to grow significantly as advancements in healthcare delivery and regional acceptance of technology propel it.

Key Ambulatory Surgery Centers IT Services Company Insights

Some key players in the market are Cerner Corporation, eClinical Works, McKesson Corporation, Medical Information Technology, Inc., Surgical Information Systems, LLC, NextGen Healthcare, Allscripts Healthcare Solutions, Inc., HST Pathways, CUREMD, Epic Systems Corporation, Athenahealth, Inc., Optum and Quatris Health. These companies play an important role in shaping and expanding the ASCs IT services market through their commitment to technological advancement and enhanced care options. In addition, these companies are continuously engaged in developing innovative software solutions that facilitate seamless communication and improve patient data management.

-

Epic Systems Corporation is a leading provider of healthcare IT solutions, well known for its electronic health record (EHR) systems. These systems provide support platforms for billing, scheduling, and clinical documentation. Epic offers tailored solutions that streamline surgical workflows, enhancing patient engagement and operational efficiency. As the demand increases for ASCs to adapt to the evolving healthcare sector, Epic remains at the forefront of driving innovation.

-

McKesson Corporation is a prominent player in the healthcare industry, offering a wide range of IT solutions and services tailored to ASCs. It is renowned for its robust pharmacy and supply chain management solutions and advanced software platforms that enhance operational efficiency and integrated technologies, which make scheduling, billing, and clinical documentation easier. By leveraging McKesson’s comprehensive IT services, ASCs eventually focus on delivering high-quality surgical services while maintaining operational excellence in a competitive market.

Key Ambulatory Surgery Centers IT Services Companies:

The following are the leading companies in the ambulatory surgery centers IT services market. These companies collectively hold the largest market share and dictate industry trends.

- Cerner corporation

- eClinical Works

- McKesson Corporation

- Medical Information Technology, Inc.

- Surgical Information Systems, LLC

- NextGen Healthcare

- Allscripts Healthcare Solutions, Inc.

- HST Pathways

- CUREMD

- Epic Systems Corporation

- Athenahealth, Inc.

- Optum

- Quatris Health

Recent Developments

-

In October 2024, McKesson Corporation announced InspiroGene, which focuses on cell and gene therapies. InspiroGene offers key features such as end-to-end supply chain management, third-party logistics programs, biologics specialty pharmacy solutions that ensure timely delivery of these complex treatments, and real-time data tracking to optimize inventory and logistics.

-

In May 2024, eClinicalWorks announced the integration of Sunoh.ai, an AI-powered medical scribe specifically tailored for dermatology clinics. This innovative tool enhances clinical documentation by making it simple for dermatologists to express observations on skin conditions, including specifics such as location, size, and color.

Ambulatory Surgery Centers IT Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 256.1 billion

Revenue forecast in 2030

USD 426.9 billion

Growth Rate

CAGR of 10.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service type, deployment, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South, Korea, Brazil, Argentina, South, Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Cerner Corporation, eClinical Works, McKesson Corporation, Medical Information Technology, Inc., Surgical Information Systems, LLC, NextGen Healthcare, Allscripts Healthcare Solutions, Inc., HST Pathways, CUREMD, Epic Systems Corporation, Athenahealth, Inc., Optum, Quatris Health.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ambulatory Surgery Centers IT Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Global Ambulatory Surgery Centers IT Services Market report based on product, Service Type, Deployment, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

EHR/EMR

-

Clinical Documentation

-

Practice Management

-

Revenue Cycle Management

-

Supply Chain Management

-

Patient Engagement

-

Others

-

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Premise

-

Web/Cloud Based

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ambulatory surgical centers IT services market size was estimated at USD 3.1 billion in 2019 and is expected to reach USD 3.2 billion in 2020.

b. The global ambulatory surgical centers IT services market is expected to grow at a compound annual growth rate of 22.8% from 2020 to 2027 to reach USD 13.5 billion by 2027.

b. North America dominated the ambulatory surgical centers IT services market with a share of 57.6% in 2019. This is attributable to the high adoption of healthcare IT services by the ambulatory centers in the U.S.

b. Some key players operating in the ambulatory surgical centers IT services market include Cerner corporation; eClinical Works; McKesson Corporation; Medical Information Technology, Inc.; Surgical Information Systems, LLC; NextGen Healthcare; Allscripts Healthcare Solutions Inc.; HST Pathways; CUREMD; and Epic Systems Corporation.

b. Key factors driving the ambulatory surgical centers IT services market growth include the growing number of ambulatory surgical centers due to the shift of surgeries from inpatient settings to outpatient settings coupled with increasing need to curb the growing healthcare costs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."