- Home

- »

- Green Building Materials

- »

-

Americas Structural Insulated Panel Market Report, 2021-2028GVR Report cover

![Americas Structural Insulated Panel Market Size, Share & Trends Report]()

Americas Structural Insulated Panel Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (EPS, XPS, Glass Wool, Polyurethane), By Application (Walls & Floors, Roofs, Cold Storage), And Segment Forecasts

- Report ID: 978-1-68038-753-7

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

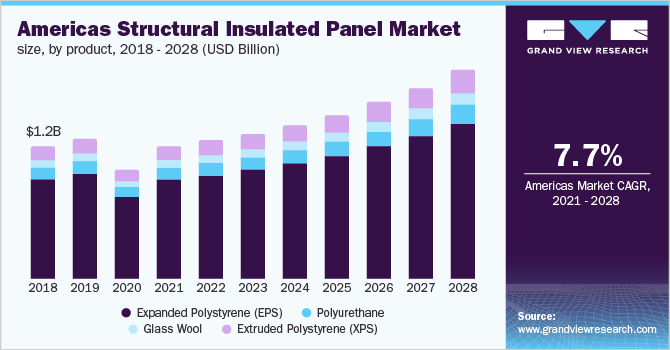

The Americas structural insulated panel market size to be valued at USD 4.27 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 7.7% during the forecast period. Increasing adoption of green building standards and growing investments in the renovation of various residential and industrial building structures are anticipated to drive the market. The American construction market, following its recovery, is expected to witness steady growth over the coming years. Favorable regulations for the adoption of building insulation materials for lowering the overall energy consumption coupled with heavy investments in the establishment of cold chain infrastructure are some of the key factors driving the market growth. The U.S. construction industry is experiencing rapid growth on account of a rising number of residential and non-residential renovations and new construction activities.

The rising consumer demand for innovative buildings with modern technologies improved aesthetic appeal, and better energy-efficiency is expected to drive the market growth. The U.S. governments’ initiatives, through the Weatherization Assistance Program (WAP), to promote thermal insulation through federal funding in households and the U.S. Department of Energy’s funding to develop highly insulating phenolic insulation foams are expected to influence the growth positively.

Structural Insulated Panels (SIPs) are expected to gain traction owing to their several benefits, such as low weight, improved appearance, and high thermal performance. Increasing demand for energy-efficient buildings owing to the stringent government regulations and rising awareness regarding environmental degradation is anticipated to fuel the demand for SIPs over the forecast period.

However, fluctuating raw material prices result in price variations of thermal insulating materials, thus affecting the manufacturers’ profit margins across the value chain. Blowing agents employed in various insulation materials, such as Polyurethane (PU) foams, Expanded Polystyrene (EPS), and Extruded Polystyrene (XPS), contain Greenhouse Gasses (GHG), which causes environmental issues, and thus, are expected to restrain the market growth.

Americas Structural Insulated Panel Market Trends

Rapid urbanization is driving the market demand for structural insulated panels owing to their wide application in ceilings and exterior walls. Associated low cost, premium quality, and strength are among the major features of these panels, which enhance their utility in various sectors.

Moreover, rising awareness regarding climate change due to increasing pollution, population, and greenhouse gas have driven the demand for efficient and cost-effective insulation panels. A structural insulated panel is a material of choice for insulation applications in high or low-temperature areas.

Furthermore, these panels are utilized widely in cold storage applications. Increasing technological advancements in various sectors including food preparation and processing, storage facilities and pharmaceutical manufacturing, and retail operations have triggered the demand for high-quality and cost-effective panels. The aforementioned factors are expected to propel the market growth during the forecast period.

On the other hand, the volatility in prices of raw materials is likely to hamper the demand for the structural insulated panel market, which in turn leads to price fluctuation of finished goods. However, strict government regulations regarding new construction have compelled builders to utilize these panels to reduce heating, ventilation, and air conditioning costs.

Product Insights

The EPS product segment led the market in 2020 and accounted for more than 76% share of the overall revenue. The segment will grow further at a steady CAGR from 2021 to 2028 due to rising demand for EPS in the building & construction industry on account of its superior properties, such as enhanced sound absorption and low weight & cost. It is one of the most commonly used insulating core materials in the manufacturing of SIPs.

SIPs are used to construct buildings to decrease the overall energy consumption of the building and regulate the temperature in the interiors, thereby making the building more sustainable. The selection of insulation material is the primary factor responsible for increasing the energy efficiency of building systems.

Metal sheets are emerging as a preferred facing material owing to their durability, fireproof property, and superior surface finish. Moreover, insulated metal panels are available in various colors, thus making them suitable for direct application on building exteriors. The most commonly used metal substrates include galvanized steel, stainless steel, aluminum-zinc coated steel, and aluminum.

Other materials used for SIPs include PU, glass wool, and Oriented Strand Board (OSB). Several market players provide raw materials for thermal insulating components. Large production facilities and high capital investments result in high-volume production of materials.

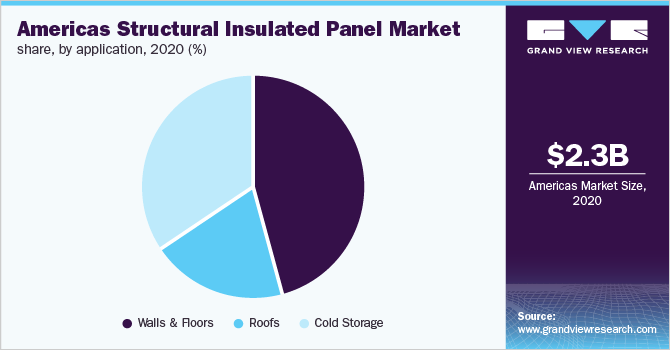

Application Insights

The walls and floors application segment led the market and accounted for over 45% of the total revenue share in 2020. The segment will expand further at the fastest CAGR from 2021 to 2028 owing to the burgeoning demand for SIPs and growing investments for the establishment of commercial structures and institutional buildings, such as schools, hospitals, theaters, malls, and hotels.

Insulation of walls is one of the essential elements to enhance the energy efficiency of buildings. Insulated walls and roofs create a protective envelope, eliminating heat transfer from the external environment through conduction and convection radiation. Polystyrene core SIPs are the most popular products used for external wall insulation owing to their low cost, high durability, and convenient installation. Insulated roof panels offer heat retention and prevention benefits, thereby enabling cozy space in houses and workspaces.

Temperature regulated by insulated roofs leads to improvement in buildings’ energy efficiency through a reduction in usage of air conditioning systems and heaters. Such benefits are projected to drive the market growth over the forecast period. Other applications include cold storage applications. The product is widely used in the cold storage industry in applications, such as walls, ceilings, and roofs, freezers, and food processing buildings, owing to its superior structural strength and insulation properties.

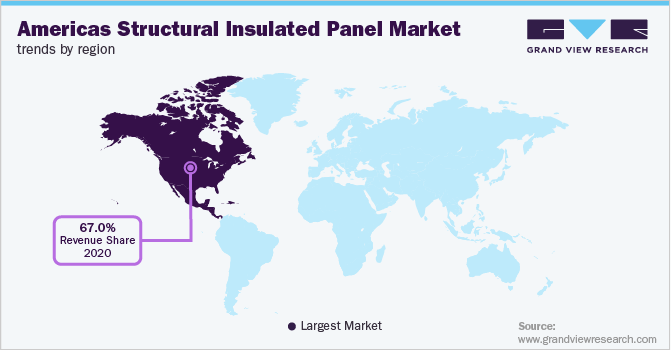

Regional Insights

North America dominated the market and accounted for over 67% of revenue share in 2020 owing to its well-developed construction industry. The growth in construction spending in the region is attributed to the increasing government initiatives towards infrastructural modernization and building energy-efficient homes. Moreover, the implementation of strict building codes, such as the International Energy Conservation Code (IECC), is likely to encourage more insulation utilization per structure, thereby supporting product demand.

The U.S. dominated the market in North America, in terms of consumption, owing to the increased demand from the residential sector, the presence of extensively developed cold chain and logistics industry, and government initiatives for the development of social infrastructure. In addition, rising awareness regarding the benefits of insulation is expected to further augment the market growth in the country.

The market in Central & South America (CSA) is expected to witness average growth over the forecast period. Business-friendly policies in the region are expected to attract greater private investment in industries including manufacturing and construction, which is expected to propel the market growth over the forecast period.

Key Companies & Market Share Insights

The market is highly competitive owing to the presence of both regional and multinational players. New product development and competitive pricing are some of the manufacturers’ key focus areas to strengthen their industry positions. In addition, many companies offer additional services, such as engineering & technical advisory and installation assistance, to enhance their customer base. Major players invest in research and development activities and continuously launch new products to gain a competitive edge.

Recent Developments

-

In June 2022, Kingspan announced an investment of 210 million Euros in a Building Technology Campus located in Ukraine. This new plant will manufacture advanced insulation and heating solutions

-

In February 2022, Kingspan Group announced the acquisition of Troldtekt A/S. The development will facilitate Kingspan’s entry into the natural materials space

-

In December 2021, PFB Corporation announced its acquisition by the Riverside Company. This acquisition will assist in the further growth of PFB Corporation

Some prominent players in the Americas structural insulated panel market include:

-

Kingspan Group

-

Metl-Span

-

Owens Corning

-

Metecno Group

-

KPS Global

-

Isopan

-

PFB Corporation

-

All Weather Insulated Panels

-

Green Span Profiles

-

American Insulated Panel Company

-

American Buildings Company

-

Ingreen Systems Corp.

-

Structural Panels Inc.

Americas Structural Insulated Panel Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2.81 billion

Revenue forecast in 2028

USD 4.27 billion

Growth rate

CAGR of 7.7% from 2021 to 2028 (Revenue-based)

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in million square feet, revenue in USD million/billion, and CAGR from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Central & South America

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Chile; Colombia; Rest of the CSA

Key companies profiled

Kingspan Group; Metl-Span; Owens Corning; Metecno Group; KPS Global; Isopan; PFB Corp.; All Weather Insulated Panels; Green Span Profiles; American Insulated Panel Company; American Buildings Company; Ingreen Systems Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas Structural Insulated Panel Market SegmentationThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the Americas structural insulated panel market report on the basis of product, application, and region:

-

Product Outlook (Volume, Million Square Feet; Revenue, USD Million, 2017 - 2028)

-

Expanded Polystyrene (EPS)

-

Polyurethane

-

Glass Wool

-

Extruded Polystyrene (XPS)

-

-

Application Outlook (Volume, Million Square Feet; Revenue, USD Million, 2017 - 2028)

-

Walls & Floors

-

Roofs

-

Cold Storage

-

-

Regional Outlook (Volume, Million Square Feet; Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

Rest of the CSA

-

-

Frequently Asked Questions About This Report

b. The Americas structural insulated panel market size was estimated at USD 2.35 billion in 2020 and is expected to reach USD 2.81 billion in 2021.

b. The Americas structural insulated panel market is expected to grow at a compound annual growth rate of 7.7% from 2021 to 2028 to reach USD 4.27 billion by 2028.

b. The extruded polystyrene (XPS) segment dominated the Americas structural insulated panel market with a share of 76.4% in 2019, owing to its high compression strength, moisture resistance, and high functionality in challenging environments.

b. Some of the key players operating in the Americas structural insulated panel market include Metl-Span, Kingspan Group, Owens Corning, PFB Corporation, Isopan, KPS Global, American Insulated Panel, and Structural Panels Inc.

b. The key factors that are driving the Americas structural insulated panel market include growing awareness pertaining advantages of building thermal insulation and rising investments in the development of cold chain infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.