- Home

- »

- Automotive & Transportation

- »

-

Cold Chain Market Size, Share, Trends, Industry Report 2033GVR Report cover

![Cold Chain Market Size, Share & Trends Report]()

Cold Chain Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Storage, Transportation), By Temperature Range, By Application (Food & Beverages, Pharmaceuticals, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-760-5

- Number of Report Pages: 350

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold Chain Market Summary

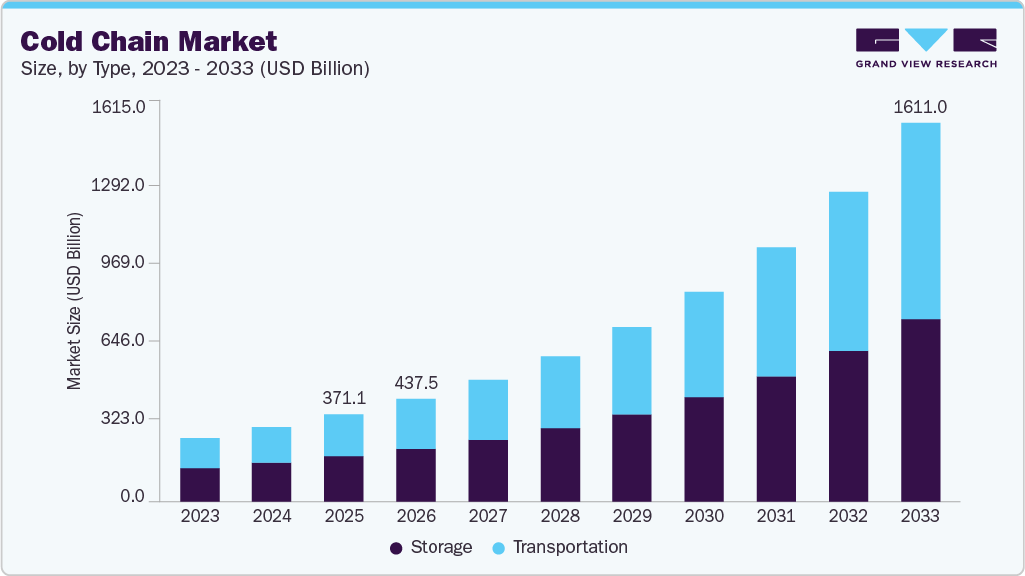

The global cold chain market size was estimated at USD 371.08 billion in 2025 and is projected to reach USD 1,611.0 billion by 2033, growing at a CAGR of 20.5% from 2026 to 2033. Changes in consumer preferences and growing e-commerce sales are expected to drive the market.

Key Market Trends & Insights

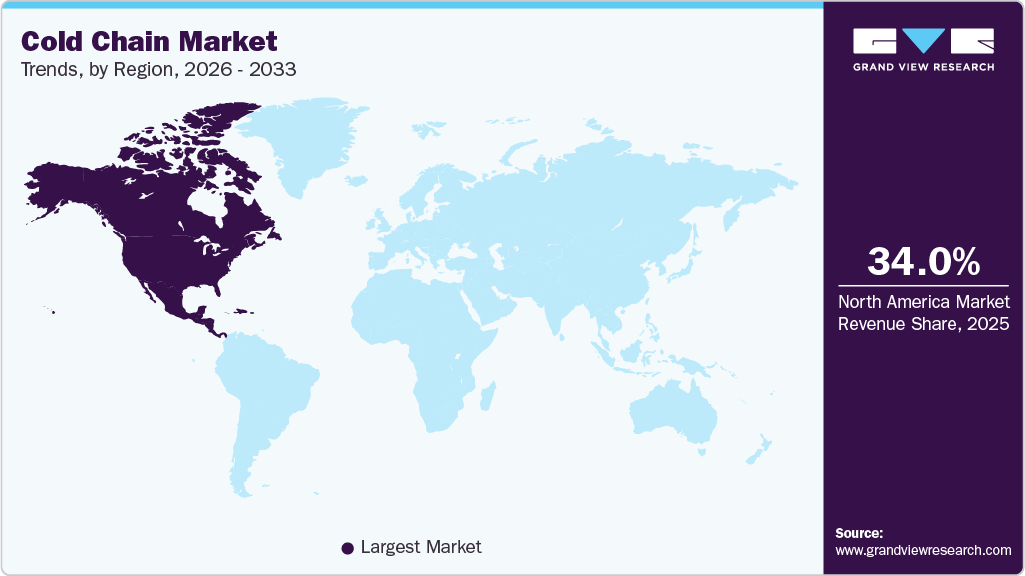

- North America cold chain market held the largest revenue share of more than 33.0% in 2025.

- The U.S. cold chain market is driven by various factors, including changing consumer preferences, increasing demand for fresh and frozen foods, and the growth of e-commerce.

- Based on type, the storage segment dominated the overall cold chain market with a revenue share of 51.8% in 2025.

- Based on temperature range, the frozen (-18°C to -25°C) segment dominated the overall market in 2025.

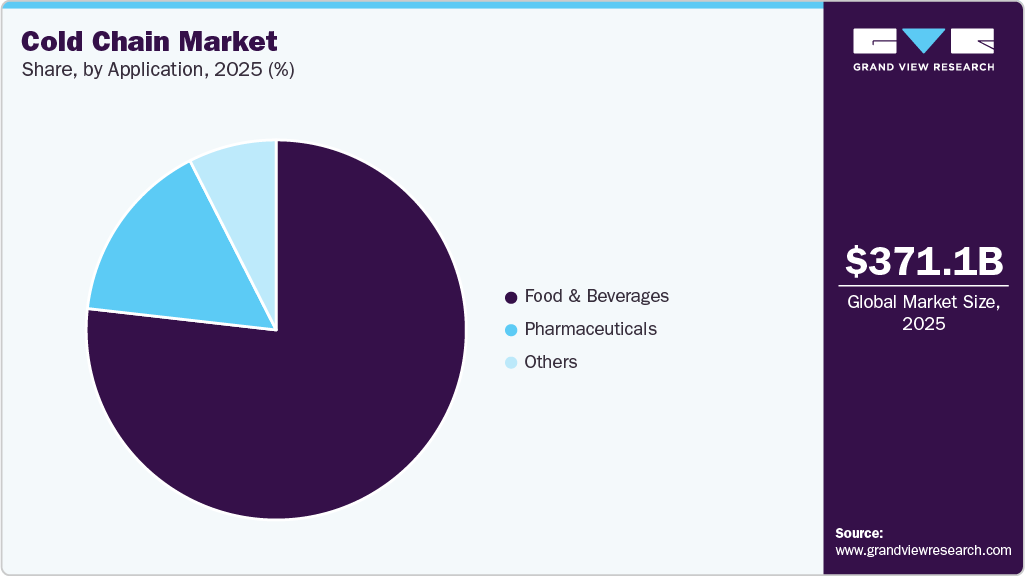

- Based on application, the food & beverages segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 371.08 Billion

- 2033 Projected Market Size: USD 1,611.0 Billion

- CAGR (2026-2033): 20.5%

- North America: Largest market in 2025

An increasing number of organized retail stores in developing economies is leading to the growing demand for cold chain solutions. Rising investment in cold chains and government initiatives to minimize food waste are expected to boost market growth. The growing adoption of technologies such as RFID and automation in cold chain applications provides significant growth opportunities for the market. The World Trade Organization (WTO) and bilateral free trade agreements, such as the European Union Free Trade Agreement (FTA) and the North America Free Trade Agreement (NAFTA), have created opportunities for exporters in the U.S. and Europe to increase trade for perishable foods in a manner that is free of import duties.The refrigerated storage market in developing economies is driven by a shift from carbohydrate-rich diets to protein-rich foods, owing to rising consumer awareness. Countries such as China are expected to portray a significant growth rate over the coming years due to a consumer-led economic transition. With growing technological advancements in warehouse management and refrigerated transportation, the market will likely expand in developing economies.

Increasing IT spending in cold storage logistics drives the growth of the cold chain market by facilitating better inventory management and improving the overall efficiency of cold chain supply systems. By investing in advanced technologies such as cloud computing, IoT, and RFID, cold storage operators can track and monitor their inventory in real time, reducing the risk of food waste, spoilage, and product recalls. The rising demand for temperature-sensitive products has emphasized the need for real-time cold chain monitoring.

Furthermore, several countries have strict regulations governing the transportation and storage of perishable food products to ensure food safety and quality. Compliance with these regulations often requires a robust cold chain system, which can be achieved with the help of IT systems. IT systems are critical in complying with these regulations as they provide real-time monitoring of temperature and humidity levels, location tracking, and data analytics.

Furthermore, several countries have strict regulations governing the transportation and storage of perishable food products to ensure food safety and quality. Compliance with these regulations often requires a robust cold chain system, which can be achieved with the help of IT systems. IT systems are critical in complying with these regulations as they provide real-time monitoring of temperature and humidity levels, location tracking, and data analytics. For instance, temperature monitoring devices such as data loggers, sensors, and RFID tags can be used to collect and transmit temperature data, which can be analyzed to ensure compliance. For example, the United States Food and Drug Administration (FDA), through the Food Safety Modernization Act (FSMA), and the European Union, through the European Union Food Hygiene Regulations have established stringent regulations for the storage and transportation of perishable food products. Both regulatory bodies mandate that all food products be transported and stored in a temperature-controlled environment and that temperature data must be collected and analyzed to ensure adherence to the regulations.

Type Insights

Based on type, the market is segmented into storage, and transportation. The storage segment dominated the overall cold chain market with a revenue share of 51.8% in 2025. The growth can be attributed to an increasing preference for packaged foods across the globe. Consumers changing dietary patterns and lifestyles are driving the demand for frozen foods. This is expected to boost the demand for storage solutions. Moreover, market players are expanding their storage capacities to meet cold storage needs. At the same time, the cold chain equipment market is also gaining better momentum.

Cold chain systems are crucial for supplying healthcare and food & beverage products. Demand for cold chain transportation solutions such as refrigerated containers and vehicles to safely transport temperature-sensitive goods is expected to drive the transportation segment over the forecast period.

Efficient cold storage management greatly depends on software and hardware components used for monitoring purposes. Hardware components include data loggers, remote temperature sensors, RFID devices, networking devices, and telematics devices. The stringent regulatory environment in the pharmaceutical industry surrounding the maintenance of product quality has positively influenced the adoption of cold chain temperature monitoring solutions.

Temperature Range Insights

Based on temperature range, the market is segmented into chilled (0°C to 15°C), frozen (-18°C to -25°C), and deep-frozen (below -25°C). The frozen (-18°C to -25°C) segment dominated the overall market in 2025. Poultry, cakes & bread, and meat need freezing temperatures to remain fresh. This is driving the need for frozen cold chain solutions to preserve the quality of perishable food & beverage and pharmaceutical products. Moreover, the wide availability of cold chain storage and transportation solutions for frozen temperature ranges drives the segment’s growth.

The chilled (0°C to 15°C) segment is expected to grow at a notable CAGR over the forecast period. To remain fresh, many vegetables, fruits, and meat require chilled temperature ranges, usually between 2°C to 4°C, during transportation. Chilled temperature storage of perishable products such as dairy products prevents deterioration, increasing shelf life. Maintaining the quality of perishable goods and minimizing wastage is driving the segment's growth.

Application Insights

Based on application, the market is segmented into pharmaceuticals, food & beverages, and others. The food & beverages segment dominated the market in 2025. Technological developments in the storage, packaging, and processing of seafood are anticipated to boost the growth of this segment. However, processed food is projected to grow significantly over the forecast years owing to continued innovations in packaging materials. Advancements in packaging materials increase the shelf life of foods. This has increased the sales of processed foods over the past few years.

The pharmaceuticals segment is expected to register significant growth over the forecast period. High product demand in the pharmaceuticals segment can be attributed to its importance in maintaining the efficacy and safety of pharmaceuticals. The cold chain in the pharmaceutical industry is driven by stringent regulatory norms, such as Goods Distribution Practices (GDP) in the European Union (EU). These regulations are a shift witnessed in governments across the world toward standardizing regulations globally for better transportation systems for healthcare-related products.

Regional Insights

North America held the largest revenue share of more than 34.0% in 2025. It will retain the dominant position throughout the forecast period as the region has significant growth opportunities for the companies planning to invest in the long haul. Increasing penetration of connected devices and a large consumer base are also expected to fuel market growth over the forecast period.

U.S. Cold Chain Market Trends

The U.S. cold chain market is driven by various factors, including changing consumer preferences, increasing demand for fresh and frozen foods, and the growth of e-commerce. One of the major drivers of the U.S. cold chain market is the increasing demand for fresh and frozen foods. Consumers are increasingly seeking fresh, healthy, and locally sourced foods and are willing to pay a premium price for high-quality products. This has increased the demand for cold chain logistics services as companies seek to ensure that their products are delivered to consumers in optimal condition.

Europe Cold Chain Market Trends

The Europe cold chain market was identified as a lucrative region in 2025. Demand is being driven by rising consumption of perishable foods, stringent pharmaceutical regulations, and a growing emphasis on sustainability across the supply chain. The EU’s regulatory landscape, especially regarding food safety (e.g., EU Regulation 852/2004) and pharmaceutical transport (e.g., GDP guidelines) has encouraged greater investments in temperature-controlled logistics infrastructure. Additionally, the market is benefiting from the modernization of cold storage facilities, integration of IoT-enabled monitoring systems, and increasing cross-border trade in perishables and biologics. Countries such as Germany, the Netherlands, and France are leading adoption, supported by strong logistics infrastructure, advanced retail networks, and export-oriented agri-food sectors.

The UK cold chain industry is expected to grow rapidly in the coming years. Key drivers include the expansion of online grocery and meal delivery services, growth in temperature-sensitive pharmaceutical logistics (especially post-Brexit), and increasing demand for traceability and compliance with national food safety standards.

Asia Pacific Cold Chain Market Trend

Asia Pacific is anticipated to register the highest growth over the forecast period, owing to increasing government investments in logistics infrastructure development and penetration of Warehouse Management Systems (WMS). The growing awareness of the importance of food safety among consumers in the Asia Pacific region, particularly when it comes to perishable goods, is leading to greater demand for cold chain logistics.

The China cold chain market is a major contributor to the Asia Pacific regional market. The market growth in China is attributed to factors such as technological advancements in the packaging, processing, and storage of seafood products. Rising demand and growing cold chain infrastructure development have made China a top market for cold chains. China is undergoing a rapid transition from a construction- & manufacturing-led economy to a consumer-led economy. Rising innovations in the pharmaceutical sector in China are also expected to boost the demand for cold chain solutions. Another major factor driving the market includes the rapid expansion of biopharma in the region.

Key Cold Chain Company Insights

Some of the key players operating in the market include Americold Logistics LLC, LINEAGE LOGISTICS HOLDING, LLC, Burris Logistics, and Wabash National Corporation, among others.

-

Americold Logistics LLC is a U.S.-based temperature-controlled warehousing and transportation company that serves the food industry. The company offers solutions such as producer solutions and retailer solutions. Under producer solutions, the company offers dedicated facilities, public refrigerated warehouses, port facilities, automation, and integrated consolidation programs. Under retailer solutions, the company offers integrated consolidation programs, i-3PL supply chains, system integration services, port facilities, automation, and network optimization study. The company makes significant investments in technology to stay ahead of the competition. The company has a presence across regions including APAC and the Americas.

-

LINEAGE LOGISTICS HOLDING, LLC provides warehousing and logistics solutions to users in various industries. The company’s solutions consist of temperature controlled public warehousing facilities for storing multiple food commodities, including pork, beef, poultry, bakery products, fruits & vegetables, seafood, ice creams, and vegetables. It also provides port-centric cold chain facilities on the East and West Coasts to serve containerized markets and break bulk.

Key Cold Chain Companies:

The following are the leading companies in the cold chain market. These companies collectively hold the largest market share and dictate industry trends

- Americold Logistics, Inc.

- LINEAGE LOGISTICS HOLDING, LLC

- United States Cold Storage

- Burris Logistics

- Wabash National Corporation

- NewCold

- Sonoco ThermoSafe (Sonoco Products Company)

- United Parcel Service of America, Inc.

- A.P. Moller - Maersk

- NICHIREI CORPORATION

- Tippmann Group

Recent Developments

-

In October 2025, Carrier Transicold used Intermodal Europe 2025 to showcase its newest container-refrigeration technologies focused on efficiency, sustainability and reliability. The company highlighted the OptimaLINE system, now past 25,000 units sold, and the EverFRESH® controlled-atmosphere technology that slows ripening and protects high-value perishables during long voyages. Together, these systems provide exporters and shipping lines with better cargo quality, lower energy use, and greater operational flexibility.

-

In November 2024, Lineage, Inc. announced the acquisition of Coldpoint's assets, a Kansas City-based provider of cold storage and transportation solutions. This strategic move expands Lineage's footprint in the Kansas City area, enhances its services along the protein corridor with direct rail access to U.S. ports, and integrates Coldpoint's 621,000-square-foot facility with advanced intermodal capabilities into its global network.

-

In November 2024, CJ Logistics America opened a state-of-the-art, 270,000-square-foot cold storage warehouse in Georgia, U.S., strategically located near major highways and railways in a key poultry production region. Equipped with advanced refrigeration and blast freezing systems, the facility offers tailored storage solutions for various products, including proteins, bakery items, and finished goods, with 30,000 racked pallet positions and on-site USDA inspection capabilities. This investment reinforces CJ Logistics America's commitment to delivering premium cold chain solutions to leading global brands.

Cold Chain Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 437.49 billion

Revenue forecast in 2033

USD 1,611.0 billion

Growth rate

CAGR of 20.5% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, temperature range, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Norway; Netherlands; Switzerland; Russia; China; Japan; India; Singapore; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Americold Logistics, Inc.; LINEAGE LOGISTICS HOLDING, LLC; United States Cold Storage; Burris Logistics; Wabash National Corporation; NewCold; Sonoco ThermoSafe (Sonoco Products Company); United Parcel Service of America, Inc.; A.P. Moller - Maersk; NICHIREI CORPORATION; Tippmann Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Chain Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global cold chain market based on type, temperature range, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Storage

-

Facilities/Services

-

Refrigerated Warehouse

-

Private & Semi-Private

-

Public

-

-

Cold Room

-

-

Equipment

-

Blast freezer

-

Walk-in Cooler and Freezer

-

Deep Freezer

-

Others

-

-

-

Transportation

-

By Mode

-

Road

-

Sea

-

Rail

-

Air

-

-

By Offering

-

Refrigerated vehicles

-

Refrigerated containers

-

-

-

-

Temperature Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Chilled (0°C to 15°C)

-

Frozen (-18°C to -25°C)

-

Deep-frozen (Below -25°C)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Norway

-

Netherlands

-

Switzerland

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold chain market was estimated at USD 371.08 billion in 2025 and is expected to reach USD 437.49 billion in 2026.

b. The global cold chain market is expected to progress at a compound annual growth rate of 20.5% from 2025 to 2033 to reach USD 1611.0 billion in 2033.

b. The storage segment accounted for the largest revenue share of more than 51.0% in 2025 in the cold chain market owing to an increasing preference for packaged foods globally.

b. The insulated containers and boxes segment held the largest revenue share of over 52.0% in 2025 in the cold chain market. The other products includes a detailed analysis of crates, ice packs, labels, and others.

b. North America held the largest revenue share of more than 34.0% in 2025. It will retain the dominant position throughout the forecast period as the region has significant growth opportunities for the companies planning to invest for the long haul. Increasing penetration of connected devices and a large consumer base are also expected to fuel market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.