- Home

- »

- Medical Devices

- »

-

Amniocentesis Needle Market Size & Share Report, 2030GVR Report cover

![Amniocentesis Needle Market Size, Share & Trends Report]()

Amniocentesis Needle Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (100 to 150 mm, Smaller Than 100 mm, and Larger Than 150 mm), By Procedure, By End-use, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-190-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Amniocentesis Needle Market Size & Trends

The global amniocentesis needle market size was estimated at USD 187.96 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.85% from 2024 to 2030. This can be attributed to several factors, like an increase in maternal age, a rising prevalence of chronic diseases among expectant mothers, and continuous advancements in healthcare technology. In addition to the growing incidence of chronic diseases complicating pregnancy, the demand for these diagnostic tools is expected to surge. Furthermore, rising acceptance of prenatal testing has become a key driving factor in the market.

The rising number of genetic disorders among newborns and the increased awareness of prenatal testing have resulted in a growing demand for amniocentesis procedures. For instance, in 2022, MJH Life Sciences reported a global increase in the burden of genetic diseases, with approximately 300,000 babies being born with sickle cell disease each year worldwide. This disease affects nearly 5% of the world's population and is notably the most common genetic disorder in the U.S. This concerning factor has highlighted the importance of early detection and diagnosis of genetic abnormalities in fetuses. Therefore, the market for amniocentesis needles is expanding, as it plays a critical role in prenatal care, enabling the identification of chromosomal and genetic disorders. In turn, it contributes to improved healthcare outcomes for expecting mothers and their babies.

In addition, the increasing prevalence of gestational diabetes is significantly impacting the market growth. This condition affects pregnant women and can have serious consequences for both the mother and the baby, leading to a higher demand for prenatal testing and monitoring. For instance, in 2022 a research paper published in Frontiers in Endocrinology reported a substantial rise in the prevalence of gestational diabetes, from 4% in 2010 to 21% in 2020. Amniocentesis, an important diagnostic procedure for identifying potential fetal risks and genetic issues, has become important in addressing these concerns. This trend helps to grow the market, and healthcare providers strive to offer comprehensive care to pregnant women and their unborn children.

Increasing acceptance of prenatal testing has become a key market-driving factor. Expected parents and healthcare providers are recognizing the importance of early and comprehensive prenatal assessments. This demand has been further fulfilled by the availability of advanced tests like non-invasive prenatal testing (NIPT), which provides highly accurate genetic information through a simple blood test, eliminating the need for invasive procedures.

Moreover technological advancements in healthcare, particularly in the field of prenatal diagnostics, play a crucial role.Continuous improvements in the design of amniocentesis needles and diagnostic methods have notably boosted accuracy, safety, and patient comfort. These enhancements focus on refining needle structure, reducing size, and refining procedural precision, ultimately ensuring a safer and more comfortable experience during amniocentesis procedures. Moreover, progress in genetic testing and molecular diagnostics has strengthened the comprehensive examination of samples obtained through amniocentesis. This advancement significantly improves the accuracy of identifying various genetic abnormalities, contributing to a better overall experience

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating due to increased demand for prenatal testing, advancements in healthcare technology, and expanding awareness among expecting parents, contributing to its rapid acceleration in market growth during this stage.

The level of merger and acquisition (M&A) activity in the amniocentesis needle market is rising due to heightened competition, consolidation efforts among key industry players to expand market reach, capitalize on technological advancements, and streamline operations in response to the growing demand for prenatal testing solutions.

Health authorities like the FDA establish strict standards for amniocentesis needle quality and safety worldwide. Adherence to these regulations is crucial for manufacturers to gain market approval, ensuring these devices meet stringent safety and efficacy criteria, vital for reliable and trusted prenatal testing.

Advancements in non-invasive prenatal testing, like cell-free DNA screening, are emerging as substitutes to traditional invasive methods such as amniocentesis within the market. These alternatives offer reduced procedural risks and greater comfort for expectant parents while providing accurate prenatal information, influencing the landscape by diversifying options for prenatal diagnosis beyond conventional invasive techniques.

Due to the growing demand for prenatal testing, companies functioning in the market are expanding their presence into new regions globally. This involves establishing partnerships with local healthcare providers, navigating regulatory frameworks, and offering comprehensive educational programs. By entering untapped markets and enhancing accessibility to their products, these companies aim to address the increasing need for prenatal diagnostic solutions in diverse geographical areas.

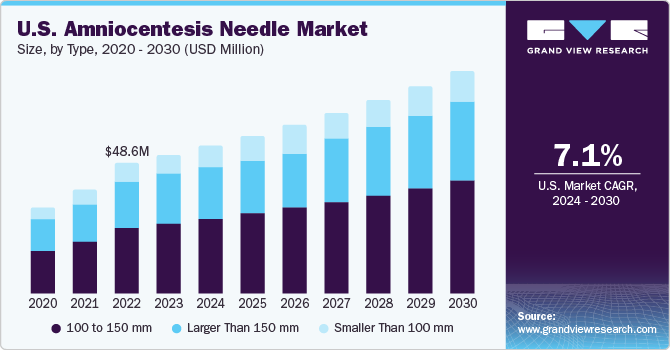

Type Insights

The 100-150 mm segment accounted for the largest market share of 52.61% in 2023. This can be attributed to their versatility and suitability for various medical applications, from vaccinations to drug administration and blood sampling. They balance precision and patient comfort, making them a preferred choice in the medical field. In particular, these needles are commonly used for females with a normal body mass index (BMI) and also given to several pregnant women with this high BMI. For instance, in the UK, a significant obstetric challenge arises from a high obesity rate, affecting 21.3% of pregnant women, with only 47.3% having a normal BMI. The usage of this needle is expected to increase in obstetric practice.

The smaller than 100 mm segment shows the fastest CAGR over the forecast period. In early pregnancies, shorter needles are increasingly preferred when the amniotic sac is smaller, and maneuvering is crucial. These needles align with the growing demand for minimally invasive procedures, causing less discomfort and tissue trauma to the patient. Advancements in needle design, such as atraumatic tips and compatibility with ultrasound guidance, are making early-trimester procedures safer and more accurate, further driving the adoption of smaller needles. In addition, medical practitioners' preference for smaller needle sizes due to enhanced maneuverability and reduced risk of complications also contributes to the heightened adoption and projected rapid expansion of this specific segment within the market.

Procedure Insights

The amniocentesis procedures segment accounted for the largest revenue share in 2023. This growth can be attributed to amniocentesis, an important prenatal diagnostic tool, and it offers insights into fetal health, genetic conditions, and chromosomal abnormalities, which is vital for expectant parents and healthcare providers. In recent years, advancements in amniocentesis techniques, such as non-invasive prenatal testing (NIPT) and advanced genetic testing technologies, have expanded its scope and accuracy. For instance, NIPT's growing adoption provides highly accurate genetic information while avoiding the invasiveness associated with other procedures. The increase in maternal age and a growing awareness of genetic disorders have also fueled the demand for such prenatal assessments.

The fetal blood transfusion segment shows significant CAGR over the forecast period. The developments in fetal medicine and perinatal care have led to an increased recognition of the efficacy of fetal blood transfusion procedures in treating specific fetal conditions. Furthermore, advancements in needle technology, such as smaller gauges and atraumatic tips, are making fetal blood transfusions safer and more feasible, further driving their adoption. Moreover, the rising incidences of fetal blood disorders, such as hemolytic disease, which require specialized interventions like intrauterine transfusions, have also contributed to the expanded utilization of fetal blood transfusion procedures in this specific medical application.

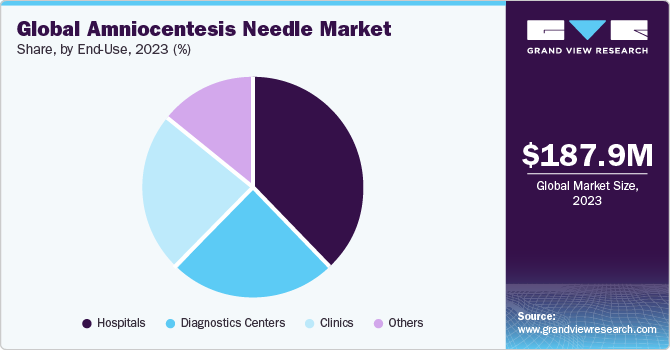

End-use Insights

The hospitals segment accounted for the largest revenue share in 2023. This can be attributed to hospitals being the primary healthcare institutions for childbirth and prenatal care, making them an essential place for amniocentesis procedures. Expectant mothers often undergo prenatal testing and genetic assessments in a hospital, and these tests often involve the use of amniocentesis needles. The advancements in prenatal screening and the importance of early detection of fetal abnormalities and genetic conditions have driven the demand for these procedures within hospitals. For instance, integrating advanced technologies like high-resolution ultrasound and genetic testing methods into hospital-based prenatal care has further boosted their role as the primary end-users of amniocentesis needles. The COVID-19 pandemic has also accelerated the significance of well-equipped hospital facilities for comprehensive healthcare services.

The clinics segment shows the fastest CAGR over the forecast period. This is due to clinics providing a more convenient and accessible option for pregnant women, especially in regions with limited healthcare infrastructure, attracting a wider patient base and boosting the demand for amniocentesis needles. Additionally, clinics quickly adopt new technologies and procedures, such as advanced amniocentesis needles, catering to the growing preference for minimally invasive and patient-centric care. This agility positions them as frontrunners in the market. Clinics often cater to specific population segments, such as high-risk pregnancies or geriatric mothers, where the need for specialized needles might be higher, further propelling their market share.

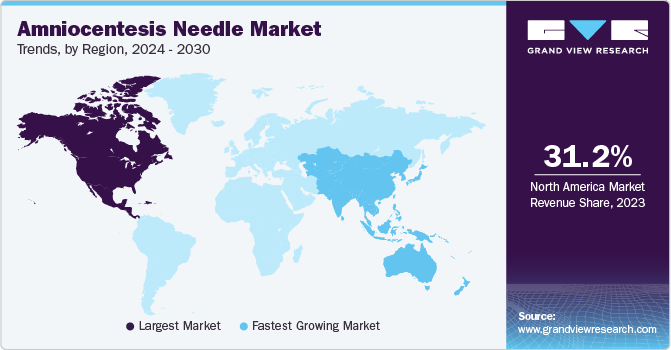

Regional Insights

North America dominated the overall global market in 2023. This can be attributed to well-established healthcare infrastructure, advanced prenatal care facilities, and a high level of awareness about the importance of prenatal testing among expectant parents. There is an increase in the number of couples in the U.S. and Canada who are opting for prenatal screening to evaluate the health of their unborn babies and check for genetic conditions and chromosomal abnormalities. The availability of advanced diagnostic technologies and new genetic testing methods within healthcare facilities in North America has greatly contributed to the region's prominent position in this field.

The U.S. accounted for North America's largest share of the market in 2023. The U.S. has a strong healthcare infrastructure and extensive research and development activities in the medical field, which have led to technological advancements in prenatal diagnostics. The increased demand for prenatal testing procedures like amniocentesis is due to a higher prevalence of genetic disorders, a growing elderly population, favorable reimbursement policies, and greater awareness among healthcare professionals and patients about the benefits of prenatal testing. These factors make the U.S. an ideal market for amniocentesis needles and other prenatal testing products compared to other countries in North America.

The Asia Pacific region is expected to grow fastest during the forecast period. This progress is driven by increasing awareness of prenatal care and the importance of genetic screening. With their large populations, countries like China and India are witnessing a growing demand for advanced prenatal diagnostics. Asian countries have led to an increased number of pregnant women seeking comprehensive prenatal care. Furthermore, ongoing technological advancements in the region and the emergence of telemedicine and digital healthcare solutions are expanding the reach of prenatal testing services.

India accounted for Asia Pacific largest share of the market in 2023. This is due to its substantial population and a rising understanding of prenatal health and genetic issues. The increased recognition of these aspects has fueled a greater need for sophisticated prenatal diagnostic techniques like amniocentesis. This heightened awareness has particularly emphasized the importance of early and accurate diagnosis, especially among a significant population, contributing significantly to India's prominence in the Asia Pacific region

Key Companies & Market Share Insights

Some of the key players operating in the amniocentesis needle market include Smiths Medical, Integra LifeSciences, Cook Medical, and CooperSurgical.

-

Smith’s Medical is known for its established presence and expertise in producing medical devices, including amniocentesis needles

-

Integra LifeSciences recognized for its long-standing commitment to developing and manufacturing surgical devices, including needles for various medical procedures

-

Cook Medical considered a mature player with a significant market share, offering a wide range of medical devices, including those used in prenatal diagnostics like amniocentesis.

-

CooperSurgical known for its extensive experience and presence in the women's health segment, offering diverse medical devices for obstetrics and gynecology, including products related to prenatal diagnostics.

Biopsybell Srl, Laboratoire CCD, RI.MOS. Srl and Medline are some of the emerging market players functioning in the market.

-

Biopsybell Srl is a pioneering Italian company specializing in diagnostic and therapeutic medical devices, including amniocentesis needles, known for its innovation and quality in the field of medical equipment.

-

Laboratoire CCD is a company recognized for its developments in medical devices, including offerings related to prenatal diagnostics, aiming to provide innovative solutions in the healthcare industry.

-

RI.MOS. Srl is an emerging key player in medical devices, particularly manufacturing needles for various diagnostic procedures, showcasing a growing presence and commitment to innovation in the sector.

-

Medline is gradually establishing its position as an emerging player in the medical device industry, exploring opportunities across diverse healthcare segments, including potential forays into prenatal diagnostics like amniocentesis needles

Key amniocentesis needle Companies:

The following are the leading companies in the amniocentesis needle market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these amniocentesis needle companies are analyzed to map the supply network.

- Smith’s Medical

- Biopsybell Srl

- Integra LifeSciences

- Laboratoire CCD

- Cook Medical

- RI.MOS. Srl

- CooperSurgical

- Medline

- Rocket Medical

- Becton Dickinson and Company

Recent Developments

-

In April 2023, Rocket Pharmaceuticals, a leading biotechnology company, has announced the expansion of its leadership team to support its growing and industry-leading pipeline of AAV and LV gene therapy assets.

-

In June 2023, Becton, Dickinson and Company finalized the sale of its surgical instrumentation, laparoscopic instrumentation, and sterilization container assets to STERIS plc.

-

In February , 2022, CooperSurgical successfully acquired Cook Medical's reproductive health portfolio for a substantial amount of USD 875 million. This portfolio encompasses a range of medical equipment designed for fertility, obstetrics, gynecology, and in vitro fertilization (IVF).

-

In March 2021 Becton, Dickinson and Company unveiled the BD Chorionic Villus Sampling (CVS) System, boasting an advanced ergonomic handle aimed at reducing hand fatigue and enhancing precision in amniocentesis procedures.

Amniocentesis Needle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 199.83 million

Revenue forecast in 2030

USD 297.35 million

Growth rate

CAGR of 6.85% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, procedure, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Smiths Medical; Biopsybell Srl; Integra LifeSciences; Laboratoire CCD; Cook Medical; RI.MOS. Srl; CooperSurgical; Medline; Rocket Medical; Becton Dickinson and Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Amniocentesis Needle Market Report Segmentation

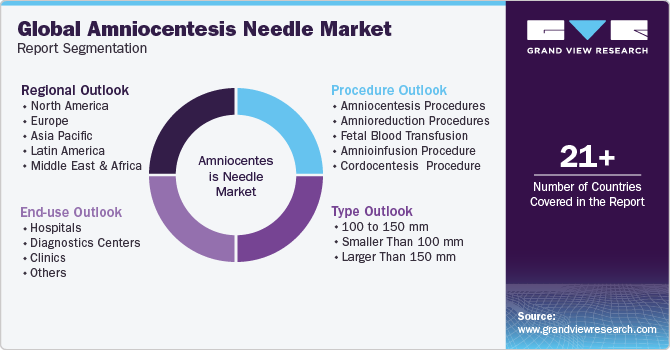

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For study, Grand View Research has segmented the global amniocentesis needle market report based on type, procedure, end use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

100 to 150 mm

-

Smaller Than 100 mm

-

Larger Than 150 mm

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Amniocentesis Procedures

-

Amnioreduction Procedures

-

Fetal Blood Transfusion

-

Amnioinfusion Procedure

-

Cordocentesis Procedure

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics centers

-

Clinics

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global amniocentesis needle market size was estimated at USD 187.96 million in 2023 and is expected to reach USD 199.83 million in 2024.

b. The global amniocentesis needle market is expected to grow at a compound annual growth rate of 6.85% from 2024 to 2030 to reach USD 297.35 million by 2030.

b. North America dominated the amniocentesis needle market with a share of 31.2% in 2023. This is attributable to the increasing number of prenatal testing, and a growing number of R&D collaborations carried out by major players in the region.

b. Some key players operating in the amniocentesis needle market include Smiths Medical, Integra LifeSciences, Cook Medical, and CooperSurgical, Biopsybell Srl, Laboratoire CCD, RI.MOS. Srl and Medline.

b. Key factors that are driving the amniocentesis needle market growth include an increase in maternal age, a rising prevalence of chronic diseases among expectant mothers, and continuous advancements in healthcare technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.